EssilorLuxottica is a multinational eyewear company that was formed through the merger of two major players in the eyewear industry: Essilor and Luxottica.

Essilor, founded in 1972, was a French company specializing in the manufacturing of ophthalmic lenses. It became a leading player in the global eyewear industry, focusing on providing innovative lens solutions to improve and protect eyesight.

Luxottica, founded in 1961, was an Italian company created by Leonardo Del Vecchio. Luxottica initially started as a small eyewear component manufacturer and later expanded into the design, manufacturing, and distribution of eyewear frames. Luxottica became well-known for owning popular eyewear brands like Ray-Ban, Oakley, and Persol, and for its retail chains such as LensCrafters and Sunglass Hut.

In 2017, Essilor and Luxottica announced their merger, creating EssilorLuxottica. The merger aimed to combine Essilor’s expertise in lens manufacturing with Luxottica’s strength in eyewear frames and retail. However, the merger faced some challenges, including corporate governance issues and power struggles between key stakeholders.

Despite these challenges, EssilorLuxottica continued to be a major player in the eyewear industry, controlling a significant portion of the market. The company’s focus remained on providing a comprehensive range of eyewear products, from lenses to frames, and maintaining a strong presence in both manufacturing and retail.

EssilorLuxottica’s strategy revolves around being a vertically integrated company that covers various aspects of the eyewear industry, from lens manufacturing to frame design and retail distribution. Here are some key elements of their strategy:

- Vertical Integration: The company aims to control the entire value chain of the eyewear industry. By merging Essilor’s expertise in lens manufacturing with Luxottica’s strength in designing frames and owning popular eyewear brands, EssilorLuxottica can offer a comprehensive range of eyewear products.

- Brand Portfolio: EssilorLuxottica owns a diverse portfolio of eyewear brands, including well-known names like Ray-Ban, Oakley, Persol, and Vogue. This allows the company to cater to different market segments and consumer preferences.

- Innovation: As a leader in the industry, EssilorLuxottica focuses on innovation in both lens technology and frame design. The company invests in research and development to bring new and advanced products to the market, with a particular emphasis on improving vision quality and addressing specific eye care needs.

- Retail Presence: EssilorLuxottica has a significant retail presence through its own stores and partnerships with other retailers. This includes optical retail chains like LensCrafters and Sunglass Hut. This retail strategy enables the company to directly reach consumers and showcase its diverse range of eyewear products.

- Global Reach: The company has a strong global presence, allowing it to tap into various markets and demographics. This global reach is crucial for expanding its customer base and adapting to regional preferences and trends.

- Digital Transformation: Like many industries, the eyewear sector is undergoing a digital transformation. EssilorLuxottica invests in digital technologies to enhance the customer experience, whether through online retail channels, virtual try-on tools, or other digital innovations in the eyewear space.

- Corporate Social Responsibility (CSR): EssilorLuxottica places importance on CSR initiatives, including sustainable practices in manufacturing and a commitment to social responsibility. This aligns with the growing consumer demand for socially and environmentally responsible business practices.

ABG specializes in acquiring and revitalizing iconic and well-known brands across various industries, including fashion, sports, entertainment, and lifestyle. The company focuses on building long-term value for its brands through strategic partnerships, licensing agreements, and collaborations.

Some of the notable brands in ABG’s portfolio include Marilyn Monroe, Elvis Presley, Muhammad Ali, Sports Illustrated, Nine West, Forever 21, and many others. The company is known for its ability to breathe new life into established brands, leveraging their heritage and popularity to create diverse and innovative product lines.

Under Jamie Salter’s leadership, Authentic Brands Group has become a major player in the brand licensing and management industry, working with a wide range of partners to extend the reach and appeal of its portfolio of iconic brands.

ABG now owns more than 50 brands, including Juicy Couture, Hervé Léger and Forever 21.

In 2022, ABG bought a majority stake in David Beckham’s brand management company DB Ventures for $269m (£200m) to drive growth in the EMEA and Asia-Pacific regions. ABG opened a European HQ in London. In March, ABG finalised its largest acquisition since 2010, buying Reebok from Adidas for $2.5bn (£2.2bn) and expanded its share in the sportswear market.

It also bought Ted Baker for £211m, turning the premium British lifestyle brand into a privately-owned company. By 2022 ABG generated £20bn in global retail sales annually and has more than 9,100 stores.

Authentic’s brand portfolio now includes Marilyn Monroe®, Elvis Presley®, Muhammad Ali®, Shaquille O’Neal®, David Beckham®, Dr. J®, Greg Norman®, Neil Lane®, Thalia®, Sports Illustrated®, Reebok®, Brooks Brothers®, Barneys New York®, Judith Leiber®, Ted Baker®, Hunter®, Vince®, Hervé Léger®, Hickey Freeman®, Frye®, Nautica®, Juicy Couture®, Vince Camuto®, Lucky Brand®, Aéropostale®, Forever 21®, Nine West®, Rockport®, Eddie Bauer®, Boardriders®, Quiksilver®, Billabong®, Roxy®, DC Shoes®, RVCA®, Element®, VonZipper®, Honolua®, Spyder®, Volcom®, Shark®, Tretorn®, Prince®, Airwalk®, Izod®, Jones New York®, Van Heusen®, Hart Schaffner Marx®, Arrow® and Thomasville®.

