Growth Champions … Amazon to Authentic, Coca-Cola and Crocs, Nubank to Nvidia, Tencent and Tesla … How the most successful companies drive, sustain and accelerate profitable growth.

January 30, 2024

Growth is the oxygen of business. It is a relentless journey towards better. It doesn’t necessarily mean being the biggest, but it does mean driving progress. Doing more, achieving more. Yes, over time, it needs to be profitable. And yes it needs to be sustainable, enduring and with positive impact.

So what drives, sustains, and accelerates, profitable growth?

Here we explore some of the most interesting growth companies, with links to their latest performance – selected to demonstrate the different approaches to growth, as well as their performance:

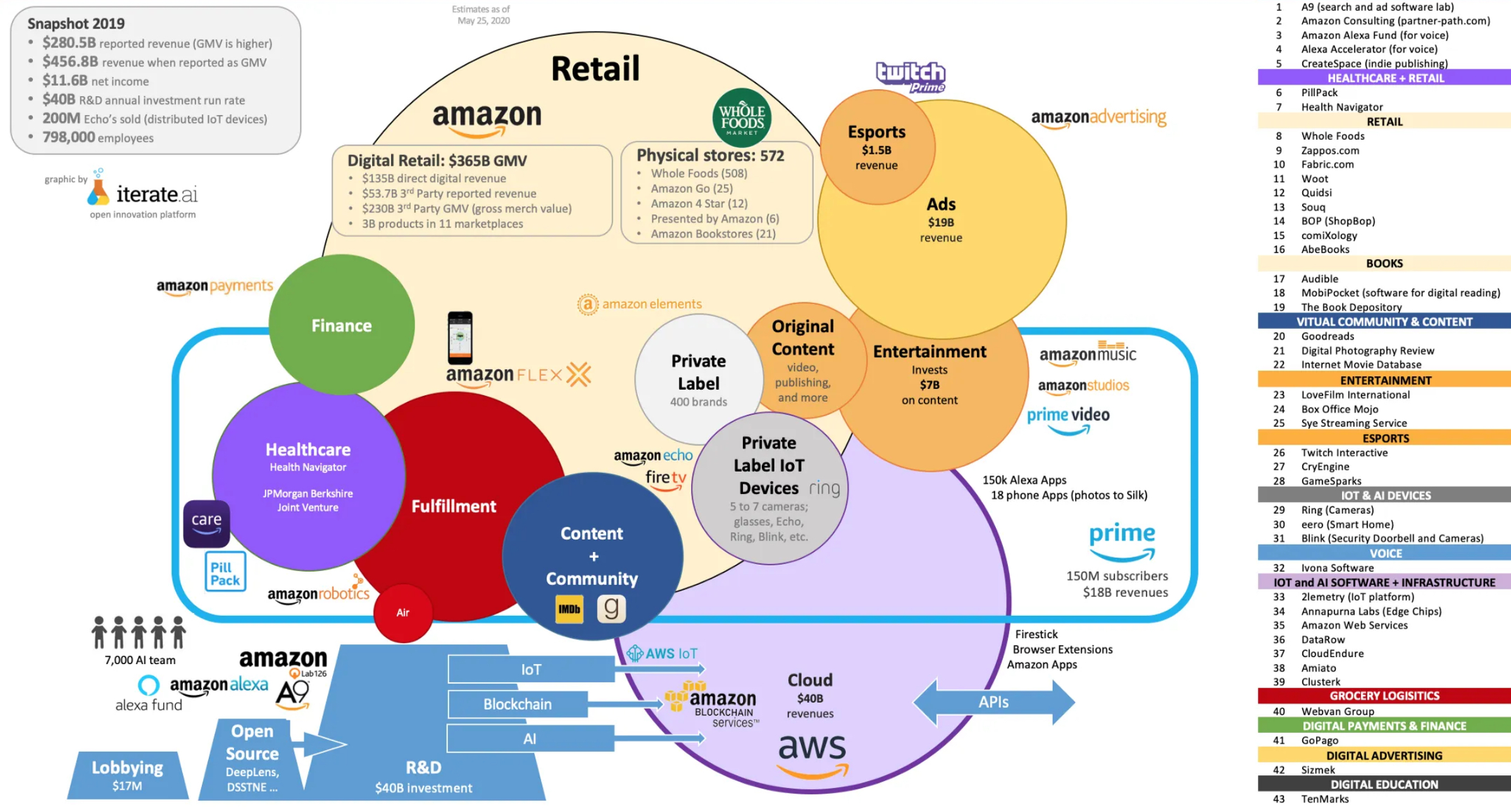

Growth Champion: Amazon

“Earth’s most customer-centric company” has been a relentless growth business for over more than 25 years, from online bookstore to everything store, since Jeff Bezos started out in his garage, back in 1994. Critical to growth has been a long-term perspective, driven initially by private ownership, extension to a marketplace platform, the broader partner ecosystem, the flywheel model, Prime customer membership, and its most profitable business, AWS.

- Amazon

- Amazon Case Study (Strategos Institute)

- Amazon Strategy Teardown (CB Insights)

- How Amazon built a Growth Ecosystem (Growth Hackers)

- Amazon Profile and Jeff Bezos Profile (Peter Fisk)

