The pace of change is not just accelerating—it’s relentless. From technological disruption to geopolitical shocks, from shifting customer expectations to climate urgency, leaders face a world in constant motion.

Traditional business strategy, built on fixed choices, multi-year plans and rigid forecasts, is no longer fit for purpose. Businesses need a new way to think and act: how to think, work, compete and win, in the FLUX.

FLUX businesses are built on a paradox: a strong, enduring direction anchored in purpose, paired with micro-moves that adapt quickly to emerging shifts. The acronym itself captures the mindset leaders must embrace:

-

Fast – moving at the speed of change.

-

Liquid – fluid in structures, roles, and approaches.

-

Uncharted – navigating uncertainty with curiosity and courage.

-

Experiential – learning by doing, testing, and iterating in real time.

Rather than locking into static plans, organizations working in flux treat strategy as a living system—constantly sensing, responding, and evolving while staying true to their core purpose.

FLUX: Anchoring with agility, enduring direction with micro moves

The term flux has been used in management writing for decades to describe constant change. Charles Handy wrote about “the age of unreason” and organisations in flux, for example.

The specific idea of FLUX as a strategy approach is developed in my new book, based on research in working with hundreds of business leaders around the world. In particular they struggled with how to replace the traditional form of business strategy, while still bring focus and alignment, alongside agility and empowerment.

FLUX emerged as a new concept.

The cornerstone of FLUX is clarity of direction. In turbulent waters, an organization’s why becomes the compass. Patagonia’s enduring commitment to “save our home planet” has enabled it to make bold moves, from donating profits to environmental causes to reshaping its supply chains. Tesla’s mission to “accelerate the world’s transition to sustainable energy” allows it to pivot across sectors—from cars to batteries to solar—while keeping a coherent trajectory.

This enduring purpose enables businesses to act with confidence, even when specific pathways remain uncertain. Without it, constant change risks leading to drift, fragmentation, and reactive decision-making.

Fast: Dynamic strategy at the speed of change

Traditional strategy cycles—annual budgets, five-year plans—are too slow for a world where new competitors, technologies, and customer behaviors can emerge overnight. A FLUX approach replaces slow cycles with rapid sensing and fast decision-making.

For example, Amazon’s ability to launch, test, and scale new services (Prime, AWS, Alexa) is underpinned by a culture of speed. Teams are empowered to act quickly, guided by clear principles rather than waiting for approval chains. Fast doesn’t mean reckless—it means accelerating learning and execution.

Strategic reviews shift from yearly retreats to ongoing strategic sprints, where leadership teams revisit priorities monthly or quarterly. Instead of predicting the future, they practice continuous foresight: monitoring signals, experimenting in parallel, and reallocating resources rapidly.

Liquid: Structures and processes that flow

Strategy in flux requires liquid structures—organizations that flex, reconfigure, and adapt as contexts change. Rigid hierarchies and departmental silos slow response; fluid teams and networks unlock agility.

Spotify’s squad model exemplifies liquid organization—small, autonomous teams aligned by shared goals but free to adapt their methods. Similarly, Haier in China has reorganized into thousands of micro-enterprises that can form alliances, pursue opportunities, and dissolve if no longer relevant.

Planning, too, becomes liquid. Annual budgets freeze assumptions; in flux, organizations use rolling forecasts and dynamic resource allocation. Capital is released in smaller tranches, tied to milestones and outcomes rather than locked-in annual cycles. This mirrors venture capital models, where funding follows proof points, not rigid plans.

Uncharted: Embracing the unknown

Strategy has traditionally been about reducing uncertainty. But in a world of flux, the unknown is unavoidable. Leaders must shift from prediction to navigation, embracing experimentation and scenario thinking.

Consider SpaceX. Elon Musk does not have a step-by-step plan to colonize Mars. Instead, the company charts an ambitious direction, then pursues uncharted pathways through iterative rockets, each failure offering lessons for the next.

Businesses adopting a flux mindset treat uncertainty as fuel for innovation. Instead of fearing disruption, they explore uncharted opportunities—like DBS Bank in Singapore, which reimagined itself from a traditional bank into a digital platform, creating new ecosystems in health, education, and sustainability.

Strategic choices under flux are less about narrowing down to one “right” answer and more about keeping multiple options open—investing in parallel bets, partnerships, and exploratory ventures.

Experiential: Strategy as a learning journey

Finally, flux strategy is experiential. Rather than relying on thick reports and predictive analytics alone, organizations learn by doing—launching pilots, testing assumptions, gathering feedback, and scaling what works.

Nike exemplifies this by treating its digital ecosystem (apps, wearables, online communities) as living experiments, constantly refining the athlete experience. Airbnb scaled globally by testing new trust mechanisms, from reviews to identity checks, learning directly from user behavior.

In flux, planning is not an intellectual exercise—it’s a cycle of hypothesis, experiment, evidence, and iteration. Strategy becomes less about certainty, more about adaptive learning.

How FLUX changes the way business works

Adopting FLUX Strategy requires reimagining the rituals of strategy itself:

-

Strategic Choices: Instead of one dominant play, leaders pursue portfolios of options. Some are core bets, others are exploratory. Success comes not from rigid execution, but from knowing when to double down, pivot, or exit.

-

Strategic Planning: Planning shifts from static documents to living roadmaps. Plans are updated frequently, with space for flexibility and surprise. Planning is participatory, drawing insights from across ecosystems—not just the boardroom.

-

Quarterly Reviews: Reviews are reframed as strategic sprints. Rather than checking KPIs against static goals, teams ask: What have we learned? What signals are emerging? Where should we shift resources?

-

Annual Budgets: Budgets become rolling and adaptive. Instead of fixing resources once a year, leaders allocate dynamically, based on learning and shifting priorities. Agile funding enables rapid scaling of new opportunities or quick exit from failing bets.

Example: How Microsoft relearnt to win in a world of FLUX

Microsoft’s core purpose — to empower every person and organization on the planet to achieve more — functions as a long-term compass. That enduring direction made it possible for leaders to shift course radically when the world changed (cloud, mobile, open source, AI) while preserving coherence across the company. The transition under Satya Nadella demonstrates FLUX in practice: maintained purpose + continuous, experimental moves that reconfigured products, culture, partnerships, and revenue models.

Then — traditional strategy: Big, multi-year bets; monolithic product cycles (big Windows launches, boxed software); rigid annual budgets and siloed business units; gated-stage reviews and centralized approvals; internal competition for limited resources; success measured by product shipments and license sales.

Now — FLUX strategy: Purpose-led but flexible portfolio of bets; rapid market experiments and continuous delivery (cloud-first, service updates); rolling forecasts and milestone-based funding; cross-functional, empowered teams; open partnerships and acquisitions to extend capabilities; data-driven learning loops from telemetry and customer behavior.

What Microsoft did

- Re-anchor decisions in purpose, not product

-

-

Use the corporate mission to evaluate strategic trade-offs (e.g., Microsoft embraced cross-platform tools because empowering customers mattered more than protecting OS monopolies).

-

Action: Every new product idea is assessed for alignment with the mission and net ecosystem value.

-

- Move from product releases to continuous delivery

-

Office → Office 365 (subscription + continuous updates) and Windows features as services reduced big-bang risk and increased customer feedback loops.

-

Action: Implement telemetry, real-time metrics, and staged rollouts to learn and iterate rapidly.

-

-

Adopt a portfolio of bets

-

Azure was scaled while preserving investments in Windows and Office — not an either/or strategy.

-

Action: Allocate capital as a mix of core bets, opportunistic experiments, and strategic options. Use small tranches (“venture within the firm”) and scale winners quickly.

-

-

Create liquid structures

-

Break large org silos into product teams, engineering groups, business-led initiatives (e.g., “One Microsoft” integration).

-

Action: Empower cross-functional squads with P&L responsibility for outcomes, not just outputs.

-

-

Open, partner, and acquire to accelerate

-

Embrace open source (Linux on Azure), acquire strategic platforms (GitHub, LinkedIn), and partner even with prior competitors.

-

Action: Redefine M&A criteria to include speed-to-market and ecosystem leverage, not merely vertical ownership.

-

-

Reform culture and leadership

-

Shift from “know-it-all” to “learn-it-all” mindset; remove internal performance systems that punished collaboration.

-

Action: Leadership models curiosity, reward experimentation and timely failure, and invests in continuous learning.

-

-

Change funding and governance

-

From annual fixed budgets to rolling forecasts and milestone-based funding tied to evidence.

-

Action: Create an internal investment committee that reallocates funds monthly/quarterly based on emerging signals.

-

-

Design for resilience & compliance

-

Strengthen security, privacy, and governance as speed increases — cloud operations require new guardrails.

-

Action: Build enterprise-grade security and compliance into every fast experiment from day one.