It continues to innovate with retail and celebrity brands, not just in terms of product development but physical stores too. Here’s a clip of its recent deal to feature Shein, the Chinese e-commerce giant, within its physical Forever21 stores, and drive footfall to its Simon shopping malls.

Excerpt from Jamie Salter interview with Drapers, January 2024:

Toronto native Jamie Salter launched New York-based conglomerate Authentic, also known as Authentic Brands Group, in 2010.

Authentic’s reach is undeniable. It owns more than 50 global brands and has recently swept up some of the most recognisable businesses in fashion retail including Reebok for $2.1bn (£1.78bn), Ted Baker for £211m, Hunter and the US’s Forever 21, alongside a $200m (£157m) majority stake in David Beckham’s brand management business DB Ventures – Salter counts Beckham, a shareholder in Authentic, as a close friend and business partner.

Despite the tough economic climate, Authentic’s acquisition trail continues in 2024. Last week, Authentic acquired US footwear brand Sperry from Wolverine Worldwide and rumours are circling that it will add Topshop to its roster this year by buying it from a beleaguered Asos.

Authentic licenses the brands it owns by segment. When Authentic buys a fashion business, it breaks it down by category or market and licenses these segments out to different suppliers, which Authentic then collects performance-based royalties from. Salter explains: “When we buy one company it may get broken up into 40 different partners around the world”. It has more than 13,000 franchise stores and 1,600 licensees in total.

The acquisition of Sperry has seen Authentic partner with Aldo Group to run Sperry’s design, production and distribution as well as lead its wholesale, ecommerce and store operations in the US.

Dividing up a business and outsourcing the different functions has been seen by many in the industry as a controversial practice. Outsourcing the Ted Baker business led to 200 redundancies in June 2023. However, the numbers are working for Authentic: global revenue in 2023 at the business was $29bn (£22.7bn) and further expansion is in the works. The business is opening a new head office in central London at the end of January, which will house its UK team of 75, alongside showrooms for its brands.

The new year will see Salter expand Authentic’s existing fashion businesses by introducing new categories, alongside setting his sights on more multi-million pound deals to grow the business. However the conglomerate is not immune to the wider economic environment and Salter expects to see a downturn as consumers continue to be hit with cost of living challenges and rising interest rates.

Salter began his career selling sporting goods and acquired Kemper Snowboards in the late 1980s. He then co-founded snowboard business Ride Inc in 1992 before stepping down in 1996 after taking the company public on tech stock market Nasdaq. Salter then co-founded financial services company Hilco Consumer Capital in 2006, a subsidiary of Hilco Global, before leaving in 2010 and launching Authentic.

Partnerships with fellow fashion retail giants are one way that Salter is growing Authentic. The business is working closely with Chinese fast fashion giant Shein. In August, SPARC group – which is a joint venture between Authentic and major US landlord Simon Property Group, acquired a minority shareholding in the Singapore-based etailer. Shein also acquired a one-third interest in SPARC Group.

Shein is now producing and selling Forever 21 products on its platforms. As part of the deal, Shein customers can return any product brought from the ecommerce to Forever 21 stores. Shein also has a series of permanent shop-in-shops at Forever 21’s 450-strong US store portfolio.

Salter says he watched Shein “very closely” as the business was “really effecting Forever 21”. He explains: “In 2021 [Forever 21] had this amazing year, right after Covid. Then starting in 2022 we saw our sales start to deteriorate and the more I looked into it, the more I saw that Shein was taking market share from us.”

Salter explains that he told Shein it was a “race to the bottom” in terms of pricing architecture, as Chinese competitor Temu began snapping at Shein’s heels. He proposed a partnership, as he said the Forever 21 brand resonated with US consumers far more than Shein, which attracted buyers only through affordable prices: “I said, you have to understand that the reason that people pay a higher price for a product is because that product has a heartbeat.

“If you give a choice to the consumer of Forever 21 or Shein at the exact same price, they will go for Forever 21 every time,” he adds.

The Shein return-to-store strategy began in early January and Salter predicts that it will “start off slow but pick up momentum.”

Meanwhile across the pond, Authentic has its eye on heritage British brands. It acquired Hunter’s IP in June 2023 after it fell into administration and will work with licensee Batra to expand Hunter’s apparel line in 2024. Batra operates Hunter’s production in the UK and Europe with footwear supply business the Marc Fisher Footwear Company at the helm of Hunter’s US operations. Salter adds that apparel “will start out of Europe and then move around the world”.

However having many licensees comes with its own challenges. After buying the struggling Ted Baker business for £211m in 2022, Authentic licensed its UK and European operations to Danish group AARC in 2023. However AARC needed additional capital to bolster its operations, leading Authentic to provided AARC with a short-term loan. In December AARC secured further funding from Secure Trust Bank Commercial Finance (STB CF) and Modella Capital to allow it to grow the Ted Baker business.