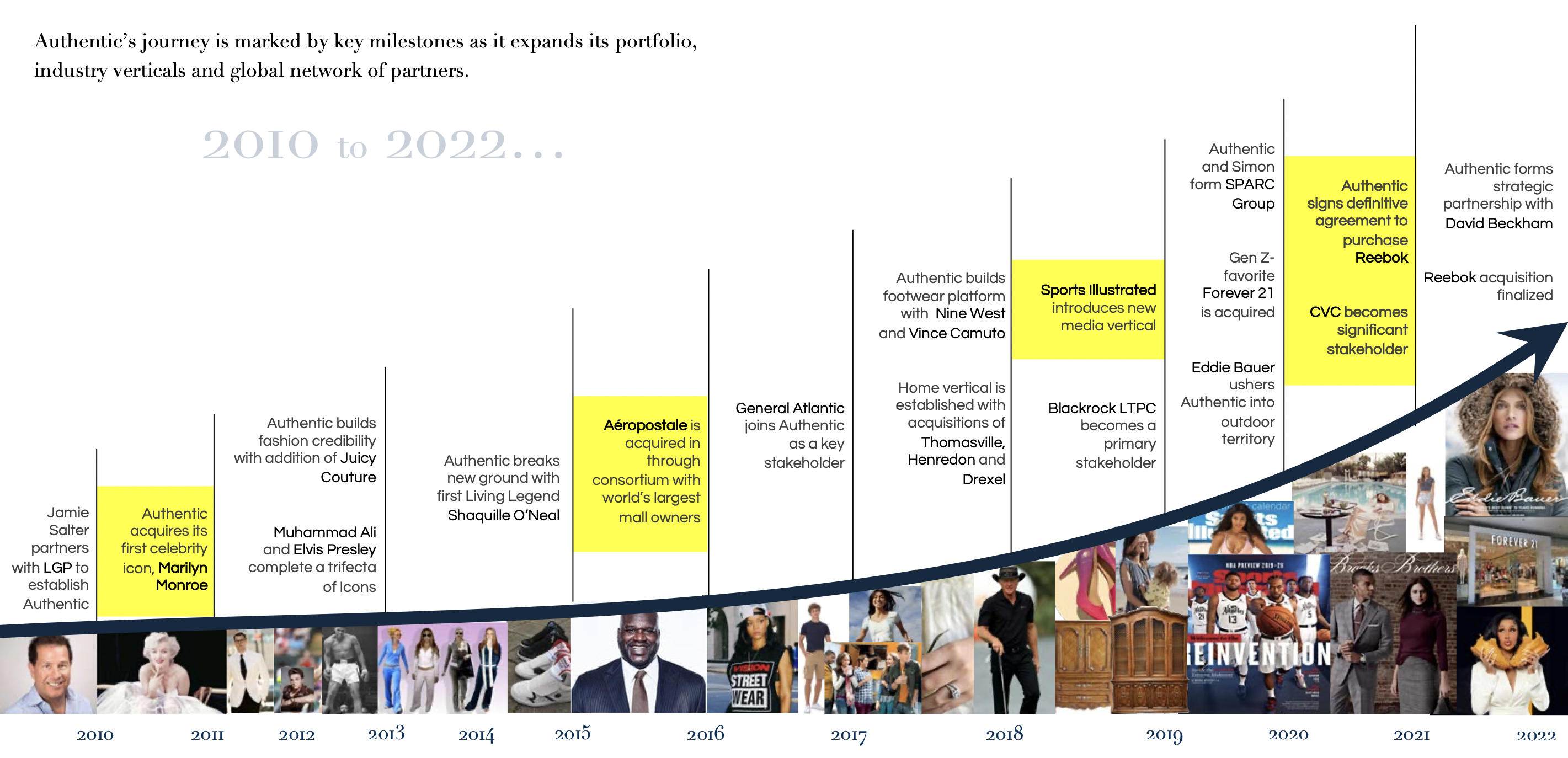

Growth Champion: Authentic Brands

Jamie Salter leads Authentic, experts in taking tired old brands and finding new growth. Authentic started with celebrity brands – like Marilyn Monroe and Elvis Presley, and more recently David Beckham. Since then it has rejuvenated brands including Reebok, Forever 21, Juicy Couture, Nine West, and Ted Baker. The business model is to take charge of the brand and business strategy, while leaving partners to operate, and create synergies between brands.

- Authentic Brands Group

- Authentic Brands Investor Presentation 2022

- Adidas sells Reebok to Authentic Brands for $2.3bn

- Jamie Salter Interview (Drapers, 2024)

- Authentic Brands Profile (Peter Fisk)

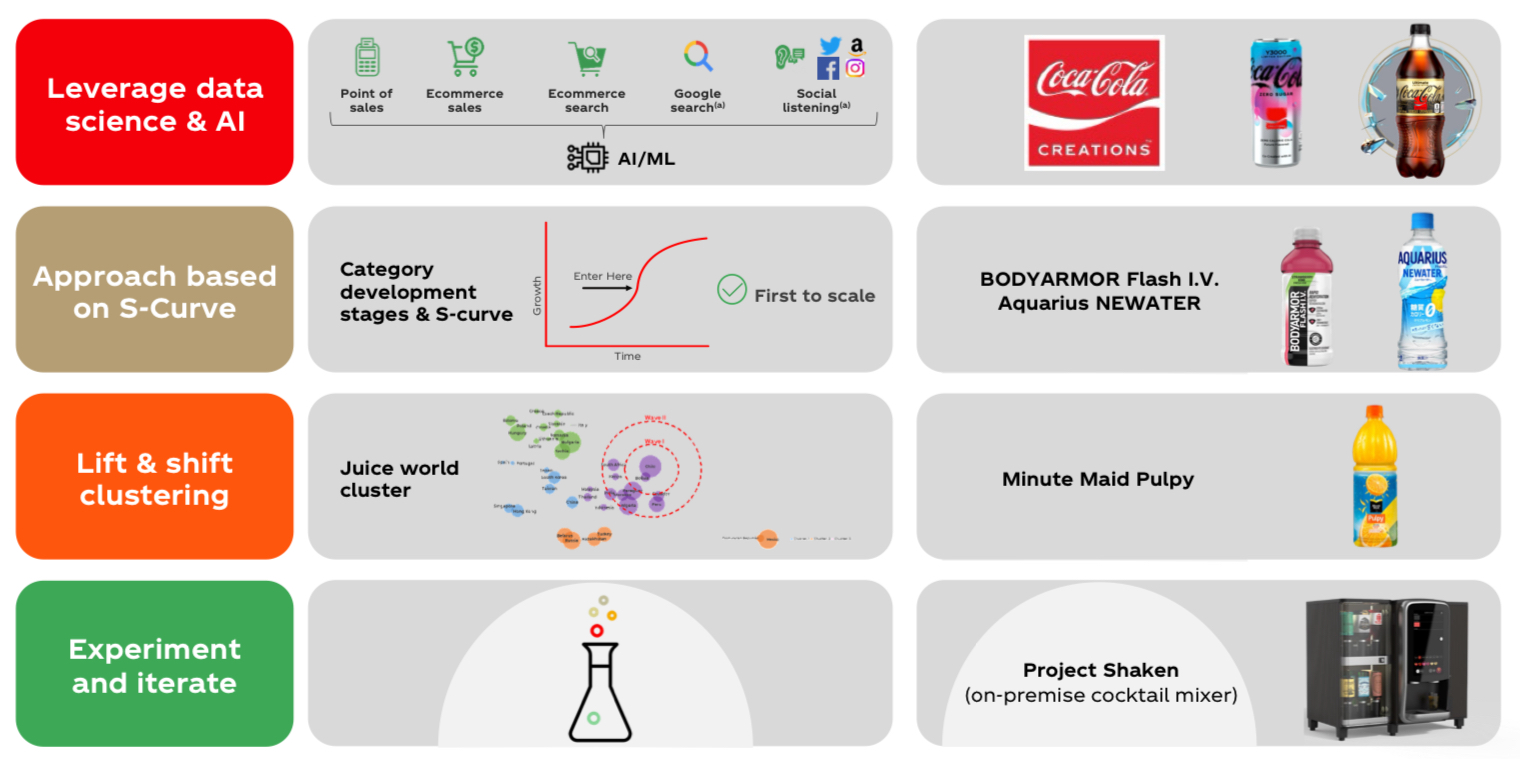

Growth Champion: Coca-Cola

Growth becomes harder as a business matures. Coca-Cola has learnt to keep evolving as markets, consumer tastes and cultures change. Key has been to retain a “human-centric” approach to brand experience, with deep insight into consumers, and the broader cultural context, leading to identifying new niches, new products, new channels, new engagement, and an ever-shifting portfolio. Innovation examples include AI-driven Coca Cola Creations, and Project Shaken, a cocktail mixer.

- The Coca-Cola Company

- Coca Cola Investor Overview Q3 2023

- Raising the Bar: Marketing and Innovation Q3 2023

- Coca Cola HBC Investor Day 2023

- Coke y3000 future magic (Peter Fisk)

Growth Champion: Crocs

People who love to hate Crocs had cause to celebrate in 2008, when investors were writing the company off as a passing fad. Crocs lost over $185 million that year and stock plunged to just over $1 a share from a high of about $69 a year earlier. But now they are back from the dead, sold 700 million pairs in the last decade, and have become a cultural icon. Crocs are a top brand among Gen Z. And limited edition Crocs are selling for up to $1,000 on the resale market.

Growth Champion: Essilor Luxottica

The Italian French company is the global leader in the design, manufacture and distribution of eyewear. It licenses many leading brands to develop premium eyewear including Ray-Ban, Oakley, Costa, Vogue Eyewear and Persol. It offers superior shopping and patient experiences with a network of 18,000 stores including world-class retail brands like Sunglass Hut, LensCrafters, Salmoiraghi & Viganò and GrandVision.

