Work.Life is a distinctly British entry in the global story of coworking: neither the headline-grabbing multinational nor a tiny local drop-in, but a purposefully designed middle ground that combines hospitality, flexible real estate thinking and community-building. Since its launch in 2015 the business has grown steadily, carving out a reputation for design-led, service-focused spaces in city-centre neighbourhoods — places aimed at freelancers, small teams and hybrid organisations that want more than a desk: they want an everyday workplace that is useful, friendly and humane.

Founders and origins

Work.Life was founded by David Kosky and Elliot Gold in 2015. Both founders arrived at the idea via non-traditional routes into workspace: Kosky came from finance and asset management, while Gold’s background included roles where culture and people were central to the proposition. Their shared conviction was simple and influential: many people want better work-lives, and the physical workplace can be designed to improve day-to-day happiness and productivity. From the outset they combined a focus on hospitality and wellbeing with a pragmatic understanding of property — the latter informed by Kosky’s asset experience — which shaped the company’s early deals and operating model.

Funding and financial model

Work.Life has principally expanded through a combination of founder reinvestment, landlord partnerships and commercially structured leasing rather than via large venture capital rounds that typify some of the global flexible-workspace chains. Rather than relying on repeated VC injections, the company’s growth emphasises operational profitability, asset selection and creating mutually beneficial relationships with property owners who want active, community-oriented uses for primetime floors. This asset-light / partnership-heavy approach reduces reliance on continual external fundraising and aligns Work.Life’s incentives with landlords: good community programming and hospitality increases occupancy and yields for both parties. The company’s public communications and reporting focus on expansion through new buildings in target cities and on ensuring strong utilisation of existing sites.

Development and growth trajectory

From a handful of pilot sites the brand scaled cautiously through the later 2010s. By late 2023 the company reported a meaningful footprint across major UK regional centres, with Manchester established as its northern flagship and a number of strategically placed London locations, plus additional regional sites such as Reading. Public comments from the founders and independent profiles indicate an estate measured in the low-to-mid tens of spaces and a membership base running into the thousands — a scale that allows a coherent community to form while keeping operational controls tight. The company’s roll-out has mixed high-street and office-district addresses, aiming to combine convenience with character.

Design and fit-out have been important in the development phase. Work.Life’s brief for many of its interiors has emphasised contemporary, colourful, locally informed design together with functional amenities: private offices, hot-desking, meeting rooms, phone booths, kitchens and break-out areas that serve both short-term visitors and regular members. Several of its Manchester and London sites were the subject of design features and case studies that stress bold, contemporary interventions — a signal that brand identity and visual language matter as much as desk counts.

Services and what members actually get

Work.Life’s proposition is deliberately broad so it can serve individuals, micro-teams and growing SMEs. Typical offerings include:

-

Hot desks and fixed desks available on flexible terms (daily, monthly).

-

Private offices for teams of various sizes, ready-to-use and fully furnished.

-

Bookable meeting rooms and event space, with A/V and support.

-

Business-grade Wi-Fi, printing, kitchen facilities, showers and secure bike storage.

-

Community programming: socials, skills sessions, breakfasts and member events.

-

A hospitality approach to reception and day-to-day service, emphasising staff who act as hosts rather than mere installers of keycards.

Beyond these core amenities, Work.Life positions itself on convenience and experience: everything from quick day-passes to long-term private suites is designed to be bookable online, with transparent pricing for many standard products and the possibility of bespoke packages for corporate clients seeking flexible hybrid solutions.

How Work.Life differs from other coworking operators

There are several dimensions on which Work.Life distinguishes itself:

-

Hospitality first — rather than treating coworking as pure real-estate arbitrage, Work.Life frames its service as hospitality: staff are hosts, design and food/drink provision are taken seriously, and member experience is a strategic lever. That positioning contrasts with some operators who prioritise rapid space replication and network scale above in-site service quality.

-

Mid-market focus — Work.Life sits between bootstrapped local hubs and the large global chains. Its target is the urban, professional user who wants a consistently good environment without the premium pricing or corporate identity of flagship global brands.

-

Landlord and asset sensitivity — the firm tends to work in partnership models with landlords and building owners instead of the high-risk, high-leverage growth strategies used by some competitors. This changes the bargaining dynamics and usually means longer leases with better mutual outcomes for landlord and operator.

-

Locality and design nuance — Work.Life’s spaces aim to reflect the immediate neighbourhood (so Old Street will have a different character from a Manchester high-street site), helping create a sense of place rather than a homogenised ‘global’ look.

These differences are strategic choices: they reduce the company’s exposure to boom-and-bust expansion risk, and they make day-to-day service and retention levers more important than sheer topline occupancy.

Business model and revenue streams

Work.Life operates a multi-stream revenue model typical of flexible workspace businesses but with several pragmatic twists:

-

Membership and desk revenue: regular income from hot-desk, fixed-desk and private-office memberships.

-

Meeting rooms and event hire: hourly and daily hire of meeting rooms, workshops and event spaces — often higher margin and useful for peaks in utilisation.

-

Ancillary services: catering, printing, locker rental and other add-ons.

-

Corporate and enterprise packages: tailored hybrid plans for SMEs and larger clients that need flexible capacity across multiple sites.

-

Landlord revenue-share or contracted management fees: in partnership models the landlord may subsidise fit-out or share revenue, lowering upfront capital needs for the operator.

Profitability depends heavily on occupancy, average revenue per desk, and the efficiency of frontline operations (staffing, bookings, cleaning). Work.Life’s measured pace of rollout suggests the company is focused on finding the right mix of profitable units rather than simply maximising footprint.

Locations and geography

Work.Life’s presence is concentrated in the UK with a clear London base and important regional assets, notably Manchester. The Manchester site serves as a northern flagship and is centrally located in the city’s business and cultural fabric; London sites are often positioned where tech, creative and professional services clusters meet. Reading and other regional towns have been included to capture commuter and suburban hybrid demand. This UK-centric footprint reinforces the brand’s regional sensitivity and allows the operator to scale operations and systems without the complexity of international markets.

Culture and community

Culture is not a marketing afterthought for Work.Life — it is core to retention. The founders have written and spoken about adopting agile, even “adhocratic”, cultural models inside the business: decision rights are pushed to operating teams; community managers are empowered to curate events; and the company prioritises staff autonomy and member happiness as leading indicators of long-term success. On the member side, programming emphasises networking, learning and wellbeing: informal meetups, workshops, start-up support and wellbeing initiatives are regular features. This dual focus — internal culture plus outward community — positions Work.Life as more than a billing engine: it is an organisation that sells everyday quality of work-life.

Strategy: pragmatism, hospitality and resilience

Work.Life’s strategy reads as pragmatic rather than ideological. Three pillars stand out:

-

Selective expansion: grow in cities where demand and local culture match the proposition; avoid land grabs that sacrifice unit economics.

-

Experience differentiation: invest in day-to-day hospitality, design and programming to keep churn low and members engaged.

