In a world of dramatic change – from AI and robotics, to climate crisis and resource constraints, shifting consumer values and social expectation – the business imperative has shifted. Once the goal was efficiency: to do more with less. Then the narrative turned to sustainability and corporate social responsibility (CSR): reduce negative impact, comply with regulation, show you care. More recently, environmental, social and governance (ESG) frameworks have offered a mainstream rubric to investors and boards.

But today a deeper shift is underway: from “less bad” to “more good”. This is the domain of regenerative business models, companies that not only minimise harm, or reuse resources, but actively rebuild ecosystems, enrich communities, and embed purpose into the heart of their value creation. Regeneration is not a sideline—it becomes strategy.

Crucially, this shift is not merely moral or philanthropic. It is becoming commercial. Because in a world of increasing volatility, companies that embed resilience, long‑term value, stakeholder alignment and ecosystem thinking are more likely to thrive. Their intangible assets — brand trust, purpose alignment, supply‑chain partnerships, community goodwill — become the strategic differentiators. Regeneration and commercial success are not opposed; in many cases they are intertwined.

In this article we examine how leading European firms are walking this path. We explore their purpose and strategy, leadership and culture, business model and innovation, supply‑chain and ecosystem design, and financial and non‑financial performance. The cases illustrate how regeneration is more than a buzzword — it is a lens for business reinvention.

What do we mean by “regenerative”?

“Regenerative” is a difficult word in the corporate world, and has many interpretations. At one end sits compliance and efficiency; next comes sustainability and then circularity — strategies designed to reduce waste and reuse materials. Regeneration goes beyond: it aims actively to rebuild ecological systems and social capital. That means restoring soil health and biodiversity, rebuilding coastal and marine habitats, reversing carbon accumulation in the atmosphere by sequestering carbon in the ground and vegetation, and reweaving fair and resilient local economies. It’s not simply a product attribute; it is a systemic ambition encoded into corporate purpose, governance, investment, and metrics.

There are three distinctive features of regenerative business models:

-

Give more than take … business models and ecosystems, products and services, are designed so that, across their lifecycle, they return more social and environmental value than they extract.

-

Reinventing the way we work … companies partner with suppliers, communities and public actors to alter production systems (for instance, shifting commodity agriculture to regenerative farming practices).

-

Purpose and profit are equally important … structures and metrics (from ownership to capital allocation) are engineered so that long-term ecological and social outcomes are core to decision-making, not peripheral.

These criteria form the lens through which we explore a new mindset for business success.

Patagonia, of course, has long been held up as a trailblazer in this context. Yvon Chouinard’s business has show the way in conscious capitalism, showing the businesses can be platforms for good, creating a business model that looks beyond money making, and a brand as a community of people fighting for a bigger cause.

But what about some of the other companies around the world?

Europe’s Regenerative Leaders

Europe has become a hotbed of regenerative businesses over recent years, driven by social and political agendas, as well as an awakening among business leaders of a better way. No company, of course, is perfect; but each of the following companies show significant progress on their journey, combining ambition with practical transformation:

Acciona, Spain … regenerative infrastructure

Strategy:

Acciona has positioned itself at the forefront of regenerative infrastructure. Its business model integrates environmental and social value creation into construction, renewable energy, and water projects. The company’s master plan goes beyond reducing harm; it actively restores ecosystems and social capital. Climate mitigation, biodiversity recovery, circular construction, and water stewardship are embedded in each project, with an explicit goal of leaving a net-positive footprint on both natural and human systems.

Leadership:

Leadership at Acciona links executive remuneration and career progression directly to measurable sustainability targets. José Manuel Entrecanales and his team have cultivated a culture in which project managers and engineers consider ecological and social outcomes as integral to decision-making. Sustainability is treated not as compliance, but as a lens through which all operational and strategic choices are evaluated.

Innovation:

The company has pioneered low-carbon concrete, modular construction that allows for disassembly and reuse, and recycling of complex materials such as wind turbine blades. Nature-based solutions — including urban green corridors, pollinator habitats, and rewilded zones — are standard practice in large-scale infrastructure projects.

Ecosystem:

Acciona’s scale allows it to convene suppliers, local authorities, NGOs, and academic institutions in a shared agenda for regeneration. Supplier standards require low-emission materials and ethical sourcing, while urban development projects are designed to integrate biodiversity, local employment, and climate resilience.

Performance:

More than 90% of Acciona’s capital investments now align with the EU sustainable taxonomy. Renewable energy operations continue strong growth, and biodiversity indices show measurable gains across key project sites. Acciona demonstrates that infrastructure can generate ecological and social value alongside financial return.

Arket, Sweden … regenerative fashion

Strategy:

Part of the H&M Group, Arket differentiates itself through durable essentials for men, women, children, and home, combining minimalistic design with circularity. Its 2030 vision aims for fully sustainable sourcing and a circular product life cycle. Unlike conventional fashion brands, Arket measures success not by volume but by product longevity, reuse, and repairability, positioning sustainable consumption as central to its strategy.

Leadership:

Arket benefits from H&M’s global infrastructure but operates with a culture of transparency and accountability. Leadership incentivises teams to prioritise durability and traceability, promoting a mindset where design, materials, and supply chain choices are all scrutinised for environmental and social impact.

Innovation:

Arket’s circular innovations include children’s clothing rental, repair services, and mono-material garments designed for recycling. Regenerative fibres — organic cotton, Tencel, and recycled polyester — are standard, while low-impact dyes and sustainable packaging reduce the brand’s environmental footprint.

Ecosystem:

The brand leverages H&M’s supplier network to implement circularity at scale, working with textile recyclers, start-ups, and technology partners. Customer engagement campaigns educate consumers on care, repair, and reuse, effectively extending the life of products while reinforcing brand loyalty.

Performance:

Despite being relatively young, Arket has enhanced customer retention and brand value through sustainability-led differentiation. Its initiatives prepare the business for a market increasingly attentive to ethical consumption, while generating operational efficiencies from reduced returns and extended product lifespans.

BayWa, Germany … regenerative agriculture

Strategy:

BayWa AG combines agribusiness, renewable energy, and building materials under a regenerative framework. Its strategy focuses on sustainable crop production, carbon-smart farming, and energy efficiency. By integrating these sectors, BayWa decouples growth from environmental degradation while enhancing resource productivity.

Leadership:

CEO Marcus Pöllinger promotes long-term ecological stewardship. Leadership works with farmers and partners to adopt regenerative practices such as cover cropping, reduced tillage, soil restoration, and biodiversity initiatives. Training programmes, financial incentives, and knowledge-sharing mechanisms embed these practices across the ecosystem.

Innovation:

BayWa has developed digital farming platforms that measure soil health, track carbon sequestration, and optimise crop yields. Simultaneously, BayWa r.e. expands solar, wind, and biogas projects that provide energy back to farms and communities, creating integrated synergies between agriculture and renewables.

Ecosystem:

The company’s ecosystem spans farmers, suppliers, energy providers, and research institutions. These stakeholders collaborate to improve soil quality, increase biodiversity, and reduce environmental impact while maintaining productivity.

Performance:

BayWa reports consistent growth in renewable energy and sustainable agriculture. Pilot projects show measurable ecological improvements, demonstrating that traditional agribusiness can be transformed into a commercially viable regenerative enterprise.

Climeworks, Switzerland … regenerative carbon

Strategy:

Climeworks leads in direct air capture technology, removing CO₂ from the atmosphere to counter climate change. Its approach is regenerative at the planetary scale: by permanently storing carbon, the company contributes directly to restoring the balance of the carbon cycle.

Leadership:

Founders Christoph Gebald and Jan Wurzbacher foster a culture of scientific excellence and climate responsibility. Leadership emphasises transparency, verification, and the scaling of technology for systemic impact. The company’s ethos integrates ethical stewardship with commercial pragmatism.

Innovation:

Climeworks’ technology generates revenue through subscriptions, corporate partnerships, and government programmes. The Orca and Mammoth plants in Iceland exemplify industrial-scale carbon capture powered by renewable energy. Research and development focus on improving efficiency, reducing costs, and integrating storage solutions that secure long-term carbon removal.

Ecosystem:

The company collaborates with governments, energy providers, and research institutions, creating a networked ecosystem that multiplies impact. Partnerships with corporations such as Microsoft and Stripe demonstrate how private and public sectors can co-invest in scalable regenerative solutions.

Performance:

Climeworks has operationalised commercial-scale direct air capture and attracted substantial investment, proving the financial and technological viability of a regenerative carbon removal model.

Danone, France … regenerative food

Strategy:

Danone integrates regenerative agriculture across its global supply chain, focusing on soil health, water stewardship, and biodiversity. The goal is to transition from linear commodity sourcing to restorative farming models, ensuring that every litre of milk or plant-based ingredient contributes to ecological renewal.

Leadership:

Executives embed sustainability metrics into corporate strategy and remuneration. Leadership cultivates collaborative relationships with farmers, promoting shared learning, capacity building, and ecosystem stewardship. Strategic decisions are evaluated through a dual lens of financial and regenerative impact.