-

What Microsoft stopped doing

-

Don’t treat strategy as an annual event.

-

Abandon the idea that strategy is finalized once a year. Replace with continuous sensing and re-prioritization.

-

-

Don’t gate everything in bureaucracy.

-

Reduce rigid approval chains that stall experiments. Let small teams try ideas and prove them quickly.

-

-

Don’t hoard capabilities; share them.

-

Stop withholding platform assets to preserve product feudalism; instead expose APIs and platforms to internal and external partners.

-

-

Don’t measure only outputs.

-

Stop rewarding lines shipped or features completed. Measure customer outcomes, retention, and learning velocity.

-

-

Don’t silo data or customers.

-

Avoid isolated analytics and separate telemetry. Centralize insights so experiments across teams learn from one another.

-

-

Don’t view failures as career-ending.

-

Stop stigmatizing failed experiments; treat them as information with clear post-mortems and learning capture.

-

How Microsoft did it

-

Real-time insights platform: Real-time signals from products that inform tiny pivots or large re-allocations.

-

Milestone-based funding: Small initial funding, clear go/no-go metrics, and automatic scale-up triggers.

-

Cross-functional squads: Product managers, engineers, marketers, and ops co-located around outcomes.

-

Rolling forecasts: Finance tied to outcomes and experiments rather than fixed annual allocations.

-

M&A playbook for speed: Integration playbooks that preserve the acquired team’s velocity while aligning with mission.

-

Leadership rituals: Frequent strategy “huddles” that review signals, test assumptions, and re-allocate resources.

However … FLUX isn’t chaos. Microsoft’s example shows you must combine speed with governance:

-

Over-experimentation can confuse customers and waste capital—limit experiments with clear hypotheses and sample sizes.

-

Cultural fatigue from constant change must be avoided—balance stability with bursts of transformation.

-

Regulatory exposure increases with scale and openness — maintain compliance and privacy as non-negotiable.

-

Loss of coherence if purpose isn’t constantly reinforced—leaders must narrate why each micro-move ties to the mission.

What can we learn from Microsoft?

Microsoft’s pivot shows FLUX is a disciplined blend of anchored purpose + micro-moves. The company preserved a guiding mission while rewiring form and process: smaller bets, faster learning, liquid teams, open ecosystems, and rolling finance. The lesson for leaders is clear — in a world where uncertainty is the norm, the right strategy is not a static blueprint but a dynamic operating system: purposeful, iterative, and relentlessly experimental.

-

Clarify an enduring purpose that’s action-guiding.

-

Build feedback loops (telemetry, customers, partners) into every initiative.

-

Fund as you would seed startups: small, fast, and outcome-tethered.

-

Make orgs liquid: create autonomous teams with clear alignment mechanisms.

-

Institutionalize learning: treat experiments as assets with documented insights.

-

Set governance that enables speed but preserves trust (security, ethics, compliance).

Leading in a state of FLUX

Embracing flux requires new leadership mindsets. Leaders must combine anchored vision with adaptive action. They must be comfortable with ambiguity, foster cultures of curiosity, and empower distributed decision-making. Most importantly, they must role-model resilience—showing that uncertainty is not a threat but a source of renewal.

This is not easy. Many executives were trained in eras of stability, where control, planning, and prediction defined good strategy. But as Satya Nadella of Microsoft notes, success today comes from a “learn-it-all” mindset, not a “know-it-all” one.

In a turbulent world, strategy can no longer be a fixed plan. It must be a living, breathing process—anchored by enduring purpose, but always in motion. FLUX Strategy captures this duality: the need to be fast, liquid, uncharted, and experiential.

The companies that thrive will not be those that resist change, nor those that chase it blindly. They will be those that flow with it—anchored, yet adaptive. Purpose gives direction; flux provides momentum. Together, they make strategy fit for a world where change is the only constant.

How can your business win in a world of FLUX? Email me for keynotes and workshops at peterfisk@peterfisk.com

Each month The Brand Doctor, business expert Peter Fisk, takes a global brand that has lost its way, and considers how it could reinvent itself. If it’s your brand, do you have the courage to change? If not, what would you do, and how could you apply these ideas for reinvention to your own business?

Gucci at the Crossroads

There is a peculiar cruelty in fashion’s calendar: brands that once seemed able to do no wrong are judged, in a heartbeat, as having done far too much. For Gucci — a house that, in living memory, turned stodgy heritage into unignorable cool and then multiplied that cool across demographics and continents — the turning point has been painfully public.

Once the engine of Kering’s fortunes, Gucci has seen precipitous declines in sales and relevance; commentators point to over-marketing, the erosion of exclusivity, an avalanche of products and collaborations that confused rather than clarified, and a failure to read the new rules of luxury consumption fast enough. The result has been a collapse in demand that ricochets through revenues, margins and market value.

At the same time, another luxury behemoth — Hermès — appears to have mastered the opposite lesson. By refusing to chase every trend, keeping its designs remarkably consistent and protecting scarcity, Hermès has accumulated a valuation that, for a period, eclipsed even that of LVMH. It is not merely a question of taste; it is a story about how brands generate durable value. Hermès’s patient stewardship of craft, queueing systems and carefully managed distribution has turned artistic conservatism into a financial superpower.

So: what went wrong at Gucci? How have markets shifted — notably across Asia and among Gen Z — and what can Gucci learn from the likes of Hermès and other resilient players? Most urgently: what must Gucci do now to arrest the decline and deliver fresh revenue, restore margins and rebuild long-term value? Below is a frank, magazine-style diagnosis, followed by bold prescriptions for reinvention — modest in some parts, radical in others — and a recommended path designed to rescue both brand and balance sheet.

The rise, the reinvention and the overstretch

Gucci’s story is a study in repeated reinvention. In the 1990s Tom Ford rebooted the label with a seductive, hyper-glamourous vision; Gucci became provocative and desirable in one deft pivot. Later, Alessandro Michele — a designer with a taste for maximalism and eclectic nostalgia — turned Gucci into a cultural phenomenon again, producing collections that read as both costume and status symbol. Those changes were not cosmetic; they re-wired demand and repositioned Gucci at the intersection of runway, music and internet culture. For a time, the house was unstoppable.

That success begets imitation, of course, and at scale it begets repetition. The strategy that made Gucci omnipresent — collaborations, limited drops, social-first marketing, rapid rollouts of logo-heavy categories — became the very engine of its over-exposure. By the early 2020s, the brand was ubiquitous: in high fashion, on the high street through knockoffs, in secondary markets, and in product lines that ranged from shoes and handbags to candles and dog-collars. In such ubiquity the brand’s aura faded. Exclusivity is a social signal; when the signal becomes noise, the value of the message drops.

The symptom was easy to measure. Sales fell sharply; Kering, heavily dependent on Gucci for revenue and much of its operating profit, struggled to regain momentum. The backlash was not merely commercial — critics accused Gucci of chasing short-term buzz over a coherent long-term identity. As experiments multiplied — more variants, more capsule collections, more licensed products — the wardrobe of the brand became crowded and its story diluted. The paradox was stark: in seeking to be everywhere, Gucci had gradually become nowhere in particular.

Not all luxury is equal: Hermès and the economics of scarcity

Hermès’s counterexample matters because it shows a very different way to create shareholder value. Hermès has leaned into craft, rarity and patience. It does not chase seasonal hype; it polishes and protects. Hermès limits supply, maintains long waiting lists for iconic items, and keeps a highly vertical supply chain that preserves quality and product mystique. Financially, the payoff is immense: scarcity begets price resilience, margins stay fat, and the brand’s valuation climbs as investors prize predictability and margin sustainability.

This is not simply conservatism as vanity. Hermès’s approach is a business model that optimises for durable pricing power and repeat purchasing among a wealthy client base that prizes provenance over novelty. Its valuation, in turn, reflects the market’s willingness to pay a premium for brands that can convert desirability into predictable profits. That is a lesson Gucci’s current owners must treat as more than an aesthetic observation: it is a stark commercial contrast.

The market has changed: Asia, Gen Z, resale and authenticity

Luxury’s growth engine in the 21st century was Asia. China’s booming demand rewrote the geography of luxury; during the 2010s one could almost predict growth by simply looking at luxury tourism flows and Chinese domestic consumption. But the early 2020s brought disruptions: economic slowdowns, shifting political sentiments and a new generation of consumers — Gen Z — whose attitudes to conspicuous consumption diverge from their elders’. For many young buyers the appeal of a brand is not merely its logo but its social meaning: sustainability, uniqueness, provenance, community and authenticity rate highly. They prize brands that tell a layered story and resist obvious flaunting.

