In today’s rapidly evolving global landscape, the convergence of technological advancements, environmental imperatives, and social equity has redefined the role of private sector investments.

Beyond mere financial returns, investors are increasingly seeking opportunities that drive innovation, foster sustainability, and promote social inclusion. This paradigm shift underscores the potential of strategic investments to empower private companies, enabling them to not only achieve profitability but also become catalysts for positive environmental and social change.

“Purposeful profitability”

Historically, the pursuit of profit and the commitment to social good were often viewed as mutually exclusive. However, contemporary business models demonstrate that these objectives can be harmoniously integrated. By aligning financial strategies with sustainable practices and inclusive growth, companies can unlock new markets, enhance brand loyalty, and mitigate risks associated with environmental and social challenges.

This integrated approach is exemplified by companies that leverage innovation to address pressing global issues. Through strategic investments, these organizations harness emerging technologies and business models to create value that extends beyond the balance sheet, contributing to the achievement of the UNs Sustainable Development Goals (SDGs).

Case Studies of Innovative Investments with Positive Impact

1. M-KOPA Solar: Empowering Off-Grid Communities in Africa

M-KOPA Solar, based in Kenya, has revolutionized access to clean energy for off-grid households through its pay-as-you-go solar systems. By partnering with mobile money platforms like M-Pesa, M-KOPA enables customers to make affordable daily payments for solar energy, eliminating the need for costly and polluting kerosene. With over 2 million homes powered across East Africa, M-KOPA not only provides sustainable energy but also improves health, education, and economic opportunities for underserved communities.

In 2023, M-KOPA expanded its offerings by introducing electric motorbikes, further contributing to the reduction of carbon emissions and promoting sustainable mobility in the region.

2. Solinftec: Transforming Agriculture with Precision Technology

Brazilian agtech company Solinftec is at the forefront of precision agriculture, utilizing AI-powered robots and real-time data analytics to optimize farming practices. Their Solix robotic system autonomously manages tasks such as weeding and crop monitoring, reducing the need for chemical inputs and enhancing yield efficiency. By securing investments from entities like Lightsmith and Blue Like an Orange Sustainable Capital, Solinftec has expanded its operations across North and South America, demonstrating how technology can drive sustainable agricultural practices.

The company’s platform provides farmers with real-time actionable insights related to planting, spraying, fertilizing, and harvesting, leading to increased productivity and reduced environmental impact.

3. Atlas Renewable Energy: Scaling Solar Power in Latin America

Atlas Renewable Energy, a leading Latin American renewable energy company, has partnered with IDB Invest and other financial institutions to develop large-scale solar projects in countries like Colombia and Brazil. These initiatives contribute to significant reductions in greenhouse gas emissions and provide clean electricity to thousands of homes. By leveraging private capital and expertise, Atlas demonstrates how the private sector can play a pivotal role in advancing the global transition to renewable energy.

For instance, the Shangri-La project in Colombia, the largest solar project financed by IDB Invest in the country, is expected to generate approximately 403.7 GWh of clean energy annually, enough to power around 214,000 homes while preventing the emission of roughly 162,000 tons of CO2 per year.

4. Kubo Financiero: Expanding Financial Inclusion in Mexico

Kubo Financiero, a digital microfinance institution in Mexico, offers accessible financial services to underserved populations through its online platform. By providing loans, savings accounts, and investment products, Kubo empowers individuals to improve their financial well-being and build credit histories. Supported by investments from IDB Invest and Google for Startups, Kubo exemplifies how fintech innovations can bridge financial gaps and promote inclusive economic growth.

The company’s model allows for lower interest rates for borrowers and higher rates of return for depositors and investors, compared with traditional financial institutions, thus fostering a more inclusive financial ecosystem.

5. Grupo Bimbo: Integrating Sustainability into Core Business Practices

Grupo Bimbo, one of the world’s largest baking companies, has committed to integrating sustainability into its operations through its “For Nature” strategy. This includes achieving net-zero carbon emissions, eliminating waste, and promoting regenerative agriculture practices. By investing in renewable energy, sustainable packaging, and healthier product formulations, Grupo Bimbo not only enhances its brand value but also contributes to global environmental goals.

The company’s commitment extends to eliminating artificial colorings from all its products by the end of 2026 and ensuring that by the end of 2025, all its bread, buns, and breakfast items will carry a health star rating of at least 3.5, in response to increasing consumer preference for healthier foods.

The role of strategic investments in scaling impact

Strategic investments play a crucial role in scaling the impact of innovative companies. By providing the necessary capital and resources, investors enable these organizations to expand their operations, enhance their offerings, and reach a broader audience. This, in turn, amplifies the positive environmental and social outcomes associated with their business models.

Moreover, investments in innovation foster a culture of continuous improvement and adaptability. Companies that prioritize research and development are better equipped to respond to emerging challenges and capitalize on new opportunities, ensuring long-term sustainability and relevance in a dynamic market.

Some of the more innovative approaches include

1. Outcome-Based Financing: Linking Capital to Results

Traditional funding models often focus on inputs and outputs, but outcome-based financing shifts the emphasis to measurable results. By aligning financial returns with the achievement of specific social or environmental outcomes, investors can ensure that capital is directed toward initiatives that deliver tangible benefits.

For instance, the UP Fund, a $50 million pool of catalytic capital, aims to remove barriers to education and employment by deploying capital in two forms—student financing and organizational financing. This approach seeks to align the incentives between students, training providers, educational institutions, and employers through an outcomes-based methodology

2. Royalties-Based Financing: A Flexible Capital Structure

A novel investment model gaining traction is royalties-based financing, where investors receive a fixed percentage of future revenues instead of equity or rigid debt structures. This approach provides capital to companies without diluting ownership or imposing fixed repayment schedules, offering flexibility and aligning investor returns with company performance.

Althera42, co-founded by former BlackRock executive Caspar Macqueen, applies this model to late-stage private tech infrastructure companies in Europe and potentially North America. The fund targets companies with €10–€100 million in annual revenue from licensing-based models with strong intellectual property, low churn, and diversified customer bases. Investors receive quarterly distributions, combining venture capital-like upside with private debt’s steady cash flow.

3. Ecosystem Investing: Building Collaborative Networks

Ecosystem investing recognizes that complex social and environmental challenges require collaborative solutions. By viewing investments within the context of a broader ecosystem, funders can adjust their behavior in response to changes within that system, leading to more sustainable and scalable impact.

An example of this approach is the Nordic model of capitalism, which emphasizes collaboration between government, business, and civil society to address social issues. This model has proven effective in scaling social innovations by fostering an environment where various stakeholders work together toward common goals.

4. Digital Technology Integration: Enhancing Scale and Efficiency

The integration of digital technologies is transforming how social enterprises operate and scale. By leveraging digital platforms, companies can reach wider audiences, streamline operations, and enhance service delivery, leading to increased impact.

The Solinftec platform, for instance, provides farmers with real-time actionable insights related to planting, spraying, fertilizing, and harvesting. This digital approach has led to increased productivity and reduced environmental impact, demonstrating the power of technology in scaling sustainable agriculture practices.

5. Tradeable Impact Credits: Monetizing Social Outcomes

Innovative financial instruments, such as tradeable impact credits, are emerging to monetize social and environmental outcomes. These credits represent verified positive impacts and can be bought and sold, providing a new revenue stream for organizations delivering social value.

A recent report suggests that developing systems to create incentives to fund and scale these outcomes, focusing especially on the communities they aim to benefit, could significantly boost social funding

Creating lasting change, creating better lives

Investing in innovation is not merely a financial decision; it is a strategic approach to creating lasting positive change. By supporting companies that integrate sustainability and social impact into their core operations, investors contribute to the development of solutions that address some of the world’s most pressing challenges. The case studies of M-KOPA Solar, Solinftec, Atlas Renewable Energy, Kubo Financiero, and Grupo Bimbo illustrate the transformative potential of such investments.

As the global community continues to confront environmental degradation, social inequality, and economic instability, the need for innovative solutions has never been more urgent. Through thoughtful and strategic investments, the private sector can drive the development and scaling of these solutions, paving the way for a more sustainable and equitable future for all.