Innovation:

Danone combines consumer-facing innovation with upstream regenerative practice. Programmes include regenerative dairy, sustainable plant-based sourcing, circular packaging, and soil carbon monitoring. Technology and data allow the company to measure outcomes at scale, aligning commercial and environmental objectives.

Ecosystem:

Farmers, co-operatives, NGOs, and suppliers collaborate to implement regenerative methods. This networked approach creates resilience, enhances biodiversity, and stabilises supply chains. Cross-sector partnerships also advance financial models for soil-carbon crediting and sustainable investment.

Performance:

Danone reports measurable improvements in soil carbon, biodiversity, and sustainable sourcing, all while maintaining market share and product profitability. Its model demonstrates that regenerative agriculture can underpin both ecological restoration and commercial growth.

EcoAlf, Spain … regenerative fashion

Strategy:

EcoAlf transforms ocean plastics and other post-consumer waste into high-quality apparel and accessories. Its strategy is purpose-driven: tackle marine pollution while demonstrating that circular materials can deliver premium consumer products. By embedding regeneration into both supply chain and brand storytelling, EcoAlf converts waste into tangible ecological and economic value.

Leadership:

Founder, my good friend, Javier Goyeneche champions a culture of environmental responsibility and creativity. Leadership prioritises material innovation, transparency, and systemic thinking, motivating teams to pursue solutions that restore natural systems while appealing to conscious consumers.

Innovation:

EcoAlf uses recycled ocean plastics, discarded fishing nets, and textile offcuts to produce clothing and bags. Its innovation extends beyond materials to business models, integrating consumer education, transparent impact reporting, and premium branding that aligns profit with planetary benefit.

Ecosystem:

The company collaborates with local waste collectors, recycling facilities, and NGOs to close the loop. Partnerships extend across design, production, and distribution, creating a network that reinforces circularity and environmental awareness.

Performance:

EcoAlf has achieved global market penetration while retaining its regenerative focus. The company demonstrates that luxury and circularity can coexist, proving that consumer goods can be both profitable and restorative.

Ecosia, Germany … regenerative search

Strategy:

Ecosia merges digital technology with ecological regeneration. Its search engine business model channels advertising revenue into reforestation and ecosystem restoration globally. By aligning user activity with planetary benefit, Ecosia operationalises regeneration at scale in an otherwise digital sector.

Leadership:

Founder Christian Kroll instils a culture of transparency, ecological responsibility, and accountability. Leadership emphasises measurable impact, with quarterly reports on tree planting and project outcomes, fostering trust with users and stakeholders.

Innovation:

The company monetises search engine traffic to fund reforestation. Innovations include integrating geographic data to prioritise planting in biodiversity hotspots, developing local community engagement models, and tracking long-term ecological outcomes.

Ecosystem:

Ecosia works with NGOs, local governments, and community groups, forming a collaborative ecosystem that maximises social and environmental value. This network extends to technology providers, advertisers, and civic partners to scale regeneration globally.

Performance:

Ecosia has planted tens of millions of trees and restored degraded land, demonstrating that a simple digital model can generate measurable regenerative outcomes while sustaining a profitable platform.

First Milk, UK … regenerative dairy

Strategy:

First Milk operates as a farmer-owned co-operative, integrating regenerative agriculture into milk production. Its approach focuses on soil health, biodiversity, and carbon sequestration, while maintaining high-quality dairy outputs.

Leadership:

Leadership promotes long-term collaboration with farmer-members, incentivising regenerative practices through both technical support and financial rewards. The culture encourages stewardship over extraction, emphasising resilience and ecological value creation.

Innovation:

The co-operative combines traditional dairy techniques with soil-restorative interventions, such as rotational grazing, cover crops, and hedgerow restoration. It monitors regenerative outcomes, linking ecological performance to member remuneration.

Ecosystem:

Farmers, co-operatives, distributors, and local communities collaborate to implement regenerative practices across the supply chain. This network creates resilience and ensures alignment between ecological goals and operational realities.

Performance:

The programme has enhanced biodiversity, soil quality, and carbon sequestration while maintaining milk yields and market competitiveness. First Milk demonstrates that regenerative agriculture can underpin both ecological health and commercial stability.

Greiner, Austria … regenerative plastics

Strategy:

Greiner, a leader in plastics and foam, has come along way since I first worked with them 10 years ago. It has embraced regeneration through its “Blue Plan” framework, focusing on reducing emissions, increasing recycled content, and restoring material value. The strategy combines operational transformation with long-term ecological objectives.

Leadership:

Leadership integrates sustainability deeply into corporate culture, promoting generational thinking, science-based targets, and innovation in materials. The management ethos balances commercial ambition with environmental accountability.

Innovation:

Greiner’s innovations include mono-material designs for easier recycling, compostable packaging, and high-recyclate foam solutions. Product development actively substitutes virgin plastics with recycled alternatives without compromising performance.

Ecosystem:

Supplier audits, EcoVadis certification, and closed-loop recycling programmes exemplify ecosystem engagement. Greiner collaborates with partners, customers, and regulatory bodies to extend the regenerative impact of its products.

Performance:

With revenues approaching €2 billion, Greiner demonstrates that industrial-scale operations can align with regenerative principles. Emission reductions, increased recycled content, and product longevity all highlight the practical viability of heavy-industry regeneration.

Holcim, Switzerland … Cement and building materials

Strategy:

Holcim is one of my favourite clients, and I have worked with their leaders across the business. It aims to transform construction into a regenerative sector. Its focus is on low-carbon cement, circular aggregates, and climate-positive construction practices. By redesigning both materials and processes, Holcim seeks to mitigate the traditionally high environmental footprint of building materials.

Leadership:

Miljan Gutevic and his executive teams embed sustainability targets into operations, R&D, and capital allocation. Leadership emphasises systemic thinking, linking material innovation to broader environmental restoration goals. Their investor presentations (see the recent Capital Markets Day 2025) are a great example of putting sustainability and regeneration at the core of their strategy.

Innovation:

Holcim invests in alternative binders, recycled aggregates, and carbon capture technologies. Pilots of carbon-negative concrete and modular construction techniques demonstrate tangible regenerative outcomes in urban development.

Ecosystem:

Collaboration with construction companies, municipalities, architects, and NGOs creates a network that extends regenerative impact across the value chain. By sharing knowledge and materials solutions, Holcim accelerates sector-wide adoption.

Performance:

Holcim has reduced CO₂ emissions per ton of cement and launched the first commercial-scale carbon-negative concrete projects. This demonstrates that heavy construction materials can evolve from extractive to restorative business models, paralleling innovations seen in Interface flooring.

IKEA, Sweden … regenerative retail

Strategy:

IKEA aims to become climate-positive by 2030, embedding circular design, renewable materials, and forest stewardship into every aspect of operations. Its approach combines product innovation with supply chain regeneration to create systemic environmental benefit.

Leadership:

Leadership integrates sustainability into product development, corporate strategy, and capital planning. Teams are incentivised to optimise both environmental impact and customer experience, fostering a culture where regeneration is core to the business model.

Innovation:

IKEA has advanced circular design, enabling product repair, reuse, resale, and recycling. Renewable and recycled materials underpin the offering, while digital platforms facilitate product take-back and lifecycle management.

Ecosystem:

Suppliers, forest managers, recyclers, and logistics partners collaborate to achieve regenerative outcomes. This mirrors Arket’s approach to circularity but at a global scale, demonstrating the intersection of industrial and retail ecosystems in driving systemic change.

Performance:

IKEA has increased the share of sustainable materials, implemented energy-positive factories, and piloted resale and repair initiatives, all while sustaining global growth. The company exemplifies the commercial feasibility of large-scale regenerative retail.

Interface, Netherlands/US … regenerative flooring

Strategy:

Interface’s mission, articulated through its Climate Take Back initiative, is to reverse climate change by creating carbon-negative flooring and restoring natural systems. Unlike incremental sustainability measures, Interface targets net-positive impact, aiming to leave the planet better than it found it.

Leadership:

Leadership fosters mission-driven innovation and transparency. Executives embed environmental responsibility into every level of decision-making, from R&D to sales, cultivating a culture where long-term ecological and financial objectives coexist.

Innovation:

Interface produces modular flooring using recycled materials, bio-based alternatives, and closed-loop designs. Programmes like Net-Works convert discarded fishing nets into carpet tiles, simultaneously reducing ocean plastic pollution and supporting coastal communities. Innovative manufacturing methods reduce carbon intensity and water usage, creating a replicable model for regenerative industrial production.

Ecosystem:

Suppliers, recyclers, NGOs, and communities collaborate to extend impact across the supply chain. Partnerships combine ecological restoration, social benefits, and commercial viability, creating a systemic regenerative ecosystem that stretches beyond the company itself.

Performance:

Interface has reduced greenhouse gas emissions per square metre of flooring while expanding revenue from sustainable products. The company demonstrates that restorative industrial practices can scale, supporting both ecological regeneration and brand leadership.