Another seismic change has been the growth of the pre-owned market. Gen Z embraces resale not only for price but because second-hand goods are a route to individuality: a vintage Gucci jacket is different in a way that a brand-new logo print is not. The proliferation of resale platforms and a cultural shift towards circular fashion have undermined the old model where more product simply meant more control. A glut of new product fuels a robust secondary market — and that market, while not inherently negative, indicates a mismatch between supply and the deep, branded desire that powers true luxury pricing.

Asia itself is more nuanced now. Young consumers in tier-one cities are sophisticated and fickle; they are global in outlook and local in sentiment. They want luxury, but redefined: the “look at me” flash of the noughties has been replaced in many cohorts by a quieter wealth — ‘slow luxury’ — where craftsmanship and understatement, or culturally resonant collaborations, matter. Brands that read that shift and adapt their product cadence will find footholds; those that do not risk being judged as yesterday’s flex.

How Gucci compares to its peers

Gucci’s difficulties cannot be solely blamed on managerial missteps. The category has changed. Yet while many houses muddle through, a few have demonstrated the right kind of discipline.

-

Hermès has insisted on scarcity, vertical integration and product stability. Its strategy turns product restraint into a pricing lever.

-

Chanel similarly controls distribution tightly and resists discounting. It keeps its classic codes intact, and while it does innovate, the changes are incremental and usually feel like cultural continuations rather than riffs.

-

Louis Vuitton has blended heritage with forward creative appointments, but it too understands the need to keep many of its most powerful symbols rare and elevated.

-

Newer players — from streetwear collaborators to “neo-luxury” digital natives — have done well by carefully mediating how and when they appear. Too many drops, too many lines and too much exposure can be a brand’s undoing.

Compared with these peers, Gucci’s error has been a tempo problem as much as a design problem. It moved from high-frequency experimentation (which had short-term commercial upsides) to a cadence that undermined long-term desirability. The lesson is not that Gucci must freeze in amber, but that control and curation — not ubiquity — produce the sweet spot where both consumers and investors align.

Reinventing Gucci: strategy for brand and balance sheet

Rebuilding Gucci requires a dual mandate: win back cultural credibility with consumers, and repair the business model to restore revenues, protect margins and re-create shareholder value. The temptation is to tinker; the wiser move is to re-set guardrails. Below I set out a strategic plan that is bold yet financially focused.

1. Re-establish scarcity and slow the cadence.

Gucci must reduce the number of launches and limit the volumes of certain symbolic categories. Practically: cap seasonal capsule releases, control wholesale allocations, and create deliberate scarcity for headline SKUs (handbags, belts). Scarcity is not a marketing slogan; it is a pricing mechanism. Over time, fewer but more intentional drops will rebuild waiting lists and improve margin per item. Financially, this reduces discounting risk and improves gross margin.

2. Simplify the offer: focus on fewer product pillars.

Museums and markets show us that clarity creates value. Gucci should identify two or three definitive product pillars (say: handbags/leather goods, footwear, and tailoring/ready-to-wear) and commit to excellence in those areas. Peripheral categories (kitchenware, mass-market fragrances beyond strategic olfactory lines) should be ruthlessly audited. By concentrating investment in the highest margin, highest-status pillars, Gucci will enhance profitability and restore signal clarity to consumers.

3. Rebalance distribution: fewer concessions, more control.

Exclusivity is also about place. Gucci must tighten control over where its most coveted pieces appear, limit promotional partnerships and renegotiate wholesale terms. The company should prioritise direct retail (owned stores and e-commerce) where possible because these channels signal premium and deliver better margins. Financially, shifting mix towards DTC can lift gross margin and give closer customer data.

4. Rebuild desirability through craft and storytelling.

Hermès’s advantage is craft; Gucci’s advantage is cultural energy. Fuse the two. Invest in artisanal lines that foreground Italian craft, create limited craft series that are numbered and certified, and tell the human stories behind them. Consumers will pay a premium for provenance; the margin upside is direct.

5. Lean into circular and experiential commerce.

Rather than pretend resale is a threat to be denied, Gucci should partner with leading resale platforms for authenticated vintage Gucci—curated by the house. This keeps control over the second-hand narrative and captures transaction fees and customer data. Additionally, invest in flagship experiences — ateliers, bespoke workshops, immersive stores — to create reasons for high-value customers to engage physically. These initiatives drive revenue (through services and higher-ticket items) and signal stewardship rather than saturation.

6. Refine collaborations to be strategic, not shameless.

Collaborations should be numbered, purposeful and confined to a long-term cultural project. A handful of culturally compatible partners a year — ideally ones that reinforce craftsmanship or heritage — will keep Gucci culturally relevant without turning it into a playground of endless co-brands.

7. Recalibrate pricing architecture and margin protection.

Gucci must avoid the erosion that comes from frequent discounts. Establish clear tiering — classic, seasonal, and limited-edition — with explicit pricing strategy for each. Protect gross margin by ensuring limited editions and craft pieces command significant premium. Over time, as scarcity re-emerges, the house will be able to lift ASPs (average selling prices) without sacrificing volume in the higher tiers.

8. Reconnect with emerging luxury tastes: Gen Z and Asia.

Winning Gen Z requires authenticity and community. Gucci should invest in local cultural partnerships that are not merely promotional but co-creative: music, art, regional designers and story-led capsule projects that respect local aesthetics. In Asia, embrace local narratives: collaborate with regional artisans, host cultural dialogues in stores and create products that carry local meaning without diluting global codes.

A bolder idea: Gucci as a house of heirlooms

If the above are sensible reforms, here is a more stretching proposition: reposition Gucci as a “house of heirlooms.” This is not mere marketing spin; it is a structural shift in how product is conceived, manufactured and priced.

Under this plan Gucci would:

-

Create a certified “Heirloom” line, physically distinct and limited in production, with serial numbers, artisan documentation and repair guarantees.

-

Offer lifetime restoration services and an authenticated resale channel run by Gucci itself (a vertically integrated pre-owned business). Gucci would buy back, certify, and resell vintage items — capturing margin on both sale and resale, and tightening the product lifecycle.

-

Introduce an archival bespoke service where clients can commission one-off pieces based on historical Gucci motifs, at prices that better reflect the true cost of couture.

-

Use this architecture to justify fewer mass launches: mass market desirables could remain, but the brand’s centre of gravity would be a premium, durable, high-margin craft tier.

Financially, this model creates several benefits: higher ASPs for the Heirloom tier; new revenue streams from services and authenticated resale fees; improved gross margins due to premium pricing; and, crucially, higher brand equity that supports long-term valuation. The downside is that implementation requires investment in workshops, artisan hiring and resale infrastructure — but those are investment items with multiyear payback and positive operating leverage if executed properly.

Rebuilding the brand

Whatever path Gucci chooses, execution must be surgical. Recommended immediate actions:

-

90-day sprint: prune lower-margin product lines, halt permissive wholesale deals, and announce a “refinement” strategy to signal seriousness to consumers and investors.

-

12-month plan: roll out the Heirloom pilot, renegotiate key distribution contracts, and launch the authenticated resale partnership.

-

24-month horizon: scale artisan workshops, open experiential flagships, and reveal a curated calendar of collaborations for the next three years.

KPIs to measure progress are straightforward: ASP movement, gross margin by product tier, proportion of revenue from DTC, resale channel take rate, inventory days, and brand desirability metrics (waiting lists, secondary market prices, social sentiment). Restoring profitability is not just about cutting costs; it is about re-creating willingness to pay.

The risks of the plan are real. Scarcity can appear contrived if not supported by product quality. Vertical resale requires competencies Gucci may lack. Slowing product cadence could suppress short-term revenue. But the cost of inaction is greater: continued erosion of brand equity leads to diminished pricing power, frozen margins and a vicious cycle of discounting that delivers immediate sales but destroys long-term value. The market has demonstrated, repeatedly, that investors prize predictability and sustainable margins. Hermès’s premium valuation is the market’s reward for patience; Gucci must aim to reclaim some of that discipline.

The luxury of restraint

Gucci’s predicament is a lesson about the economics of desirability. Ubiquity makes a brand visible; scarcity makes it valuable. In turbulent markets — as Asia’s tastes evolve and Gen Z reshapes the rules — the houses that will win are those that understand not only how to be loved today, but how to remain coveted tomorrow.

The path forward for Gucci is less about radical stylistic reinvention and more about strategic self-discipline. Reduce noise. Invest in craft. Curate scarcity. Privatise resale. Make fewer, more meaningful things, and charge appropriately for them. Rewire distribution so that the most prized items are truly rare. In so doing Gucci will rebuild both its cultural cachet and its financial muscle: higher ASPs, improved margins, more reliable cashflows and — in time — restored market value.

That is the paradoxical freedom of luxury: by choosing to do less, Gucci can again become the house that commands the world’s attention.