-

Partnerships with landlords: use bespoke asset deals to limit upfront capital and align incentives with building owners.

Taken together, these moves reduce exposure to the worst swings of the coworking cycle. They also allow the brand to pursue two important customer groups simultaneously: independent workers who demand community and small teams who need flexible, low-friction office solutions.

Challenges and competitive landscape

A candid assessment must acknowledge several headwinds that face any UK coworking operator in the second half of the 2020s:

-

Hybrid working norms: many companies are still experimenting with how often staff should be in the office. Coworking demand is robust, but it is often for different usages (day passes, satellite hubs) than the pre-pandemic permanent-desk model. Operators must be nimble to serve episodic use patterns.

-

Competition: international operators continue to expand selectively and local boutique operators compete on price and niche services. Work.Life’s differentiation must be continually reinforced by service quality and local brand authenticity.

-

Property cycles and cost inflation: rent pressures and fit-out costs can squeeze margins; partnership models help, but macroeconomic shocks affect occupancy and corporate decision-making.

What next — plausible futures for Work.Life

Looking forward there are a few credible strategic avenues for Work.Life:

-

Hub-and-spoke for employers: position as the satellite network for companies adopting hybrid strategies — offer multi-site passes and simple corporate admin so employers can give staff local hubs without the expense of long leases. This is a natural extension of the company’s current product set.

-

Deepen landlord partnerships and management contracts: moving into more management-style deals where Work.Life operates spaces on behalf of owners could accelerate footprint while keeping capital needs low. The operator-as-hospitality partner model scales well in this format.

-

Experience and wellbeing differentiation: continue to invest in programming, food & beverage and mental-health offerings that make the physical office more attractive than home alternatives. Hospitality-led retention is hard to replicate at scale, and it plays to Work.Life’s strengths.

-

Regional consolidation: double down on UK regions where the brand has traction (Manchester, Reading, other cities) to create denser networks that appeal to companies with geographically dispersed teams.

-

Technology and analytics: small investments in utilisation analytics, booking UX and CRM will pay off. Data-driven pricing and space optimisation can increase revenue per square metre without compromising experience.

Work.Life’s story to date is one of deliberate, experience-led growth. The founding team combined property know-how with a hospitality sensibility and built a brand that sits comfortably between boutique local hubs and global chains. Its reliance on landlord partnerships and a measured expansion plan makes it less vulnerable to boom-and-bust funding cycles; its focus on hospitality and community gives it defensible customer-facing advantages. The challenges ahead are the familiar ones for the sector — hybrid work uncertainty, cost pressures and increasing competition — but Work.Life’s model is well-suited to navigate them so long as it keeps balancing service, sensible site economics and the curatorial, local feel that members value.

Interface is widely recognised as a global leader in sustainability and a trailblazer in environmentally responsible business practices.

Founded in 1973 by Ray Anderson in LaGrange (Georgia, USA) Interface began as a modest American manufacturer of carpet tiles—a business that was almost entirely traditional in both its operations and environmental outlook.

Over the decades, however, the company evolved dramatically, becoming a global innovator not only in modular flooring but also in sustainable business models, circular economy practices, and regenerative thinking. Today,

Interface is more than a flooring manufacturer; it is a symbol of what businesses can achieve when they commit to purpose-driven transformation.

Early Growth

Ray Anderson launched Interface in response to the growing commercial demand for carpet tiles in the United States—a trend he had observed in Europe. Initially, the business focused on manufacturing and distributing modular carpets, which were especially popular in corporate office environments.

The business grew steadily throughout the 1980s and early 1990s through acquisitions, expanding its global footprint into Europe and Asia, and gaining market share in the commercial interiors sector. The company’s innovative approach to carpet tile design—emphasizing flexibility, durability, and easy replacement—helped differentiate it from traditional wall-to-wall carpet providers.

But Interface’s greatest transformation began not with a new product or market expansion, but with a profound shift in its founder’s thinking. In 1994, Ray Anderson experienced what he later called his “spear in the chest” moment. Preparing for a speech on the company’s environmental vision, he was struck by the realization that Interface, like most industrial companies, was contributing heavily to environmental degradation.

Inspired by Paul Hawken’s book The Ecology of Commerce, Anderson began to question the very foundation of the industrial model and initiated a radical shift in Interface’s purpose—from a petroleum-intensive manufacturer to a company committed to becoming environmentally restorative.

Sustainability as strategy

This epiphany marked the beginning of what Interface called “Mission Zero”—a bold corporate promise to eliminate any negative impact the company had on the environment by 2020. At the time, this seemed not only ambitious but perhaps even naïve. However, under Anderson’s leadership, Interface undertook sweeping changes: rethinking materials, redesigning products, reengineering processes, and working across its supply chain to decarbonize and reduce waste.

The company focused on seven fronts: eliminating waste, reducing emissions, using renewable energy, closing the loop on materials, resource-efficient transportation, sensitizing stakeholders, and redesigning commerce. Each area became a platform for innovation.

Interface began to replace virgin nylon with recycled fibers and experimented with bio-based materials. It overhauled manufacturing processes to minimize energy and water use. It created new recycling partnerships and product take-back programs, such as ReEntry™, which collected used carpet tiles for recycling or reuse. Even design was reimagined through the lens of biomimicry, notably in its Nature-Inspired Flooring collections, which mimicked organic patterns to reduce visible wear and waste.

Interface also sought to use its influence to transform the industry. It opened its processes to others, shared best practices, and advocated for green building standards. It was one of the first companies to align its innovation strategy with the principles of circular economy, focusing not only on reducing environmental harm but regenerating ecosystems and building long-term value. By 2019, Interface had reduced its greenhouse gas emissions from manufacturing by 96%, used 89% renewable energy across its global operations, and sourced 60% of raw materials from recycled or bio-based sources.

Innovation and growth

While sustainability defined its purpose, Interface remained commercially agile and innovative. It expanded its product portfolio beyond carpet tiles to include resilient flooring products such as luxury vinyl tile (LVT) and rubber flooring through its acquisition of Nora Systems in 2018. These expansions allowed Interface to serve broader markets—education, healthcare, hospitality, retail, and more—with integrated flooring systems designed for aesthetics, durability, and environmental performance.

Interface was also early to embrace the convergence of sustainability and digital technology. Its design platform and tools allowed architects and designers to customize flooring solutions while visualizing environmental impacts. Its commitment to transparency and third-party certifications—such as Environmental Product Declarations (EPDs), Health Product Declarations (HPDs), and Cradle to Cradle—positioned the company as a trusted partner in green building projects worldwide. Interface flooring has been installed in iconic sustainable buildings and certified LEED and WELL projects around the globe.

The company’s commercial success and environmental leadership proved that sustainability and profitability are not mutually exclusive. Throughout the 2010s, Interface consistently ranked as one of the most sustainable companies globally and outperformed many peers in market value and customer loyalty. Its integrated approach to business strategy, product design, supply chain management, and environmental performance became a benchmark in the corporate sustainability world.

