Coca-Cola’s Y3000 initiative showcases how AI can drive both product innovation and consumer engagement. Using AI to analyze global preferences and emotions, the company created a futuristic limited-edition flavor, Y3000 Zero Sugar, designed to resonate with forward-looking consumers. The initiative also includes the AI-powered Y3000 CAM, an augmented reality feature that lets users scan packaging to unlock personalized visual experiences, deepening brand connection. Launched in select global markets, Y3000 positions Coca-Cola as a leader in integrating AI into product development and marketing, blending creativity, technology, and strategic market insight.

Running is undergoing a quiet revolution.

Once a solitary, performance-driven pursuit defined by stopwatch times and shoe design, it is becoming something far broader — a social, digital, and emotional ecosystem that touches every part of life. In the next decade, the companies that lead this transformation will not be the traditional shoe brands that once defined the category, but those that can connect running into wider systems of wellbeing, community, data, and purpose.

The changing rhythm of running … from stopwatch to state of mind

Twenty years ago, running was largely the same the world over. You laced up a pair of shoes, went out the door, and sought to run faster or further. Success was measured by the stopwatch or the finish line. Yet over the past two decades, running has exploded — not only in numbers, but in meaning. More than 400 million people now run regularly worldwide, twice as many as at the turn of the millennium. The motivations, settings, and cultures of running have diversified just as dramatically.

For some, it is still a test of human endurance. For others, it is a form of therapy, a mindful escape, or a daily ritual of self-care. The marathon runner chasing a sub-three-hour finish now coexists with the park jogger seeking twenty minutes of calm before work, the city crew running through neon-lit streets to a DJ soundtrack, and the remote worker breaking up their day with a 5K for mental clarity.

The rise of everyday running — inclusive, adaptive, creative — is redefining what the sport means. It has shifted from an activity towards a lifestyle, from a performance metric to a cultural identity, and from a product market to a full-spectrum ecosystem.

A more diverse and purposeful movement … new faces, new feelings

The modern running landscape is shaped by participation that is more diverse than ever. Women now represent close to half of all recreational runners worldwide, compared to barely a third in the early 2000s. New life stages are entering the fold — retirees who run for longevity, parents seeking energy and resilience, teenagers drawn by digital challenges and social belonging.

The motivations have fragmented and multiplied. In London, the fastest-growing demographic of runners are over forty, using running to manage stress and health. In Lagos and Nairobi, social running clubs have become new status symbols of ambition and connectedness. In Tokyo, night running is booming among younger workers as a counterweight to long office hours. Across cities from Berlin to Buenos Aires, women-led crews are redefining safety and confidence through visibility — turning running into a form of quiet activism.

The “why” of running has changed as much as the “who.” What was once about achievement is now about alignment — the pursuit of balance, vitality, and purpose. For many, running has become a means of self-expression rather than self-competition.

As the world changes, running changes … reshaping how and why we run

Running does not exist in a vacuum; it mirrors the world’s larger forces. Climate change is already influencing when, where, and how people run. In hotter regions, early morning and indoor running are replacing midday outings. Cities from Singapore to Barcelona are introducing shaded “runable corridors” to protect citizens from heat stress. Shoe brands like On and HOKA are exploring breathable, heat-adaptive materials.

Meanwhile, air quality and environmental awareness are pushing runners towards greener routes, trails, and nature-based experiences. Trail running — once a niche sport — is now one of the fastest-growing segments globally, not only for its physical challenge but its restorative power. Yet even here, new tensions emerge: the impact of mass trail events on fragile ecosystems, and the growing need for climate-resilient recreation.

Technology is another shaping force. Data, wearables, and digital communities have transformed running into a connected experience. A decade ago, the idea of a virtual marathon was unthinkable. Today, digital races on Strava, Garmin, or Zwift connect runners across continents. AI coaching, once reserved for elites, is being democratised through platforms like Runna, NURVV, and Nike Run Club.

Urban design, too, is playing its part. The most progressive cities now view running not as sport but as public health infrastructure. Paris, Copenhagen, and Melbourne are weaving running routes into their green mobility networks. In this sense, the future of running is not only on our feet but in our cities.

The Rise of “Soft Performance”

The old gospel of running was “faster, further, harder.”

The new one is “smarter, steadier, kinder.”

For decades, the culture of running revolved around personal bests. Progress was measured in numbers — faster times, longer distances, higher VO₂ max scores. But there is a growing rebellion against this relentless quantification. The new generation of runners is less obsessed with speed and more concerned with sustainability — both personal and environmental.

The idea of “soft performance” is taking hold. It values consistency over competition, recovery over strain, and enjoyment over exhaustion. The best run, for many, is not the hardest, but the one that feels best — a run that fits into a balanced, emotionally intelligent lifestyle.

This philosophy is being reflected in training methods, recovery tools, and even shoe design. Biomechanics is moving from maximising output to preventing injury. Companies such as ASICS are developing gait-optimised shoes that adapt to runners’ form and fatigue. Recovery is becoming an active domain — with brands like Therabody, Hyperice, and WHOOP turning rest and regeneration into science.

The “future runner” may not be the fastest, but the most adaptable: someone who runs with awareness, recovers intelligently, and integrates running into a long and healthy life.

The age of intelligent running … data gets personal and emotional

Technology’s next wave is not about tracking more data, but about making it more meaningful. Today’s runners can measure everything from cadence to heart rate variability, yet the real innovation lies in turning those insights into personalised, actionable guidance.

AI coaching systems are already learning from individual physiology and behaviour. Imagine an algorithm that knows not just how you run, but why — adjusting your plan when you’ve had a stressful day, slept badly, or need a boost of motivation. These systems are evolving into companions rather than monitors.

The next frontier will be integrated intelligence — where devices, clothing, and shoes talk to one another in real time. Shoes could detect imbalance and adjust cushioning mid-run; a smartwatch might signal an adaptive cool-down when stress hormones rise. Data could sync seamlessly with nutrition, sleep, and emotional tracking to create a complete picture of wellbeing.

Yet with this progress comes a critical question: who owns the runner’s data? As the value of personal performance data rises, the power may shift from brands to platforms — from Nike and Adidas to Apple, Strava, and healthtech ecosystems like Garmin Connect or Fitbit. The competition is no longer for market share in footwear, but for the digital relationship with the runner’s life.

By 2035, personalisation could go even further. We may see modular, 3D-printed shoes built to a runner’s gait and muscle composition, with replaceable elements to extend life and reduce waste. Sustainability and precision will merge — creating a new generation of “smart shoes” that are less about fashion and more about personal optimisation.

The Psychology of the New Runner … mirror of the modern psyche

Behind every data point is a human story. Runners today are motivated by deeper psychological needs than in the past — autonomy, belonging, recovery, and meaning. For Generation Z in particular, running is a form of identity — not just a hobby but a signal of values: authenticity, community, and care for self and planet.

Social media has amplified this. Platforms like Strava have become digital town squares where runners share routes, moods, and milestones. Yet the same technology can also breed comparison anxiety. The pendulum is swinging toward more mindful, private, and sensory experiences.

The “soft performance” mindset embodies this shift. Progress might mean running without headphones, noticing the rhythm of breath, or using the run to process emotions. These are not measurable outputs, but qualitative ones — reflected in mood, confidence, and consistency.

At the same time, the psychology of running is being reshaped by health trends like GLP-1 drugs, which are changing attitudes to body image and weight. The challenge for the running ecosystem will be to stay anchored in intrinsic motivation — movement as joy and vitality — rather than as a response to pharmacological quick fixes.

Running as culture and community … crews and collectives

Running is no longer just a sport; it is a cultural language. Across the world, running communities are expressing creativity, identity, and social connection in ways that transcend competition.

In New York, Black Roses NYC turned night running into a cultural movement blending street fashion, hip-hop, and rebellion. In Paris, the Run Dem Crew inspired an entire generation of urban runners who value self-expression over split times. In Mexico City, crews like Aire Libre blend running with indigenous spirituality and eco-awareness.

These communities are shaping the social architecture of running’s future. They are fluid, diverse, often non-hierarchical — reflecting the values of younger generations. Some gather weekly in local parks; others connect through global challenges and digital races. The formats are hybrid: hyper-local but globally visible.

Women-led running groups are perhaps the most transformative force. Crews like Adidas Runners Women in Berlin, She Runs It in Johannesburg, and Tokyo’s Women’s Run Collective are redefining what it means to feel safe and seen. These spaces are about belonging first, running second — yet they are expanding participation more effectively than any marketing campaign.

For brands, these communities are the new frontiers of engagement. They exist outside traditional sponsorships or product launches, but they are shaping cultural relevance and loyalty in ways advertising never could.

The call of the wild … climate, travel, and the outdoors

As the climate crisis intensifies, running is being redefined by geography and ecology. Warmer climates are pushing runners toward morning and evening slots; poor air quality is driving the rise of indoor running and treadmill communities. Companies like Peloton and Zwift have turned indoor running into social, gamified environments.

Meanwhile, trail running is booming — part of a wider shift toward nature, adventure, and reconnection. Brands such as Salomon and The North Face are thriving in this space, but so too are wellness brands offering “run retreats” that blend mindfulness, nature, and community. In Iceland, trail running festivals draw thousands of participants combining fitness with environmental awareness. In Japan, the tradition of forest bathing has merged with slow running — a mindful immersion in nature rather than a race against it.

Climate-resilient running will demand new gear, new routes, and new attitudes. Shoes made from plant-based foams, breathable recycled materials, and circular production will become standard. Smart apparel will monitor hydration and UV exposure. But the greater change will be philosophical: a realisation that running is not apart from nature, but part of it.

The future ecosystem … from product to platforms, brands to ecosystems

The greatest shift now underway is structural. For half a century, running’s ecosystem revolved around the shoe companies. Nike, Adidas, ASICS, New Balance, and others designed products, sponsored athletes, and orchestrated the culture. They built the marketing narratives, the race partnerships, the visual identities of running itself.

