In today’s world, customers no longer just buy products—they buy solutions, experiences, and outcomes. The most successful brands are realizing that to stay relevant and grow, they must think beyond the narrow scope of their products or services. Instead, they need to focus on the broader problems their customers face and leverage partnerships to deliver end-to-end solutions. Mercedes-Benz offers a compelling example of how a brand can make this shift, moving from a traditional product manufacturer to an ecosystem orchestrator, providing value far beyond the car itself.

Understanding the Customer Problem

The first step is to see the world through the customer’s eyes. For Mercedes-Benz, the shift to electric vehicles (EVs) revealed a fundamental insight: owning an EV is not just about having a luxury car—it’s about access to reliable, sustainable energy. Customers want to charge their vehicles efficiently, reduce energy costs, and ideally do so using renewable sources. The problem is no longer only about driving; it’s about mobility and energy management at home, on the road, and within the larger environment of the city.

Brands that excel at solving customer problems start by identifying unmet needs in the broader context of their product. Apple didn’t just sell an iPhone; it addressed how people communicate, work, entertain themselves, and stay healthy in an increasingly connected life. Peloton didn’t just sell a stationary bike; it addressed how people find time-efficient, social, and motivating ways to exercise at home. The lesson is clear: products are entry points, but problems are opportunities.

Building an Ecosystem of Partners

Once a brand understands the broader problem, it often cannot solve it alone. Here is where ecosystems come into play. An ecosystem is a network of partners, technologies, and services that collectively deliver value to the customer. Mercedes-Benz exemplifies this approach through its partnerships with companies like Bosch, a global leader in energy and IoT solutions.

Together, Mercedes and Bosch provide home energy solutions linked directly to EV ownership. Through this partnership:

-

Customers can install solar panels and home energy storage systems, allowing them to charge vehicles using renewable energy.

-

Bosch’s expertise in smart-home technology ensures that energy consumption is optimized, balancing household needs with vehicle charging schedules.

-

Mercedes integrates these services into its digital platform, Mercedes me, which enables customers to manage cars, energy, and mobility services from a single interface.

The key insight here is that Mercedes didn’t limit itself to cars. By orchestrating a network of partners, the company can deliver a complete mobility and energy experience, turning a one-dimensional product into a multi-dimensional solution.

Shifting From Products to Services

Ecosystems unlock new business models by transforming products into services and experiences. Mercedes-Benz is experimenting with subscription models that combine vehicles, charging infrastructure, and home energy solutions. This approach creates recurring revenue streams while deepening customer engagement.

Consider how this approach can be applied in other industries:

-

A fitness brand could partner with nutrition, wellness, and technology companies to provide personalized health ecosystems.

-

A financial services company could collaborate with utilities, mobility providers, and tech platforms to offer integrated life planning solutions, beyond insurance or banking products.

-

A consumer electronics company could partner with home automation, content, and service providers to deliver a seamless smart-living ecosystem.

The principle is the same: focus on the customer’s broader journey and orchestrate a network to meet those needs holistically.

Digital Platforms as the Glue

Ecosystems thrive when there is a central hub that connects partners, collects insights, and delivers a seamless customer experience. Mercedes me acts as this hub for Mercedes-Benz, linking cars, energy solutions, and mobility services. Through the platform, Mercedes can:

-

Track energy usage patterns and recommend optimal charging times.

-

Offer predictive maintenance and vehicle updates, enhancing reliability.

-

Provide personalized offers and services based on user behavior and preferences.

Digital platforms turn ecosystems from a loose network into a coordinated, intelligent system, enabling brands to act on data insights while keeping the customer experience smooth and integrated.

Benefits for Brands

Brands that adopt ecosystem thinking gain multiple advantages:

-

Customer loyalty and engagement: Customers become embedded in a broader network of solutions that are hard to replicate.

-

New revenue streams: Ecosystems open doors to services, subscriptions, and value-added offerings beyond the original product.

-

Innovation acceleration: Partnering with other experts allows brands to innovate faster and address complex problems they could not solve alone.

-

Sustainability and purpose alignment: Solutions that integrate energy, mobility, and technology enhance social and environmental impact, which increasingly matters to consumers.

Lessons for Any Brand

Mercedes-Benz demonstrates a few universal lessons for brands seeking to move beyond products:

-

Start with the problem, not the product: Understand what customers truly need in the context of their lives.

-

Collaborate strategically: Partner with companies that have complementary strengths to expand the value proposition.

-

Invest in platforms: Use digital systems to orchestrate partners, manage services, and personalize experiences.

-

Think in terms of services, not products: Explore subscriptions, bundled offerings, and integrated experiences to deepen engagement.

-

Measure broader impact: Evaluate success not only in sales but also in the outcomes delivered for customers, such as convenience, cost savings, or sustainability.

The future of business lies in moving beyond products to solving broader customer problems through ecosystems. Mercedes-Benz exemplifies this shift by combining cars, home energy, digital platforms, and strategic partnerships into a unified mobility experience. Brands that adopt this mindset can unlock new growth, stronger customer relationships, and meaningful impact, while transforming themselves from product sellers into problem-solvers and ecosystem orchestrators.

In a world where products are increasingly commoditized, the real competitive advantage belongs to those who see the bigger picture, collaborate effectively, and deliver holistic solutions. The Mercedes-Benz model is not just a blueprint for the automotive industry—it is a lesson for any brand seeking relevance and growth in the 21st century.

Who are the most inspiring business leaders today?

- Request the free e-book “A-Z of Inspiring Business Leaders 2025” at peterfisk@peterfisk.com

How do they lead in a world of uncertainty, complexity and relentless change, to deliver today and also create tomorrow? How do they engage stakeholders, see a bigger picture, have a focus on the future, drive innovation and transformation? And how do they succeed as people, in their relationships with their colleagues, and in their personal drive and resilience?

I’ve had the privilege to meet some of the world’s great business leaders. I remember sitting down with Virgin founder Richard Branson, telling me about is love of big crazy ideas and taking personal risks like hot-air ballooning and more recently space travel, but after 50 years a lingering fear of meeting with his finance team and deciphering a balance sheet.

Last year I interviewed Spanish business leader Pablo Isla, ranked by HBR as the world’s best CEO, who said he is only human, and can only be expected what most humans can do. But in the smartest way possible. Equally humble was Jim Snabe, chairman of Siemens, who talked about how he is always curious, always learning, constantly inspired by other leaders and their companies around the world.

Satya Nadella was truly inspiring. Watching him talk to his Microsoft leadership team, he was a body of passion, entrancing with his vision of the possibilities of technology, and the confidence to transform their business. Melanie Perkins, the young Australian founder of Canva, was equally compelling, but in a far more practical and down to earth way.

One of my most thought-provoking (and complex) conversations was with Haier’s chairman Zhang Ruimin. Once I told him that I also had a scientific background, he wanted to talk quantum physics, as an analogy for organisation design. He was fascinating, talking about how his “rendanheyi” approach to living organisations, was about freedom and innovation, but also how different operating models could create more potential, and then kinetic, energy.

So, who are the most inspiring business leaders today – and what can we learn from them?

Who are the most inspiring business leaders today?

How do they lead in a world of uncertainty, complexity and relentless change, to deliver today and also create tomorrow? How do they engage stakeholders, see a bigger picture, have a focus on the future, drive innovation and transformation? And how do they succeed as people, in their relationships with their colleagues, and in their personal drive and resilience?

I’ve had the privilege to meet some of the world’s great business leaders. I remember sitting down with Virgin founder Richard Branson, telling me about is love of big crazy ideas and taking personal risks like hot-air ballooning and more recently space travel, but after 50 years a lingering fear of meeting with his finance team and deciphering a balance sheet.

Last year I interviewed Spanish business leader Pablo Isla, ranked by HBR as the world’s best CEO, who said he is only human, and can only be expected what most humans can do. But in the smartest way possible. Equally humble was Jim Snabe, chairman of Siemens, who talked about how he is always curious, always learning, constantly inspired by other leaders and their companies around the world.

Satya Nadella was truly inspiring. Watching him talk to his Microsoft leadership team, he was a body of passion, entrancing with his vision of the possibilities of technology, and the confidence to transform their business. Melanie Perkins, the young Australian founder of Canva, was equally compelling, but in a far more practical and down to earth way.

One of my most thought-provoking (and complex) conversations was with Haier’s chairman Zhang Ruimin. Once I told him that I also had a scientific background, he wanted to talk quantum physics, as an analogy for organisation design. He was fascinating, talking about how his “rendanheyi” approach to living organisations, was about freedom and innovation, but also how different operating models could create more potential, and then kinetic, energy.

As I travel around the world – working with diverse companies, meeting incredible business leaders, and sharing the best ideas from across sectors and geographies in keynotes and workshops – I mused on who are the most inspiring business leaders today – how do they succeed into today’s very different world – and what can we learn from them?

The best leaders aren’t just good at managing. They explore, envision and elevate their personal possibilities and business potential. They connect, transform, and enable their organisations to achieve more. They are future makers.

