Lead the Change: Growth Strategies

September 23, 2025 at ESP25 at IE Business School, Madrid

Incredible technologies and geopolitical shifts, complex markets and stagnating growth, demanding customers and disruptive entrepreneurs, environmental crisis and social distrust, unexpected shocks and uncertain futures.

For every business leader, the challenge is about making sense of today’s rapidly changing world, and understanding how to prepare for, and succeed, in tomorrow’s world.

We explore how businesses can survive and thrive, and move forwards to create a better future. How to reimagine business, to reinvent markets, to reengage people. We consider what it means to combine profit with more purpose, intelligent technologies with creative people, radical innovation with sustainable impact.

We learn from the innovative strategies of incredible companies – Alibaba and ASML, Biontech and BlackRock, Canva and Collossal, NotCo and Netflix, Patagonia and PingAn, Spotify and Supercell, and many more. We also take a look at what this means for insurance, and some of the most innovative companies in the field.

Are you ready to seize the opportunities of a changing world?

How will you – and your strategy, organisation, people and projects – embrace the challenges and opportunities of change ahead of us? Where are your biggest opportunities for innovation and growth? What are your priorities to balance short and longer term? How will you behave as a manager and leader?

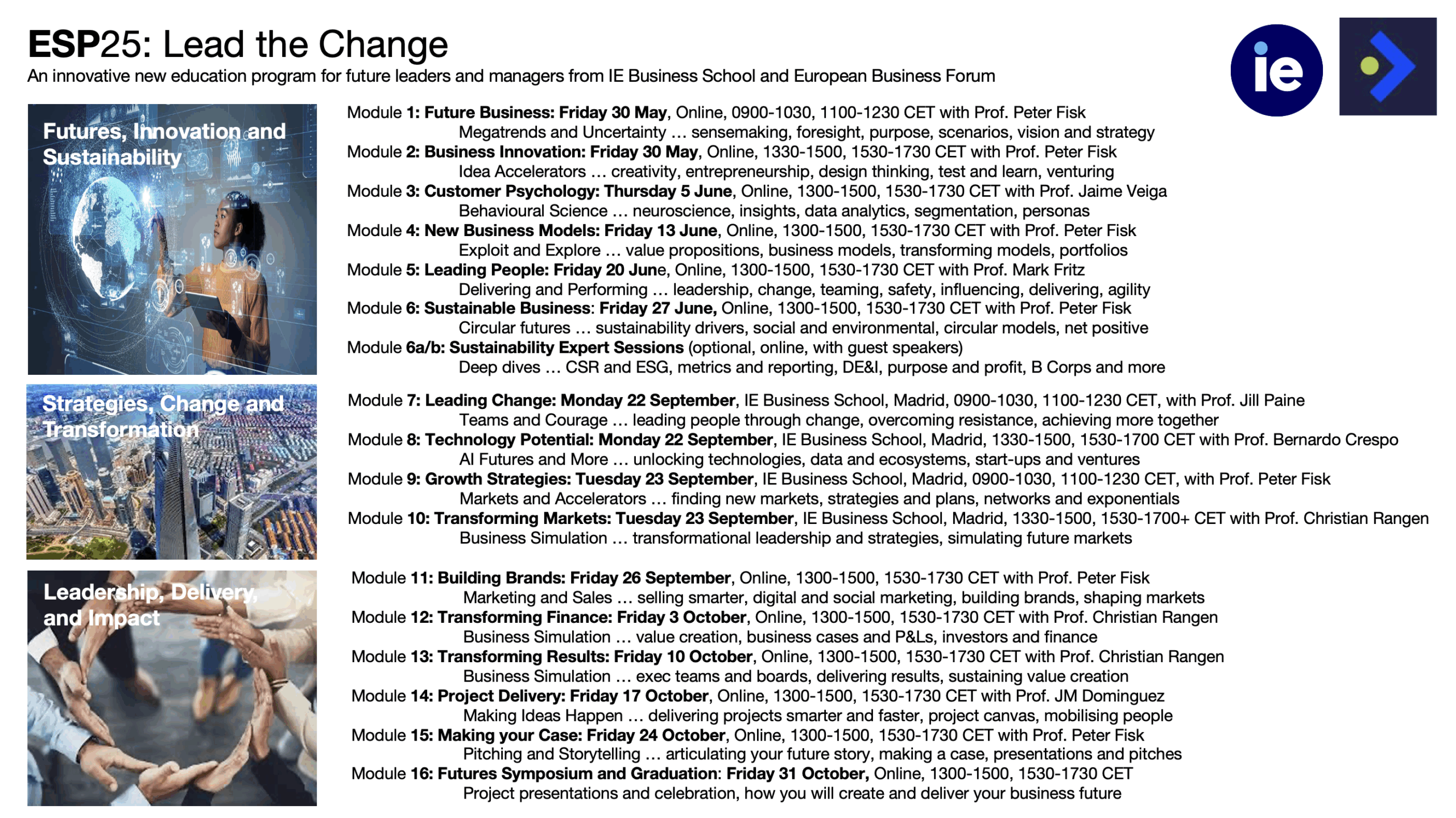

We’ve developed a new program for business leaders, managers of companies large and small, to get up to speed with the very latest ideas, tools and approaches to business, learning from companies and experts around the world. It’s called the Executive Management Program, delivered as a hybrid program online and in face to face in Madrid.

It’s like a Mini MBA, but fit for today’s world, where challenges like economic uncertainty and climate change are matched by opportunities like the applications of AI and new business models. It includes an exciting dynamic business simulation, about managing and leading change, plus insights and ideas from the world’s most interesting companies, right now.

In fact it brings together much of the Global Online MBA from IE Business School, which is ranked #1 in the world, and in particularly for topics such as ESG and sustainability. The faculty is made up of expert professors from IE and beyond, and we spend a number of days in Madrid at IE’s Executive Education campus.

For more info, contact me directly: peterfisk@peterfisk.com

Module 9: Growth Strategies, defining direction and accelerating progress in a world of relentless change

In today’s volatile, fast-evolving business environment, growth is no longer a linear, predictable process. Market conditions are constantly shifting, technology is accelerating, competition is intensifying, and customer expectations are becoming more fluid. For business leaders, the challenge is not just how to grow—but how to grow smartly, sustainably, and strategically in a world defined by complexity and uncertainty.