But that era is fading. The running ecosystem is now too broad, too interconnected, to be controlled by any single category. The power is moving from product to platform — from objects to systems.

Apple, Strava, Garmin, and WHOOP are increasingly the orchestrators of running’s digital lives. Lululemon, once an apparel brand, now occupies the intersection of yoga, mindfulness, and running — representing a more holistic expression of health. Even healthcare providers and insurers are entering the space, rewarding runners for activity as part of preventative health programmes.

In this new landscape, running is less about what you wear and more about what you connect to. It is a network of devices, communities, experiences, and values — a system that stretches from footwear to food, from yoga to recovery, from data to design.

Traditional footwear brands still matter, but their roles are changing. They can no longer simply sell shoes; they must create ecosystems of experience. Nike’s move into digital coaching, community apps, and sustainable materials is a start. On’s partnership with Strava, and its experiments with subscription footwear, hint at new models. Yet the real opportunity lies in integration: connecting running with sleep, nutrition, mindfulness, and longevity.

The next great orchestrator of running may not be a shoe brand at all, but a health platform that unites all these threads — a company that sees running as one element of a longer, healthier, more meaningful life.

Defining the next decade … future tensions and scenarios

The evolution of running will not be linear. It will be defined by a series of tensions — between performance and pleasure, data and intuition, solitude and community.

Some runners will embrace the quantified self, using AI and biometrics to perfect every stride. Others will seek liberation from metrics, embracing “barefoot data” — the art of running by feel. Urban runners will weave through city parks with smart headphones that guide their route and rhythm, while others will disappear into forests with nothing but breath and soil.

By 2035, four scenarios could emerge:

- Integrated Health Ecosystem will see running merge with healthcare, insurance, and digital wellness — a core pillar of preventative medicine.

- Tech-Augmented Athlete will live within a full feedback loop of integrated data and technology, sensors and AI.

- Nature Revival will drive a counterculture of digital minimalism, eco-running, and slowness.

- Community Renaissance will transform running crews into micro-brands and social enterprises that shape local culture.

Each of these futures will coexist, offering different expressions of what running means in modern life.

Beyond the finish line … bold bets and blind spots

The boldest prediction for the next decade is that the running industry will no longer be led by footwear brands. Instead, it will be absorbed into a trillion-dollar personal wellbeing ecosystem — one that spans health, data, mobility, and lifestyle. The companies that thrive will not be those who design the best shoes, but those who orchestrate the richest systems.

The greatest blind spot today lies in emotion. Running is ultimately a feeling — a rhythm of body and mind. As technology and data multiply, the human experience risks being lost. The brands that succeed will be those that design for emotion as much as function — crafting experiences that make people feel alive, connected, and grounded.

Shoe brands have dominated the running market for a century – because running is essentially the simplest form of sports – all you need is a decent pair of shoes. But that could easily change. As the aspiration becomes more than the run, the brands who can capture a bigger idea, connect the system, and do more for people, is the brand they will trust most. These brands will become the new ecosystem orchestrators

It is about reweaving movement into the fabric of everyday life — as medicine, as mindfulness, as connection. The future of running belongs to those who can move beyond shoes to systems, beyond performance to purpose, and beyond sport to something more elemental: the ongoing reinvention of what it means to be human in motion.

Each month The Brand Doctor, business expert Peter Fisk, takes a global brand that has lost its way, and considers how it could reinvent itself. If it’s your brand, do you have the courage to change? If not, what would you do, and how could you apply these ideas for reinvention to your own business?

Beyond the Spritz

In the golden light of a European summer, the cheerful orange-hued glass of a Aperol Spritz has become nothing less than an icon of modern lifestyle drinking. It signals sundowners, friendship, sociability, the terrace hour, the turn from work to leisure. Yet, today this icon finds itself at a crossroads. For the parent company, Campari Group, Aperol is a financial powerhouse—accounting for roughly a quarter of global revenues. But that very success brings pressure: growth needs to come not just from more Spritzes in more bars, but from reinvention—into new geographies, new formats, new occasions and even new brand extensions.

We explore the history of Aperol, its pivotal role within the Campari Group, the strategic challenges it faces, and the bold opportunities ahead. It ends with a recommendation of where the most significant financial prize lies—both in terms of sales growth, profitability and value creation—and how Campari should mobilise the brand to capture it.

From regional aperitif to global cultural moment

Aperol’s story begins in Padua, in 1919. Conceived by the Barbieri brothers, it was designed as a light-alcohol bittersweet aperitif, made with sweet and bitter oranges, gentian, rhubarb and cinchona bark. From those humble Veneto roots, the brand lingered in northern Italian cafés for decades before the modern explosion of the “Aperol Spritz” serve—Aperol plus prosecco plus soda—emerged in the 1950s and onward. Over time, that serve developed from a regional ritual into an international lifestyle emblem.

When Campari Group acquired Aperol in 2003, the brand entered a new phase. With a conscious globalisation strategy, the company turned the cocktail into a cultural export: think sunset terraces, orange-glow glasses, summers in Europe, photos on Instagram. Underpinned by that visual identity and the simplicity of the serve, Aperol rode two intersecting consumer trends: the rise of lighter, more social drinking (it has only 11 % ABV) and the urban, experience-driven shift in cocktails and aperitivo culture.

By 2019, the brand had achieved annual growth of around 16.5 % (pre-pandemic) and had become the group’s key engine of growth—the “spritz” moment made it a phenomenon. Today, Aperol constitutes approximately 24 % of Campari Group’s global sales, making it the single largest brand in the portfolio. To meet that scale, in 2024 Campari announced a €75 million investment to double Aperol’s production capacity in its Novi Ligure plant, adding 100 million bottle units of capacity via a new bottling line.

Aperol transformed from a local aperitif into a global lifestyle brand, and the Spritz become shorthand for “early evening, convivial social time”. It delivered serious growth, and for Campari, became the crown jewel brand.

Current situation: strength and strain

Insta perfect

Aperol brings a number of powerful advantages to the Campari portfolio. It is recognisable, rooted in a strong narrative (Italian aperitivo culture), visually compelling (its distinctive orange hue), and aligned with major social drinking trends (lighter ABV, shareable serve, Instagrammable moment). It has successfully moved beyond Italy and is present in dozens of markets worldwide. In many geographies Aperol contributes disproportionately to Campari’s headline numbers—for instance, growth of the brand helped the UK business post 19 % sales growth in the UK in 2018.

With that leverage, Campari has invested in capacity, branding, and infrastructure accordingly—reflecting a belief that Aperol remains the group’s long-term growth lever.

Changing markets

However, the current state is not without its warning signs. First, the growth story is increasingly one of “more of the same” rather than radical new levers. The Spritz serve is well penetrated in Europe, and any brand that becomes iconic risks plateauing. In a 2021 interview Campari flagged that while Aperol still had “huge opportunity ahead of us” there was a recognition that in its home market of Italy the brand may have already saturated many of the core aperitivo households.

Second, structural dependence is an issue: Aperol is the aperitif brand, but the key serve—the Spritz—requires sparkling wine (or at least sparkling beverage) + soda + ice + orange garnish. Campari controls Aperol, but not the wine or soda component. This limits the brand’s margin control, and consumer experience can vary by how the serve is executed by bars or home hosts. That dilution of control is a strategic constraint.

Third, the global drinks sector is shifting. Health, moderation, and low-/no-alcohol trends are accelerating, and while Aperol’s 11 % ABV is lower than many spirits, it is still an alcoholic drink. On-trade channel dynamics are evolving (home consumption, RTD formats, regulatory scrutiny), and the explosion of RTD spritz-type cocktails and competitor brands (rosé spritzes, flavour variants) threaten to dilute Aperol’s exclusivity.

Fourth, geographic expansion remains challenging. While the brand is strong in Europe, growth in Asia, Latin America and other under-penetrated markets requires overcoming local consumption cultures, regulatory frameworks, and distribution logistics. Campari’s recent results indicate that overall growth is moderating: for example, the full-year 2024 net sales of Campari Group were €3.07 billion with only 2.4% organic growth.

Campari’s financial dependence

From a financial perspective, Aperol’s importance cannot be overstated. As noted, it is roughly one-quarter of group sales. The company’s investment in capacity underscores the expectation of further growth. The doubling of the bottling line suggests an expectation of significant volume increase. Its growth rate (historically double-digit) has driven margin expansion, high returns on invested capital, and contributed materially to the premiumisation narrative of the group. With Aperol considered “high margin” within the portfolio, the brand has delivered above-average profitability.

Aperol is the growth engine in the Campari Group portfolio—big, powerful, and relatively premium. But the model that got it here—Spritz + sunset terraces + friendly social hour—is reaching maturity. The next phase of growth must come from reinvention rather than reliance.

Options for reinvention

Given the backdrop of both opportunity and saturation, the question for Campari is: how can Aperol evolve? What are the strategic pathways open to the brand? Below we explore several major themes—each carries distinct implications for sales growth, profitability and value creation.

New geographies

The first frontier is geographic expansion. While Europe remains the stronghold, there is considerable scope in Asia, Latin America, Africa and parts of North America. For Campari Group, the Asia-Pacific region currently accounts for only around 7-8% of group sales—a relatively small base for future growth.

In those markets, Aperol can be positioned as a globally aspirational lifestyle brand—a European tradition brought to vibrant, fast-growing urban hospitality scenes. In Asia especially, there is growing appetite for premium imported brands, experiential drinking, rooftop bars, and social occasions that mirror Western aperitivo culture.

However, entry will require adaptation: local consumer tastes (perhaps preferring less bitterness, more sweetness), climate considerations (very warm regions mean faster ice-melting, more soda dilution), distribution/logistics, import duties and regulatory complexity. It may also require local partnerships (with sparkling wine producers, soda producers, local bar chains) and heavy investment in on-trade activation to educate consumers about the spritz ritual.