More from Peter Fisk

- Eyes on Tomorrow: What Leaders Must See before Everyone Else … exploring the most important megatrends that are transforming markets, and leadership mindsets, and how the best companies embrace them as opportunities … based on the new Megatrends 2035 report by Peter Fisk, and its implications for every business.

- The Reinvention Playbook: Thriving in a World of Relentless Change … the best organisations seek to continually reinvent themselves in a world of constant, uncertain and dynamic change. They rethink, refocus, and reinvent everything – embracing new agendas from AI to GenZ, climate change and social inequality.

- The Nexus Effect: Unlocking the Power of Connections … How can businesses and brands really unlock the power of data and networks, flywheels and AI, communities and ecosystems, to transform their futures?

- The New Growth Playbook: 9 New Ways to Accelerate Growth … many companies struggle to find new ways to grow their business … instead we look at how the best companies find radically new ways to grow.

- Super Innovators: Innovation Beyond the Normal … 10 radical ways to disrupt conventions, embrace deeper insights, unlock valuable assets, and stretch innovation for more dramatic impact.

- Consumer of the Future … “Aisha blinked twice, the smart lenses in her eyes had already scanned her biometric mood, cross-checked her carbon budget, and pulled up items her climate-positive friends were buying this week”

- Competing in the FLUX: How to develop a dynamic strategies in a world of relentless change … combining a strong, enduring direction with micro-moves that adapt quickly to emerging shifts:

- Business Transformation: The new superpower of business leaders … reimagining the future, redefining strategy, reinventing the organisation, rewiring performance … the journey to deliver step change in value creation.

- The Sustainable Consumer: Go on, do the Right Thing … how brands can accelerate the consumer shift to sustainable products and practices … from food and fashion, to energy and electric cars, making sustainability desirable and better.

- The “Performer Transformer” Leaders: How great leaders deliver today and create tomorrow … with dual thinking, to build dynamic ambidexterity, continually strategyzing, to perform and transform.

- The Hire-Wire Act of Leadership: Leading in a world of intense competition and relentless change … being visionary and innovative, learning to adapt and endure … inspired by Taylor Swift, Roger Federer, Beyoncé, and Lionel Messi

- Becoming a Future-Ready Business … in a world of relentless change, organisations need to anticipate change, embrace innovation, empower talent, and align deeply with the evolving needs of society and the planet

Leadership today is a high-wire act.

The world is more volatile, more interconnected, and more unpredictable than ever. New technologies disrupt markets overnight, competition is no longer local but global, and the speed of change leaves little time for complacency.

In this unforgiving arena, leaders need more than strategy; they need adaptability, resilience, creativity, and the ability to inspire people around a shared vision.

Some of the richest insights into modern leadership do not come from corporate boardrooms but from the worlds of music, sport, and politics.

Figures like Taylor Swift, Roger Federer, and Barack Obama have mastered the art of reinvention, performance, and influence in contexts where the stakes are high and the spotlight relentless. Alongside them, innovators like Lionel Messi, Beyoncé, Oprah Winfrey, Selena Gomez, and David Guetta show what it means to lead movements and industries through personal mastery, purpose, and collaboration.

For business leaders, these high performers offer profound lessons in how to thrive in times of intense competition, innovation, and change.

Taylor Swift: Reinvention as a Leadership Strategy

Few contemporary figures embody the art of reinvention better than Taylor Swift. Over nearly two decades, she has transformed herself from a teenage country singer into a global cultural force whose influence stretches far beyond music. Each “era” of Swift’s career represents not just an artistic pivot but also a strategic redefinition of her brand.

What makes her approach so powerful for business leaders is the intentionality behind her reinventions. She reads the cultural moment, anticipates shifts in her audience, and positions herself ahead of the curve. When country music felt limiting, she crossed into pop with 1989 and became a megastar. When the industry questioned her control over her own work, she turned the dispute into a campaign for artist ownership, re-recording her albums to regain her masters and reframing the narrative in her favor.

Swift’s lesson for leaders is clear: reinvention is not failure or a loss of identity — it is survival. In business, markets evolve and consumer tastes change. Leaders who cling too tightly to what worked yesterday risk irrelevance tomorrow. Like Swift, leaders must learn to treat reinvention as a deliberate act of growth, not a reaction to crisis.

Her mastery of digital platforms adds another dimension. Swift has used social media not merely as a promotional tool but as a community-building space. She creates intimacy at scale, making fans feel personally seen and valued. For leaders, this highlights the importance of authentic connection in the digital age. In a world of automation and AI, human connection and trust become scarce and valuable commodities.

- Parallel: Swift is like Netflix, which has constantly reinvented itself — from DVD rentals to streaming, from streaming to original content, from content to gaming — always staying ahead of audience expectations.

- Lesson: Reinvention is not reaction but anticipation. Leaders must actively redefine themselves before the market forces them to.

Roger Federer: Grace Under Pressure and the Long Game

Where Swift teaches reinvention, Roger Federer exemplifies longevity. Over a two-decade career, he maintained elite performance in one of the most physically and mentally demanding sports in the world. His grace on the court was matched by his resilience off it, adapting his game as his body aged and new competitors emerged.

Federer’s genius was not only technical but strategic. Early in his career, he relied on athleticism and aggressive shot-making. Later, he refined his style into one based on efficiency, conserving energy with shorter points, impeccable footwork, and tactical variety. He reinvented his game to extend his career, much as businesses must reinvent processes and strategies to remain competitive.

Just as important was his mental composure. Federer faced rivals like Nadal and Djokovic, who often seemed more physically dominant. Yet he rarely appeared flustered. His poise under pressure became a hallmark, turning critical points into opportunities rather than threats. Leaders in business face their own “match points”: moments of crisis, sudden disruptions, or high-stakes decisions. Federer shows that calm confidence, built on preparation and belief, can turn pressure into performance.

Beyond sport, Federer also curated his legacy. His retirement was not the end but the beginning of a new chapter as philanthropist, investor, and ambassador. For leaders, this demonstrates the importance of thinking not only about immediate wins but about long-term impact. Leadership is not just about quarterly results; it is about building enduring influence.

- Parallel: Federer’s adaptability mirrors Toyota’s philosophy of continuous improvement (Kaizen). Just as Toyota refines processes to extend product lifecycles and reduce waste, he refined his playing style to sustain high performance over decades.

- Lesson: Efficiency and composure are as critical as raw performance. Long-term leadership depends on resilience, adjustment, and the ability to deliver under pressure.

Barack Obama: Leadership Through Vision and Voice

If Swift embodies reinvention and Federer demonstrates resilience, Barack Obama shows the power of narrative and vision in leadership. Obama rose from relative obscurity to the U.S. presidency largely through his ability to articulate hope and possibility in a time of division.

What stands out is his mastery of voice — not only in speeches but in the way he connected across cultures and generations. Obama framed politics not as a technical exercise but as a story in which ordinary people could see themselves as protagonists. This skill of framing and storytelling is critical for business leaders. In times of uncertainty, data and analysis matter, but it is vision and narrative that mobilize people.

Obama also embraced the digital age of campaigning. His 2008 run pioneered the use of social media and online fundraising, redefining how politics engaged with citizens. Business leaders face a similar imperative: to harness digital platforms not merely for efficiency but for engagement, creating ecosystems where people feel part of a larger mission.

At the same time, Obama demonstrated equanimity under intense scrutiny. His presidency was marked by crises — economic collapse, wars, social upheaval — yet his leadership was defined by calm deliberation and the ability to bring people together. In business, where polarizing pressures can divide teams, the capacity to unify around shared purpose is a defining quality of great leadership.

- Parallel: Obama’s use of narrative resembles Apple’s brand storytelling. Both created movements not just through products or policies, but by telling stories that people wanted to believe in and be part of.

- Lesson: Data informs, but vision inspires. Leaders must be storytellers who give meaning to collective effort, especially in uncertain times.

Lionel Messi: Mastery, Consistency, and Adaptability

If Federer represents elegance, Lionel Messi represents relentless mastery. Across two decades, he has been one of the greatest footballers of all time, known for his vision, precision, and consistency under immense pressure. Unlike athletes who relied primarily on physical power, Messi thrived through creativity, anticipation, and relentless refinement of skill.