The New Growth Imperative

Growth remains the ultimate barometer of business success. It fuels innovation, attracts talent and capital, and secures long-term competitiveness. But how growth is achieved—and the mindset required to pursue it—has changed. Yesterday’s playbooks often fall short in today’s dynamic context. Strategic planning must now embrace flexibility, agility, and optionality, while maintaining a clear sense of direction and differentiation.

There is no single growth formula. Instead, businesses need to develop multi-dimensional growth strategies that combine organic and inorganic approaches, short-term wins and long-term bets, core reinvention and new market expansion—all underpinned by data, experimentation, and cultural alignment.

Organic vs. Inorganic

Growth strategies broadly fall into two categories:

- Organic Growth: achieved from within—by improving products, services, operations, and customer experiences. Organic growth is typically more sustainable and aligned with the company’s core capabilities and culture. It includes product innovation, market expansion (new geographies or segments), pricing optimization, digital transformation, customer retention and loyalty programs. Organic growth is especially effective when a company has a strong brand and customer base, clear differentiation and internal capabilities, opportunities to expand wallet share or improve efficiency

- Inorganic Growth: achieved from outside – by acquisitions, partnerships, or investments. It is often used to enter new markets quickly, acquire new technologies or capabilities, consolidate share, or accelerate scale. Inorganic growth can be faster, but also riskier, particularly if cultural integration is poor or strategic alignment is weak.

Apple has achieved sustained organic growth by building an ecosystem of products and services—iPhones, Macs, AirPods, and now a growing suite of digital services (iCloud, Apple Music, Apple Pay)—designed to work seamlessly together and increase customer lifetime value. Amazon’s acquisition of Whole Foods gave it immediate access to the grocery space, while its purchase of MGM Studios expanded its content portfolio for Prime Video. Amazon combines bold organic innovation (e.g. AWS, Alexa) with strategic inorganic moves to build flywheels in multiple domains.

-

Use organic growth when you have clear internal strengths, cultural alignment, and time to build.

-

Use inorganic growth when time-to-market is critical, capabilities are missing, or the opportunity cost of waiting is high.

Of course most companies use both.

Building strategies with focus and agility

In a rapidly changing world, strategic planning must shift from rigid roadmaps to adaptive frameworks. Growth strategies must be:

-

Clear in intent (what are we solving for?)

-

Focused in direction (where can we win?)

-

Flexible in execution (how do we adapt as we go?)

This means using scenario thinking, modular planning, and feedback loops to remain responsive while staying grounded in a clear vision.

