Banking is one of the oldest industries in human civilization, yet today it stands at a profound inflection point. For centuries, banks have played the same roles: safeguarding money, enabling transactions, and allocating capital. Their architecture—branches, balance sheets, bureaucracies—has endured revolutions, wars, and crises. But in today’s world of rapid and relentless change, banks face pressures unlike any in their history.

This change is being driven by megatrends—deep, structural forces that reshape economies and societies over decades. Megatrends are not fads or short-term shifts; they are global, transformative, and unavoidable. Among the most powerful are digitization, democratization, personalization, and sustainability. Together, they are redefining markets, reshaping customer aspirations, and opening the door to radical new business models. For banks, they pose a stark question: are you fit for the future, or destined for irrelevance?

Megatrends shaking up every market

Megatrends are already disrupting industries once thought stable:

-

Digitization has transformed music from physical products (vinyl, CDs) into streaming experiences. Spotify doesn’t sell songs; it sells moods, discovery, and personalization. Banking too will move from rigid products to seamless financial experiences.

-

Democratization has reshaped retail. Platforms like Shopify and TikTok empower anyone to become a merchant or influencer. The power is shifting from institutions to individuals. In finance, democratization means fintech apps that let people invest, trade, and borrow without a traditional bank.

-

Personalization has redefined travel. Airbnb offers not just rooms but customized experiences, curated through data and algorithms. For banking, personalization means moving beyond one-size-fits-all products to services tailored to individual life goals.

-

Sustainability is transforming professional services. Leading consultancies and law firms now advise on ESG, inclusion, and climate strategy, recognizing clients expect impact beyond profit. For banks, sustainability will define lending portfolios, risk models, and purpose.

These examples reveal a profound truth: markets are no longer about selling standardized products within rigid sectors. They are becoming customer-centric spaces—health, mobility, wealth, learning—where solutions are fluid, integrated, and often invisible.

Why banks are not fit for the future

Traditional banks struggle to adapt to this new reality. Their weaknesses are structural:

-

They are product-centric—mortgages, credit cards, savings accounts—rather than customer-centric.

-

They are bound by legacy IT systems and compliance-heavy cultures that slow down innovation.

-

They are focused on risk avoidance rather than value creation.

Worse, banks face a deeper existential problem: their core functions—moving money, safeguarding deposits, assessing risk, and allocating capital—can now be done by algorithms, platforms, and protocols. AI can underwrite credit instantly. Blockchain can move assets across borders in seconds. Platforms like Revolut or Nubank deliver financial services without the bureaucracy of traditional banks.

Just as music labels lost control to streaming platforms, or travel agents vanished in the age of Expedia and Airbnb, banks face the risk of becoming irrelevant intermediaries—utilities in the background of ecosystems they no longer control.

Thinking differently

Banks have traditionally looked inward for inspiration—benchmarking peers, regulators, or fintechs. But to truly reinvent themselves, they should look to unexpected innovators in culture and technology.

Take Taylor Swift. She has reinvented herself repeatedly across genres and eras, owning her narrative and deepening emotional bonds with fans. The “Eras Tour” is more than music; it’s an immersive experience and community. For banks, the lesson is that reinvention is not just about products—it’s about storytelling, transparency, and belonging. Just as Swift re-recorded her masters to reclaim ownership, banks could help customers reclaim ownership of their data and financial future, turning dry transactions into empowering journeys.

Or consider Roblox, the gaming platform where users create, trade, and interact in virtual worlds. It thrives on co-creation and ecosystems, not top-down control. Banking could move from closed systems to open, participatory platforms where customers, fintechs, and even communities co-create value—whether in the metaverse, through programmable money, or shared investment spaces.

Other inspiring parallels abound. Lego rebuilt itself by listening to fans, opening its innovation process, and turning into a collaborative platform for creativity. Banks could follow, letting customers shape services, from personalized savings “quests” to community-driven lending. Patagonia shows how purpose-led reinvention can build trust and resilience; banks could embed sustainability and ethical finance at the core, not the periphery.

The common thread? These innovators put people, participation, and purpose at the heart of reinvention. They treat audiences as collaborators, not passive consumers. If banks could learn to think like a pop star, a gaming platform, or a purpose-driven brand, they could transform themselves from bureaucratic utilities into living, adaptive, customer-centric ecosystems.

Reimagining banks

The AI Money OS

Imagine an AI-driven personal financial operating system—a Money OS—that sits on your phone or wearable, not inside a bank. Instead of opening different accounts, credit cards, or apps, you’d have a single intelligent assistant managing everything: payments, savings, investments, insurance, taxes, even philanthropy. This AI doesn’t just process transactions; it learns your life goals, risk appetite, and preferences, then proactively optimizes your financial world.

Need to save for a house? The AI automatically reallocates spending, negotiates better mortgage rates across providers, and locks in your best option. Planning a holiday? It bundles travel insurance, hedges currency risk, and smooths cash flow—all invisibly. It could even plug into your health data to lower premiums or carbon footprint to channel money into greener investments. In this model, the “bank” disappears into the background, while the Money OS becomes your financial brain.

Embedded and Invisible Finance

Beyond AI, we are already seeing banking dissolve into everyday experiences. Buying a Tesla with built-in financing, paying via Uber or Amazon without noticing, or insuring your iPhone at checkout—these are signals of a world where finance is embedded in ecosystems. In the future, mortgages could come bundled with your home purchase, investment products could sit inside your favorite social platform, and wealth advice might be delivered via your gaming avatar.

Community and Tokenized Banking

Decentralized finance (DeFi) points to another radical model: community-driven, tokenized banking. Imagine local or interest-based communities issuing their own tokens, raising capital, and funding shared projects without traditional banks. These tokens could represent not just money, but identity, loyalty, and belonging. Banks might survive as custodians of trust and compliance, but the economic value creation shifts into networks and communities.

Bank as API, not Institution

Some banks may embrace radical reinvention by becoming financial infrastructure providers. Rather than competing on products, they supply regulated rails—identity verification, settlement, compliance—as “banking-as-a-service” for fintechs, platforms, and enterprises. In this future, customers may never see the bank brand at all; it becomes invisible plumbing, like electricity or internet protocols.

Inspired by pioneering peers

Some organizations already glimpse the future:

-

DBS talks about “invisible banking”—embedding finance seamlessly into life’s moments.

-

Nubank disrupted Latin America by offering simplicity, transparency, and fairness to customers exploited by traditional banks.

-

Revolut is building a financial super-app: payments, crypto, insurance, investments, all in one interface.

-

WeBank, the Tencent-backed digital-only bank with no branches, focusing on micro-lending and SME finance powered by AI and data from WeChat.

-

KakaoBank is a mobile-only bank leveraging South Korea’s super-app culture; profitable and massively popular among younger customers.

- Apple shows how non-banks can dominate finance by leveraging trust, design, and integration. Millions use Apple Pay and Apple Card without thinking of them as “banking.”

The lesson is clear: the most transformative financial services may not come from banks at all.