Geographic expansion offers pure volume growth: if Aperol can penetrate new markets, the brand can move from being a European success to a truly global brand. The logic for value: large volume + premium price + high margin = significant incremental profitability. The multiplier effect is clear because incremental volume tends to yield incremental margin and also benefit from scale in marketing and bottling.

Format innovation

Second, format innovation offers another lever. The original Spritz serve is simple and strong—but times have changed. Consumer behaviour now includes more at-home consumption, more convenience, more RTD (ready-to-drink) formats, and more drive towards lower-alcohol, convenient serve solutions.

Some possible format directions:

-

RTD cans and bottles: Pre-mixed Aperol Spritz in a can or bottle for home, outdoor, picnic or festival consumption. This extends the brand beyond bars and restaurants into retail, convenience and leisure. For Campari, this means capturing incremental channel share in off-trade and perhaps improving margin (depending on cost/packaging).

-

Bar tap and on-premise dispense solution: Imagine a dedicated “Aperol Spritz on tap” solution for bars and clubs: a chilled keg or cartridge system where Aperol + sparkling wine + soda is dosed automatically, ensuring consistency of serve and speed of service. This would give bar operators an easy route, and Aperol further brand visibility. However it may dilute premium perception if the serve becomes “cheap, easy, high-volume”.

-

Home kits and accessories: Branded home-entertaining kits (bottle of Aperol + branded glassware + garnish + instructions), or portable versions for outdoor/holiday use. These reinforce the lifestyle positioning of the brand and drive premium margins.

-

Low/no-alcohol variant: While the current Aperol is 11 % ABV, there is growing demand for moderation and social drinking without over-intoxication. A “Aperol Light” (eg ~6 % ABV) or “Aperol 0.0” (non-alcoholic version) could open new segments—drivers, health-conscious, younger consumers.

-

Flavour variants: Extensions such as “Aperol Citrus Twist”, “Aperol Berry Spritz”, or region-specific flavours (e.g., Asian variant using lychee, yuzu) can inject freshness. Each variant refreshes interest, stimulates trade and builds “spritz franchise” rather than single product.

Format innovation brings both margin upside and channel extension. RTD and kits can improve margin if priced premium and sold in growing channels; low-/no-alcohol variants open new consumer segments and help future-proof the brand; bar-tap solutions provide on-trade advantage. The key is to manage complexity, protect core brand positioning and avoid cannibalisation of the classic serve.

Occasion expansion

Third, one of the most compelling opportunities lies in occasion expansion—that is, going beyond the pre-dinner aperitif moment into new social rituals and times of day. Historically, Aperol Spritz has been associated with early evening, pre-dinner ritual—the terrace hour, the end of the workday. But consumer living patterns are changing: brunch, rooftop poolside, day-drinking, home entertaining, outdoor lifestyle, and even the “after-dinner digestif/long-drink” moment are becoming important.

Possible new occasions:

-

Brunch or late-morning social sip: Position Aperol Spritz as the daylight social drink for city-brunch, weekend terrace, poolside lunch. The lighter ABV and refreshment factor suit daytime.

-

Home-entertaining and social gathering: Strengthen the narrative of Aperol being the host’s friend—easy serve, fun flavour, social sharing. Home entertainment has grown in importance, especially post-pandemic.

-

Outdoor leisure and holiday lifestyle: Insert Aperol into beach-bars, pool-side resorts, rooftop terraces, picnic kits—turn it into a holiday symbol beyond the city bar.

-

After-dinner or night-out transition drink: Perhaps less intuitive, but positioning a variant of Aperol as the “end of the evening” drink—lighter than heavy cocktails, still social, a way to prolong the night rather than start it.

-

Non-alcoholic social sip and driver inclusion: With moderation rising, there is opportunity for Aperol-branded mock-spritz alternatives for non-drinkers/ drivers/social inclusivity.

Occasion expansion is powerful because it increases frequency of consumption and penetration of contexts. If the same consumer could have an Aperol moment not just once after work but again at brunch, at home, on holiday, the brand’s share of occasion rises. For profitability, this means incremental volume against existing infrastructure, higher utilisation of capacity, and improved return on marketing investment. From value-creation perspective, building the brand into “the social sip of multiple moments” enhances brand equity and resilience.

Lifestyle ecosystems and brand experience

Fourth, going beyond bottle to experience offers a premium layer of value creation—turning Aperol into more than a product, but a lifestyle ecosystem. Brands such as Fever‑Tree (premium mixers), Red Bull (energy lifestyle) and even hospitality offshoots (e.g., branded cafés, bars) show how brand can move into service and space.

For Aperol, this might mean:

-

Branded Aperol Spritz Bars in major global cities (London, New York, Shanghai, Sydney) with signature décor, Spritz flight menus, curated music, perhaps even sunset-only opening hours. This builds brand visibility and premium feel.

-

Pop-up activations: rooftop terrace events, beach clubs, festival lounges targeting the social-media generation.

-

Branded glassware and home accessories: limited-edition glass sets, ice buckets, portable cooler bags, all reinforcing the ritual.

-

Partnerships with hotel rooftop bars, cruise lines, airline lounges—places where lifestyle meets affordably premium.

While this is more capex-intensive (or partner-intensive) than a pure-product play, it carries brand-equity upside. A stronger lifestyle brand commands premium pricing, better margins, and is more insulated from commoditisation. It also helps protect against dilution from competitive “spritz” knock-offs by embedding the brand into place and experience.

Channel and value-chain control

Finally, an often-overlooked dimension: capturing more of the spritz value chain. As mentioned, Aperol is the aperitif component—but the spritz serve also relies on sparkling wine and soda. Campari may look to secure more control of these adjacent elements. Possible steps: co-brand or partner with a premium sparkling wine (prosecco or equivalent) under the Aperol banner; create pre-mixed bottles where Aperol is blended with sparkling wine and soda; create experiential kits that include all components and branded service.

This move would allow Campari to capture more margin, improve reliability of consumer experience, reduce reliance on third-party sparkling wine performance, and fortify the brand’s proprietary position in the spritz habit. The trade-off is complexity—wine is a different business, distribution varies, margins may differ—but the upside is strong if managed carefully.

Which opportunity is the most significant financially?

Given all the above, where lies the most significant financial opportunity for Aperol and Campari Group? What will drive the largest incremental sales growth, margin expansion, and value creation?

Although each of these levers is important, the occasional expansion combined with format innovation emerges as the biggest prize. Here’s why:

-

Occasion expansion broadens the frequency of consumption and lifts utilisation of existing brand equity and infrastructure. For example, convincing consumers to drink Aperol not just at pre-dinner but at brunch, poolside, or at home means more servings per person per year. It leans on the brand’s already-strong identity but stretches it into adjacent moments.

-

Format innovation enables channel expansion (RTD, home kits, low/zero-alcohol variants) which opens incremental volume in off-trade, outdoor/leisure settings, and reaches consumers who may never go to the bar. Off-trade margins can be higher (or at least stable), and home consumption is a rising trend globally.

-

Combined, these two levers allow expansion without the full cost and complexity of geographic frontier expansion or owning hospitality venues. They have shorter lead-times, can be scaled relatively quickly, and leverage current consumer behavioural shifts.

Moreover, from a profitability standpoint: once marketing infrastructure and brand equity are in place, additional formats and occasions tend to provide incremental margin more quickly than opening new countries (which require high distribution/education costs) or opening branded venues (which require capex and operational risk). In other words: frequency + new formats = margin leverage.

From a value-creation perspective: the brand becomes more resilient, less tied to one moment (the pre-dinner drink) or one geography (Europe), more relevant to multiple consumer moments, and thus commands higher brand equity. That in turn justifies premium pricing, stronger margin, and greater sustainability of growth—transforming Aperol from a “single-serve icon” into a “global lifestyle brand”.

Therefore my recommendation is: Campari must prioritise the occasion × format axis as the fastest, highest-leverage growth pathway for Aperol. Other levers (geography, service ecosystems, value-chain control) should run in parallel, but the immediate focus and investment should target capturing more drinking occasions and developing new formats that allow the consumer to integrate Aperol into more moments, more channels, more frequently.

Potential roadmap for growth

To operationalise this, here is a five-year strategic roadmap for Aperol, emphasising milestones, investment focus, and expected financial outcomes.

Year 1–2 (Short-Term):

-

Launch a premium RTD Aperol Spritz can/bottle in priority markets (UK, US, Australia) with high visibility support.

-

Release a limited-edition flavour variant (e.g., “Aperol Citrus Twist”) in summer season, with bar activations and influencer campaigns.

-

Run the “Spritz Brunch” campaign across major cities (London, Milan, Sydney) to establish Aperol as the brunch-day social sip.

-

Develop and launch a home-entertaining kit (Aperol bottle + branded glass + garnish + instructions) for travel-retail and premium supermarkets.

-

Audit on-trade execution standards globally: ensure glassware, ratio, garnish, ice quality to protect brand experience.

Year 3–4 (Medium-Term):

-

Introduce a “Aperol Light” (approx. 6 % ABV) and test a “Aperol 0.0” non-alcoholic version in select markets with strong moderation trends (Nordics, Australia).

-

Expand RTD footprint into leisure occasions (festivals, beach bars, rooftop events) and seasonal variants (holiday edition, winter spiced).

-

Establish two flagship Aperol Spritz Bars—one in Asia (e.g., Singapore or Shanghai) and one in North America (e.g., Miami or LA)—as experiential anchors.

-

Explore co-branded sparkling wine or “Aperol Spritz Prosecco” kit in one market (e.g., UK) to pilot value-chain extension.

-

Expand “Spritz at Home” e-commerce and DTC bundles, coupled with digital community building (social content, user-generated serve ideas, home-entertaining clubs).