Here are some of the attributes which, for me, make them inspiring. Collectively these attributes create a New Leadership DNA:

-

They lead with vision and purpose. They see the big picture and help others see it too. They’re not just reacting to the present — they’re creating the future. Their vision is rooted in a strong sense of purpose that goes beyond profit: social impact, sustainability, human empowerment, or systemic change. Nadella’s growth mindset has been transformational.

-

They embrace complexity and uncertainty. Instead of fearing change, they lean into ambiguity. They use it as a catalyst for innovation. They build organisations that are agile, resilient, and adaptive — capable of pivoting quickly without losing direction. Jensen Huang has been at Nvidia’s helm since its founding in 1995, a constant source of direction and stability.

-

They drive innovation and reinvention. They foster a culture of experimentation, learning, and continuous reinvention. They don’t cling to legacy models — they challenge assumptions, embrace bold thinking, and ask: What’s next? Jim Hagemann Snabe, chairman of Siemens, is a passionate advocate of continuous reinvention.

-

They connect deeply with stakeholders. They actively listen, collaborate, and co-create with customers, employees, partners, and communities. They build trust through transparency and consistent values — which is essential in a noisy, polarised world. Yvon Chouinard, founder of Patagonia is one of my business heroes.

-

They are human-centered and emotionally intelligent. They lead with empathy, humility, and authenticity. They show vulnerability, care for their teams, and encourage psychological safety. They’re focused not just on what gets done but how — creating healthy, high-performing cultures. Perkins loves to say, “we’re a family, and we’re here to do good”.

-

They invest in their own growth and resilience. They cultivate mental clarity, self-awareness, and inner strength — practices like reflection, coaching, mindfulness, and lifelong learning. They’re passionate, driven — but also grounded and emotionally regulated, even under pressure. Jacinda Ardern, former PM now leadership coach, is a great example.

-

They build teams, not empires. They create leadership ecosystems, not command-and-control hierarchies. They empower others, distribute decision-making, and build collective intelligence. They know that innovation and impact come from collaboration, not heroism. Erin Meyer told me this one, learnt from Reed Hastings, while writing No Rules Rules together.

Collectively these attributes create a New Leadership DNA.

Sam Altman, Open AI

Sam Altman is a visionary entrepreneur and investor who has become one of the most influential figures in artificial intelligence. Born in 1985, Altman studied computer science at Stanford University before dropping out to launch the location-based app Loopt. Though Loopt was not a major commercial success, it marked Altman as a rising star in tech. He went on to lead Y Combinator, one of Silicon Valley’s top startup accelerators, where he helped launch and support companies like Airbnb, Dropbox, and Stripe.

In 2015, Altman co-founded OpenAI alongside Elon Musk and others with the mission of ensuring that artificial general intelligence (AGI) benefits all of humanity. Under his leadership, OpenAI has developed some of the most advanced AI systems in the world, including ChatGPT. Altman has championed a unique capped-profit model to align AI development with broad societal benefit. His tenure has seen OpenAI grow from a nonprofit research lab into a global force, forging major partnerships—including a multibillion-dollar collaboration with Microsoft.

He has been at the forefront of AI safety debates and calls for global AI governance. Altman’s impact lies not only in advancing cutting-edge AI, but in reframing how tech companies balance innovation, ethics, and profit.

Mary Barra, GM

Mary Barra made history in 2014 when she became the first female CEO of a major global automaker, General Motors. Born in Michigan in 1961, Barra holds a degree in electrical engineering and an MBA from Stanford. Her career at GM spans over four decades, beginning as a co-op student inspecting fender panels. She steadily rose through the ranks with roles in engineering, HR, and manufacturing.

As CEO, Barra has spearheaded GM’s transformation from a traditional automaker to a forward-looking mobility company. She led the company through a massive cultural and operational shift, emphasizing transparency and accountability after the ignition switch crisis. Barra’s vision has centered on an all-electric future: she committed GM to producing only zero-emissions vehicles by 2035, and has significantly invested in EVs and autonomous technology, including the development of the Chevrolet Bolt and the Cruise AV platform.

Barra has also been a leading advocate for diversity and inclusion, setting ambitious DEI goals and increasing female representation across leadership. Under her guidance, GM returned to profitability after bankruptcy, streamlined its global operations, and began to redefine American automotive innovation. She is widely regarded as one of the most powerful and transformative leaders in the global auto industry.

Tim Cook, Apple

Tim Cook took over as CEO of Apple in 2011, following the death of Steve Jobs. Born in Alabama in 1960, Cook holds a degree in industrial engineering from Auburn University and an MBA from Duke University. He joined Apple in 1998 after roles at IBM, Compaq, and Intelligent Electronics. Initially brought in to streamline Apple’s supply chain, Cook’s operational brilliance helped turn Apple into a global logistics powerhouse.

As CEO, Cook has overseen Apple’s transformation into the world’s most valuable company, pushing its market cap past $3 trillion. Under his leadership, Apple has expanded its product line with innovations like the Apple Watch, AirPods, and Apple Silicon chips. He has also pivoted Apple toward services—such as Apple Music, iCloud, and Apple TV+—which now form a major growth engine. While Jobs was known for visionary product design, Cook is recognized for his steady hand, global scaling, and quiet but firm leadership style.

Cook has brought a values-based approach to Apple’s leadership, championing privacy as a human right, committing to carbon neutrality, and supporting social justice causes. Openly gay and a strong advocate for LGBTQ+ rights, Cook has modernized Apple’s culture while maintaining its core design ethos. His legacy is one of sustainable, disciplined innovation and values-driven business leadership.

Axel Dumas, Hermès

Axel Dumas is the CEO of Hermès International and a sixth-generation member of the founding Hermès family. Born in 1970, Dumas studied philosophy and political science before training at Sciences Po and the École Nationale d’Administration (ENA), a prestigious French school for civil servants. Before joining Hermès in 2003, he worked in banking at Paribas.

Dumas became CEO in 2013 and has since guided the French luxury house through a period of exceptional growth and resilience. Unlike many luxury conglomerates, Hermès has stayed independent and family-controlled, maintaining its artisanal heritage and commitment to craftsmanship. Dumas has upheld this legacy while subtly modernizing the brand—expanding into new markets, accelerating digital capabilities, and opening flagship stores in key global cities.

Under his leadership, Hermès has remained one of the most exclusive and admired luxury brands in the world. Its iconic Birkin and Kelly bags continue to be symbols of prestige, and the brand has enjoyed soaring demand in Asia and among younger luxury consumers. Dumas has been praised for balancing tradition with innovation, preserving Hermès’ scarcity-driven model while building a highly profitable and sustainable global business.

Daniel Ek, Spotify

Daniel Ek is the co-founder and CEO of Spotify, the world’s leading music streaming platform. Born in Sweden in 1983, Ek showed early entrepreneurial instincts, starting tech ventures in his teens and becoming a millionaire by age 23. In 2006, he co-founded Spotify with Martin Lorentzon, aiming to combat music piracy and offer a better way to access music legally.

Launched in 2008, Spotify revolutionized how people consume music, introducing freemium streaming supported by ads or subscriptions. Ek’s data-driven, user-focused approach turned Spotify into a global platform with over 500 million users and 200+ million paying subscribers. Under his leadership, Spotify has continually innovated—through algorithmic playlists, podcast acquisitions (like Joe Rogan and Gimlet Media), and tools for creators.

Ek has championed the idea that tech can democratize the music industry, giving artists more direct access to fans. He’s also had to navigate complex relationships with record labels, creators, and regulators, while fending off growing competition from Apple, Amazon, and YouTube. His vision and persistence have made Spotify one of the most transformative companies in digital media, reshaping the business model of an entire industry.

Jane Fraser, Citigroup

Jane Fraser made history in 2021 as the first woman to lead a major U.S. bank when she became CEO of Citigroup. Born in Scotland in 1967, Fraser earned degrees from Cambridge University and Harvard Business School. She began her career at Goldman Sachs and McKinsey & Company, where she became a partner, before joining Citi in 2004.

Over nearly two decades at Citigroup, Fraser held multiple leadership roles, including CEO of Citi’s Latin America operations and head of its global consumer bank. Her appointment as CEO marked a turning point for the institution, which has long trailed rivals JPMorgan Chase and Bank of America in profitability and efficiency. As CEO, she quickly launched a major strategic overhaul—streamlining global operations by exiting consumer banking in multiple markets, refocusing on wealth management, and investing in technology and compliance.

Fraser has also prioritized culture change and operational transparency. She is leading Citi through a long-needed transformation of its risk management infrastructure, driven by regulatory demands and a goal of making the bank leaner, safer, and more client-focused. In a traditionally male-dominated field, Fraser has emerged as a symbol of inclusive leadership and a thoughtful, steady hand in an era of financial transformation.

Marcos Galperin, Mercado Libre

Marcos Galperin is the founder and CEO of Mercado Libre, Latin America’s largest e-commerce and fintech company. Born in Argentina in 1971, he studied economics at Wharton and earned his MBA at Stanford, where the idea for Mercado Libre was born. Launched in 1999, the company is often referred to as the “Amazon of Latin America,” though its model also blends features of eBay, PayPal, and Shopify.