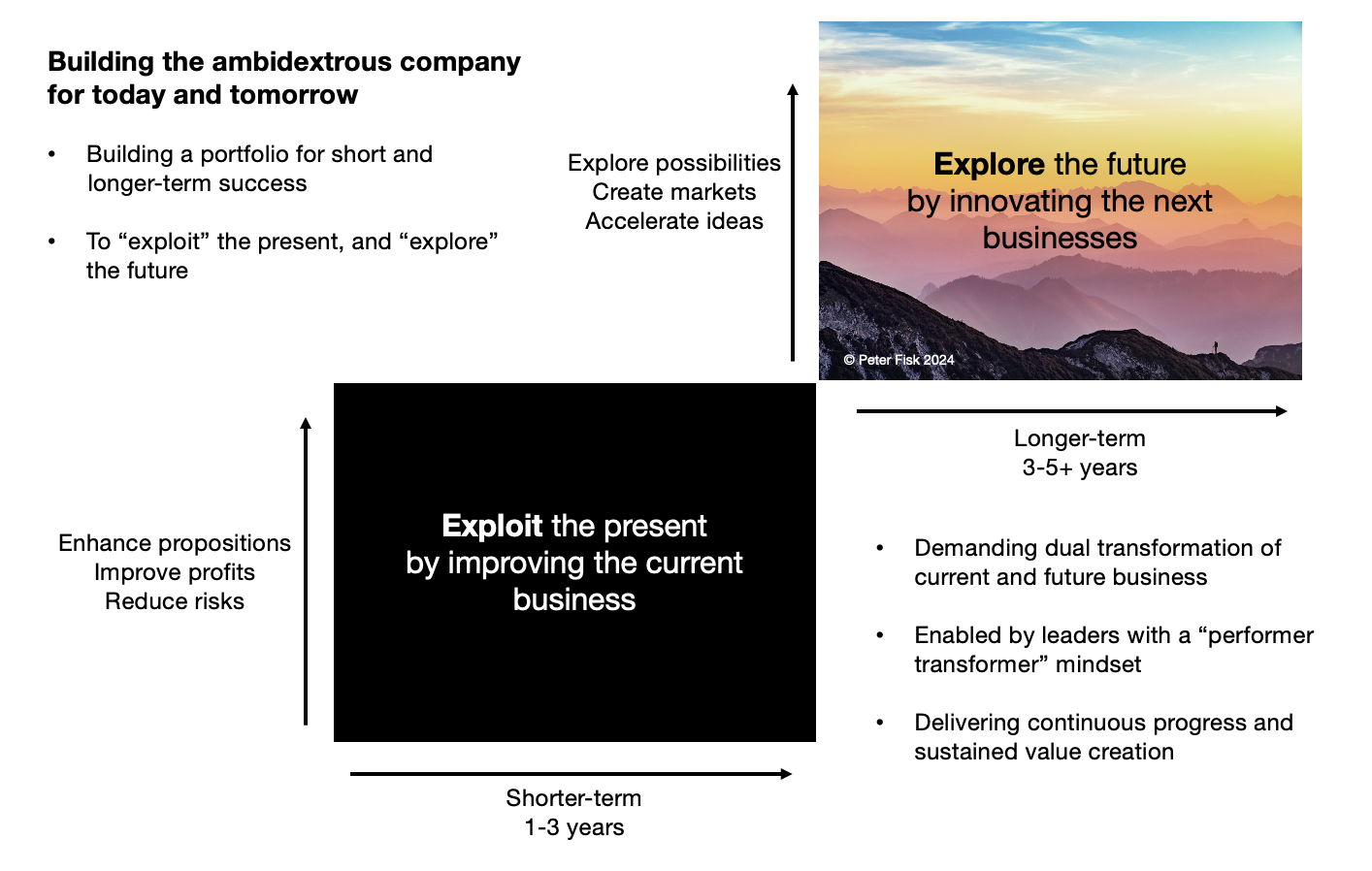

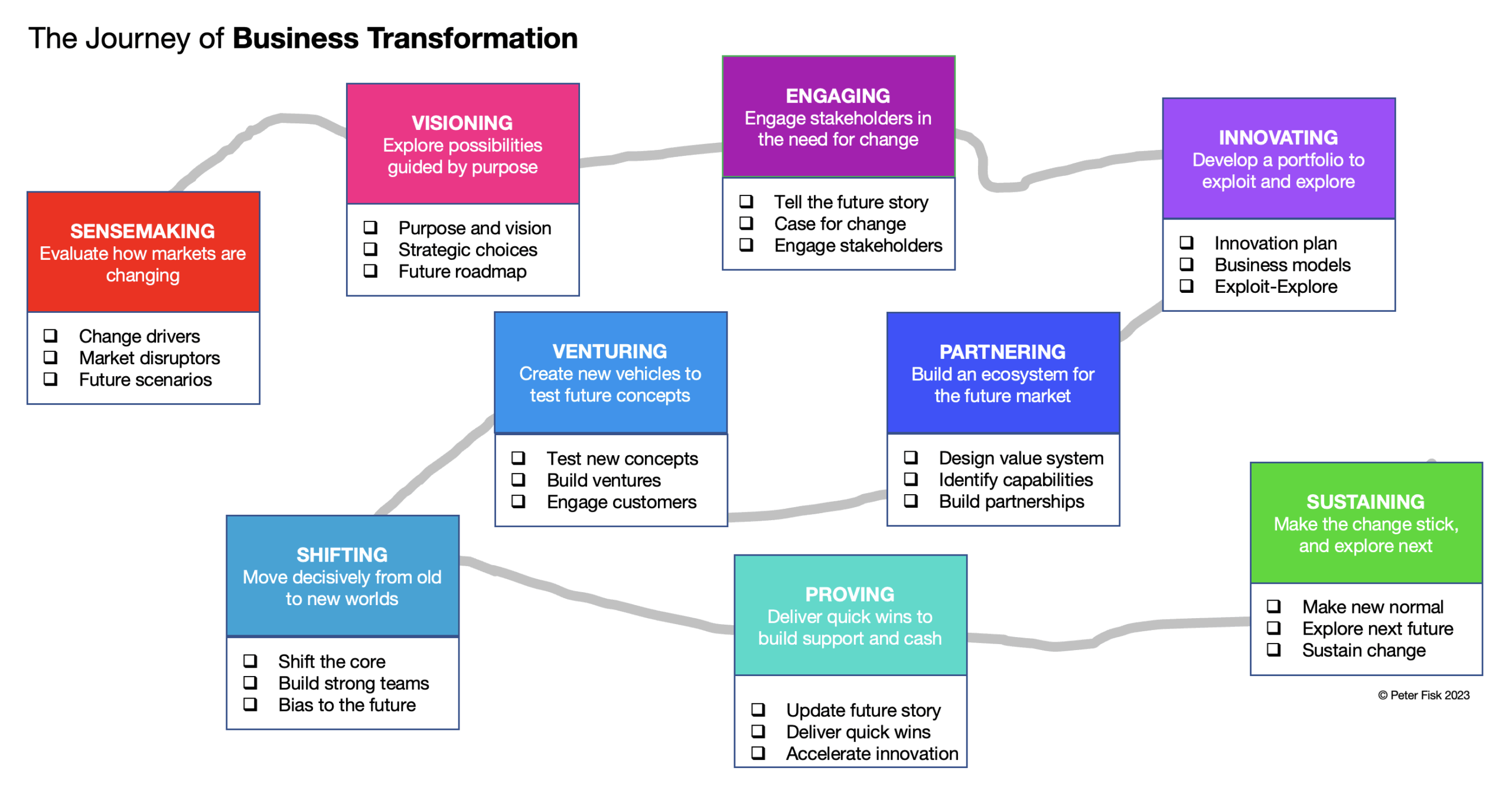

The big shifts

Are banks doomed? Not if they are willing to reinvent themselves radically. Reinvention requires:

-

Shifting from products to platforms: Don’t just sell loans or cards—curate ecosystems like “housing journeys” or “mobility solutions” that integrate finance with life goals.

-

Owning the trust layer: In a world of AI and decentralized systems, banks could reposition as the guarantors of security, ethics, and fairness. Trust may be their last—and greatest—asset.

-

Partnering with big tech and fintechs: Rather than fighting Apple or Amazon, banks can provide the regulated backbone while tech partners deliver user experiences.

-

Radical transparency and purpose: Future customers will demand values-driven finance—carbon-neutral, inclusive, fair. Reinvention means putting purpose at the heart of business models.

-

Becoming AI-powered organisms: Banks must evolve from bureaucracies into intelligent systems that learn, adapt, and anticipate customer needs.

Leading the change

Leadership is the critical differentiator. To reinvent, leaders must shift their mindset:

-

From ownership to orchestration: Banking’s future is about co-creating ecosystems, not controlling customers.

-

From safety to experimentation: Standing still is now the riskiest strategy. Leaders must embrace experimentation and fast learning.

-

From scarcity to abundance: In digital finance, value comes not from scarcity but from personalization, trust, and insight.

-

From institutions to intelligence: Reimagine banks as intelligent, adaptive systems that think and act in real time for customers.

-

From sectors to spaces: Stop defining banking as a narrow sector. Instead, think about wealth, health, mobility, or learning as integrated customer spaces where finance plays an enabling role.

Reinvention or irrelevance

The megatrends of digitization, democratization, personalization, and sustainability are shaking every market—and banking is no exception. The question is not whether finance will change, but whether banks will be part of that change.

The future of banking may not be about banks at all. It may be about AI Money OS systems, embedded finance meshes, or decentralized wealth commons. It may be about fintech super-apps or tech giants embedding finance invisibly into daily life.

Traditional banks still have assets—scale, regulation, and trust—but they must reinvent radically to stay relevant. They must move beyond products to experiences, from intermediaries to platforms, from risk-averse bureaucracies to adaptive, intelligent systems.

The winners will not be those who protect the past, but those who embrace the future—who recognize that the world doesn’t need “banks” so much as it needs better ways to enable people to live, thrive, and achieve their aspirations.

For leaders, the choice is stark: reinvent or disappear.

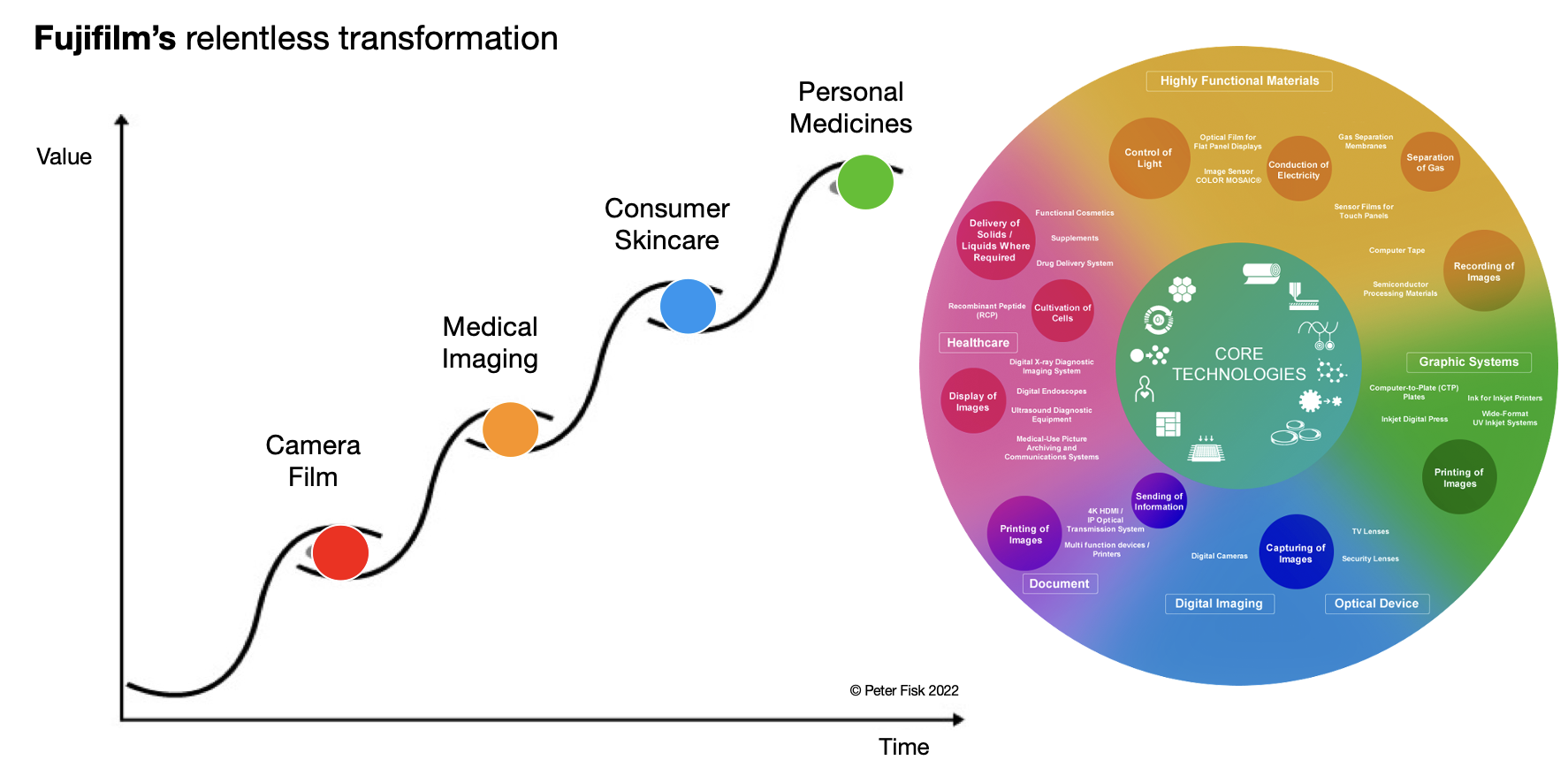

Few companies in modern history have undergone as many profound transformations as DSM. Born in the soot and struggle of Europe’s early industrial age, DSM has travelled further, over more decades, across more sectors, and with more reinvention than almost any other global business. Its journey from Dutch State Mines to a world leader in life sciences and materials is a story of strategic courage, long-term stewardship, and an ability to escape the gravitational pull of one’s past.

This is not just a tale of diversification or repositioning. It is a case study in how an organisation repeatedly sheds its skin, anticipates change, confronts the realities of its environment, and—perhaps most importantly—chooses purposefully what it will stop doing as well as what it will grow. DSM shows how to move from the harsh economics of commodities to the superior dynamics of high-value, science-based markets. Few firms begin their lives digging coal from the ground and end up developing nutrition formulas for infants, enzymes for animal health, coatings for electronics, low-carbon materials for mobility, and biology-based solutions to global challenges.