From sustainability to regeneration

After achieving most of its Mission Zero goals by 2020, Interface launched a new and even more ambitious phase: “Climate Take Back.” This program commits the company to go beyond neutrality and actively reverse global warming. It reflects a shift from being less bad to doing more good—from reducing footprints to creating positive handprints.

A key part of this vision is the development of carbon-negative products. In 2020, Interface introduced the world’s first carbon-negative carpet tile, using materials and processes that sequester more carbon than they emit over the product’s life cycle. This was made possible through innovation in yarn systems, backing materials, and supply chain partnerships that embedded carbon in safe, durable forms rather than releasing it into the atmosphere.

Interface also integrates nature-based solutions into its operations and partnerships, such as investing in regenerative agriculture and supporting ocean plastic clean-up. Its Net-Works™ initiative, launched in collaboration with the Zoological Society of London and later acquired by Aquafil, helped coastal communities collect discarded fishing nets for recycling into carpet fiber—reducing ocean plastic, providing income for communities, and creating circular supply chains.

The company’s embrace of regenerative principles—repairing ecosystems, revitalizing communities, and restoring balance—places it in the vanguard of next-generation sustainable businesses. It seeks to inspire other companies to adopt similar mindsets and collaborate on systemic change.

Leadership, culture, and impact

Interface’s transformation has always been grounded in values-led leadership. Ray Anderson, until his death in 2011, remained a passionate advocate for environmental stewardship, and his legacy continues to inspire both within and beyond Interface. Subsequent CEOs have carried forward this mission, embedding sustainability into the company’s DNA rather than treating it as a separate function. Today, the company’s leadership is committed to integrating ESG principles across all aspects of performance—from diversity and inclusion to supplier engagement and community outreach.

Internally, Interface nurtures a strong culture of purpose, creativity, and innovation. Employees are empowered to contribute ideas and align their roles with broader environmental and social goals. Training programs, design sprints, and cross-functional teams are used to keep the sustainability agenda dynamic and integrated.

Interface also measures and reports its progress with unusual clarity and transparency. It has consistently published corporate sustainability reports with science-based targets and has been recognized by CDP, Corporate Knights, and others for leadership in climate performance.

Inspiring others

Interface is one of the most compelling examples of a company that has redefined its purpose and business model around sustainability—not as a constraint but as a catalyst for innovation, value creation, and leadership. From its modest beginnings as a carpet tile manufacturer to a regenerative business that helps reverse global warming, Interface exemplifies how a business can succeed commercially while advancing human and planetary well-being. Its journey continues to inspire other organizations to think differently about their impact, their legacy, and the future they are helping to create.

L’Oréal was founded in 1909 by Eugène Schueller, a young French chemist. He developed one of the first safe hair dyes, which he sold to Parisian hairdressers. This marked the beginning of L’Oréal’s journey in the beauty industry.

The company initially focused on hair colour products. Over the years, it expanded its product range to include skincare, makeup, and fragrances.

Under the leadership of François Dalle in the 1950s and 1960s, L’Oréal began its international expansion. The company acquired several strategic brands and entered new markets.L’Oréal has continued to innovate and expand its global presence. The company has embraced digital technologies, sustainability, and social responsibility in its operations

Portfolio of Brands

L’Oréal’s portfolio includes a wide range of brands catering to different consumer needs and preferences. Here are some of the key brands:

Consumer Products

- L’Oréal Paris: A leading brand offering a wide range of hair care, skincare, and makeup products.

- Garnier: Known for its natural and organic skincare and hair care products.

- Maybelline New York: A popular makeup brand offering products for various skin tones and types.

- NYX Professional Makeup: Affordable and high-quality makeup products for professional and everyday use.

- Dark & Lovely: A brand focused on hair care products for textured hair.

L’Oréal Luxe

- Lancôme: A luxury skincare and makeup brand.

- Yves Saint Laurent: Offers high-end makeup and skincare products.

- Armani: Known for its luxury fragrances and cosmetics.

- Kiehl’s Since 1851: Specializes in skincare products.

- Ralph Lauren Fragrances: Offers a range of luxury fragrances.

Professional Products

- Redken: A professional hair care brand used by hairstylists worldwide.

- Kérastase: Specializes in high-end hair care products.

- Matrix Essentials: Offers professional hair color and styling products.

Dermatological Beauty

- CeraVe: Focuses on skincare products designed for sensitive skin.

- Biotherm: Offers skincare products that harness the power of thermal water.

- Helena Rubinstein: Known for its innovative skincare solutions.

Innovative Leader

L’Oréal has been at the forefront of innovation, particularly with the use of AI and digital technologies:

- HAPTA: L’Oréal developed the world’s first handheld computerized makeup applicator designed for consumers with limited mobility. This device uses AI to provide precise and easy application of makeup.

- TrendSpotter: This AI-powered tool scans online sources to quickly identify and react to emerging beauty trends. It helps L’Oréal stay ahead of the competition by developing new products based on real-time data.

- Virtual Makeup Try-On: Through partnerships with companies like Perfect Corp. and The Good Glamm Group, L’Oréal launched virtual makeup try-on tools. These tools use augmented reality (AR) to allow customers to try on makeup virtually, enhancing the online shopping experience.

- Personalized Skincare Advice: In retail spaces, L’Oréal has introduced AI-loaded iPads that provide personalized skincare advice and recommendations based on individual skin needs.

- Metaverse and Social Commerce: L’Oréal has ventured into the metaverse and social commerce, developing a dedicated incubator in partnership with Station F and Meta. They also partnered with Ready Player Me to create full-body 3D avatars for use in the metaverse.

- Product Impact Labeling: L’Oréal launched a labeling system that provides online shoppers with visibility into the environmental impact of their purchases compared to other products in the same category.

These innovations showcase L’Oréal’s commitment to leveraging AI and digital technologies to enhance customer experiences and stay ahead in the beauty industry.

L’Oréal has continued to achieve remarkable business success leading up to 2025, and reported a 5.6% rise in sales to €43.4 billion for the year ending December 31, 2024. This growth was driven by strong performance across all divisions, with dermatological beauty surpassing €7 billion for the first time. The company achieved a record 20% operating margin, reflecting efficient management and strong profitability.

Europe was the largest contributor to growth, with sales up by 9.3%. The region saw double-digit growth across all categories, led by haircare and fragrances.Dermatological beauty saw strong momentum in emerging markets, with brands like La Roche-Posay, CeraVe, Vichy, SkinCeuticals, and Skinbetter Science leading the way.

Key strategic initiatives include

- Omnichannel Strategy: The professional products division expanded through an omnichannel strategy, with significant acceleration in e-commerce and selective distribution.

- New Partnerships: L’Oréal signed a long-term, exclusive beauty partnership with Jacquemus, enhancing its luxury division.

