In a world of frenetic change, many companies find it difficult to find new growth.

Global markets are typically growing at around 2-3% (according to IMF for 2025-26). Most developed markets are largely stagnant. India tops the developing markets, with 7% growth. But these are averages. Go inside most companies, and they have ambitions to grow at 10% even 20%. So they have to think differently.

The companies shaping tomorrow are those unafraid to stretch, to reimagine strategy itself, and to embrace emerging models of growth that transcend boundaries and industries.

Instead of trying to sell more of the same – seeking to scale conventional markets, and get more from tired audiences – they look at future growth differently, new spaces, and new approaches.

- Nubank in Brazil reinventing finance to target the unbanked with simplicity and accessibility.

- On Running leveraging culture, design, and community to grow into a global sports brand.

- DeepMind applying AI to protein folding, unlocking trillion-dollar opportunities in medicine.

- Rocket Lab lowering the cost of access to space, redefining an entire industry.

These signals are not isolated—they’re fragments of the next economy taking shape. These companies don’t just compete harder, they create new markets, and play a different game.

What are the best growth strategies?

The world’s fastest growing bank, Nubank from Brazil, uses social inclusion as a growth engine, targeting the unbanked. LVMH demonstrates the power of orchestrated ecosystems. Shopify shows how empowering others creates compounding growth. Crocs shows the value of cultural resonance. BYD exemplifies bold reinvention. Unilever anchors growth in purpose, On in circularity, DBS in ecosystems, and IKEA in localisation.

Growth strategies used to be simple and predictable – inspired by Igor Ansoff’s simple matrix of options – expand geographically, capture market share, and acquire rivals – sell more.

But in today’s volatile world, defined by digital disruption, shifting consumer values, climate imperatives, and geopolitical uncertainty, growth has become less about scale at all costs and more about reinvention.

The next generation of growth is built on agility, purpose, and innovation. Companies are not just selling more products to more people; they are creating self-reinforcing growth systems, tailoring experiences to micro-markets, leveraging ecosystems, and aligning with deeper human aspirations.

It’s also about value creation. Look across every sector – the biggest selling brands are rarely the most valuable – Volkswagen generates 4 times more revenue than Tesla, but Tesla’s market cap is 20 times bigger. Pepsico is twice as big as Coca Cola, but Coca Cola twice as valuable as Pepsico.

Growth is not simply about selling more, or being bigger. It needs to deliver economic value. Which it means to be growth that is profitable, progressive and will proliferate into the future.

So what are the best next-generation ideas for strategy and growth? Here are 10 ideas. These are not yet perfect frameworks; they are stretching visions of how the most innovative business may evolve in the decade ahead.

1. Growth loops, self-perpetuating growth

Traditional business models imagined growth as linear: invest in marketing, capture customers, sell more, and scale. But the most dynamic companies today are embracing growth loops.

In these models, every new customer contributes to further growth—through data, referrals, or network effects. Shopify, for example, has built a flywheel where each new merchant not only brings revenue but also strengthens its ecosystem of apps, payments, and logistics. That, in turn, attracts more developers and partners, creating a compounding cycle of growth.

Similarly, Nubank, the Brazilian digital bank, thrives on referrals. Its low-cost, mobile-first offering appeals to millions excluded by traditional banks. Every satisfied customer brings in others, creating viral momentum. Within a decade, Nubank became one of the world’s largest fintechs, serving over 100 million customers across Latin America. These growth loops are less about linear expansion and more about building self-perpetuating systems.

Spotify thrives on loops: more listeners attract more artists, creating better playlists, which attract more listeners. Revolut applies this logic to fintech: each product (cards, crypto, savings) feeds data into better recommendations and higher cross-sell.

Quantum growth loops take this further, creating self-reinforcing flywheels across industries. Imagine healthcare ecosystems where patient data fuels AI diagnostics, improving treatments, which attract more patients, generating more data. The loop compounds, accelerating both growth and innovation.

Strategy in this model is less about planning and more about accelerating loops.

2. Market making, not market sharing

Instead of competing for slices of existing demand, leaders create entirely new market spaces. BYD moved from batteries into electric vehicles, then into SkyRail, inventing new categories of urban mobility. Strategy shifts from positioning against rivals to naming and shaping whole industries.

Traditional strategy begins with industry analysis; next-generation strategy begins with customer worlds. Companies now create markets that previously did not exist, building categories shaped more by aspirations and experiences than by product lines.

Red Bull exemplified this with energy drinks, crafting a lifestyle category defined by extreme sports and adrenaline culture. More recently, Grab in Southeast Asia created the “super-app” category, integrating ride-hailing, payments, food, and finance into a daily-life platform. In Africa, M-Pesa pioneered mobile money, not by competing with banks but by creating an entirely new financial infrastructure. The lesson: growth comes from market-making, not market share.

Looking ahead, speculative opportunities abound: healthcare may blend into wellness and performance, powered by AI coaches; urban mobility may fuse housing, micro-mobility, and entertainment into seamless living systems. Companies that see life-activities, not industries, will shape the growth markets of tomorrow.

3. Culture coding, tapping into emerging ideas

The next advantage may not come from technology but from decoding culture—tapping into emerging values, aesthetics, and identities. Strategy is less about product-market fit than movement-market fit — scaling by mobilising tribes around ideas, memes, and values.

Liquid Death turned canned water into a $1B lifestyle brand by hacking into metal culture, absurd humor, and sustainability. Netflix scales globally by producing hyper-local cultural content—from Korean dramas to Spanish thrillers—that resonate far beyond their origins. In India, Byju’s educational platform grew by blending global tech with local parental aspirations.

Future growth may come from breaking hidden codes: designing products for neurodiverse communities; embedding indigenous knowledge into climate solutions; crafting services that speak to generational shifts in identity and belonging. Strategy becomes cultural semiotics as much as economics.

4. Regenerative growth, not extractive growth

The growth frontier is not consuming more resources but restoring and regenerating them. Growth strategies will focus on adding back more than they take.

Sustainability is no longer sufficient. The next step is regenerative growth, where businesses actively restore ecosystems, communities, and trust. This is not CSR or offsetting; it is strategy that aligns value creation with planetary renewal.

NextEra Energy in the USA reinvented itself from fossil-heavy Florida Power & Light into the world’s largest producer of wind and solar energy, scaling renewables profitably while reshaping its growth logic. Interface, the flooring company, moved from reducing impact to regenerative design, creating carpets that clean the air and contribute to biodiversity.

The emerging frontier lies in regenerative supply chains: Hermès experimenting with mushroom-based leather; Nestlé investing in regenerative agriculture; and startups like Climeworks scaling carbon removal. The companies that integrate regeneration into their core models will earn advantage not just in reputation but in resource resilience and regulatory alignment.

5. Orchestrating ecosystems, not going alone

The most valuable companies of the last decade—Apple, No company can do everything itself. Growth increasingly comes from ecosystem orchestration—building platforms and partnerships that multiply value creation.

The most valuable companies of the last decade—Apple, Amazon, Alibaba—are not single businesses but ecosystems. Yet the next generation of ecosystems will be more fluid, decentralized, and participatory.

LVMH, for example, has turned its portfolio of luxury maisons into a growth engine that’s greater than the sum of its parts. Each brand, from Louis Vuitton to Dior to Sephora, benefits from shared knowledge, cross-brand collaborations, and group-level investments in sustainability and digital innovation. By curating an ecosystem rather than simply owning brands, LVMH ensures that success in one area fuels momentum in others.

In Asia, DBS Bank has gone beyond financial services to create an ecosystem around daily life. From digital health tools to travel platforms to sustainable living guides, DBS positions itself as a trusted partner in broader life journeys, not just banking. This ecosystem approach deepens relationships and opens new revenue streams in unexpected places.

Revolut used partnerships and APIs to expand rapidly across banking, trading, insurance, and travel without owning traditional infrastructure.

Future ecosystems may look more like biological systems—open, adaptive, with porous boundaries. Imagine city-level ecosystems where transport, healthcare, food, and finance are interconnected through shared data platforms, with citizens co-creating value. Strategy shifts from “owning the customer” to orchestrating flows of trust, data, and participation.