- Essilor Luxottica

- Essilor Luxottica at a glance

- Capital Markets Day 2022

- Results Presentation Q3 2023

- Essilor Luxottica Profile (Peter Fisk)

Growth Champion: LVMH

LVMH, from Christian Dior to over 70 luxury brands, including Louis Vuitton and Givenchy, Sephora and Tiffany, has multiplied 20 times in market value under the leadership of Bernard Arnault. In 1984 he spotted an opportunity to acquire a finance company that had lost its way, but still owned some interesting assets including Christian Dior, and department store Le Bon Marche. He quickly set about refocusing the business and reenergising its best assets for a changing world.

- LVMH

- LVMH Snapshot 2024

- LVMH Group Presentation 2023

- LVMH Annual Report 2023

- Bernard Arnault Profile (Peter Fisk)

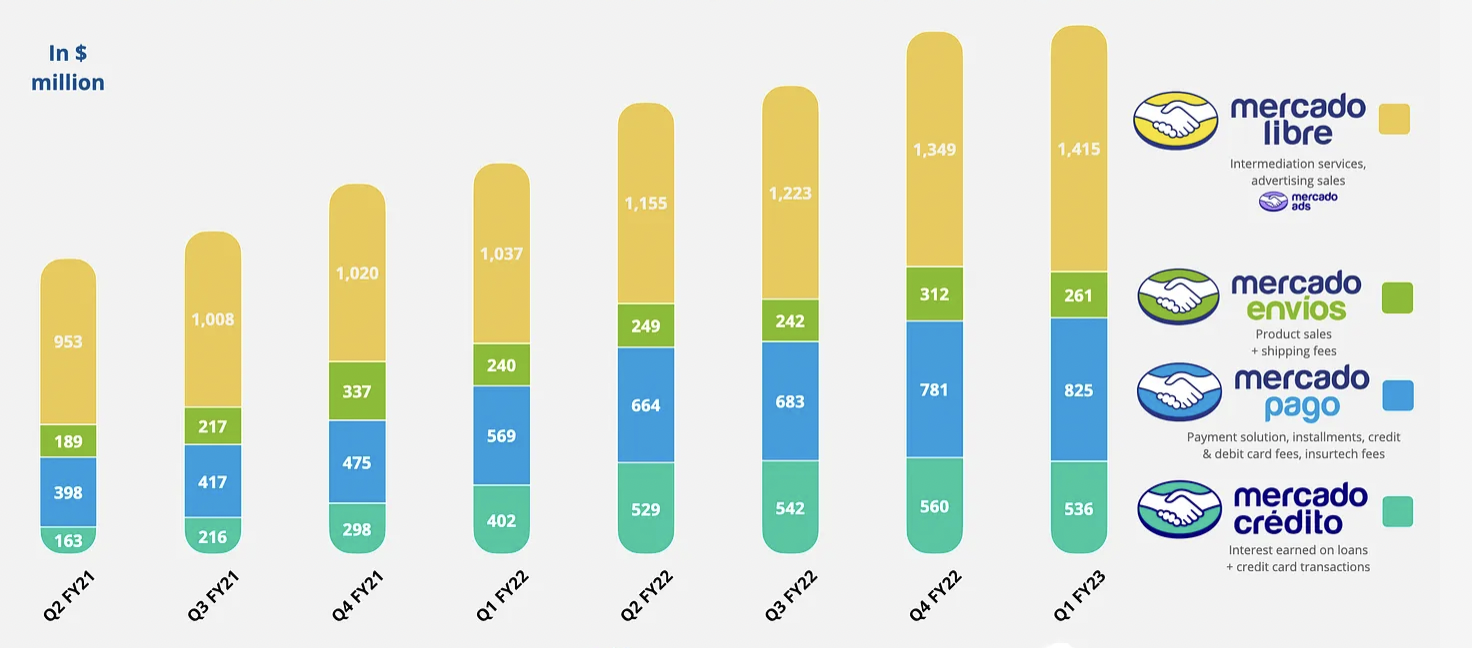

Growth Champion: Mercado Libre

Mercado Libre is on a mission “to democratize commerce and financial services to transform the lives of millions of people in Latin America”. It hosts the largest online commerce and payments ecosystem in Latin America, and operates in 18 countries, although Brazil alone accounts for 65% of its revenue, growing to 96% when including Argentina and Mexico. MELI was founded in 1999 by Marcos Galperin and two colleagues while at Stanford.

- Mercado Libre

- Mercado Libre Institutional Presentation 2023

- Six Stories of Mercado Libre (The Generalist)

- Marcos Galperin Profile (Peter Fisk)