More from Peter Fisk

- What’s New and Next in Branding? Brands capture an irresistible idea, compelling and intuitive, engaging and inspiring people in ways that companies and products cannot. They build platforms and connections through which customers and business can achieve more.

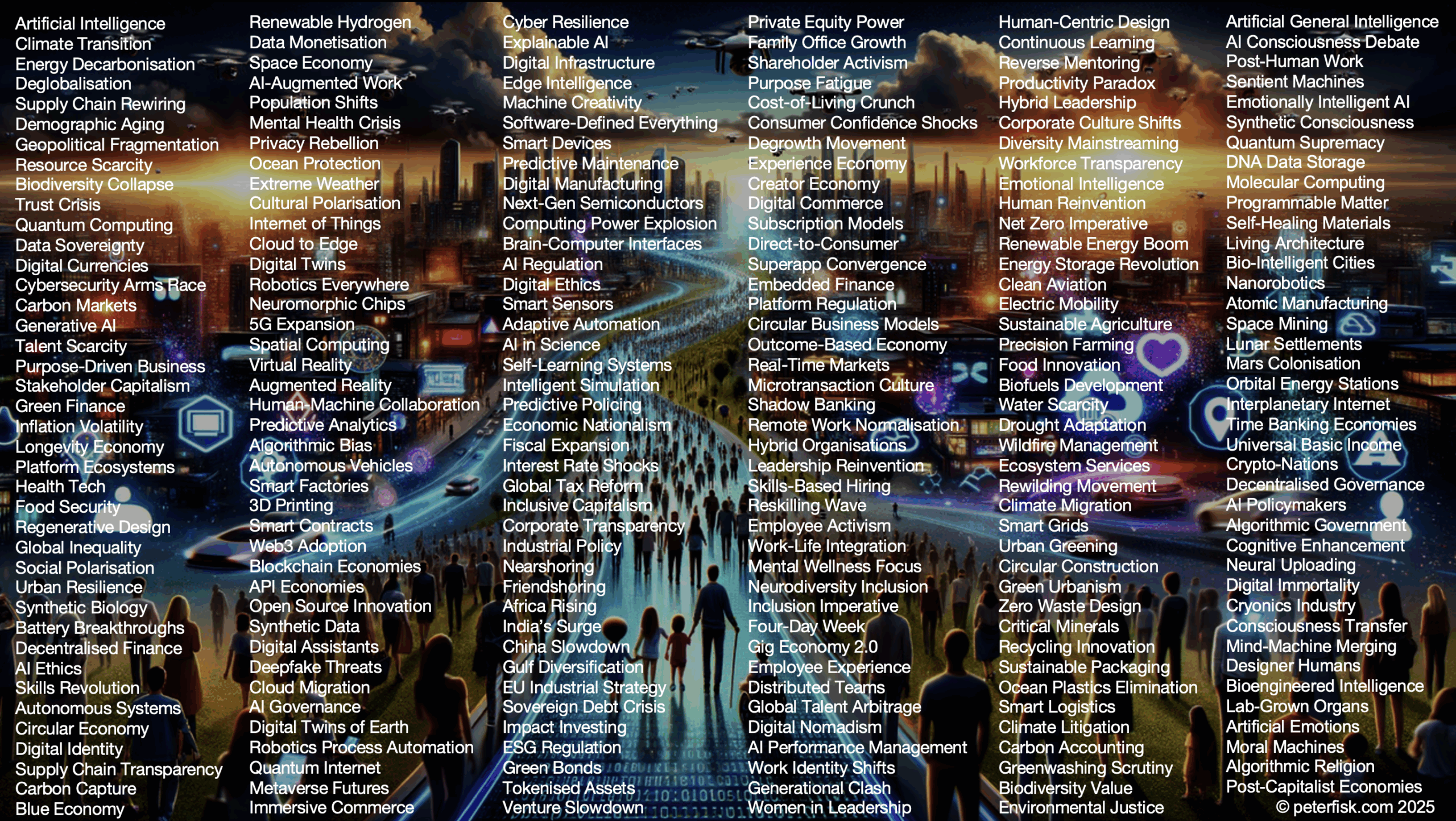

- Eyes on Tomorrow: What Leaders Must See before Everyone Else … exploring the most important megatrends that are transforming markets, and leadership mindsets, and how the best companies embrace them as opportunities … based on the new Megatrends 2035 report by Peter Fisk, and its implications for every business.

- The Reinvention Playbook: Thriving in a World of Relentless Change … the best organisations seek to continually reinvent themselves in a world of constant, uncertain and dynamic change. They rethink, refocus, and reinvent everything – embracing new agendas from AI to GenZ, climate change and social inequality.

- The Nexus Effect: Unlocking the Power of Connections … How can businesses and brands really unlock the power of data and networks, flywheels and AI, communities and ecosystems, to transform their futures?

- The New Growth Playbook: 9 New Ways to Accelerate Growth … many companies struggle to find new ways to grow their business … instead we look at how the best companies find radically new ways to grow.

- Super Innovators: Innovation Beyond the Normal … 10 radical ways to disrupt conventions, embrace deeper insights, unlock valuable assets, and stretch innovation for more dramatic impact.

- Consumer of the Future … “Aisha blinked twice, the smart lenses in her eyes had already scanned her biometric mood, cross-checked her carbon budget, and pulled up items her climate-positive friends were buying this week”

- Competing in the FLUX: How to develop a dynamic strategies in a world of relentless change … combining a strong, enduring direction with micro-moves that adapt quickly to emerging shifts:

- Business Transformation: The new superpower of business leaders … reimagining the future, redefining strategy, reinventing the organisation, rewiring performance … the journey to deliver step change in value creation.

- The Sustainable Consumer: Go on, do the Right Thing … how brands can accelerate the consumer shift to sustainable products and practices … from food and fashion, to energy and electric cars, making sustainability desirable and better.

- The “Performer Transformer” Leaders: How great leaders deliver today and create tomorrow … with dual thinking, to build dynamic ambidexterity, continually strategyzing, to perform and transform.

- The Hire-Wire Act of Leadership: Leading in a world of intense competition and relentless change … being visionary and innovative, learning to adapt and endure … inspired by Taylor Swift, Roger Federer, Beyoncé, and Lionel Messi

- Becoming a Future-Ready Business … in a world of relentless change, organisations need to anticipate change, embrace innovation, empower talent, and align deeply with the evolving needs of society and the planet