Year 5 (Longer-Term):

-

Scale geographical frontier markets (Asia-Pacific, Latin America) with tailored Aperol moment activations—local flavour variants, tropical serve adaptation, local on-trade partnerships.

-

Launch global “Spritz Hour” partnership with major hotel brands or bar chains, embedding Aperol into global hospitality systems.

-

Review and scale value-chain integration globally if pilot succeeds: co-brand sparkling wine, streamlined supply chain.

-

Refresh brand visual identity subtly if needed, and launch new “Aperol lifestyle” merchandise line (glasses, chic bags, limited-edition bottles) to deepen premium credentials.

Expected financial outcomes

By focusing on occasion × format, Campari can target incremental volume growth of say 8–10 % per annum for Aperol globally, even as some European growth moderates. Off-trade and home consumption channels may yield higher margin than traditional on-trade. If the RTD, low-ABV and home kits become 20-30 % of Aperol’s volume by Year 5, margin expansion becomes significant. With production capacity already being expanded (100 million bottle units via Novi Ligure plant upgrade), the infrastructure is in place to support higher volume without proportional cost increases—which drives operating leverage and incremental profit uplift.

As Aperol’s volume grows, the brand’s share of total Campari revenues increases, thus raising Campari’s group profitability. Given Aperol is one of the higher margin brands within the portfolio, its growth disproportionately benefits group margin and return on invested capital. From a value-creation lens, a resilient, multi-occasion, multi-format global Aperol brand commands higher brand equity, which supports premium pricing, protects margin erosion, and offers a buffer against competitive encroachment.

Risks and mitigation

Of course, ambitious though it is, this strategy has its risks. It’s worth flagging them along with mitigation approaches.

-

Brand dilution risk: If Aperol spreads across too many occasions, formats or variants, it may lose its “signature moment” status. Mitigation: maintain the original “Classico Spritz” as anchor, limit number of variants per year (2–3 max), and ensure every new launch connects back to Aperol’s brand essence (Italian aperitivo, conviviality, orange glow).

-

Cannibalisation risk: The new formats (RTD, home kits, low-ABV) may cannibalise classic bottle sales. Mitigation: price differentiation, channel segmentation (e.g., RTD in off-trade, variants in speciality retail, classic serve in on-trade), and clear messaging about how formats differ.

-

Operational complexity: New formats, new occasions, new geographies all increase complexity in production, logistics, marketing. Mitigation: Use phased implementation, focus on priority markets first, partner with experienced distributors, and capitalise on scalable marketing templates.

-

Competitive encroachment: As “spritz” becomes a category, other brands will launch competing flavours, cheaper serves, or local variants. Mitigation: Campari must defend Aperol through brand experience, premiumisation, and by remaining first-mover in innovations (RTD, low-ABV, occasion expansion).

-

Macro headwinds: Global economic slowdown, regulatory changes (alcohol taxes, trade tariffs), moderation trends. Mitigation: The low-ABV strategy helps; geographic diversification reduces dependence on any one market; operational discipline protects margin.

Orange Glow

In the pantheon of beverage brands, Aperol occupies a rare space. It is both a distinctive product and a cultural symbol—the Spritz glass with its orange glow, the terrace at sunset, the convivial moment when life turns from day to night. For the Campari Group, Aperol is not just another brand—it is the engine of growth, the largest contributor to revenue, and the premium asset around which much of the company’s future value is built.

Yet, size brings its own challenge. The “easy” growth story—just sell more Spritzes in more bars—won’t carry the brand as far as it must go. The world’s drinking occasions are fragmenting, consumer attitudes are shifting, and competition is encroaching. What Aperol needs is to evolve: to become less a niche pre-dinner ritual and more a global, multi-occasion, multi-format lifestyle brand.

In doing so, Campari must focus its efforts where the financial leverage is greatest: expanding occasions and innovating formats. By creating new opportunities to drink Aperol—at brunch, at home, poolside, in cans, as low-ABV variants—the brand can increase frequency and channel breadth, capture higher margin formats, and deepen its lifestyle credentials. Geographical expansion, experience venues and value-chain integration are important second levers but should support—not overshadow—the core priority of spectrum expansion.

If the roadmap is followed, Aperol can continue to grow at double-digit rates globally, shift more volume into higher-margin formats, and become less dependent on any one serve or market. The profitability uplift will come from incremental volume over existing capacity (thanks to production expansion), superior margins in new formats, and the premium brand positioning that supports higher pricing and resilience. In turn, the Campari Group’s overall margin and return on investment will improve, underpinned by the strongest brand in the portfolio.

Aperol has earned its iconic status. Now it must earn its future status. If Campari executes the strategy with boldness, clarity and discipline, Aperol will not just remain a “Spritz brand” but become the globally dominant brand of social sipping—a brand built for many moments, many occasions, many geographies, not just one. The financial prize is significant—and it awaits.

More from Peter Fisk

- What’s New and Next in Branding? Brands capture an irresistible idea, compelling and intuitive, engaging and inspiring people in ways that companies and products cannot. They build platforms and connections through which customers and business can achieve more.