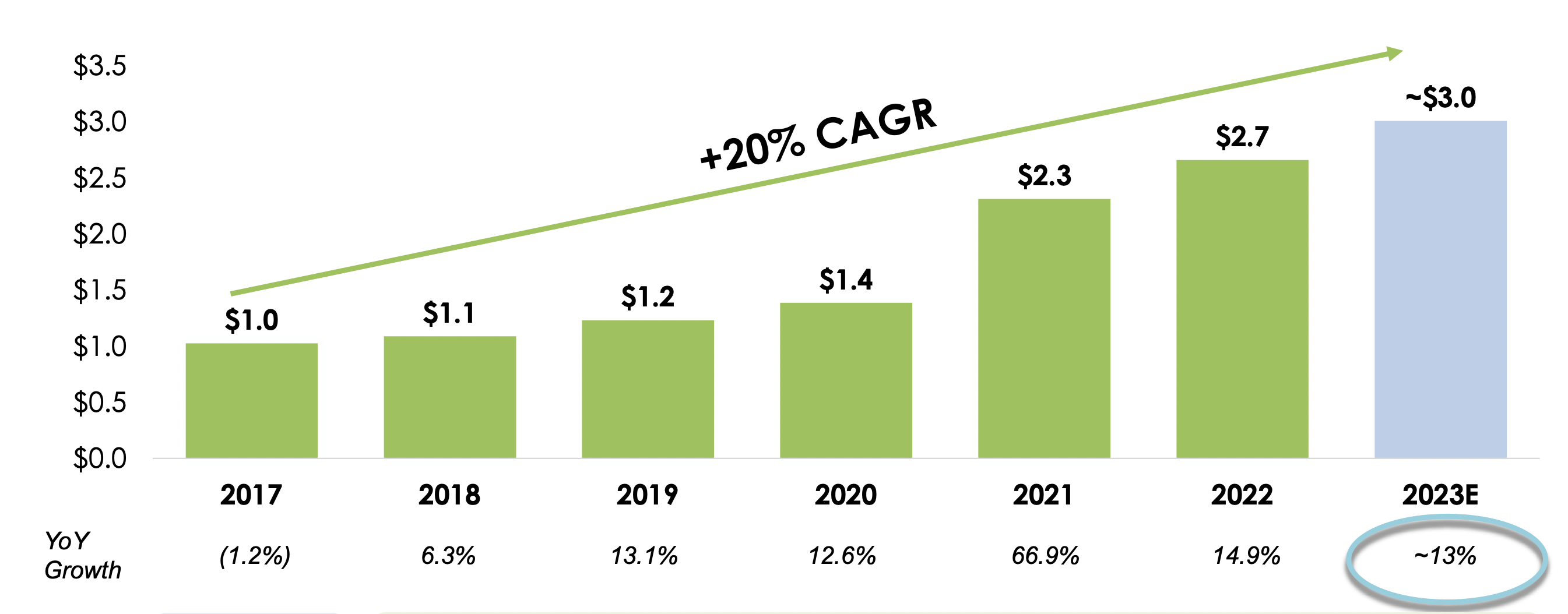

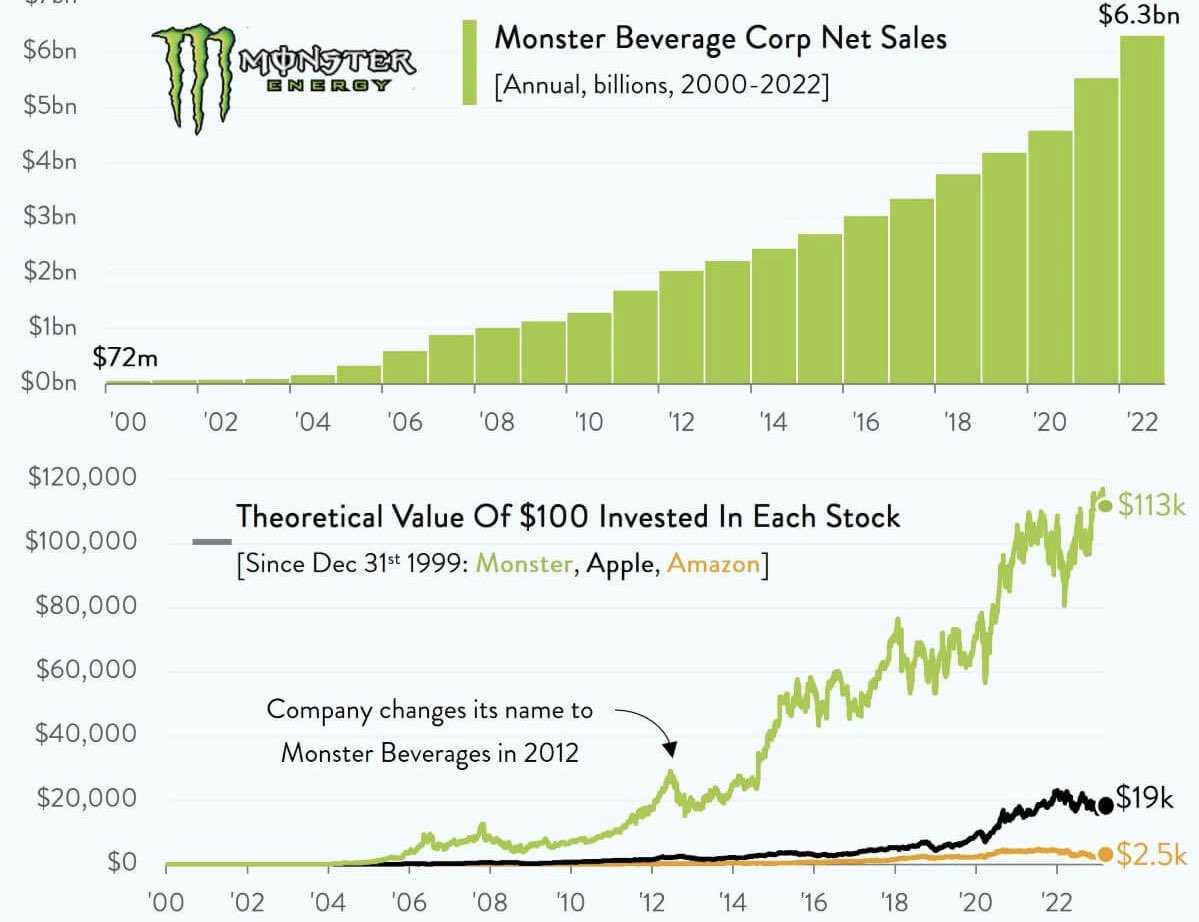

Growth Champion: Monster Beverage

Monster Beverage is the top-performing US business of the past 30 years – a $1,000 investment in 1994 would be worth $2,000,000 today (+200,000% gain). It produces a range of energy drinks including Monster Energy, Relentless and Burn, but was originally founded as Hansen’s in 1935 in Southern California, selling juice products. Monster is 20% owned by Coca-Cola and benefits from distribution through its global network.

- Monster Investor Presentation 2024

- Monster Annual Report 2022

- Monster Design Case Study

- Monster Profile by Peter Fisk

Growth Champion: Novo Nordisk

Novo Nordisk is a global healthcare company, based in Denmark, with more than 90 years of innovation and leadership with a clear focus on diabetes care. It’s innovation is patient-centric, focused on what it can be best at, and delivered by one of the world’s most sustainable companies. Most recently, a new diabetes drug Ozempic was found to have remarkable side effects, creating significant weight loss in patients. It has now become the world’s most in-demand obesity drug.

- Novo Nordisk

- Novo Nordisk Investor Presentation Q3 2023

- Novo Nordisk Corporate Strategy, Capital Markets Day 2022

- Ozempic makes NN Europe’s most valuable company (Peter Fisk)

- Novo Nordisk Profile (Peter Fisk)