Klima, Germany … regenerative living

Strategy:

Klima offers a digital platform that enables individuals and organisations to measure, reduce, and offset their carbon footprint. Its regenerative approach encompasses ecosystem restoration, carbon neutrality, and behaviour change, translating climate responsibility into tangible outcomes.

Leadership:

Leadership emphasises transparency, accountability, and measurable environmental impact. Teams are encouraged to integrate climate science into product design and user engagement, cultivating a culture of climate-conscious innovation.

Innovation:

Klima funds tree planting, ecosystem rehabilitation, and carbon offset projects through subscription services and corporate partnerships. Innovative algorithms track user emissions and measure reductions, linking behaviour change to actionable regenerative outcomes.

Ecosystem:

The company collaborates with reforestation NGOs, project developers, and local communities, creating a networked model of environmental restoration. Corporate clients and individual users amplify the regenerative effect, while technological integration ensures data-driven impact monitoring.

Performance:

Klima has facilitated measurable reductions in CO₂ emissions and supported ecosystem restoration projects across multiple continents. Its tech-enabled regenerative model demonstrates that digital platforms can play a vital role in systemic environmental impact.

Lush, UK … regenerative cosmetics

Strategy:

Lush integrates regenerative sourcing, ethical supply chains, and community engagement into its cosmetics business. Ingredients are chosen not only for quality but for their ability to restore and maintain ecological systems.

Leadership:

Leadership champions mission-driven culture, embedding social and environmental goals into product development, marketing, and operations. Lush demonstrates how corporate governance can directly reinforce regenerative outcomes.

Innovation:

Lush’s products use natural, ethically sourced ingredients. Programmes include packaging-free “naked” products, refill initiatives, and regenerative farming partnerships. Research and sourcing teams work to continually improve both environmental and social impacts.

Ecosystem:

Supplier networks are carefully managed to promote fair trade, biodiversity, and local community development. Collaborations with NGOs and farmers strengthen regenerative practices while creating resilient, traceable supply chains.

Performance:

Lush maintains strong financial performance alongside measurable social and environmental impact. Its approach illustrates that regenerative principles can be central to brand differentiation, loyalty, and profitability in consumer goods.

PulPac, Sweden … regenerative packaging

Strategy:

PulPac develops fibre-based alternatives to single-use plastics, aiming to regenerate natural systems by substituting renewable, recyclable materials for traditional plastics. The company positions itself at the intersection of material innovation and systemic environmental restoration.

Leadership:

Leadership integrates sustainability into R&D and business growth strategies. Corporate culture encourages material innovation that scales globally while reducing carbon intensity and environmental burden.

Innovation:

PulPac’s proprietary technology produces high-performance fibre packaging suitable for food, pharmaceuticals, and consumer goods. Innovations include high-speed manufacturing processes and compatibility with recycling infrastructure, ensuring low environmental impact at scale.

Ecosystem:

The company works closely with consumer goods brands, material suppliers, and recyclers to expand regenerative impact. Partnerships ensure that fibre substitution translates into measurable ecological benefits, closing the loop on single-use plastic reduction.

Performance:

PulPac has scaled operations internationally, demonstrating that fibre-based, low-carbon packaging solutions are commercially viable. Environmental impact metrics highlight reductions in plastic waste and carbon emissions, reinforcing the regenerative potential of industrial innovation.

Triodos Bank, Netherlands … regenerative finance

Strategy:

Triodos specialises in financing enterprises that deliver social, cultural, and environmental benefits. The bank’s regenerative approach integrates ethical principles into investment decisions, creating systemic positive outcomes across multiple sectors.

Leadership:

Leadership fosters a culture of transparency, ethical responsibility, and long-term thinking. Corporate governance aligns lending and investment policies with measurable regenerative outcomes, demonstrating that finance can be a driver of ecological and social restoration.

Innovation:

Triodos designs lending and investment products that prioritise renewable energy, regenerative agriculture, and social enterprises. Innovative financial instruments link returns to environmental and social impact, allowing capital to flow to projects that generate measurable regeneration.

Ecosystem:

Partnerships with NGOs, renewable energy developers, and social enterprises amplify systemic impact. Triodos’ approach demonstrates the catalytic effect of finance in scaling regenerative solutions across geographies and sectors.

Performance:

The bank has delivered stable financial returns while ensuring positive ecological and social outcomes. Its model proves that banking can be transformed into a regenerative enterprise that supports both profit and planetary well-being.

Veja, France … regenerative footwear

Strategy:

Veja integrates regenerative cotton farming and Amazonian wild-rubber sourcing into its footwear production. Its approach is systemic, targeting soil health, community empowerment, and ecosystem restoration within the supply chain. By embedding regenerative principles into raw material sourcing, Veja demonstrates that fashion can be both profitable and restorative.

Leadership:

Leadership emphasises transparency, environmental integrity, and social impact. Founders Sébastien Kopp and François-Ghislain Morillion cultivate a mission-driven culture, encouraging ethical decision-making across design, sourcing, and marketing.

Innovation:

Veja’s innovations combine sustainable materials, ethical production, and durable design. The company also develops traceable supply chains using digital tools, ensuring that each product reflects measurable regenerative impact.

Ecosystem:

Veja collaborates closely with cooperatives, smallholder farmers, and NGOs to implement regenerative practices. Partnerships support biodiversity, fair income, and local community development, creating a resilient and scalable regenerative ecosystem.

Performance:

Veja has achieved global recognition for sustainability, product quality, and profitability. Its model illustrates that regenerative sourcing can drive brand differentiation and commercial success simultaneously.

Vestre, Norway … regenerative furniture

Strategy:

Vestre designs and manufactures public furniture with a regenerative lens, prioritising biodiversity, low-carbon production, and social value creation. Its approach extends beyond product to factory and urban environment, aiming to leave a net-positive ecological footprint.

Leadership:

Leadership embeds long-term environmental and social objectives into strategic planning. CEO Olav Kristensen promotes a culture where design thinking, industrial manufacturing, and sustainability are inseparable, creating alignment between purpose and execution.

Innovation:

Vestre innovates with low-emission steel production, circular material usage, and design that encourages community engagement and ecological restoration. Its flagship factory, The Plus, embodies regenerative principles in architecture, energy, and workflow.

Ecosystem:

Suppliers, designers, urban planners, and municipalities collaborate to maximise social and environmental impact. Projects integrate ecosystem thinking at city scale, demonstrating how industrial design can influence urban regeneration.

Performance:

Vestre has secured international contracts while achieving significant reductions in carbon footprint and environmental impact. Its regenerative approach strengthens brand value, employee engagement, and global competitiveness, illustrating the viability of purpose-led industrial design.

Wildfarmed, UK/Belgium … regenerative food ingredients

Strategy:

Wildfarmed connects major food brands with regenerative farms, focusing on soil health, biodiversity, and carbon sequestration. Its purpose is to transform conventional agricultural supply chains into networks of ecological and social renewal.

Leadership:

Leadership prioritises systemic change, farmer engagement, and regenerative agriculture education. Founders cultivate a culture that balances commercial viability with environmental responsibility, ensuring that each product sourced contributes positively to the ecosystem.

Innovation:

Wildfarmed acts as a bridge between regenerative farms and industrial-scale manufacturers. Innovations include traceability platforms, impact measurement tools, and sourcing models that reward ecological stewardship, enabling regenerative practices to scale commercially.

Ecosystem:

The company’s ecosystem spans farmers, brands, and supply chain partners. By integrating regenerative criteria into purchasing decisions, Wildfarmed creates incentives for widespread adoption of soil-restorative practices, enhancing biodiversity and carbon capture across landscapes.

Performance:

Despite its smaller scale, Wildfarmed has enabled measurable ecological improvements while maintaining commercial viability for partners. Its model demonstrates that supply chain innovation can operationalise regeneration in global food systems.

Common Themes in Regeneration

Across Europe, leading regenerative companies reveal a coherent set of principles and practices that distinguish them from conventional sustainability initiatives. What unites these businesses is not just a commitment to reduce harm, but a deliberate strategy to create net-positive social, environmental, and economic impact.

From carbon-capturing technologies to circular fashion, regenerative enterprises demonstrate that business can restore ecosystems, strengthen communities, and redefine value creation. Several interlinked themes emerge as critical to their success.

Regenerative Strategy

At the heart of every regenerative company is a purpose-driven strategy that transcends traditional corporate responsibility. This strategy is proactive, systemic, and measurable: it aims not only to mitigate negative impact but to generate positive ecological and social outcomes. Companies like Climeworks target atmospheric carbon removal at scale, EcoAlf transforms marine waste into high-value apparel, and ACCIONA designs infrastructure projects that enhance biodiversity, water quality, and climate resilience.

Regenerative strategies are often codified into specific, quantifiable objectives—carbon neutrality targets, soil health metrics, circular material utilization rates, biodiversity enhancements, or water conservation goals. These metrics inform investment decisions, product development, and operational priorities, creating a clear line of sight between corporate purpose and measurable outcomes. Importantly, these strategies align with wider systemic agendas, such as the EU sustainability taxonomy, ensuring that regenerative ambition is compatible with regulatory frameworks and market incentives.