Galperin has been instrumental in shaping Latin America’s digital economy, bringing e-commerce and digital payments to markets historically underserved by traditional infrastructure. Under his leadership, Mercado Libre built its own logistics network and digital wallet system (Mercado Pago), which has become a critical tool for financial inclusion in the region. The company weathered multiple economic and political crises by remaining agile and relentlessly user-focused.

Galperin’s vision was not only technological but also social—empowering millions of small businesses and consumers across Latin America to access digital commerce, payments, and credit. Today, Mercado Libre is one of the most valuable companies in the region, a rare tech success story from the Global South. Galperin is seen as a pioneer in emerging market innovation, combining entrepreneurial resilience with scalable impact.

Jensen Huang, Nvidia

Jensen Huang is the co-founder and CEO of Nvidia, the company that pioneered graphics processing units (GPUs) and transformed them into essential tools for AI, gaming, and data science. Born in Taiwan in 1963, Huang moved to the USA as a child and studied electrical engineering at Oregon State and Stanford. In 1993, he co-founded Nvidia with a focus on high-performance graphics cards for gaming—a niche that would evolve into one of the most powerful computing platforms in the world.

Under Huang’s visionary leadership, Nvidia expanded beyond gaming to become a leader in AI and high-performance computing. The company’s CUDA platform and GPU architecture are now central to deep learning, powering everything from self-driving cars to large language models. Huang has masterfully steered Nvidia into new verticals—healthcare, automotive, data centres—while maintaining its edge in graphics.

In recent years, Nvidia has become one of the most valuable chipmakers globally, particularly due to the AI boom. Huang is known for his charismatic public speaking, black leather jacket, and long-term thinking. He’s often described as one of the most influential figures in the future of computing. His greatest achievement may be transforming a gaming company into the engine room of the AI revolution.

Hisayuki Idekoba, Recruit

Hisayuki “Deko” Idekoba is the CEO of Recruit Holdings, the Japanese conglomerate behind major global platforms like Indeed and Glassdoor. Born in 1974, Idekoba studied at the University of Texas at Austin and joined Recruit in 1999. He quickly became known for his entrepreneurial mindset and global outlook within a traditionally domestic-focused company.

Idekoba rose through the ranks by spearheading Recruit’s digital transformation. He was instrumental in the 2012 acquisition of Indeed, a bold move that positioned Recruit as a global leader in online job search. Under his guidance, Indeed grew exponentially, dominating the recruitment market in the U.S. and expanding into dozens of countries. When he became CEO of Recruit Holdings in 2021, Idekoba brought a vision of decentralized, innovation-driven management, shifting the culture toward agility and international expansion.

He has led the company’s charge into AI-powered job matching and remote work solutions, pushing Recruit beyond its roots in print media and domestic staffing. His approach—described as collaborative and product-centric—has made the company one of the few Japanese firms to build a dominant presence in global tech. Idekoba represents a new breed of Japanese executive blending Silicon Valley-style innovation with Japan’s attention to quality and long-term thinking.

Jessica Jackley, Kiva

Jessica Jackley is an entrepreneur and social innovator best known as the co-founder of Kiva, the first person-to-person micro-lending platform. Born in 1977, Jackley studied philosophy and political science at Bucknell University and earned an MBA from Stanford. Her early work at Village Enterprise and the Stanford Center for Social Innovation inspired her belief in the power of entrepreneurship to fight poverty.

In 2005, Jackley co-founded Kiva alongside Matt Flannery. The platform allowed individuals to lend small amounts of money to entrepreneurs in developing countries, giving rise to a global microfinance movement. By enabling direct connections between lenders and borrowers, Kiva revolutionized philanthropy and demonstrated that ordinary people could play an active role in global development. To date, Kiva has facilitated over $1.8 billion in loans across more than 80 countries.

Jackley’s work emphasized dignity, trust, and the human story behind business. She has since founded other ventures focused on mission-driven entrepreneurship and taught at universities including USC and Stanford. A frequent speaker and author, her impact lies not only in financial innovation but in changing the narrative around aid—from one of charity to one of empowerment. Jackley remains a pioneer in socially conscious technology and inclusive finance.

Dara Khosrowshahi, Uber

Dara Khosrowshahi became CEO of Uber in 2017, brought in to stabilize the embattled ride-hailing company after a series of scandals and leadership turmoil under co-founder Travis Kalanick. Born in Iran in 1969, Khosrowshahi fled the country with his family during the Iranian Revolution and eventually settled in the U.S. He earned a degree in engineering from Brown University and began his career in finance.

Before Uber, he served for 12 years as CEO of Expedia, transforming it into one of the world’s largest online travel companies through smart acquisitions and global expansion. At Uber, he was tasked with restoring the company’s reputation, improving regulatory relations, and achieving financial sustainability. He prioritized cultural reform, launched safety features, and emphasized compliance and transparency.

Under Khosrowshahi’s leadership, Uber expanded beyond ride-hailing into delivery (Uber Eats), freight logistics, and autonomous vehicle partnerships. He led the company through its 2019 IPO and into profitability. While managing backlash from gig worker policies and navigating pandemic challenges, Khosrowshahi has helped reshape Uber into a multi-modal platform, broadening its services and geographical footprint.

His style – calm, thoughtful, and values-driven – contrasts sharply with Uber’s previous leadership. Khosrowshahi’s steady hand has been key in turning the company from a volatile startup into a more mature, globally integrated business.

Lei Jun, Xiaomi

Lei Jun is the founder and CEO of Xiaomi, one of the world’s leading smartphone and consumer electronics brands. Born in China in 1969, Lei studied computer science at Wuhan University and became a successful tech executive early in his career, notably serving as CEO of software company Kingsoft and founding the e-commerce platform Joyo.com, which was later acquired by Amazon.

In 2010, Lei founded Xiaomi with the vision of delivering high-quality, affordable smartphones and smart devices. His approach, inspired by Apple but tailored for the Chinese market, emphasized sleek design, community-driven product development, and lean operations. Xiaomi quickly gained market share by offering premium features at competitive prices and bypassing traditional retail channels with a direct-to-consumer model.

Lei is known for his charismatic leadership and close engagement with users through social media. Under his guidance, Xiaomi grew into a global powerhouse—not just in smartphones, but in a broad range of IoT and lifestyle products. The company’s ecosystem now includes everything from smart TVs to electric scooters, and its MIUI operating system has created a sticky user base.

Lei’s impact lies in democratizing access to smart technology and proving that a Chinese company could compete on design, brand, and innovation globally. He has been compared to both Steve Jobs and Jeff Bezos for his hybrid of product obsession and platform thinking.

Phuti Mahanyele-Dabengwa, Naspers

Phuti Mahanyele-Dabengwa is a trailblazing South African business leader and the CEO of Naspers South Africa. She became the first black woman to hold this role in 2019. With degrees from Rutgers University and De Montfort University, and executive training from Harvard, Mahanyele has built a career at the intersection of finance, development, and digital innovation.

Before joining Naspers, she served as CEO of Shanduka Group, a leading investment firm founded by Cyril Ramaphosa, and later founded Sigma Capital, a private investment group focused on infrastructure and growth-stage businesses. At Naspers, one of Africa’s largest tech investors and parent company of Prosus, Mahanyele is leading efforts to grow South Africa’s digital economy and support homegrown startups in sectors like education, fintech, and e-commerce.

She has championed inclusive innovation and worked to close the gap between global capital and African entrepreneurship. Her leadership at Naspers includes managing major investments in companies like Takealot and Mr D Food, while also building programs to empower small businesses and create jobs.

Mahanyele-Dabengwa’s influence extends beyond boardrooms—she’s a vocal advocate for women in leadership and economic transformation in South Africa. Her career reflects a commitment to using capital for social change and technological empowerment across the continent.

Satya Nadella, Microsoft

Satya Nadella is the CEO and Chairman of Microsoft, widely credited with reviving the company’s innovation culture and positioning it at the forefront of cloud computing and AI. Born in India in 1967, Nadella studied electrical engineering before moving to the U.S. to earn degrees from the University of Wisconsin and the University of Chicago. He joined Microsoft in 1992, initially working on Windows NT.

Nadella rose through the ranks by leading transformative projects, including the successful development of Microsoft’s cloud platform, Azure. Appointed CEO in 2014, he replaced Steve Ballmer at a time when Microsoft was perceived as stagnating. Nadella reoriented the company’s strategy around cloud computing, AI, and cross-platform openness, shedding the insular approach of earlier years.

Under his leadership, Microsoft acquired LinkedIn, GitHub, and Activision Blizzard (pending final regulatory approvals), and launched transformative products like Microsoft Teams and Copilot AI. He has driven record-breaking financial performance and pushed Microsoft’s valuation beyond $3 trillion.

Equally important has been Nadella’s cultural reset—fostering empathy, learning, and collaboration. His leadership style is deeply humanistic, shaped by personal experiences and a belief in technology as a tool for empowerment. He’s often hailed as one of the most effective and values-driven CEOs of the 21st century.

Makiko Ono, Suntory

Makiko Ono made headlines in 2023 when she became the first female CEO of Suntory Beverage & Food, a major Japanese drinks company known for brands like Orangina, Ribena, and Boss Coffee. A trailblazer in Japan’s male-dominated corporate landscape, Ono joined Suntory in 1982 and built a career across marketing, global operations, and corporate planning.