Future growth will come from hijacking underutilized networks — from logistics to identity systems — and redirecting them to new markets. Instead of building everything themselves, companies hack into existing ecosystems and reverse-expand.

6. Micro localization, being different for everyone

Globalization once meant scale and standardization; the new frontier is hyper-local relevance delivered globally. Micro-localization is the ability to adapt products, services, and strategies to the nuances of neighbourhoods, cultures, and individuals—while retaining the advantages of global scale.

Take IKEA. Once famous for its one-size-fits-all flat-pack furniture, IKEA is reinventing itself as a brand that flexes to local contexts. In Tokyo, it sells compact furniture tailored to tiny apartments. In India, it offers traditional Indian meals alongside Swedish meatballs in its in-store restaurants. And increasingly, it’s experimenting with small-format city stores and digital-first models to meet urban consumers where they are.

Crocs offers another surprising example. Written off as a fad a decade ago, the brand has rebounded by leaning into local subcultures and social media trends. Its limited-edition collaborations—from K-pop bands in Korea to luxury designers in Paris—speak directly to niche communities, creating demand spikes that ripple globally. Growth is no longer about mass standardisation but about intimacy at scale.

Coca-Cola has long practiced this, adjusting flavors and marketing to local tastes. But new players are pushing further. TikTok’s algorithm personalizes content not only to countries but to micro-communities and even individuals. Jumia in Africa adapts e-commerce to local infrastructure gaps, offering pay-on-delivery and motorbike logistics.

Speculatively, AI-powered manufacturing could enable “glocal factories” producing customized goods for each city block, while retail experiences could morph daily based on real-time community data. Growth will not come from one-size-fits-all but from billions of micro-fits scaled intelligently.

7. Experience multiverses, immersive brands and communities

Products and services are no longer enough; companies now compete in experience universes. The next step is multi-layered experiences blending physical, digital, and virtual dimensions.

Disney reinvented itself multiple times—from animation to theme parks to streaming—each time amplifying its storytelling ecosystem. Nike’s digital platforms like SNKRS and Run Club transform the brand from a product company into a participatory culture. Hermès thrives not just on luxury goods but on immersive experiences that embody scarcity, craftsmanship, and cultural symbolism.

Tomorrow’s growth may come from “experience multiverses”—a luxury fashion brand offering physical goods, virtual garments for avatars, and AI-personalized design experiences. Companies that orchestrate these multiverses, blending identity, status, and emotion across realities, will define the next growth frontier.

8. Invisible multipliers, unlocking intangible assets

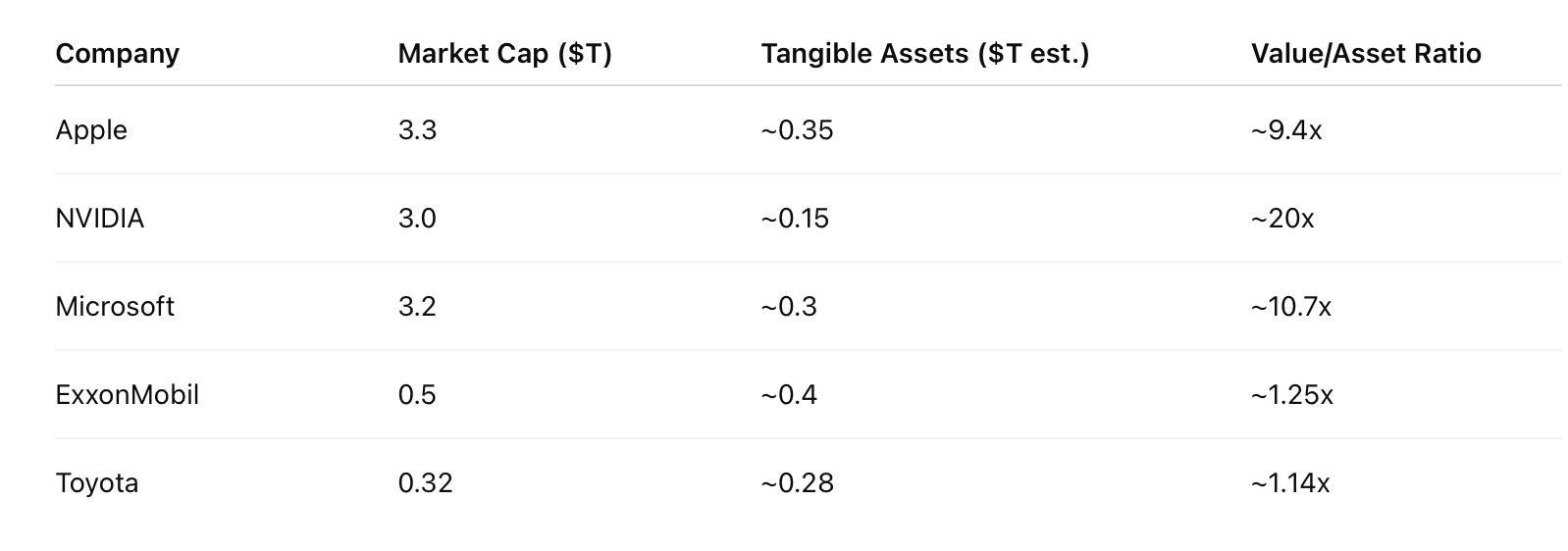

The most valuable assets in business today are no longer factories, fleets, or physical inventories. Instead, they are intangible and often invisible—brands, data, trust, and partnerships. These forces now account for the majority of corporate value creation, shaping how companies grow, compete, and endure.

A strong brand is more than a logo or slogan; it is a living promise that commands loyalty and price premiums. Apple and Nike are worth far more than the sum of their products because their brands embody meaning, aspiration, and belonging. Hermès’ value lies less in bags and more in the aura of scarcity, heritage, and cultural capital.

Data is the new capital of the digital age. The ability to capture, analyze, and act on information enables companies like Alibaba, Netflix, and Moderna to anticipate needs, personalize experiences, and accelerate discovery. Yet data only becomes valuable when translated into insight and action.

Trust is the ultimate currency. In a world of information overload and rising skepticism, organizations that demonstrate authenticity, responsibility, and fairness win enduring advantage. Tesla’s volatility shows how fragile trust can be, while Patagonia’s long-term commitment to environmental integrity shows how powerful it can become.

Partnerships enable ecosystems that extend growth beyond the boundaries of one company. Amazon, Tencent, and Reliance are not just businesses; they are platforms that orchestrate networks of partners, developers, and customers, multiplying value through shared creation. ASML, the Dutch semiconductor company, thrives not on physical machines alone but on an irreplaceable ecosystem of patents, know-how, and collaborative trust.

The next growth frontier lies in mastering these invisible drivers—cultivating brands that inspire, data that empowers, trust that endures, and ecosystems that scale. Those who do will define the economy of the future.

Speculatively, companies may trade in new intangibles: “trust tokens” for AI systems, data sovereignty as a service, or cultural capital as measurable value on balance sheets. Strategy in this age is less about factories and more about curating, scaling, and protecting the invisible.

9. Temporal strategies, competing at different speeds

Companies can accelerate growth by exploiting differences in time horizons — moving faster or slower than competitors and markets expect. Strategy becomes time design — mastering how value unfolds across seconds, years, and generations.

Growth strategies have traditionally been linear—quarterly targets, five-year plans. Next-gen strategies manipulate time itself: accelerating, slowing, or bending growth trajectories to shape competitive advantage.

Amazon is a master of long-term patience, sacrificing near-term profits to build infrastructures like AWS or Prime that compound over decades. Conversely, fast-fashion brands like Temu and Shein compress design-to-delivery cycles to mere days, weaponizing speed as a strategic advantage.

Speculatively, companies may offer “time as a service”: insurance models that protect not just assets but lifespans; education platforms that accelerate or extend learning windows. Growth becomes not just about market share but about controlling the tempo of industries.

10. Real-time strategy, enabled by AI

Strategy becomes less about annual plans and more about real-time algorithmic adaptation. Alibaba’s “City Brain” dynamically optimizes traffic flows in Hangzhou with AI — imagine the same principle applied to corporate strategy. The company’s strategy evolves autonomously, recombining assets as markets change, like a biological system.