In effect, regenerative strategy reframes business from a transactional, extractive activity into a restorative system, where every decision—from sourcing to end-of-life design—contributes to environmental and social health.

Regenerative Leadership

Leadership is the engine of regenerative transformation. In these companies, executives do more than set high-level vision; they embed regenerative thinking into culture, governance, and performance systems. Senior leaders link remuneration, career progression, and investment priorities directly to ecological and social outcomes, signalling that regeneration is central to business success.

This leadership ethos cultivates a culture of long-term thinking, resilience, and adaptability. Employees are empowered to participate in sustainability initiatives, suggest innovations, and engage with communities. At Greiner, cross-departmental collaboration drives closed-loop plastics solutions, while at Vestre and Veja, leadership ensures that regenerative principles permeate daily operational decisions—from sourcing and design to logistics and retail.

Crucially, regenerative leadership extends beyond internal culture: it shapes external partnerships, drives advocacy, and aligns corporate strategy with systemic environmental and societal goals. It positions companies as both market leaders and ecosystem stewards, capable of influencing peers, suppliers, and regulators.

Regenerative Innovation

Innovation in regenerative companies is multidimensional, extending far beyond technology to business models, service design, and system-wide processes. Companies demonstrate that regenerative principles can be commercially viable, generating new revenue streams while restoring natural and social systems.

For example:

-

Arket experiments with rental and resale models for clothing, extending product lifespans and reducing resource demand.

-

Climeworks operates subscription-based carbon capture services, monetizing ecological restoration at scale.

-

PulPac produces fibre-based packaging as a high-performance alternative to single-use plastics, creating circular material flows in industries traditionally dependent on virgin resources.

-

Wildfarmed bridges regenerative farmers with industrial-scale food manufacturers, incentivizing soil restoration and biodiversity while maintaining commercial viability.

Such innovation challenges the linear “take-make-dispose” paradigm, fostering circularity, net-positive outcomes, and system-wide resilience. The regenerative mindset encourages companies to design offerings, processes, and collaborations that generate both ecological benefit and business advantage, proving that restoration and profitability are mutually reinforcing.

Regenerative Ecosystems

No company operates in isolation; regeneration is inherently collaborative and networked. Leading businesses actively engage suppliers, communities, NGOs, governments, and even competitors to achieve systemic impact.

Notable examples include:

-

Interface’s Net-Works programme, which collects discarded fishing nets to manufacture carpet tiles, simultaneously restoring marine ecosystems and supporting livelihoods for coastal communities.

-

Ecosia, which directs search-engine revenue into tree-planting initiatives managed in partnership with local NGOs.

-

Danone, collaborating with farmers and cooperatives across Europe to embed regenerative practices into dairy and plant-based supply chains.

In these cases, the supply chain functions not just as a cost center, but as a driver and amplifier of regenerative impact. Companies cultivate ecosystems where stakeholders share knowledge, align incentives, and jointly measure outcomes, demonstrating that regeneration is as much about relationships as it is about technology or products.

Regenerative Performance

A defining feature of regenerative enterprises is the mutual reinforcement of financial and environmental performance. Far from being a burden, regenerative initiatives enhance brand reputation, foster customer loyalty, engage employees, and strengthen operational resilience.

Financially, companies report growth in revenue from sustainable products, operational efficiencies, and risk mitigation. For example:

-

IKEA’s repair and resale programmes extend product life and reduce raw material costs.

-

Climeworks’ subscription revenue model scales alongside measurable carbon removal.

-

EcoAlf has built a profitable global fashion brand based on recycled materials.

Non-financial performance is equally critical and measurable:

-

Greenhouse gas reductions (Holcim, Interface)

-

Soil regeneration and carbon sequestration (Danone, Wildfarmed, First Milk)

-

Biodiversity enhancement (Acciona, Vestre, Veja)

-

Water conservation (BayWa, Acciona)

-

Social impact metrics including fair labor practices, community development, and employee well-being (Lush, Triodos Bank)

By quantifying both ecological and social outcomes, these companies demonstrate that regeneration is not a soft aspiration but a strategic, measurable, and profitable business imperative.

Regenerative Futures

The regenerative revolution is underway, offering a compelling narrative for the future of business. Across sectors, companies like Climeworks and Danone, Greiner and Holcim, demonstrate that restoring the planet and society need not compromise financial success. On the contrary, embedding regeneration can foster innovation, resilience, and long-term growth.

The cases illustrate that regeneration is both practical and scalable, spanning advanced industrial operations, consumer goods, agriculture, finance, and technology. Leadership, purpose, innovative business models, and ecosystem engagement form the pillars of success. Crucially, regeneration shifts the frame from avoiding harm to actively creating positive impact, aligning commercial success with the flourishing of people and planet alike.

In a world facing rapid ecological, social, and economic change, the regenerative revolution is not optional—it is a blueprint for sustainable prosperity, proving that businesses can thrive while restoring the very systems upon which they depend.

The companies above represent different routes to regeneration.

Greiner shows how heavy industry can reorient towards regenerative ends through product design, alliance building and operational decarbonisation. Ecoalf demonstrates how consumer brands can turn environmental restoration (marine clean-ups) into the raw material for premium products, creating jobs and local benefits. Interface and Patagonia reveal the power of governance and supply-chain redesign to make profound claims credible. Danone, Unilever and IKEA underline the systemic leverage of global buyers to alter agricultural and material systems. Vestre and VEJA show that industrial architecture and transparent supply chains can embed environmental renewal into daily life.

What can leaders learn?

-

Integration into Core Strategy: Regeneration is most successful when it is embedded into the business model, rather than treated as an ancillary initiative. Companies like Acciona, IKEA, and Interface exemplify strategic integration, linking financial performance with ecological outcomes.

-

Leadership and Culture: Executive commitment, performance incentives, and cultural alignment are essential. Across the sample, leadership consistently connects vision, operations, and measurable impact — from BayWa’s stewardship ethos to Triodos Bank’s ethical investment principles.

-

Innovation Across Products and Processes: Regeneration is driven by both material and process innovation. Holcim’s carbon-negative cement, PulPac’s fibre-based packaging, and EcoAlf’s marine-waste apparel show that regenerative thinking catalyses new product categories and business opportunities.

-

Ecosystem Thinking: Partnerships with suppliers, communities, NGOs, and governments amplify impact. Ecosystem approaches ensure that regenerative gains are systemic rather than localised, as seen in Climeworks’ carbon capture networks or Wildfarmed’s supply chain interventions.

-

Performance and Measurability: Financial and ecological metrics are increasingly intertwined. European regenerative leaders demonstrate that profit and impact are not mutually exclusive — measurable environmental restoration often correlates with customer loyalty, market differentiation, and operational resilience.

-

Scalability and Replicability: Many of these companies, from Greiner to Arket, show that regenerative models can scale across sectors, geographies, and industrial processes, proving that regeneration is commercially viable at multiple levels.None of this is easy. Regeneration requires patient capital, new metrics, policy support and an acceptance that short-term profit optimisation will sometimes be subordinate to long-term ecological and societal value creation. Yet the evidence is mounting that companies can — and some already do — write business models that replenish the natural and social capital on which all commerce ultimately depends.

Across sectors and geographies, Europe’s regenerative leaders reveal a new paradigm for business—one in which strategic purpose, leadership, innovation, ecosystem engagement, and measurable impact converge. Their approaches show that companies can go beyond sustainability, actively restoring natural systems, empowering communities, and generating commercial value.

In a world facing escalating ecological and social challenges, these examples provide a blueprint for business transformation, proving that regeneration is both a moral and economic imperative.

More from Peter Fisk

- Eyes on Tomorrow: What Leaders Must See before Everyone Else … exploring the most important megatrends that are transforming markets, and leadership mindsets, and how the best companies embrace them as opportunities … based on the new Megatrends 2035 report by Peter Fisk, and its implications for every business.

- The Reinvention Playbook: Thriving in a World of Relentless Change … the best organisations seek to continually reinvent themselves in a world of constant, uncertain and dynamic change. They rethink, refocus, and reinvent everything – embracing new agendas from AI to GenZ, climate change and social inequality.