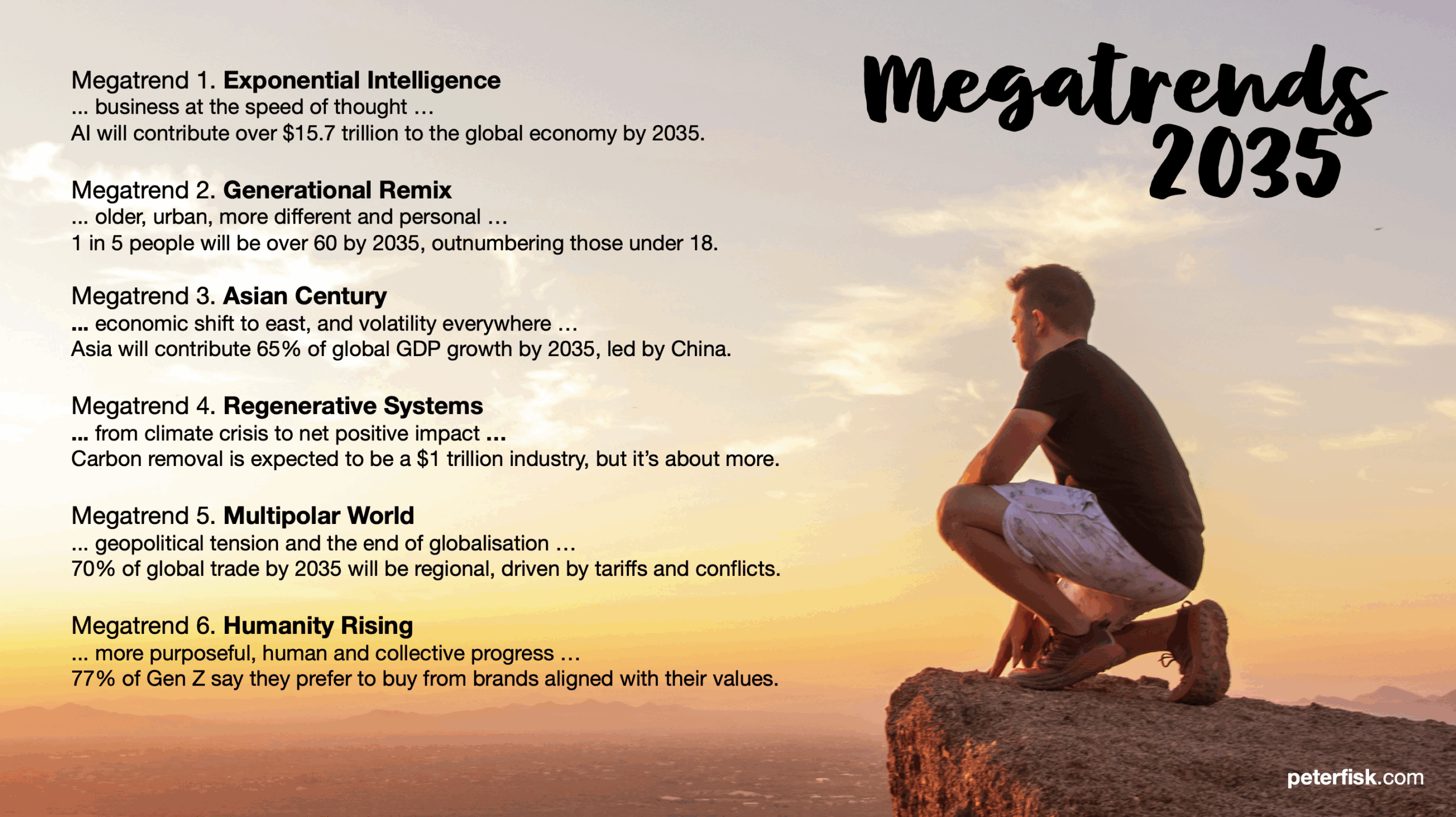

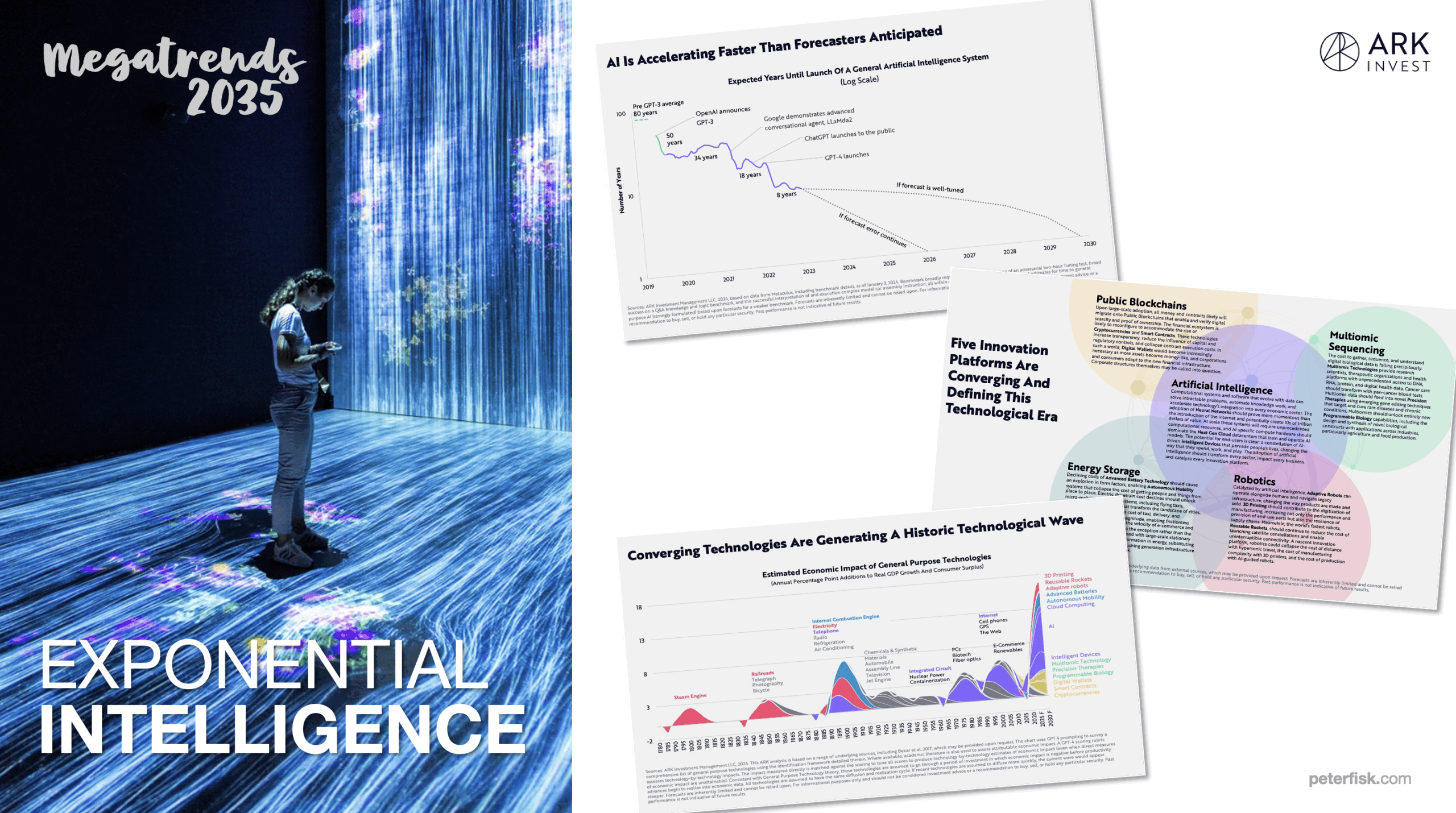

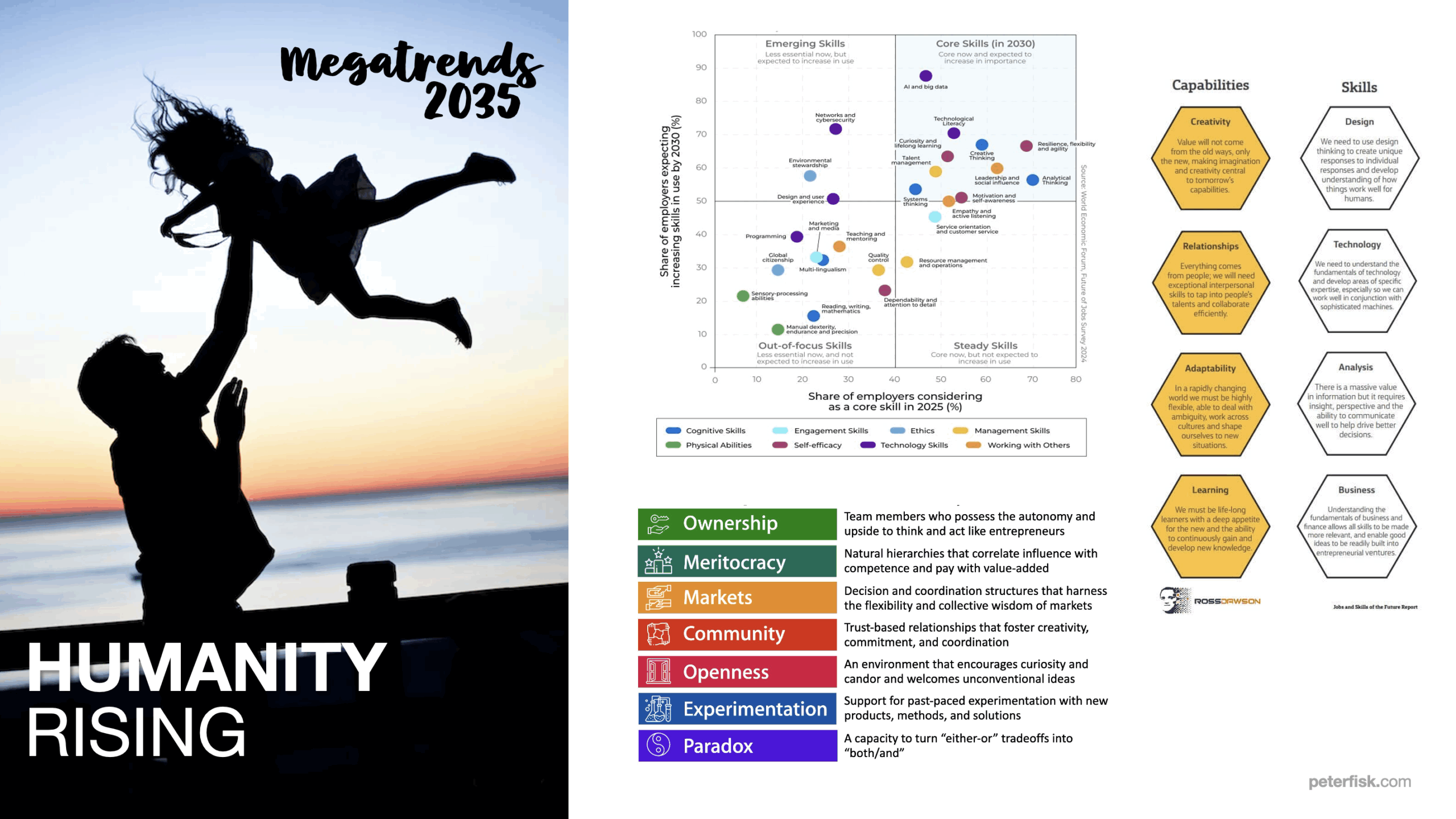

- Eyes on Tomorrow: What Leaders Must See before Everyone Else … exploring the most important megatrends that are transforming markets, and leadership mindsets, and how the best companies embrace them as opportunities … based on the new Megatrends 2035 report by Peter Fisk, and its implications for every business.

- The Reinvention Playbook: Thriving in a World of Relentless Change … the best organisations seek to continually reinvent themselves in a world of constant, uncertain and dynamic change. They rethink, refocus, and reinvent everything – embracing new agendas from AI to GenZ, climate change and social inequality.

- The Nexus Effect: Unlocking the Power of Connections … How can businesses and brands really unlock the power of data and networks, flywheels and AI, communities and ecosystems, to transform their futures?

- The New Growth Playbook: 9 New Ways to Accelerate Growth … many companies struggle to find new ways to grow their business … instead we look at how the best companies find radically new ways to grow.

- Super Innovators: Innovation Beyond the Normal … 10 radical ways to disrupt conventions, embrace deeper insights, unlock valuable assets, and stretch innovation for more dramatic impact.

- Consumer of the Future … “Aisha blinked twice, the smart lenses in her eyes had already scanned her biometric mood, cross-checked her carbon budget, and pulled up items her climate-positive friends were buying this week”

- Competing in the FLUX: How to develop a dynamic strategies in a world of relentless change … combining a strong, enduring direction with micro-moves that adapt quickly to emerging shifts:

- Business Transformation: The new superpower of business leaders … reimagining the future, redefining strategy, reinventing the organisation, rewiring performance … the journey to deliver step change in value creation.

- The Sustainable Consumer: Go on, do the Right Thing … how brands can accelerate the consumer shift to sustainable products and practices … from food and fashion, to energy and electric cars, making sustainability desirable and better.

- The “Performer Transformer” Leaders: How great leaders deliver today and create tomorrow … with dual thinking, to build dynamic ambidexterity, continually strategyzing, to perform and transform.

- The Hire-Wire Act of Leadership: Leading in a world of intense competition and relentless change … being visionary and innovative, learning to adapt and endure … inspired by Taylor Swift, Roger Federer, Beyoncé, and Lionel Messi

- Becoming a Future-Ready Business … in a world of relentless change, organisations need to anticipate change, embrace innovation, empower talent, and align deeply with the evolving needs of society and the planet

AI is no longer an experiment running in the backrooms of tech companies. Over the last two year it has become the new operating system for business — rewiring how organisations create, deliver, and capture value.

There are plenty of excited tech articles that will bamboozle you with complex terminology and mind-boggling systems. There are also plenty of dystopian societal views that will focus on ethics and regulation. The reality is that it’s here, rapidly accelerating, and we should be using it. Practically, usefully, creatively, now.