The Farfetch fallout has also impacted Authentic. Farfetch narrowly avoided bankruptcy after being plagued by falling revenue and profit, when South Korean retailer Coupang swept in with a last-minute rescue deal on 18 December. In February 2022, Authentic announced that was partnering with New Guard’s Group (NGG), Farfetch’s wholesale and licensing arm, to operate Reebok’s European wholesale operations and ecommerce. Salter says that Reebok accounts for between 30%-40% of NGG’s business and Salter predicts that NGG it will be sold this year, although he says Authentic is not interested in purchasing it.

Growth is on Salter’s agenda for 2024: “Bigger is better, globally is better – this is the company’s mandate,” he states.

Authentic will not confirm its quest for Topshop but Salter says “we’ve got our eyes on a pretty big deal”.

Salter is confident in Authentic’s licensing strategy and says the business is going “to continue to be careful, stick to our global [strategy] and continue to buy brands that stand the test of time”.

And what keeps him up at night?

“I think the economy slowing down is going to hurt us the same as it hurts anybody else. So that’s a good and a bad thing, as it makes things easier on the ‘buy’ side.”

Salter says businesses with debt will suffer with rising interest rates and that “there’s going to be a lot of pressure on big companies to unload some of their prime assets”.

Rains is a Danish outerwear company that was founded by Daniel Brix Hesselager and Philip Lotko in 2012 in Aarhus, Denmark. The brand is known for its stylish and functional rainwear, including waterproof jackets, coats, and accessories. Rains focuses on providing modern and minimalist designs that are not only fashion-forward but also highly practical for rainy weather.

The company takes inspiration from its Scandinavian roots, incorporating clean lines and simplicity into its designs. Rains aims to create rainwear that not only keeps you dry but also looks good, making it suitable for both urban environments and outdoor activities.

Rains’ products are characterized by their use of durable and waterproof materials, ensuring that wearers stay protected from the elements. The brand has expanded its product range to include backpacks, travel bags, and other accessories, all featuring the same commitment to quality and functionality.

Rains has gained international recognition for its contemporary approach to rainwear and has become a popular choice for individuals who value both style and practicality in their outdoor gear. The brand’s headquarters and flagship store are located in Aarhus, Denmark, and they have a global presence with distribution in various countries.

Bad Bunny, whose real name is Benito Antonio Martinez Ocasio, is a Puerto Rican singer, rapper, and songwriter. Born on March 10, 1994, in Vega Baja, Puerto Rico, Bad Bunny rose to prominence in the Latin music scene with his unique blend of reggaeton, Latin trap, and other musical influences.

Bad Bunny gained attention in 2016 when he released music on SoundCloud, and his popularity continued to grow with the release of his debut single “Soy Peor” in 2017. He quickly became a leading figure in the Latin music industry, known for his distinctive style, energetic performances, and collaborations with other prominent artists.

His debut album, “X 100pre,” was released in 2018 and received critical acclaim. Bad Bunny’s music often explores themes of love, heartbreak, and social issues, and he has been praised for pushing the boundaries of traditional Latin music.

In addition to his successful music career, Bad Bunny has ventured into other areas of entertainment. He has made appearances in films, including a role in the 2022 film “Narcos: Mexico.” Bad Bunny has also been involved in fashion, collaborating with brands and making a statement with his bold and eclectic style.

Bad Bunny has become a cultural icon and a trailblazer in the Latin music industry, breaking barriers and gaining recognition on a global scale. His influence extends beyond music, making him a multifaceted and dynamic figure in the world of entertainment.

Whatever he creates becomes a worldwide hit. Over the last three years, he has been Spotify’s most-streamed artist, with 35.9 billion plays. His YouTube channel has attracted more than 32 billion views—more than those of Justin Bieber, Ed Sheeran and, yes, Taylor Swift. He has won three Grammys and 11 Latin Grammys. In April, he made history as the first Latin artist to headline the Coachella music festival.

And he’s done it all while singing solely in Spanish. “Spanish is part of me, it’s in my DNA,” he says. “I like speaking it wherever I go—not to force it on people, but because it’s who I am.”

Vuori was founded in 2013 by Joe Kudla in Encinitas, California. Kudla, a former investment banker and outdoor enthusiast, started the brand with the goal of creating activewear that could seamlessly transition from performance to everyday life.

The idea behind Vuori was to provide comfortable, functional, and stylish activewear for various activities, from yoga and running to casual wear. Kudla was inspired by his love for the outdoors and the active lifestyle of Southern California.

Vuori focuses on using high-quality, sustainable materials in their products. They incorporate performance-enhancing features into their designs while ensuring that the clothing remains fashionable and versatile.

The brand has gained popularity for its commitment to sustainability, using eco-friendly fabrics and implementing environmentally conscious practices in their manufacturing processes.

Since its inception, Vuori has grown and gained a dedicated following, attracting people who appreciate activewear that not only performs well but also reflects a commitment to ethical and sustainable practices.