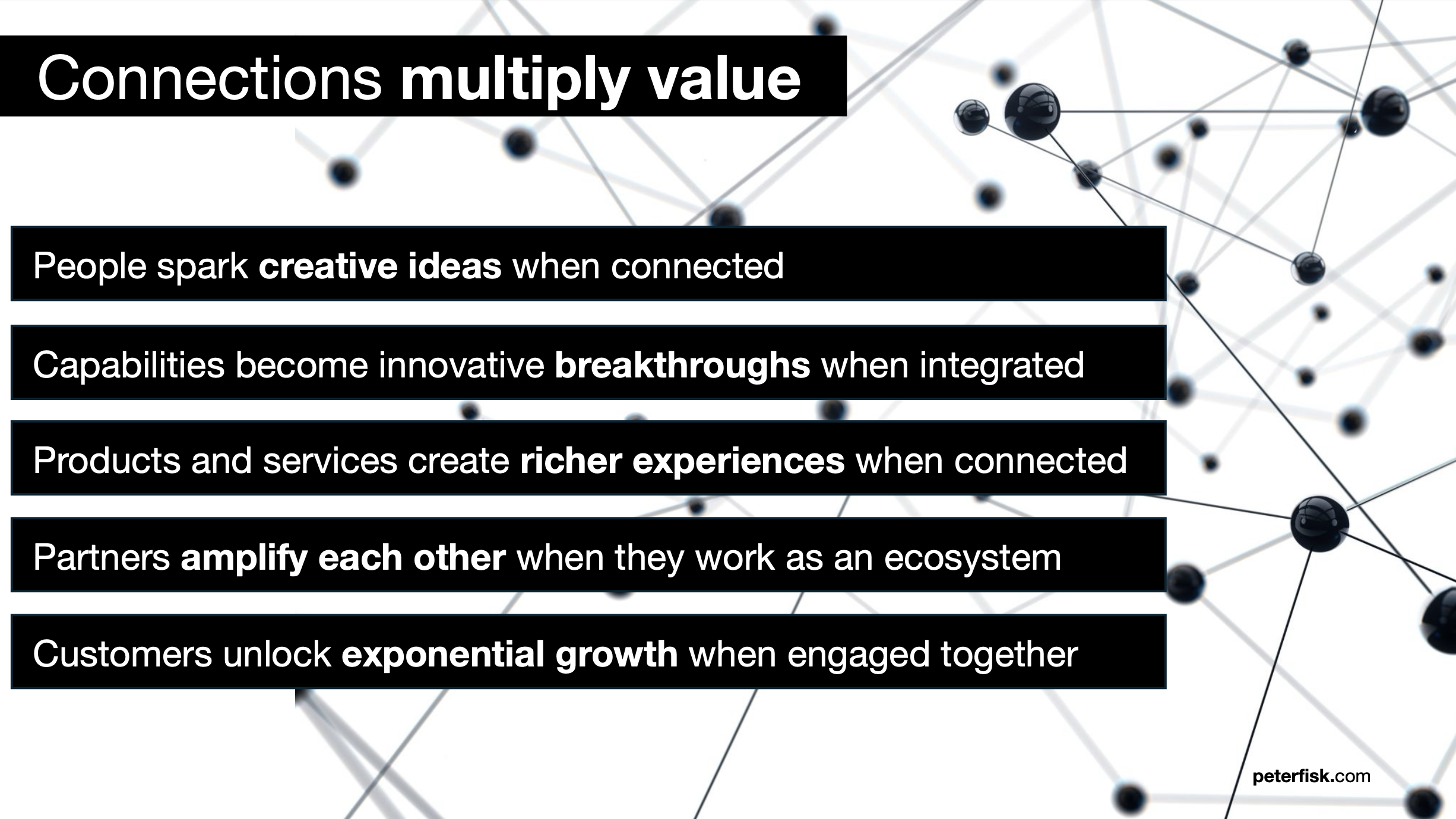

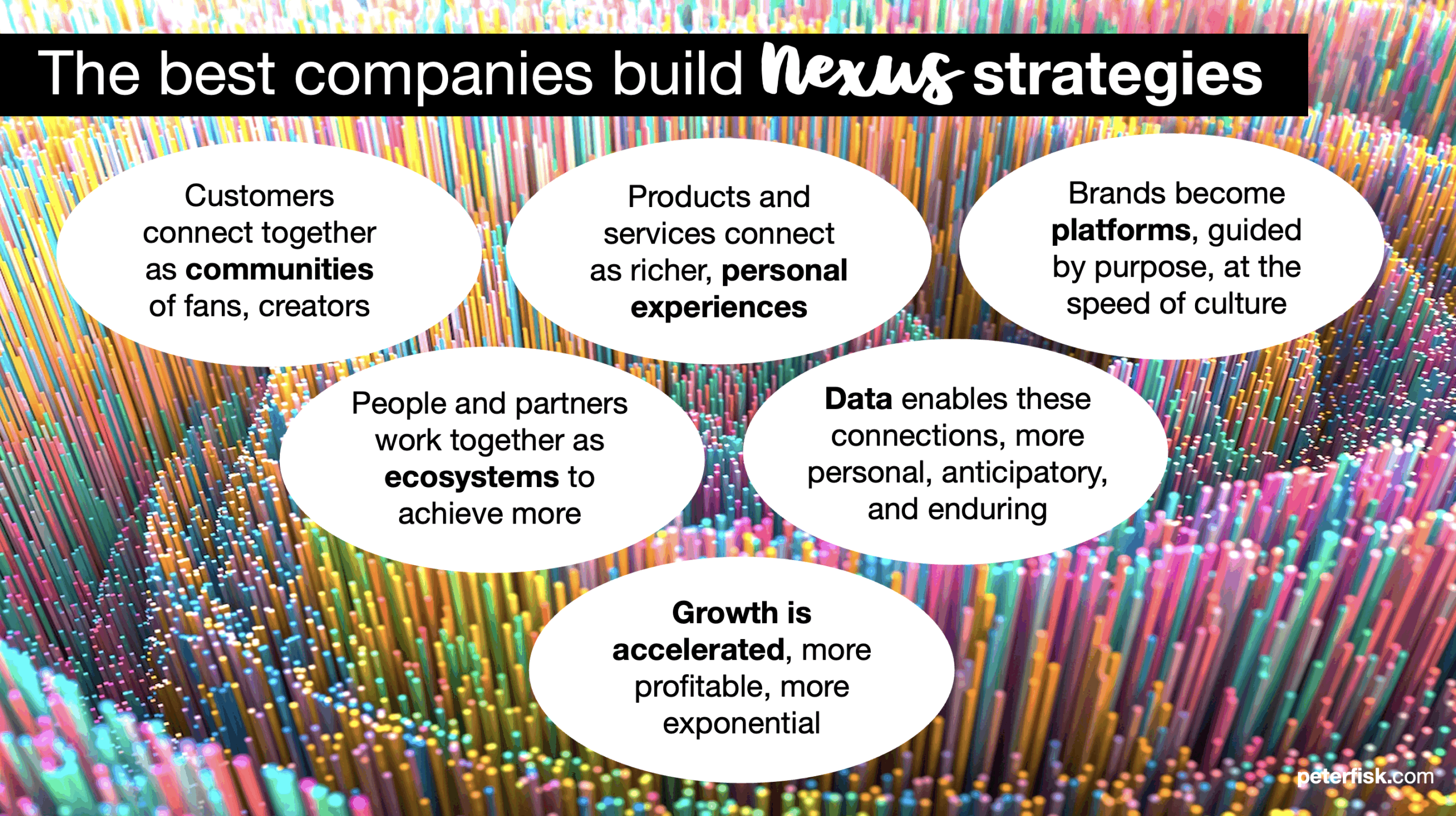

- The Nexus Effect: Unlocking the Power of Connections … How can businesses and brands really unlock the power of data and networks, flywheels and AI, communities and ecosystems, to transform their futures?

- The New Growth Playbook: 9 New Ways to Accelerate Growth … many companies struggle to find new ways to grow their business … instead we look at how the best companies find radically new ways to grow.

- Super Innovators: Innovation Beyond the Normal … 10 radical ways to disrupt conventions, embrace deeper insights, unlock valuable assets, and stretch innovation for more dramatic impact.

- Consumer of the Future … “Aisha blinked twice, the smart lenses in her eyes had already scanned her biometric mood, cross-checked her carbon budget, and pulled up items her climate-positive friends were buying this week”