- Sustainability: L’Oréal was recognized as a sustainability leader, receiving a platinum medal from EcoVadis.

- Beauty Stimulus Plan: L’Oréal is optimistic about the outlook for the global beauty market and expects growth to accelerate in 2025. The company plans to drive this growth through an exciting pipeline of new launches and continued strong brand support.

Nicolas Hieronimus, CEO of L’Oréal, expressed confidence in the company’s ability to outperform the global beauty market and achieve another year of growth in sales and profit.

In 2012, Will Ahmed, a Harvard University student athlete, founded the company, stylised as WHOOP, to help athletes gain greater visibility into their own fitness and rest. At the time he wrote a paper “The Feedback Tool: Measuring Intensity, Recovery, and Sleep.”

Along with two fellow students at Harvard, John Capodilupo and Aurelian Nicolae, he incubated a prototype at Harvard Innovation Labs. In 2021 the company raised $200 million from SoftBank’s venture capital fund, with a valuation of $3.6 billion.

Growth Market

The US dominates the global wellness economy, commanding a staggering $1.8 trillion—over twice the size of China’s market. Within this thriving $5.6 trillion global market, the US leads in nearly every sector, showcasing a dramatic shift towards health and lifestyle optimisation.

The fitness tracker market grew to $47.65 billion in 2023, and to $57.77 billion in 2024, marking an impressive 21.2% growth. This surge is fuelled by heightened health awareness, broader integration of wellness in insurance and corporate sectors, and a cultural shift towards preventative health.

Additionally, the sleep economy is booming, projected to hit $585 billion in 2024, driven by increasing public awareness of sleep’s essential role in health, backed by rising investments in sleep technology.

Human Performance

“Our mission is to unlock human performance”

“We’re revolutionising the way that people understand their bodies. WHOOP provides unprecedented visibility into the relationship between physiology and performance, helping people reach their highest potential physically, mentally, and emotionally.”

“WHOOP doesn’t count steps—instead measuring only the metrics scientifically proven to make a significant impact on your physical and mental health. WHOOP outperforms other leading wearables, delivering over 99% heart rate and HRV tracking accuracy and gold-standard sleep tracking, making it one of the most powerful, most accurate, and most wearable human performance tools you can buy.”

- WHOOP collects a lot of personal fitness data on its users, on the order of 50MB-100MB per day, which is 1,000x-10,000x the quantity collected by a Fitbit/Apple Watches.

- Proprietary algorithms: WHOOP monitors strain, recovery, and sleep using proprietary algorithms based on Heart Rate Variability (HRV), the variation in time between each heartbeat, as well as four other variables tracked 100 times per second

- WHOOP In-house research lab: “WHOOP is the only wearable in the game that has a dedicated research facility that empowers its own members to influence product features and be a part of groundbreaking discoveries about health and performance. When you participate, you are eligible for free months on WHOOP or select gift cards.”

Wearable Metrics

WHOOP developed a wearable device that tracks metrics like sleep, recovery, and strain.

The first version, WHOOP 1.0, was released in 2015, followed by several iterations, with the latest being WHOOP 4.0 in 2021. Ahmed has always refused to add a screen to WHOOP as a conscious design choice as it increases the perception of its “scientific” effectiveness.

WHOOP operates on a subscription-based model. Instead of charging for the hardware, WHOOP provides the device for free and charges a monthly fee for access to the WHOOP app, where users can view and analyze their data. This model allows WHOOP to focus on providing value through software and analytics.

WHOOP has introduced several innovative features over the years:

- WHOOP Coach: A personalized health and fitness coaching feature powered by OpenAI.

- Stress Monitor: Tracks daily stress levels through heart rate variability and resting heart rate.

- WHOOP Live: Integrates WHOOP data into live sports broadcasts.

- Battery Technology: WHOOP 4.0 features a battery developed by Sila Nanotechnologies that increases battery capacity.

“WHOOP Coach takes proprietary WHOOP algorithms, a custom-built machine learning model, the latest in performance science and research, and your unique biometric data to identify patterns and connections in your WHOOP data. With OpenAI’s latest technology, WHOOP Coach generates highly individualized, conversational responses to your health, fitness, and wellness questions – all within seconds.”

Business Model

At its commercial debut in late 2016, WHOOP initially priced its devices at one-time fee of $500, with production costs ranging between $250-$300 per unit..

As production scaled and costs declined coupled with observing user retention over extended periods, specifically low churn in those extended customer lifetimes, CEO Will Ahmed recognised the strategic advantage of transitioning to a subscription model as there was revenue there to be made.

Inspired by the market performances of Fitbit and Peloton, Ahmed saw the substantial value investors assigned to subscription models over one-time hardware sales, prompting WHOOP to adopt a similar approach.

Now, WHOOP focuses on “keeping your customers every day,” a strategy that demands constant innovation and the addition of immediate value. The move to a subscription model means Whoop must “release new features that are adding value now,” ensuring customer retention and satisfaction daily.

This deeper focus has intensified strategic discussions within WHOOP, making every feature development decision a step towards enhancing their customer-centric mission and strengthening their competitive advantage. By embedding a relentless pursuit of innovation in its DNA, WHOOP not only sustains its subscriber base but also drives its market leadership.

The Best Obsess

WHOOP’s ad campaign “The Best Obsess” features athletes and business thinkers.

It seeks to showcase the deep commitment of some of the world’s high performers including rock climber Alex Honnold, Whole30 co-founder and CEO Melissa Urban, the most decorated swimmer of all time, Michael Phelps, leading entrepreneur Steven Bartlett and Liverpool football star Virgil Van Dijk.

When Whoop set out to transform health monitoring, they started at the pinnacle of human performance—elite athletes – and got Michael Phelps and LeBron James in their first 100 users.

Instead of the usual routes crowded with pitches—agents, managers, even family—Whoop targeted an often overlooked yet influential figure: the personal trainer. This approach proved to be a masterstroke. By connecting with personal trainers who were pivotal yet under the radar, Whoop positioned their product directly into the routines of these top athletes.

“We got to know their trainers, Mike Mancias for LeBron and Keenan Robinson for Phelps,” the founder recounts. These trainers, recognising the value Whoop could offer in tracking recovery and performance, integrated the technology into their training regimens. The result? A seamless endorsement from some of the biggest names in sports.

This early adoption wasn’t just about celebrity endorsements; it was about proving the product’s worth in the most demanding scenarios. “If we could get the world’s best athletes to organically like Whoop, then building a brand around performance that could scale to consumers would follow,” he shares.

e.l.f. Beauty was founded in June 2004 by Joseph Shamah, a 23-year-old New York University business student, Scott Vincent Borba, a beauty industry veteran, and Joey’s father, Alan Shamah. The name “e.l.f.” stands for Eyes, Lips, Face, reflecting the brand’s initial focus on affordable makeup products.

What set e.l.f. apart from the start was its commitment to offering high-quality cosmetics at an incredibly low price point. Initially, products were priced at just $1, making them accessible to a wide audience. The brand was also one of the first digitally native beauty brands, selling exclusively online before expanding to retail stores.