Kuala struggled to find support for his Vuori in the early days. Brands like Allbirds and Glossier were growing rapidly with DTC models, and billion dollar valuations. VCs told him, that he wasn’t being disruptive enough. But he stuck to a model of finding premium channel partners, and focus on profitability.

In a recent interview with Fast Company, Kudla reflected “A lot of those startup founders saw their businesses though a tech lens, whether that was selling new kinds of products online or using AI. All of this hooked tech investors. Meanwhile, we were just focused on trying to create really excellent workout shorts.”

But eight years later, Kudla is now grateful that investors weren’t eager to fund Vuori. It forced him to stay focused on profitability, rather than growth. By year two, Vuori was already in the black, which is very different from many other DTC brands, which have struggled to turn a profit.

And in the end, investors began to take note of Vuori’s healthy balance sheet, and came knocking. In 2021, Japanese investor Softbank poured $400 million into Vuori, landing it a whopping $4 billion valuation. Now, Vuori is headed towards an IPO, which could come as soon as mid-2024.

For centuries a site along the Rio Tinto in Huelva, Spain, has been mined for copper, silver, gold and other minerals. Around 3000 BC, Iberians and Tartessians began mining the site, followed by the Phoenicians, Greeks, Romans, Visigoths and Moors. After a period of abandonment, the mines were rediscovered in 1556 and the Spanish government began operating them once again in 1724.

However, Spain’s mining operations there were inefficient, and the government itself was otherwise distracted by political and financial crises, leading the government to sell the mines in 1873 at a price later determined to be well below actual value. Following purchase of the mine, a syndicate including Matheson and Deutsche Banks launched the Rio Tinto Company, in 1873. At the end of the 1880s, control of the firm passed to the Rothschild family, who increased the scale of its mining operations.

Today the Rio Tinto Group is an Anglo-Australian multinational company that is one of the world’s largest metals and mining company. Although primarily focused on extraction of minerals, it also has significant operations in refining, particularly the refining of bauxite and iron ore. It is based in London and Melbourne.

Rio Tinto;s purpose builds on a goal of over 150 years, “finding better ways to provide the materials the world needs.”

“We were at the forefront of automation – trucks, trains and drills – and remote operations in our industry. We’ve found better, lower carbon ways of producing materials like aluminium and copper. And we’ve introduced the world’s first sustainability label for aluminium using blockchain technology.

The need for innovation is greater than ever. The energy transition and continued urbanisation will require more of the materials that make these things possible, such as copper, aluminium, iron ore, lithium and minerals. If the materials that make renewable energy possible cause more harm in production than their products offset, nobody benefits. Much of the technology we need to get to net zero by 2050 doesn’t exist today, so we need to contribute, support and partner to make it a reality.

Breakthrough technologies also create opportunities for our business. For example, technology advances are helping our geologists to find new deposits, unlock previously economically unviable resources, and extending the life of existing assets. We’re also creating new products from waste. We became the first producer of scandium oxide in North America, using an innovative process we developed to extract high purity scandium oxide from waste streams without the need for any additional mining.”

Rio Tinto has embraced digitalization in various aspects of its operations. Here are some examples of Rio Tinto’s digitalization initiatives:

- Autonomous Haulage System (AHS): Rio Tinto has implemented an Autonomous Haulage System across its mining operations. Large autonomous trucks are used to transport ore and waste material, guided by GPS and advanced sensors. This technology improves safety, efficiency, and productivity by reducing the risk of accidents and enabling continuous operation.

- Remote Operations Centers: Rio Tinto operates Remote Operations Centers (ROCs) for its mines, which use advanced technologies such as artificial intelligence (AI), machine learning, and real-time data analytics. These ROCs monitor and control the mining operations remotely, allowing for optimized production planning, equipment maintenance, and resource allocation.

- Integrated Mine Planning and Optimization: Rio Tinto utilizes digital tools and software to integrate mine planning and optimization processes. These tools analyze various factors, such as geological data, resource availability, and market conditions, to optimize mine design, production scheduling, and material blending. This digital approach improves operational efficiency and maximizes resource utilization.

- Digital Twin Technology: Rio Tinto employs digital twin technology, which involves creating virtual replicas of physical assets or systems. Digital twins are used to simulate and analyze different scenarios, enabling predictive maintenance, optimizing equipment performance, and enhancing overall operational efficiency.

- Data Analytics and Predictive Maintenance: Rio Tinto utilizes data analytics and predictive maintenance algorithms to analyze large volumes of data collected from sensors and equipment. By monitoring the health and performance of machinery in real-time, potential equipment failures can be predicted, and maintenance activities can be scheduled proactively. This approach reduces downtime, lowers maintenance costs, and improves operational reliability.

- Robotics and Automation: Rio Tinto has implemented robotic and automated systems in its mining operations. Robots are used for tasks such as drilling, blasting, and rock sample analysis. Automation reduces human exposure to hazardous environments and enhances accuracy and productivity.