This long arc of reinvention offers inspiration and instruction for any business seeking to escape commoditisation, create a new strategic identity, or build a future rooted in knowledge, innovation, and societal value.

Born in the Age of Coal

DSM began in 1902 as a state-owned coal mining company. Its purpose was simple: secure the Netherlands’ domestic energy supply. Coal was the backbone of industrial progress, fuelling factories, transport, and the modern state. For decades, DSM’s mines powered Dutch development. Thousands of workers descended into the shafts each day, and DSM became a symbol of national resilience.

But coal was a brutal, low-margin, high-labour industry. It was cyclical, politically charged, and increasingly threatened by technological change. By the 1950s and 60s, it was clear that coal was losing its primacy to oil and gas. The geology of Dutch coal was challenging, and costs were rising. DSM’s leaders faced a stark question: if the nation no longer needed coal, what was DSM for?

That question would become the defining theme of DSM’s next century.

Reinvention One: From Coal to Chemicals

Most state-owned industrial giants cling to their origins. They double down, defend their turf, and decline. DSM did the opposite. In the 1960s, it embarked on its first great metamorphosis: a deliberate, disciplined pivot from mining to chemicals.

This was not an intuitive shift. Chemicals required new skills, new assets, new technologies, and new markets. DSM knew little about the field. But it was pragmatic: chemistry was adjacent to energy; it made use of by-products; and it aligned with broader industrialisation trends. The company closed its mines and invested the cash into petrochemicals, fertiliser plants, and industrial chemicals.

The closure of the last DSM coal mine in 1974 symbolised the end of one industrial era and the birth of another. But this transition also taught DSM three important lessons:

-

You cannot begin a transformation until you stop defending the past.

-

Reinvention requires building new capabilities before the old ones fade.

-

Purpose must evolve with the world, not against it.

This shift gave DSM economic resilience and placed it into sectors with higher technological intensity, but chemicals too were competitive and cyclical. The company had moved up the value chain—but not far enough.

Reinvention Two: From Petrochemicals to Performance Materials

By the 1980s and 90s, DSM recognised a second threat: petrochemicals, like coal, were commoditising. Global supply was rising. Prices were unstable. New producers from Asia and the Middle East were emerging.

Again, DSM chose the harder road: move to higher value. It began shedding commodity assets and reinvesting in performance materials—engineering plastics, resins, coatings, and high-strength fibres. These were areas where specialised chemistry, application know-how, and long-term collaboration with customers created barriers to entry and pricing power.

Products such as Dyneema—one of the world’s strongest fibres—became emblematic of this new DSM: innovative, highly engineered, premium, global.

This shift marked DSM’s transition from an industrial giant to a knowledge-based enterprise. No longer just a producer of molecules, DSM became a developer of solutions.

Key strategic traits emerged:

- A willingness to prune the portfolio:

DSM exited commodity products even when they were still profitable, understanding that strategic coherence and future value matter more than short-term earnings. - A commitment to R&D:

DSM invested heavily in science, linking research to customer problems and market trends. - Building through partnerships:

Rather than invent everything itself, DSM forged alliances in technology, universities, start-ups, and industry. - Shaping markets, not just serving them:

DSM helped define emerging categories in performance materials, positioning itself as a thought leader rather than a follower.

Yet the company wasn’t finished. Another, even more radical shift lay ahead.

Reinvention Three: Into Life Sciences and Nutrition

In the late 1990s and early 2000s, DSM made its boldest strategic jump: from chemicals and materials into life sciences, nutrition, health, and biological solutions. This was not adjacency. This was reinvention at DNA level.

Why such a leap?

Several forces converged:

-

The global push for healthier food and better nutrition.

-

A need for sustainable agriculture and animal health.

-

Scientific advances in biology, enzymes, and fermentation.

-

Higher margins and stronger growth in nutrition markets.

-

A belief that the world’s biggest challenges would be biological, not industrial.

DSM embarked on a series of transformative acquisitions—vitamins, enzymes, food ingredients, and human and animal nutrition businesses. It created a global platform spanning food fortification, dietary supplements, animal feed, infant formula, personal care ingredients, and biotechnological innovations.

The company redefined itself as a “life sciences and materials sciences” business, eventually dropping materials entirely to focus on nutrition, health, and bioscience.

This reinvention was grounded in a new strategic mindset:

- From selling products to solving human problems:

Malnutrition, animal productivity, sustainable proteins, healthy ageing. - From industrial chemistry to biological science:

Enzymes that reduced waste, fermentation processes that replaced chemicals, bio-based ingredients for global brands. - From resource extraction to knowledge creation:

DSM’s value now lay not in what it mined, but what it understood, developed, and designed.

Reinvention Four: DSM-Firmenich and the Era of Bio-innovation

DSM’s most recent transformation was its merger with Firmenich, the Swiss fragrances, taste, and ingredients leader. This created a company at the frontier of nutrition, wellness, and sensory experience.

This move did several things:

-

It reinforced DSM’s exit from industrial chemicals.

-

It placed the business in premium consumer-linked categories.

-

It fused bioscience with creativity—biology with design, molecules with experience.

-

It created a platform for sustainable proteins, biotech-based foods, and next-generation nutrition.

The merger signalled DSM’s belief that the future of food, wellness, beauty, and consumption will be shaped by biology, digital science, and experiential chemistry. Consumers will demand healthier, more sustainable, more personalised products—and DSM-Firmenich wants to be at the heart of those supply chains.

Secrets of DSM’s Success … How to Reinvent Again and Again

DSM’s story is not luck or accident. It is methodical reinvention built on seven deep capabilities that other companies can learn from.

1. The Courage to Let Go

Most organisations fail to transform not because they can’t imagine the future, but because they can’t leave the past. Every DSM transformation began with decisive exits:

-

Closing mines.

-

Selling petrochemicals.

-

Exiting commodity materials.

-

Shrinking exposure to low-value categories.

These choices freed capital, talent, and organisational attention. DSM understood that you must dismantle the old business architecture to build the new one.

The courage to let go is a leadership quality as much as a strategy.

2. Reinvention as a Continuous Discipline

DSM did not transform once; it transformed repeatedly. Reinvention was not an event but a capability. The company built muscles for change:

-

Early detection of decline in sectors.

-

Willingness to pivot years before crises forced it.

-

Leaders who embraced disruption rather than resisted it.

-

Talent systems that valued learning and cross-disciplinary skills.

DSM institutionalised transformation so deeply that reinvention became its identity. Where other companies feared change, DSM treated it as a source of advantage.

3. A North Star: Solving Societal Needs with Science

At every strategic pivot, DSM aligned itself to emerging societal challenges:

-

Energy security (coal).

-

Industrial modernisation (chemicals).

-

Advanced manufacturing (materials).

-

Human and animal health (nutrition).

-

Sustainable food systems (bioscience).

-

Wellness and sensory experiences (DSM-Firmenich).

This tethering to global needs gave DSM relevance, resilience, and legitimacy. It was never a business searching for markets; it was a business responding to the world’s next set of problems.

This purpose-driven approach galvanised employees, attracted partners, and offered a long-term compass for strategic decisions.

4. Science as the Ultimate Differentiator

DSM understood that science—not scale—would be the basis for competitive advantage. It invested in laboratories, universities, research networks, and long-term technological bets.

Unlike commodity industries, where competition is driven by cost, logistics, and pricing, science-based sectors reward knowledge, patents, formulation expertise, and customer collaboration. Science allowed DSM to move into categories with higher margins, lower cyclicality, and greater loyalty.

And crucially: science-based businesses are harder to replicate. They create defensible moats.

5. Strategic M&A and Portfolio Management

DSM became a master of buying and selling businesses to shape its strategic direction. It did not diversify randomly. Every acquisition or divestment was part of a coherent migration up the value chain.

When DSM entered nutrition, it bought capabilities it didn’t possess and sold assets that no longer fit. It was unsentimental and analytical—but also long-term and patient.

Many companies acquire for scale; DSM acquired for transformation.

6. Partnership Ecosystems Rather Than Vertical Integration

DSM did not try to build everything. It partnered—with universities, start-ups, NGOs, food companies, energy firms, and governments. These partnerships accelerated innovation, reduced risk, and enabled entry into new sectors.

Partnerships also positioned DSM as a collaborator in solving global challenges, not merely a supplier.

7. Culture That Balances Purpose and Performance

DSM cultivated an internal culture of responsibility, sustainability, and curiosity. Staff believed they were working on meaningful challenges: malnutrition, climate change, healthy living. This engagement created loyalty, pride, and motivation.

At the same time, DSM maintained disciplined financial governance, operational excellence, and strategic clarity. Purpose was not a substitute for performance, but a driver of it.

What DSM’s transformations achieved

DSM’s reinventions generated several long-term impacts that offer lessons to others:

- Escape from Commodity Traps. Moving away from volatile markets improved margins, stability, and valuations.

- Creation of a High-Value Identity. DSM became associated with innovation, life sciences, and sustainability—not coal or chemicals.

- Global Relevance. By aligning to nutrition, wellness, and biology, DSM integrated itself into global supply chains serving billions.

- Talent Transformation. DSM attracted scientists, technologists, and innovators, creating a flywheel of capability development.

- Resilience Through Diversity. The business evolved so far from its origins that macrotrends in energy or basic chemicals no longer constrained it.

- Social Legitimacy and Brand Strength. DSM became known for sustainability, public responsibility, and ethical governance—traits that enhanced its ability to operate globally.

Lessons for companies seeking to add value

Any organisation wishing to emulate DSM’s journey—whether in mining, fertilisers, materials, energy, or industrial sectors—can learn from these strategic principles.

Reinvention Starts with Letting Go of Legacy

You cannot become a premium, high-value company if your systems, culture, and capital are tied up in low-margin industries. Strategic exits are essential to strategic growth.

Define the Future by Problems, Not Products

Rather than asking, “What can we sell?”, ask: “What global problems are we uniquely positioned to help solve?” This reframes strategy around value creation, not volume.

Build Capability Stacks, Not Just Categories

DSM moved from chemistry to materials to biology—not by switching sectors, but by building the capabilities that connected them. The real engine of transformation is capability development.

Make Science and Innovation the Heart of Advantage

To escape commoditisation, a company must create knowledge that others cannot easily replicate. This requires sustained investment in R&D and the courage to build expertise for the long term.

Use M&A to Accelerate Reinvention, Not Patch Gaps

Acquisitions should be used to build the future, not protect the past. Sell businesses that limit strategic coherence. Buy businesses that expand your innovation frontier.

Become a Platform, Not Merely a Producer

Companies that offer ecosystems—knowledge, tools, solutions, partnerships—gain deeper customer intimacy and stickiness. This makes margins sustainable and positions the company as indispensable.

Anchor Transformation in Purpose

Purpose gives direction in moments of uncertainty. DSM’s purpose evolved, but always focused on societal betterment. Purpose made tough decisions easier and gave reinvention moral legitimacy.