Key principles:

-

Anchor in purpose and value creation

A meaningful purpose acts as a compass during turbulent times. Companies like Unilever and Patagonia have embedded their purpose into product, culture, and growth strategies, helping them maintain focus amid shifting market dynamics. -

Pursue adjacent and breakthrough growth

Core growth may plateau. Leaders must balance:-

Core optimization: making the existing business better

-

Adjacent expansion: entering closely related markets

-

Breakthrough bets: exploring transformative opportunities

-

Example:

Adobe shifted from selling boxed software to a cloud-based subscription model (Creative Cloud), enabling it to unlock recurring revenue and launch new digital tools—an organic transformation that fueled years of sustained growth.

-

Embrace test-and-learn

Growth now depends on experimentation, not just execution. Agile, iterative approaches allow companies to test new ideas, learn fast, and pivot. This is especially useful in customer acquisition, product development, and geographic expansion.

Example:

Booking.com is known for running thousands of A/B tests daily—refining everything from UX to pricing to messaging. This culture of experimentation enables precision growth optimization.

-

Keep capital and talent flexible

Growth strategies need dynamic allocation of capital and talent. Leaders should regularly reassess where to double down, where to pivot, and where to cut.

Growth accelerators: Data, Platforms, and Flywheels

1. Data as a Growth Driver

Data is no longer a byproduct—it’s a growth engine. When leveraged correctly, data enables:

-

Hyper-personalized customer experiences

-

Predictive analytics for demand and supply

-

Real-time decision-making and optimization

Example:

Netflix uses viewing data to recommend content, guide original programming investments, and improve user retention. Its entire growth model is built on data-led personalization.

2. The Power of Flywheels

A flywheel is a self-reinforcing system where each action strengthens the next. Great companies engineer growth flywheels that compound over time.

Amazon’s flywheel famously begins with customer experience → more traffic → more sellers → better selection → lower costs → better customer experience. Each component reinforces the next, creating exponential momentum.

Other examples:

-

Spotify: more users → better data → better recommendations → more engagement → more artists attracted

-

Airbnb: more hosts → more listings → more users → more bookings → better data and reviews → more trust and growth

Flywheels require a systems-thinking mindset. Leaders must design and align each component for mutual reinforcement.

Examples of Growth Strategies

MercadoLibre built a homegrown e-commerce ecosystem in Latin America, offering marketplace, fintech (MercadoPago), logistics (MercadoEnvios), and more. By solving structural pain points in emerging markets, it created a multi-sided flywheel for growth. Reliance disrupted India’s telecom market by launching Jio with free internet and cheap data. It then built digital platforms (e.g., JioMart, JioSaavn) to monetize its massive user base. It combined infrastructure investment with data-driven digital expansion. Tesla’s growth isn’t just about cars—it’s about ecosystems. With electric vehicles, charging networks, software updates, and energy products, it created a vertically integrated growth engine. Its innovation-driven strategy balances product expansion with brand loyalty.

AWS … the power of cloud

Growth strategy:

-

Transformed Amazon’s internal infrastructure into a cloud services platform for the world.

-

Scaled a highly profitable, usage-based SaaS business while others still sold physical servers.

-

Offered APIs and tools that enabled startups and enterprises to build rapidly.

Growth impact:

-

Became the profit engine for Amazon: ~$90B revenue (2023), ~30% operating margin.

-

Powers a massive portion of the global internet economy.

-

Enabled Amazon to subsidize retail operations and expand into healthcare, devices, and AI.

Apple … ecosystem growth engines

Growth strategy:

-

Shifted from being a hardware innovator to building a services ecosystem (App Store, iCloud, Music, Pay).

-

Designed a closed ecosystem with high customer lock-in and premium branding.

-

Invested heavily in proprietary chips and vertical integration.

Growth impact:

-

Gross margins regularly exceed 42%.

-

Apple Services segment alone generates $80B+ annually, with higher margins than devices.

-

Became the world’s first $3 trillion company (2022).

BYD … from batteries to automobiles

Growth strategy:

-

Transitioned from battery maker to EV and hybrid vehicle giant.

-

Developed a closed-loop model with internal batteries, chips, and semiconductors.

-

Benefited from Chinese government incentives and global demand for affordable EVs.

Growth impact:

-

Surpassed Tesla in EV sales (2023) in certain quarters.

-

Revenue grew to $75B+, with strong profitability.