Where companies once used AI as a tool, the next wave builds AI into the strategy-making process itself. “AI-native” strategy means dynamic, self-learning models of decision-making where foresight, simulation, and adaptation are embedded in real time.

Ping An in China is an early mover: it uses AI across health, finance, and insurance ecosystems, not only to improve customer service but to decide where to expand next. Mercado Libre in Latin America deploys AI to optimize logistics, credit scoring, and product recommendations at planetary scale. These companies do not bolt AI onto existing strategies; their strategies evolve through AI.

Imagine a future boardroom where strategy sessions run as human-AI collaborations: executives asking questions, AI generating multiple possible scenarios, simulating competitor moves, even stress-testing supply chains under climate shocks. Strategy becomes less about annual reviews and more about living, evolving code.

From strategy to imagination

These 10 ideas signal a shift: from strategy as analysis to strategy as imagination.

Companies that win will be those that reinvent not only what they do but how they think about growth itself—market-making, AI-native decision-making, regenerative advantage, living ecosystems, micro-localization, experience multiverses, temporal play, quantum loops, cultural decoding, and unlocking new assets.

The signals are already here – from DBS in Singapore to Hermès in Paris, from Mercado Libre in São Paulo to NextEra in Florida. Yet the most exciting frontier is still speculative: how these logics will collide, recombine, and accelerate in ways.

The next generation of growth is not about bigger, faster, cheaper. It’s about different.

It is about organisations that reinvent perpetually, design for exponential technologies, and embrace regenerative principles. It is about orchestrating ecosystems, shaping cultural currents, and inventing markets that never existed. It is about moving across time horizons with agility and, above all, growing humanity and the planet alongside profit.

If the 20th century was the era of scale, the 21st is the era of reinvention and imagination. Tomorrow’s growth will not come to those who plan the best—it will come to those who see the furthest, adapt the fastest, and dare the boldest.

Footnote: Growth inspirations

Here are 9 mini cases of brands driving growth:

Shopify … Powering the Entrepreneur Economy

Shopify has become the backbone of a new generation of entrepreneurs and small businesses by making e-commerce simple, scalable, and global. Rather than competing as a retailer itself, Shopify built a platform model that gives millions of merchants the tools to sell online, manage payments, ship products, and market to customers. Its strategy has been to constantly expand the ecosystem—adding integrations with social platforms like TikTok, partnerships with logistics providers, and AI-driven marketing tools. By enabling others to grow, Shopify grows too, capturing value as digital commerce expands across geographies and categories. During the pandemic, Shopify accelerated adoption as small retailers rushed online, but its growth engine is longer term: empowering entrepreneurship, tapping into the long tail of niche markets, and expanding into financial services. Its model shows how a company can scale by democratizing access to technology and capturing the collective growth of its customers.

Nubank … Redefining Banking in Latin America

Brazil-based Nubank has grown into one of the world’s largest digital banks by challenging the inefficiencies and high fees of traditional Latin American banks. Starting with a simple no-fee credit card managed through a sleek app, Nubank attracted millions of young, underserved customers frustrated with legacy banking. Its growth strategy is built on simplicity, transparency, and customer trust. By expanding into savings, personal loans, and small business services, Nubank has created a financial super-app that addresses the unmet needs of over 100 million people across Brazil, Mexico, and Colombia. Crucially, it uses data and AI to underwrite credit for populations often excluded from banking. Its low-cost, digital-only model allows scale without physical branches, while network effects drive customer acquisition through referrals. Nubank’s growth proves that reinventing business models for emerging markets can unlock both social impact and extraordinary commercial opportunity.

LVMH … Reinventing Luxury for a New Era

LVMH, the world’s largest luxury group, accelerates growth not by chasing trends but by shaping them. Its strategy blends heritage with reinvention, using its maisons—from Louis Vuitton to Dior to Tiffany—to continually refresh desirability. Under Bernard Arnault, LVMH has invested heavily in experiences, from flagship stores that serve as cultural spaces to immersive brand activations with artists and designers. It has expanded into high-growth categories like beauty and hospitality, while also betting on technology—acquiring digital-native brands, experimenting with NFTs, and driving e-commerce through platforms like Sephora. LVMH has also leaned into sustainability, repositioning luxury as timeless and regenerative, appealing to new generations of consumers who equate value with responsibility. By managing a portfolio of brands with creative independence but shared resources, LVMH captures both scale and scarcity. Its growth comes from a powerful cycle: cultural relevance creates desire, and desire creates long-term pricing power.

Crocs … From Ugly Duckling to Fashion Phenomenon

Once mocked as unfashionable, Crocs has staged one of the most remarkable brand turnarounds of recent years. Its growth strategy is built on radical reinvention—turning its clunky foam clogs into a canvas for self-expression and cultural play. Through collaborations with fashion houses like Balenciaga, musicians like Post Malone, and influencers across TikTok, Crocs repositioned its brand as cool, ironic, and endlessly customizable. The introduction of Jibbitz charms transformed shoes into personal statements, driving repeat purchases and community engagement. Operationally, Crocs has streamlined its product line, focused on direct-to-consumer sales, and used social listening to anticipate trends in real time. The result: a brand once written off has become a global growth engine, doubling revenues and capturing a new generation of fans. Crocs shows how even the most unfashionable company can accelerate growth by leaning into cultural currents, embracing partnerships, and making its brand a platform for creativity.

BYD … Driving the Global EV Transition

China’s BYD (Build Your Dreams) has grown from a battery maker into one of the world’s largest electric vehicle producers, rivaling Tesla. Its growth strategy is rooted in vertical integration—BYD makes its own batteries, chips, and key components, giving it cost and supply chain advantages. This allows it to offer a wide range of affordable EVs and hybrids, making clean mobility accessible to the mass market, not just premium buyers. BYD is also expanding aggressively into buses, trucks, and global markets, from Europe to Southeast Asia. Backed by Warren Buffett’s Berkshire Hathaway, BYD has leveraged scale and technology to accelerate adoption of EVs worldwide. By focusing on affordability, range, and reliability, BYD captures segments often ignored by Western competitors. Its growth demonstrates how emerging-market champions can leapfrog by aligning with megatrends like electrification, while rethinking value chains to gain speed, resilience, and market dominance.

On … Making Sportswear Cool

Swiss sports brand On has accelerated growth by reinventing running shoes with its distinctive “CloudTec” cushioning technology, making performance both functional and stylish. Its early adoption by elite athletes, combined with partnerships with fashion retailers, positioned On at the intersection of sport and lifestyle. Growth has been fueled by a strong direct-to-consumer model, global expansion, and a community-driven marketing strategy that emphasizes storytelling around innovation and sustainability. On has also pioneered circular business models, such as a subscription service for recyclable running shoes, appealing to environmentally conscious consumers. Its IPO in New York validated its status as a global challenger to Nike and Adidas, with revenues soaring. By blending Swiss engineering, design flair, and digital-first engagement, On demonstrates how a challenger brand can accelerate growth by creating a differentiated product experience and expanding into adjacent markets like apparel and outdoor gear.

DBS Bank … From Traditional to Digital Powerhouse

Singapore’s DBS has transformed itself from a bureaucratic state bank into one of the world’s most innovative financial institutions. Its growth strategy is built on digital transformation—not as a bolt-on, but as a complete cultural reinvention. DBS embraced agile methods, customer journey redesign, and AI-driven services, branding itself as the “Digital Bank of Singapore.” It launched digibank, a mobile-only offering in India and Indonesia, acquiring millions of new customers at low cost. The bank also integrated sustainability into its growth, financing renewable energy projects and helping clients transition to greener operations. By rethinking itself as a tech company with a banking license, DBS boosted profitability, customer satisfaction, and international reach. Its story illustrates how even incumbents in highly regulated industries can accelerate growth by reimagining their culture, customer experience, and business model around digital-first principles.