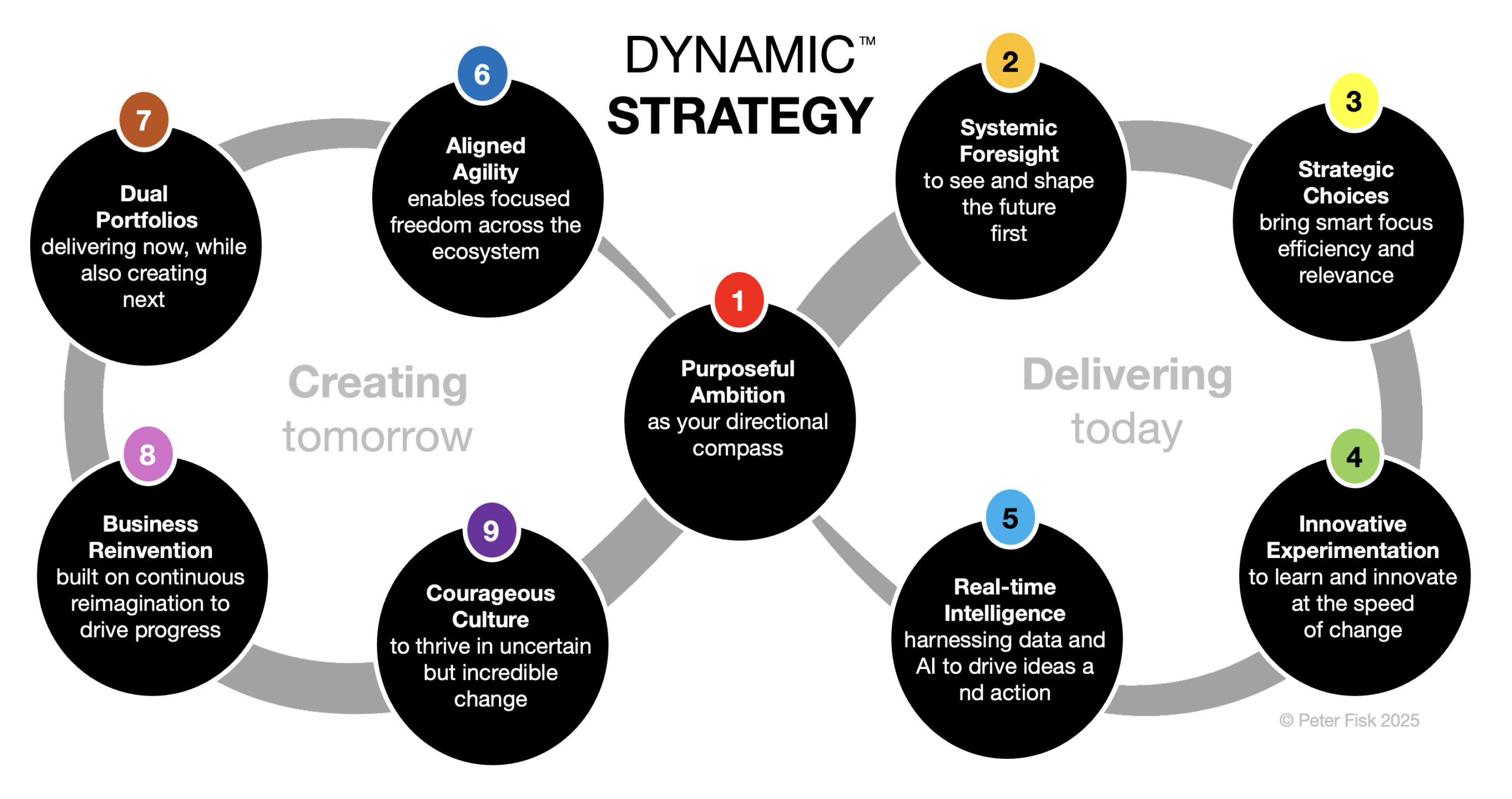

- Competing in the FLUX: How to develop a dynamic strategies in a world of relentless change … combining a strong, enduring direction with micro-moves that adapt quickly to emerging shifts:

- Business Transformation: The new superpower of business leaders … reimagining the future, redefining strategy, reinventing the organisation, rewiring performance … the journey to deliver step change in value creation.

- The Sustainable Consumer: Go on, do the Right Thing … how brands can accelerate the consumer shift to sustainable products and practices … from food and fashion, to energy and electric cars, making sustainability desirable and better.

- The “Performer Transformer” Leaders: How great leaders deliver today and create tomorrow … with dual thinking, to build dynamic ambidexterity, continually strategyzing, to perform and transform.

- The Hire-Wire Act of Leadership: Leading in a world of intense competition and relentless change … being visionary and innovative, learning to adapt and endure … inspired by Taylor Swift, Roger Federer, Beyoncé, and Lionel Messi

- Becoming a Future-Ready Business … in a world of relentless change, organisations need to anticipate change, embrace innovation, empower talent, and align deeply with the evolving needs of society and the planet

The boardroom on the top floor of a glass-fronted tower in Milan’s Porta Nuova district was silent. Outside, the Lombardy sun glinted off the spires of the Duomo. Inside, the atmosphere was deliberate, almost surgical.

The CEO of a global consumer goods company was not studying the quarterly P&L. He was staring at a digital signals map projected across an entire wall — a living mosaic of emerging behaviours, regulatory shifts and technological inflections. The falling cost of lab-grown collagen in Singapore. The rise of sober-curious social clubs in Berlin. A proposed EU directive on the “Right to Repair”.

“The 2026 budget is irrelevant,” he said eventually, turning to his executive team. “If we are still planning for a world where people buy things to own them, rather than access them, we are managing a museum — not a business. Our competitors are no longer just other FMCG firms. They are the companies that see the world from the outside-in.”

That moment marked the creation of the company’s new Impact Function — a mandate to connect foresight directly to strategy, capital allocation and everyday decisions. It also reflected a much broader shift now taking place in boardrooms from Milan to London to New York.

The definition of leadership is changing.

To lead today is no longer to be the custodian of past success. It is to become an architect of the future.

Why the future has arrived early

For decades, leadership was largely about managing what you could see. Markets moved slowly. Industries were stable. Strategy was a plan; execution was the challenge. The future could safely be left to forecasts, five-year cycles and specialist teams.

That era is over.

Today, the future arrives early — and unevenly. It breaks into the present through technology, regulation, climate, geopolitics and culture. It reshapes supply chains before it reshapes markets. It changes consumer expectations before organisations are ready to respond.

We are living in an age of outside-in volatility.

The most powerful forces acting on businesses no longer originate inside industries or value chains. They emerge from the margins — from social movements, youth culture, environmental limits, regulatory intervention and exponential technologies — and cascade rapidly into the core.

In this environment, long-term thinking is no longer a luxury. It is a prerequisite for relevance.

From performance to preparedness

Many organisations remain well run — operationally disciplined, financially strong, executionally capable. Yet they struggle not because they are inefficient, but because they are increasingly misaligned with the future.

Performance without relevance is temporary.

A future mindset reframes the central leadership question. Not:

How do we optimise what we do today?

But:

What will matter — and still matter — in five, ten or fifteen years?

This is not about prediction. It is about preparedness.

Every major strategic decision is a bet on the future — whether leaders acknowledge it or not. The difference between resilient organisations and vulnerable ones is whether those bets are conscious, tested and diversified.

Thinking like a futurist: discipline, not dreaming

Foresight is often misunderstood as speculation or trend-watching. In reality, it is a discipline — a structured way of observing how the world is changing and what those changes imply for strategy, capability and investment.

At its core, a future mindset involves three capabilities:

-

The ability to detect weak signals early

-

The discipline to interpret them systemically

-

The courage to act before certainty arrives

This is not about forecasting a single future. It is about preparing for multiple plausible ones.

The most future-ready leaders do not ask, “What will happen?”

They ask, “What would we do if this happened?”

From foresight to decision-making: what best practice looks like

To identify the gold standard in corporate foresight, it is not enough to look at companies with innovation labs or trend reports. The true leaders are those who have embedded foresight into governance, capital allocation and everyday operations.

Disney: backcasting the future of experience

Disney’s evolution from a traditional animation studio into a multi-platform entertainment ecosystem is the result of deliberate future thinking.

Rather than extrapolating from the present, Disney frequently uses backcasting — defining a desired future state and working backwards to determine what capabilities, technologies and acquisitions are required to get there.

When Disney asks, “What will immersive storytelling look like in 2040?”, the answer shapes decisions made today — from acquisitions such as Pixar, Marvel and Lucasfilm to investments in theme parks, streaming platforms and experiential technologies.

Disney also maintains a dedicated strategic foresight capability that works directly with the C-suite, identifying disruptive “black swan” events — from pandemics to shifts in travel behaviour — and exploring their implications long before they materialise.

The result is not agility alone, but coherence across decades.

Shell: making uncertainty governable

Shell is widely regarded as the pioneer of corporate foresight. Its scenarios team has been operating for more than half a century, famously helping the company navigate the oil shocks of the 1970s by having already rehearsed a world of volatile prices and geopolitical disruption.

What distinguishes Shell is not the quality of its scenarios, but how they are used. Shell does not attempt to predict a single future. Instead, it develops multiple, radically different “possible worlds” — and stress-tests strategy and investments against each of them.

Foresight at Shell is not advisory. It is institutionalised. No major capital project proceeds without a scenario resilience check. In effect, foresight functions as a governance mechanism, forcing leaders to confront uncomfortable possibilities before committing billions.

Uncertainty is not eliminated — it is made manageable.

Unilever: using the future as a strategic constraint

Unilever stands out for its deeply outside-in approach, particularly around social and environmental megatrends.

Through its Sustainable Living Plan — now evolved into the Unilever Compass — the company integrated foresight into its brand and portfolio strategy. Instead of asking what competitors are doing, Unilever asks what the world will require.

What does it mean to operate within planetary boundaries?

What will consumers expect of brands in a carbon-constrained, resource-limited world?

These questions become strategic constraints that shape innovation, sourcing, packaging and marketing decisions today.

Unilever uses “future-fit” benchmarks — measuring brands not just against current market norms, but against what will be necessary by 2030 and beyond. This forces earlier, sometimes uncomfortable, pivots — but builds long-term relevance and trust.

Siemens: turning foresight into investment logic

As an industrial technology leader, Siemens has institutionalised foresight through its “Pictures of the Future” methodology.

