Nubank

Reinventing financial services in Latin America

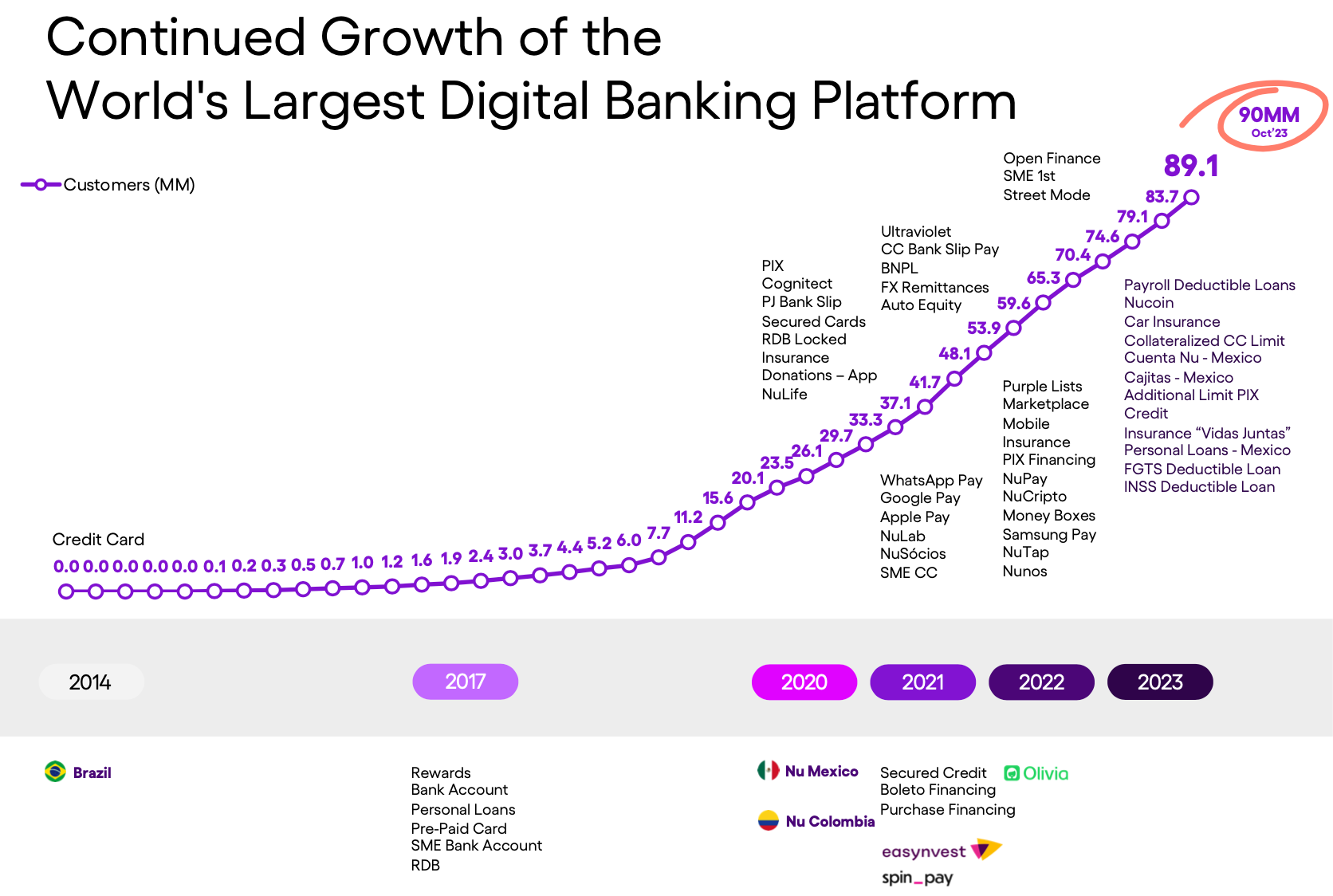

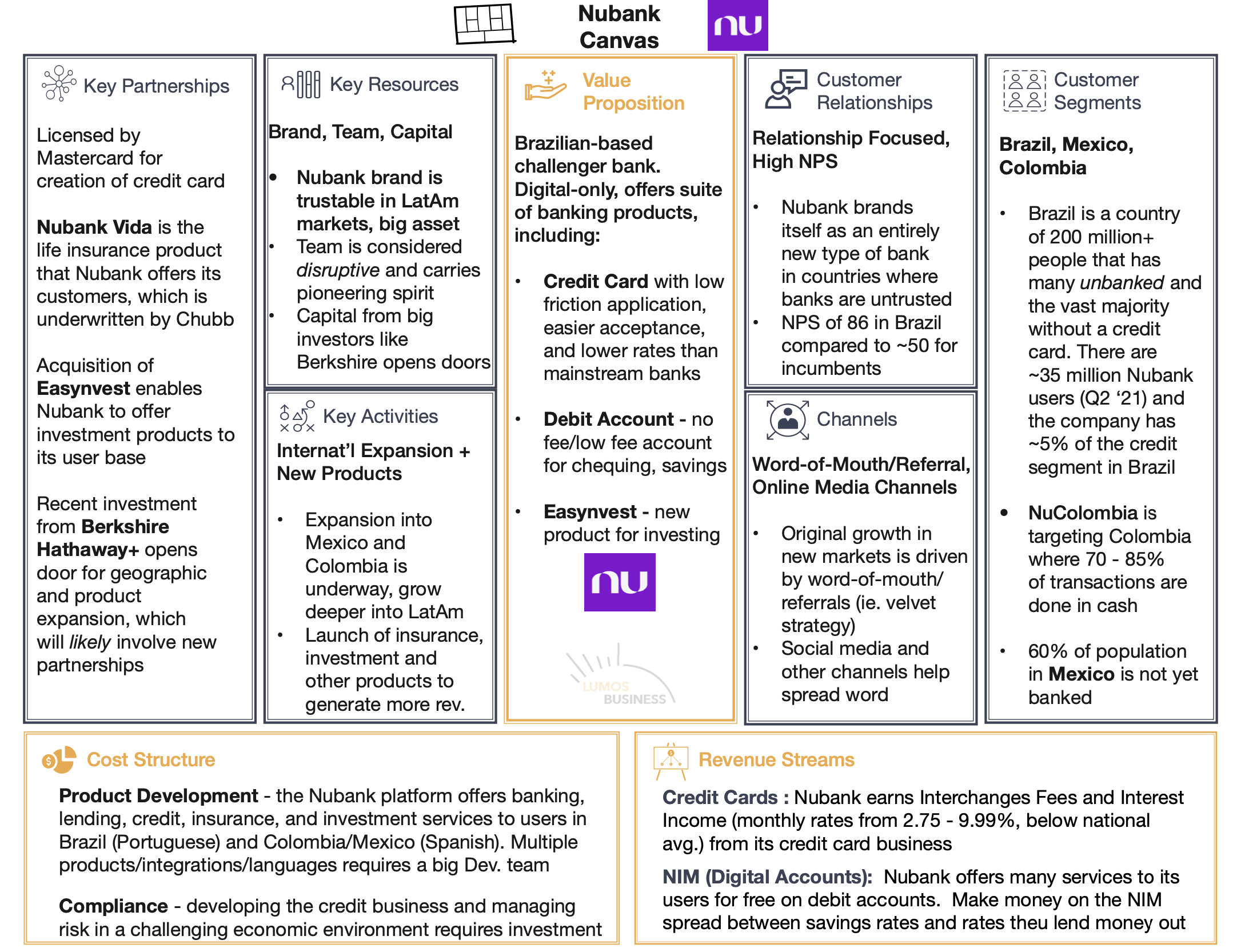

Nubank was born in 2013 with the mission to fight complexity to empower people in their daily lives by reinventing financial services. It is one of the world’s largest digital banking platforms, serving more than 80 million customers across Brazil, Mexico, and Colombia. As one of the leading tech companies in the world, Nu leverages proprietary technologies and innovative business practices to create new financial solutions and experiences for individuals and SMEs that are simple, intuitive, convenient, low-cost, empowering, and human. Guided by its mission, Nu is fostering access to financial services across Latin America.

Nubank is a leading Brazilian neobank, or fintech business, recognised for its innovative and customer-centric approach to banking services.