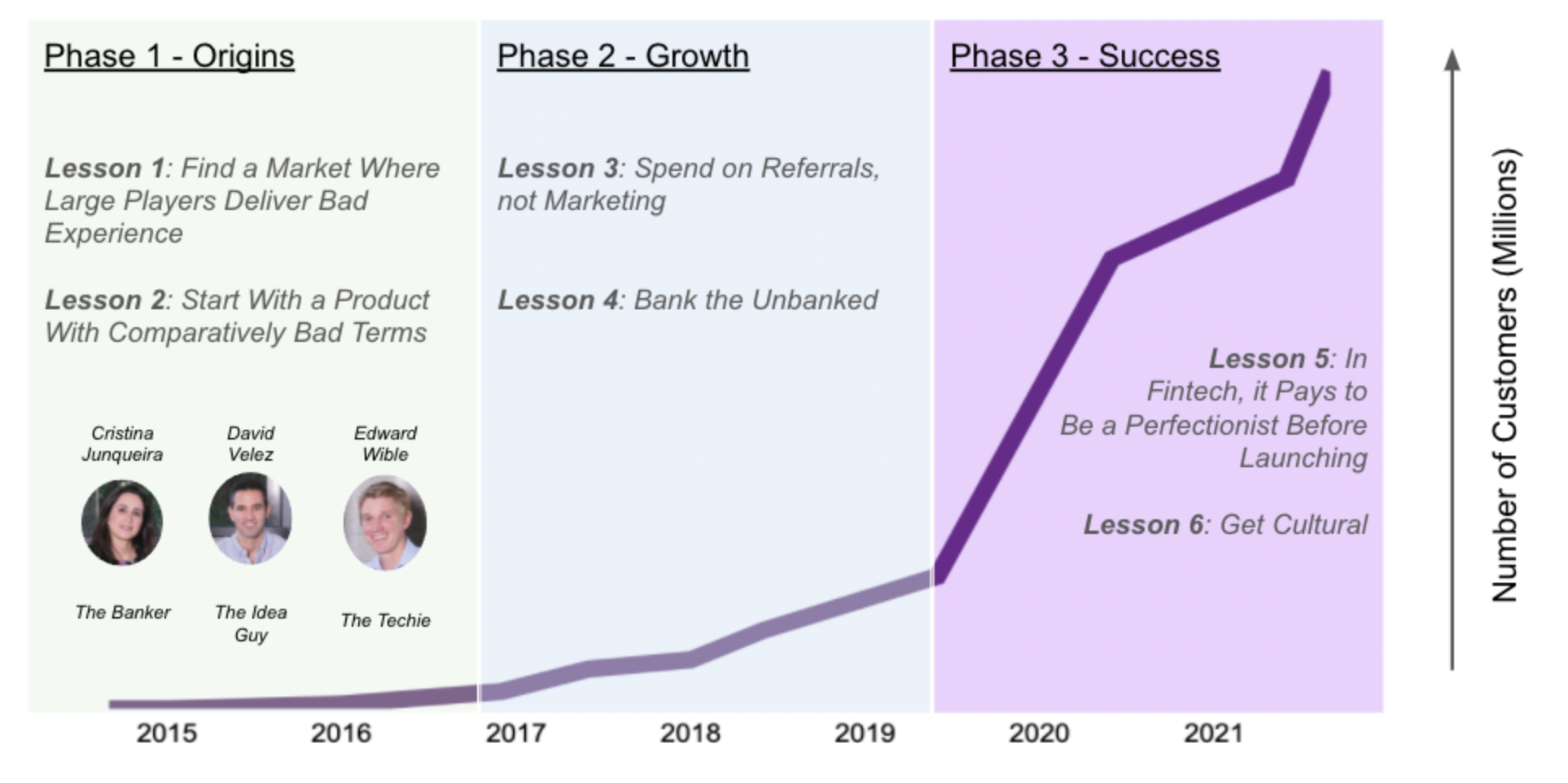

Growth Champion: Nubank

Nubank launched in 2013 with the mission to fight complexity to empower people in their daily lives by reinventing financial services. Its first product was a credit card that differentiated itself by not charging traditional fees, such as annual fees or over-limit fees, and all based in a digital app. It is now one of the world’s largest digital banking platforms, serving more than 80 million customers across Brazil, Mexico, and Colombia.

- Nubank

- Nubank Earnings Presentation Q3 2023

- How Nubank became a $30 billion fintech (FT)

- Nubank Profile and Cristina Junqueira Profile (Peter Fisk)

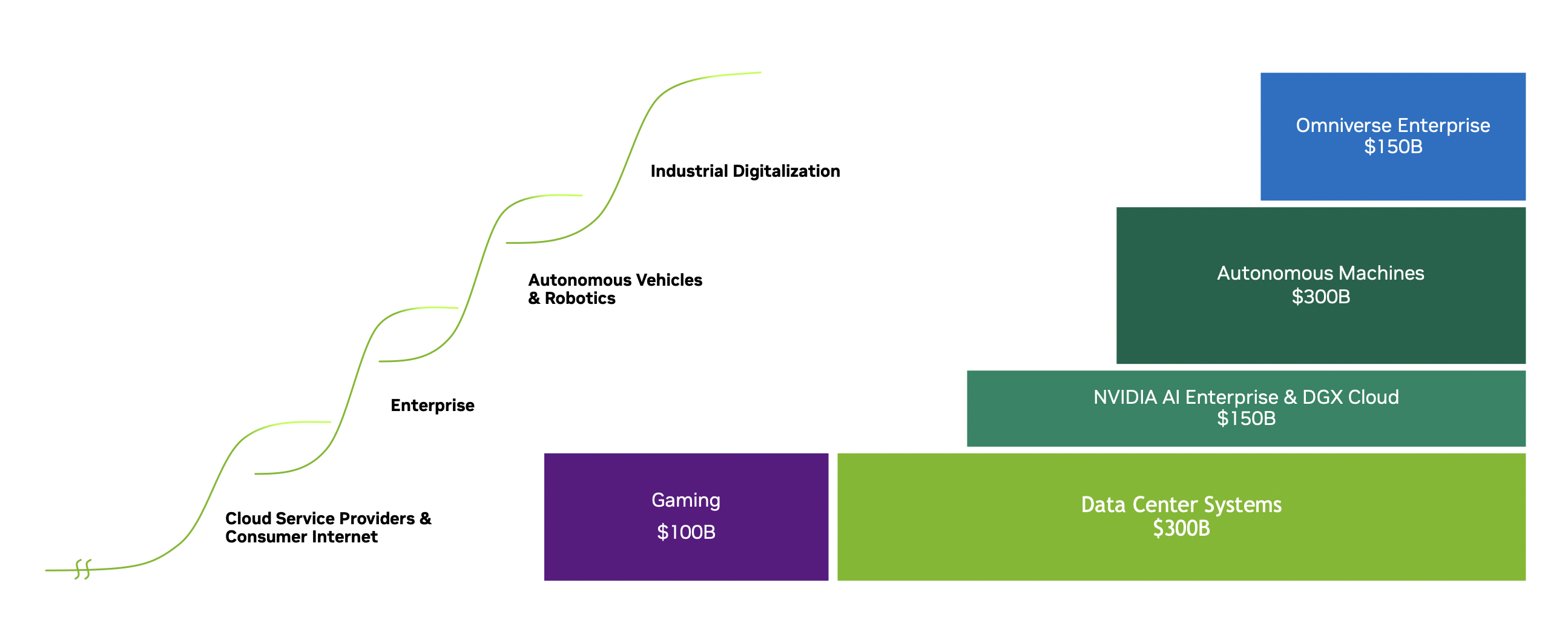

Growth Champion: Nvidia

AI is transforming our world. The software that enables computers to do things that once required human perception and judgment depends largely on hardware made possible by Jensen Huang who cofounded Nvidia in 1993. In 2024, Nvidia’s earnings are forecast to increase at a compound annual growth rate of 103% over the next five years. That would be more than double the 48% CAGR Nvidia’s bottom line has clocked in the past five years.

- Nvidia Story

- Nvidia Investor Presentation Oct 2023

- Nvidia Investor Presentation Nov 2023

- Nvidia growth forecasts (Yahoo Finance)

- Jensen Huang Profile (Peter Fisk)