With over four decades at the company, Ono’s ascent to CEO reflects both her deep institutional knowledge and her forward-looking leadership. She previously led international business units in Europe and Asia, bringing a global mindset and a focus on local innovation. Her appointment signaled Suntory’s commitment to diversity, inclusion, and breaking traditional hierarchies.

As CEO, Ono is focused on expanding global market share, increasing health-conscious product lines, and embedding sustainability across operations. She has championed initiatives to reduce plastic waste, promote ethical sourcing, and adapt to changing consumer trends. She’s also emphasized internal reform—encouraging flexible work styles and nurturing the next generation of leaders, particularly women.

Makiko Ono’s leadership is symbolic of a larger cultural shift in Japanese business. She combines deep tradition with an appetite for reinvention, bringing a unique voice to both corporate Japan and the global beverage industry.

Melanie Perkins, Canva

Melanie Perkins is the co-founder and CEO of Canva, a graphic design platform that has revolutionized the way people create visual content. Born in Perth, Australia, in 1987, Perkins studied communications and commerce at the University of Western Australia. She came up with the idea for Canva while teaching students how to use complex design software. Frustrated by the steep learning curve, she envisioned a tool that made design simple and accessible to everyone.

In 2013, Perkins launched Canva with co-founders Cliff Obrecht and Cameron Adams. The platform offered a drag-and-drop interface and templates that allowed anyone—from students to small businesses—to design professional-looking graphics, presentations, and social media posts. Canva quickly gained traction, growing into one of the world’s fastest-growing software companies. As of 2024, it boasts over 135 million users and a valuation of $40 billion.

Perkins’ leadership is marked by purpose-driven values. She built Canva with a commitment to inclusivity, simplicity, and social impact, offering free access to nonprofits, educators, and students. She also made headlines by pledging to give away most of her wealth through the Canva Foundation.

As one of the youngest female tech CEOs globally, Perkins has not only disrupted the design industry but has also become a role model for women in tech and entrepreneurship. Her achievements represent the power of mission-led innovation on a global scale.

James Quincey, Coca-Cola

James Quincey is the Chairman and CEO of The Coca-Cola Company, where he has led a sweeping transformation of the 137-year-old beverage giant. Born in London in 1965, Quincey studied engineering at the University of Liverpool before joining Coca-Cola in 1996. He worked his way up through leadership roles across Latin America and Europe, eventually becoming COO in 2015 and CEO in 2017.

Quincey’s tenure as CEO has been defined by bold change. He moved Coca-Cola beyond its core soda business, accelerating its shift toward a “total beverage company” with a portfolio that now includes coffee, water, tea, plant-based drinks, and alcohol. He has overseen acquisitions like Costa Coffee and Topo Chico, while also divesting underperforming brands to streamline the company’s focus.

Crucially, Quincey has pushed Coca-Cola toward more sustainable and digitally enabled operations. He’s introduced ambitious goals for reducing sugar content, improving packaging sustainability, and increasing transparency. Internally, he has fostered a more agile, data-driven culture, embracing e-commerce and global innovation.

Quincey’s leadership has revitalized one of the world’s most iconic brands, making it more relevant in a changing world. His strategic clarity and appetite for reinvention have ensured Coca-Cola’s continued dominance while future-proofing it for a new generation of consumers.

Hana Al Rostamani, First Abu Dhabi Bank

Hana Al Rostamani is the Group CEO of First Abu Dhabi Bank (FAB), the UAE’s largest bank and one of the most influential financial institutions in the Middle East. Appointed CEO in 2021, she became the first woman to lead a major bank in the UAE, breaking new ground in a traditionally male-dominated industry.

Al Rostamani holds a degree in business from George Washington University and an MBA from the American University in Washington, D.C. Prior to joining FAB, she held leadership positions at Emirates NBD and in the telecom sector. At FAB, she previously served as Deputy CEO and Group Head of Personal Banking, where she drove innovation in digital banking and customer experience.

As CEO, Al Rostamani has led a major digital and strategic transformation. She’s focused on expanding FAB’s regional and international presence, enhancing sustainability practices, and investing in fintech partnerships. Under her leadership, the bank has grown its global footprint while supporting the UAE’s economic diversification agenda and sustainability goals.

Her style blends visionary strategy with inclusive leadership, and she’s widely recognized as a trailblazer for women in finance. Al Rostamani represents a new generation of Middle Eastern leaders—globally minded, tech-savvy, and values-driven—who are redefining the region’s role in the global financial system.

Nik Storonsky, Revolut

Nik Storonsky is the co-founder and CEO of Revolut, the UK-based fintech company that has disrupted traditional banking with its digital-first, app-based model. Born in Russia in 1984, Storonsky moved to the UK and began his career in investment banking at Lehman Brothers and Credit Suisse. With a background in physics and economics, he combined technical acumen with financial insight to launch a new kind of bank.

Frustrated by the inefficiencies and high fees in traditional finance, Storonsky co-founded Revolut in 2015 with developer Vlad Yatsenko. What began as a low-fee currency exchange card evolved into a global financial super app offering banking, stock trading, crypto, budgeting, and more—all through a sleek mobile interface.

Storonsky’s leadership has been aggressive, fast-paced, and results-driven. He scaled Revolut from a London startup to one of Europe’s most valuable fintechs, with over 30 million users across more than 35 countries. His focus on lean operations and rapid product development has made Revolut a case study in fintech disruption.

However, his style has also drawn scrutiny for its intensity and workplace culture. Despite controversies, Storonsky remains one of the most influential figures in modern finance, pushing the boundaries of digital banking and challenging legacy institutions to innovate or fall behind.

Jessica Tan, Ping An

Jessica Tan is Co-CEO and Executive Director of Ping An Group, one of China’s largest financial and healthcare conglomerates. With degrees from MIT in electrical engineering, economics, and computer science, Tan worked at McKinsey & Company before joining Ping An in 2013. Her mandate: lead digital transformation across the sprawling insurance and banking empire.

Tan has been instrumental in reinventing Ping An from a traditional insurer into a tech-powered ecosystem. Under her guidance, the company has launched innovative platforms in healthcare (Good Doctor), smart city services, wealth management, and AI-driven underwriting. She helped establish Ping An as a pioneer in the integration of finance, health, and technology—often described as “tech-fin” rather than “fintech.”

Her leadership has led to Ping An being consistently ranked among the world’s most innovative companies. Tan is known for her systems thinking and cross-disciplinary leadership—fusing data, design, and digital strategy in one of the world’s most complex markets. She has also been a strong advocate for female leadership in tech and finance.

Tan’s role at Ping An shows how legacy institutions can leapfrog into the future with the right strategic vision and tech capabilities. Her work offers a roadmap for large-scale innovation in highly regulated industries.

Hamdi Ulukaya, Chobani

Hamdi Ulukaya is the founder and CEO of Chobani, the brand that brought Greek yogurt into the American mainstream. Born in Turkey in 1972 into a Kurdish dairy farming family, Ulukaya immigrated to the U.S. in the 1990s and started a feta cheese business before acquiring a defunct yogurt plant in upstate New York in 2005. With no outside investment, he launched Chobani in 2007.

Ulukaya’s approach was simple: better ingredients, better taste, and better values. He built Chobani into the top-selling yogurt brand in the U.S. within five years, disrupting a category long dominated by legacy players. His strategy combined product innovation, bold branding, and tight control of manufacturing and distribution.

But Ulukaya is known as much for his values as his business acumen. He implemented generous employee benefits, including profit sharing and paid parental leave, and hired hundreds of refugees to work in Chobani factories. In 2016, he signed the Giving Pledge and has spoken globally about the need for CEOs to put humanity before profit.

Through Chobani, Ulukaya has shown that food entrepreneurship can be both scalable and socially responsible. His leadership blends immigrant grit, product excellence, and a deep belief in business as a force for good.

David Vélez, Nubank

David Vélez is the founder and CEO of Nubank, Latin America’s largest digital bank and one of the most disruptive fintech companies globally. Born in Medellín, Colombia, in 1981, Vélez earned degrees in engineering and management science from Stanford University. His early career included roles at Morgan Stanley, General Atlantic, and Sequoia Capital, where he was tasked with expanding the firm’s presence in Brazil.

The idea for Nubank emerged from Vélez’s personal frustration with Brazil’s traditional banking system, characterized by high fees and poor customer service. In 2013, alongside co-founders Cristina Junqueira and Edward Wible, he launched Nubank with the goal of leveraging technology to offer a more customer-centric banking experience. Starting with a no-fee credit card managed entirely through a mobile app, Nubank rapidly expanded its product offerings to include digital accounts, personal loans, and investment services.

Under Vélez’s leadership, Nubank has experienced exponential growth. By 2024, the company surpassed 100 million customers across Brazil, Mexico, and Colombia, making it one of the world’s largest digital banks Nu International. This growth has been driven by a commitment to simplifying banking and reducing costs for consumers. Nubank’s impact is evident in the reduction of banking concentration in Brazil, with the market share of the top five banks decreasing from 70% in 2014 to 58% by the end of 2022 Nu International.