-

Expanded to global markets (Europe, Asia, LATAM), becoming a key global EV player.

Shopify … enabling every store to be global

Growth strategy:

-

Democratized e-commerce with an intuitive platform for SMBs and creators.

-

Avoided competing with Amazon directly; instead built tools and an app marketplace.

-

Integrated payments, logistics, and marketing into its platform.

Growth impact:

-

Revenue grew from $205M (2015) to over $7B (2023).

-

Reached profitability in key quarters while maintaining strong reinvestment.

-

Became one of Canada’s most valuable companies, with a global merchant base.

Netflix … making and streaming movies

Growth strategy:

-

Moved from DVD rentals to a streaming-first, content-producing tech platform.

-

Leveraged data analytics and AI to drive content investments and personalization.

-

Scaled globally fast with local content in multiple markets.

Growth impact:

-

From 22M subscribers (2011) to 260M+ globally (2024).

-

High user retention and average revenue per user (ARPU).

-

Operating margins grew from single digits to over 20% in recent years.

Nvidia … chips to power the future

Growth strategy:

-

Pivoted from graphics chips to powering AI, data centers, and deep learning.

-

Developed CUDA, a platform that made GPUs essential for modern AI work.

-

Benefited massively from the generative AI and LLM boom.

Growth impact:

-

Stock price rose over 20x between 2016 and 2024.

-

Became a $2 trillion company and one of the most profitable chipmakers globally.

-

Gross margins regularly exceed 65%, with exponential revenue growth.

Reliance Jio … from petrochemicals to super apps

Growth strategy:

-

Launched ultra-low-cost mobile data and telecom services to underserved masses.

-

Bundled services like streaming, messaging, and payments.

-

Funded through Reliance Industries’ oil & gas business, and then spun into a digital platform.

Growth impact:

-

Gained 400M+ subscribers in under 5 years.

-

Drove India’s digital transformation and increased data consumption 10x.

-

Raised billions from global investors (Facebook, Google), valuing Jio at over $65B.

LVMH … unlocking the brand portfolio

Growth strategy:

-

Consolidated luxury brands across fashion, jewelry, wines, and cosmetics.

-

Preserved brand exclusivity while digitally modernizing marketing and direct-to-consumer.

-

Expanded aggressively into Asia, especially China.

Growth impact:

-

Became the world’s most valuable luxury company ($500B+ market cap).

-

Operating margin over 25%, with strong pricing power and global brand dominance.

-

Acquisitions like Tiffany & Co. strengthened portfolio and cross-brand synergy.

MercadoLibre … the digital backbone of Latin America

Growth strategy:

-

Built the “Amazon + PayPal of Latin America” with e-commerce, logistics, and fintech.

-

Created MercadoPago to solve payments for the unbanked.

-

Scaled across 18+ countries, solving local infrastructure challenges.

Growth impact:

-

Market cap surged from ~$5B (2015) to $80B+ (2024).

-

Maintained profitability with strong user growth and low CAC.

-

MercadoPago is now a major fintech player across LATAM.

Tesla … not just cars, but an energy business

Growth strategy:

-

Redefined the electric vehicle market with a vertically integrated, software-first business model.

-

Built its own battery tech, charging infrastructure, and AI-based self-driving system.

-

Positioned itself not just as a carmaker but as an energy + tech company.

Growth impact:

-

Market cap surged from ~$50B in 2017 to over $750B by 2024.

-

Delivered profitability across multiple years, despite high capital investment.

-

Created one of the most profitable vehicle businesses globally (per unit gross margin).

What Sets Growth Leaders Apart?

Growth leaders share common traits:

-

Clarity of vision and adaptability of plans

-

Relentless customer focus

-

Digital and data fluency

-

Operational agility and organizational alignment

-

Long-term thinking balanced with fast execution

They foster cultures that reward curiosity, speed, and continuous improvement. And they design their businesses to not just respond to change—but thrive on it.

Art and Science

Developing a growth strategy in a fast-changing world requires both discipline and dynamism. Business leaders must:

-

Understand when to build and when to buy

-

Balance focus with experimentation

-

Use data and platforms as accelerators

-

Design reinforcing systems like flywheels

-

Lead with purpose and agility

There’s no one-size-fits-all solution. But the companies that grow best are those that learn fastest, adapt intelligently, and never lose sight of what makes them valuable to the world. Growth, in this sense, is not just about scale—it’s about creating enduring, compounding value in an ever-evolving world.

Find out more and book >