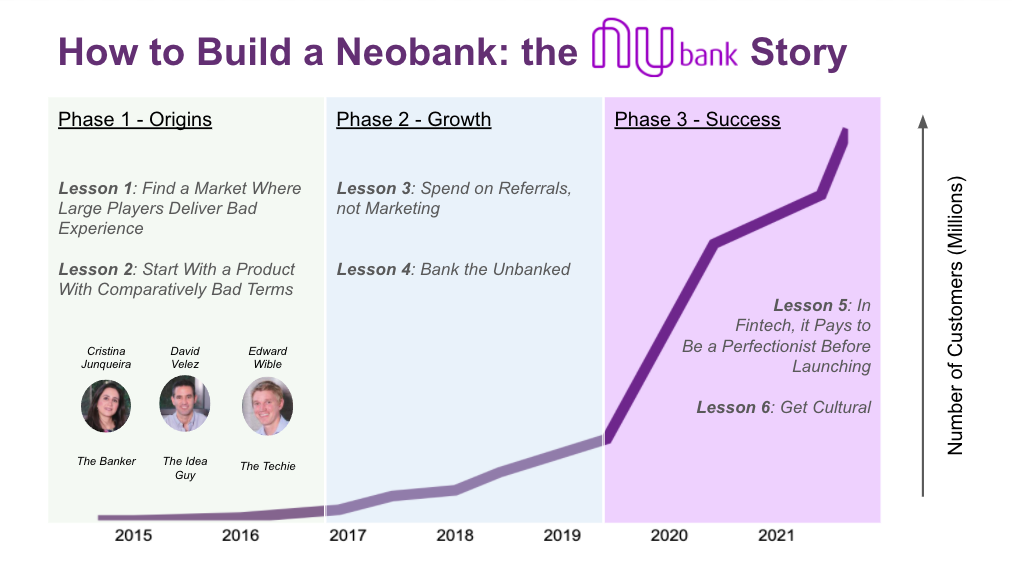

Nubank was founded in 2013 by David Vélez, Cristina Junqueira, and Edward Wible in São Paulo, Brazil. The founders aimed to challenge the traditional banking model by providing a more transparent, accessible, and customer-friendly alternative.

Its first product was a credit card that differentiated itself by not charging traditional fees, such as annual fees or over-limit fees. The credit card application process was entirely digital, allowing customers to apply and manage their accounts through a mobile app.

Over the years, Nubank expanded its product offerings beyond credit cards. It introduced a digital savings account (NuConta) in 2017, offering a simple and fee-free savings experience. Additionally, the company introduced personal loans and other financial products to cater to a broader range of financial needs.

Nubank achieved “unicorn” status in 2018, reaching a valuation of over $1 billion. The company’s success was driven by its customer-centric approach, digital focus, and the popularity of its products in a market where traditional banking services often came with high fees and bureaucracy.

Nubank expanded its operations beyond Brazil, targeting other Latin American markets. The company ventured into Mexico in 2019, marking its first international presence. The expansion aimed to replicate Nubank’s success in providing accessible and user-friendly financial services.

In 2021, Nubank filed for an initial public offering (IPO), marking a significant milestone for the company. The IPO was closely watched, as Nubank continued to disrupt the traditional banking industry and attract a large customer base.

Nubank’s story is characterized by its commitment to simplicity, transparency, and customer empowerment in the financial services sector. It has gained popularity for challenging the status quo and offering innovative solutions to meet the evolving needs of consumers in the digital age.

Nubank’s strategy revolves around challenging traditional banking models by providing a customer-centric, transparent, and digital banking experience. Here are some key elements of Nubank’s strategy:

- Digital-First Approach: Nubank is built on a digital-first model, allowing customers to access and manage their financial products entirely through a mobile app or website. This approach eliminates the need for physical branches and paperwork, offering a more convenient and efficient banking experience.

- Customer-Centricity: Nubank places a strong emphasis on customer satisfaction and aims to address pain points commonly associated with traditional banking, such as hidden fees, complex processes, and poor customer service. The company focuses on simplicity, transparency, and responsiveness to customer needs.

- Fee-Free Banking: Nubank initially gained attention by offering a credit card with no annual fees, over-limit fees, or other traditional charges. This fee-free model was extended to other products, including savings accounts and personal loans, creating a more attractive value proposition for customers.

- Product Diversification: While Nubank started with a credit card, the company has expanded its product portfolio to include digital savings accounts (NuConta), personal loans, and other financial services. This diversification allows Nubank to cater to a broader range of financial needs for its customer base.

- Innovation and Technology: Nubank invests heavily in technology and innovation to enhance its products and services continually. The company leverages data analytics and machine learning to provide personalized financial solutions, improve risk assessment, and streamline processes.

- International Expansion: Nubank has pursued international expansion, starting with its entry into the Mexican market. The company aims to replicate its success in other Latin American countries, bringing its customer-centric approach to a broader audience.

- Financial Inclusion: Nubank has a commitment to financial inclusion, targeting underserved populations and providing them with access to essential financial services. The digital nature of Nubank’s offerings makes it more accessible to individuals who may have limited access to traditional banking infrastructure.

- Transparency and Education: Nubank prioritizes transparency in its communication with customers, ensuring that users understand the terms and conditions of their financial products. The company also focuses on financial education, providing resources to help customers make informed financial decisions.

Nubank’s strategy revolves around disrupting the traditional banking landscape by leveraging technology, prioritizing customer satisfaction, and offering a range of fee-free and accessible financial products. The success of this strategy is evident in Nubank’s rapid growth and popularity among consumers in the markets it serves.