The brand quickly gained popularity and expanded its product line. In 2005, Target began carrying e.l.f. products, which helped the brand reach a broader audience. By 2010, e.l.f. had secured a minority investment from TSG Consumer Partners, allowing for further growth and expansion.

Over the years, the company has diversified its product range to include not just makeup, but also bath products, skincare items, and professional tools. The brand has also expanded internationally, selling products in 17 countries and partnering with major retailers like Walmart, Kmart, and Ulta Beauty.

e.l.f. has embraced technology and innovation, launching features like virtual makeup try-on to enhance the shopping experience. This has been particularly appealing to Gen Z consumers, who appreciate the convenience and interactivity of digital tools.

In 2014, Tarang Amin took over as CEO, leading the company through a period of significant growth and transformation. Under his leadership, e.l.f. has continued to innovate and expand its market presence. Amin was named Modern CEO of the Year in 2023 for his efforts in steering the company towards sustainable growth and success.

In 2023, e.l.f. made a notable acquisition by purchasing the skin-care brand Naturium for $355 million, further expanding its product portfolio and market reach.

The brand’s journey from a budget-friendly online startup to a globally recognized beauty brand is a testament to its innovative approach and commitment to affordable, high-quality products.

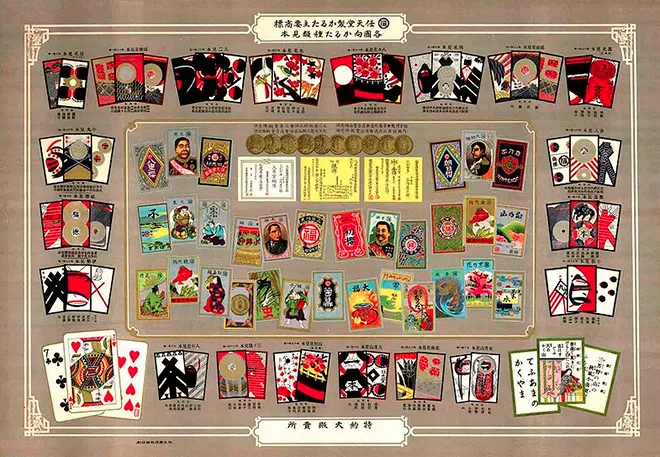

In 1889, Fusajiro Yamauchi founded Nintendo Koppai in Kyoto, Japan, to manufacture hanafuda, a type of Japanese playing cards.

Western-style playing cards originally came to Japan in the 16th century with Portuguese traders, but over the ensuing three centuries a variety of different card games were created in Japan. The most popular in the late 1800s were hanafuda, cards printed with beautiful, colorful images of flowers. The yakuza often used hanafuda in their illicit gambling halls.

The fact that the cards were often used for gambling was reflected in the name Yamauchi gave to his company. “Nin-ten-do” is written with characters that mean, roughly, “luck-heaven-hall,” or the place where you put your fortune in the hands of the gods.

Over the next 60 years, Nintendo became the country’s preeminent maker of playing cards, expanding into making toranpu (“trump,” for Western playing cards) and introducing a number of innovations to the Japanese market. The firm was the first to produce durable plastic-coated playing cards in Japan, and struck a deal to print cards with Disney characters on the backs. This had the effect of widening the market for playing cards, turning a gambler’s tool into a children’s toy.

The Nintendo company stayed in the hands of the Yamauchi family for over a century. Fusajiro Yamauchi’s great-grandson Hiroshi took over in 1949 at the young age of 22.

One of the new president’s first acts was to have all remaining Yamauchi family members fired, so that it would be clear who was in charge. Yamauchi oversaw the expansion of the company out of the playing-card business and into a wide variety of other products, all of which were failures – until the company moved into electronic toys and games.

Forging a partnership with the hardware maker Sharp that has lasted to this day, Nintendo engineers developed unique electronic toys like the Beam Gun, which used solar cells to let kids imagine they were firing a gun and making targets explode. From there, the company expanded into home and arcade videogames.

Nintendo, to this day, is the predominant playing-card maker in Japan, still producing hanafuda decks, although some of them now have Super Mario characters printed on them instead of flowers.

1970s: Entering the Video Game Industry

Nintendo’s pivotal turn toward the gaming industry occurred in the early 1970s:

- 1972: Nintendo first delved into the arcade game market with EVR Race and later Computer Othello. While not hugely successful, it laid the groundwork for future ventures.

- 1977: The company released Color TV-Game, a series of home consoles (similar to Pong), which helped establish Nintendo’s presence in the video game space.

- 1978: Nintendo’s arcade division, under Gunpei Yokoi, introduced Game & Watch (1980), a line of handheld electronic games, which became a precursor to portable gaming.

- 1979: The game Donkey Kong marked a major breakthrough. Created by Shigeru Miyamoto, it introduced the world to Mario, one of Nintendo’s most iconic characters.

1980s: Rise of Iconic Characters and the Famicom Era

The 1980s were pivotal in shaping Nintendo’s legacy, and the company solidified its place as a gaming juggernaut:

- 1981: Donkey Kong (arcade) introduced Mario (originally named “Jumpman”) and established Nintendo as a major player in the arcade market. The success of Donkey Kong and its characters laid the groundwork for Super Mario Bros. in the following years.

- 1983: Nintendo released the Famicom (Family Computer) in Japan, a home console that would later be rebranded as the Nintendo Entertainment System (NES) for the global market. The NES revolutionized home gaming, introducing iconic franchises like Super Mario Bros., The Legend of Zelda, and Metroid.

- 1985: The release of Super Mario Bros. for the NES was a game-changer, solidifying Nintendo’s dominance in the video game market. The game’s gameplay mechanics and character design set new standards for platformers.

- 1989: Nintendo launched the Game Boy, the world’s first widely successful portable gaming system. Its Tetrisbundle proved to be a game-changer, turning handheld gaming into a global phenomenon.

1990s: 3D Gaming and Console Wars

The 1990s saw the gaming industry evolve into a competitive space with cutting-edge technologies, rivalries, and the birth of iconic franchises:

- 1991: The Super Nintendo Entertainment System (SNES) launched, further expanding Nintendo’s global influence. Classic titles like The Legend of Zelda: A Link to the Past, Super Mario World, and Super Metroidbecame staples of the era.

- 1996: The Nintendo 64 was released, marking Nintendo’s entry into 3D gaming. With Super Mario 64, The Legend of Zelda: Ocarina of Time, and GoldenEye 007, the N64 set the standard for 3D platformers and shooters. The console’s use of cartridges, however, limited third-party support compared to Sony’s PlayStation(which used CDs).

- 1998: Nintendo introduced the Game Boy Color, an enhanced version of the Game Boy, offering color graphics and a robust library of titles.