Vélez’s vision extends beyond Latin America. In 2025, he announced plans to consider relocating Nubank’s legal domicile to the UK as part of a broader global expansion strategy, including potential entry into the U.S. market Reuters. His leadership has been recognized internationally; in 2023, he was named one of the top five CEOs in the world by The Economist and received numerous accolades for innovation and influence Nu International.

David Vélez’s journey from a frustrated banking customer to the helm of a fintech giant underscores his commitment to financial inclusion and innovation. By challenging traditional banking norms, he has not only transformed the financial landscape in Latin America but also set a precedent for digital banking worldwide.

Emily Weiss, Glossier

Emily Weiss is an American entrepreneur renowned for founding Glossier, a beauty brand that redefined the industry with its digital-first approach and emphasis on community engagement. Born in 1985, Weiss studied studio art at New York University and began her career with internships at Teen Vogue and positions at W magazine and Vogue. In 2010, she launched the beauty blog “Into the Gloss,” which featured interviews and insights into beauty routines, quickly amassing a dedicated following.

Recognizing a gap in the market for beauty products that resonated with the modern consumer, Weiss founded Glossier in 2014. Starting with just four products, the brand emphasized a “skin first, makeup second” philosophy, promoting natural beauty and simplicity. Glossier’s success was fueled by its direct-to-consumer model, leveraging social media and customer feedback to drive product development. By 2019, the company had achieved a valuation of $1.2 billion, solidifying its status as a major player in the beauty industry.

Weiss’s leadership style was characterized by a deep understanding of her audience and a commitment to authenticity.However, the company faced challenges, including critiques about workplace inclusivity and the need for broader representation. In May 2022, Weiss stepped down as CEO, transitioning to the role of executive chairwoman to focus on strategic initiatives and motherhood. Her journey from blogger to beauty mogul underscores the power of community-driven branding and the evolving landscape of consumer engagement.

Zhang Xin, SOHO China

Zhang Xin is a renowned Chinese entrepreneur and co-founder of SOHO China, one of the country’s leading real estate developers. Born in Beijing in 1965, she moved to Hong Kong at the age of 14, where she worked in factories for five years to save money for her education. Her determination led her to the UK, where she earned a Bachelor’s degree in Economics from the University of Sussex (where she studied at the same time as me!) and a Master’s in Development Economics from Cambridge University.

After a stint in investment banking with Goldman Sachs, Zhang returned to Beijing and, alongside her husband Pan Shiyi, founded SOHO China in 1995. Under her leadership, the company became a major force in China’s urban development, completing over 5.5 million square meters (approximately 60 million square feet) of projects in Beijing and Shanghai.Zhang’s vision brought innovative architectural designs to China’s skylines through collaborations with world-renowned architects. In 2014, recognizing the shift in real estate dynamics, Zhang spearheaded the launch of SOHO 3Q, pioneering the coworking space concept in China. This move reflected her adaptability and foresight in addressing the evolving needs of urban professionals.

Beyond her business ventures, Zhang is deeply committed to philanthropy. In 2005, she and her husband established the SOHO China Foundation, focusing on education initiatives to alleviate poverty. The foundation’s notable SOHO China Scholarships have supported approximately 50 Chinese students pursuing undergraduate degrees at prestigious institutions like Harvard, Yale, and the University of Chicago.

Zhang’s contributions have earned her international recognition. In 2014, Forbes listed her among the world’s most powerful women, and she has been acknowledged for her influence in both business and philanthropy. In 2022, she stepped down as CEO of SOHO China to focus on supporting the arts and philanthropic pursuits. She has since taken on the role of Founder of Closer Media, a New York City-based film production company and financier.

Zhang Xin’s journey from factory worker to influential entrepreneur exemplifies resilience, innovation, and a commitment to societal betterment.

Tadashi Yanai, Uniqlo

Tadashi Yanai is a prominent Japanese businessman, best known as the founder and CEO of Fast Retailing Co., Ltd., the parent company of Uniqlo. Born in 1949 in Ube, Yamaguchi Prefecture, Japan, Yanai graduated from Waseda University with a degree in economics and political science. He began his career in his father’s tailoring business, which he transformed into a global retail empire.

Under Yanai’s leadership, Uniqlo evolved from a single store in Hiroshima to an international brand known for its high-quality, affordable, and functional clothing. His innovative approach to retail, emphasizing simplicity, efficiency, and customer satisfaction, set Uniqlo apart in the competitive fashion industry. Yanai’s commitment to continuous improvement and adaptability has been instrumental in Fast Retailing’s global expansion, including significant markets in Asia, Europe, and North America.

Beyond business, Yanai is recognized for his philanthropic efforts and contributions to education. He has donated substantial sums to various causes, including disaster relief and academic institutions. His leadership philosophy, centered on ambition, innovation, and social responsibility, has earned him accolades and positioned him as one of Japan’s most influential business figures.

Zhang Yiming, ByteDance

Zhang Yiming is a Chinese entrepreneur who founded ByteDance, the technology company behind the globally popular app TikTok. Born in 1983 in Longyan, Fujian Province, China, Zhang graduated from Nankai University with a degree in software engineering. He began his career at various tech companies, including Microsoft, before venturing into entrepreneurship.

In 2012, Zhang established ByteDance with the vision of leveraging artificial intelligence to deliver personalized content.The company’s first product, Toutiao, became a leading news aggregation platform in China. However, it was the launch of TikTok (known as Douyin in China) in 2016 that catapulted ByteDance to international prominence. TikTok’s innovative algorithm and user-friendly interface attracted a massive global user base, particularly among younger demographics.

Zhang’s emphasis on a flat organizational structure and data-driven decision-making fostered a culture of rapid innovation at ByteDance. Despite facing regulatory challenges and scrutiny over data privacy, Zhang maintained a focus on global expansion and technological advancement. In 2021, he stepped down as CEO, citing a desire to focus on long-term strategy and innovation. Zhang’s impact on the digital media landscape is profound, having reshaped content consumption and social media engagement worldwide.

Accelerating profitable business growth has become not just a challenge of execution, but one of vision, agility, and strategic leadership. Today’s business environment is shaped by rapid technological change, shifting consumer expectations, geopolitical instability, climate imperatives, and economic volatility. Against this backdrop, leaders are under immense pressure to deliver sustained growth while navigating a landscape that is uncertain, complex, and frequently unpredictable.

At the heart of the challenge is the tension between speed and sustainability. Growing quickly often requires aggressive investments—in marketing, talent, product development, or global expansion. These investments can erode short-term profits and introduce strategic risk. Conversely, focusing too heavily on cost control and profit margins can lead to stagnation, missed opportunities, and underinvestment in innovation. Striking the right balance is especially difficult in rapidly changing markets, where customer needs, technologies, and business models evolve constantly.

Leaders need to become adept at making the right growth bets in an increasingly fragmented world. Traditional markets are saturated, while emerging ones are volatile. New technologies emerge faster than many companies can adapt. In this environment, identifying which opportunities to pursue—and which to avoid—requires leaders to rethink conventional strategy. Long-term planning cycles are being replaced by more adaptive, scenario-based approaches. Yet even as they move quickly, leaders must ensure that every growth initiative is aligned with core capabilities, customer needs, and long-term brand equity. Overextension, or chasing growth at any cost, can undermine profitability and erode strategic focus.

Leaders also face the challenge of balancing innovation with operational discipline. Profitable growth depends not only on breakthrough ideas but on executional excellence—scaling efficiently, managing costs, and maintaining quality. This tension is particularly acute in periods of uncertainty, where resource allocation decisions must be made with incomplete information. The best leaders create organizations that can innovate at the edges while staying grounded in strong business fundamentals.

At the same time, the leadership challenge is increasingly about building cultures that can thrive in ambiguity. Organizational agility, speed, and resilience have become competitive differentiators. This requires more than adopting agile methods or digital tools; it demands a fundamental shift in mindset. Leaders must empower teams to take initiative, embrace experimentation, and learn quickly from failure. Hierarchical, risk-averse cultures that once protected profits may now inhibit growth. Shaping a more entrepreneurial, adaptive culture is one of the most difficult—and essential—tasks for today’s executives.

The people dimension of leadership is equally critical. Amid a generational shift in workforce expectations, businesses must align growth ambitions with purpose, inclusivity, and sustainability. Employees want to work for companies that stand for more than just shareholder value. Customers expect brands to take a stand. Growth strategies that fail to address these shifts risk backlash, disengagement, or irrelevance. Strategic growth in today’s world must be both profitable and responsible.

Moreover, the external environment adds layers of complexity. Trade tensions, inflation, regulatory changes, and geopolitical risks can rapidly reshape market dynamics. Leaders must be fluent in macroeconomics and geopolitics, not just balance sheets. They must also develop organizations that are capable of sensing change early and responding decisively. This requires robust data systems, scenario thinking, and a strong leadership bench that can navigate through turbulence.

In this context, accelerating profitable growth is not just about scaling up—it’s about building organizations that are bold, resilient, and adaptable. Strategic clarity, cultural alignment, and visionary leadership have become the new cornerstones of sustainable success in an age of relentless change.