- Ecosystems Inc: from music disruption to every industry by Peter Fisk

- The Nexus Effect: unlocking the power of connections by Peter Fisk

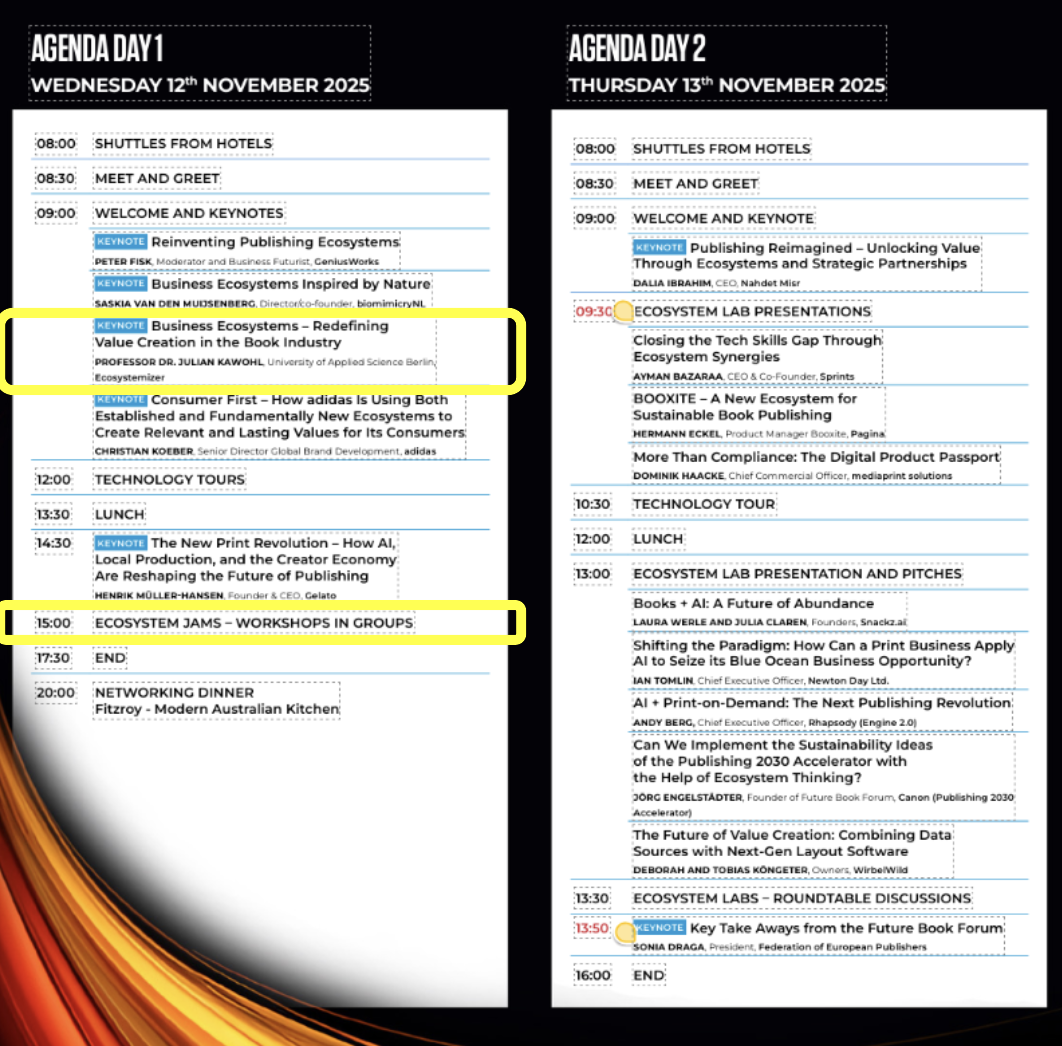

- FBF25: Beyond Books, Unlocking the Power of Ecosystems hosted by Peter Fisk

In nature, everything is connected. Every leaf, river, bird, and grain of soil participates in a complex dance of energy, matter, and meaning. Forests breathe life into the air that oceans carry across the planet; fungi whisper through root networks beneath our feet; coral reefs bloom and fade in cycles of abundance and renewal. Nature is not a static system, nor is it controlled by a single actor. It is an ever-evolving web of relationships that thrives through adaptation, interdependence, and diversity.

Today, as business leaders seek to navigate turbulent times — climate crises, technological disruption, social fragmentation, and global realignment — they might look to nature for lessons in how to thrive amidst complexity. For billions of years, life has experimented, failed, evolved, and reinvented itself. In doing so, it has developed a timeless wisdom for how systems grow, sustain, collapse, and regenerate. Understanding this can help us build, manage, and evolve business ecosystems that are not only more resilient but more meaningful and humane.

We explore how natural ecosystems form, function, and transform, before drawing deep parallels with the business ecosystems of today — networks of organisations, technologies, and people that co-create value and shape markets. Nature, it turns out, is the ultimate strategist.

Understanding Natural Ecosystems

The Format of Nature’s Systems

A natural ecosystem is a living system of interrelated organisms and their physical environment. It encompasses the flow of energy, the cycling of nutrients, and the intricate web of relationships between producers, consumers, and decomposers. From tropical rainforests to polar tundra, from coral reefs to desert plains, each ecosystem has a unique structure — its own format, one might say — that reflects the interaction between life and environment.

An ecosystem is not just a collection of species; it is a dynamic network of exchanges. Plants harness sunlight and convert it into chemical energy; herbivores consume plants; carnivores consume herbivores; decomposers recycle the waste and return nutrients to the soil. These interactions are circular, not linear. Nothing is wasted. Everything feeds something else.

The format of a natural ecosystem can be described in three layers:

-

Energy Flow: The fundamental movement of energy through the system — from the sun to plants, animals, and decomposers.

-

Nutrient Cycling: The continuous recycling of essential materials like carbon, nitrogen, and phosphorus, ensuring long-term fertility.

-

Trophic Structure: The hierarchy of feeding relationships — producers, consumers, predators — that maintains balance and diversity.

Healthy ecosystems are self-organising. They do not rely on external control. They maintain stability through diversity, redundancy, and feedback loops. When one species declines, others adapt; when resources change, the system reorganises. This is what ecologists call dynamic equilibrium — a balance achieved through constant movement, not stasis.

Formation: How Ecosystems Emerge

Ecosystems are born from opportunity — from the interplay between environment and life’s restless creativity. A bare rock after a volcanic eruption becomes the stage for pioneering lichens; their acids break down stone into soil, inviting mosses and ferns; these invite insects, which attract birds; and soon a thriving forest stands where once there was only lava.

This process, known as ecological succession, unfolds in stages:

-

Pioneer Stage: Hardy species colonise barren environments, breaking down rock and enriching soil.

-

Intermediate Stage: Grasses, shrubs, and small trees establish themselves, stabilising the landscape.

-

Climax Community: Mature, stable ecosystems emerge, with complex food webs and high biodiversity.

But stability never lasts forever. Fires, floods, disease, and climate shifts periodically disrupt even the most ancient forests. Yet these disturbances are not merely destructive — they are agents of renewal. In nature, disturbance is part of design. The old gives way to the new; nutrients are released, sunlight reaches the forest floor, and new life begins again.

Thus, ecosystems are constantly forming, transforming, and reforming. The cycle of birth, growth, death, and regeneration is not a failure of the system but its essence. Nature’s resilience comes not from rigidity but from its ability to adapt, reorganise, and evolve.

Disruption and Renewal: The Logic of Change

To the untrained eye, a forest fire looks catastrophic. Yet within months, green shoots emerge; within years, animals return; within decades, a richer, more diverse ecosystem may stand where the old one burned. Ecologists call this the adaptive cycle — the logic of nature’s renewal.

This model, originally developed by ecologist C.S. Holling, describes the recurring pattern through which complex systems evolve. It consists of four phases:

-

r – Growth: Rapid expansion, innovation, and exploitation of new opportunities.

-

K – Conservation: Maturity, efficiency, and accumulation of structure and resources.

-

Ω – Release: Collapse, disturbance, or creative destruction — when accumulated rigidity breaks down.

-

α – Reorganisation: Renewal, experimentation, recombination, and the emergence of new forms.

Every natural ecosystem moves through this cycle at its own rhythm. A pond may evolve and dry up over seasons; a forest may take centuries. The critical insight is that collapse is not an endpoint — it is a phase in the perpetual dance of life. In Holling’s words, “In nature, collapse becomes compost for the next generation.”

What We Can Learn from Nature’s Systems

Nature’s systems thrive because they follow a few timeless principles — elegant operating conditions that enable life to persist and flourish through endless change.

1. Context Is Everything

Every organism is locally attuned and responsive. A cactus conserves water because it lives in the desert; a willow bends with the wind because it grows by rivers. No universal strategy works everywhere — survival depends on fit.

For businesses, the lesson is profound. Many organisations attempt to impose standardised models across regions, cultures, or industries. But thriving ecosystems — biological or commercial — emerge when participants are contextually intelligent. They sense their environment, adapt behaviours, and co-evolve with their surroundings. In other words: strategy should emerge from place, not be imposed upon it.

2. Relationships Before Tasks

In nature, relationships matter more than roles. The success of a forest is not determined by any single tree but by the symbiosis between trees, fungi, insects, and animals. Cooperation, reciprocity, and mutual benefit are the building blocks of resilience.

In business ecosystems, value creation increasingly depends on networks of partners rather than isolated firms. Apple’s iPhone succeeded not because of the device alone but because of its surrounding ecosystem — app developers, accessory makers, and content providers. The same is true for Amazon’s marketplace, Tesla’s charging network, or Shopify’s developer community. Healthy business ecosystems, like natural ones, thrive on trust, shared purpose, and mutual interdependence.

3. Change Happens

Evolution is continuous; renewal follows disturbance. In nature, there is no such thing as permanent stability. Life adapts — or it dies. Systems that cling to the past become brittle; those that embrace change flourish.

For organisations, this is a call to build adaptability into the core. Instead of resisting disruption, leading companies harness it as fuel for renewal. They experiment, iterate, and evolve — constantly shedding what no longer serves them. The capacity for renewal is the true measure of longevity.

The Adaptive Cycle in Business

The adaptive cycle provides a powerful lens through which to understand the evolution of industries, markets, and organisations. Every business ecosystem — whether in publishing, technology, fashion, or energy — moves through its own rhythm of growth, conservation, collapse, and reorganisation.

Let’s translate the four phases of nature’s adaptive cycle into the language of business.

r – Growth: Exploration and Innovation

This is the entrepreneurial phase — a time of opportunity, creativity, and rapid expansion. In nature, this is the pioneer stage: grasses colonising bare soil after a fire. In business, it is the startup or early growth phase, marked by experimentation and risk-taking.

Examples abound: the early days of Silicon Valley; the rise of digital publishing; the renewable energy revolution. The focus is on discovering niches, testing ideas, and establishing footholds. Diversity flourishes; competition is intense but generative.

In this phase, energy is abundant but structure is weak — just like the first shoots of a forest. The challenge for leaders is to nurture diversity without losing coherence, to allow innovation while maintaining purpose.