IKEA … Democratising Sustainable Living

IKEA has accelerated growth by making sustainable living affordable and aspirational. The Swedish retailer is rethinking its entire model—from using renewable materials and circular design to offering services like furniture rental and buyback. It has invested in renewable energy, owning wind and solar farms to power its stores and supply chain. At the same time, IKEA has doubled down on digital, expanding e-commerce, experimenting with virtual showrooms, and partnering with platforms like Alibaba. Its growth is also geographic, with rapid expansion into India and Southeast Asia. IKEA’s strength lies in its ability to democratize design and now sustainability, positioning itself as the brand that helps millions of households live better within planetary boundaries. By aligning growth with purpose, and innovating across product, service, and market models, IKEA shows how legacy retailers can accelerate into the future without losing their core identity.

Unilever … Purpose and Performance at Scale

Unilever has pursued growth by embedding sustainability into its business model. Its “Sustainable Living Brands”—such as Dove, Hellmann’s, and Ben & Jerry’s—grow faster than the rest of its portfolio, proving that purpose can drive performance. Unilever has focused on reducing plastic, cutting carbon, and reshaping food portfolios around plant-based products, while also leading in social issues from diversity to hygiene access. Its growth strategy is to meet shifting consumer values while using its global scale to accelerate systemic change. Investments in AI-driven marketing, direct-to-consumer platforms, and partnerships with startups also keep it relevant with new generations of shoppers. By aligning profit with positive impact, Unilever has repositioned itself as a growth company fit for the 21st century—winning not only consumers but also employees, investors, and regulators. The company’s example shows how legacy players can accelerate growth by making purpose inseparable from their brand and innovation strategy.

Ads inspire, ads engage, ads become iconic.

While the marketing world has hugely shifted over the last 35 years since I worked on my first ad (a spot for British Airways creating a global image of people around the world, which became quite iconic), ads still have an important place in building brands, connecting with people emotionally and aspirationally, and becoming reflections of culture and creativity.

Today’s marketing world is driven by a much more individual, intelligent and interactive focus on consumers. From AI and data analytics, to digital platforms and mobile apps, personalisation and gamification, social influencers and live events. The marketing mix has become more science than art, but there is still a place for ads … Here are my favourites of 2024:

“Introducing Icons” by Airbnb

I love Airbnb, for its unusual, interesting places to stay. Its Icons series of experiences includes the opportunity to stay at Prince’s Purple Rain house, the Clock Room at Musée d’Orsay in Paris, and the Ferrari Museum in Italy, as well as the Up House, created in meticulous detail by Verb to celebrate 15 years since the Pixar film Up was released.

“Is it even a city?” by Visit Oslo

I love Oslo, and in particular the Bislett Stadium, the spiritual home of distance running. It’s a great city, with a designer waterfront including its spectacular Opera House. An antidote to holiday ads that are all smiles, this deadpan ad from Visit Oslo delivers the city’s charms in a left-field way via one very bored resident.

“All the Ads” by DoorDash

DoorDash’s 2024 Super Bowl campaign, offering a prize from every brand that advertised during this year’s big game to the first person who figured out its ridiculously long promo code, took a lot of legal wrangling and constant revisions. It was big and fun, and served as an effective product demo of the brand’s promise to now deliver anything and everything, and not just food.

“The Co-Worker” by Ikea

Ikea opened its game The Co-Worker on Roblox, offering players a chance to experience the working world of Ikea (kinda) on the platform. A genuine recruitment drive, the campaign gave audiences the opportunity to apply for one of ten paid roles in the virtual store. The open call to become a virtual Ikea co-worker amassed over 178,000 applications over the two-week application window.

“If you’re into it, it’s in the V&A” by V&A Museum

Museums can seem old, boring, stuffy and irrelevant. But they don’t have to be that way, as London’s V&A has demonstrated through many innovative exhibitions. This ad campaign for the V&A planted its message in dozens of objects hidden across the UK, particularly shone for its unusual approach to promoting a venerated institution and its commitment to craft.

World Cup Delivery by PedidosYa

Argentina’s passion for football reached new heights as Lionel Messi, after enduring numerous lost finals over 36 years, finally clinched the World Cup victory. Breaking a spell that had loomed over the nation for more than three decades, Argentina erupted in unprecedented jubilation. Amidst the euphoria, everyone wanted to know when the team would arrive home?

“Spreadbeats” by Spotify

Spotify’s B2B campaign “Spreadbeats” featured a music video created and distributed entirely within a media plan spreadsheet. Aiming to make media plans as vibrant and energetic as Spotify’s brand and platform, the campaign follows a single cell—E7—and its evolution into a colourful 3D character, a metaphor for the creative ways brands can reach audiences through both audio and visual formats.

“Handshake Hunt” by Mercado Libre

Mercado Libre, the leading online shopping platform in Latin America, executed a unique campaign named “Handshake Hunt” during Black Friday. Partnering with TV channel Globo, the campaign displayed QR codes for discounts whenever a handshake appeared on-screen. Targeting the online retail market in Brazil, the campaign utilised various media channels including product placement, outdoor, out-of-home, and sales promotions.

“We are Ayenda” by WhatsApp

WhatsApp released a documentary “We Are Ayenda” telling the extraordinary story of the Afghan Youth Women’s National Football Team and their remarkable escape from Afghanistan after the Taliban took power in 2021. The documentary debuted during the Women’s World Cup and is now available on Prime Video.

“A British Original” by British Airways

Finally, back to British Airways, who unveiled a pioneering multi-channel initiative named “A British Original,” celebrating the airline’s staff, passengers, and the essence of the nation itself. The campaign delves into the diverse motivations behind travel, whether it’s for reconnecting with loved ones, seeking solace, or immersing oneself in a new culture. It comprised more than 500 distinctive print, digital, and outdoor executions, along with over 32 short films.

“Gamechangers” are individuals, companies, innovations, or events that significantly alter the status quo in their respective fields. They often introduce new ideas, technologies, or practices that disrupt existing norms and pave the way for new opportunities, improved efficiencies, or entirely new markets.

Almost 10 years ago I wrote the book “Gamechangers” which won awards and was translated into over 30 languages. It featured disruptive companies like Airbnb, shaking up the world of hospitality, cryptocurrencies, harnessing the power of network technologies, and even Elon Musk, with a mindset for disrupting any industry.

- Be the Gamechanger … 10 ways to change your game, from strategic purpose to target audiences, unusual products to unexpected services, customer experiences to new business models

- 100 Leaders … profiles of game changing leaders, from Anne Wojcicki to Bernard Arnault, Cristina Junqueira to Ben Francis, Zhang Ruimin to Zhang Yimin, and many more.

- 250 Companies … case studies of gamechanging companies, from 1Atelier to 77 Diamonds to A Boring Life, Aerofarms to Alibaba, Babylon to Boom Supersonic and many more.

- Gamechangers Latin America … from Camposol to Cariuma, NotCo to Nubank … Learning from brands thriving in adverse and volatile markets

- Gamechangers Turkey … from Appsilon diamonds created in the lab, to Biolive plastics made from olive stones … Oleatex’s plant-based vegan leather, and WeWalk’s smart canes.

So who are the Gamechangers of 2025?

I’m looking for companies who are disrupting markets, challenging the conventions, shaping the new behaviours, and succeeding. They might do this by reimagining products and services, channels and pricing, business models or ecosystems.

Take the purest spring water, for example, and think how you can make it more engaging to young people. Liquid Death has become a cult brand, and highly profitable business. Or consider Athletic Brewing, a great tasting beer, perfect after a workout. And with zero alcohol.

Here’s my shortlist:

- Abridge: Using AI to transcribe doctor-patient interactions and generate medical notes, improving healthcare documentation and patient care.

- Adyen has transformed the payment industry by providing a single platform for businesses to accept payments anywhere in the world, both online and in-store.

- Agility Robotics: Developing humanoid robots that can walk, grasp, and carry objects, revolutionizing logistics and manufacturing.

- Arabica: Coffee shops with Asian minimalism, African coffee roastery, and Arabic meeting place. Founded by Japanese entrepreneur seeking to “See the World Through Coffee”.

- Athletic Brewing:Whether you’re looking to cut out alcohol for life or just for a night, you shouldn’t have to sacrifice your ability to be healthy, active and at your best, to enjoy great beer.

- Agua Bendita produces super-luxury handmade bikinis, inspired by their Colombian roots, and made by a team of 700 single mothers from off-cuts of fabric.

- Beauty Pie: Subscription based platform

- allowing members to purchase products directly from top-tier labs at a reduced price.