Messi’s career shows leaders the value of sustained excellence. In an era where businesses are tempted to chase the next big trend, Messi demonstrates the power of compounding mastery. His consistency on the pitch mirrors the importance of delivering value again and again for customers.

But Messi is not only about consistency; he is also about adaptability. Moving from Barcelona, where he had spent his entire career, to Paris Saint-Germain, and later to Inter Miami, he showed how even the greatest can reinvent themselves in new contexts. Business leaders often struggle with legacy: systems, habits, and reputations built in one environment may not translate to another. Messi proves that humility and adaptability are as important as raw talent.

Moreover, Messi’s leadership is quiet but powerful. Unlike more vocal figures, his example is through performance and presence. For leaders, this underscores that influence does not always require charisma or volume — sometimes excellence itself is the most compelling form of leadership.

- Parallel: Messi is like Amazon — consistently excellent in execution, yet willing to expand into new fields (from books to e-commerce, cloud, entertainment, and logistics) without losing the discipline of operational mastery.

- Lesson: Excellence compounds. Leaders who deliver consistently and adapt humbly to new environments build trust and longevity.

Beyoncé: Innovation, Empowerment, and Business Acumen

Beyoncé offers another perspective on leadership in a changing world: the fusion of creativity, innovation, and empowerment. Like Taylor Swift, she is not only an artist but also a business strategist who has built an empire across music, fashion, film, and digital streaming.

Her artistry is rooted in innovation. Albums like Lemonade or the surprise release of her self-titled record redefined how music could be launched and consumed. By bypassing traditional promotional cycles, Beyoncé disrupted industry norms and set new standards for direct-to-consumer engagement. Leaders in business can learn from this boldness: sometimes the best way to lead is to rewrite the rules of the game.

Equally important is her focus on empowerment. Beyoncé uses her platform to champion diversity, inclusion, and female empowerment, aligning her artistry with cultural relevance. In the corporate world, this translates into purpose-driven leadership: success today requires aligning business outcomes with values that matter to employees and customers.

Her ventures into streaming (with Homecoming on Netflix), fashion (Ivy Park), and even investments demonstrate strategic diversification. Beyoncé’s career is a case study in building ecosystems rather than products. Leaders should see innovation not as isolated projects but as interconnected strategies that reinforce each other.

- Parallel: Beyoncé’s strategy echoes LVMH, the luxury giant that blends heritage with innovation, building interconnected brands that thrive on cultural relevance and aspirational values.

- Lesson: Innovation works best when aligned with purpose. Leaders must expand influence by building ecosystems — interconnected ventures that reinforce each other — rather than isolated projects.

David Guetta: Collaboration and Digital Reinvention

David Guetta has transformed electronic music into a global phenomenon through relentless innovation, digital savvy, and strategic collaborations. Starting in the 1990s Paris club scene, Guetta leveraged the emerging digital music ecosystem to expand the reach of electronic dance music. He foresaw the potential of streaming, remix culture, and cross-genre collaboration long before they became mainstream.

Guetta’s leadership lies in his ability to connect talent and audiences in unexpected ways. By partnering with pop stars, rappers, and global musicians, he has expanded EDM’s appeal while continually reinventing his sound. He embraces technology as a tool for creativity, using digital platforms to release music directly to fans, monitor trends, and optimize engagement. His adaptability has allowed him to thrive in an industry marked by rapid obsolescence and fickle consumer tastes.

For business leaders, Guetta illustrates the power of ecosystem thinking. Success is not achieved in isolation; it emerges from partnerships, networked influence, and digital integration. He demonstrates that collaboration and digital reinvention are essential for sustaining relevance in fast-changing markets. Guetta’s career exemplifies agility, foresight, and the ability to blend creativity with strategic positioning — key traits for leaders navigating the modern competitive landscape.

- Parallel: Guetta is like Spotify — thriving by creating platforms for collaboration, remixing, and new discovery. Both show that in a digital-first world, leadership is about curating ecosystems of connection, not just producing content.

- Lesson: Collaboration fuels reinvention. Leaders must see partnerships not as threats but as multipliers of value in fast-changing environments.

Oprah Winfrey: Purpose and Cultural Impact

Oprah Winfrey’s career is a masterclass in purpose-driven leadership. Rising from a challenging childhood marked by poverty and adversity, she forged a media empire that blends business acumen, cultural influence, and authentic connection. Her success is rooted not in mere talent but in the ability to identify what people truly want: content that resonates emotionally, inspires, and empowers. Winfrey understood early that media could be a vehicle not only for entertainment but for influence and social impact.

Her leadership style is characterized by empathy, authenticity, and vision. She built her brand on trust, consistently delivering value to her audience while maintaining a strong ethical compass. From The Oprah Winfrey Show to the OWN network, Oprah has transformed industries by redefining what it means to be a media mogul. She champions purpose-driven business practices, demonstrating that profitability and impact are not mutually exclusive.

Winfrey’s approach offers lessons for business leaders in the modern era: embed authenticity in every decision, align operations with core values, and use influence responsibly. She demonstrates how a leader can shape culture, inspire loyalty, and drive systemic change. In a world of constant disruption, her example underscores the importance of vision, emotional intelligence, and resilience as critical leadership assets.

- Parallel: Oprah resembles Unilever, which aligns corporate strategy with sustainability and values. Both prove that purpose can be a competitive advantage, building loyalty in a crowded marketplace.

- Lesson: Values are the new currency of leadership. Authenticity and purpose inspire deeper engagement than financial incentives alone.

Selena Gomez: Vulnerability, Connection, and Building Community

Selena Gomez represents a new generation of leaders who combine creativity, entrepreneurship, and social advocacy. Emerging as a child star, Gomez transitioned seamlessly into music, film, and digital influence, demonstrating adaptability and long-term strategic thinking. Beyond entertainment, she built Rare Beauty, a cosmetics brand emphasizing inclusivity, authenticity, and mental health awareness, redefining the way celebrity brands interact with consumers.

Gomez’s leadership is grounded in vulnerability and relatability. She has publicly discussed mental health struggles, autoimmune disease, and personal challenges, turning transparency into a source of trust and community-building. This openness has allowed her to connect deeply with audiences and cultivate loyal followers across multiple platforms. In addition, her brand strategy emphasizes values-driven business: Rare Beauty is designed not just to sell products but to empower users and promote social change.

For business leaders, Gomez exemplifies modern leadership traits: the ability to diversify across domains, leverage personal influence responsibly, and embed mission-driven values into business operations. She shows that adaptability, authenticity, and purpose are competitive advantages, demonstrating that leaders can cultivate both emotional and commercial impact simultaneously. Her example underscores the importance of aligning brand, business strategy, and social responsibility in today’s fast-moving landscape.

- Parallel: Gomez’s approach echoes Patagonia, which turned environmental activism into a defining strength. Both built communities not by hiding imperfections but by sharing values openly.

- Lesson: Transparency is power. In an age of distrust, leaders who show vulnerability and align business with genuine social causes create stronger communities.

Lessons for Leaders

Drawing across these high performers, several themes emerge that are directly applicable to leaders navigating today’s competitive and innovative landscape:

-

Reinvent Relentlessly (Taylor Swift) – Stay ahead by redefining yourself before the market forces you to. Innovation is not a project; it is a way of being.

-

Play the Long Game (Roger Federer) – Adapt your strategies to sustain performance over time. Efficiency, resilience, and composure are as critical as short-term wins.

-

Lead Through Vision and Voice (Barack Obama) – Craft narratives that mobilize people, especially in times of uncertainty. Facts inform, but stories inspire.

-

Deliver Mastery with Adaptability (Lionel Messi) – Pursue excellence consistently while staying humble and ready to adapt when contexts change.

-

Build Ecosystems with Purpose (Beyoncé) – Innovate boldly, align with values, and expand influence through interconnected ventures rather than isolated products.

-

Reinvent Relentlessly (Taylor Swift/Netflix) – Stay ahead by redefining yourself before the market forces you to. Innovation is not a project; it is a way of being.

-

Play the Long Game (Roger Federer/Toyota) – Adapt your strategies to sustain performance over time. Efficiency, resilience, and composure are as critical as short-term wins.

-

Lead Through Vision and Voice (Barack Obama/Apple) – Craft narratives that mobilize people, especially in times of uncertainty. Facts inform, but stories inspire.