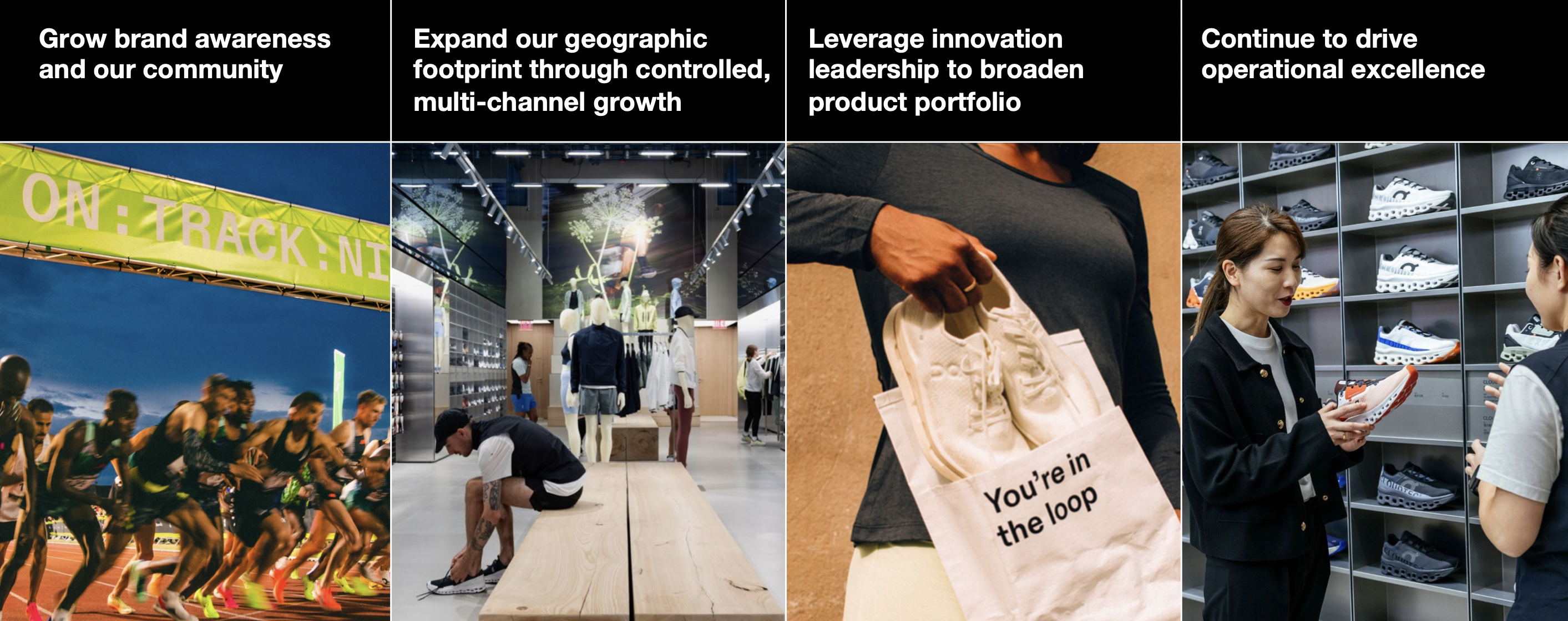

Growth Champion: On

Olivier Bernhard is on a mission to “ignite the human spirit through movement” and to make Swiss brand On “the most premium global sportswear brand”. The former triathlete devoted himself to finding a running shoe that would give him the perfect running sensation. In doing so he crossed paths with a like-minded Swiss engineer who had an idea for a new kind of running shoe. In 2010 he got together with two friends to develop a product range fully engineered in Switzerland.

- On

- On Investor Day 2023

- On Annual Report 2022

- Circular Running (Peter Fisk)

- On Profile (Peter Fisk)

Growth Champion: Ping An

Ping An is the world’s largest insurance business, and more generally provides products and services through its five ecosystems in financial services, healthcare, auto services, real estate services and smart city solutions. The company’s first steps beyond finance started in 2012. Co-CEO Jessica Tan has developed a vision of “technology plus finance” as key to Ping An’s ongoing growth, most notably with Good Doctor as the world’s leading digital healthcare platform.

- Ping An

- Ping An Investor Day 2023

- Ping An Results Presentation Oct 2023

- Ping An Healthcare’s “Good Doctor” (Peter Fisk)

- Ping An Profile and Jessica Tan Profile (Peter Fisk)

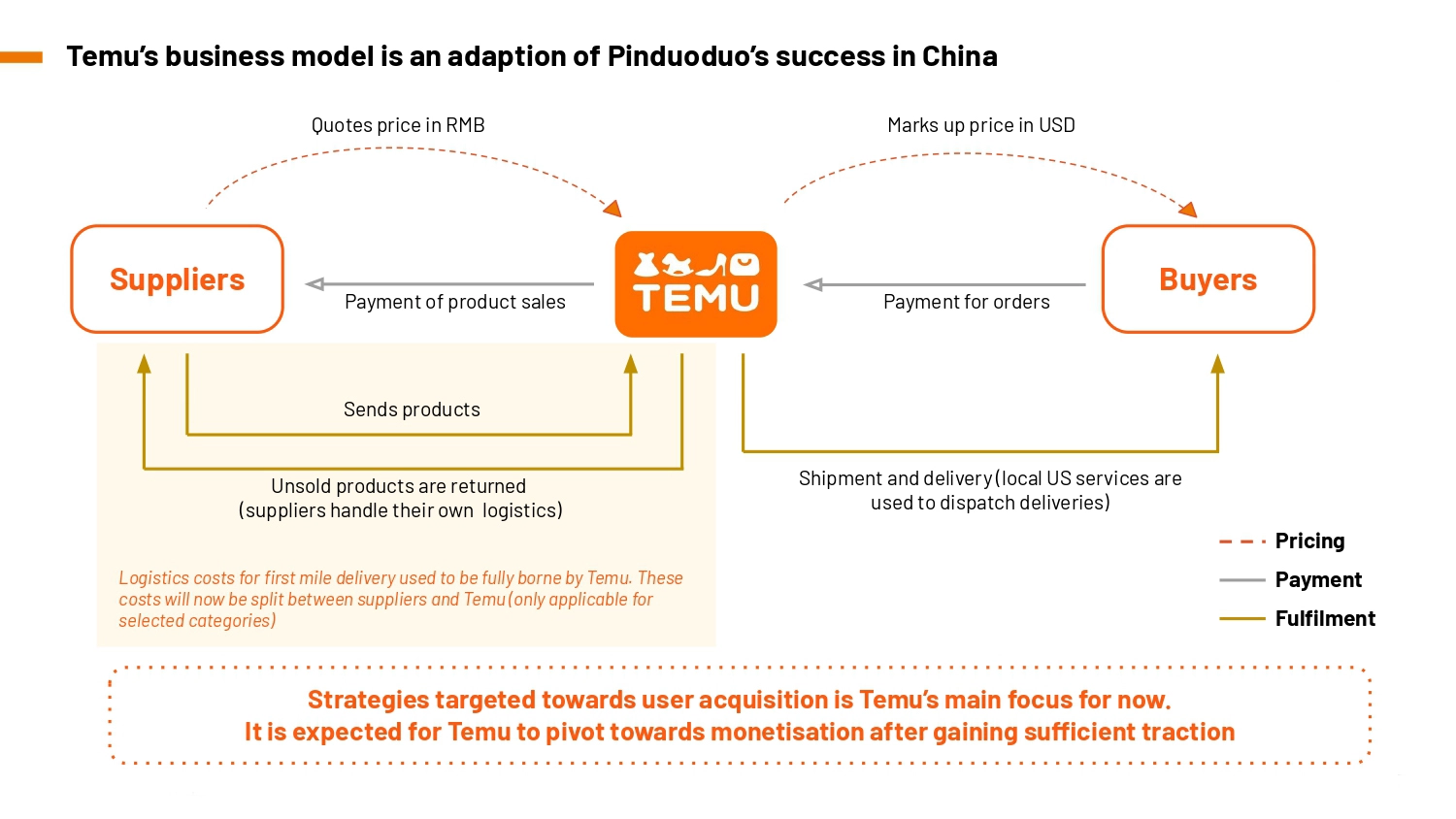

Growth Champion: Temu

The Pinduoduo-owned online fashion. retail platform burst into western markets in September 2022, and immediately outperformed the similar Shein business, and has continued to gain more visitors than Amazon. While Chinese owned, Temu is a US registered company, based in Boston USA. It’s focus is on super-cheap, super-fast, medium-quality fashion, using an on-demand super-fast business model. Sales are driven by social media, live-streaming, relentless offers, and gamification.