Transformation Must Be Continuous, Not Episodic

True reinvention is not a one-off strategic project. It is a continuous capability, supported by talent, governance, innovation, and organisational culture.

DSM’s example of a blueprint for reinvention

DSM’s journey shows that transformation is not about prediction but about readiness. The company did not know in 1902 that biology would be its future, nor in the 1960s that nutrition would become a global megatrend. But DSM constantly prepared itself for opportunity by:

-

watching the world carefully,

-

identifying shifts early,

-

discarding fading businesses,

-

investing in knowledge,

-

building relationships in emerging sectors,

-

betting on science,

-

and embedding a culture that welcomed change.

This is the real secret of DSM: it became a company that is more afraid of standing still than moving forward.

The Reinvention Imperative

DSM stands as one of the most remarkable transformation stories in modern business—a company that has reinvented its purpose, portfolio, and identity again and again. Its journey offers a beacon for companies locked in commodity markets, squeezed by competition, or seeking relevance in a volatile world.

The DSM story teaches that transformation is neither linear nor comfortable. It demands courage, clarity, and a willingness to sacrifice familiar assets for future potential. But it also shows that the rewards—strategic freedom, premium margins, global impact, and societal value—are profound.

DSM began life in the darkness of deep coal mines. Today, it operates in the light of biological science, nutrition, and health—industries that enrich and sustain life.

Its century-long journey demonstrates that, with vision and resolve, any company can escape its past, reinvent its future, and become something radically new.

“The future of music is access, not ownership” says Daniel Ek, founder and CEO of Spotify. “We no longer compete for shelf space, we compete for attention” adds Lucian Grainge, the CEO of Universal Music Group.

TikTok has become the new radio. It’s the primary platform for launching new music. Or YouTube, or Fortnite, or QQ. Artists now have to think like startups. It’s no longer just about the song, but the story, the brand, the community.

The music industry has undergone one of the most radical transformations of any creative sector in the past two decades.

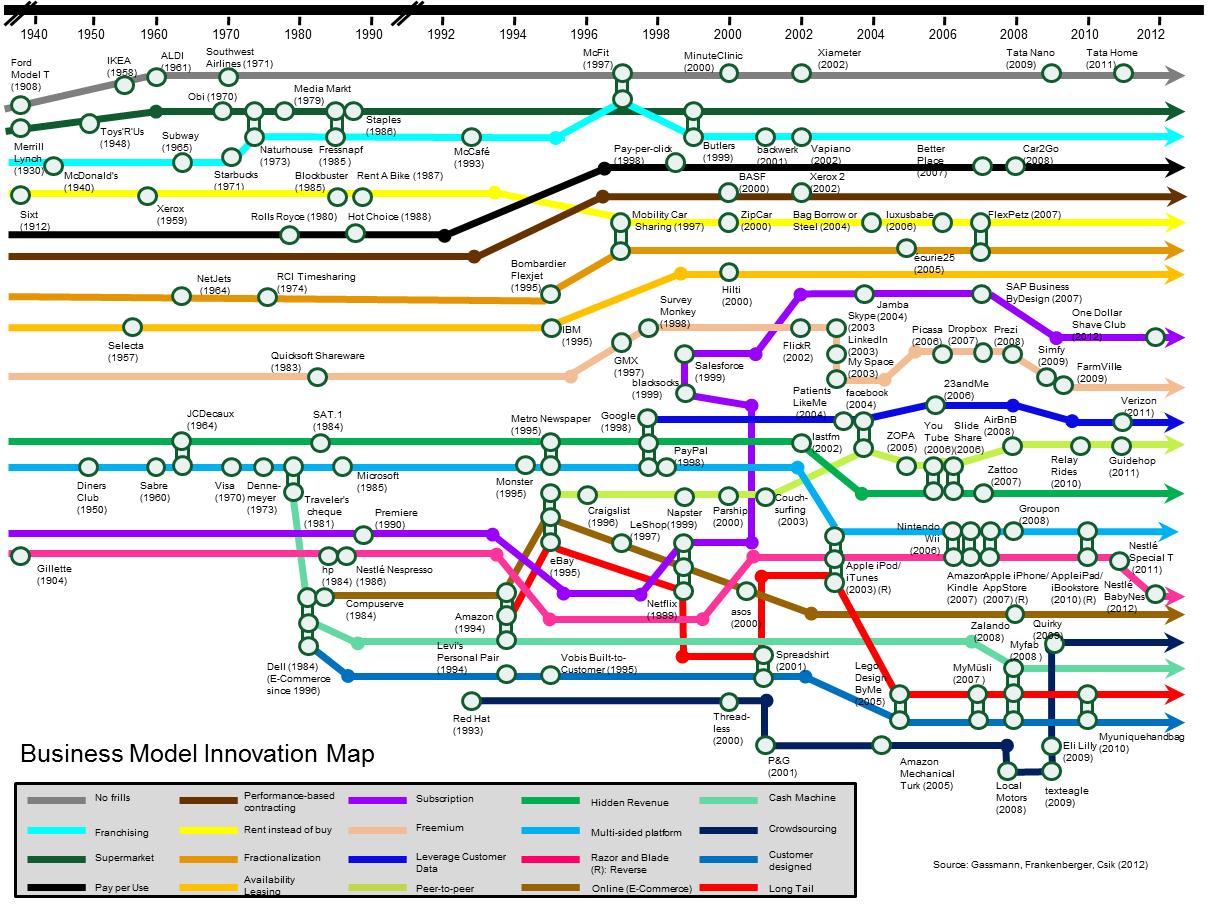

From vinyl and CDs to downloads and now streaming, it has shifted not just in how music is distributed and consumed, but in how value is created, shared, and monetised. At the heart of this reinvention lies ecosystem thinking—a strategic mindset where companies co-create value by building interconnected platforms, partnerships, and services rather than operating as isolated entities.

Ecosystem thinking

Ecosystem thinking transformed the music industry from a linear value chain—where record labels controlled production, distribution, and promotion—into a dynamic, digital-first network of platforms, creators, tech companies, rights holders, fans, and brand partners. This reinvention enabled new business models, global scale, personalised experiences, and powerful feedback loops of data and innovation.

Before the digital era, the music industry operated under a vertically integrated model. Artists signed to labels who controlled recording, marketing, manufacturing, and distribution. Revenues flowed primarily through physical sales. This model was lucrative but rigid, and power was concentrated in the hands of a few major players.

The rise of file-sharing platforms like Napster in the late 1990s exposed the vulnerability of this model. While illegal, peer-to-peer sharing revealed the latent consumer demand for digital access, personalization, and convenience. The industry’s initial response was defensive—lawsuits and DRM restrictions—rather than innovative.

This fragmentation of control marked the beginning of a new phase: reinvention through ecosystems.

Phase 1: The rise of platform ecosystems

The true shift began with Apple’s iTunes in 2001, which offered a legal alternative to piracy by unbundling albums into single tracks, priced affordably. iTunes created a platform ecosystem in which Apple aggregated content from labels and delivered it through proprietary devices like the iPod. The key shift was toward access over ownership—users didn’t need CDs, they just needed a device and a store.

Apple’s model integrated hardware, software, and content. The success of iTunes proved that digital music could be monetized at scale—but the model still emphasised downloads, a one-time transactional economy.

Phase 2: Streaming and the subscription ecosystem

The next leap came with Spotify (founded in 2006, launched in 2008), which championed streaming as a service. Instead of buying individual tracks, users could subscribe and gain access to an entire music library. This was not just a new revenue model—it was an entirely new ecosystem logic:

-

Platform-centric: Spotify didn’t own the content but created a platform where listeners, artists, labels, curators, advertisers, and developers could interact.

-

Data-driven: Personalization engines like “Discover Weekly” used listening behavior to recommend new music, creating a virtuous cycle of engagement.

-

Global reach: Spotify scaled rapidly by partnering with mobile operators and telecoms in emerging markets.

-

Multi-sided revenue: Free users brought in ad revenue; premium users brought subscription income; artists and labels got new promotional and monetization tools.

This shift made continuous access, algorithmic discovery, and social sharing central features of music consumption.

“Streaming didn’t just change the format; it changed the business model, the marketing, and the global flow of culture” says Rob Stringer, Chairman, Sony Music Group

Ecosystem value creation

Spotify and competitors like Apple Music, YouTube Music, Amazon Music, and TikTok now function as platform orchestrators—connecting and enabling a vast range of ecosystem participants:

-

Artists: Self-publishing tools (e.g. Spotify for Artists, SoundCloud) allow artists to release and promote music directly, monitor analytics, and monetize streams—democratizing entry.

-

Fans: Personalized playlists, AI-generated recommendations, and social features deepen emotional connections and increase engagement.

-

Labels & Rights Holders: Gain access to real-time data on performance, regional preferences, and virality—transforming strategy.

-

Advertisers & Brands: Can target specific audiences through audio ads, branded playlists, and partnerships with artists.

-

Third-party Developers: Build integrations via APIs for DJ tools, fitness apps (e.g., Peloton), or AI-music analysis platforms.

In this model, value is co-created through the interplay of multiple participants. The platform becomes more than a distributor; it is a marketplace, a promoter, a data provider, and a collaboration space.

Ecosystem reinvention beyond streaming

The reinvention of the music industry didn’t stop at streaming. It extended into a broader creative and commercial ecosystem, with music integrated into:

-

Social media platforms like TikTok, where music clips go viral, sparking new hits and reviving old ones.

-

Gaming environments such as Fortnite or Roblox, where artists hold virtual concerts, selling digital merchandise and building new fan experiences.

-

Brand partnerships, where companies use music and artists to tell stories, build cultural relevance, and reach new audiences.

-

Fitness and wellness, through collaborations with apps like Calm, Strava, or Apple Fitness+.

Artists now think in ecosystems too—launching podcasts, virtual experiences, NFTs, fashion collaborations, and exclusive fan clubs (like Patreon or Discord communities).

Monetization and new value pools

Through ecosystem thinking, the music industry has found new monetization streams:

-

Subscriptions (Spotify, Apple Music)

-

Ad revenues (YouTube, free-tier platforms)

-

Live-streamed events and virtual concerts

-

Digital merchandise, NFTs, and metaverse performances

-

Brand partnerships and sync deals

-

Fan subscriptions and exclusives

In some cases, artists make more from social integrations or brand deals than from streams alone. The rise of “middle class” musicians—who don’t top charts but thrive within niche ecosystems—is enabled by direct fan relationships and alternative monetization.

Ecosystem enablers: data, AI, and open APIs

Data is the nervous system of the modern music ecosystem. Spotify’s discovery algorithms, YouTube’s content ID, and TikTok’s trend monitoring all use AI to connect artists to fans more efficiently than ever before. APIs allow innovation at the edges, enabling third parties to build remix apps, lyric tools, visualizations, and fan engagement features.