-

Deliver Mastery with Adaptability (Lionel Messi/Amazon) – Excellence must be consistent, but context demands flexibility.

-

Build Ecosystems with Purpose (Beyoncé/LVMH) – Create interconnected ventures rooted in cultural relevance and values.

- Harness Collaboration and Platforms (David Guetta/Spotify) – In a digital world, ecosystems and partnerships multiply impact.

-

Lead with Purpose and Authenticity (Oprah Winfrey/Unilever) – Trust and values are the ultimate foundation of influence.

-

Turn Vulnerability Into Strength (Selena Gomez/Patagonia) – Transparency builds community and deepens loyalty.

The common denominator across Swift, Federer, Obama, Messi, Beyoncé, Winfrey, Gomez, and Guetta is not talent alone but the deliberate cultivation of adaptability, resilience, and authenticity. They do not simply react to change — they anticipate it, shape it, and use it to fuel their influence.

For business leaders, this is the challenge of our age. AI, climate change, geopolitical shifts, and social transformation are rewriting the rules of every industry. In such a world, the best leaders will not be those who cling to traditional playbooks but those who, like these high performers, embrace uncertainty as a stage on which to perform their best work.

Leadership is no longer about commanding from above but about orchestrating movements, telling compelling stories, and embodying values that resonate. It is about combining strategic reinvention with human connection, turning moments of pressure into opportunities for transformation.

In short, the leaders who thrive in this world of intense competition, innovation, and change will be those who learn to lead not just with their heads but with imagination, resilience, and authenticity — much like the performers, athletes, and statesmen who inspire us far beyond their own fields.

More from Peter Fisk

- Eyes on Tomorrow: What Leaders Must See before Everyone Else … exploring the most important megatrends that are transforming markets, and leadership mindsets, and how the best companies embrace them as opportunities … based on the new Megatrends 2035 report by Peter Fisk, and its implications for every business.

- The Reinvention Playbook: Thriving in a World of Relentless Change … the best organisations seek to continually reinvent themselves in a world of constant, uncertain and dynamic change. They rethink, refocus, and reinvent everything – embracing new agendas from AI to GenZ, climate change and social inequality.

- The Nexus Effect: Unlocking the Power of Connections … How can businesses and brands really unlock the power of data and networks, flywheels and AI, communities and ecosystems, to transform their futures?

- The New Growth Playbook: 9 New Ways to Accelerate Growth … many companies struggle to find new ways to grow their business … instead we look at how the best companies find radically new ways to grow.

- Super Innovators: Innovation Beyond the Normal … 10 radical ways to disrupt conventions, embrace deeper insights, unlock valuable assets, and stretch innovation for more dramatic impact.

- Consumer of the Future … “Aisha blinked twice, the smart lenses in her eyes had already scanned her biometric mood, cross-checked her carbon budget, and pulled up items her climate-positive friends were buying this week”

- Competing in the FLUX: How to develop a dynamic strategies in a world of relentless change … combining a strong, enduring direction with micro-moves that adapt quickly to emerging shifts:

- Business Transformation: The new superpower of business leaders … reimagining the future, redefining strategy, reinventing the organisation, rewiring performance … the journey to deliver step change in value creation.

- The Sustainable Consumer: Go on, do the Right Thing … how brands can accelerate the consumer shift to sustainable products and practices … from food and fashion, to energy and electric cars, making sustainability desirable and better.

- The “Performer Transformer” Leaders: How great leaders deliver today and create tomorrow … with dual thinking, to build dynamic ambidexterity, continually strategyzing, to perform and transform.

- Becoming a Future-Ready Business … in a world of relentless change, organisations need to anticipate change, embrace innovation, empower talent, and align deeply with the evolving needs of society and the planet

Five athletes, with a shared ambition: to run the first ever sub-six-hour 100km in history.

Adidas called it “the story of how a group of radical minds ushered in a new era of performance, a story of elite athletes working alongside the world’s sharpest product innovators, and the jaw-dropping ultramarathon history that followed.”

Indeed it was exciting – Sibusiso Kubheka (South Africa), 100km world record holder Aleksandr Sorokin (Lithuania), Charlie Lawrence (USA), Jo Fukuda (Japan) and Ketema Negasa (Ethiopia) were each backed by precision-engineered Adidas footwear and state-of-the-art apparel designed for speed and endurance.

Kubheka was the athlete who pulled off the unthinkable in an astonishing 5:59:20, shaving 6 minutes and 15 seconds off the previous fastest time of 6:05:35.

In the same week Adidas also launched the world’s first specialist treadmill running shoe.

Over 50,000 people run on treadmills every day, yet nobody has designed a shoe for them before. An obvious gap in some ways, and yet a blue ocean for growth.

Most innovation focuses on products. Still. But we all know that it is the bigger context – the consumer experience, services beyond products, and the ecosystem of partners, the business model, the market model – where innovation can have more impact.

It is estimated that the market will be around USD 48,419.3 million in 2025 and USD 75,916.4 million in 2035 at a compound annual growth rate (CAGR) of 4.6% during the period of forecast.

Super shoes are now normal

As the world’s top athletes come together this week in Tokyo for the 2025 World Athletics Championships, the sport sits at an inflection point.

The “super shoe” era that began with the Vaporfly has matured: carbon plates, PEBA/TPEA-type foams, and aggressive rocker geometries have become mainstream across dozens of models and many brands.

At the same time, new materials and supply-chain priorities are reshaping design decisions, governing bodies have tightened rules, and a new generation of brands – some old, some reinvented, some startup – are pursuing different bets: sustainability, personalisation, embedded tech, direct-to-consumer culture, and niche community authenticity.

So what’s changing, who’s shaping the market, which new technologies matter, and how will shoes, apparel and accessories evolve over the next 5 years?

After a decade of rapid innovation, World Athletics and national federations have moved from reactive to proactive: setting clear limits on stack heights, limiting the number and construction of plates, and publishing approved-shoe lists.

Regulatory shifts (for example new consolidated limits for track and road shoes, and separate track/road rules that came into force after 2022 and evolved into further clarifications in 2024–25) constrain the absolute extremes of a single “secret” podium shoe and force brands to innovate within stricter boundaries.

That regulatory pressure pushes R&D into three places: smarter foam chemistry (durability and energy return), mechanical geometry (rocker profiles, localised stiffness), and supporting services (sensing, custom fit, coaching ecosystems). This matters: with obvious “game-changing” leaps less likely to be achieved by a single plate or a radical sole height, new winners will be brands that combine modest hardware gains with software, fit, durability, and ecosystem value.

They also need to think beyond the product, about the consumer – the runner – who they are, where, what and why they run.

Market analysis

According to FMI, from 2025 to 2035, the running shoes market boom will remain constant due to several factors, including an ever-growing awareness for health, an increasing engagement in sports and fitness activities, along with continuous ongoing innovations concerning the designs of athletic footwear.

Offering shock absorption, support, and traction, running shoes are an essential item for casual runners and ambitious professional athletes and fitness enthusiasts alike. It is estimated that the market will be around USD 48,419.3 million in 2025 and USD 75,916.4 million in 2035 at a compound annual growth rate (CAGR) of 4.6% during the period of forecast.

Growing global wellness trend, rising popularity of marathons and recreational running, and the use of advanced materials including lightweight foams and breathable uppers are promoting growth of the market. Namely, the emergence of e-commerce and brand partnerships with influencers enhance consumer involvement and product availability.

But obstacles such as counterfeit products, intense competition, and high product development costs still remain. Manufacturers have turned to opt for sustainable manufacturing, personalized fit/features technologies, and direct-to-consumer/DTC strategies to tackle these barriers.

The running shoes market has been segmented based on type as well as end user, which has seen increasing cat demand from both recreational and competitive runners. Key types include road running, trail running, and track shoes. These are mainly because road running shoes outnumber the others, being versatile and used on a daily basis, and trail shoes, with more focus on rugged outsole and trail performance.

Men are the largest consumers among end-users followed by women and children. The women’s category is seeing strong growth, aided by inclusive branding and expanding product lines. As consumers gravitate toward shoes focusing on various terrains, training intensities and foot anatomies, brands are investing in various systems for responsive cushioning, energy return and sustainability to meet changing expectations.