- Digital Supply Chain and Logistics: Rio Tinto employs digital solutions to optimize its supply chain and logistics operations. These solutions use real-time data to track and monitor shipments, optimize routes, and manage inventory levels, ensuring timely delivery of raw materials and reducing operational costs.

Rio Tinto’s digitalization efforts are aimed at improving safety, productivity, and sustainability in its mining operations. By embracing digital technologies, the company strives to optimize its processes, enhance decision-making, and create more efficient and sustainable mining practices.

Siemens & Halske was founded by Werner von Siemens and Johann Georg Halske on 1 October 1847. Based on the telegraph, their invention used a needle to point to the sequence of letters, instead of using Morse code. The company, initially called Telegraphen-Bauanstalt von Siemens & Halske, is the forerunner of today’s German industrial giant, which continues to reinvent itself in a digital world.

Today headquartered in Munich and Berlin, Siemens and its subsidiaries employ approximately 311,000 people worldwide and reported a global revenue of around €72 billion in 2022. It is the largest industrial manufacturing company in Europe.

The principal divisions of Siemens are Digital Industries, Smart Infrastructure, Mobility, Healthineers, and Financial Services, with Siemens Healthineers and Siemens Mobility operating as independent entities.

Major business divisions that were once part of Siemens before being spun off include semiconductor manufacturer Infineon Technologies(1999), Siemens Mobile (2005), Gigaset Communications (2008), the photonics business Osram (2013), and Siemens Energy (2020).

Siemens has been a strong proponent and driver of digitalization across industries. The company recognises the transformative potential of digital technologies and has actively incorporated them into its offerings. Digital-specific businesses include:

- Digital Industry: Siemens provides a comprehensive portfolio of digital solutions for industrial automation, manufacturing, and process industries. Their offerings include digital twins, which are virtual replicas of physical assets, enabling simulation and optimization of processes. Siemens also offers industrial IoT platforms, cloud-based services, and analytics tools to collect and analyze data for improved efficiency, predictive maintenance, and better decision-making.

- Digital Energy: Siemens leverages digital technologies to optimize energy generation, transmission, and distribution. Their digital energy solutions help utilities and grid operators monitor and control power systems in real-time, ensuring reliable and efficient energy supply. Siemens also enables the integration of renewable energy sources, energy storage systems, and smart grid technologies to create more sustainable and resilient energy networks.

- Digital Healthcare: Siemens is a significant player in digital healthcare solutions. The company offers a wide range of medical imaging equipment, laboratory diagnostics, and clinical IT systems. These technologies enable the digitization of healthcare processes, such as medical imaging, patient data management, and telemedicine, leading to improved diagnostics, treatment, and patient care.

- Smart Infrastructure: Siemens provides intelligent infrastructure solutions for buildings, cities, and transportation. Their smart building technologies optimize energy consumption, enhance occupant comfort, and enable predictive maintenance. Siemens’ smart city solutions integrate various urban systems, including transportation, energy, and public services, to improve efficiency, sustainability, and livability. In transportation, Siemens offers digital solutions for rail automation, traffic management, and intelligent transportation systems.

- Digital Services: Siemens offers a range of digital services to support its customers throughout the lifecycle of their products and systems. These services include remote monitoring, predictive maintenance, and performance optimization. By utilizing data analytics and machine learning algorithms, Siemens helps customers maximize the availability, reliability, and performance of their assets, reducing downtime and maintenance costs.

Siemens’ digitalization efforts aim to empower industries and society to embrace the potential of digital technologies, enabling greater efficiency, sustainability, and competitiveness. Through their innovative digital solutions, Siemens continues to shape the future of various sectors and contribute to the advancement of the digital economy.

A recent article gave more insight into Siemens’ approach to innovation:

Companies expect half of their revenues five years from now to come from businesses and offerings that do not yet exist. As a consequence, building new businesses that aim to reach beyond a company’s existing core business has become one of the top strategic priorities at those organizations – double the share of recent years.

In contrast to an M&A-only strategy (in which corporations buy or merge with established companies) and corporate venture capital (in which they mostly invest in external startups), internal business building makes the most of a core organization’s existing assets and capabilities to create separate but linked businesses.

As a consequence, many companies seek to concurrently exploit and explore, that is to sustain their existing businesses and build new ones in parallel. What makes implementing this challenging is the fact that exploiting existing businesses on one side and exploring new businesses on the other draw on disparate requirements

Siemens Digital Industries has fully realized the need to become ambidextrous and develop its exploratory business building capabilities. “Explorers are seen as those burning the money, while Exploiters earn the money” says Franz Menzl, VP Technology and Innovation & CTO Factory Automation. “Therefore, a decisive question to be addressed to build new businesses in a corporate environment is: How can exploratory innovation be accomplished in a capital-efficient, bold and successful way?”