K – Conservation: Efficiency and Stability

As ecosystems mature, resources become concentrated and networks stabilise. Energy flows efficiently, but flexibility declines. In business, this corresponds to the maturity phase — when companies optimise for efficiency, scale, and predictability.

Industries standardise processes, dominate markets, and extract value from established systems. This is the phase of consolidation — and often of complacency. Innovation slows; bureaucracy grows; margins tighten.

The ecosystem becomes tightly coupled — highly efficient but fragile. Like an old-growth forest, it looks stable but is vulnerable to shock. The lesson here: efficiency without adaptability is the prelude to collapse.

Ω – Release: Disruption and Collapse

Eventually, rigidity meets reality. A drought, a pest, or a wildfire disrupts the forest; in business, it might be a new technology, regulation, or shift in consumer behaviour. The structures that once created strength now become liabilities.

This is the creative destruction phase — what economist Joseph Schumpeter called the essential driver of capitalism. The book industry, for instance, moved through growth and consolidation and now finds itself in a release phase, disrupted by digital platforms, self-publishing, and AI.

For leaders, the challenge is not to resist collapse but to use it as compost. Decline, if embraced with humility and imagination, becomes the seedbed of renewal. The key is to let go of what no longer serves — rigid hierarchies, outdated models, or unhelpful assumptions — to make space for new growth.

α – Reorganisation: Renewal and Regeneration

After fire comes renewal. The soil is rich, the landscape open, and opportunity abundant. In business, this is the moment of reinvention — when new ideas, players, and structures emerge.

Startups flourish in the ashes of incumbents; new technologies unlock latent value; new networks form. The most successful companies in this phase embrace experimentation, recombination, and learning. They don’t rebuild the old system; they design the next one.

This is where purpose, imagination, and collaboration matter most. Renewal is not about recovery; it is about regeneration — the creation of something more resilient, diverse, and adaptive than before.

The Architecture of Business Ecosystems

Business ecosystems, like natural ones, are living systems of interdependence. They are not linear value chains but networks of collaboration, connecting suppliers, partners, platforms, customers, and even competitors in shared value creation.

Formation

Just as a pioneer plant colonises a barren landscape, new business ecosystems often begin with a catalyst — a technology, idea, or unmet need that opens a new niche. Think of how the iPhone spawned a mobile app ecosystem, or how the rise of renewable energy has birthed vast collaborations between utilities, battery makers, and software firms.

These ecosystems attract participants who see mutual opportunity. Over time, shared platforms emerge — standards, technologies, or marketplaces that enable coordination. The structure evolves organically as participants specialise, collaborate, and compete.

Structure

Healthy business ecosystems exhibit several characteristics:

-

Diversity: Multiple actors with complementary roles and perspectives.

-

Interdependence: Each participant contributes to, and depends on, others for success.

-

Feedback Loops: Continuous exchange of information and value.

-

Adaptability: The capacity to evolve in response to change.

In digital ecosystems, these dynamics are visible in platform economies — from Amazon’s marketplace to Microsoft’s developer network. But similar logics apply in local innovation clusters, such as Silicon Valley or Shenzhen, where dense networks of collaboration fuel creativity and speed.

Disruption and Renewal

Like forests, business ecosystems eventually face disruption. Technologies mature, consumer needs shift, and environmental or social pressures demand change. Some ecosystems collapse; others evolve. The difference lies in whether participants treat disruption as a threat to stability or a trigger for evolution.

Learning from Nature’s Design Principles

The parallels between natural and business ecosystems offer powerful guidance for leaders seeking to design systems that endure.

1. Diversity Creates Resilience

Monocultures — whether of crops or corporations — are inherently fragile. Diversity allows systems to absorb shocks, innovate, and adapt. In business, diversity of thought, talent, and partnership fuels creativity and robustness.

2. Redundancy Is Strength, Not Waste

In nature, multiple species perform similar roles, ensuring that if one fails, others can fill the gap. In business, redundancy — overlapping capabilities, flexible teams, distributed authority — increases adaptability. Lean efficiency must be balanced with slack for resilience.

3. Feedback Loops Maintain Balance

Ecosystems regulate themselves through feedback — predator-prey relationships, nutrient cycling, climate response. Similarly, businesses need mechanisms for sensing, learning, and adjusting in real time. Data analytics, customer feedback, and agile management all mirror nature’s feedback intelligence.

4. Collaboration Outperforms Competition

Nature is not a gladiatorial arena but a network of cooperation. Mycorrhizal fungi connect trees through underground networks, sharing nutrients and information. Likewise, companies in ecosystems succeed by creating value together, not merely competing for share. Partnership is strategy.

5. Renewal Follows Disturbance

Disturbance is not failure; it is the engine of evolution. In times of disruption, leaders should focus less on restoring the old order and more on designing the conditions for renewal — cultivating experimentation, decentralising authority, and inviting new voices.

From Sustainability to Regeneration

The language of business has long borrowed from nature — “growth,” “roots,” “organic,” “ecosystem” — but too often superficially. Sustainability has become a corporate mantra, but nature teaches us something deeper: regeneration.

Sustainability seeks to maintain what exists; regeneration seeks to renew what has been depleted. In natural terms, sustainability is equilibrium; regeneration is evolution. A regenerative business ecosystem restores value to society, nature, and the economy — creating positive feedback loops that enhance the whole system.

Companies like Patagonia, Interface, and Unilever are embracing this logic: designing circular supply chains, investing in social capital, and aligning growth with planetary health. These are not acts of altruism; they are acts of adaptation. As in nature, survival depends on symbiosis.

The Future of Business Ecosystems

We are entering an age when no company can thrive alone. The challenges of our time — climate, AI, inequality, health, trust — are systemic, not isolated. They require systemic responses. Business ecosystems are the organising structures of the future.

But to build them wisely, we must look beyond the mechanical metaphors of the past and rediscover the living intelligence of nature. The future belongs to leaders who think like gardeners — who cultivate conditions for others to grow, nurture diversity, and trust the self-organising power of relationships.

As with forests and reefs, the most vibrant business ecosystems are those that continuously renew themselves, balancing order and chaos, stability and change, growth and release. The art of leadership, then, is not control but cultivation — creating the conditions for life to flourish.

Nature’s Mirror

In nature, everything is connected, and everything changes. Systems rise and fall, species appear and disappear, yet life endures — endlessly creative, adaptive, and interdependent. The same is true of business.

To understand ecosystems, in nature or commerce, is to understand the flow of energy, the importance of relationships, and the inevitability of transformation. Nature teaches us that collapse is not the end, but the beginning of renewal. The ashes of the old forest nourish the seeds of the new.

As we face our own age of disruption, the wisdom of nature offers both comfort and challenge. Comfort, in knowing that change is part of the pattern; challenge, in learning to let go of what no longer serves, and to design for life, not control.

In the end, the businesses that endure will not be those that conquer markets but those that co-evolve with them — alive to context, rich in relationships, and ready to renew.

- Join me at this year’s Future Book Forum (FBF25)

- Read my article The Spotify of Books about Gelato

The traditional model of book publishing—author, editor, publisher, print production, distribution, reader—is increasingly under pressure. New technologies, changing reader habits, globalisation and the surge of digital formats all point to a future in which a printed book is just one node in a far broader ecosystem of content, services and experiences. At the heart of that transformation lies artificial intelligence (AI). But the real opportunity is not merely in using AI as a tool; it’s in rethinking publishing as an ecosystem, where books become platforms for engagement, data, interaction and value creation.

Why AI matters

AI brings several powerful shifts to publishing:

-

Production efficiency and scale: What once required months of editing, design, typesetting, translation, layout and distribution can now often be compressed, automated or significantly accelerated via AI tools. For example, one study of the African book-publishing sector notes that AI is altering “content acquisition by authors and publishers, content and product development, as well as the marketing and distribution of products.”

-

Smarter metadata, discoverability and rights-management: AI can analyse manuscripts for market potential, suggest keywords and metadata, translate text, generate alt-text for accessibility, and optimise cover design or pricing. A vendor dossier on “AI in Book Publishing” highlights use-cases such as trend prediction, demand forecasting, translation & audio, rights management and e-book generation.

-

Personalised experiences: Readers are no longer passive recipients of a static artifact. With AI we can imagine more adaptive reading journeys (e-books that change sequence based on reader behaviour), multi-format companions, recommendations based on engagement signals, and interactive or branching content.

-

Global reach and localisation: AI driven translation, region-specific case-studies, localised editions, voice-narration for audiobooks all expand the book’s potential into global micro-markets with much faster turnaround and lower cost.

-

Ecosystem monetisation beyond one-time sales: With digital platforms, memberships, courses, spin-offs, communities and data streams, books can become recurring-value products rather than single-purchase events.

Why ecosystems matter

The real leap for publishing isn’t just adding AI tools; it’s embracing ecosystem-based models. What does this mean?