This approach combines systematic trend scouting with “wild card” analysis — low-probability, high-impact events that could fundamentally reshape markets. The output is not generic trend decks, but detailed future scenarios for specific domains such as energy systems, mobility and urban infrastructure.

Crucially, these future pictures inform R&D roadmaps and portfolio decisions. When foresight suggests that decentralised energy will dominate, Siemens begins reallocating investment away from centralised fossil-based systems years before markets peak.

Foresight becomes an early-warning system — and a trigger for capital reallocation.

Lego: designing for future relevance

LEGO’s turnaround from near-bankruptcy in the early 2000s was built on a profound commitment to foresight and human insight.

The company established a Future Lab that operates with startup-like autonomy, supported by a global scanning network of children, educators, technologists and cultural observers. The goal is not to track toy trends, but to understand how play itself is evolving — cognitively, socially and digitally.

This foresight reshaped LEGO’s strategy: expanding into digital gaming, movies and experiences, while simultaneously investing in sustainable materials and circular design.

LEGO did not abandon its core. It reinterpreted it for the future.

Foresight in action

Across these organisations, a clear pattern emerges. Foresight works when it meets four conditions:

It sits close to power

Foresight reports to the CEO or Chief Strategy Officer — not buried in marketing or innovation.

It balances time horizons

Leaders manage today’s performance, tomorrow’s growth and the day-after-tomorrow’s disruption simultaneously.

It welcomes diverse thinking

Anthropologists, scientists, designers and even science-fiction writers sit alongside economists and strategists.

It shapes decisions, not just dialogue

Foresight informs capital allocation, portfolio choices and risk appetite — not just workshops.

What leaders must do differently

A future mindset is not a function or a framework. It is a leadership stance.

It requires leaders to move:

- From certainty to curiosity

- From defending legacy to designing possibility

- From control to orchestration

- From short-term optimisation to long-term relevance

Making better decisions today

Crucially, a future mindset improves the quality of decisions made now.

Leaders use foresight to allocate capital more intelligently — shifting investment away from defending declining models and towards building future capabilities. Portfolios are actively rebalanced, with clear distinctions between businesses that generate cash today and those that create relevance tomorrow.

Risk is reframed. Instead of being treated solely as something to minimise, emerging risks — regulatory, technological, environmental — are surfaced early, when mitigation is cheaper and strategic options still exist. Foresight enables leaders to avoid costly late-stage pivots by acting before pressure becomes acute.

At the same time, opportunity is pulled forward. Future-ready organisations enter new spaces earlier, shape standards, build ecosystems and secure talent before competitors recognise the shift. This is how advantage compounds — not through speed alone, but through timing.

The result is not reckless ambition, but informed boldness.

What it means in practice

Across the world’s most future-ready organisations, the same patterns appear:

-

Foresight reports to the CEO or Chief Strategy Officer

-

Leadership balances today, next and beyond

-

Diverse thinkers complement traditional strategists

-

Insight is directly linked to investment and governance

Foresight works when it shapes decisions, not when it decorates presentations.

Perhaps most importantly, it requires leaders to create psychological safety — allowing uncomfortable signals to surface, inconvenient questions to be asked, and sacred assumptions to be challenged.

The future rarely fails loudly. It whispers first.

The future is built now

The future is not a distant destination. It is something organisations build — decision by decision, investment by investment, assumption by assumption.

Back in that Milan boardroom, the CEO did not simply admire the signals map. He acted on it. 20% of R&D investment was reallocated from line extensions to future-facing innovation.

The organisations that will define the next decade are already being shaped today — by leaders willing to think beyond certainty, act before proof, and design for a world that does not yet fully exist.

Leadership, now, is no longer about managing what is.

It is about architecting what comes next.

Food is no longer a slow-moving sector defined by incremental change. It has become one of the most dynamic arenas of reinvention in the global economy — shaped by economic pressure, scientific breakthroughs, cultural shifts and radically changing consumer expectations.

Across markets, consumers are rewriting the rules. They are trading down ruthlessly on staples while paying more for products that feel healthier, more ethical or more meaningful. They are sceptical of marketing claims yet hungry for innovation. They demand transparency, functionality and flavour — simultaneously. And they expect brands to evolve as quickly as the rest of their lives.

For food businesses, this creates tension — but also extraordinary opportunity. The winners of the next decade will not be those that merely defend market share, but those that reimagine value, redefine premium, and turn food into an experience, not just a product.

10 trends reinventing food

1. Value sensitive with premium splurges

Consumers everywhere are more price-conscious than they have been in decades. Staples are scrutinised, brands are swapped without hesitation, and private label continues to gain ground. Yet this is not a race to the bottom.

Instead, consumers practise strategic frugality. They save aggressively on basics in order to splurge on one or two items that matter — a healthier oil, a premium snack, a product with meaning or indulgence attached.

The new rule: Value and premium now coexist in the same basket.

2. Premium redefined as “better-for-you”

Luxury cues alone no longer justify higher prices. Today’s premium is increasingly nutritional, functional and preventative: more protein, more fibre, less sugar, cleaner labels, functional ingredients.

Health is no longer a niche — it is a decision filter. Consumers may still buy indulgence, but they increasingly want reassurance that it fits a healthier lifestyle.

The new rule: Premium equals credibility, not decoration.

3. Plant-based goes mainstream

The plant-based movement has moved beyond early adopters. The future is not strict veganism, but flexitarianism — consumers blending plant and animal proteins based on taste, health, cost and occasion.

Innovation is shifting from ideology to sensory performance: better texture, better taste, simpler ingredients and hybrid solutions.

The new rule: Plant-based wins when it feels normal, not worthy.

4. Technology enters the kitchen

AI, fermentation, precision processing and even 3D printing are reshaping food formulation. These technologies are closing the taste and texture gaps that once limited healthier or sustainable alternatives.

What was once R&D-led experimentation is now commercially viable at scale.

The new rule: Food innovation is becoming computational.

5. Private label becomes premium

Retailer brands are no longer generic substitutes. They are curated, premiumised and often more innovative than national brands — offering exclusivity, storytelling and price advantage simultaneously.

This shifts power in the value chain and forces brands to rethink their role.

The new rule: Retailers are no longer just distributors — they are brand builders.

6. Sustainability moves from ethics to economics

Sustainability has crossed a crucial threshold. It is no longer just a moral argument; it is a growth strategy. Brands that reduce waste, upcycle ingredients, shorten supply chains or improve transparency increasingly win loyalty and justify premium pricing.

Consumers reward brands that prove — not proclaim — their impact.

The new rule: Sustainability must pay its way.

7. Food as functional medicine

Consumers increasingly view food as a tool for long-term wellbeing — supporting gut health, energy, immunity and metabolic balance.

This blurs the boundary between food, beverage and wellness, opening new premium categories and consumption moments.

The new rule: Food is preventative care.

8. Convenience gets premiumised

Busy, urban lifestyles drive demand for convenience — but not at the cost of quality. Premium ready meals, meal kits and prepared foods are thriving by combining time-saving with restaurant-level expectations.

The new rule: Convenience is no longer cheap — it is curated.

9. Digital discovery reshapes brand building

Social platforms, influencers and DTC channels increasingly define what gets noticed, trialled and shared. Brands can scale faster than ever — but also lose relevance just as quickly.

Marketing is no longer about campaigns; it is about continuous participation in culture.

The new rule: Visibility beats shelf space.

10. Trust, provenance and local relevance

In many regions — particularly MENA — consumers place growing emphasis on halal integrity, traceability, local sourcing and family trust.

Global brands must feel local, authentic and accountable.

The new rule: Trust is the ultimate differentiator.

10 innovators reinventing food

These companies are not just innovative — they are commercially successful, reshaping categories and expectations.

1. NotCo … Reinventing food with AI

Origin and evolution

NotCo was founded in Santiago, Chile, in 2015 by a technologist, a food scientist and a brand builder who shared a provocative idea: food formulation could be radically improved if humans stopped relying solely on intuition and tradition. Instead of starting with ingredients, NotCo started with data. They built an AI platform — nicknamed “Giuseppe” — capable of analysing molecular structures, flavour compounds and consumer preferences to design plant-based foods that mimic animal products.

What they do differently

Rather than marketing plant-based food as an ethical compromise, NotCo focuses obsessively on taste, texture and familiarity. Their products — such as NotMilk, NotMayo and NotBurger — are designed to be direct replacements for everyday staples. AI allows the company to test thousands of ingredient combinations rapidly, dramatically shortening development cycles and improving sensory performance.

Commercial success and scaling

NotCo has raised hundreds of millions of dollars and expanded far beyond Latin America into North America and Europe. Crucially, it has partnered with major global food companies, using its AI engine to reformulate existing products — including dairy and ice cream — rather than positioning itself purely as a challenger brand.

Why it matters

NotCo demonstrates that the future of food innovation may be computational. It shows how AI can unlock scale, speed and consistency — turning plant-based from a niche ideology into a mainstream solution. For large food groups, it offers a blueprint for how technology can augment, rather than replace, industrial food systems.