- Bumble: A social discovery app empowering women to make the first move in dating, friendships, and professional networking

- Canva: An online design tool making graphic design accessible to everyone with easy-to-use templates and collaboration features.

- Colossal Biosciences seeks to reawaken the past, to bring back extinct species using CRISPR technology, through genetic rescue, to support biodiversity

- Duolingo, the language learning app has transformed the way people learn new languages by making the process fun, accessible, and gamified.

- EcoSpirits: Introduces new pricing models that incentivize consumers to return bottles for recycling, promoting a circular economy.

- Ecovative uses mycelium, from mushrooms, to grow category defining products ranging from leather like textiles to sustainable packaging.

- Elf: A beauty and skincare brand known for its affordable, clean, and effective products. 100% vegan, no animal testingand made without the nasty bad-for-you stuff.

- FanDual. Online fantasy sports and sports betting platform, transforming the way fans engage with sports, providing an immersive and interactive experience.

- Fenty: Known for its inclusive beauty products, Fenty continues to disrupt the beauty industry with its wide range of shades and innovative formulations.

- Fervo Energy: Innovating in geothermal energy to provide a sustainable and reliable source of clean energy.

- Gorilla Glass. Known for its durable and damage-resistant glass used in smart phones and other electronic devices

- Halo Top Creamery is attracting more ice cream lovers with a promise of lower calories and less guilt.

- Helsing: Specializing in AI-powered defence solutions, Helsing is transforming how military operations are conducted.

- Impossible Foods has revolutionized the food industry by offering sustainable and delicious options that closely mimic the taste and texture of traditional meat.

- Impulse Space: Working on space propulsion technology to make space travel more efficient and cost-effective.

- Ipsy: Personalized makeup and beauty products by monthly subscription, exclusive offers, and how-to video tutorials from the brand’s stylists.

- Iqos. Heats tobacco instead of burning it, producing a vapor that contains nicotine but has less ash, smoke, and odour compared to conventional cigarettes

- Jio: An Indian telecommunications company providing affordable internet services and revolutionizing digital connectivity in India.

- Klarna. Known for its “buy now, pay later” financial services, Klarna has revolutionized the way consumers shop online by offering flexible payment options

- Liquid Death: Known for its bold branding and canned water, Liquid Death has disrupted the beverage industry.

- Meati: This company produces high-protein, sustainable meat alternatives made from mushroom roots.

- Miniso: “It isn’t just a store; it’s a playground of endless fun and excitement” with 6,000 stores worldwide in 100 countries.

- Mirror: This reflective screen offers personalized workouts with top trainers, providing a virtual fitness studio experience.

- Nextdoor: Transformed the way neighbourhoods connect and communicate by providing a platform to share news, events, recommendations, and services.

- Niyara India: This brand has quickly become a go-to for modern Indian women, blending elegance, comfort, and affordability.

- NotCo: Using artificial intelligence to create plant-based alternatives to animal products, NotCo is revolutionizing the food industry.

- Oatly: This plant-based milk brand has gained significant market share by appealing to consumers looking for sustainable and healthy alternatives to dairy.

- Octopus Energy: A renewable energy supplier in the UK, committed to providing affordable and sustainable energy solutions.

- OpenAI: Continues to lead the AI revolution with its generative AI models, impacting various industries from cybersecurity to agriculture.

- Parkrun: A global initiative that organizes free weekly 5km events in local parks, promoting community and fitness.

- Peloton: Known for its interactive fitness equipment and online classes, Peloton has revolutionized home workouts.

- Quibi. Known for its short-form mobile streaming platform, quick, engaging content designed for mobile devices, catering to the modern, on-the-go consumer.

- Reformation: This brand focuses on sustainable fashion and has a strong online presence, making it a leader in digital marketing and e-commerce.

- Revolut. The money superapp, or neobank, enabling everyday banking, currency exchange, stock trading and more. With a particular focus on travellers.

- Seedlip: Partners with bars and restaurants to offer non-alcoholic cocktail options, promoting the idea of “mindful drinking.

- Skims: Sells underwear, loungewear and shapewear, and focuses on body positivity and sizing inclusivity.

- Smarter: This company brought the Internet of Things (IoT) to consumers with products like Wi-Fi-connected kettles and fridge cameras.

- Surreal Cereal: Disrupting the breakfast scene with their delectably nutritious, zero-sugar, high-protein cereals,

- Sway: A beverage brand that has made waves with its innovative flavors and sustainable packaging.

- Tony’s Chocolonely wants to make all chocolate 100% slave free. Not just our chocolate, but all chocolate worldwide.

- Too Good To Go is a mobile app that connects customers to restaurants and stores that have unsold, surplus food

- Tru Earth: A laundry detergent brand that offers eco-friendly and waste-free packaging, appealing to environmentally conscious consumers.

- Unmind. Provides a digital platform offering tools and resources for employees to manage their mental well-being,

- Varda Space Systems: Developing space infrastructure to support the growing space economy, including satellite manufacturing and space logistics.

- Waabi: Focused on autonomous driving technology, Waabi is making strides in making self-driving cars safer and more reliable.

- Who Gives a Crap: A toilet paper brand that donates 50% of its profits to build toilets for those in need around the world.

- Whoop: A wearable tech company that provides detailed insights into athletes’ performance and recovery.

- Xero. Transformed how medium-sized businesses manage their finances by offering user-friendly and efficient tools that streamline accounting processes.

- Youfoodz. Revolutionized the convenience food market in Australia by offering fresh, healthy, gourmet meal options that are delivered directly to your door.

- Zepto: A rapid delivery startup that promises delivery within 10 minutes, disrupting the food delivery market.

- Zipline: A company using drones to deliver medical supplies to remote and hard-to-reach areas.

Decarbonisation is the priority for many business leaders.

While value creation, making sense of changing markets, exploring new growth markets and unlocking emerging technologies, rethinking business models, reducing costs, and driving growth all matter, decarbonisation is the obvious, urgent agenda that stands out for many of the leaders I meet.

From airlines to automotive, construction and energy, fashion and food, there is a huge priority placed on reducing carbon emissions through new materials, processes, and ways of working.

Look at the investor presentations of companies from British Airways to Volkswagen, Holcim and Shell, Inditex to Nestle, in each case “decarbonisation” is the keyword. How to reduce the emissions of existing ways of working, how to transition to new business models. And for investors, how to reduce risk, tap into growth markets, and deliver growth.

Energy companies are obviously at the forefront of this. Some of my clients like Enel and Iberdrola are leading the energy transition, and others like Siemens are finding ways to accelerate it. In construction, Holcim is regenerating cities out of existing waste materials, rebuilt with green cement, and with more sustainable designs for ongoing use.

Volkswagen in a desperate situation, unable to transition from ICE to EV world. In fashion, brands like H&M to Patagonia embrace reuse and up cycling, recycled fabrics, while new fibre emerge that can do more. In food, companies like Danone and Nestle are actively changing how we farm, and what we eat, while Too Good to Go ensures our food doesn’t go to waste.

So what does it take? And who are the companies accelerating a better future, with less carbon, and sometimes more positive impact too?

Low Carbon Energy: Renewables and Hydrogen

Most CO2 emissions arise from burning fossil fuels such as coal, natural gas, and petroleum, for energy sourcing. As a result, utilities and energy providers are promoting energy transition. Some of the renewable energy systems include advanced photovoltaics (PV) that capture solar energy more efficiently and wind turbines that eliminate the need for huge installations or high-low wind speeds. Additionally, companies are making significant innovations in the areas of hydroelectricity, geothermal energy, and biofuels.

- Geothermal: Celsius Energy is a French startup that uses geothermal energy for heating and air conditioning buildings. It uses a heat transfer fluid that circulates in a 200-meter-deep heat exchanger. A heat pump then exchanges the calories with the basement to supply heat to the building during winter and extract them in summer. Additionally, a digital control system minimizes electricity consumption by optimising subsurface operations and heat pumps in real time. Thus, Celsius Energy allows commercial buildings to reduce their dependence on fossil fuels by utilising a local renewable source of energy.