-

Platform thinking: Instead of treating each book as a one-off artefact, publishers and authors build platforms that host a network of content, services, reader engagement, community feedback, micro-products and data-flows. The book becomes entry-point.

-

Interconnected services and content: A book might lead to a companion app, interactive webinars, live events, workshops, subscriptions, spin-out micro-editions, localised versions, audiobooks, case-study databases, community networks.

-

Data and feedback loops: Reader behaviour (time spent, dropout points, commentary, sharing) feeds back into the platform and shapes subsequent content, editions, formats, spin-offs. AI helps interpret the data, identify niches, prompt authors/publishers to act.

-

Rights and licensing fluidity: Rather than waiting years for spin-offs, rights to translation, adaptation into courses, games, apps, merchandise can be activated more rapidly. The ecosystem spans industries.

-

Global and local hybridisation: Ecosystems serve global reach while enabling local flavour. A central edition might be adapted regionally using AI translation + local examples + print-on-demand.

-

Reader as co-creator: In some ecosystem models, the reader becomes part of the creative economy—via annotations, feedback, branching narratives, community-led spin-outs. This shifts the role of reader from consumer to collaborator.

Why this matters now

For authors (especially self-publishing), for smaller presses, and for innovators, the convergence of AI + ecosystem thinking offers a generational opportunity: lower barriers to entry, richer forms of engagement, faster time-to-market, greater global reach, and diversified revenue streams. But it also demands new skills (digital platform design, community building, data insight, rights strategy), new mindsets (book as service not just product) and new ethics (AI-use transparency, quality control, author compensation, localised value). The risk is that without thoughtful design, the publishing floodgates may open so wide that quality, trust and distinctiveness are lost.

People plus machines

The UK’s Publishers Association commissioned a report titled People plus Machines: The Role of Artificial Intelligence in Publishing. Among many findings: two-thirds of large AI-active publishers reported they are already seeing benefits from AI investment. The report also documents specific case-studies: for example, Taylor & Francis partnered with Danish AI-technology firm UNSILO for a three-year collaboration to deploy AI tools in content workflows.

-

This case shows the shift from individual publisher projects to ecosystems of organisations: publishers working with AI-vendors, universities, research centres, tech firms.

-

It illustrates how internal publishing workflows (editing, metadata, layout, translation) are being embedded into broader service ecosystems where machine + human co-operate.

-

By strengthening workflows, the book becomes faster to market, better tailored, and more discoverable — which supports the platform + ecosystem model: the book sits within a network of data, analytics, user insights and downstream services.

Even in “traditional” publishing, the future is not outsourcing one tool but building partnerships (ecosystems) across functions—machine + human + network—to drive smarter, more efficient publishing.

Pioneers of the ecosystem future

Here are illustrative examples from around the world—platforms, publishers, start-ups, services—that demonstrate different facets of the AI-ecosystem future of publishing. For each, I outline what they are doing, why it matters and what you might learn from them.

Case 1: Spines .. self publishing

Spines is an AI-powered self-publishing platform founded by Israeli entrepreneur Yehuda Niv, that allows authors to upload manuscripts and, through an AI-augmented workflow (editing, proofreading, cover design, formatting, distribution), reach global markets in as little as two weeks.

Why it matters: It exemplifies how automation and platformisation make publishing faster, cheaper and more accessible. It lowers the barrier to publishing many voices, thus broadening the ecosystem of content.

What to learn: If you’re self-publishing your business book, adopting a workflow that is efficient, uses AI tools for editing/formatting and links to global distribution, you reduce cost/time and can focus more on value-creation (content, marketing, ecosystem) rather than purely production minutiae.

Case 2: Gelato … print on demand network

Gelato offers a global POD network with production partners across dozens of countries, enabling local fulfilment, regional print runs, low inventory, global distribution for books and other print products.

Why it matters: Physical print still matters, and the ecosystem must integrate print-on-demand, local fulfilment and on-demand versions of books (including regional variants). POD networks unlock localisation and rapid market response.

What to learn: For your business book, consider using POD networks to support regional versions (e.g., Europe, Asia) without large print runs. Localised editions + print-on-demand = cost-efficient global reach.

Case 3: Bookmaker … authoring and production platform

Bookmaker is an AI-based platform (developed by Keenethics) which supports book creation—from interview transcription, outline generation, drafting, to formatting and publishing. It integrates generative AI for text outlining, proof-reading and style consistency.

Why it matters: This shows the fundamental transformation of the authoring and production stage—not just distribution. Authors and publishers can engage AI earlier in the process to accelerate ideation, drafting and revision.

What to learn: You could use AI tools during the ideation phase of your book: outline generation, style templates, translation hints. Treat drafting as part of an ecosystem workflow rather than isolated weeks of writing.

Case 4: Wattpad … trans-media ecosystems

Wattpad, a digital storytelling community, turns popular user-generated stories into books, films or TV. In Japan the model of manga publishers like Shueisha extends into games, merchandise, anime and global licensing.

Why it matters: These are quintessential ecosystem models: the “book” is content that flows into other media, formats and experiences. The value isn’t locked in the book alone.

What to learn: Even for a business book, think beyond the print: webinars, interactive apps, spin-out micro-stories, podcasts, subscription communities. Your book becomes a node in a multi-format ecosystem.

Case 5: Notion Press … self-publishing platform

Notion Press is an Indian self-publishing platform that supports authors with services (editing, marketing, distribution) and aims to reduce lead-times and cost.

Why it matters: It reinforces that platforms are democratising publishing globally; the ecosystem includes many voices, micro-niches and regional markets.

What to learn: If you are self-publishing, leverage the ecosystem of services (editing + marketing + distribution) rather than only doing everything yourself. Platform-supported publishing enables scale and quality.

Case 6: Xynapse Traces … experimental imprint

Xynapse Traces is a publishing imprint built around a multi-model AI infrastructure: ideation pipelines, automated production, human oversight, delivering 52 books in a year, reducing time-to-market by ~90 % and cost-by ~80 % compared to traditional workflows.

Why it matters: This is a glimpse of what publishing might become: high-throughput content factories integrated with data, AI, and distribution. It points to how niche markets or fast-moving topics can be served far more quickly.

What to learn: Consider whether your topic—business innovation/reinvention—is time‐sensitive and whether you might use a quicker production model (e.g., digital-first, micro-editions) rather than a slow annual book cycle. The ecosystem mindset means you can publish chapters, updates, regional spin-outs, rather than one static edition.

Case 7: SnackzAI … book summaries

SnackzAI provides AI-generated summaries of popular books, oriented to busy readers. It invites partnerships with authors and publishers.

Why it matters: This shows how the book ecosystem includes derivative formats—summaries, micro-learning modules—targeting different audience segments. The full-book becomes part of a larger suite.

What to learn: Your ecosystem could include “micro-lessons” extracted from chapters of your book (for executives on the move), short audio bites, quick reference guides. These formats extend reach and engagement.

Case 8: iAuthor …digital platform

iAuthor is a UK-based crowdsourced book-platform linking authors and readers, enabling sharing of samples, analytics, promotional packages.

Why it matters: Platforms that connect author ↔ reader communities provide additional value layers (analytics, discovery, marketing) as part of the ecosystem.

What to learn: You might consider embedding your book launch into a platform/community where readers can sample, comment, engage. The ecosystem becomes relational.

Case 9: Publishing.ai … workflow and production tools

Publishing.ai (and similar platforms) offer dashboards for topic idea generation, outline creation, manuscript generation, and sales analytics.

Why it matters: The authoring/production stage is being re-imagined as a platform. This matters for all authors, especially in self-publishing.

What to learn: Consider adopting (or partnering with) such tools to accelerate your production and free up time for engagement, ecosystem design, marketing, localisation.

Case 10: Rhapsody Media … content-production services

Rhapsody Media’s Engine 2.0 offers content‐production services blending automation, AI and human workflows, enabling “100 pages or 100,000 pages” scale outputs.

Why it matters: It shows how the ecosystem of content (books, serials, marketing assets) is supported by high-scale infrastructure; publishers can outsource parts of the ecosystem rather than building everything in-house.

What to learn: For your project think of the ecosystem’s infrastructure: editing, layout, branding assets, micro-content, marketing collateral. Use service-providers or platforms rather than build everything from scratch.

What the future looks like and how to prepare

As these cases show, the future of publishing is not just incremental change—it is structural. The book becomes less a standalone artefact and more a node in a dynamic ecosystem of content, platforms, community, data and services. To prepare and thrive, authors and publishers need to think differently.