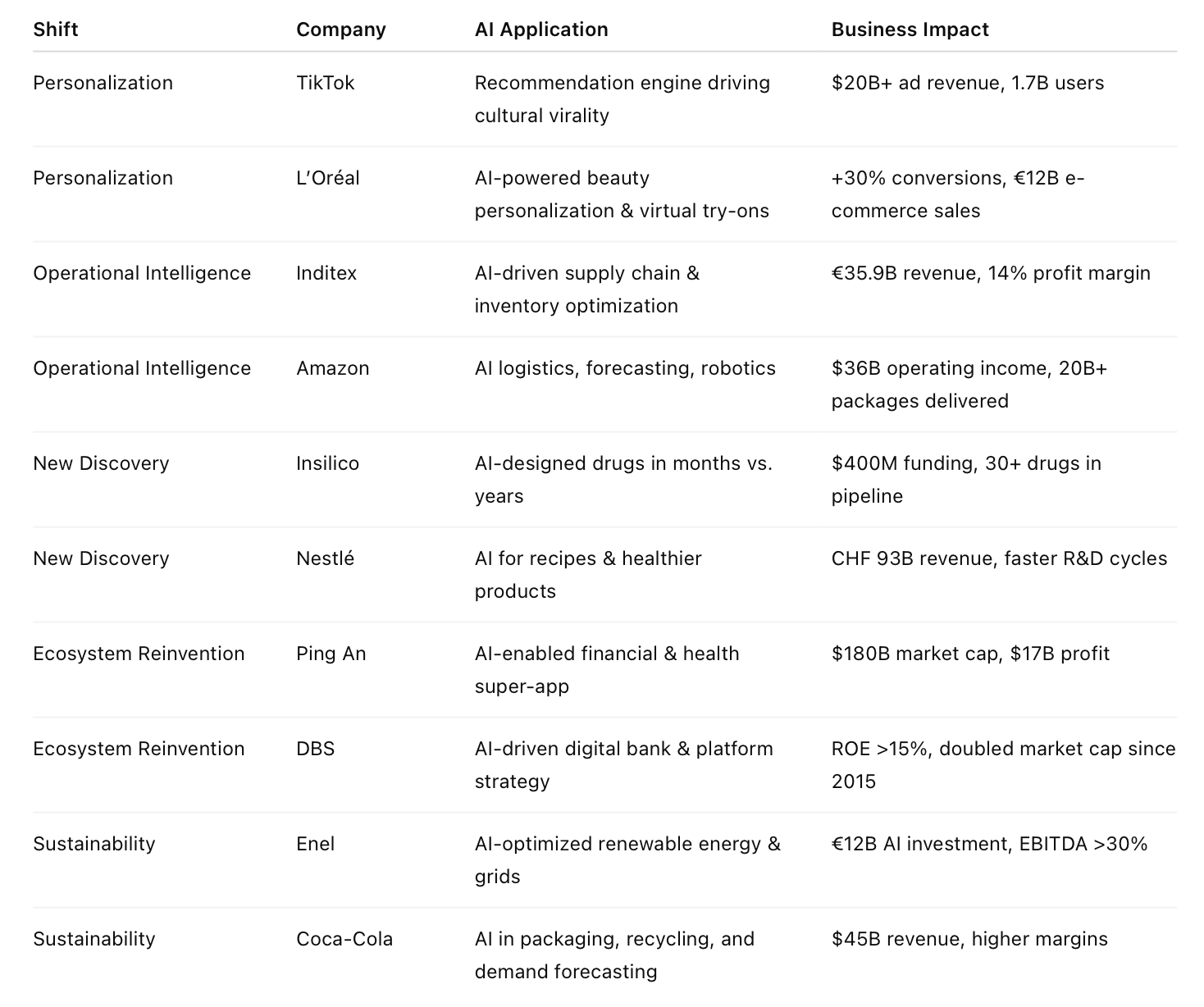

What’s striking is not just the speed of adoption but the variety of ways it’s being applied. Across industries, AI is creating five big shifts that are transforming customer experiences, business models, and ultimately performance.

-

AI-driven personalisation: Making every interaction smarter, faster, and more human, at scale.

-

AI-driven intelligence: Turning supply chains, stores, and logistics into living, adaptive systems.

-

AI-driven discovery: Unlocking ideas and innovations that humans alone could not find.

-

AI-driven ecosystems: Expanding the boundaries of what businesses can do by orchestrating services across industries.

-

AI-driven sustainability: Tackling the planet’s toughest challenges while improving efficiency and resilience.

Let’s dive into 10 companies who illustrate these shifts in action — from TikTok to Coca-Cola, Insilico to DBS — to see how AI is reshaping the future of business.

Shift 1: AI-driven personalisation

The future belongs to businesses that know customers better than they know themselves. AI-driven personalization uses deep learning to decode individual behaviors, predict needs, and serve up hyper-relevant experiences in real time.

TikTok: The algorithm that became culture

TikTok isn’t just an app, it’s a cultural engine. Its meteoric rise — to over 1.7 billion monthly active users by 2024 — is powered by a recommendation system that feels uncannily personal. Unlike platforms that depend on who you follow, TikTok’s For You Page uses AI to predict what you want to see next, based on every swipe, pause, replay, and share.

The scale of this intelligence is staggering: TikTok reportedly processes billions of data points daily, and its machine learning models can identify emerging trends in hours, not weeks. That’s why songs, memes, or micro-trends can go viral globally within a day.

The business impact? In 2023, TikTok’s ad revenue hit $20 billion, rivalling Meta’s Instagram. Brands are drawn to its ability to micro-target audiences not by demographics but by behavior — a 15-year-old sneakerhead in São Paulo and a 45-year-old fashion fan in Seoul might both see the same dance trend, personalized in context.

TikTok has shown that personalisation is no longer about segments of one, it’s about moments of one. And that redefines how consumer businesses think about engagement.

L’Oréal: Personalised beauty at scale

L’Oréal, the world’s largest beauty company, has turned AI into a makeover machine. For decades, beauty marketing was about broad categories: oily vs. dry skin, blonde vs. brunette hair. Today, L’Oréal uses AI to personalize beauty for millions of consumers worldwide.

Through its acquisitions of AI startups like ModiFace, L’Oréal enables customers to virtually try on lipstick shades, experiment with hair colors, and even simulate skincare outcomes. In 2022, over 1 billion consumers used its virtual try-on tools, either online or in stores.

Beyond front-end experiences, L’Oréal applies AI to product recommendations. Its “Perso” device, powered by machine learning, analyzes local environmental conditions (like humidity or pollution) and personal skin data to dispense customized skincare formulas at home.

The result? L’Oréal’s e-commerce sales have surged to 28% of total revenue (over €12 billion in 2023), with personalization tools shown to increase conversion rates by up to 30%. In a $600 billion beauty market, AI isn’t just a gimmick — it’s a profit driver.

Shift 2: AI-driven intelligence

AI is turning operations into self-optimizing systems that respond to demand in real time. This isn’t just efficiency — it’s agility at scale.

Inditex: From fast fashion to smart fashion

Inditex, the parent of Zara, has long been admired for its “fast fashion” supply chain. Now it’s becoming “smart fashion.” The company uses AI to analyze real-time sales, social media trends, and store data to predict demand and optimize inventory.

For instance, AI models suggest which designs to push to which regions, ensuring that stock is continuously aligned with hyper-local tastes. Store managers input feedback daily into handheld devices, which feeds back to headquarters and AI systems. The turnaround from insight to action can be measured in days, not months.

Financially, this intelligence pays off: Inditex posted record revenues of €35.9 billion in 2023, with net profit margins rising to over 14%, outperforming rivals like H&M. AI-driven operational efficiency is part of why Zara can keep offering new products twice a week without drowning in unsold stock.

Amazon: The machine behind the marketplace

Amazon’s obsession with customers is powered by an equally intense obsession with AI. From the moment a shopper clicks “buy,” an invisible army of algorithms takes over: predicting what products to stock, where to place them, and how to ship them in the fastest and cheapest way.

The company uses machine learning for demand forecasting, robotics in warehouses, and AI-driven routing systemsthat save millions of miles in delivery journeys. In AWS, Amazon even sells its operational AI expertise to other firms.

The impact is measurable. Amazon’s logistics network can deliver over 20 billion packages annually, and its same-day or next-day delivery promise is only viable because AI makes fulfillment hyper-efficient. In 2023, despite rising costs, Amazon’s operating income rebounded to $36 billion, showing how AI-driven intelligence can protect margins in low-margin businesses.

Shift 3: AI-driven discovery

AI doesn’t just optimise — it creates. By simulating, predicting, and experimenting at digital speed, AI unlocks new possibilities for innovation – ideas, communication, experiences and product development.

Insilico Medicine: AI as a drug hunter

Drug discovery is notoriously slow and expensive — often costing over $2 billion per drug and taking more than a decade. Insilico Medicine is flipping that script with AI.

The company’s AI platform, Pharma.AI, generates novel drug candidates by predicting how molecules will behave in the human body. In 2021, Insilico announced it had designed a new fibrosis drug in just 18 months at a cost of $2.6 million— a fraction of industry norms.

As of 2024, Insilico has 30+ drugs in its pipeline, with several in clinical trials. If successful, the approach could dramatically reduce healthcare costs and bring treatments to patients faster. Investors believe: Insilico has raised over $400 million and is valued above $1.5 billion.

Nestlé: Smart flavours and healthier foods

Food giants are also leaning on AI to innovate. Nestlé, the world’s largest food and beverage company, uses AI to develop new recipes, optimize flavors, and improve nutrition profiles.

For example, Nestlé’s AI systems analyze massive datasets of consumer taste preferences, ingredient interactions, and health outcomes to design products that are both delicious and healthier. One success was the reformulation of its popular chocolate bars, where AI suggested new combinations to cut sugar by 30% without altering taste.

AI also accelerates R&D. Nestlé’s R&D centers now use machine learning to predict consumer acceptance of new products before they hit the shelves, cutting months from the traditional product cycle. In 2023, the company posted revenues of CHF 93 billion, with innovation cited as a key growth driver in categories like plant-based foods and beverages.

Shift 4: AI-driven ecosystems

The most ambitious use of AI is not within a single business but across ecosystems — creating new markets and redefining industries.

Ping An: From insurer to super-app

China’s Ping An began as an insurance company. Today, it’s a $180 billion market cap giant that runs one of the world’s most diverse financial ecosystems. AI is its glue.