- Green Hydrogen: Versogen is a US-based startup that creates an electrolyzer for low-cost green hydrogen production. Its proprietary platform technology, PiperION, applies advanced anion exchange membranes that enable the use of low-cost construction materials in electrolyzers, fuel cells, and other electrochemical devices. This makes them more economical than conventional proton exchange membranes (PEMs). Hence, Versogen solves the main challenge in large-scale green hydrogen production and accelerates the global transition toward net zero.

Carbon Capture

While low carbon energy sources are critical in the fight climate change, they alone are not enough to reverse the effects of global warming. Hence, startups are working on carbon capture, utilization, and storage (CCUS) technologies, driving decarbonization across industries. Top priority is direct air capture, i.e., capturing CO2 directly from ambient air instead of point sources such as power plants or factories. This opens up concentrated opportunities for carbon sequestration and utilization.

- Direct Air Capture: US-based startup Heirloom develops a cost-effective direct air capture solution. It deploys carbon mineralization technology with widely available, low-cost minerals to produce oxides that naturally bind to CO. The process doesn’t rely on energy-intensive and high-cost air contractors. Heirloom injects the captured carbon underground into geological structures. There, it remains permanently trapped away from the atmosphere.

- Vehicle Emissions: Remora is another US-based startup that develops a retrofit carbon capture unit for semi-trucks. The device attaches to the vehicle exhaust pipe and captures up to 80% of total emissions. It uses carbon scrubbing technology to strip greenhouse gases from the tailpipe and release clean air. The solution automatically compresses the CO2 and stores it in onboard tanks. Once the offload tanks fill up, the startup picks up the CO2 with a tanker truck and delivers it to concrete producers or other end-users who store it away for a long time.

Low Carbon Materials: Construction and Fashion

There is a huge scope for decarbonisation in changing the type of materials used. For the construction industry this includes cement, asbestos, vinyl flooring, and polystyrene insulations that are highly toxic to the environment. Low carbon construction materials such as self-healing concrete, 3D graphene, aerographite, modular bamboo, and wool bricks are gaining popularity as sustainable alternatives.

- Alternative Cement: Betolar is a Finnish startup that makes Geoprime, a sustainable cement alternative. It is a geopolymer-based low carbon material that the startup uses to create cement-free construction materials. To further sustainability, Betolar utilizes side streams of energy, steel, paper, pulp, and mining industries to produce these construction materials including stabilization, precast, and ready-mix concrete. By providing low carbon materials, Betolar enables the construction industry’s transition to carbon neutrality.

- Sustainable Fibres: Indian startup Canvaloop produces a carbon-negative textile fibre for slow fashion. The startup’s proprietary technology converts hard barks of Himalayan hemp into a soft cotton-like form. It is then processed into sustainable fibre, HempLoop+. Besides selling fiber and yarns, the startup uses its fibre to make sustainable jeans, yoga mats, and masks that are plastic-free and prevent the release of microplastics in the wastewater stream. Hence, by using a crop that naturally captures CO2, Canvaloop enables decarbonization in the fashion industry.

Low Carbon Travel: Airlines and Automotive

Trains, planes and automobiles are one of the largest carbon-emitting sectors and the most efficient way to decarbonise the industry is electrification. While battery electric vehicles (BEVs) have been here for some time, fuel cell electric vehicles (FCEVs) are emerging to be more effective. This is because they are powered by hydrogen and emit only water vapor and warm air. However, even with BEVs, widespread usage is still a challenge due to the non-availability of EV charging stations and range anxiety. To resolve this, startups are developing EV charging station networks as well as modular charging solutions.

- Charging Stations: Indian startup Charzer provides Kirana Charzer, a low-cost, compact, IoT-powered EV charging station. It is installable in shops, restaurants, houses, and offices, among others. The startup also offers a mobile app that allows riders to locate the nearest charging point and book slots from a network of 300+ charging stations across India. By converting local groceries, malls, and even small tea shops into EV charging stations, Charzer creates a vast charging network for EV riders, accelerating EV adoption.

- Green Hydrogen: Danish startup Everfuel offers green hydrogen supply and fuelling solutions. The system produces hydrogen using renewable electricity only during the availability of surplus energy to reduce energy costs. This approach also provides the power grid with efficient energy storage and enhances the efficiency of renewable energy production. Everfuel connects vehicle manufacturers to the complete hydrogen value chain, ensuring a supply of clean hydrogen fuel to their customers.

Low Carbon Nutrition: Food and Drink

Meat accounts for the majority of the CO2 emissions in the food production industry. But, the demand for meat is only going upward. This is why food tech startups are constantly looking for alternative protein sources including plant products like soybean, pea, chickpea, and nuts, as well as fungi and insects. Some startups are genetically modifying plants to mimic the taste and texture of animal meat while retaining the original nutritional qualities. Others are taking it a step forward by leveraging food ingredients like spirulina, which naturally captures CO2.

- Plant-Based Foods: UK-based startup Moolec creates plant-based alternative proteins through molecular farming. The startup’s process induces animal proteins’ gene DNA codes inside the genome of plants to produce proteins the way animals do. Each protein is selected to add value in terms of targeted functionality like taste, texture, and nutritional values. Thus, Moolec is enabling the food sector to reduce its reliance on animal-based meat and, thereby, decrease its carbon footprint.

- Positive Drinks: Dutch startup FUL offers climate positive drinks with spirulina, nutritious blue-green algae. This superfood is climate-friendly as it captures atmospheric CO2 and converts it into oxygen and nitrogen. Moreover, the startup enables CO2 recycling by using carbon dioxide to grow spirulina. FUL is thus decarbonizing the food and beverage industry by flipping the tradition of emitting CO2 in the production process.

Walking into Starbucks is more than asking for a tall skinny latte. It’s an immersive lesson in brand psychology.

From the size of cups (why is Tall the smallest size?), to the structure of its pricing menu (which size seems best value?), to the handwritten name and emoji written on your cup. There is fascinating science to each of these seemingly unimportant factors.

Behavioural sciences explores the psychological, emotional, and cognitive factors that influence human behaviour, and these principles have found wide applications in marketing, customer experience, and business strategy. Below is a summary of 25 of the most impactful behavioral science concepts, particularly in relation to customer behavior, along with examples of how brands have successfully applied them.

1. Loss Aversion

Loss aversion, a principle from Prospect Theory, suggests that people are more motivated by the fear of losing something than by the desire to gain something of equivalent value. In a marketing context, this is used to push customers toward action by emphasizing what they stand to lose.

- Example: Airlines and hotels often use limited-time offers and emphasize the idea that a price or discount is “disappearing soon” to encourage customers to book immediately, highlighting the potential loss of the deal.

2. Scarcity

Scarcity occurs when something is perceived as limited in availability, which increases its value and desirability. This taps into the human tendency to want things we can’t easily get.

- Example: Fashion brands like Supreme and Nike use limited-edition products and “drops” to create urgency and increase demand.

3. Anchoring

Anchoring refers to the human tendency to rely heavily on the first piece of information offered (the “anchor”) when making decisions. In sales, the initial price or offer can dramatically influence how customers perceive the value of a product.

- Example: Many retailers display a high-priced item first, followed by a mid-range price. The high price serves as an anchor, making the second item seem like a better deal.

4. Framing Effect

The framing effect refers to how information is presented, which can significantly influence decision-making and judgment. Positive framing tends to produce more favorable outcomes.

- Example: A restaurant might describe a dish as “80% lean” rather than “20% fat” to make it sound healthier and more appealing.

5. Social Proof

Social proof refers to the idea that people are more likely to engage in a behavior if they see others doing it. This is often used in marketing to increase credibility and desirability.

- Example: Amazon uses customer reviews and ratings to provide social proof. Consumers are more likely to purchase items that have high ratings and positive feedback from others.

6. Reciprocity

The reciprocity principle states that people feel a psychological obligation to return favors. Brands leverage this by offering free gifts, samples, or services with the expectation that customers will reciprocate by making a purchase.

- Example: Online retailers often offer free samples or discounts on the next purchase to encourage return business.

7. Commitment and Consistency

Once a person commits to something, they are more likely to stick to it due to a desire for consistency. Brands can use this principle by getting customers to make small commitments that lead to larger actions.