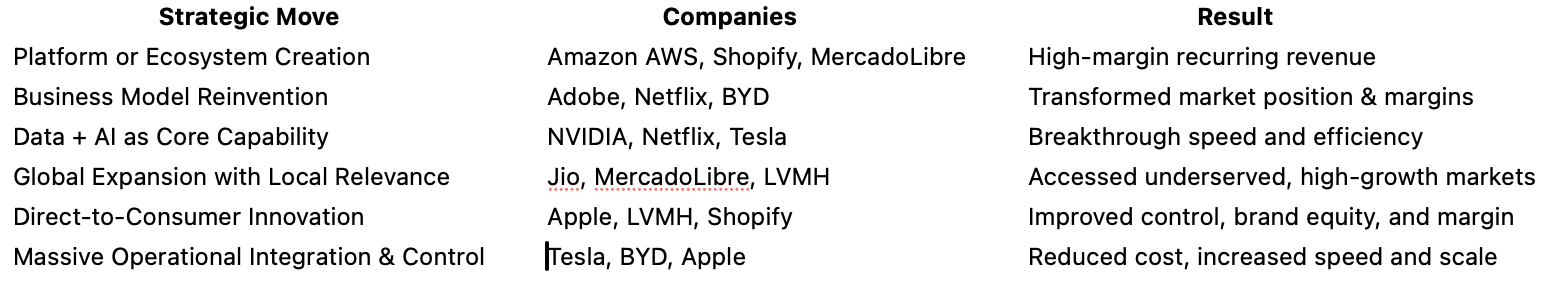

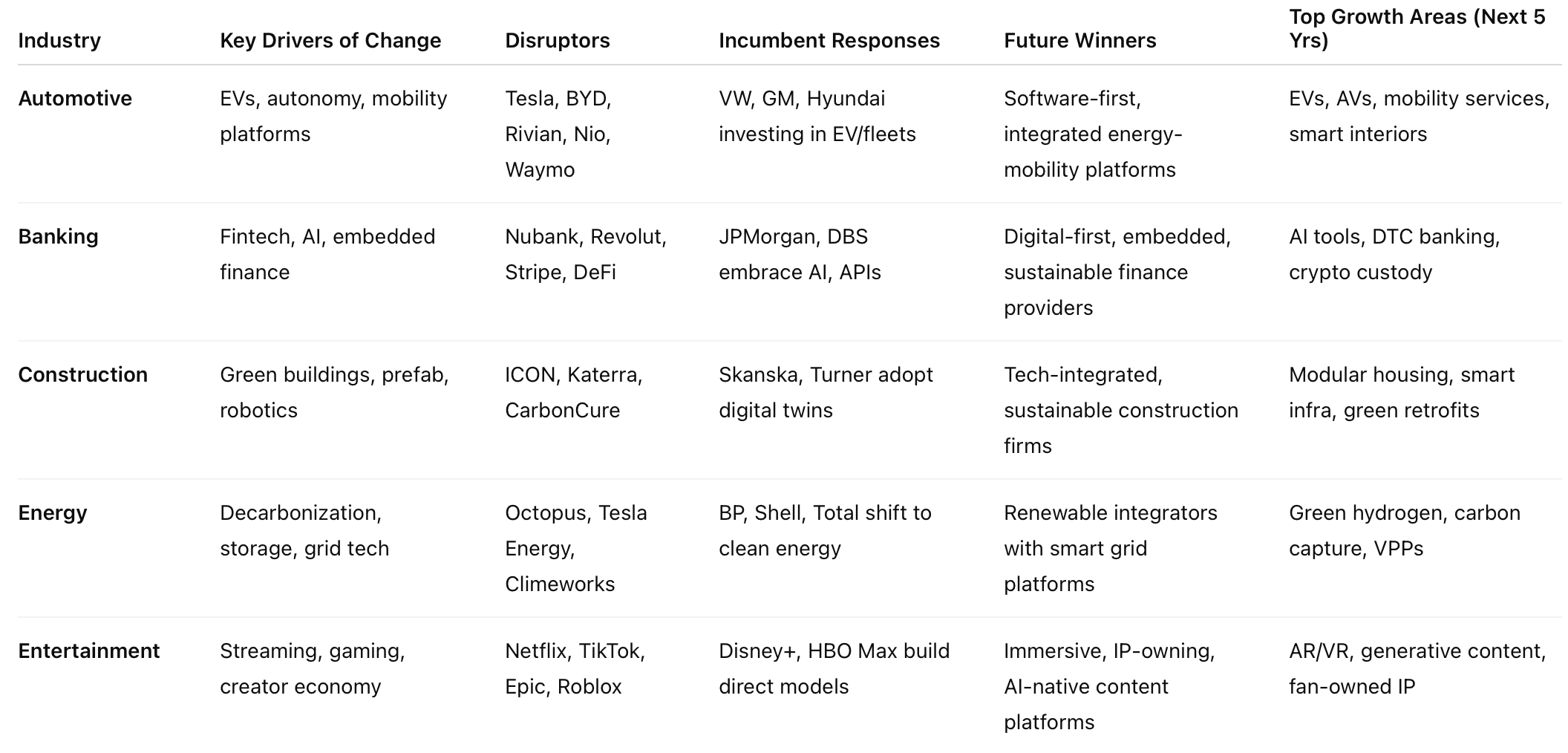

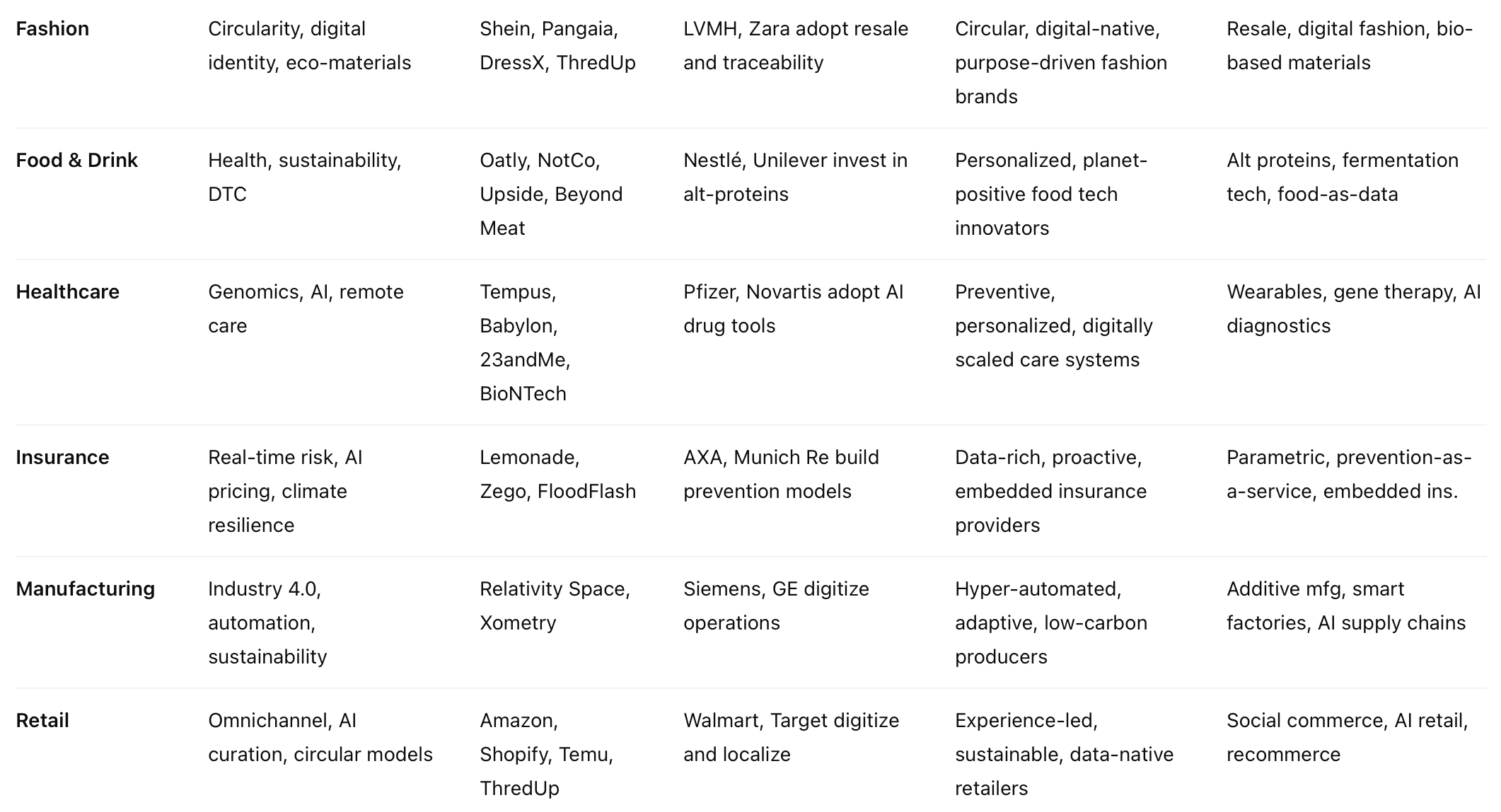

Growth champions

Here are real-world examples of larger companies (not just startups) from around the world that have achieved exponential, supercharged, and profitable growth—along with what they did and the results they achieved.