Ping An’s platforms — from Good Doctor (healthcare) to Lufax (wealth management) — serve over 225 million customers. Its AI systems process 1.5 billion financial transactions daily and enable services like instant loan approvals, facial recognition-based insurance claims, and AI-powered medical consultations.

By using AI to orchestrate an ecosystem of adjacent services, Ping An has reduced churn, increased cross-selling, and positioned itself as a daily-life companion for millions. Its net profits hit $17 billion in 2023, a testament to the power of AI to scale ecosystems.

DBS Bank: Creating the invisible bank

Singapore’s DBS Bank, once seen as a bureaucratic state-owned lender, has been ranked as the world’s best bank for the last 6 years. AI is central to this transformation. DBS’ strategy, driven by CEO and former CTO Piyush Gupta, is to help people “live better, bank less”. What does this mean? Embedding banking into an ecosystem of life – travel, entertainment, retail and more.

AI has been critical to this transformation. DBS uses machine learning for fraud detection, personalized financial advice, and credit risk assessment. More radically, it embeds banking into customer journeys — from travel booking to ride-hailing — through ecosystem partnerships.

DBS’s digibank in India and Indonesia is almost fully AI-driven, serving millions of customers with minimal human intervention. Its efficiency has helped DBS achieve ROE above 15%, among the best in global banking, while market cap has more than doubled since 2015.

Shift 5: AI-driven sustainability

AI is also emerging as a force for good — making it possible to tackle environmental challenges while improving performance.

Enel: Smarter, cleaner energy

Italian utility giant Enel operates in over 30 countries, managing one of the world’s largest renewable energy portfolios. AI helps it balance supply and demand, optimize grid performance, and reduce carbon emissions.

Enel’s AI systems forecast energy demand in real time and adjust renewable energy inputs, ensuring grid stability. Predictive maintenance powered by AI reduces downtime in wind and solar farms, saving millions annually.

Financially, Enel’s embrace of AI-enabled renewables has driven strong growth: it invested €12 billion in digital and AI upgrades as part of its decarbonization plan, while maintaining EBITDA margins above 30%.

Coca-Cola: Smarter Packaging and Supply Chains

Coca-Cola may sell a 100-year-old product, but it’s using AI to reinvent sustainability. The company uses AI to design lighter bottles, optimize recycling systems, and reduce its carbon footprint. For example, Coca-Cola’s AI-driven demand forecasting reduces overproduction, saving on both costs and emissions. Its collaboration with AI startup Circularity Informatics helps analyze recycling streams, increasing plastic recovery rates.

In 2024, Coca-Cola reported over $45 billion in revenues and highlighted digital and AI-driven efficiencies as a contributor to improved operating margins. By aligning sustainability with profitability, Coca-Cola shows how AI can make doing good, good for business.

AI-driven business reinvention

Across industries, AI is no longer about efficiency or novelty. It’s about reinvention.

These five shifts show how businesses can:

-

Build intimacy with customers at massive scale (personalization).

-

Run operations that adapt in real time (operational Intelligence).

-

Create products that leapfrog human imagination (new discovery).

-

Expand into ecosystems that reshape industries (ecosystem reinvention).

-

Drive sustainability as both purpose and profit (sustainability acceleration).

Here’s a summary:

The companies leading these shifts are already reaping the rewards in profitability, market cap, and cultural relevance. The question for leaders everywhere is not whether to adopt AI — but whether they are bold enough to reinvent their business with it.

Denmark has long been a quiet superpower of innovation. A small nation with just under six million people, it has repeatedly reshaped global markets — from wind energy and shipping to enzymes, toys and pharmaceuticals. Its innovation model is distinctive: science-based, purpose-driven, and built on a culture of trust and collaboration.

Yet even Denmark’s biggest innovators face headwinds. Global competition, rising costs, political scrutiny and market over-expectation have taken their toll on stock prices and confidence. But innovation is not just about smooth growth curves; it is also about reinvention, resilience and staying ahead of the curve.

Having worked with the leaders of many Danish companies, I have a huge imagination for the country, and their quiet, thoughtful approach. At the same time, there is a need to step up and see a changing international marketplace. In a small country, they need to think creatively about how to grow beyond geography, to compete and collaborate in new ways on the global stage.

Today, Danish innovation can be seen in two waves: the established giants who remain global leaders despite near-term financial pressures, and a new generation of challengers who are reimagining markets with digital, circular and climate-tech models.

Danish Giants: Innovators under pressure

Novo Nordisk

The pharmaceutical giant has been the face of Denmark’s economic success, leading the global revolution in diabetes and obesity care through its GLP-1 drugs (Ozempic, Wegovy). Recently, its share price fell sharply after cutting guidance and announcing job cuts. But the underlying science remains transformative. Novo is investing in next-generation treatments — including oral obesity drugs and powerful combination therapies like CagriSema. Demand for obesity and metabolic health solutions is massive and growing, and Novo’s science, scale and pipeline will keep it central to the health innovation story for years to come.

Ørsted

Once a fossil-fuel utility, Ørsted reinvented itself as the world leader in offshore wind. Recent financial results have disappointed, with high interest rates, supply-chain pressures and intense competition hitting its margins. But the world still needs Ørsted’s expertise in building, operating and financing massive offshore energy systems. It is piloting hybrid parks that combine wind, solar and storage, while investing in green hydrogen. Ørsted remains at the heart of the clean-energy transition, even if near-term profitability is volatile.

Vestas

Vestas continues to be the largest pure-play wind turbine manufacturer globally. Like Ørsted, it has been squeezed by supply-chain inflation and policy delays, but it is investing heavily in digitalization and predictive maintenance to make wind energy more reliable and efficient. Its ability to combine cutting-edge turbine design with global service networks keeps it central to renewable energy innovation.

Mærsk

Shipping giant AP Moller-Maersk has embarked on an ambitious journey to decarbonize global trade. It is pioneering methanol-powered vessels, building partnerships to scale green fuels, and developing digital logistics platforms. The company’s profits have been hit by freight volatility and high decarbonization costs, but Maersk’s commitment to transforming a carbon-intensive sector remains one of the boldest industrial bets in the world.

Lego

Lego is one of Denmark’s most beloved brands and a global cultural icon. Financially, it has faced the challenge of slowing growth in toy markets, but it continues to push innovation in digital play, education, and most notably, sustainable materials. Its experiments in bio-based plastics and circular reuse models could redefine how consumer brands tackle sustainability, proving that play and purpose can coexist.

Bang & Olufsen

Bang & Olufsen is Denmark’s iconic luxury audio and design company, renowned for combining high-fidelity sound with striking industrial design. Despite recent financial challenges and volatile sales due to competition from mainstream electronics brands, B&O continues to innovate with premium product lines and strategic collaborations with Ferrari, HP, and lifestyle brands. Its focus on craftsmanship, sustainability in materials, and direct-to-consumer digital channels helps maintain brand relevance. While the company operates in a niche market, its commitment to design excellence, sound quality, and experiential innovation ensures B&O remains a global symbol of Danish luxury and creative ingenuity.

Danfoss

Danfoss is a global leader in industrial technology, specializing in heating, cooling, electrification, and energy-efficient solutions. It plays a critical role in decarbonizing industry and buildings, with advanced R&D in energy optimization and automation. Though global cost pressures and energy price volatility have affected margins, Danfoss continues to expand into electrification and renewable solutions. Its innovation strategy emphasizes digital controls, IoT integration, and sustainable engineering. With a strong international footprint and commitment to solving complex energy challenges, Danfoss exemplifies how Danish industrial firms combine engineering expertise, sustainability, and innovation to maintain global leadership in evolving markets.

Danish Challengers: Next generation innovators

Pleo

Pleo is reimagining business finance through smart expense-management tools. Its cards, software and analytics give companies of all sizes transparency and control over spending. It has scaled rapidly across Europe and continues to add features that integrate with accounting systems and automate admin. Pleo shows how Danish fintech can take a human-centered problem — messy expense reports — and solve it with design simplicity and tech agility.

Too Good To Go

This food-waste marketplace is now one of Denmark’s most visible global startups. The app connects consumers with surplus food from restaurants and retailers, creating a simple, win-win solution. It has scaled across Europe and the U.S., saving hundreds of millions of meals. Too Good To Go is proof of Denmark’s ability to combine social impact with commercial scale, addressing one of the world’s most urgent sustainability problems.

Ganni

Ganni is a Copenhagen-based fashion brand disrupting traditional apparel markets through sustainability, digital-first strategy, and circular business models. The company has grown rapidly via direct-to-consumer sales, global collaborations, and seasonal “drop” campaigns, creating a loyal, socially conscious audience. Circular initiatives, resale programs, and eco-friendly production differentiate Ganni from traditional fast fashion, appealing to consumers seeking style with purpose. Despite operating in a highly competitive global fashion market, Ganni leverages digital engagement, strong branding, and agile supply chains to scale internationally. Its success illustrates Denmark’s strength in creative industries and sustainable, mission-driven business innovation.

Universal Robots

Universal Robots, a pioneer in collaborative robots (cobots), makes industrial automation accessible to small and medium-sized enterprises. Their flexible, easy-to-program robots help manufacturers increase productivity, reduce labor costs, and improve safety. Owned by Teradyne, Universal Robots has maintained strong growth (~20% YoY), expanding adoption across automotive, electronics, and general manufacturing. Continuous innovation in software, AI integration, and user-friendly interfaces allows it to remain competitive while democratizing automation. By fostering Denmark’s robotics cluster and exporting advanced industrial solutions worldwide, Universal Robots exemplifies how Danish engineering, innovation, and design thinking can transform manufacturing on a global scale.

Trustpilot

Founded in Copenhagen, Trustpilot has become a global platform for online reviews. Its challenge is ensuring trust and combating fake reviews — but that is also where its innovation lies. By combining moderation systems, machine learning and transparency standards, Trustpilot is redefining how reputation is built online. In an era of declining trust, Denmark’s ethos of openness and fairness finds expression in this platform.