Many companies still follow the big bet approach to innovation, i.e., pre-selecting a very small number of ideas and opportunities (occasionally a single one only) they intend to put all their funding into, that have typically crystallized out of

- idea competitions

- pitch contests

- gut feel

- presentations to and decisions by executives (gut feel again)

- advisory from consultancies and external experts

However, experience and data from the startup space has shown: nobody can pick winners! The vast majority of startups fail and less than 1% become Unicorns, ie grow to companies with a valuation of more than $1bn. In fact, the failure rate ranges between 70 and 90%, depending on the study considered. Bottom line: Failure is inherent in starting new ventures, success cannot be predicted upfront and uncertainty is high. But what is the key reason for this high startup failure rate? And what needs to be tackled to increase the yield?

In their latest analysis, CBInsights have presented the top reasons for startup failure. It reveals that besides running out of cash and failing to raise new capital (38% of postmortems), the top reason is: no market need, i.e., lack of customer demand for the startup’s offering (35%) – followed by

- Got outcompeted (20%)

- Flawed business model (19%)

- Regulatory/legal changes (18%)

- Pricing/cost issues (15%)

- Not the right team (14%)

But how about Corporates and new ventures started inside them? A body of research also reveals here, that 70-90% of corporate innovation efforts fail – a striking analogy to the startup space! Obviously, it’s not possible to pick winners in the corporate space, either – particularly not in the exploration (vs. exploitation) space away from the existing core business. In light of these issues, Siemens has entered a collaboration with Bosch Innovation Consulting geared towards solving the Ambidexterity challenge, opening up new markets and business models and advancing evidence-based innovation management. The reasons for corporate innovation failure can be manifold, but mostly trace back to having missed addressing one or several of the following key questions, according to Franz Menzl:

Value creation

- Who is the customer?

- What problem are we solving?

- What value proposition do we have?

- Why would anyone pay for this?

Value delivery and capture

- Do we have channels?

- Can we build it? Should we?

- Do we need partners?

- Is it repeatable, scalable, profitable?

Strategic framing and alignment

- Does this venture fit our strategy?

- Where will it land in our organization (existing BU, standalone,…)?

- Are we committed to investing it until it has been scaled up?

Tackling inherent uncertainty and increasing the yield of exploratory ventures in corporate innovation requires maximizing the number of business experiments through a portfolio approach, keeping their cost as low as possible and following a structured approach that scrutinizes the very questions above. Or as Jeff Bezos put it “If you can increase the number of experiments you try from a hundred to a thousand, you dramatically increase the number of innovations you produce.”

In essence, this logic provides the basis of Siemens Digital Industries’ modern innovation framework, which aims at building exploratory capabilities in addition to existing core business strengths and, thereby, turning Siemens Digital Industries into an Ambidextrous Organization.

Building new growth businesses calls for a paradigm change: Rather than going all-in too early and risking waste of resources in case of failure, a more effective and resource-efficient approach is to gradually increase investment with in-market evidence, based on phase-specific criteria (see exhibit below).

Bosch has developed and honed data-driven innovation by having run ca. 800 internal ideas through this process. Improvements have been impressive:

- 7-10x more ideas evaluated

- 4-6x faster time to revenue

- 3-6x increase in venture net present value (NPV)

- Significant savings that can be reinvested into innovation and new business building

Drawing on Bosch’s experience, Siemens Digital Industries has established a holistic exploratory innovation approach (see exhibit below) to build new growth businesses that combines two elements:

Foresight-driven Innovation – targeted at identifying and exploring high-potential opportunity areas (also known as search fields, hunting zones,…).

DI Innovation Framework – targeted at discovering, validating and scaling new ventures within those opportunity areas. It covers an end-to-end process and leverages a powerful combination of coaches, leading innovation methodologies and tailored trainings for the entrepreneurial teams along the process. This process is characterized by three key success factors: Strategic Framing, Learning ahead of Investment and Purposeful Integration with Core Business. The DI Innovation Framework puts three critical priorities front and center:

- Shift from a technology view to a customer-centric view (with in-market evidence)

- Empowerment of innovation project teams to take data-driven, self-declared go/no-go decisions

- Transparency towards share- and stakeholders and engaging them with data and insights from experiments, investment release upon passed maturity level (VC-based funding approach), demonstration of investment-efficiency.

At the moment, ten ideas/projects are running through the validation phase of the DI Innovation Framework, centered around topics like AI-based robotics for logistics and the food industry up to the Autonomous Factory designed by and for people.

Franz Menzl concludes: “We have already made important learnings on our journey to building new growth businesses for Siemens Digital Industries and thus becoming ambidextrous as an organization, four central ones of which being:

- Focusing strongly on high-value customer problems is crucial.

- Running innovation as a diversified portfolio of small bets proves key.

- Operating ambidextrously requires maintaining a zero-mistake culture in core businesses, but also creating an experimentation-driven culture in exploratory businesses.

- Giving exploratory businesses sufficient independence to test their business model hypotheses rapidly and efficiently has turned out indispensable.”

Hilti AG develops, manufactures, and markets products for the construction, building maintenance, energy and manufacturing industries, mainly to the professional end-user. It concentrates mainly on anchoring systems, fire protection systems, installation systems, measuring and detection tools (such as laser levels, range meters and line lasers), power tools (such as hammer drills, demolition hammers, diamond drills, cordless electric drills, heavy angle drills, power saws) and related software and services

Hilti has transformed the way in which it works directly with its construction customers by embracing a digital mindset to its tools, systems, and services. This includes a new rental-based business model, and asset management system.