- 1999: Pokémon Red and Blue launched in North America, quickly becoming a cultural phenomenon and establishing the Pokémon brand, which would go on to be one of the most profitable and influential in gaming history.

Shigeru Miyamoto, Nintendo’s legendary game designer, created The Legend of Zelda based on his childhood adventures in Sonobe, Japan. Supposedly, As a young boy, Miyamoto loved wandering through forests, exploring caves, and discovering hidden ponds near his hometown. His sense of curiosity and wonder heavily influenced the gameplay, practically encouraging players to explore open worlds and uncover secrets. This is a perfect example of how real-life childhood experiences can inspire groundbreaking happenings in the virtual and actual worlds.

2000s: Innovation, the Rise of Handhelds, and Online Gaming

The 2000s saw continued innovation and expansion into new areas:

- 2001: Nintendo GameCube was released, though it struggled against Sony’s PlayStation 2 and Microsoft’s Xbox. Nevertheless, the GameCube was home to beloved titles like Super Smash Bros. Melee, The Legend of Zelda: The Wind Waker, and Metroid Prime.

- 2004: Nintendo DS hit the market and became the best-selling handheld console of all time. Its dual-screen design, with a touch screen on the bottom, was revolutionary, and games like Mario Kart DS, Nintendogs, and Brain Agehelped it become a massive success.

- 2006: Wii launched and became a global phenomenon, thanks to its unique motion-sensing controller. The Wii’s innovative gameplay experience, exemplified in games like Wii Sports and Super Mario Galaxy, attracted a broad audience, including casual gamers. The Wii’s success also marked the beginning of Nintendo’s shift towards a more family-friendly, accessible gaming philosophy.

- 2007: The Legend of Zelda: Twilight Princess became a critical and commercial success, continuing the series’ legacy as one of the most beloved franchises in gaming.

- 2008: Nintendo’s DS and Wii helped to reshape gaming’s target audience, moving beyond traditional gamers to include families, seniors, and non-gamers.

Shigeru Miyamoto says that Mario’s appearance went through some drastic changes because of the technological boundaries of the day. The hat was used to cover the hair which could not be shown because it would be bland and non-believable. They used white gloves to help the player track his movements and a mustache was added to add at least a facial feature to the character.

All of those features now shape his iconic characteristics which have been used throughout all these years. From different video games to cameos and movies, Mario is everywhere and has brought joy to billions of people.

2010s: The Rise of the Switch and New Business Models

The 2010s marked a decade of bold risks and successful reinventions:

- 2011: The Nintendo 3DS debuted with glasses-free 3D technology, offering experiences like Super Mario 3D Land and The Legend of Zelda: A Link Between Worlds. It became a major success despite a rocky start, thanks to a price drop and strong software lineup.

- 2012: Wii U, a follow-up to the Wii, struggled commercially despite its innovative GamePad controller with a touchscreen. However, it was home to standout games like Super Mario 3D World, Splatoon, and The Legend of Zelda: Breath of the Wild (which was later released on the Nintendo Switch).

- 2017: Nintendo Switch launched, combining the best of home console and handheld gaming into one device. Its hybrid design, ability to play on the go, and accessibility to a wide range of gamers made it a runaway success. Iconic games like The Legend of Zelda: Breath of the Wild, Super Mario Odyssey, and Animal Crossing: New Horizons helped make the Switch one of the best-selling consoles of all time.

2020s: Expanding Influence and Continued Innovation

In the 2020s, Nintendo remains a dominant player in the gaming world, focusing on unique experiences and expanding its impact beyond gaming:

- 2020: Animal Crossing: New Horizons became a massive success, particularly during the COVID-19 pandemic, as it provided a much-needed escape for millions of players worldwide.

- 2023: Super Mario Bros. Movie, a collaboration with Illumination Entertainment, was released, showcasing Nintendo’s broader ambitions in entertainment beyond games, further cementing Mario’s status as a global pop culture icon.

- 2024 and beyond: Nintendo continues to innovate with its hardware, gaming experiences, and expansions into various forms of media, while also preserving its rich legacy of beloved franchises like Super Mario, Zelda, Pokémon, and Metroid.

Nintendo has changed its name various times throughout the company’s history. Back in 1963, the company’s third president (Hiroshi Yamauchi) renamed it from Nintendo Playing Card Co. Ltd. To Nintendo Co. Ltd because they had changed their main business models and approach. But as it is a Japanese company, the name gets its root from Kanji characters. Nin, Ten and Do translate to “leave luck to heaven” which sounds as poetic as it is strange.

Some of Nintendo’s key innovation milestones over the last 5 decades have included:

- Handheld Gaming: With the Game Boy in 1989 and subsequent consoles like the DS, Nintendo helped popularize portable gaming, ensuring it would be a permanent part of the gaming landscape.

- Motion Controls: The Wii’s motion-sensing controllers revolutionized gaming by introducing motion-based interaction, making gaming more active and accessible.

- Hybrid Console Design: The Nintendo Switch’s hybrid concept (play at home or on the go) redefined the console market and proved to be a massive commercial success.

- Innovative Game Design: Nintendo’s games consistently push the envelope with creativity, character design, and world-building, from Super Mario to Zelda and beyond.

- Family-Friendly Appeal: Nintendo’s consoles and games have consistently attracted a wide demographic, from young children to older adults, fostering a diverse and inclusive gaming community.

Ren Zhengfei, Huawei’s founder, established the company in Shenzhen, China, with an initial focus on reselling telephone switches. At the time, China’s telecommunications sector was underdeveloped, and Ren saw an opportunity to build a domestic company that could provide affordable and reliable telecom infrastructure.

The company’s name, Huawei, is derived from the Chinese characters “华” (Hua, meaning China or splendid) and “为” (Wei, meaning action or achievement), which together can be interpreted as “China’s achievement” or “splendid achievement.”

In the early years, Huawei was primarily focused on research and development (R&D) to create telecom products that would be competitive with international giants. Its first major breakthrough came in the early 1990s, when Huawei developed its own PBX (private branch exchange) switches, which were key components for phone systems used by businesses and government agencies. This allowed Huawei to offer products at a lower cost compared to foreign competitors, particularly in the Chinese market.

Global growth

By the early 2000s, Huawei had established itself as a significant player in the Chinese market. However, its ambitions went far beyond China. During this period, the company expanded rapidly into international markets, focusing on providing telecom infrastructure to both developing and developed countries. Key events during this period include:

- Global Expansion: Huawei began selling its telecom equipment to countries in Europe, the Middle East, Africa, and Latin America, offering competitive pricing and technology. Huawei’s global expansion was helped by its willingness to offer financing and flexible terms for developing countries’ telecom operators.

- Strategic Acquisitions: Huawei’s international strategy involved acquisitions to bolster its product portfolio. For example, in 2003, Huawei acquired 3Com’s stake in Huawei-3Com, a joint venture, giving it access to networking hardware technology. Huawei also acquired Nortel Networks’ GSM business in 2009, which strengthened its position in mobile broadband and further opened up North American markets.