Moreover, open data helps drive artist-centric tools like Songkick for tours, Chartmetric for insights, and LANDR for mastering and promotion—extending the value chain horizontally.

Winning in an ecosystem world

Reinvention through ecosystems has required a new kind of leadership in music:

-

Orchestrators like Spotify or TikTok balance the needs of creators, users, brands, and regulators.

-

Labels now operate more like venture capitalists—investing in artist development, building brands, and managing rights across platforms.

-

Artists act as entrepreneurs—developing personal brands, multi-platform presence, and diverse revenue streams.

Ecosystem thinking is strategic, collaborative, and adaptive. Success is no longer about controlling assets, but enabling others to create value with them.

Despite its many successes, the music ecosystem still faces challenges, and need for further business model reinvention:

-

Artist compensation remains a hot topic—many argue that streaming revenues are too low.

-

Market concentration is a risk, with a few platforms controlling discovery and monetization.

-

Algorithmic influence shapes not just consumption, but what gets created—potentially narrowing diversity.

-

Copyright management across platforms and countries remains complex.

Nonetheless, the industry continues to innovate, exploring AI-generated music, blockchain-based rights tracking, immersive virtual experiences, and deeper fan personalisation.

Music as a living ecosystem

The reinvention of the music industry through ecosystem thinking has redefined how music is made, discovered, shared, and monetized. It has turned passive listeners into active participants, centralized players into enablers, and static catalogues into living, evolving digital experiences.

More than a technological shift, this transformation reflects a deeper change in business philosophy: from ownership to access, from control to coordination, and from isolated value chains to dynamic, networked ecosystems.

As platforms, creators, fans, and brands continue to co-evolve, the music industry stands as a powerful example of how ecosystem thinking can unlock growth, resilience, and creativity in a digital world.

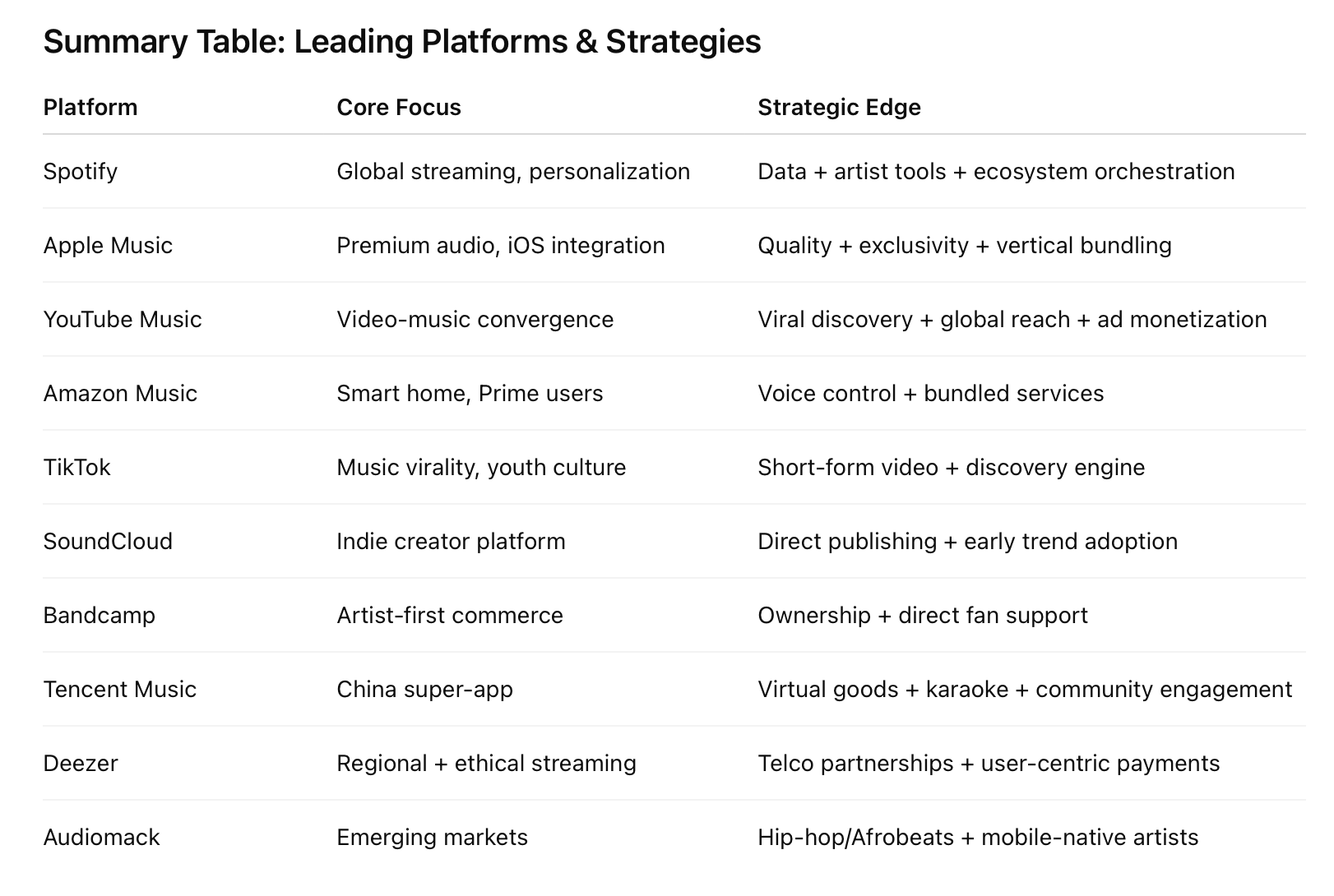

Here are profiles of the leading digital music platforms and how each has strategically positioned itself within the new music ecosystem:

1. Spotify

Founded: 2006 (Sweden)

Business Model: Freemium streaming (ad-supported + subscription)

Strategy: Ecosystem Orchestrator + Data Innovator

Spotify is the world’s largest music streaming platform by users, with over 600 million monthly active users and around 236 million premium subscribers (as of 2025). Its core strength lies in data-driven personalization, with features like Discover Weekly, Release Radar, and Wrapped. Spotify positions itself as a neutral platform between creators and listeners, offering artist tools (Spotify for Artists), podcasts, and an expanding AI stack (e.g. AI DJs, real-time lyric translation). It has made strategic acquisitions in podcasting (e.g. Anchor, Gimlet) and is moving into audiobooks, aiming to become the “audio home” across formats.

2. Apple Music

Founded: 2015 (USA)

Business Model: Subscription-only streaming

Strategy: Premium Experience + Vertical Integration

Apple Music leverages the Apple ecosystem (iOS, AirPods, Apple Watch) to deliver a high-quality, seamless user experience. It emphasizes exclusive content, artist-led shows (e.g., Elton John’s Rocket Hour), and higher-quality audio (lossless, Dolby Atmos). Unlike Spotify, Apple focuses less on social discovery and more on curation and integrationwith user lifestyles, including fitness, spatial audio, and live radio (e.g. Apple Music 1). Apple uses music as a value-added feature to retain subscribers within its larger services bundle.

3. YouTube Music

Founded: 2015 (USA)

Business Model: Freemium streaming + integrated with YouTube Premium

Strategy: Video-Music Integration + Global Reach

Owned by Google, YouTube Music benefits from deep integration with YouTube, the world’s most-used platform for music videos. It excels in global accessibility and virality, especially in emerging markets and among Gen Z. Its ecosystem strength lies in combining video, audio, user-generated content, and fan engagement. Many music trends now begin on YouTube Shorts. Google’s AI also helps power personalized recommendations and smart playlists, while its advertising infrastructure supports monetization for both majors and independents.

4. Amazon Music

Founded: 2007 (as Amazon MP3), rebranded in 2016

Business Model: Bundled with Prime + stand-alone subscriptions

Strategy: Ecosystem Bundle + Smart Devices

Amazon Music leverages its Prime ecosystem and Alexa-enabled smart devices to build frictionless music experiences. Its strategy emphasizes access through voice, integration with shopping and home automation, and bundling music with Prime subscriptions. While it has less cultural influence than Spotify or YouTube, it is strong in households and among passive users. It also offers high-definition and spatial audio options to compete on quality.

5. TikTok (ByteDance)

Founded: 2016 (China)

Business Model: Ad-based + e-commerce + music licensing

Strategy: Viral Discovery + Creator-Driven Ecosystem

TikTok has emerged as the most powerful music discovery platform for younger audiences. Songs often go viral on TikTok before reaching traditional charts. The platform’s short-form video format and algorithmic feed prioritize engagement and shareability. TikTok is building a deeper music ecosystem through SoundOn (artist distribution platform), licensing deals with major labels, and partnerships with streaming services. It doesn’t replace music platforms but acts as a catalyst for discovery and culture, influencing everything from Spotify playlists to brand campaigns.

6. SoundCloud

Founded: 2007 (Germany)

Business Model: Freemium streaming + creator subscriptions

Strategy: Independent Artist Hub + Creator Monetization

SoundCloud pioneered open music sharing and remains a go-to platform for independent and experimental artists. Its strategic focus is on creator empowerment—offering tools for publishing, monetizing, and analyzing tracks. It allows artists to control rights and monetize directly through SoundCloud Premier, Repost, and fan-powered royalties. The platform is a testing ground for trends, subcultures, and new genres, often ahead of mainstream platforms.

7. Bandcamp

Founded: 2008 (USA)

Business Model: Direct artist-to-fan sales

Strategy: Ethical Commerce + Artist Control

Bandcamp offers an alternative model centered around ownership and direct support. Fans can buy digital downloads, vinyl, merch, and more, with a majority of revenues going directly to artists. Bandcamp Fridays (fee-free sales days) have become a cultural event. It fosters niche and indie communities by emphasizing transparency and artist-first ethics. While small in scale, it has loyal users and is often used by creators as a primary income source.

8. Tencent Music Entertainment (TME)

Founded: 2016 (China)

Business Model: Freemium streaming + virtual gifts + karaoke + social

Strategy: Super App Ecosystem + Monetization Variety

TME operates QQ Music, Kugou, and Kuwo, dominating China’s streaming space. Its strategy blends music, social interaction, gaming, and virtual gifts, making music part of a broader entertainment super-app. Revenue comes not just from ads or subscriptions, but also from microtransactions, digital merchandise, and fan-driven economies. TME is a case study in ecosystem monetization diversity, with an emphasis on engagement and community.

9. Deezer

Founded: 2007 (France)

Business Model: Freemium streaming

Strategy: Open Partnerships + Local Curation

Deezer positions itself through localization, openness, and integration. It has partnered with telcos, hardware makers, and brands to expand globally. It also advocates for user-centric payment models, aiming to create fairer revenue shares. Deezer emphasizes editorial curation and regional content, particularly in Europe and Latin America.