- Example: Subscription services like Netflix or Spotify offer free trials to get customers to commit to a service, which increases the likelihood of them continuing the service once they’ve already made a commitment.

8. Endowment Effect

The endowment effect suggests that people tend to assign more value to things they own compared to things they don’t. This can be leveraged by brands offering free trials or samples.

- Example: Apple’s free trial of its ecosystem (iCloud, Apple Music) makes customers more attached to the products, increasing the likelihood of continued use or purchasing.

9. Default Bias

People tend to stick with pre-set options rather than making a choice. Marketers often exploit this by setting beneficial defaults, leading customers to make decisions that they might not otherwise.

- Example: Many subscription services set auto-renewal as the default, leading customers to continue the service without actively opting out.

10. Overchoice (Paradox of Choice)

The paradox of choice suggests that offering too many options can overwhelm customers and result in decision paralysis. Brands can use this insight by limiting options or simplifying choices.

- Example: Apple offers a limited selection of products, which makes decision-making easier for customers compared to tech companies with a wide range of options.

11. Urgency

Creating a sense of urgency by highlighting time-sensitive deals or limited-time offers motivates customers to act quickly rather than delay their purchase.

- Example: Websites often use countdown timers for flash sales or “only X items left in stock” to prompt customers to make immediate decisions.

12. The Power of ‘Free’

Offering something for free taps into a deep-seated psychological response. Free items, even if of low value, can spur higher conversion rates or engagement.

- Example: Dropbox’s free storage offer significantly contributed to its growth by encouraging users to try the service and refer friends.

13. Trust and Authority

People are more likely to follow advice or recommendations from perceived authorities or experts. Brands use endorsements, certifications, or influential figures to leverage this bias.

- Example: Brands like L’Oréal use dermatologist endorsements or celebrity influencers to gain trust and increase sales.

14. Cognitive Dissonance

Cognitive dissonance occurs when people experience discomfort from holding conflicting beliefs or behaviors. Brands can reduce this discomfort by providing reassurance or confirming customers’ decisions.

- Example: After a purchase, brands like Apple often send thank-you notes and customer satisfaction surveys, reinforcing the consumer’s decision.

15. Paradox of Familiarity

Humans tend to gravitate toward what’s familiar, even if it’s not necessarily the best option. Brands use this to make customers more comfortable and increase repeat business.

- Example: Coca-Cola and McDonald’s maintain consistent branding and messaging, which creates familiarity and comfort for their consumers.

16. Emotional Appeal

Emotional connection is a powerful motivator. Brands often tap into emotions like happiness, fear, or nostalgia to build strong relationships with customers.

- Example: Coca-Cola’s “Share a Coke” campaign tapped into personal connections and happiness by using customer names on bottles.

17. Visual Cues

Humans are highly influenced by visual stimuli. Brands use design, color, and imagery to guide customers’ decisions.

- Example: Companies like McDonald’s use red and yellow in their branding, as these colors are associated with energy and hunger.

18. Frugality Bias

People tend to value things that seem like a good deal. The perception of getting value for money can be a strong motivator.

- Example: Costco’s bulk-buying model creates the illusion of getting more for less, which appeals to customers’ desire for savings.

19. The Mere Exposure Effect

This principle suggests that people tend to develop a preference for things simply because they are familiar with them.

- Example: Advertising heavily, like Nike’s continuous brand exposure, leads to greater consumer familiarity, which in turn boosts brand preference.

20. Nudging

Nudging is subtly guiding people toward a desired behavior without restricting their choices. It’s an ethical way of influencing behavior.

- Example: Supermarkets often place healthier foods at eye level to nudge customers toward healthier choices.

21. Conformity

People often align their behavior with that of others in order to fit in. Brands can use group-based appeals to encourage customers to act a certain way.

- Example: Social media platforms like Instagram use likes, shares, and comments to encourage conformity to trends and behaviors.

22. Intermittent Reinforcement

Intermittent reinforcement occurs when rewards are given at unpredictable intervals. This unpredictability can increase the likelihood of a behavior being repeated.

- Example: Loyalty programs that offer occasional unexpected rewards (such as a surprise discount) motivate customers to keep returning.

23. Time Discounting

People tend to devalue rewards the further away they are in time. Brands can exploit this by offering immediate rewards or discounts.

- Example: Credit card companies often offer immediate cashback or sign-up bonuses to encourage consumers to choose their cards over others.

24. Self-Perception Theory

People form their attitudes and beliefs based on their own behavior. If a customer behaves in a certain way, they may justify it by changing their attitudes or beliefs to align with their actions.

- Example: After purchasing an eco-friendly product, customers may develop more pro-environmental attitudes, reinforcing their purchase decision.

25. Priming

Priming occurs when exposure to a certain stimulus influences how a person responds to a subsequent stimulus. Brands can prime consumers’ minds to think positively about their products.

- Example: Luxury brands like Rolex prime consumers by showcasing high-end, aspirational imagery in their marketing materials, leading to increased desire for their products.

Behavioral sciences provide critical insights into customer behavior, and brands that apply these principles effectively can create more engaging, persuasive, and successful marketing strategies. By understanding and leveraging concepts like loss aversion, scarcity, social proof, and reciprocity, companies can better influence consumer decisions, enhance customer satisfaction, and drive loyalty. Whether through framing choices, nudging behavior, or creating emotional connections, these psychological insights allow brands to craft experiences that resonate deeply with customers and improve long-term business performance.

Seeing the Unseen

A century ago, the world’s most valuable companies were measured by how much land they owned, how many tons of steel they produced, or how many barrels of oil they extracted from the ground. Today, the most valuable companies own few factories and carry little inventory. Their value lies not in what you can touch—but in what you cannot.

Apple, Alphabet, Amazon, Microsoft, and Nvidia are trillion-dollar businesses not because of their physical assets, but because of the brands they’ve built, the ecosystems they’ve cultivated, the trust they’ve earned, the data they control, and the software they deploy at planetary scale. What makes these businesses so valuable is largely invisible—intangible assets that never show up fully on a balance sheet, yet define competitive advantage in the modern age.

We are living through a silent revolution. According to Ocean Tomo, intangible assets made up just 17% of the market value of S&P 500 companies in 1975. By 2020, that number had soared to over 90%. The traditional accounting lens—designed in the industrial era—struggles to capture this shift. In boardrooms and spreadsheets, what matters most is often missing. Leaders trained to manage physical assets and short-term profits are now navigating a world where value lives in code, content, relationships, creativity, culture, and algorithms.

This book is about that unseen world. It is about the hidden engines of exponential growth, the value drivers that define market leadership today, and the reasons so many companies still overlook them.

The Intangible Economy Is Already Here

The signs are everywhere. A shoe company like On Running can IPO with billion-dollar valuations thanks to its cult brand and community before turning a profit. A firm like OpenAI can become one of the most watched organizations on earth while giving away its most valuable product for free. A cosmetics company like LVMH can dominate not by owning raw materials, but by commanding desire, loyalty, and prestige.

These examples point to a profound truth: in an age of abundance, what’s scarce is trust, attention, belief, identity, and insight. Intangible assets are the levers that create this scarcity—and therefore, value.

What makes this shift difficult for many leaders to grasp is that intangible assets don’t behave like physical ones. A factory depreciates over time. A brand, when nurtured, can appreciate. A machine wears out. A great culture compounds. A physical product scales linearly. A software product scales exponentially, at zero marginal cost. In the industrial economy, more capital meant more capacity. In the intangible economy, more creativity, trust, and data mean more leverage.

What We Fail to See, We Fail to Manage

For all their importance, intangible assets remain poorly understood. Many leaders default to thinking of them as “soft,” “fluffy,” or hard to quantify. They focus on what they can measure—plant, property, and equipment—while ignoring what truly drives performance.

The consequence is a profound misalignment. Businesses underinvest in brand, culture, design, and systems thinking because they don’t appear as “assets.” They overlook customer data as a strategic asset. They treat software as an expense, not an investment. They outsource creativity while trying to own factories.

Meanwhile, the companies that win today—from Tesla to TikTok, from Figma to Ferrari—build their entire business models around intangible leverage. They invest in creating ecosystems, not just products. They design brands with emotional resonance. They use culture as a strategic weapon. They understand that what people feel, believe, share, and remember matters as much as what they buy.