- Digital Tools and Services: Hilti offers a range of digital tools and services to support construction professionals. This includes software solutions for design and planning, project management, and asset management. These digital tools help streamline processes, improve collaboration, and enhance productivity on construction sites.

- Hilti Connect: Hilti Connect is a cloud-based platform that provides construction professionals with real-time access to information about their Hilti tools and equipment. It allows users to track the location of tools, monitor usage, schedule maintenance, and receive notifications about tool status and performance. This digital platform helps optimize tool management, reduce downtime, and improve efficiency.

- ON!Track Asset Management System: Hilti’s ON!Track is an asset management system that enables construction companies to track and manage their assets, including tools, equipment, and consumables. It uses barcoding and RFID technology to monitor asset usage, location, and maintenance history. This digital solution helps prevent loss, optimize inventory, and ensure the availability of the right tools at the right time.

- Digital Training and Education: Hilti provides digital training and education programs to empower construction professionals with knowledge and skills. This includes online training modules, virtual reality (VR) training simulations, and webinars. These digital learning tools enable flexible and accessible training, ensuring that professionals stay up to date with the latest techniques and best practices.

- Hilti Mobile Apps: Hilti offers a range of mobile apps that provide access to product information, technical data, and installation instructions. These apps also enable users to place orders, track deliveries, and access customer support. Mobile apps from Hilti enhance convenience, speed up processes, and support on-site decision-making.

- Smart Construction Solutions: Hilti integrates smart construction solutions into its product offerings. For example, Hilti’s PROFIS Engineering software allows engineers to design and analyze connections in steel structures efficiently. It provides accurate calculations, reduces design time, and ensures compliance with codes and standards.

- Internet of Things (IoT) and Connectivity: Hilti incorporates IoT capabilities into its products, enabling them to collect and transmit data. For instance, some Hilti tools can communicate usage data to the Hilti Connect platform, providing insights into tool performance and usage patterns. This data-driven approach helps optimize maintenance, improve tool performance, and enhance productivity.

Hilti “Fleet Management” rental service allows customers to access a wide range of Hilti tools and equipment on a short-term basis, providing flexibility and cost-effectiveness for construction projects. It includes:

- Tool Selection: Hilti offers a comprehensive selection of tools and equipment for rent, including power tools, drilling and demolition equipment, anchoring systems, laser measuring devices, and more. They cater to various construction needs, allowing customers to rent the specific tools required for their projects.

- Flexible Rental Periods: Hilti Rental provides flexible rental periods, allowing customers to rent tools for as long as they need them. Whether it’s a few days, weeks, or months, customers can customize the rental duration based on their project timeline and requirements.

- Well-Maintained Equipment: Hilti ensures that their rental equipment is well-maintained and in good working condition. The tools undergo regular inspections and servicing to ensure their reliability and performance. This helps customers avoid downtime due to equipment malfunctions.

- On-Time Delivery and Pickup: Hilti strives to provide a smooth rental experience by offering on-time delivery and pickup services. They coordinate with customers to arrange the delivery of rented tools to the desired location and promptly collect them once the rental period is complete.

- Training and Support: Hilti offers training and support for customers renting their tools. They provide guidance on tool operation, safety procedures, and proper maintenance. This helps customers maximize the effectiveness of the rented equipment and ensures safe usage on the job site.

- Transparent Pricing: Hilti provides transparent pricing for their rental services. They offer competitive rates based on the rental period and the specific tools or equipment being rented. Customers can get a clear understanding of the costs involved and make informed decisions.

Another digital initiatives is the ON!Track asset management system, a cloud-based software solution that enables construction companies to effectively track and manage their assets, including tools, equipment, and consumables, throughout their lifecycle. It includes:

- Asset Tracking and Management: ON!Track provides construction companies with a centralized platform to track and manage their assets. Each asset is tagged with a unique barcode or RFID tag, allowing for easy identification and monitoring. The system captures important asset information such as location, maintenance history, and calibration status, providing real-time visibility into asset utilization and maintenance requirements.

- Inventory Optimization: The ON!Track system helps construction companies optimize their inventory by providing accurate and up-to-date information on asset usage and availability. Companies can avoid overstocking or understocking tools and materials, leading to improved cost control and increased productivity. The system also sends notifications for maintenance or calibration requirements, ensuring that assets are properly maintained for optimal performance.

- Tool Management and Theft Prevention: ON!Track helps prevent tool loss and theft through enhanced tracking capabilities. Construction companies can monitor the movement of tools across job sites and receive alerts if tools are moved without authorization. This helps mitigate the risk of asset loss, reduces replacement costs, and enhances overall security.

- Data-Driven Decision Making: The digitalization of asset management with ON!Track enables data-driven decision making for construction companies. The system generates comprehensive reports and analytics on asset utilization, maintenance costs, and productivity. This information empowers companies to make informed decisions about resource allocation, equipment investment, and process improvements.