AWS … the power of cloud

Growth strategy:

-

Transformed Amazon’s internal infrastructure into a cloud services platform for the world.

-

Scaled a highly profitable, usage-based SaaS business while others still sold physical servers.

-

Offered APIs and tools that enabled startups and enterprises to build rapidly.

Growth impact:

-

Became the profit engine for Amazon: ~$90B revenue (2023), ~30% operating margin.

-

Powers a massive portion of the global internet economy.

-

Enabled Amazon to subsidize retail operations and expand into healthcare, devices, and AI.

Apple … ecosystem growth engines

Growth strategy:

-

Shifted from being a hardware innovator to building a services ecosystem (App Store, iCloud, Music, Pay).

-

Designed a closed ecosystem with high customer lock-in and premium branding.

-

Invested heavily in proprietary chips and vertical integration.

Growth impact:

-

Gross margins regularly exceed 42%.

-

Apple Services segment alone generates $80B+ annually, with higher margins than devices.

-

Became the world’s first $3 trillion company (2022).

BYD … from batteries to automobiles

Growth strategy:

-

Transitioned from battery maker to EV and hybrid vehicle giant.

-

Developed a closed-loop model with internal batteries, chips, and semiconductors.

-

Benefited from Chinese government incentives and global demand for affordable EVs.

Growth impact:

-

Surpassed Tesla in EV sales (2023) in certain quarters.

-

Revenue grew to $75B+, with strong profitability.

-

Expanded to global markets (Europe, Asia, LATAM), becoming a key global EV player.

Shopify … enabling every store to be global

Growth strategy:

-

Democratized e-commerce with an intuitive platform for SMBs and creators.

-

Avoided competing with Amazon directly; instead built tools and an app marketplace.

-

Integrated payments, logistics, and marketing into its platform.

Growth impact:

-

Revenue grew from $205M (2015) to over $7B (2023).

-

Reached profitability in key quarters while maintaining strong reinvestment.

-

Became one of Canada’s most valuable companies, with a global merchant base.

Netflix … making and streaming movies

Growth strategy:

-

Moved from DVD rentals to a streaming-first, content-producing tech platform.

-

Leveraged data analytics and AI to drive content investments and personalization.

-

Scaled globally fast with local content in multiple markets.

Growth impact:

-

From 22M subscribers (2011) to 260M+ globally (2024).

-

High user retention and average revenue per user (ARPU).

-

Operating margins grew from single digits to over 20% in recent years.

Nvidia … chips to power the future

Growth strategy:

-

Pivoted from graphics chips to powering AI, data centers, and deep learning.

-

Developed CUDA, a platform that made GPUs essential for modern AI work.

-

Benefited massively from the generative AI and LLM boom.

Growth impact:

-

Stock price rose over 20x between 2016 and 2024.

-

Became a $2 trillion company and one of the most profitable chipmakers globally.

-

Gross margins regularly exceed 65%, with exponential revenue growth.

Reliance Jio … from petrochemicals to super apps

Growth strategy:

-

Launched ultra-low-cost mobile data and telecom services to underserved masses.

-

Bundled services like streaming, messaging, and payments.

-

Funded through Reliance Industries’ oil & gas business, and then spun into a digital platform.

Growth impact:

-

Gained 400M+ subscribers in under 5 years.

-

Drove India’s digital transformation and increased data consumption 10x.

-

Raised billions from global investors (Facebook, Google), valuing Jio at over $65B.

LVMH … unlocking the brand portfolio

Growth strategy:

-

Consolidated luxury brands across fashion, jewelry, wines, and cosmetics.

-

Preserved brand exclusivity while digitally modernizing marketing and direct-to-consumer.

-

Expanded aggressively into Asia, especially China.

Growth impact:

-

Became the world’s most valuable luxury company ($500B+ market cap).

-

Operating margin over 25%, with strong pricing power and global brand dominance.

-

Acquisitions like Tiffany & Co. strengthened portfolio and cross-brand synergy.

MercadoLibre … the digital backbone of Latin America

Growth strategy:

-

Built the “Amazon + PayPal of Latin America” with e-commerce, logistics, and fintech.

-

Created MercadoPago to solve payments for the unbanked.

-

Scaled across 18+ countries, solving local infrastructure challenges.

Growth impact:

-

Market cap surged from ~$5B (2015) to $80B+ (2024).

-

Maintained profitability with strong user growth and low CAC.

-

MercadoPago is now a major fintech player across LATAM.

Tesla … not just cars, but an energy business

Growth strategy:

-

Redefined the electric vehicle market with a vertically integrated, software-first business model.

-

Built its own battery tech, charging infrastructure, and AI-based self-driving system.

-

Positioned itself not just as a carmaker but as an energy + tech company.

Growth impact:

-

Market cap surged from ~$50B in 2017 to over $750B by 2024.

-

Delivered profitability across multiple years, despite high capital investment.

-

Created one of the most profitable vehicle businesses globally (per unit gross margin).

Growth leaders

Accelerating business growth is a top priority for leaders across industries and geographies. Yet, their approaches often reflect a combination of bold vision, customer obsession, innovation, and adaptability.

Satya Nadella, CEO of Microsoft, emphasizes the power of continuous transformation:

“Our industry does not respect tradition—it only respects innovation. You have to be willing to be in a constant state of renewal to drive growth.”

Nadella’s strategy has centered on reinventing Microsoft’s core business through cloud computing, AI, and enterprise services—leading to a dramatic turnaround and more than tripling of its market value since 2014.

Melanie Perkins, CEO of Canva, focuses on simplicity and scale:

“We set out to solve a real problem for people. If you truly democratize access to a tool, growth becomes exponential.”

Canva’s easy-to-use design platform now serves over 150 million users, largely driven by word-of-mouth and product-led growth.

Dara Khosrowshahi, CEO of Uber, stresses customer-centric agility:

“Growth is not just about more—it’s about better. We grow when we serve more people more effectively, not just when we expand our footprint.”

Under his leadership, Uber has diversified into delivery, freight, and new mobility formats, driving both expansion and efficiency.

Reed Hastings, co-founder of Netflix, ties growth to culture and speed:

“Don’t tolerate brilliant jerks. The cost to teamwork is too high. And don’t wait—speed is the number one thing we focus on.”

Netflix’s willingness to pivot—from DVDs to streaming, then to content production—has powered global subscriber growth and brand dominance.

From digital disruptors to legacy turnarounds, today’s most effective leaders understand that growth is less about scale for its own sake—and more about evolving with purpose, speed, and clarity.

Growth frameworks

Here are some of the most powerful concepts, models, and frameworks for accelerating business growth today.

1. The Flywheel Model

Popularized by Jim Collins and adopted by companies like Amazon and HubSpot, the flywheel model redefines how businesses think about growth. Unlike the traditional sales funnel, which ends after conversion, the flywheel emphasizes momentum and continuous customer engagement.

The flywheel has three key phases:

- Attract: Draw in prospects through valuable content, branding, and thought leadership.

- Engage: Nurture leads through meaningful interactions, personalized experiences, and exceptional service.

- Delight: Turn customers into promoters through consistent value and support, creating referrals and repeat business.

What makes the flywheel powerful is its self-reinforcing nature—each delighted customer adds energy to the system, generating exponential growth through loyalty and word-of-mouth.

2. The Growth Loops Framework

Growth loops are another evolution beyond funnels. Instead of a linear model where leads go in and customers come out, growth loops are systems where the output of one cycle becomes the input of the next. For example:

- Content Loop: Users create content → more content attracts users → those users create more content (e.g., YouTube, Reddit).

- Referral Loop: A user refers a friend → the friend signs up and refers others → loop continues (e.g., Dropbox, Uber).

- Product Loop: Usage of the product drives value that attracts new users (e.g., Figma’s collaboration features).

Unlike one-off marketing tactics, growth loops embed growth into the product experience itself, enabling compounding returns over time.

3. The Jobs to Be Done (JTBD) Theory

Developed by Clayton Christensen, JTBD helps businesses understand the true motivations behind customer decisions. Instead of focusing on demographics or product features, JTBD asks: “What job is the customer hiring this product to do?”

For example, a person buying a drill doesn’t really want a drill—they want a hole in the wall. Or deeper still, they want to hang a family photo, which may be about creating a feeling of home. Understanding these emotional and functional jobs unlocks innovation, differentiation, and more targeted growth strategies.

JTBD encourages:

- Customer-centric product development

- Better marketing messages

- Disruption of entrenched competitors by meeting overlooked needs

4. Blue Ocean Strategy

Developed by W. Chan Kim and Renée Mauborgne, this framework helps companies escape the bloody waters of “red ocean” competition by creating entirely new markets or “blue oceans.”

Key tools within the strategy include:

- The Strategy Canvas: Visualize how competitors compete and where to differentiate.

- The Four Actions Framework: Ask what to Eliminate, Reduce, Raise, and Create to deliver a unique offering.

Companies like Cirque du Soleil and Tesla used blue ocean thinking to create entirely new customer value propositions, achieving rapid and defensible growth. It’s a powerful framework for innovation-led growth rather than price-led battles.