North America

The North America running shoes market continues to thrive, with factors including strong consumer spending on fitness, the presence of prominent athletic companies, and growing interest in endurance events. Smart and high-performance running footwear demand is significant in the United States and Canada.

Europe

The Europe market is driven by increasing sports participation, rising inclination towards eco-friendly products, and robust retail infrastructure. The UK, and France are asking for lightweight, sustainable running shoes which does not compromise style and function.

Asia-Pacific

The Asia-Pacific region is the fastest-growing running shoes market, primarily driven by rising middle-class income, fitness culture, and government-run health initiatives. In these countries, the national governments invest heavily in the domestic sports industries, people spend increasing time and expenditure on sports and the demand for footwear among urban and suburban population is inspired.

Challenges

Market Saturation and Short Product Lifecycle

One of the biggest challenges for the running shoes industry is the intense competition and rapid product turnover, with large brands constantly launching new designs, limited editions, and performance-enhancing models. Such saturation breeds price wars, brand dilution and inventory pressure, especially for retailers that serve non-competitive and casual runners.

Further, with the average running shoes having a short lifespan (300-500 miles) that adds pressure on consumers to replace the shoes often and worsens environmental waste found in the lack of recycling programs. And now, with the rise of counterfeits and cheap knock-offs, getting through to consumers has not just become noisy, but really muddy when it comes to brand loyalty and value perception.

Opportunities

Surge in Health Awareness, Personalization, and Sustainable Footwear

The positive aspect here is that the market still benefits from growing global interest in health, fitness, and outdoor activity which translates into steady demand for running and jogging footwear. With comfort, performance and injury prevention increasingly at the top of consumer priorities, brands are putting their budgets behind biomechanically optimized soles, responsive cushioning systems and foot-type-specific styles.

The growing utilization of 3D foot scanning, gait analysis and app-based customization is allowing firms to offer more tailored running journeys. At the same time, consumer demand for eco-conscious products is also driving investment in recycled materials, biodegradable outsoles and closed-loop takeback programs, enabling brands to differentiate themselves through sustainability and transparency of product lifecycle.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Basic compliance with product safety and material labelling standards. |

| Technological Advancements | Launch of carbon-plated midsoles and breathable engineered mesh uppers. |

| Sustainability Trends | Early efforts in recycled polyester uppers and eco-friendly packaging. |

| Market Competition | Dominated by global brands with strong marketing and athlete endorsements. |

| Industry Adoption | Common in marathon training, casual jogging, and gym fitness. |

| Consumer Preferences | Demand for lightweight, cushioned, and stylish running shoes. |

| Market Growth Drivers | Growth fuelled by fitness trends and urban outdoor activity. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Expansion into eco-certification, carbon labelling, and footwear recycling mandates. |

| Technological Advancements | Growth in smart insoles, gait-responsive cushioning, and AI-designed performance features. |

| Sustainability Trends | Industry-wide shift to closed-loop systems, plant-based foams, and modular repairable shoe components. |

| Market Competition | Greater disruption from tech-integrated footwear startups and sustainability-focused challengers. |

| Industry Adoption | Expanded into custom training programs, virtual races, and terrain-specific running modules. |

| Consumer Preferences | Preference for sustainable, personalized, and smart shoes that track and adapt to performance. |

| Market Growth Drivers | Expansion driven by digital health integration, personalization, and sustainability awareness. |

Next generation materials

Smarter foams and tuned polymers

PEBA (often under trade names such as Pebax) and PEBA-like compounds have dominated the most lively midsoles because of exceptional rebound and lightness. By 2025 many brands—from Nike to Saucony, Hoka, New Balance, Puma and more—are using PEBA formulations or advanced TPUs to get that “bouncy” feel while trying to improve durability and reduce cost. Expect continuing work on hybrid foams (PEBA blended with more durable EVA variants), micro-architectured foams (engineered cell structures), and small additive blends that target specific distance profiles (tempo vs marathon).

Mechanical innovation without breaking rules

With one rigid plate usually permitted, designers will focus on multi-material plates (composite + thermoplastic inserts) that tune forefoot/heel dynamics and stability, and on macro-geometry: asymmetric stack heights, longitudinal channels that alter bending stiffness, and intelligent tread patterns. Stability winglets, localized pads and variable durometer inserts will let a single model serve multiple runner types via simple modular swaps (replaceable midsole pods or outsole sections). Recent race models from mainstream brands (and Puma’s Fast-R NITRO Elite 3 as a concrete example) show how intense iteration is yielding incremental but meaningful gains.

Durability, circularity and new supply-chain choices

One of the clearest future battlegrounds is resilience: historically the bounciest foams deliver the worst longevity. Runners and retailers are demanding better miles/dollar and lower lifecycle impacts. Brands like Allbirds have leaned into radical material choices (sugarcane-based midsoles, tree/eucalyptus uppers, “net-zero” experiments) and open-sourcing parts of their processes; expect more experimentation with recycled polymer formulations, reclaimed foams and take-back programs that convert used midsoles back into new compound feedstock. Sustainability will shift from PR to product economics: lighter-touch supply chains, modular replaceability and demonstrated carbon/reporting credentials will become competitive advantages.

The rise of brand clusters

When the shoe performance gap narrows, brand story and community matter. Three clusters will stand out.

Specialist performance houses

These are the mid-sized performance brands that double down on a focused promise: trail speed, marathon performance, or daily durability. Hoka (Deckers), Saucony, Brooks, Mizuno and Karhu are sharpening technical portfolios—race shoes with tuned foams, trainers that compete on mileage and stability, and trail models with plated rockered geometries. They capture serious runners who want performance but also fit, foot health and trustable customer support. Independent labs and media outlets continue to rank these brands highly in 2025 buyer guides.

Culture and community brands

Tracksmith, Allbirds, and smaller niche labels will continue to grow by selling identity as much as tech. Tracksmith’s retro, “running class” aesthetic and community activation (brick-and-mortar clubs and storytelling) prove that apparel and coaching culture are powerful. Allbirds proves a different playbook: mainstream comfort + sustainability, which wins urban runners and recovery-day buyers rather than elite racers. These brands matter because they expand the market and make running a lifestyle choice, not just a performance pursuit.

Platform and tech-driven entrants

Brands that add software and sensing to footwear (or partner closely with sensor companies) will find recurring revenue and coachable improvement loops. Expect partnerships or verticalizations with companies such as Nurvv, Stryd, RunScribe, and new insole/smart fabric ventures; the product is no longer just a shoe but a “performance platform” — hardware + firmware + training insights. Academic and commercial advances in low-cost insoles and textile sensors (solar-assisted power, thin pressure arrays) are making embedded sensing feasible at scale. That opens new revenue: subscriptions for gait coaching, injury-prevention analytics, and bespoke training plans based on actual strike mechanics.

Beyond shoes

The shoe is the hero, but apparel and accessories become differentiators:

-

Smart apparel: Textile strain sensors and deep-learning models are moving from lab papers to commercial trials (AI-driven smart sportswear and transformer-based insole pose estimation). Expect shirts and compression garments that combine breathing data, posture cues, and running form feedback via phone apps or coach dashboards. Elite teams and coaching hubs will adopt these first; consumer versions will follow.

-

Modular race kits: Clothing designed to be minimalist for races (integrated pockets, sweat shedding, aerodynamic seams) that pair with specific shoe geometries. Brands that offer combined shoe+apparel “systems” for a target outcome (10k PR kit, marathon comfort kit) will stand out.

-

Recovery and health accessories: Insoles, foot beds, and targeted muscle oxygen sensors will be bundled as part of premium offerings—an ecosystem play similar to cycling (shoes, and power meter, and coaching). Stryd and RunScribe prove business model possibilities by offering hardware that feeds platforms.

Next brands to watch

Beyond the household giants, Adidas and Asics, New Balance and Nike, a mix of incumbents and insurgents will lead:

-

Puma — aggressively repositioning itself as a performance player with the Fast-R NITRO series and R&D investment; their claims and lab testing show measurable efficiency gains and real marathon adoption. Puma is a big example of a legacy brand reasserting performance cred.

-

On Running — Swiss design culture, cloud-style cushioning and robot-woven uppers; they continue to push geometry and manufacturing novelities while expanding apparel and community events.