2. Meati … Whole-food protein without compromise

Origin and evolution

Meati was founded in Colorado, drawing inspiration from traditional fermentation and the natural structure of fungi. Instead of isolating proteins and rebuilding them through heavy processing, Meati grows mycelium — the root structure of mushrooms — in controlled environments to create whole-food protein.

What they do differently

The company’s approach stands in contrast to earlier generations of alternative proteins. Meati products are minimally processed, naturally fibrous and nutritionally dense, containing complete protein, fibre and micronutrients. They are positioned not as substitutes, but as a new category of protein altogether.

Commercial success and scaling

Meati has attracted significant investment and experienced rapid growth in consumer awareness and retail distribution. Its products appeal not only to vegans but to mainstream consumers seeking healthier, less processed foods. The brand has gained traction in both retail and foodservice, accelerating trial.

Why it matters

Meati signals a shift away from ultra-processed alternatives towards biologically inspired food. It suggests that the future of protein innovation may lie in working with nature more intelligently, rather than engineering around it — a powerful idea for both consumers and regulators.

3. Tru Fru … Making health indulgent again

Origin and evolution

Tru Fru was founded in the USA to address a gap in the snacking landscape: the binary choice between indulgent treats and purely healthy options. The founders’ idea was deceptively simple — real fruit, lightly processed, coated in chocolate, yoghurt or freeze-dried for freshness. By bridging this divide, Tru Fru created a category of “health-forward indulgence” that appealed to children, adults, and health-conscious consumers alike. The brand emerged at a moment when consumers were increasingly seeking snacks that delivered both pleasure and nutritional reassurance.

What they do differently

Tru Fru distinguishes itself through a combination of clean ingredients and playful indulgence. Its products are visually appealing, portion-controlled, and approachable, making them feel like everyday treats rather than niche health foods. Branding is bold, modern and inclusive, emphasising fun and quality without moralising. The company also invests in flexible formats — from single-serve options to family packs — to meet multiple consumption occasions.

Commercial success and scaling

Revenue growth has been extraordinary, with repeat purchase rates demonstrating strong consumer loyalty. Distribution spans grocery chains, specialty retailers, and online channels, allowing the brand to scale nationally while maintaining a premium feel. Tru Fru’s success demonstrates that simplicity, when combined with strong branding and clear value, can outperform more complex product innovations in crowded snack categories.

Why it matters

Tru Fru shows that “better-for-you” doesn’t need scientific jargon or functional claims to resonate. It highlights the enduring power of intuitive value propositions, particularly when health and indulgence are combined seamlessly. For brands, it underscores the importance of making nutritious options emotionally and culturally compelling.

4. FieldGoods … Elevating ready meals to restaurant quality

Origin and evolution

FieldGoods, from Australia, was launched with the mission of challenging the perception that convenience food must compromise on quality. Drawing inspiration from fine-dining kitchens, the founders focused on seasonal ingredients, chef-driven recipes, and sustainable sourcing practices. The brand aimed to transform ready meals from mundane pantry staples into premium, restaurant-quality experiences that could fit into busy modern lifestyles.

What they do differently

FieldGoods pays meticulous attention to every touchpoint — from recipe development to packaging design. Meals are crafted to feel freshly prepared rather than mass-produced, with premium ingredients and authentic flavours. The brand also emphasises sustainability and transparency, ensuring sourcing practices and ingredient quality align with the values of its target consumers.

Commercial success and scaling

FieldGoods has consistently delivered strong year-on-year growth and secured listings with high-end retailers. Its products command a price premium justified by quality, convenience and ethical sourcing. The success of the brand demonstrates that consumers are willing to pay more for convenience when it is paired with a sense of craftsmanship and trust.

Why it matters

FieldGoods represents the premiumisation of time. In an era of increasingly busy lifestyles, convenience itself has become a luxury. The brand highlights how ready meals can be repositioned from utilitarian solutions to aspirational, value-driven offerings.

5. DASH Water … Turning waste into brand equity

Origin and evolution

DASH Water was founded in the United Kingdom to tackle two challenges simultaneously: reducing sugary drink consumption and addressing food waste. The brand uses surplus and “wonky” fruit — often rejected by conventional retail — to flavour sparkling water, turning ingredients that would otherwise be discarded into a central product proposition.

What they do differently

Sustainability is embedded into the product and brand DNA rather than being an afterthought. DASH positions upcycled ingredients as aspirational, playful, and desirable, making environmental responsibility both accessible and culturally appealing. Its branding combines transparency, humour, and clarity to create a compelling narrative that resonates with environmentally conscious consumers.

Commercial success and scaling

DASH has experienced rapid growth and wide distribution in the UK and beyond, becoming a recognised name in a competitive beverage market. Its B Corp certification reinforces credibility, building trust among premium-conscious consumers who care about ethical and sustainable consumption.

Why it matters

DASH proves that sustainability can drive commercial performance. By reframing food waste as an opportunity for innovation and differentiation, the brand illustrates that environmental responsibility can become a strategic growth lever rather than a compliance exercise.

6. Olipop ... Reinventing soft drinks for the gut-health age

Origin and evolution

Olipop was founded out of frustration with traditional soft drinks and early functional beverages that lacked mainstream appeal. The founders sought to reimagine soda as a functional, gut-friendly option by combining prebiotics, botanical extracts, and nostalgic flavours. The idea was to deliver both health benefits and the familiar sensory pleasures of classic sodas.

What they do differently

Olipop maintains the emotional and taste cues of traditional soda while providing tangible nutritional benefits. Its product positioning bridges wellness and enjoyment, making functional beverages appealing to consumers who might otherwise avoid health-forward drinks. Packaging, messaging, and product innovation all emphasise modern, approachable health without alienating mainstream audiences.

Commercial success and scaling

The brand is among the fastest-growing beverages globally, with strong retail presence in North America and e-commerce channels. It has achieved near-unicorn valuation territory, reflecting strong investor confidence and market traction.

Why it matters

Olipop illustrates how legacy categories can be revitalised by integrating science with emotional resonance. It demonstrates that even well-established markets like soda can be disrupted when health and nostalgia converge.

7. Banza … Disrupting the middle of the aisle

Origin and evolution

Founded by young entrepreneurs in the United States, Banza was created to address the nutritional shortcomings of staple foods like pasta. The founders sought to deliver a product that improved health without asking consumers to change familiar cooking or eating habits, using chickpeas as the primary ingredient.

What they do differently

Banza combines higher protein and fibre content with the taste, texture, and cooking experience of traditional pasta. The brand positions itself as approachable and fun rather than preachy, making nutritional enhancement feel natural rather than forced. Packaging, marketing, and messaging reinforce accessibility and everyday use.

Commercial success and scaling

Banza has become one of the largest pasta brands in the United States, with national retail presence and strong consumer loyalty. Its success demonstrates that health-focused innovation can thrive in conventional categories without requiring significant behavioural shifts.

Why it matters

Banza shows that transformation does not always require dramatic lifestyle changes. Instead, incremental improvements, smart ingredient choices, and relatable branding can shift the market from within.

8. Infinite Roots … Scaling through foodservice first

Origin and evolution

Germany’s Infinite Roots originated in Europe’s alternative protein ecosystem with a deliberate focus on foodservice rather than retail. The founders recognised that chefs could act as early adopters and taste influencers, accelerating the acceptance of plant-based protein formats that were unfamiliar to everyday consumers.

What they do differently

By targeting professional kitchens first, Infinite Roots ensured high-quality execution and rapid feedback loops. Foodservice acted as a credibility engine, allowing the brand to perfect formulations and build trust before entering mass retail channels.

Commercial success and scaling

The company’s products have been rapidly adopted across hospitality networks, creating momentum for broader retail expansion. Partnerships with premium restaurants and institutional buyers have established a strong foundation for growth.

Why it matters

Infinite Roots illustrates how channel strategy can accelerate adoption of innovative products. Targeting chefs and foodservice operators first can reduce consumer risk perception, build trust, and validate premium positioning.

9. Revo Foods and Juicy Marbles … Reinventing seafood alternatives

Origin and evolution

Revo Foods and Juicy Marbles joined forces in Germany to tackle one of the most challenging protein categories: seafood. The collaboration combined advanced plant-protein structuring, flavour science, and 3D technology to recreate fish fillets with realistic texture, taste, and nutritional profiles.

What they do differently

Unlike most plant-based brands focused on burgers or mince, this partnership prioritises whole-cut experiences. The products are positioned as premium, sustainable alternatives suitable for restaurants and retail consumers who value authenticity and culinary performance.

Commercial success and scaling

Early adoption in European markets has highlighted strong demand for sophisticated, category-expanding alternatives. The collaboration has generated investor interest and has set the stage for future expansion into new markets and species.

Why it matters

Revo Foods and Juicy Marbles push the boundaries of plant-based innovation, demonstrating that alternative proteins can move beyond simple meat replacements into complex, premium dining experiences.

10. Coccola … Transforming a beverage idea

Origin and evolution