- Pinduoduo Overview 2022

- Is Temu the future of buying things? (New Yorker)

- How Temu works (EJet Sourcing)

- Temu Profile and Pinduoduo Profile (Peter Fisk)

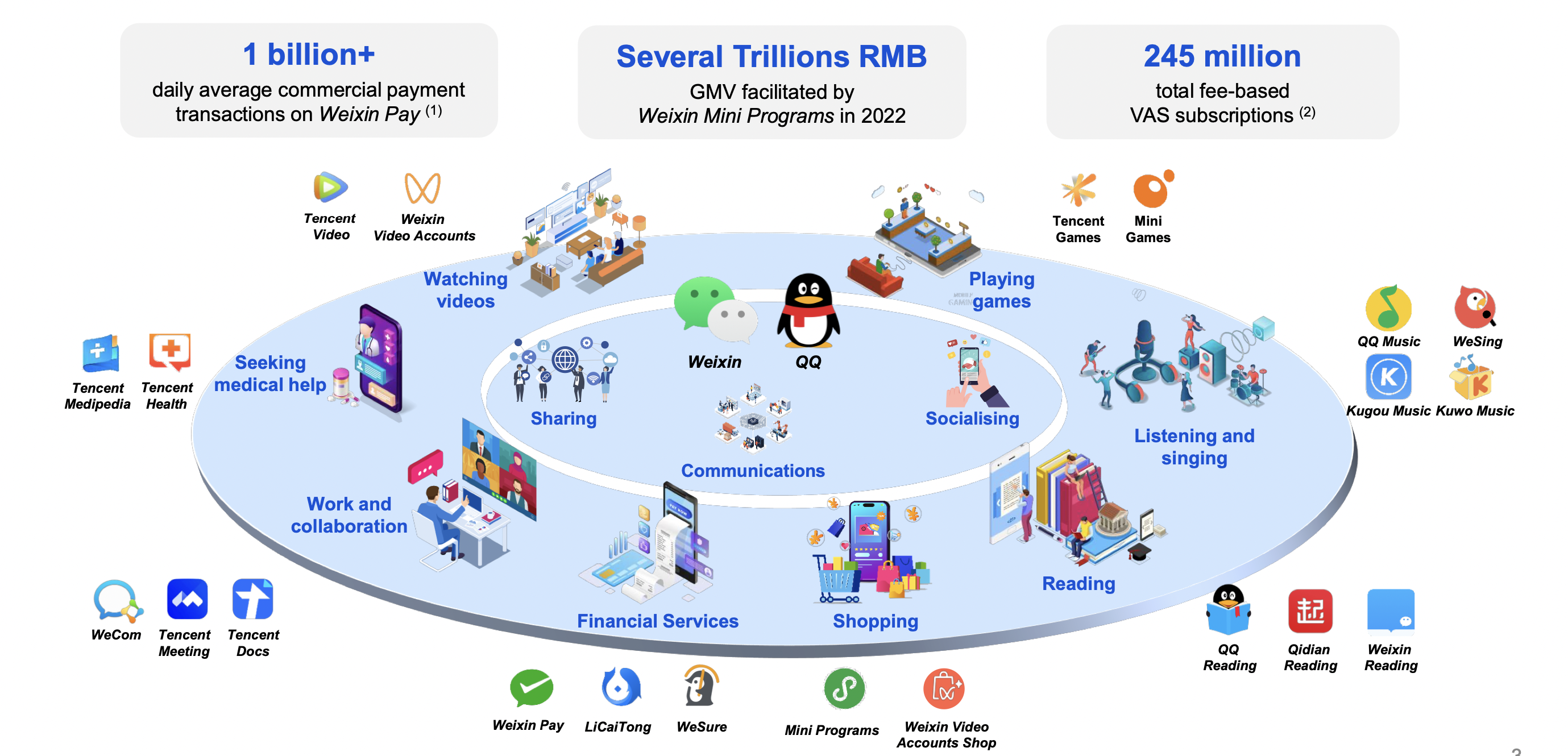

Growth Champion: Tencent

Tencent is a tech ecosystem, with a purpose “Value for Users, Tech for Good”. It’s social platforms WeChat (known as Weixin in China) and QQ connect users with each other, with digital content and daily life services in just a few clicks. It was founded in 1998 by Ma Huateng, known as Pony Ma, in Shenzhen. Launched in 2011, WeChat has grown into the most popular and widely used mobile app globally, and serves as a central part of daily life for its many users in China and beyond.

- Tencent

- Tencent Corporate Overview 2023

- Tencent Results Presentation Q3 2023

- Tencent Profile (Peter Fisk)

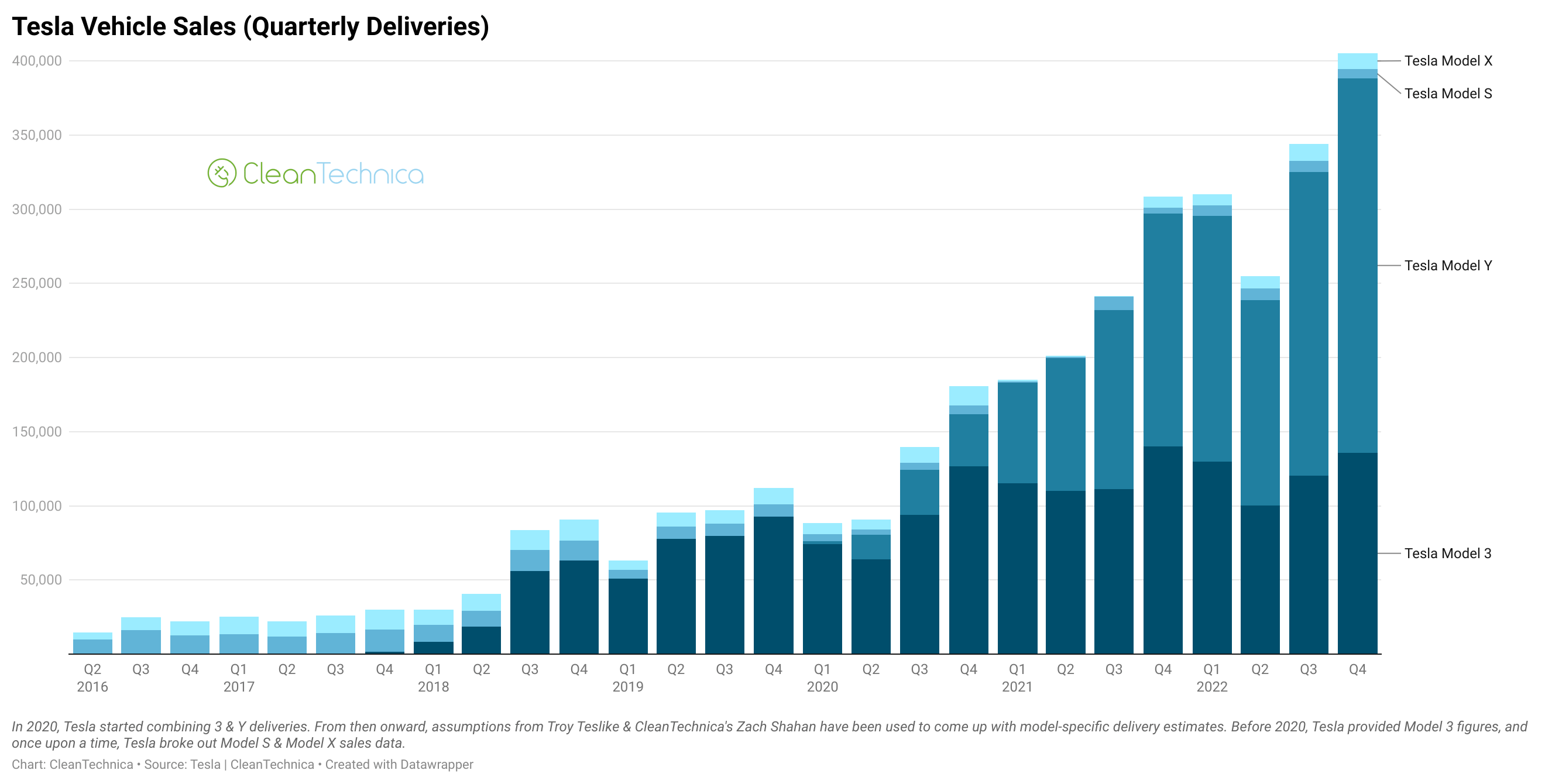

Growth Champion: Tesla

Faster than a Ferrari, powered by the sun. Tesla was founded in 2004 “to accelerate the world’s transition to sustainable energy”. Elon Musk took over as CEO in 2008, and achieved profitability in 2013. Tesla is by far the world’s most valuable automotive company (more valuable than the next 9 companies together), but it is much more than that. Tesla’s latest strategy “Master Plan Part 3” describes how it plans to transform the future of energy.