From Value Chains to Value Loops

Industrial-era thinking treated businesses like linear machines: input goes in, value is added, and output goes out. But the intangible age favours loops—feedback systems, compounding advantages, and reinforcing dynamics.

A strong brand attracts customers, which improves data, which improves products, which deepens loyalty, which strengthens the brand. A thriving culture attracts talent, which builds better software, which drives customer satisfaction, which attracts more talent. These loops don’t just create value—they accelerate it.

That’s why intangible assets matter more than ever: they don’t just create one-time benefits; they create flywheels. The most successful businesses build, protect, and invest in these flywheels. The least successful ones treat them as “nice to haves.”

The Blind Spots of Traditional Management

There is a paradox at the heart of modern capitalism. What creates long-term value—brand equity, trust, culture, intellectual property, proprietary data—is largely ignored in quarterly earnings calls. Analysts ask about costs and margins, not community or design. Boards evaluate risk in terms of financial compliance, not reputational fragility.

This isn’t just a gap—it’s a governance crisis. When leaders don’t understand what’s driving 90% of their company’s value, bad decisions follow. Cost-cutting initiatives gut creative teams. Rebrands miss the cultural moment. Technological capabilities are treated as IT problems, not core strategy. Culture is seen as HR’s domain, rather than the foundation of execution.

To succeed in the era of intangible value, we need to upgrade our models—not just our metrics, but our mental models.

The New Literacy of Leadership

What’s needed is a new literacy for leadership—an ability to see, value, and build the invisible. This includes:

- Understanding how brand equity compounds and how to measure it

- Treating data not just as a byproduct, but as a core asset

- Investing in software and design as growth multipliers

- Leading culture not through slogans but through systems

- Designing ecosystems that scale beyond the firm

The most successful modern leaders—from Satya Nadella to Melanie Perkins—have embraced this shift. They’ve moved beyond managing inputs and outputs to curating experiences, enabling ecosystems, and empowering cultures of innovation.

This is not about softening business. It’s about sharpening it for the realities of the new economy.

Welcome to the Invisible Business

The age of tangible advantage is over. We’ve entered a new era—one where unseen forces determine success. If we can learn to see what others ignore, we can unlock extraordinary value.

This is your guide to the future of value creation. Welcome to the invisible business.

From Steel to Stories, How Value Has Shifted

In 1911, U.S. Steel became the world’s first billion-dollar corporation. Its value was measured in iron ore, blast furnaces, railway lines, and rolling mills. Capital investment meant physical scale, and industrial power meant control over supply chains and manufacturing capacity. Business success was made of concrete, steel, and sweat.

Fast forward to today, and the world’s most valuable companies look entirely different. Apple, Alphabet, Amazon, Microsoft, and Meta sit at the top of the list—not because they produce more physical goods than their rivals, but because they dominate in software, platforms, ecosystems, brand trust, user data, and design. Their true value lives not in things, but in intangibles: code, ideas, relationships, culture, and networks.

We have undergone a profound shift in the way economic value is created, measured, and understood. The industrial economy rewarded those who built the biggest factories and shipped the most units. The post-industrial economy—our economy—rewards those who build the strongest brands, harness the most useful data, and design the most engaging experiences.

We have moved from steel to stories—from atoms to bits, from scale to networks, from ownership to access, from extraction to attention.

The Age of Tangibles

For most of the 20th century, economic success was synonymous with industrial prowess. Oil giants, car manufacturers, mining conglomerates, and heavy engineering firms defined global capitalism. Value creation was linear and physical: extract raw materials, transform them through machinery, and distribute them through logistics networks.

Business models were built on vertical integration and economies of scale. The goal was efficiency, the metric was output, and the advantage was size. This was the age of assembly lines, smokestacks, and scale economics. Companies built value by owning more—more factories, more assets, more inventory, more people.

Accounting standards were designed to measure this world. Balance sheets captured physical plant and equipment. Profit and loss statements tracked input costs and unit margins. Depreciation schedules mirrored asset wear and tear. Tangible assets dominated both corporate strategies and financial reports.

But as the century wore on, something began to change.

The Rise of Intangibles

In 1975, the average S&P 500 company derived 83% of its value from tangible assets. By 2020, that number had reversed: more than 90% of corporate value came from intangibles. Brands, patents, software, algorithms, relationships, customer lists, organizational know-how, and proprietary data now drive the lion’s share of enterprise value.

This shift wasn’t just a feature of tech companies. It was everywhere. A luxury goods firm like Hermès generates value through scarcity, craftsmanship, and storytelling. A media platform like Netflix wins on user experience, original content, and engagement data. A company like Tesla builds not just electric vehicles but a cult-like brand, proprietary AI systems, and a massive software-defined platform.

What these companies have in common is that their most valuable assets are not visible on a factory tour—and in many cases, not fully captured on a balance sheet.

Why This Shift Matters

Intangible assets behave differently than tangible ones. They scale faster, last longer, and interact in more complex ways.

- Brands compound emotional trust, allowing premium pricing and customer loyalty.

- Software can be duplicated at near-zero marginal cost, enabling exponential scaling.

- Data gets more valuable the more it is used, especially in machine learning.

- Culture drives internal performance and external perception.

- Networks grow stronger with every new node, creating winner-take-most dynamics.

[I know these are not the right ISO categories, you can correct the details]

These properties create new kinds of competitive advantage. While tangible assets depreciate, intangible assets—when well managed—often appreciate. A factory may produce a million units a year. But a viral app, a trusted brand, or a magnetic story can reach billions—instantly.

The best companies build intangible flywheels. For example, Amazon collects customer data to improve recommendations, which increases engagement, which attracts more sellers, which improves selection, which brings more customers—who then provide more data. This self-reinforcing loop creates momentum that is hard to replicate with physical assets alone.

The Industrial Mindset vs. the Intangible Reality

Despite this profound shift, many leaders and organizations still operate with industrial-era mental models. They view value creation through the lens of control, ownership, and output. They prioritize efficiency over emotion, scale over meaning, and cost-cutting over trust-building.

This creates strategic blind spots. For example:

- A company cuts its marketing budget to protect margins, eroding brand equity that took decades to build.

- A business outsources its software development, losing control over its core platform.

- A team undervalues culture as a “soft” issue, only to suffer high turnover and low innovation.

- A firm treats its customer data as a compliance risk rather than a strategic asset.

These are not minor missteps—they are existential risks in an era where intangibles define market leadership.

The iPhone Moment

The story of Apple and Nokia offers a stark illustration of this shift. In the early 2000s, Nokia was the world’s leading phone manufacturer. It had factories across the globe and a dominant market share. Apple, on the other hand, had no experience in phones—but it had a powerful brand, a design philosophy, and an ecosystem mindset.

When the iPhone launched in 2007, it didn’t just introduce a new product—it redefined the value equation. Apple focused on the user experience, the emotional connection, the app ecosystem, and the seamless integration between hardware and software. Nokia, focused on cost-efficient manufacturing and feature lists, couldn’t keep up.

Within a few years, Apple became the most valuable company in the world. Nokia exited the phone business. Tangibles lost to intangibles.

The Intangible Economy

Today, value doesn’t reside on the factory floor. It lives in the minds of customers, the relationships between users, the algorithms inside platforms, and the ideas embedded in design. The most important assets are often invisible—until they’re gone.

To lead in this world, businesses must learn to see, measure, and manage these new value drivers. That requires letting go of outdated assumptions and building new capabilities. It means investing in creativity, culture, brand, and systems. It means designing business models that harness flywheels, data loops, and network effects.

Most importantly, it means telling better stories—not just to customers, but internally, to guide strategy, mobilize teams, and shape identity.

Because in the age of intangibles, stories scale better than steel.

Airbnb: Unlocking Trust

Airbnb has built a global hospitality empire without owning a single hotel. Its core asset isn’t real estate—it’s trust. From its early days, Airbnb recognized that enabling strangers to stay in one another’s homes required more than a clever platform. It needed to create a global sense of safety, community, and emotional connection. By investing heavily in design, reputation systems, host standards, and a narrative around “belonging,” Airbnb turned trust into its most valuable currency.