10. Audiomack

Founded: 2012 (USA)

Business Model: Freemium streaming

Strategy: Emerging Market Focus + Hip-Hop & Afrobeats Culture

Audiomack is a fast-growing player in Africa, the Caribbean, and the U.S. urban music scene. Its strategy centers on youth culture, mobile-first consumption, and direct artist uploading. It builds local ecosystems by investing in emerging artists and providing tools for real-time metrics and monetization.

Ecosystems Inc … examples of how to reinvent every industry

The reinvention of the music industry offers powerful lessons for other sectors. Once dominated by physical sales and industry gatekeepers, music has evolved into a dynamic, digital-first ecosystem led by platforms like Spotify, YouTube, and TikTok. These platforms don’t just distribute content—they connect creators, fans, advertisers, developers, and data in ways that continually generate value and innovation.

Other industries—from healthcare to fashion, education to finance—can learn from music’s transformation by embracing ecosystem thinking. This means shifting from linear, siloed value chains to multi-sided platforms where different actors co-create value. Key characteristics include:

-

Connectivity: Linking diverse stakeholders through digital platforms.

-

Personalization: Using data to tailor experiences in real-time.

-

Continuous value creation: Delivering ongoing services rather than one-off transactions.

-

Network effects: Gaining value as more users, creators, and partners join.

-

Open architecture: Allowing integration, innovation, and adaptation over time.

The result is not just a better product, but a more responsive, scalable, and future-ready business model. Just as music moved from ownership to access, so can many other industries—from selling to streaming, from control to collaboration.

1. Healthcare … from treatments to health ecosystems

Old Model: Siloed providers offering one-off services (e.g. hospitals, insurers, pharmacies).

Ecosystem Model: Platforms like CVS Health, Ping An Good Doctor, or Babylon Health connect care, diagnostics, insurance, wearables, and virtual consultations into integrated health ecosystems.

-

Personalization: Just like Spotify recommends music, health ecosystems can use AI to personalize treatment plans or preventive care.

-

Platform Strategy: Connect patients, doctors, insurers, pharmacies, and digital health startups.

-

Value Creation: Continuity of care, lower costs, and better outcomes through real-time data sharing.

Ping An Good Doctor, launched by Ping An Insurance, is China’s largest digital health platform. With over 400 million registered users, it offers online consultations, diagnostics, health checkups, medicine delivery, and AI-powered triage — all in one app.

-

Platform Orchestration: Connects patients, doctors (both in-house and external), hospitals, pharmacies, and insurers.

-

AI-Driven Personalization: Uses AI to provide initial diagnoses, route patients to the right doctor, and suggest health plans.

-

Vertical Integration: Builds offline “One-Minute Clinics” (smart booths) across Chinese cities to bridge physical-digital care.

Ping An’s ecosystem model has reduced friction, increased access to care, and allowed rapid scaling. Like Spotify’s hybrid model of human + algorithmic curation, it blends AI with professional expertise.

2. Education … from institutions to learning ecosystems

Old Model: Universities and schools as gatekeepers of learning.

Ecosystem Model: Platforms like Coursera, Khan Academy, and Duolingo offer modular, lifelong learning through content, tools, and community.

-

Access over Ownership: Just as music moved from CDs to streaming, learning is shifting from degrees to continuous, on-demand content.

-

Ecosystem Design: Involve content creators (e.g. professors), learners, employers, edtech tools, and credentialing bodies.

-

Feedback Loops: Learning paths are continuously updated based on learner performance and job market needs.

Coursera, founded in 2012 by Stanford professors, is a global online learning platform with over 140 million users and partnerships with 300+ top universities and companies.

-

Multi-Sided Platform: Connects learners, educators, institutions, and employers — creating a rich, interconnected education ecosystem.

-

Modular Learning: Offers flexible, stackable credentials (courses, certificates, degrees), much like how Spotify unbundled albums into playlists and songs.

-

Personalization & AI: Suggests learning paths based on skills, career goals, and usage patterns. Uses AI to tailor content recommendations, mirroring music algorithms.

-

Corporate & Government Partnerships: Offers Coursera for Business, Government, and Campus — embedding education into workforce systems.

Coursera has become a leading force in democratizing education globally, moving from a content library to a full ecosystem of skills, credentials, and career pathways. Like Spotify, it redefined access and empowered both creators (educators) and consumers (learners).

3. Automotive … from selling cars to mobility-as-a-service

Old Model: Buy or lease a vehicle from a dealership.

Ecosystem Model: Platforms like Tesla, Uber, and MaaS apps like Bolt connect cars, ride-hailing, energy, insurance, and smart city infrastructure.

-

Platform Logic: Tesla connects software, EV charging, insurance, and over-the-air updates.

-

Network Effects: Uber builds an ecosystem of drivers, riders, restaurants, and logistics.

-

Data as Asset: Predictive maintenance, usage-based insurance, route optimization—all fed by real-time data.

Tesla is not just a car company — it’s an integrated mobility, energy, and software platform. Its success lies in treating the car as a node in a broader ecosystem, not just a product.

-

Vertical Integration: Controls everything from battery production to software, energy services (Powerwall, Solar Roof), and even insurance.

-

Continuous Upgrades: Like Spotify’s streaming updates, Tesla delivers over-the-air software updates to improve vehicle performance and add features post-purchase.

-

Network Effects: Connects Tesla vehicles into shared systems — from autonomous driving data learning to Supercharger networks.

-

AI + Data Loop: Uses real-time driving data for autopilot training and fleet optimization, akin to music platforms using listening data for personalization.

Tesla’s integrated model offers a seamless user experience while continuously expanding into adjacent spaces (robotaxis, energy storage, grid services). This mirrors how platforms like Apple Music or YouTube built adjacent services around core content.

4. Fashion … from product-driven to creator-driven ecosystems

Old Model: Seasonal collections pushed by fashion houses to retailers.

Ecosystem Model: Platforms like Instagram, Depop, and StockX empower creators, resellers, and consumers to co-create and trade fashion in real time.

-

Creators as Brands: Influencers and micro-brands gain traction without traditional backing.

-

Circular Economy: Secondhand marketplaces and upcycling apps form part of the fashion loop.

-

Digital Goods: Virtual fashion in gaming and the metaverse (e.g. Balenciaga in Fortnite).

StockX launched in 2016 as a “stock market of things,” enabling users to buy and sell sneakers, streetwear, and luxury items with price transparency, authentication, and real-time demand signals. It now processes billions in GMV annually and has become a cultural hub for sneakerheads and collectors.

- Two-Sided Marketplace: Connects sellers (resellers, retailers, individuals) and buyers (enthusiasts, investors) in a transparent pricing environment, like Spotify connects artists and fans.

-

Data as Currency: Provides real-time pricing charts, historical trends, and volume data — turning fashion into a speculative, dynamic asset class.

-

Trust Infrastructure: Builds authentication, condition grading, and transaction security — key to ecosystem health and stickiness.

-

Cultural Integration: Acts as a hub for sneaker culture, drops, and community-driven demand, leveraging scarcity and social influence like viral hits in music.

StockX transformed secondhand goods into financial assets. Much like how Spotify allowed obscure tracks to gain global traction, StockX gave niche fashion products global visibility and liquidity. The company monetizes not just transactions but the data, culture, and community around them.

5. Finance … from products to financial wellness ecosystems

Old Model: Banks offering siloed services—checking, loans, investing.

Ecosystem Model: Platforms like Revolut, Alipay, and Plaid connect personal finance, investing, insurance, crypto, and rewards.

-

API-driven Ecosystems: Fintechs connect to banks, credit bureaus, payroll providers, and e-commerce platforms.

-

User Control: Like artists using Spotify for Artists, customers can manage their financial data and insights in one place.

-

Embedded Finance: Financial services appear within non-financial platforms (e.g. BNPL in retail).

Revolut started in 2015 as a travel-focused money app and evolved into a financial super app, offering banking, crypto, stock trading, budgeting, and more to 40+ million users worldwide.

-

All-in-One Platform: Combines checking, saving, FX, trading, lending, and insurance — turning financial services into a continuous engagement experience, like Spotify’s audio ecosystem.

-

Personalized Insights: AI-driven notifications and budgeting tools help users manage money better, mirroring personalized recommendations in music apps.

-

APIs + Open Banking: Connects with third-party fintechs, creating a modular system where users can plug in services.

-

Gamified UX: Rewards, challenges, and community engagement drive usage, similar to TikTok’s engagement mechanics.

Revolut is redefining consumer expectations in banking — focusing on UX, real-time updates, and financial control. Like Spotify gave users control over what and how they consume music, Revolut puts customers in control of their financial lives.

6. Media and Entertainment … from channels to content ecosystems

Old Model: Studios create, control, and distribute content through owned channels.

Ecosystem Model: Platforms like Netflix, YouTube, and Twitch enable content creation, distribution, monetization, and fan engagement across communities.

-

Creator Economy: Anyone can be a content creator, and monetization is built into the ecosystem (ads, subscriptions, donations).

-

Personalization: AI-driven recommendations akin to Spotify’s playlists.

-

Community-Driven Discovery: Fans co-create culture, memes, remixes—similar to how TikTok shapes music.

Netflix, founded in 1997 as a DVD rental company, became the first major streaming service in 2007. Today it’s a global media powerhouse, with 270+ million subscribers in 190+ countries, and a leader in both content production and delivery.

-

Vertical Control of Value Chain: Produces, distributes, and curates content end-to-end — like Apple in music or Tesla in mobility.

-

Data-Driven Personalization: Uses viewer data to drive algorithmic recommendations, content commissioning, and global rollouts (e.g. “House of Cards” was greenlit based on viewer preferences).

-

Global Localism: Builds region-specific content ecosystems (e.g. K-dramas, Spanish thrillers) that scale globally, turning local hits into global phenomena (à la “Squid Game”).

-

Multi-Stakeholder Platform: Connects creators, audiences, advertisers (in ad-tier), and now game developers — extending the platform into new media.

Netflix reshaped how content is consumed, produced, and monetized. Like Spotify, it removed traditional industry gatekeepers and used algorithms and audience feedback to shape creative direction. It turned entertainment into a dynamic, participatory, data-led experience.

Explore more

- Next Generation Business Models: Redefining value, ownership, scale, and trust by Peter Fisk

- Reinventing business ecosystems for more profitable growth by Peter Fisk

- Building a Butterfly Brand: How “branded ecosystems” achieve more in a world of relentless change by Peter Fisk

- Has Apple become more or less innovative in recent years? by Peter Fisk

- Cross Industry Innovation for Future Business Ecosystems by Z Punkt

- Ecosystem Strategy Map by Julian Kawohl

- How do you Design a Business Ecosystem by BCG Henderson

Over the past two decades, Asia has transformed from being the world’s factory to becoming its innovation engine. From super apps and AI platforms to smart logistics and consumer electronics, Asian companies are now at the forefront of technological disruption and business reinvention. They are reshaping industries, influencing global standards, and outpacing many Western counterparts—not just in scale but in the speed and imagination of innovation.