- Tesla Investor Day 2023

- Tesla Investor Update Q3 2023

- Tesla Master Plan Part 3

- Tesla Profile and Elon Musk Profile (Peter Fisk)

Growth Champion: Tony’s Chocolonely

Dutch journalist, Teun van de Keuken, founded the chocolate company in 2005 to fight against modern slavery on cocoa farms. Over 10 years it grew 10x, 24% a year, and a gross margin of 46%, and is the leading chocolate brand in Netherlands. It’s latest “fair” report starts with “Another choc-tastic year, proving that social impact and economic growth can soar together.”

- Tony’s Chocolonely Annual Fair Report 2022/23

- 10X+ growth from €1m to €100m in 10 years (SOM)

- Tony’s Chocolonely Profile (Peter Fisk)

So what drives growth?

Growth might seem obvious, but it is often confused. Profitable growth is the key driver of value creation.

Consider the automotive market. Tesla has the highest growth rate (around 35% CAGR over 5 years). And while Volkswagen sells 4 times more cars than Tesla ($335 billion to $95 billion revenue in 2023), Tesla is almost 10 times more valuable than Volkswagen ($650 billion vs $65 billion in terms of market cap). Ferrari is the most profitable (25% operating margin to Tesla’s 14%), but is even less valuable than VW, with almost no growth. Tesla, of course, is also the most sustainable.

- How do you drive and sustain profitable growth?

- Does it mean doing more? Or less, by doing the best things better?

- Is it all about smarter selling, or more about innovating?

- To existing markets and customers, or looking beyond to new opportunities?

- How does growth fit with sustainability, and using less natural resources?

- Can inorganic growth replace the need for real, organic growth?

- Is growth still the primary way to drive long-term value creation financially?

- Does growth need a strategy, and active leadership, or is it just a result?

- What inspires growth, sustains growth, and accelerates growth?

Explore more about growth

- Growth Recoded (video) by Peter Fisk

- Finding and accelerating better growth by Peter Fisk

-

Growth in an uncertain world by Deloitte

- 4 Stages of Growth: Start-up, Grow-up, Scale-up

-

Video: AG Lafley on Growth Strategy

- Video: Inside P&G’s Growth Factory

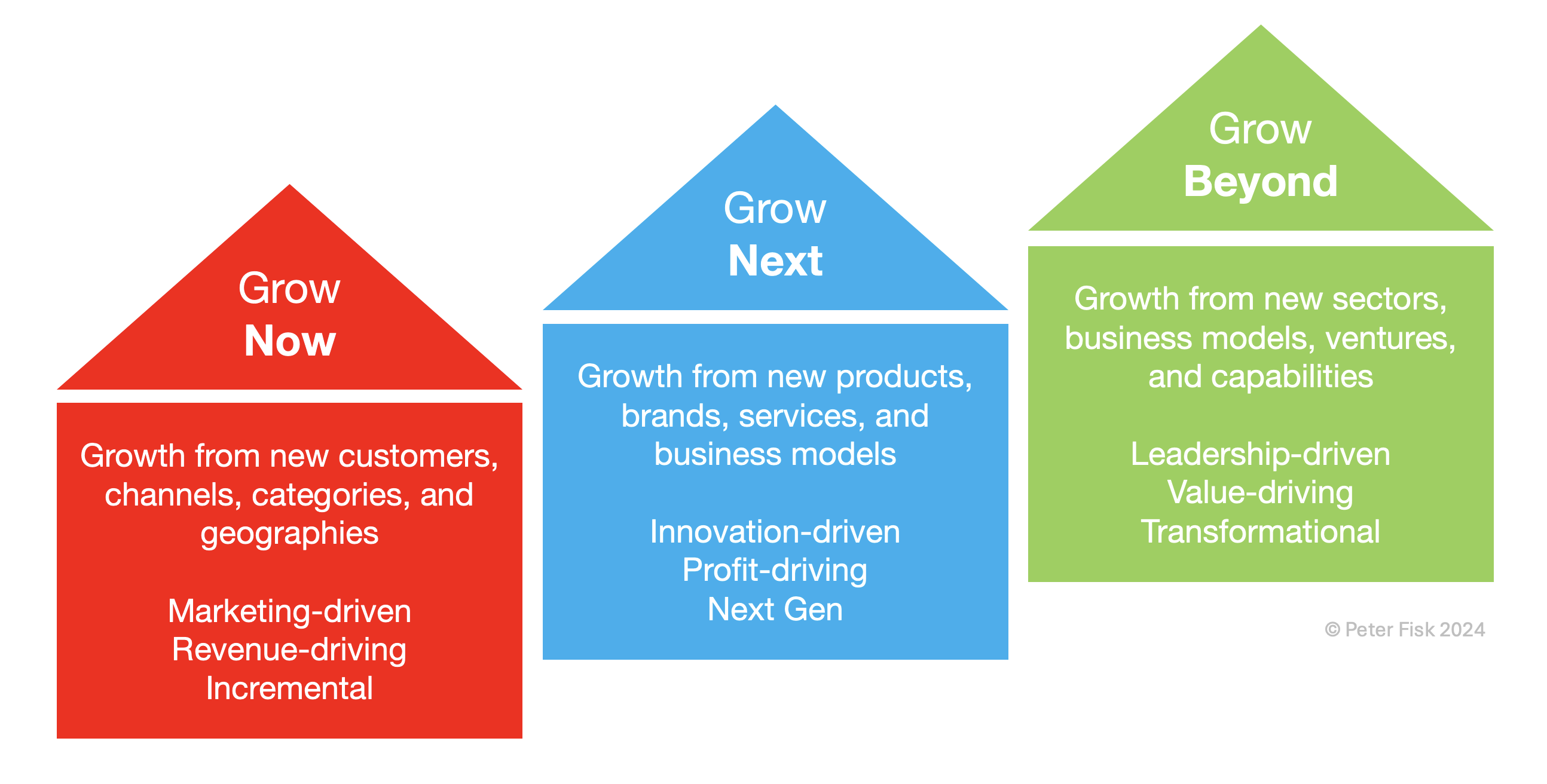

- Now New Next: Growth Champions by Mckinsey

- Leading for Growth by McKinsey

- Growth Triple Play by McKinsey

- 6 Strategies for Growth by McKinsey

-

10 Rules of Growth by McKinsey

- Summary of Growth IQ by Tiffani Bova

- Growth IQ Workbook by Tiffani Bova

- Life Centricity Playbook by Accenture

- 11 Secrets for Exponential Growth by Salim Ismael

And also

- New topics for inspiring growth keynotes by Peter Fisk

- Practical strategic growth workshops by Peter Fisk

- Accelerated executive development by Peter Fisk

More from the blog