Northvolt

Europe's attempt to compete with Chinese in EV

Northvolt was founded to enable the transition to a decarbonised future by establishing a sustainable battery industry. To do this, the Swedish company pioneered a new approach to battery manufacturing rooted in a commitment to fossil-free energy, sustainable sourcing of raw materials and recycling. Building the world’s greenest battery was no easy task, and at the end of 2024 the start-up filed for bankruptcy.

Northvolt AB was a Swedish battery developer and manufacturer, specialising in lithium-ion technology for electric vehicles.

The company was founded as SGF Energy in 2015 by Peter Carlsson (now CEO) and Paolo Cerutti (now COO) who were working in Supply Chain and Operations Planning at Tesla Motors prior to that. In 2017, the company changed its name to Northvolt. It was founded with the aim to supply the automotive industry with electric vehicle batteries.

In June 2017, companies including BMW Group, Volkswagen Group, Goldman Sachs and Folksam announced that they would invest in the company. In total, the investments amounted to $1 billion, framed as a way to challenge what was reported as the dominance of Tesla, Inc. and Asian companies such as Toyota and Nissan on the market for electric vehicle batteries.

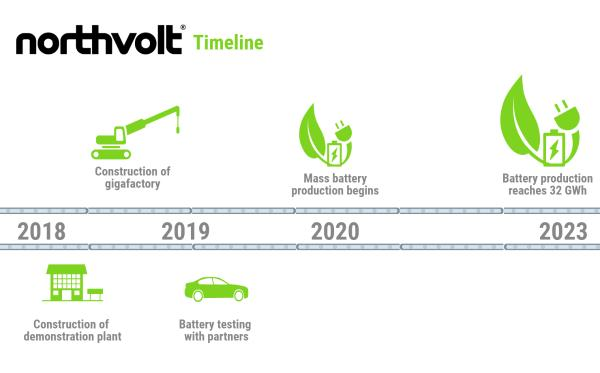

Northolt started building a battery factory in Skellefteå, Sweden, with the aim to start production of electric vehicle batteries in 2021. The first battery in Skellefteå was assembled in December 2021, and the production for commercial uses is started in 2022.

The company made swift progress on its mission to deliver the world’s greenest lithium-ion battery with a minimal CO2 footprint and has grown to over 3,500 people from over 110 different nationalities. Northvolt secured more than $55 billion worth of contracts from key customers, including BMW, Fluence, Scania, Volkswagen, Volvo Cars and Polestar, to support its plans, which include establishing recycling capabilities to enable 50 percent of all its raw material requirements to be sourced from recycled batteries by 2030.

So what went wrong?

Northvolt filed for bankruptcy in November 2024 due to a combination of internal challenges and external pressures, including production problems, dwindling funding, and intense competition from China.

Here’s my outsider’s view of the factors that contributed to Northvolt’s downfall:

Internal Challenges:

- Production Scalability Issues: Northvolt struggled to scale up production effectively, leading to delays and missed targets.

- Over-reliance on Chinese Machinery and Personnel: The company reportedly relied heavily on Chinese machinery and personnel, which caused communication problems and inefficiencies.

- Excessive Spending and Subpar Safety Standards: Some reports suggest that Northvolt’s spending was excessive and that safety standards were subpar.

- Flawed Battery Design: Some sources suggest that Northvolt’s most critical issue was a fundamentally flawed battery design, which could not be fixed through process improvements.

- Logistical and Operational Inefficiencies: Northvolt faced challenges with material losses and communication within its multinational team.

- Rapid Hiring and Confusion: The company hired aggressively, leading to confusion and unclear expectations among employees.

- Slower-than-Anticipated EV Adoption: The slower-than-expected growth of the electric vehicle market put additional strain on the company.

- Rising Capital Costs: Increased interest rates and capital costs made it harder for Northvolt to secure funding.

- Geopolitical Instability and Supply Chain Disruptions: Events like the Russia-Ukraine war and supply chain disruptions further impacted the company.

- Competition from China: China’s dominance in the EV battery market and its established players like CATL and BYD posed a significant challenge.

- Loss of Major Orders and Cancellation of Deals: Northvolt lost major orders and had deals canceled, including a 2 billion euro agreement with BMW.

- Lack of Funding: Northvolt failed to secure new funding, leading to its bankruptcy filing.

- Operational Discipline and Diversified Supply Chains are Crucial: Northvolt’s struggles highlight the need for greater operational discipline and diversified supply chains to avoid over-reliance on specific regions.

- Focus on Commercialisation of Technology: Companies need to focus on commercializing their technologies and not just on lab-level breakthroughs.

- The Importance of Domestic Manufacturing: A robust domestic manufacturing base can help mitigate risks and bolster competitiveness.

- EU’s Reliance on China: Northvolt’s failure raises concerns about Europe’s reliance on Asian battery manufacturers.