A vision of 2028-2030

Imagine this scenario: You publish a business book on reinvention. Upon release you don’t just sell print copies; you launch a digital platform. A month after publication you roll out: a companion app with interactive tools (frameworks from the book, personalised prompts), a membership community of readers sharing case-studies and experience, short “snack” micro-lessons for busy executives, a podcast series featuring deeper interviews with the book’s leaders and entrepreneurs, regional localised editions (Europe, Asia, Latin America) with tailormade case-studies and print-on-demand fulfilment. All are powered by AI analytics: the system monitors which chapters resonate, where readers drop off, what questions they ask; your team uses that insight to commission short-run spin-out titles, webinars, workshops. The book evolves: an updated edition appears six months later with new region-specific content; localisation adaptations follow and are printed via local fulfilment networks. The whole is a “learning-and-engagement ecosystem”, not simply a one-time product.

Key strategic questions

-

What is the ecosystem you want around your book? It might include membership, online tools, micro-content, live events, community, regional versions. Chart the nodes.

-

How will AI enable your production, distribution and engagement? Which parts of your process can be automated or augmented? How will you use data, analytics, recommendation, translation?

-

How will you engage readers beyond the purchase? How do you build retention, community and ongoing value? How will you generate recurring revenue rather than only book sales?

-

How will you go global and local at the same time? Which markets will you target? How will you localise content? How will you manage regional versions, local fulfilment and language adaptation?

-

How will you manage quality, trust and brand? With AI you may scale fast, but you must also guard quality, ethical use of AI, authenticity of author voice, rights management.

-

What partnerships will you need? Platform providers, AI-tools, print-on-demand networks, localisation services, distribution partners, marketing/analytics services.

-

What are your intangible assets? Your author brand, community network, data on reader behaviour, content rights, platform membership – these become central value drivers.

Practical roadmap

-

Preparation/Ideation Phase

-

Use AI tools (e.g., outline generators, topic research) to refine the book’s themes, market positioning, case-study selection.

-

Sketch the ecosystem: what companion content, micro-formats, community, regional versions do you want?

-

Map the production workflow: manuscript → editing → design → e-book/audiobook → print-on-demand → distribution.

-

-

Production Phase

-

Adopt efficient tools/platforms for editing, layout, metadata, translation (e.g., XML workflows like BOOXITE-style, generative drafting tools like Bookmaker).

-

Produce core formats: print, e-book, audiobook. Use POD for print runs to reduce risk.

-

Prepare companion formats: summary modules, micro-lessons, interactive worksheets, online course components.

-

-

Launch & Ecosystem Activation

-

Launch the core book, but simultaneously launch the ecosystem (membership portal, app, webinars, community).

-

Monitor reader engagement via analytics: which chapters are visited, how long users stay, which micro-modules are used.

-

Use AI-driven recommendation: “If you liked chapter 3, try micro-module X”, “Here’s a live workshop relevant to you”.

-

-

Iteration & Extension

-

Based on data, revise content: maybe release updated edition, regional spin-offs, tailored case-studies for local markets.

-

Expand formats: podcasts, live events, certification modules, corporate training packages.

-

Monetise via subscriptions, services, membership upsells, regional licences, spin-off books.

-

-

Global & Local Scaling

-

Use AI-assisted translation/localisation to launch editions in other languages/markets.

-

Use POD networks for regional print fulfilment to keep inventory minimal.

-

Build regional communities or affiliate networks (e.g., Europe, Asia) around localised content.

-

-

Long-Term Ecosystem Management

-

Keep your reader community alive: quarterly updates, member-only content, new case-studies, interactive live events.

-

Maintain data insights: reader behaviour, engagement patterns, conversion to services.

-

Keep investing in your intangible assets: brand, platform, data, community. These become more valuable than the individual book.

-

The future of book publishing is not merely about faster production or cheaper global distribution (though both are real). It is about reimagining what a book is. A book in 2030 will often be the hub of an ecosystem: digital tools, community, services, data flows, global & local versions, multi-format experiences. AI is the engine that makes this scale feasible, but the strategic shift is adopting the ecosystem mindset.

Join me at this year’s Future Book Forum to explore more!

Appendices

More about Gelato

Gelato is a global print-on-demand (POD) platform with a network in 32+ countries (140+ production partners) that enables creators and publishers to produce and fulfil print products (photo-books, children’s books, notebooks, apparel) locally without inventory. While primarily about POD products (not always traditional trade books), it demonstrates how physical publishing/distribution can become on-demand, localised and connected to digital/creator ecosystems.

-

Inventory-free, global fulfilment: Key for enabling regional versions of books, regional print runs, rapid adaptation, without large stocks.

-

Creator economy link: Authors/publishers can link to POD networks to offer special editions, personalised books, regional spins, and integrate with e-commerce platforms.

-

Extending beyond the book: The same infrastructure can serve spin-offs (merchandise, interactive personalisation, ancillary products) — so the book becomes part of a broader product ecosystem.

More about Booxite

Booxite is a new production-platform announced in June 2025 by German publishing-technology firm pagina GmbH (in collaboration with partners such as SiteFusion) that offers an “end-to-end” digital workflow for book publishing: from manuscript ingestion, author/editor collaboration, through automated typesetting (InDesign server), digital asset management, print-ready layout, e-book output, accessibility (alt-text), all on one XML-based platform. Notably, Booxite adopts a “pay-per-use” model rather than large software licensing: a publisher pays for each title processed, making it attractive for small and mid-sized presses. It also explicitly aims to be “KI-ready” (AI-ready) by virtue of having structured XML workflows designed for downstream AI tools (e.g., automatic alt-text generation, metadata extraction).

-

Smarter production: By moving the publishing workflow into a digital, collaborative, structured platform, Booxite reduces manual cost, turnaround time and error-rates.

-

Platform thinking: Booxite effectively turns the publisher’s production chain into a software-and-services ecosystem rather than a purely in-house process. The platform is a node connecting author, editor, typesetter, printer, digital output.

-

Foundation for AI/analytics: With consistent XML data, publishers can feed downstream AI tools (metadata extraction, recommendation, cost-analysis).

More about Rhapsody

Though not a traditional book-publisher, Rhapsody Media offers “Engine 2.0” — a proprietary content production system blending automation, AI tooling and human oversight — targeted at high-volume publishing, catalogues, book-brands, digital asset workflows. Their platform supports large-scale production: “From one-off creative to full-scale editorial programmes … whether you’re producing 100 pages or 100,000”.

-

Workflow scalability: Large content volumes (books, serials, related marketing assets) become manageable via AI + automation.

-

Enabling platforms: Entities like Rhapsody Media become part of the publisher ecosystem — service nodes providing infrastructure for publishers/brands.

-

Cross-media extension: The same workflow system can handle books, marketing assets, digital media — enabling the “book-plus” model.

More about SnackzAI

SnackzAI is an app described as “the first AI-book summary app” that uses generative AI to provide high-quality book summaries across topics like entrepreneurship, personal development, management and leadership. It offers a “Author and Publisher Partner Programme” inviting collaborations to expand its summary catalogue.

-

Audience engagement & new formats: SnackzAI captures the attention of time-poor readers by providing condensed knowledge experiences. It shifts reading from “full book” to “snackable micro-learning” — a different user journey.

-

Platform + service model: Rather than selling a single book, the app offers a subscription or service to access many summaries, making the book’s content part of a larger digital ecosystem.

-

Up- and downstream flows: For authors and publishers, partnering with such a platform opens new rights/licensing, derivative content, and possibly leads-to-full-book sales.

If you’ve ever felt simultaneously exhilarated and exhausted by the world of business, you’re not alone. The phrase “there’s never been a better time, never been a worse time” could be the unofficial motto of modern leadership.

On one hand, the possibilities seem limitless: global markets, artificial intelligence, sustainability innovation, and digital connectivity offer unprecedented opportunities for those bold enough to seize them. On the other hand, disruption, volatility, ethical scrutiny, and relentless pace make every decision feel like stepping onto a tightrope during an earthquake.

For today’s leaders, this paradox is not an abstract concept—it is lived experience. Every board meeting, product launch, and strategy session carries both the thrill of opportunity and the dread of risk.

In many ways, the modern business leader is a tightrope walker, acrobat, and visionary rolled into one. This article explores how business leaders navigate this contradictory terrain, drawing lessons from experience, innovation, and ingenuity, and offering inspiration for anyone charged with shaping the future of enterprise.

Paradox

Consider this: a start-up founder in London can prototype a product, access a global customer base, and scale operations internationally in months, not years. Meanwhile, geopolitical tensions, economic uncertainty, supply-chain fragility, and AI ethics loom over every decision. It is a world where yesterday’s certainties dissolve overnight, yet yesterday’s limitations have been obliterated by technology and connectivity.

It is both a renaissance and a minefield. Leaders must simultaneously dream and calculate, embrace experimentation while managing existential risk. This duality is the heart of our paradox: the very conditions that make the present the “best time” are inseparable from those that make it the “worst time.”

Technology