- Research and Development: Huawei invested heavily in R&D to differentiate itself from competitors. By the end of 2010, Huawei’s R&D spending had reached billions of dollars annually. Huawei’s R&D strategy focused on developing next-generation telecom equipment and creating a range of consumer electronics products. This approach laid the foundation for future innovations, including in the emerging field of 5G.

Electronics and Telecoms

Huawei’s growth is often attributed to its diverse range of products and services. The company operates in multiple business segments, primarily divided into carrier networks, enterprise, and consumer business.

Carrier Networks

Huawei is one of the world’s largest providers of telecommunications infrastructure, and its Carrier Networks business is the backbone of the company. This segment includes:

- Telecom Equipment: Huawei designs and manufactures telecom gear for wireless (4G, 5G), fixed-line, and broadband networks. Its products include base stations, routers, switches, and core network equipment that telecom operators use to build and maintain their networks.

- 5G Technology: Huawei has been at the forefront of the development of 5G technology, providing equipment for 5G networks worldwide. Its 5G infrastructure products have been praised for their advanced capabilities and cost-effectiveness, making Huawei a global leader in the rollout of 5G networks. Despite facing security concerns in certain Western countries, Huawei has managed to secure deals in Asia, Africa, and Europe, where its technology is deployed in a large number of 5G networks.

- Cloud and AI Solutions: Huawei’s telecom equipment is increasingly integrated with cloud and artificial intelligence (AI) technologies. The company’s Huawei Cloud division is growing rapidly, offering cloud computing services, AI platforms, and software-as-a-service (SaaS) solutions to businesses around the world.

Enterprise Solutions

Huawei’s Enterprise Business focuses on providing networking and ICT solutions for industries such as government, finance, education, and transportation. The company offers products like:

- Data Centers: Huawei builds data center infrastructure, providing servers, storage systems, and networking hardware for large enterprises.

- Enterprise Networking: The company offers a variety of networking products, including routers, switches, and wireless access points, designed for use in corporate and industrial environments.

- Cybersecurity Solutions: Huawei has built a portfolio of cybersecurity products and services to address the growing demand for secure enterprise networks and cloud services.

Consumer Electronics

The Consumer Business is another major revenue driver for Huawei. This segment includes:

- Smartphones: Huawei became one of the world’s leading smartphone manufacturers, competing directly with Apple and Samsung. Its flagship Mate and P series smartphones were known for cutting-edge technology, including high-performance cameras (often developed in collaboration with Leica), advanced processing chips (e.g., the Kirin chipset), and large, high-resolution displays. Huawei became the second-largest smartphone maker globally by market share before facing setbacks due to US trade restrictions.

- Wearables and Tablets: Huawei also manufactures a variety of wearables, such as smartwatches and fitness trackers, as well as tablets. Its Huawei Watch and Huawei Band series gained popularity, especially in markets like Europe and Asia.

- Laptops and PCs: Huawei’s MateBook series of laptops have found success in the high-end consumer laptop market, particularly in Europe and Asia.

- Smart Home Devices: Huawei has ventured into the smart home market with products like the Huawei AI Cube, smart speakers, and home appliances, integrating IoT (Internet of Things) into consumer electronics.

Business Model

Huawei’s business model is based on three key pillars: innovation, cost efficiency, and vertical integration.

- Innovation: Huawei has invested billions of dollars in R&D, resulting in numerous patents, particularly in areas like 5G, semiconductors, and AI. This commitment to R&D has helped the company stay ahead of the curve in telecom infrastructure and mobile technology.

- Cost Efficiency: Huawei has a reputation for offering high-quality products at competitive prices. This cost advantage helped it become a leading player in global telecom infrastructure markets, especially in developing regions where cost is a key consideration.

- Vertical Integration: Huawei’s business model also relies on significant vertical integration. It designs and manufactures much of its own telecom equipment, including chips, networking hardware, and software. This allows the company to control costs and quality while creating customized solutions for clients.

Commercially, Huawei saw massive growth in the 2010s, especially in emerging markets where it became a preferred partner for telecom operators. Despite being placed on the U.S. Entity List in 2019, which severely restricted its access to critical technology such as Google services for its smartphones, Huawei remained resilient. It pivoted towards creating its own software ecosystem (with HarmonyOS), continued expanding its telecom infrastructure business, and focused on high-end markets in Europe and Asia for its smartphones.

Future Strategy

Huawei’s future strategy revolves around five key pillars:

- Leadership in 5G: Huawei continues to position itself as a leader in 5G infrastructure, with plans to expand 5G networks globally. The company is working on the next-generation of telecom technology, such as 6G, which will be a critical part of its strategy for the next decade.

- Diversification into Cloud and AI: Huawei is heavily invested in cloud computing and artificial intelligence. Huawei Cloud is positioned as a key player in China and is expanding into international markets, particularly in Southeast Asia, Europe, and Africa.

- Consumer Technology: Despite setbacks in the smartphone market, Huawei is committed to developing its HarmonyOS ecosystem, which will drive its smartphone, tablet, and smart home device businesses. The company is also investing in AI-powered devices like wearables and smart home technology.

- Self-Reliance and Semiconductor Development: Due to the U.S. sanctions that have cut off Huawei’s access to foreign chips, the company is focused on becoming more self-reliant in chip manufacturing. Huawei’s HiSilicon division is working on developing cutting-edge semiconductors for use in its own devices and telecom equipment.

- Sustainability: Huawei has made sustainability a key element of its corporate strategy, particularly in reducing the environmental impact of its products. The company is investing in green technology, including energy-efficient telecom infrastructure and renewable energy solutions for its data centers.

Huawei’s evolution from a small telecom reseller to a global technology giant is a testament to its relentless focus on innovation, cost-efficiency, and adaptability. The company has built a diversified business model spanning telecom infrastructure, consumer electronics, cloud services, and AI. Despite facing significant challenges—particularly the ongoing geopolitical tensions and trade restrictions—it has continued to evolve, focusing on key areas like 5G, cloud, and self-reliance in semiconductor manufacturing

Circles was co-founded by Rameez Ansar, Abhishek Gupta, and Adeel Najam. The trio, who previously worked in companies like McKinsey, BCG, and Temasek Holdings, were frustrated with the status quo in the telco industry and decided to create their own telco. They started out at BLK 71, a startup hub in Singapore, and have since expanded to other countries.

Circles aims to revolutionize the telecommunications industry by offering customer-centric services. They focus on providing flexible, no-contract plans, lower prices, and better customer service compared to traditional telcos. They also built a proprietary operating system called Circles to create a superior customer experience and more competitive telco offerings.

It offers a range of digital mobile services, including voice, data, roaming, and international calls. They also provide Unlimited Data on Demand and Unlimited Outgoing Calls, catering to the modern consumer’s need for flexibility and customization. Additionally, they have launched digital lifestyle features like Discover, an AI-driven events and movie-based platform.