How did this transformation happen? And why are companies like Bytedance, DJI, Grab, Jio, Haier, Ping An, Sea and Tencent now regarded as among the world’s most innovative?

1. Massive, Demanding, Digital-First Markets

Asia’s biggest asset is its population: more than 4.7 billion people, including the fastest-growing middle class in the world. These markets are mobile-first, young, and digitally native—forcing companies to innovate quickly and at scale.

Take Bytedance, the parent company of TikTok. Founded in China in 2012, it leveraged AI-driven personalization to reimagine content consumption. Unlike platforms that rely on social graphs, TikTok’s content is algorithmically curated, creating an addictive user experience that has since been copied globally. The Chinese market’s diversity and size gave Bytedance an ideal sandbox to refine this model before going global.

Similarly, Grab, founded in Malaysia and now headquartered in Singapore, has evolved from a ride-hailing app into Southeast Asia’s leading super app. It integrates transportation, payments, food delivery, insurance, and more—meeting the needs of consumers in fragmented, infrastructure-light environments. This model was born out of necessity in a region where digital infrastructure had to leapfrog traditional systems.

2. Innovating for Inclusion and Scale

Asian innovators often solve problems unique to their regions—lack of physical infrastructure, informal economies, or underserved populations. These constraints inspire inclusive innovation that often proves globally relevant.

Jio, the Indian telecom and digital services company launched by Reliance Industries in 2016, disrupted India’s telecom market with free calls and ultra-low data costs. By building its network from scratch using 4G and investing heavily in digital content, cloud, and services, Jio connected over 450 million Indians online in just a few years. This was not just innovation in pricing—it was a digital nation-building strategy. Now, Jio is extending into healthcare, education, fintech, and AI with homegrown ambition.

Ping An, one of the world’s largest insurance and financial services companies, turned itself into a technology-first enterprise. It uses AI, big data, and blockchain to serve over 220 million customers and 500 million internet users. Its Good Doctor app became China’s leading health tech platform, with AI-driven diagnostics and 24/7 telemedicine. Ping An’s transformation reflects how Asian firms are embedding tech at the core of traditional sectors like insurance, banking, and healthcare.

3. Reimagining Business Models

Many Asian companies are not just adopting Western models—they are inventing new ones. The concept of the super app, for instance, did not originate in Silicon Valley but in China and Southeast Asia.

Tencent’s WeChat is a prime example. Starting as a messaging app, it became a platform for payments, news, games, shopping, and government services. By enabling third-party mini-programs within the app, Tencent created a mobile-first operating system for everyday life. This level of integration, with seamless UX across services, is rare outside Asia and has influenced global tech giants like Meta and PayPal.

Similarly, Sea Group, based in Singapore and best known for its gaming arm Garena and e-commerce platform Shopee, has created regionally tailored services that blend social engagement with transaction. Shopee’s gamified shopping experience and localized promotions turned it into a leading e-commerce player across Southeast Asia and Latin America.

4. Flexible Ownership and Ambitious Leadership

Ownership structures in Asia are often more flexible and founder-led than in the West. This allows for bold decisions, long-term thinking, and alignment between innovation and execution.

Consider Haier, the Chinese home appliance giant. It reinvented itself into a modular, platform-driven organization using a management philosophy called “Rendanheyi”—empowering small, autonomous teams to act like startups. Haier’s shift from manufacturing to an ecosystem-based innovation model allowed it to acquire GE Appliances in the US and become a leader in smart home solutions globally.

Asian founders and leaders often exhibit a unique blend of nationalism and entrepreneurial drive. Masayoshi Son of SoftBank exemplifies this with his long-term, global investment thesis built around AI and connectivity. Similarly, Mukesh Ambani’s Jio strategy was as much about transforming India as it was about dominating markets.

5. Supportive Governments and Innovation Ecosystems

Governments across Asia have played a crucial role in enabling innovation through infrastructure, policy, and funding.

In China, the government’s “Made in China 2025” strategy incentivized R&D in AI, robotics, and semiconductors. The creation of special economic zones and digital infrastructure hubs enabled companies like DJI (the global leader in drones) and SenseTime (a major AI player) to scale rapidly.

Singapore and South Korea have long invested in education, IP protection, and startup incubation. Singapore’s EDB (Economic Development Board) and Temasek have backed ventures in fintech, biotech, and green energy. South Korea’s Samsung and Hyundai ecosystems are supported by government-led research and supplier networks, allowing them to stay globally competitive in semiconductors, mobility, and clean tech.

Even in India, digital public goods like Aadhaar (digital identity) and UPI (real-time payments infrastructure) have given startups a massive platform to innovate and scale. IndiaStack is now being exported to other developing economies.

6. Bold Visions, Global Playbooks

Asian innovators are increasingly building for the world. Ant Group, for example, pioneered mobile payments with Alipay and now drives global fintech innovation. Tokopedia and Gojek merged to create GoTo Group, aiming to be Southeast Asia’s leading digital ecosystem.

Japanese firms like Rakuten are combining e-commerce, fintech, and mobile telecoms under one brand, while NTT is pushing the boundaries of smart cities and digital twins. In South Korea, Kakao has replicated the super app model with a creative edge in content, entertainment, and NFTs.

Even in frontier tech, Asia is advancing rapidly. SK Hynix and TSMC are global semiconductor leaders. Baidu and Naver are pioneering autonomous vehicles and language AI. In Japan, Preferred Networks is pushing the edge in deep learning for industrial automation and robotics.

7. A Future Shaped in Asia

The next decade of innovation will be increasingly shaped in Asia—not just because of its population or capital, but because of its mindset.

Asian companies are not afraid to leapfrog. They build for complexity, scale, and inclusion. They merge physical and digital worlds. They rewire traditional industries with AI, data, and platform logic. And they move fast.

As the world grapples with climate change, aging populations, urban congestion, and economic inequality, Asia’s innovation playbook—problem-solving at scale, embedding tech everywhere, and integrating services around user needs—may become the global blueprint.

Companies like Bytedance, Grab, Jio, Haier, Ping An, and Tencent are just the beginning. The next wave—from Indonesia to India, Japan to Korea, China to Vietnam—is coming. And they’re not just competing with Silicon Valley. They’re defining what innovation looks like in the 21st century.

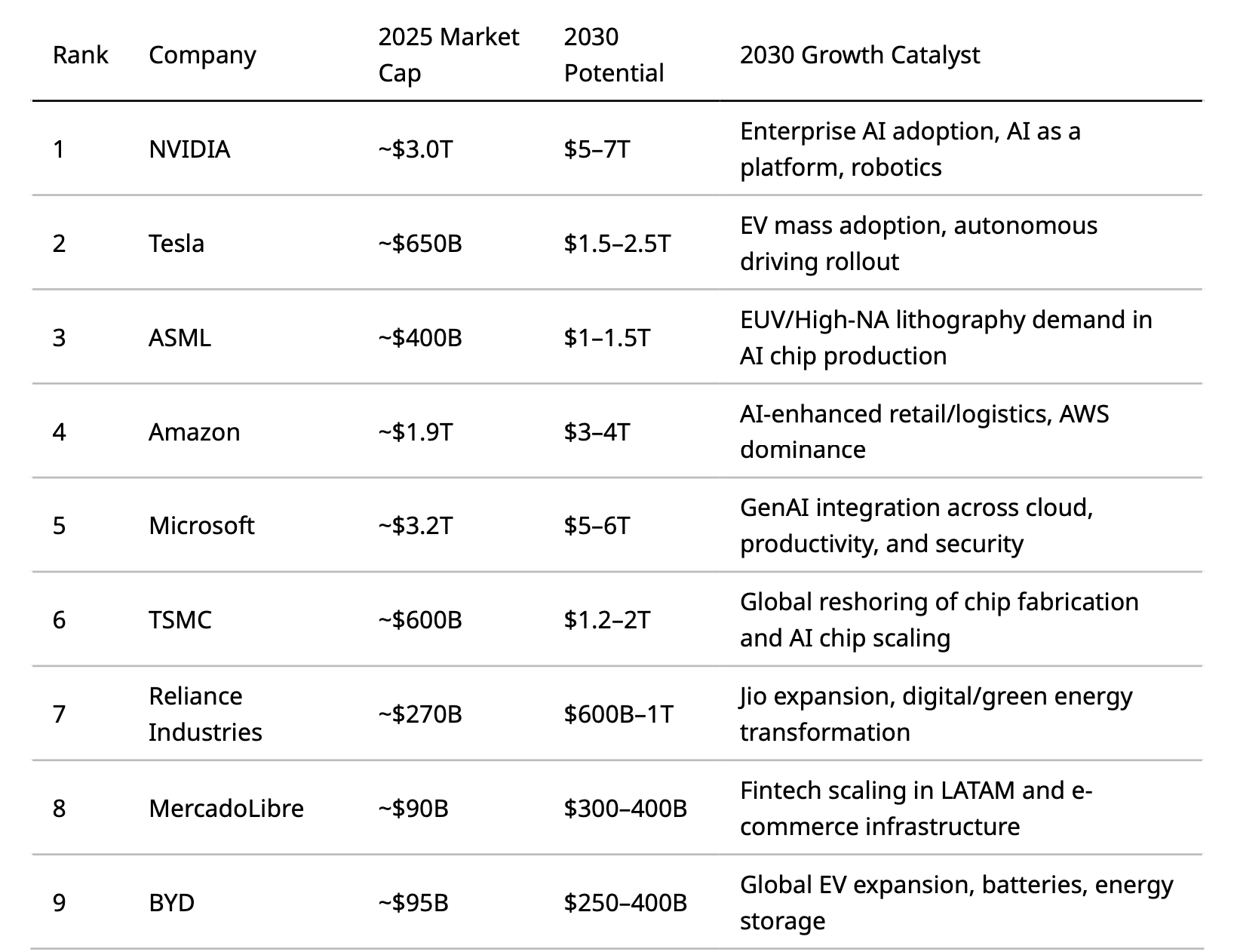

Predicting which companies will see the most significant stock market growth by 2030 involves identifying those best positioned at the intersection of exponential technologies, structural global shifts, and strong execution. These are companies driving or benefiting from megatrends such as AI, climate tech, biotech, digital transformation, and changing demographics.

Here is a curated selection of companies across sectors and geographies that are well-positioned for outsized growth — along with the reasons why. (Remember these are not investment recommendations, simply an analysis of markets and companies, and illustration of their value-based growth potential!).

For each company we consider the strategic significance of the company—”why” it is well-positioned to grow significantly. We also identify the “2030 growth catalyst”, meaning the specific events likely to supercharge the company’s growth by 2030, and the broader “growth drivers”, ie the structural, longer-term factors that will sustain and support the company’s growth over time – technologies, capabilities, business models, partnerships, or geographic expansion.

1. Nvidia … powering the AI revolution

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA began as a graphics chip company for gaming. Under CEO Jensen Huang, it has evolved into a dominant force in AI computing, data centers, autonomous vehicles, and more. It grew exponentially with the rise of GPU computing and now leads the AI revolution with its full-stack AI platform, including CUDA software, GPUs, and supercomputers like DGX.

