The world’s most loved brands and businesses succeed not with a single-minded view on financial results – but with more vision, more innovation and more care – and they are often the most valuable too.

Less carbon, less waste, circular business models and social initiatives, are good but not enough. CSR and ESG metrics are important, but could go much further. Sustainability reports are still vanity publications. This is really entry level sustainability.

The best companies embrace sustainability challenges as opportunities for the core business to innovate, to find new ways to grow, and sometimes to fundamentally reinvent itself. Sustainable innovations can often be better than the old products or practices which they replace. Sustainable growth can often faster, and more profitable too.

And while there are fabulous sustainable innovations by start-ups, in needs the audiences and resources of much larger companies to embrace these, and transform their organisations for real impact.

Schneider Electric: Life is On

The French company is a global leader in energy management and automation, and has made significant strides in sustainability, guided by a purpose “to empower people to make the most of their energy and resources, and to bridge progress and sustainability”.

SE’s most distinctive strategy has been to decentralise energy generation and distribution through the use of microgrids, enabling local individuals and communities to generate and share their energy, for consumers to become prosumers. A wide range of solutions help businesses and homes reduce energy consumption. Their products, from smart meters to energy-efficient buildings, help lower carbon emissions. The company invests heavily in renewable energy sources and promotes their use through its energy solutions.

Patagonia’s purpose is to “build the best product, cause no unnecessary harm, and use business to inspire and implement solutions to the environmental crisis.” This mission reflects their commitment to sustainability and environmental stewardship, and they are considered one of the world’s most sustainable brands. The company, founded by Yvon Chouinard in 1973, based in Ventura, California. A certified B-Corporation, is on a mission is to save our home planet.

It prioritises reducing their environmental impact through initiatives like the Worn Wear program, which encourages customers to buy used Patagonia products. The company ensures fair labor conditions in their supply chain, with many of their factories being Fair Trade Certified. They use recycled and organic materials in their products, aiming to create durable, repairable, and recyclable items. Patagonia donates 1% of its annual sales to environmental causes through the 1% for the Planet initiative, and plans to make all of its products by weight from recycled and organic materials by 2025.

The Swedish company’s purpose is “to create a better everyday life for the many people.” This vision goes beyond just selling home furnishings; it aims to have a positive impact on the world, from the communities where they source raw materials to how their products help customers live more sustainably.

It is considered one of the world’s most sustainable innovators. It has set ambitious climate goals, aiming to be climate positive by 2030. This means they plan to reduce more greenhouse gas emissions than they emit. They focus on designing products that can be reused, refurbished, and recycled, minimising waste and promoting resource efficiency. The company uses renewable and recycled materials in their products and aims to phase out single-use plastics, invests in renewable energy sources and energy-efficient technologies in their stores and operations, and ensures fair labour conditions and supports social initiatives, such as providing affordable housing solution.

With a purpose “to make sustainable living commonplace” Unilever seeks to integrate sustainability into every aspect of their business, from product development to supply chain management, and to inspire consumers to adopt more sustainable lifestyles.

Unilever is considered one of the world’s most sustainable brands because if its ambitious goals, including to achieve net zero emissions across its value chain by 2039. They are committed to reducing plastic waste by using more recycled materials and developing innovative packaging solutions. Unilever supports fair trade and ethical sourcing, ensuring that farmers and workers in their supply chain are treated fairly. Through initiatives like the Shakti program, Unilever empowers women in rural communities by providing them with entrepreneurial opportunities.

Harnessing new technologies

While innovations are not just about new technologies, they do provide capabilities to solve the big problems we face in new ways. Here are some of the most exciting sustainable innovations of 2024:

- Sustainable Plastic Alternatives: Innovations aimed at reducing plastic waste by creating biodegradable and compostable materials. eg AirCarbon

- Biodegradable Packaging: New packaging solutions that break down naturally without harming the environment. eg Mori

- Garbage Bins for the Ocean: Devices designed to collect and recycle plastic waste from oceans and waterways. eg Seabin

- Solar Generators: Portable and efficient solar-powered generators for renewable energy on the go.

- Renewable Energy Storage: Advanced storage solutions to capture and store renewable energy more effectively.

- CO2-Reducing Robots: Robots and AI technologies that help reduce carbon dioxide emissions in various industries. eg Kiwibot.

- Zero-Carbon Cement: New methods of producing cement with minimal carbon emissions.

- Microbial Fertilizers: Using microbes to help farmers reduce the need for chemical fertilize

- Carbon-Capturing Microbes: Microbes engineered to capture and store carbon dioxide from the atmosphere.

Building better brands

Developing a sustainable brand typically involves several stages or levels:

- Finding purpose: Understanding the core purpose and mission of your brand. This involves identifying why sustainability matters to your brand and how it aligns with your values.

- Establish priorities: Assessing your current practices and identifying areas for improvement. This step helps you understand your environmental impact and set realistic goals.

- Build a roadmap: Developing a clear strategy and action plan to achieve your sustainability goals, and how they link to business priorities and results.

- Sustainable practices: Integrate basic sustainable practices into your operations, from sourcing materials like clean energy to production and distribution, building a circular model over time.

- Build a platform for good: Engaging with stakeholders, including customers, employees, and partners, to create a community around your sustainable brand.

- Authentic storytelling: Effectively sharing your sustainability journey and achievements with your audience in a way that is real, tangible and useful. Get others to tell the story for you.