5. The Ansoff Matrix

A classic model still relevant today, the Ansoff Matrix outlines four main strategies for growth:

- Market Penetration: Sell more of the same product in the same market (e.g., promotions, loyalty programs).

- Market Development: Enter new markets with existing products (e.g., international expansion).

- Product Development: Develop new products for the current market (e.g., upsells, feature enhancements).

- Diversification: Enter new markets with new products (e.g., launching a new business unit).

Each strategy comes with its own risks and rewards. The matrix helps leaders weigh those tradeoffs and decide where to place their bets.

6. The Lean Startup Methodology

Ideal for both startups and established businesses launching new initiatives, Lean Startup encourages fast, iterative growth based on customer feedback.

Key principles include:

- Build-Measure-Learn loop: Quickly build a Minimum Viable Product (MVP), measure user response, and learn what works.

- Validated learning: Use experiments and real-world data to guide decisions rather than assumptions.

- Pivot or persevere: Adjust course quickly based on what you learn.

Companies like Dropbox and Airbnb used lean principles to accelerate early growth by reducing time to market and adapting rapidly to customer needs.

7. Moonshot Thinking

Coined by Google and championed by Moonshot thinkers, 10x Thinking is the idea of aiming for 10 times improvement rather than incremental gains.

This forces radical creativity: Instead of asking “How can we increase revenue by 10%?” ask “How can we grow it 10x?” This approach unlocks:

- Bold innovation

- Systems redesign

- Disruption of legacy models

Companies like SpaceX, Google X, and OpenAI thrive on 10x thinking. It reframes limitations as creative constraints and can spark revolutionary growth strategies.

8. OKRs (Objectives and Key Results)

OKRs, popularized by Intel and adopted by Google, are a goal-setting framework that aligns teams around ambitious objectives with measurable results.

Each OKR consists of:

- Objective: A clear, qualitative goal (e.g., “Become the market leader in AI-enabled design tools”)

- Key Results: Quantifiable outcomes that measure progress (e.g., “Acquire 1M users by Q4,” “Increase NPS to 75+”)

OKRs keep teams focused, aligned, and accountable, while encouraging stretch goals. Growth-driven companies use them to track what truly matters.

9. The Business Model Canvas

Developed by Alexander Osterwalder, the Business Model Canvas offers a one-page visual representation of how a business creates, delivers, and captures value.

It breaks a business down into nine essential building blocks, including:

- Value Propositions

- Customer Segments

- Channels

- Revenue Streams

- Key Partnerships

The canvas helps leaders identify growth levers, spot weaknesses, and quickly prototype new business models—especially helpful when adapting to market shifts or launching new offerings.

10. Pirate Metrics (AARRR Framework)

Developed by Dave McClure, the AARRR framework breaks down the customer lifecycle into five key stages:

- Acquisition – How do users find you?

- Activation – Do they have a great first experience?

- Retention – Do they come back?

- Referral – Do they tell others?

- Revenue – Do they generate income?

This metric-driven framework helps businesses optimize each stage of the funnel with data, enabling sustainable growth. It’s especially popular in SaaS and digital startups, but adaptable to most industries.

What’s the best tool for you?

There’s no one-size-fits-all approach to growth. The best businesses combine these frameworks based on their industry, maturity, goals, and culture. Some will focus on product-led growth, others on ecosystem expansion. But all successful growth strategies share a few things in common: a deep understanding of customer needs, the ability to adapt fast, and the discipline to measure what matters.

To accelerate business growth, don’t just chase tactics. Build a system. Use models like the Flywheel, JTBD, Lean Startup, and OKRs not just as tools—but as ways of thinking. In an era where change is constant, the ability to reinvent, test, and scale is the ultimate growth engine.

Growth Accelerators

The best growth accelerators are strategies, tactics, and capabilities that businesses use to supercharge their growth trajectory—not just by increasing revenue, but by doing so profitably, efficiently, and sustainably. These accelerators span technology, strategy, innovation, marketing, operations, and leadership—and the most successful companies often combine multiple levers simultaneously.

Here’s a breakdown of some of the most powerful and widely adopted growth accelerators, with real-world examples from companies around the world.

1. Platform & Ecosystem Models

Turn your business into a platform where others create value with you.

-

What it does: Creates network effects, reduces cost of growth, expands customer reach.

-

Examples:

-

Apple (App Store): Developers build apps → more users → more device sales.

-

Shopify: Built an e-commerce platform enabling millions of merchants; ecosystem partners do the selling, development, and services.

-

-

Impact: High-margin, scalable growth with minimal cost per new transaction.

2. Digital Transformation & Automation

Use data, AI, and automation to scale faster and smarter.

-

What it does: Increases efficiency, improves decision-making, enables hyper-personalization, lowers customer acquisition and retention costs.

-

Examples:

-

Unilever: Uses AI to optimize marketing ROI and demand forecasting.

-

Schneider Electric: Built smart energy platforms using IoT and AI.

-

-

Impact: Boosts profit margins while accelerating innovation cycles.

3. Customer-Centric Innovation

Design around what customers truly need—not what you want to sell.

-

What it does: Drives product-market fit, reduces churn, increases CLV.

-

Examples:

-

Netflix: Shifted from DVD rental to streaming, then to original content based on viewing behavior.

-

L’Oréal: Uses AI and AR to personalize beauty products and recommendations.

-

-

Impact: Faster uptake, stronger brand loyalty, more repeat business.

4. Subscription & Recurring Revenue Models

Switch from one-time transactions to ongoing relationships.

-

What it does: Provides predictable, scalable, and higher-margin revenue.

-

Examples:

-

Adobe: Moved from boxed software to Creative Cloud subscription—tripled revenue and boosted margins.

-

BMW & Porsche: Testing subscription-based access to car fleets (mobility-as-a-service).

-

-

Impact: Higher customer lifetime value and stable cash flow to reinvest in growth.

5. Brand-Led Growth & Community Building

Build brand equity and emotional connection to fuel organic expansion.

-

What it does: Reduces CAC, increases retention and referrals, builds pricing power.

-

Examples:

-

Nike: Fuses community, lifestyle content, and digital experiences (Nike Run Club, SNKRS app).

-

Patagonia: Purpose-driven branding created a loyal, activist customer base.

-

-

Impact: Stronger differentiation and long-term customer value.

6. Data Monetization & AI-Driven Insights

Turn data into new products, services, and predictive capabilities.

-

What it does: Opens new revenue streams and drives smarter decisions.

-

Examples:

-

Amazon Web Services (AWS): Built tools for companies to monetize their own data.

-

Uber: Uses ride data to optimize pricing, routes, and driver incentives.

-

-

Impact: Data becomes an asset that multiplies value creation.

7. Aggressive Global or Adjacent Market Expansion

Enter new geographies or verticals with tailored offerings.

-

What it does: Unlocks scale quickly, diversifies risk, leverages brand and IP.

-

Examples:

-

Starbucks: Used hyper-local store design and product menus to expand globally.

-

Tesla: Expanded from luxury EVs to energy storage and grid solutions.

-

-

Impact: Large revenue boosts with relatively low R&D cost if done strategically.

8. Strategic M&A and Venture Investments

Buy, invest in, or partner with innovative companies to accelerate capabilities.

-

What it does: Provides instant access to new tech, markets, or teams.

-

Examples:

-

Facebook (Meta): Acquired Instagram, WhatsApp, and Oculus to dominate social and VR.

-

Google (Alphabet): Acquired YouTube and DeepMind to become AI-first.

-

-

Impact: Rapid acceleration beyond organic growth capacity.

9. Agile Operating Models

Adopt lean, cross-functional teams that can adapt fast and iterate quickly.

-

What it does: Shortens innovation cycles, improves responsiveness to market shifts.

-

Examples:

-

Spotify: Scaled its engineering culture through “squads” and “tribes.”

-

Amazon: “Two-pizza teams” enable autonomy and innovation across the company.

-

-

Impact: Speed becomes a competitive advantage.

10. Sustainability as a Growth Driver

Turn climate action and ESG into strategic growth opportunities.

-

What it does: Attracts talent, opens new markets, aligns with regulatory trends.

-

Examples:

-

Ørsted: Pivoted from fossil fuels to renewable energy and became a global leader.

-

IKEA: Committed to climate-positive operations and circular product design.

-

-

Impact: Growth aligned with future-proof, planet-positive business models.

- Megatrends 2035: the 6 dramatic forces shaking up every market

- Accelerating Growth: leading in a world of uncertainty, change, and opportunity

- Next Generation Business Models: redefining value, reinvented with AI

- Vodafone CEO Accelerator: preparing today’s business leaders to shape tomorrow’s opportunities

The global telecommunications industry is undergoing a profound transformation. As connectivity becomes ubiquitous and commoditized, telcos face an existential choice: evolve beyond the traditional “dumb pipe” model or risk irrelevance. The telco of the future must become an intelligent, human-centric platform that embeds itself into everyday life and business operations. By embracing AI, edge computing, digital services, and platform thinking, telcos can move from infrastructure providers to orchestrators of integrated, personalized, and predictive services.

The end of the dumb pipe