- 2025 Market Cap: $3 trillion

- 2030 Potential Market Cap: $6 trillion

- Why: The foundational infrastructure provider for AI, from GPUs to full-stack AI computing platforms.

- 2030 Growth Catalyst: Enterprise adoption of generative AI, AI-as-a-platform services, expansion into robotics and autonomous systems.

- Growth Drivers:

- World’s leading supplier of GPUs, central to AI, machine learning, and edge computing.

- Expanding into AI software, networking, and data centre platforms.

- Strong ecosystem dominance, high margins, and strategic leadership in generative AI.

2. ASML … the machines that make semiconductors

Founded in 1984 as a joint venture between Philips and ASM International, ASML is headquartered in Veldhoven, Netherlands. Under CEO Peter Wennink, it has become the global monopoly in extreme ultraviolet (EUV) lithography. ASML plays a pivotal role in the semiconductor value chain, enabling the production of the smallest and most advanced chips. Its technology is critical to Moore’s Law and the future of AI and high-performance computing.

- 2025 Market Cap: $500 billion

- 2030 Potential Market Cap: $1.2 trillion

- Why: Sole supplier of EUV lithography, essential for advanced semiconductor manufacturing.

- 2030 Growth Catalyst: Surge in demand for next-gen chips across AI, 5G, and quantum.

- Growth Drivers:

- High-margin, high-barrier tech monopoly

- Long-term supplier contracts with TSMC, Intel, Samsung

- Expanding capacity to meet global reshoring demand

3. Tesla … accelerating the transition to clean energy

- 2025 Market Cap: $750 billion

- 2030 Potential Market Cap: $2.5 trillion

- Why: Beyond EVs: energy, AI robotics, and autonomy leader.

- 2030 Growth Catalyst: Commercialisation of autonomous vehicles and Tesla Energy at scale.

- Growth Drivers:

- Energy storage and solar business

- Robotaxi network

- Dojo AI training platform and humanoid robots

4. BYD … dreams driving the future of mobility

BYD (Build Your Dreams) was founded in 1995 by Wang Chuanfu as a rechargeable battery company. It entered the auto industry in 2003 and became one of the world’s largest EV makers. Known for vertical integration, BYD manufactures its own batteries, chips, and EV components. Backed by investors like Warren Buffett, it leads China’s EV market and is rapidly expanding into global markets.

- 2025 Market Cap: $100 billion

- 2030 Potential Market Cap: $450 billion

- Why: Vertically integrated EV manufacturer dominating China and expanding globally.

- 2030 Growth Catalyst: Global mass-market EV adoption, battery exports.

- Growth Drivers:

- In-house batteries and chips

- Affordable EV models for emerging markets

- Global expansion (ASEAN, LATAM, EU)

5. Reliance Jio … becoming India’s leading lifestyle brand

- 2025 Market Cap: $250 billion

- 2030 Potential Market Cap: $800 billion

- Why: India’s most diversified conglomerate, pivoting from oil to digital, retail, and clean energy.

- 2030 Growth Catalyst: Jio as India’s dominant digital ecosystem across telecom, finance, and commerce.

- Growth Drivers:

- Jio Financial, JioMart, JioCinema, and 5G services

- Green hydrogen and solar investments

- 1.4B person digital consumer base

6. MercadoLibre … the digital backbone of Latin America

Founded in 1999 by Marcos Galperin in Argentina, MercadoLibre is Latin America’s leading e-commerce and fintech platform. It operates in 18 countries, offering online marketplaces, digital payments, logistics, and credit services. With its MercadoPago and MercadoEnvios platforms, it serves both consumers and merchants. Under Galperin’s leadership, it continues to scale digital services in a region with growing internet penetration and fintech demand.

- 2025 Market Cap: $80 billion

- 2030 Potential Market Cap: $350 billion

- Why: Amazon + PayPal of Latin America with strong moat in logistics and fintech.

- 2030 Growth Catalyst: Latin America’s digital finance revolution and rising e-commerce penetration.

- Growth Drivers:

- MercadoPago’s banking and credit services

- Logistics and fulfillment infrastructure

- Cross-border commerce expansion

7. Eli Lilly … biotech powerhouse, AI-powered drugs

- 2025 Market Cap: $850 billion

- 2030 Potential Market Cap: $2.2 trillion

- Why: Dominates obesity and diabetes treatment with Mounjaro; strong biotech pipeline.

- 2030 Growth Catalyst: Mainstream use of GLP-1 drugs for metabolic disease and longevity.

- Growth Drivers:

- FDA approvals for Alzheimer’s and cancer drugs

- Global rollout of Mounjaro/Zepbound

- Expansion in emerging health markets

8. TSMC … the world’s largest chip maker

Founded in 1987 by Morris Chang, TSMC (Taiwan Semiconductor Manufacturing Company) pioneered the pure-play foundry model. Headquartered in Hsinchu, Taiwan, and led by C.C. Wei, it is the world’s largest contract chip manufacturer. TSMC produces the most advanced chips for top tech companies globally and is central to innovation in AI, smartphones, and high-performance computing.

- 2025 Market Cap: $600 billion

- 2030 Potential Market Cap: $1.2 trillion

- Why: World’s most advanced semiconductor foundry powering Apple, Nvidia, AMD, etc.

- 2030 Growth Catalyst: AI, automotive, and IoT chips becoming core infrastructure.

- Growth Drivers:

- Geographical diversification (US, Japan, EU fabs)

- Leadership in 3nm and advanced packaging

- Supply chain resilience and premium pricing

9. NextEra Energy … America’s leading clean energy business

Founded in 1984 and headquartered in Florida, NextEra Energy is the parent of Florida Power & Light and NextEra Energy Resources. Under CEO John Ketchum, it leads in wind and solar energy generation in North America. The company is at the forefront of the clean energy transition, investing in grid modernization and storage, and leveraging policy support like the Inflation Reduction Act.

- 2025 Market Cap: $150 billion

- 2030 Potential Market Cap: $300 billion

- Why: Largest renewable energy generator in the US.

- 2030 Growth Catalyst: Scaling solar, wind, and grid-scale battery storage.

- Growth Drivers:

- IRA subsidies and regulatory tailwinds

- Digital grid infrastructure

- Distributed energy services for businesses and consumers

10. ARM … designing next generation chips

ARM was founded in 1990 as a joint venture between Acorn Computers, Apple, and VLSI Technology. Based in Cambridge, UK, it designs energy-efficient chip architectures widely used in mobile and embedded systems. Now led by CEO Rene Haas, ARM has expanded into data centers and AI edge computing. Its flexible licensing model powers over 250 billion chips globally, making it foundational to modern electronics.

- 2025 Market Cap: $120 billion

- 2030 Potential Market Cap: $400 billion

- Why: Dominant CPU architecture for mobile, AI edge, IoT, and increasingly cloud.

- 2030 Growth Catalyst: AI at the edge, IoT proliferation, and high-margin licensing.

- Growth Drivers:

- Embedded AI chips for smart devices

- Expanding royalty streams from data centers

- Strategic shift toward value-based licensing

In summary

In addition here are some “bonus picks” … smaller, high-potential, higher-risk companies that could see significant stock market growth by 2030:

1. UiPath … smart robotics from Romania

Founded in 2005 in Romania by Daniel Dines and Marius Tîrcă, UiPath is a global leader in robotic process automation (RPA). Headquartered in New York, the company helps enterprises automate repetitive tasks across systems using AI-powered bots. Led by co-founder and CEO Daniel Dines, UiPath has grown rapidly with a strong customer base in finance, healthcare, and logistics. Its automation-first platform is expanding into intelligent automation and process mining.

- 2025 Market Cap: $10 billion

- 2030 Potential Market Cap: $100 billion

- Why: UiPath is a leader in robotic process automation (RPA), offering AI-powered tools that automate repetitive tasks in enterprise workflows. With the convergence of AI and automation, demand for intelligent systems to boost productivity is surging.

- 2030 Growth Catalyst: Enterprise AI adoption, mass automation of back-office functions, AI copilots for every worker.

- Growth Drivers:

- Expansion into end-to-end AI-powered automation platforms

- Deeper integrations with cloud platforms (Microsoft, AWS, Google)

- Growing demand in finance, healthcare, government sectors

- Upselling AI-based orchestration and analytics services

2. Palantir … making sense of complex data

Founded in 2003 by Peter Thiel, Alex Karp, and others, Palantir started as a data analytics company for defense and intelligence. Under CEO Alex Karp, it expanded into commercial sectors with platforms like Foundry and Gotham that help organizations integrate and make sense of complex data. With increasing adoption in healthcare, finance, and manufacturing, Palantir is gaining traction as AI-driven decision-making becomes mission-critical.

- 2025 Market Cap: $55 billion

- 2030 Potential Market Cap: $300 billion

- Why: Palantir specializes in AI-driven big data analytics, serving defense, intelligence, and commercial clients. It’s gaining traction for its Foundry and AIP platforms that offer mission-critical decision-making tools powered by LLMs.

- 2030 Growth Catalyst: AI-infused enterprise decision platforms; scaled use across commercial sectors and public infrastructure.

- Growth Drivers:

- Accelerating shift from bespoke to scalable AI platforms

- Strong US and NATO government contracts (defense, healthcare, intelligence)

- Commercial expansion in pharma, manufacturing, energy

- Thought leadership in AI ethics, security, and national resilience

3. Sea Group … Singapore retail meets entertainment

- 2025 Market Cap: $30 billion

- 2030 Potential Market Cap: $120 billion

- Why: Sea operates Southeast Asia’s dominant e-commerce (Shopee), digital financial services (SeaMoney), and gaming (Garena). With Southeast Asia’s growing middle class and digital infrastructure, Sea is well positioned as a regional tech super-app.

- 2030 Growth Catalyst: Regional super app combining shopping, fintech, and entertainment in one platform.

- Growth Drivers:

- Shopee scaling e-commerce in Indonesia, Vietnam, Philippines, Brazil

- SeaMoney expansion into payments, insurance, lending

- Return of gaming growth via Garena’s new titles or cross-border IP

- Digital infrastructure and logistics play in fast-growing economies

4. Illumina … leading the genomics revolution

Founded in 1998 and based in San Diego, Illumina is a pioneer in DNA sequencing technologies and genomics solutions. The company, now led by CEO Jacob Thaysen, enables researchers, hospitals, and pharmaceutical companies to sequence genomes quickly and affordably. Despite recent strategic challenges, it remains critical to the advancement of precision medicine, population genomics, and biotech R&D.

- 2025 Market Cap: $30 billion

- 2030 Potential Market Cap: $120 billion

- Why: Illumina is the global leader in DNA sequencing technology. Its platforms power genomics research, precision medicine, and diagnostics, all central to the healthcare revolution.