Haldor Topsøe

Topsoe is Denmark’s hidden industrial hero, developing catalysts and process technologies that enable cleaner fuels, green hydrogen and e-methanol. It recently invested in scaling solid-oxide electrolyzers for industrial hydrogen production, a technology with game-changing efficiency potential. While less visible than consumer apps, Topsoe’s breakthroughs are vital for decarbonising heavy industry.

Seaborg Technologies

Alongside these more mature players, Denmark is seeding a new crop of startups. One standout is Seaborg Technologies, developing compact molten-salt nuclear reactors designed to provide safe, modular and carbon-free power. It is still pre-commercial, but it reflects Denmark’s willingness to explore bold technologies at the frontier of climate solutions.

Denmark’s Innovation DNA

Looking across these companies, five strengths stand out:

-

Science-to-scale capability. Denmark excels at translating deep science — in biology, chemistry, engineering — into scalable products, from Novo Nordisk’s pharmaceuticals to Topsoe’s catalysts.

-

Systems thinking. Giants like Ørsted and Maersk tackle problems end-to-end, designing integrated systems rather than isolated fixes.

-

Trust and social purpose. Companies like Too Good To Go and Trustpilot reflect a cultural focus on fairness, sustainability and transparency.

-

Global from day one. With a small home market, Danish firms are export-oriented and internationally ambitious.

-

Policy support for green and social innovation. Danish government policies have nurtured early adoption in wind energy, biotech and sustainability, giving firms a platform to scale globally.

Denmark’s innovation landscape today is not without challenges. Novo Nordisk and Ørsted have seen share prices wobble; Maersk and Vestas face cost pressures; Lego must reinvent materials at scale. Yet their capacity to adapt and reinvest in the future keeps them at the center of global innovation.

At the same time, a new wave of challengers — digital, circular, climate-tech startups — is pushing into new spaces with agility and mission-driven zeal. Together, they show why Denmark remains one of the world’s most innovative economies: a place where science meets design, and where business is inseparable from purpose.

It’s a superfast, crazy and unpredictable world – no time to read, no time to think – indeed, leaders face unprecedented challenges: rapidly evolving technologies, shifting consumer expectations, and the imperative to balance profitability with purpose.

Success no longer comes solely from operational excellence or market dominance—it requires vision, creativity, and a deep understanding of people, brands, and the future. That’s why I keep reading. And you should too.

So here are 8 books that I dipped into over the summer vacation. They inspired me, and maybe will you …

They’re a mix of practical guidance, inspirational stories, and forward-thinking frameworks that can help leaders navigate this complex world. Some reveal the mental habits of extraordinary performers, others illuminate minimalist principles for clarity in a noisy marketplace, while a few offer visionary approaches to sustainability, futures thinking, and storytelling.

It’s time to think differently, act strategically, and inspire teams and customers alike. I summarise my insights, and practical takeaways from each book that I think can shape smarter, more purposeful leadership.

Let My People Go Surfing by Yvon Chouinard

Yvon Chouinard’s memoir and manifesto, Let My People Go Surfing, blends storytelling with philosophy, offering an unconventional yet deeply principled approach to business leadership. As founder of Patagonia, Chouinard recounts the company’s journey from a small climbing equipment shop to a globally recognized outdoor brand. Yet the focus is never on profit alone; it is on purpose, values, and stewardship of the planet.

Chouinard presents his core belief: business can—and should—be a force for good. He describes decisions that challenge conventional corporate thinking, such as promoting work-life balance, embracing environmental responsibility, and taking bold stances on social issues. The book highlights Patagonia’s commitment to sustainable materials, activism, and long-term thinking, offering a model of how ethical principles can coexist with commercial success.

In the 1950s, Chouinard began blacksmithing to create his own climbing gear, leading to the establishment of Chouinard Equipment. This venture eventually became the largest supplier of climbing hardware in the U.S., highlighting his commitment to quality and innovation.

Chouinard’s environmental consciousness grew over time, influencing Patagonia’s product choices. In the 1990s, he emphasized that the company’s existence was to generate profits for environmental causes, integrating sustainability into the core of the business

“When the waves are good, surf. When there’s powder on the mountains, ski.”

This guiding principle reflects Chouinard’s belief in prioritizing passion and well-being over rigid work schedules. It underscores Patagonia’s flexible work culture, where employees are encouraged to embrace nature and personal pursuits, fostering creativity and satisfaction.

“You can’t wait until you have all the answers before you act.”

The memoir is infused with humour, irreverence, and personal reflection, making it engaging while conveying profound lessons about leadership, culture, and innovation. It challenges readers to reconsider the role of business in society, encouraging leaders to prioritize integrity, environmental stewardship, and human-centered management.

Ultimately, Let My People Go Surfing is more than a company history; it is a manifesto for conscious, values-driven leadership that inspires readers to redefine what success truly means in business.

Hidden Genius: The Secret Ways of Thinking That Power the World’s Most Successful People by Polina Marinova Pompliano

Hidden Genius delves into the cognitive habits, thought patterns, and decision-making approaches that distinguish high achievers across industries. Polina Marinova Pompliano draws from interviews with entrepreneurs, creatives, and investors to uncover mental frameworks that enable success in uncertain, high-pressure environments.

The book is both inspiring and practical. It identifies key traits such as pattern recognition, contrarian thinking, disciplined curiosity, and resilience, showing how these habits translate into real-world results. Pompliano highlights how successful people structure their time, manage risks, and cultivate networks to amplify their impact.

Chef Grant Achatz, renowned for his innovative approach to molecular gastronomy, faced a devastating challenge when diagnosed with stage four tongue cancer. The disease threatened not only his life but also his ability to taste and create. Undeterred, Achatz adapted by focusing on the interplay of sight and smell to craft flavors, transforming his culinary creations into multisensory experiences. This reinvention exemplifies the power of resilience and adaptability in the face of adversity.

David Goggins, a former Navy SEAL and ultramarathon runner, is renowned for his mental toughness and ability to push through extreme pain. Pompliano delves into his philosophy, emphasizing the importance of facing discomfort and using it as a catalyst for personal growth. Goggins’ story serves as a testament to the power of perseverance and the mindset required to achieve extraordinary feats.

By focusing on the psychology behind performance rather than just tactics or strategy, Hidden Genius empowers readers to rethink how they approach challenges and opportunities. It blends narrative, case studies, and exercises, making it actionable for leaders who want to optimize thinking, creativity, and influence. The book’s unconventional lens—examining the “how” of thought rather than the “what” of actions—offers a fresh perspective on personal and organizational success.

Think Like The Minimalist by Chirag Gander and Sahil Vaidya

Think Like The Minimalist explores how simplicity can become a strategic asset in modern business. Gander and Vaidya argue that in today’s cluttered marketplaces, less is often more: a minimalist approach to design, communication, and user experience allows brands to stand out, focus attention, and foster deeper connections with customers.

The book illustrates minimalist principles in branding, product design, UX, and customer communication. It emphasizes clarity, precision, and intentionality, guiding leaders to strip away noise and focus on what truly matters. By showcasing case studies and practical examples, the authors demonstrate how leading brands have used minimalism not just aesthetically but strategically, simplifying customer journeys, messaging, and product offerings.

What makes the book compelling is its insistence on thoughtful reduction rather than arbitrary removal. Minimalism, the authors argue, is about maximizing impact, creating emotional resonance, and enhancing usability. The book also explores cultural and psychological aspects, showing how minimal design encourages engagement and loyalty in modern consumers who are increasingly overwhelmed by choice and information.

Through accessible storytelling and concrete frameworks, Think Like The Minimalist inspires leaders to apply disciplined simplicity to their branding and business strategy, achieving elegance, focus, and long-term differentiation.

Facing Our Futures: How Foresight, Futures Design and Strategy Creates Prosperity and Growth by Nikolas Badminton

Facing Our Futures presents a forward-looking, methodical approach to strategy in an unpredictable world. Nikolas Badminton emphasizes that traditional linear planning is no longer sufficient in the face of rapid technological change, geopolitical shifts, and societal transformation. Instead, organizations need to develop foresight capabilities: the ability to anticipate, explore, and shape multiple potential futures.

The book introduces practical tools such as scenario planning, horizon scanning, and the Positive Dystopia Canvas—a method for imagining disruptive futures to inform current strategy. Badminton stresses that foresight is not merely about prediction; it is about resilience, adaptability, and creative problem-solving. Leaders learn to frame uncertainties as opportunities for innovation rather than threats to stability.

Drawing on examples from companies, governments, and social innovators, the book illustrates how futures thinking can lead to both commercial success and societal impact. Badminton bridges the gap between theory and practice, showing how strategic foresight informs investment decisions, product development, talent management, and ecosystem building.

The prose is both visionary and grounded. It inspires leaders to cultivate a forward-thinking mindset, challenge assumptions, and design organizations that can thrive amid volatility. Ultimately, Facing Our Futures positions foresight not as an optional skill but as an essential capability for creating sustained prosperity and growth in the 21st century.

The Life Cycle of a CEO: The Myths and Truths of How Leaders Succeed by Claudius Hildebrand and Robert Stark

In The Life Cycle of a CEO, Hildebrand and Stark explore the evolving journey of modern business leaders, offering an evidence-based and nuanced perspective on what it takes to succeed at the highest level. The authors identify five stages of a CEO’s journey—launch, calibration, reinvention, complacency, and legacy—illustrating how leadership is dynamic, not fixed.

The book combines data from studies of hundreds of CEOs with vivid anecdotes to challenge conventional myths about leadership. It examines the pressures, decision-making dilemmas, and psychological demands faced by executives, highlighting both triumphs and failures. The authors emphasize that effective leaders learn to adapt their style, cultivate emotional intelligence, and align personal values with organizational vision.