-

Hoka, Saucony — innovation leaders on foam tuning and marathoner-focused models. Hoka’s blend of cushioning and rocker geometry, and Saucony’s race DNA, give them runway in both everyday and elite markets.

-

Brooks , Mizuno — Brooks on everyday support and sustainability; Mizuno with wave technologies and a premium running heritage.

-

Allbirds, Tracksmith — not for podium dominance, but for convincing significant segments of runners that sustainability and culture matter; Allbirds’ net-zero experiments and open recipe approach are important industry signals.

-

Startups — Nurvv, Stryd, RunScribe and a wave of smart insole/lab spinouts: these companies will either be acquired by footwear brands or will become essential partners for “connected” product lines. New low-cost research from universities (solar-powered pressure insoles, sub-$1 e-textiles) hints at scalable consumer deployments.

-

Regional and heritage labels — Karhu, Diadora, Salomon, and other regional specialists will continue to find loyal markets by mixing authenticity with technical improvements. They might not have the global reach of Nike, but they have credibility in niches (trail, mountain, classic track).

Business models and retail

-

DTC and community: Direct-to-consumer stores that double as running hubs, coaching clinics and product test centres (increasingly what Tracksmith and On are doing). Community fuels loyalty and word-of-mouth.

-

Subscription and service offerings: Shoe+insole+app bundles with monthly coaching or injury monitoring subscriptions. This spreads lifetime revenue and makes premium margins more dependable.

-

Circularity programs: Trade-in, refurbished midsoles, and “replaceable pods” make shoes cheaper to own and more sustainable—appealing to younger consumers and urban markets that prize ethics.

-

B2B to pro teams and nations: Winning elite teams or federations (as showcased in world championships and Olympics) still offers halo effects. But the proof points will increasingly be on durability, measured gains in running economy, and analytics support rather than sensational PR claims alone.

Personalisation and data

Two trends converge: personalization (fit, stiffness, drop, orthotic) and data-driven coaching. Expect:

-

At-home gait scans and local 3D foot printing for insole/upper customization.

-

Adaptive shoes (semi-modular soles or insole inserts sold separately to tune for tempo vs long run).

-

App ecosystems that use every run to improve shoe life estimates, suggest training adjustments, and pre-empt injuries via gait drift detection from smart insoles and clothing sensors. Research prototypes and commercial offerings (Nurvv, Stryd, and academic sensor papers) show the pathway is real.

2025 and beyond

Tokyo 2025, and similar championships, function as the laboratory and the billboard. Race selections — who wears what on the start line — influence amateur choices. But by 2025 the story is less about a single dominant plate and more about brand ecosystems: fit, coach buy-in, and marginal gains from sensors/coaching.

We’ll see more elite athletes experiment with combinations: a PEBA-based race day shoe, a resilient daily trainer from a specialist brand, and data-driven recovery tools supplied by third-party tech companies. That diversification of athlete tech choices will be mirrored across recreational markets.

So what should you watch over the next 5 years?

-

Material breakthroughs: New foams that match PEBA rebound but improve durability or lower carbon footprint.

-

Modularity: Shoes with replaceable midsole pods or swap-in plates that let one shoe serve multiple roles.

-

Sensor mainstreaming: Affordable, durable smart insoles and textile sensors integrated into mass-market trainers.

-

Sustainable product lines: More mainstream, non-niche circular products (e.g., Allbirds commercializing net-zero techniques).

The short story: the future of running shoes is plural, not monopolistic. The era of a single brand defining “fast” is giving way to a richer ecosystem where materials chemistry, modular product design, data services, sustainability credentials, and community authenticity all matter. As Tokyo 2025 shows, elite competition will continue to be a laboratory that accelerates adoption, but the commercial winners will combine measured hardware gains with software, circular economics, and lived community value.

When Piyush Gupta took over as CEO of DBS Bank in 2009, he inherited a bank that was deeply rooted in Singapore’s institutional banking history. It was a strong bank, well-regarded, but also very much a traditional banking organisation—hierarchical, with legacy systems, heavy use of branches, and with relatively low expectations for what “digital” might allow. Over the next decade and a half, Gupta reimagined what DBS could be: not merely a bank that digitises, but a bank that becomes embedded in people’s lives in ways where banking itself becomes largely invisible.

The transformation has been multi-year, deep, and has involved changes in strategy, culture, technology, structure, mindset, and how success is measured. It is the story of an incumbent bank doing more than incremental change—of trying, experimenting, failing, learning, iterating, and gradually turning itself into something that, for many observers, has become a template for what banking might become in an era of fintechs, smartphones, changing customer expectations, and new competition.

The Purpose: “Live more, bank less” and the Invisible Bank

In 2018 DBS formally unveiled a new brand promise: “Live more, bank less.” This was more than marketing. It underlined a shift in how DBS conceived of its role: not to pull customers into banking, branches, apps, or complex financial products, but to push banking out of the way—to make it so simple, seamless, embedded, invisible—so people had more time and mental space for the things they care about.

Gupta described this as enabling an “invisible bank,” where banking services are woven into everyday life rather than standing apart. This could mean marketplaces for utilities, property, or cars embedded into the bank’s digital channels; seamless cross-border remittances; APIs; tools for small-businesses that reduce friction; services that anticipate customer needs; and generally reducing the cognitive and physical load of banking.

This positioning was meant to align with several trends: smartphone ubiquity, customer expectations of speed, convenience, fewer steps; the shift in many industries from product to experience; the rise of platform businesses; and competition from fintechs and large technology firms moving into financial services. DBS saw that just adding digital features to old banking wouldn’t be sufficient—it needed to reimagine processes, systems, and culture.

Early Stages: Culture, strategy, and the first moves

Gupta had a background in Citi, in operations, payments and technology, which gave him both credibility and a perspective that banking could be more than what it was. Upon taking the CEO role, he asked whether he really got to run the company and whether he could transform its culture. From early on, he believed culture was not optional—it had to come first if the other parts of the strategy were to succeed.

A turning point came around 2013, when Gupta and the board recognised that digitalization would not simply be an incremental improvement. They saw what companies like Alibaba and Ant Financial were doing — payments, insurance, lending, etc., all operating via digital platforms without traditional branch networks or salespeople—and realised DBS would have to change its frame of reference. They began asking “What would Amazon do?” or “What would big-tech do?”, rather than merely looking at what other banks were doing.

From that point forward, DBS embarked on several strategic shifts:

-

A strong emphasis on customer journey thinking: mapping customer pain points, redesigning processes end-to-end (not just slapping on a mobile app).

-

The ambition to digitise deeply: not just front-end changes but middle and back-end, operations, risk, compliance. “Killing paper” was one mantra: trying to eliminate paperwork and manual steps wherever possible.

-

Reorganising how the bank works: agile teams, open spaces, cross-functional squads, usage of design thinking, embedding human-centred design labs and anthropologists, etc.

Hackathons, experiments, and mobilising the imagination

One of the signature features of DBS’s transformation was how it opened up experimentation inside the bank. Gupta and senior leadership deliberately used hackathons, internal experiments, and required that many parts of the organisation run experiments. The idea was not just to generate new products, but to shift mindsets—so staff at all levels felt empowered, aware they could try, fail, iterate, learn. And by exposing many people to this process, you build muscle—both psychological and organisational—for change.

Some of the key elements in this experimental culture:

-

In 2015, hackathons (including “MegaHackathon”) involving senior executives as well as start-ups were run. Staff who had rarely engaged with prototyping or coding were thrown into fast, 72-hour challenge sprints to prototype ideas.

-

Many of the experiments were mandated: in 2015, for example, “everyone’s KPI” included running an experiment. Senior leadership also had KPIs tied to owning customer journeys or employee journeys.

-

Collaborations with FinTechs / start-ups: hack-to-hire events, accelerators, ecosystems. DBS did not try to do everything internally, but partnered, invested, borrowed methodology. That included embracing lean startup, design thinking, feedback loops.

This imagination was applied to services and products as well: digital-only banks like digibank in India, mobile apps like PayLah!, innovations for SMEs, tools for cash management (Treasury Prism), etc. The objective was not simply to bring features but to reimagine what banking could feel like in the digital age.