The brand is known for its bold and unconventional marketing campaigns. They have mocked traditional telcos for their long-term contracts, poor customer service, and expensive data options. Their campaigns often go viral, making them a key differentiator in the market.

Circles has seen significant growth since its launch. They have expanded to markets like Taiwan, Australia, Indonesia, and Japan. The company has also attracted investments from notable backers like Warburg Pincus, Peak XV Partners (formerly Sequoia Capital India & Southeast Asia), EDBI, and Founders Fund.

In a quiet corner of south London is the home of the bouncy foam that revolutionised distance running, and the material scientists in white coats who not only created this incredible stuff but are working on new foams that may yet allow Eliud Kipchoge and his main rivals in the marathon to go faster still.

The genesis of the super shoes that have enabled male and female athletes to smash world records on the road and track these past few years amounts to an extraordinary story. A tale of how this century-old British firm, founded by a man who had been mentored in the United States by Thomas Edison, happened almost by chance to develop a foam that transformed a multibillion-pound industry as well as a sport.

Zotefoams plc is recognised as the world leader in advanced technical foams. The company is the direct descendant of Onazote Limited, the company that was founded in 1921 and commercialised the world’s first hard and soft expanded rubber.

Inspired by the work of three Austrian brothers, Hans, Fritz, and Herman Pfleumer, who had conceived the original concept of filling tyres with some form of expanded lightweight material, rather than air, Charles Marshall, patented a process to manufacture expanded rubbers of all kinds – hard and soft.

In the sun-baked deserts of Saudi Arabia lies a treasure trove of liquid gold. This is the home of Saudi Aramco. As the largest oil company in the world, Aramco as it is now known, is a titan whose story is deeply intertwined with the history of modern Saudi Arabia and the global energy landscape.

It is the world’s largest oil company, one of the world’s largest companies by market cap, generating annual profits equal to the combined totals of Amazon, Nvidia, and Meta.

It is also the single most contributing force behind Saudi Arabia’s rise to power. Its control over global oil supplies has made it a key player in international politics, shaping global energy dynamics through crises and conflicts.

Aramco’s vision is to be “the world’s preeminent integrated energy and chemicals company, operating safely, sustainably, and reliably”. And its mission, “to strive to provide reliable, affordable, and sustainable energy globally while delivering value to shareholders.”

Liquid gold

Aramco’s roots trace back to the 1930s when the Arabian Peninsula was a landscape of nomadic tribes and a few scattered towns. The world was already aware of the potential of oil, but no one was certain of the riches lying beneath the Arabian sands. That was until geologists from Standard Oil of California (SoCal) arrived in 1933 with a bold concession from the Saudi government to explore for oil.

SoCal’s venture into the Arabian Peninsula was far from guaranteed success. The Arabian landscape was harsh and unforgiving, with extreme heat and little infrastructure. The first geologists who arrived faced not only the natural challenges but also the skepticism of many who doubted that oil could be found there. Despite the many skeptics, the team established their base in Dhahran, a small coastal area that would eventually become the epicenter of Saudi Arabia’s oil industry.

Over the next five years, the search for oil was fraught with disappointment. The initial wells drilled by SoCal’s geologists came up dry, one after another. There was a growing sense of frustration and doubt, not just among the workers in the field, but also back in the United States, where SoCal’s management began to question the viability of the entire operation. This situation is reminiscent of the Norwegian government’s discovery of the Ekofisk oil field in 1969 after four years of exploration and setbacks. That discovery eventually led to one of the country’s most valuable assets, which became the backbone of Norway’s sovereign wealth fund – the largest sovereign wealth fund in the world.

The first years were met with disappointment. After drilling a series of dry wells, SoCal’s geologists were on the verge of giving up. But in 1938, persistence paid off when they struck oil at Well No. 7 in Dhahran. This well, later named the “Prosperity Well,” marked the beginning of a new era for Saudi Arabia and the world. The company, initially named the California Arabian Standard Oil Company, would evolve into the Arabian American Oil Company, or Aramco, and eventually into Saudi Aramco after Saudi Arabia took full ownership in 1980.

Geopolitics and partnerships

The story of Aramco is as much about geopolitics as it is about oil. The company initially operated as a partnership between the Saudi government and a consortium of American companies, including Standard Oil of California (which later became Chevron), Texaco (now owned by Chevron), and Exxon Mobil. This partnership was instrumental in shaping the modern Saudi state, providing the funds needed to transform the Kingdom from a desert backwater into a modern nation.

Aramco’s operations were not just confined to extracting oil. The company built entire communities from scratch, including the city of Dhahran, which became the epicenter of the oil industry in Saudi Arabia. Aramco introduced modern amenities, built schools and hospitals, and even brought baseball to the desert, reflecting its strong American heritage.

One of the most fascinating stories about Saudi Aramco is the discovery and development of the Ghawar oil field in 1948. Stretching over 174 miles, Ghawar is the largest conventional oil field in the world, producing millions of barrels of oil daily at its peak. For decades, Ghawar has been the beating heart of Saudi Aramco, generating more wealth than perhaps any other single natural resource in history.

The sheer scale of Ghawar is mind-boggling. It is said that if Ghawar were a country, its oil production would rank among the top 10 in the world. The field has produced more than 65 billion barrels of oil since its discovery and is still a critical asset in Aramco’s portfolio. The story of Ghawar is one of engineering marvels, as Aramco’s engineers have employed cutting-edge technology to maintain its output, even as the field matures.

Over the decades, Saudi Aramco has faced numerous challenges, from navigating global oil shocks to adapting to changing geopolitical landscapes. One significant moment was the 1973 oil embargo, during which Arab oil producers, including Saudi Arabia, drastically cut exports to the West in response to U.S. support for Israel in the Yom Kippur War. This event not only quadrupled oil prices but also demonstrated the immense power Saudi Arabia wielded over global energy markets.

As the years passed, Saudi Aramco evolved from an oil extraction company into an integrated energy giant, investing in refining, petrochemicals, and alternative energy sources. In 2019, Aramco made headlines with its IPO, the largest in history, raising $25.6 billion at a $1.7 trillion valuation. This IPO was part of Saudi Arabia’s Vision 2030 plan, an ambitious blueprint to diversify the Kingdom’s economy away from its dependence on oil.

Future growth

As the world moves towards a future of renewable energy and reduced carbon emissions, the role of Saudi Aramco will undoubtedly evolve. The company is investing heavily in technologies that could redefine its place in the global energy market, from hydrogen production to carbon capture. At the same time, it continues to be a critical player in ensuring the stability of global oil supplies.

The story of Saudi Aramco is far from over. It is a tale of discovery, ambition, and resilience. It is the story of how a nation’s fortunes can be transformed by the power beneath its feet and how a company can shape the destiny of an entire country. As Saudi Aramco looks towards the future, it carries with it a legacy of innovation, leadership, and a constant quest for energy that will likely continue to influence the world for generations to come.