- Enhanced Customer Experience: Hilti’s ON!Track system goes beyond asset management by providing additional features that enhance the customer experience. Customers can access their asset information, track orders, and request service and repairs through a user-friendly web portal or mobile app. This streamlines communication, improves customer satisfaction, and fosters long-term partnerships.

Hilti’s implementation of the ON!Track asset management system demonstrates their commitment to digitalization and providing innovative solutions to the construction industry. By leveraging digital technologies, Hilti has enabled construction companies to streamline their asset management processes, optimize inventory, prevent theft, and make data-driven decisions for improved productivity and profitability.

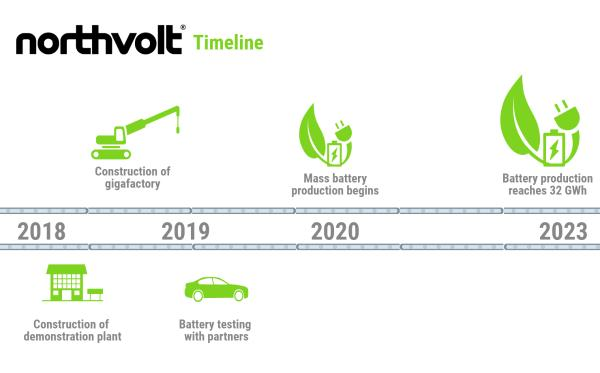

Northvolt AB was a Swedish battery developer and manufacturer, specialising in lithium-ion technology for electric vehicles.

The company was founded as SGF Energy in 2015 by Peter Carlsson (now CEO) and Paolo Cerutti (now COO) who were working in Supply Chain and Operations Planning at Tesla Motors prior to that. In 2017, the company changed its name to Northvolt. It was founded with the aim to supply the automotive industry with electric vehicle batteries.

In June 2017, companies including BMW Group, Volkswagen Group, Goldman Sachs and Folksam announced that they would invest in the company. In total, the investments amounted to $1 billion, framed as a way to challenge what was reported as the dominance of Tesla, Inc. and Asian companies such as Toyota and Nissan on the market for electric vehicle batteries.

Northolt started building a battery factory in Skellefteå, Sweden, with the aim to start production of electric vehicle batteries in 2021. The first battery in Skellefteå was assembled in December 2021, and the production for commercial uses is started in 2022.

The company made swift progress on its mission to deliver the world’s greenest lithium-ion battery with a minimal CO2 footprint and has grown to over 3,500 people from over 110 different nationalities. Northvolt secured more than $55 billion worth of contracts from key customers, including BMW, Fluence, Scania, Volkswagen, Volvo Cars and Polestar, to support its plans, which include establishing recycling capabilities to enable 50 percent of all its raw material requirements to be sourced from recycled batteries by 2030.

So what went wrong?

Northvolt filed for bankruptcy in November 2024 due to a combination of internal challenges and external pressures, including production problems, dwindling funding, and intense competition from China.

Here’s my outsider’s view of the factors that contributed to Northvolt’s downfall:

Internal Challenges:

- Production Scalability Issues: Northvolt struggled to scale up production effectively, leading to delays and missed targets.

- Over-reliance on Chinese Machinery and Personnel: The company reportedly relied heavily on Chinese machinery and personnel, which caused communication problems and inefficiencies.

- Excessive Spending and Subpar Safety Standards: Some reports suggest that Northvolt’s spending was excessive and that safety standards were subpar.

- Flawed Battery Design: Some sources suggest that Northvolt’s most critical issue was a fundamentally flawed battery design, which could not be fixed through process improvements.

- Logistical and Operational Inefficiencies: Northvolt faced challenges with material losses and communication within its multinational team.

- Rapid Hiring and Confusion: The company hired aggressively, leading to confusion and unclear expectations among employees.

- Slower-than-Anticipated EV Adoption: The slower-than-expected growth of the electric vehicle market put additional strain on the company.

- Rising Capital Costs: Increased interest rates and capital costs made it harder for Northvolt to secure funding.

- Geopolitical Instability and Supply Chain Disruptions: Events like the Russia-Ukraine war and supply chain disruptions further impacted the company.

- Competition from China: China’s dominance in the EV battery market and its established players like CATL and BYD posed a significant challenge.

- Loss of Major Orders and Cancellation of Deals: Northvolt lost major orders and had deals canceled, including a 2 billion euro agreement with BMW.

- Lack of Funding: Northvolt failed to secure new funding, leading to its bankruptcy filing.

- Operational Discipline and Diversified Supply Chains are Crucial: Northvolt’s struggles highlight the need for greater operational discipline and diversified supply chains to avoid over-reliance on specific regions.

- Focus on Commercialisation of Technology: Companies need to focus on commercializing their technologies and not just on lab-level breakthroughs.

- The Importance of Domestic Manufacturing: A robust domestic manufacturing base can help mitigate risks and bolster competitiveness.

- EU’s Reliance on China: Northvolt’s failure raises concerns about Europe’s reliance on Asian battery manufacturers.