Technology as enabler: platforms, APIs, data and infrastructure

Transforming culture is necessary but not sufficient: the tech scaffolding must support the new kinds of services and the speed of experimentation. Under Gupta, DBS made substantial investments in technology infrastructure, data analytics, AI/ML, cloud and microservices.

Some of the tech infrastructure moves included:

-

Moving toward API-based architecture and integrating services via APIs, enabling both internal modularity and external partnerships.

-

Building tech development hubs (e.g. outside Singapore: e.g. in India, Hyderabad) that are not just cost centres but innovation and value centres.

-

Embracing agile methodologies, “chaos engineering” (similar to practice in tech companies where resilience, failure, stress-testing are built into development) so new services are resilient.

-

Using data and analytics deeply: tracking customer behaviour; distinguishing digital vs traditional customers; measuring cost-to-serve, engagement; developing internal metrics / KPIs for digital value capture.

Through these, the bank could launch new products more rapidly, respond more flexibly, solve friction points in customer journeys, reduce branch-centric dependency, lower operational cost, while improving customer experience.

Culture shift: mindset, leadership, organisation

For many incumbents, culture is the hardest piece. DBS’s transformation is perhaps as much about the “people stuff” as about tech or strategy.

Key culture shift dimensions:

-

Leadership behaviour: Gupta personally involved in innovation; chairs Customer Experience Council and Innovation Council; taking roles in setting KPIs around customer journeys.

-

Mandating experimentation: experiments not optional, but expected; hackathons as both learning / ideation events and as cultural signal.

-

Flattening hierarchies: more cross-functional teams, open space design labs, breaking down silos, encouraging collaboration between traditional bankers and tech talent. D

-

Employee empowerment & learning: offering training, exposing staff to digital, design thinking, encouraging staff outside of tech or innovation to engage.

All this combined to generate increasing internal momentum: people began to believe change was possible. The confidence to try new things rose. Errors and failures were tolerated as part of learning rather than punished. Over time, the culture of innovation became embedded rather than being seen as a specialist function.

Multi-year transformation: phases, challenges, and scaling

Such transformation does not happen overnight. DBS’s journey can be seen in roughly phases, with different challenges in each.

-

Early diagnosis and strategy setting (around 2009-2013): When Gupta takes over, identifies need to change, sets direction: what is digital, what customer expectations are changing. In these early years, foundations are laid: customer journeys, innovation teams, initial experiments.

-

Execution and embedding (2014-2017): Running many experiments; redesigning internal processes; building infrastructure; launching new digital-only banks (e.g. digibank in India); moving some services to paperless, signatureless, branchless forms; evolving the brand promise. The “Live more, bank less” positioning comes in 2018 after the bank has made considerable progress.

-

Scaling, measurement, and refinement: As the innovation programmes produce some early successes and bumps, DBS invests more heavily, monitors what works and what doesn’t; refines its approach; scales successful experiments; improves tech reliability; builds platforms; ensures regulatory compliance; builds out marketplace features; strengthens risk and operations to support scale.

-

Recognition, external proof, continuous renewal: As DBS’s transformation gained traction, awards, external recognition increased; the bank continued to develop its offering, shift into new geographies; introduce new services; partner; invest in sustainability and purpose; anticipate regulatory, technological, and customer trend shifts. Along the way, there have also been challenges: tech glitches, regulatory demands, maintaining reliability and trust as innovation pushes boundaries.

Recognition and awards: the World’s Most Innovative Bank

DBS’s transformation has not gone unnoticed. Over recent years, DBS has collected many high-profile awards, recognition, and was repeatedly cited as a leader in digital banking innovation.

Some of the recognitions include:

-

Euromoney “World’s Best Digital Bank” multiple times.

-

Awards from The Banker, Global Finance, IFR Asia among others, as “Asia’s Best Bank”, “Best Bank in the World,” etc.

-

In 2019, DBS achieved the rare feat of simultaneously holding three global titles: “Bank of the Year” by The Banker, “Best Bank in the World” by Global Finance, and “World’s Best Bank” by Euromoney.

-

Numerous other industry awards and trailblazer acknowledgements (Retail Banker International Asia Trailblazer Awards, etc.).

These recognitions serve two functions: external validation (useful for investor confidence, regulatory legitimacy, recruiting talent) and internal motivation (reinforcing that the transformation is real, that efforts are being noticed, giving internal stakeholders signals that change is paying off).

What Changed, what gains, what gaps?

By transforming in this way, DBS achieved many of its goals, though not without challenges and trade-offs.

Gains

-

Customer experience improvements: reduced waiting times, more digital channels, smoother journeys, more convenience. Branch-centric friction was reduced.

-

New digital products and services: digibank, mobile wallet apps, tools for SMEs, improved cash management, faster cross-border remittances, marketplaces embedded in bank platforms.

-

Operational efficiencies: with digital tools, automation, reduction of manual work, paper, more flexible tech stack, cost savings in some parts of the bank. Also improved data practices so that decisions are more evidence-based.

-

Cultural engagement: staff more involved, more skill development, more willingness to try new things. Many internally report that the bank feels different: faster pacing, more experimentation.

Challenges, Gaps, Tensions

-

Reliability vs agility: pushing innovation and speed can expose systems to strains. As reported in recent years, DBS has faced regulatory scrutiny for tech failures / service outages. These show that as banking becomes more digital and embedded, any failure can have bigger consequences.

-

Balancing risk, regulation, security: financial services are heavily regulated. Innovating in payments, data, AI, cross-border services demands strong risk, compliance, cybersecurity. Not trivial to keep pace.

-

Profitability of new ventures: some experiments take time to reach scale or profitability; getting the right customer segments (as in the digibank India vs Indonesia experience) is tricky. Learnings from early missteps inform later decisions.

-

Cultural inertia: no transformation completely resets all legacy behaviour. Old ways of doing things, risk aversion, silos, hierarchical decision-making persist. Changing mindset is slower than changing tech. Also attracting and retaining tech/innovation talent in competition with fintechs and tech firms is a challenge.

“Invisible Banking” in practice

What does the invisible bank look like when you pull back from all the rhetoric? What are some examples of how DBS has embedded banking deeper into customers’ lives, reducing friction and making banking less front-and-centre?

-

Marketplaces embedded in the bank’s digital channels (for cars, property, electricity) so customers can take care of non-banking life tasks in or adjacent to their banking experience.

-

digibank in India (branchless, paperless, signatureless) represents a leap toward banking that exists only in the mobile / digital sphere

-

Tools like Treasury Prism for corporate clients, which simplify cash-management operations.

-

For individual customers, mobile wallets (PayLah!), apps, digital onboarding, fewer in-branch requirements. Predictive analytics, personalisation, anticipating when customers need which product or service.

Through all this, DBS sought to reduce the need for customers to think about banking—to reduce steps, to eliminate friction, to anticipate needs. The idea is that paying for groceries, saving, transferring money, getting a mortgage, etc., become part of everyday life, not separate or onerous tasks. That is the invisible bank.

Scaling and sustaining transformation

For a bank as large as DBS, sustaining this transformation over many years has required discipline, investment, and continuous renewal.

-

Measurement and metrics: DBS developed a “digital value capture” methodology to measure things like return on equity for digital customers vs traditional customers, transaction frequency, cost to serve, etc. This helped make the business case for digital investments more concrete.

-

Investment in infrastructure: tech hubs, cloud migration, modular APIs, more insourced tech so as to reduce reliance on third-party legacy dependencies.

-

Governance and leadership alignment: senior leadership bought in; KPIs aligned; boards supportive; leadership behavior modelling change. Without alignment at the top (CEO, senior teams, board) many such efforts fail. Gupta insisted on leading from the front.

-

Repeat, iterate, learn: experiments often start small, then scaled; some failed; some succeeded; learnt from failures. For example, lessons from digibank in India fed into strategy in Indonesia.

Beyond awards, the legacy is visible in many fronts: the number of customers using digital channels; the bank’s ability to respond to disruptions; generally high customer satisfaction; consistent financial performance (profits, growth); and the reputational capital that allows DBS to compete both with legacy banks and with fintechs / tech-enabled challengers. Also visible in the way DBS has influenced other banks in Asia and beyond: its practices around design thinking, API architecture, innovation culture, experimentation are often cited case studies.

New CEO, and the journey continues

After some 14-plus years guiding DBS through this transformation, Piyush Gupta retired in March 2025. His deputy Tan Su Shan stepped up to succeed him as CEO

This leadership transition comes at an opportune and challenging time: while the foundation is strong (technology, culture, recognition, customer base), the bank must maintain momentum, handle rising expectations (from customers, regulators, investors), ensure reliability (especially digital infrastructure), keep up with rapidly evolving AI / machine learning / sustainability / regulatory pressures, navigate macroeconomic headwinds, and continue to adapt.

The question going forward is: how much of the transformation is institutionalised so that it survives CEO transitions, market shocks, technological disruption? Will the “invisible bank” thesis continue to guide strategy? Will experimentation continue to be a core competency, not a luxury? Will culture remain agile, learning-oriented, and focused on customer journeys?

Lessons from DBS’s Reinvention

DBS’s transformation under Piyush Gupta offers many lessons—for banks, for incumbents more broadly, and for organisations hoping to become more digitally native and customer-centric.

-

Start with purpose, not just technology. The purpose (“Live more, bank less,” invisible bank) gives direction. It helps align everything—culture, strategy, product, tech. Technology without purpose tends to produce disconnected experiments.

-

Culture is central. You can change systems, hire technologists, build apps—but unless the culture empowers experimentation, tolerates failure, gives people agency, aligns leadership, you will hit resistance, slow uptake, and reverse-sliding.

-

Experiment broadly, fail fast, learn and scale. DBS didn’t wait for perfect; it ran many experiments, some of which failed; many small, many in parallel; prioritized learning. Hackathons, KPIs tied to experiments, cross-functional teams helped.

-

Measure impact rigorously. Not just customer satisfaction or adoption, but linking digital customers to profitability, cost to serve, return on equity, etc. That gives legitimacy to investments.

-

Invest in tech infrastructure early and deeply. Legacy systems are a drag; to enable agility, scalability, reliability, embedding banking invisibly requires a robust, modular, API-friendly, cloud-capable stack.

-

Leadership matters. Having a leader who is deeply committed, willing to take risk, push culture, show up, lead from the front makes a big difference. Also, aligning incentives and governance so that leadership is held to building the future, not only delivering past metrics.

DBS’s transformation under Piyush Gupta is one of the clearest modern examples of how an incumbent financial institution can reimagine itself—not simply to digitise and reduce cost, but to become more of a platform, more invisible, more embedded in customer lives. The “Live more, bank less” purpose is not just a slogan; it has guided strategy, culture, product design and organisational form.

Because it has been sustained over more than a decade, with repeated experiments, learning, measurement, cultural change, and deep investment in technology, DBS has earned wide recognition—not just for innovation, but for performance, for customer experience and for being ahead of many peers in understanding what banking could become in the 21st century.

Looking back on Gupta’s transformational journey, the legacy is strong, though by no means perfect or fully complete. The challenges ahead are substantial: maintaining reliability under complexity; staying ahead of rapidly changing technology (especially AI, regulation, platform competition); staying true to the invisible bank promise when trade-offs between innovation, risk, and cost are difficult. But DBS has shown that transformation of this scale is possible; that culture, technology, imagination and purpose can combine to change what a bank is.

Each month The Brand Doctor, aka business expert Peter Fisk, takes a global brand that has lost its way, and considers how it could reinvent itself. If it’s your brand, do you have the courage to change? If not, what would you do, and how could you apply these ideas for reinvention to your own business?

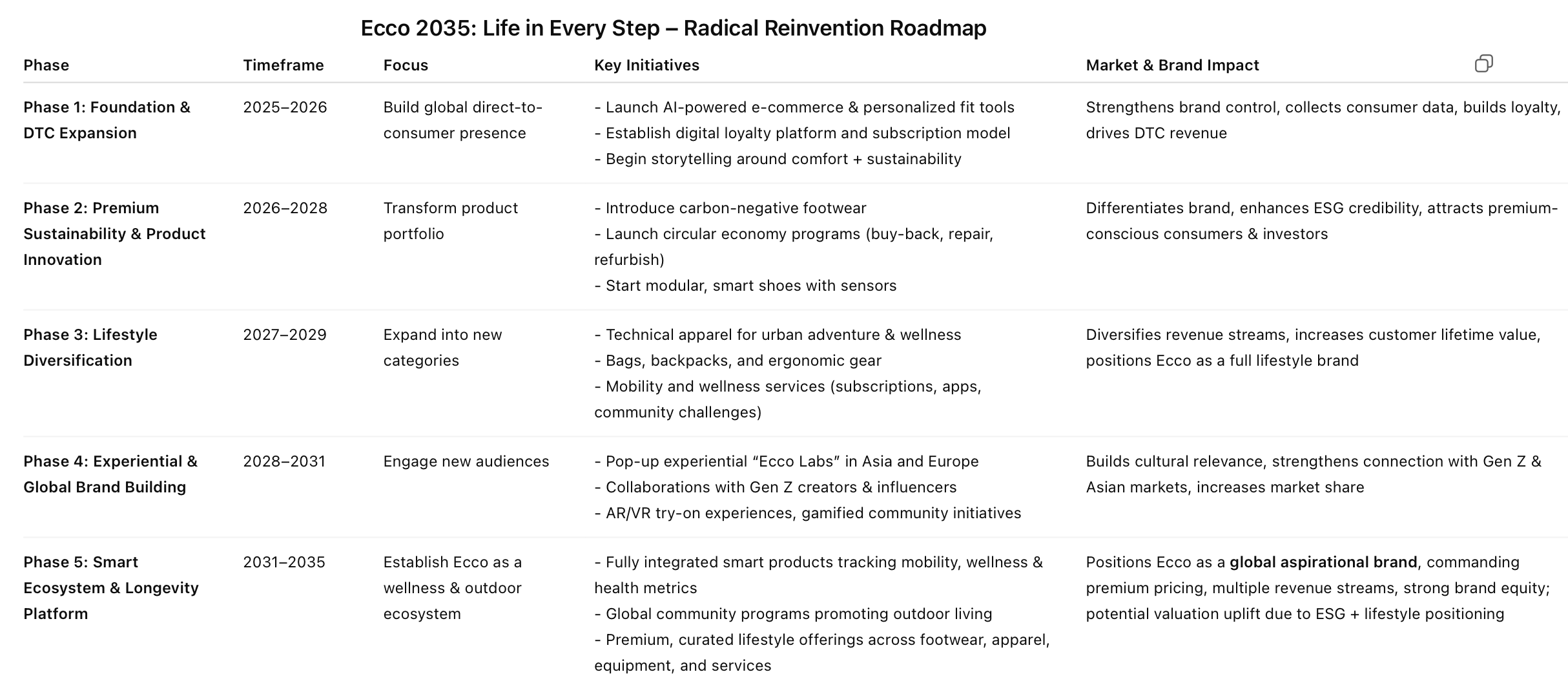

Ecco

For decades, Ecco has been synonymous with comfort and craftsmanship. The Danish footwear brand earned its reputation producing high-quality, durable shoes and leather goods, combining elegant Scandinavian design with the promise of all-day comfort.

Yet as the global market evolves, consumer behaviour shifts, and sustainability becomes central to brand value, Ecco faces a pivotal moment: to remain a leader, it must reinvent itself for the future.

This reinvention requires more than incremental change—it demands a radical rethinking of the brand, its audiences, and its products.

The concept at the heart of this transformation is simple yet profound: “Live Outdoors.” By embracing the idea that life, wellness, and human experience thrive outdoors, Ecco can create a new lifestyle platform that appeals to a broad spectrum of global consumers while opening multiple revenue streams beyond traditional footwear.

Review: What’s the problem?

Despite a strong reputation for comfort, quality, and craftsmanship in footwear, the brand faces growing challenges in today’s fast-evolving global market. Its core strength—functional, all-day comfort—has limited appeal to younger, style-conscious consumers. Gen Z and Millennials increasingly prefer brands that combine trend-forward design, sustainability, and lifestyle relevance, leaving Ecco perceived as safe but uninspiring.

Of course, not every brand needs to focus on young people first. The money, and growth, is often in older audience.