- Business dashboard: Continuously track your progress and report on your sustainability efforts to maintain transparency and accountability, and show how they enhance business results too.

- Sustain and evolve: Regularly review and refine your sustainability practices, gradually making them more core to your business model, your competitive advantage and commercial success.

Contact me at peterfisk@peterfisk.com

More free downloads:

- New research: The World’s Most Sustainable Innovators

- New research: Gamechangers Turkey: The Most Sustainable Innovators

- Video: Business for a Better World

- Article: Sustainable Advantage

- Book: People Planet Profit: Sustainable Innovation by Peter Fisk

- New research: Ipsos Global Trends Report

- Resources: Sustainable Futures Project

More from Peter Fisk:

- Keynote speaking: inspiring speaker on future megatrends, disruptive innovation, and courageous leadership

- Business workshops: world class facilitation, applying the most innovative ideas practically

- Executive education: customised, leading edge, in-house programs and with top business schools

- Strategic consulting: expert, collaborative, facilitate support and advice to boards, executives and project teams

Navi Radjou is a joyful guy. A friend, a great thinker, and inspiration.

I first met him almost 20 years ago, as a fellow new entrant to the Thinkers50 radar of new business thinkers. His beaming face and infectious laugh are enough to like him immediately. And then he tells his story, of where he has come from, and what matters to him.

Navi describes himself as “an uplifter”, which is perhaps what we all need after a year of pandemic lockdown, fear and anxiety, and economic uncertainty.

In a recent email, he told me how he was that week moving to a new apartment just across the road from New York’s Central Park. To me this seemed like a big upheaval, especially during a pandemic, but he reassured me that with every move he finds himself with less possessions – living light, you might say.

Another word is frugal – which is perhaps what he is best known for – or rather the concept of “frugal innovation”. Labelling himself as a French-American, who grew up in Pondicherry in south-eastern India (made famous by the book, Life of Pi), he has a passion for how companies can innovate faster, better, and sustainably in today’s tech-driven, resource-constrained global economy that is increasingly shaped by climate change.

Big idea

His next big idea is “conscious design” which he describes as “the ability to integrate our thinking, feeling, intuiting, doing”.

“When I turned 45, I reflected on my life and saw a pattern. Until then, I had treated the various aspects of my background — my Indian roots, French education, and my professional life in the USA — as distinct. I realised that the time has come for me to integrate these unconnected dots of my background into something more holistic.

“I also see this reflected in our times. We are entering what I call The Age of Convergence, in which first-world and third-world issues like climate change, escalating pollution, social inequality, chronic illnesses, are converging to create ‘problems without borders’ that affect every person on Earth irrespective of gender, skin colour, or income level.”

As the world struggles to fight the Covid-19 virus, we can see this challenge more clearly than ever – “until we are also safe, nobody is safe” – in the need to share and support vaccinations in every corner of the planet.

“The human race needs to transcend its superficial differences and converge toward unity so that all men and women can join forces to co-create solutions without borders that overcome the wicked problems afflicting entire mankind.”

He says that he sees this convergence happening in himself as he seeks to integrate the rich aspects of a multicultural background — the millennia-old Indian spiritual wisdom, the French tradition of rational thinking and scientific analysis, and the entrepreneurial spirit of Silicon Valley — to gradually become a “whole” person.

So what does this mean in practice? As we recover from Covid-19 we need to design new products and services, processes and experiences with emphasis on safety, health, and sustainability. However, even more importantly, he says, we also need to design

- new organizational structures (to accommodate virtualised/decentralised workplaces and drive bottom-up innovation)

- new wise and resilient leadership models that foster diversity and thrive on ambiguity

- new collaborative industry value networks (that encourage co-creation rather than competition

- new inclusive/regenerative socio-economic ecosystems like the frugal economy (the title of his bestselling book).

- new grassroots political governance (like participative democracy).

All the above activities, he suggests, are focused on designing a better outer world, yet we should perhaps pay more attention to also creating a better inner life.

“There is a spiritual revolution under way as more people, especially Gens Y/Z seek meaning in life. As such, we all need to become conscious designers of our subjective inner life” he says.

“To consciously design a more purposeful life, one needs to harness and integrate four inter-related faculties related faculties: thinking (mind), feeling (heart), intuiting (soul), and doing (body).”

Radjou intends to infuse this holistic and integrative perspective into his work so that he can inspire people worldwide to create a better future. “Conscious design will be key to crafting a fulfilling personal life and to co-create conscious organizations and conscious societies of the 21st century.”

Here is my latest World Economic Forum article on Triple Regeneration, a new “caring” paradigm that goes beyond sustainability and CSR.

New book

And now, I’m so excited that his new book is finally here: The Frugal Economy.

Great title. A book has immediate power when it defines a new paradigm, a new way of thinking, and winning. This book does. Particularly the subtitle.

Or as Navi puts it, “Humanity’s pursuit of greatness meets the reality of finite resources”.

In the book he delivers an incisive and engrossing treatment of how human beings facing climate change can reconcile our built-in drive to “do more” and “be better” with our planet’s finite resources. You’ll discover how we can thrive within planetary boundaries while achieving sustainable growth for generations to come.

He says “the book offers a wise middle path between degrowth and hypergrowth.”

It’s enriched with over 100 inspiring examples, helping you to explore how to create greater value with less and find:

- Practical strategies for doing more with less, benefiting both people and the planet

- Success stories of businesses fueling transformative megatrends like B2B sharing, distributed manufacturing, and triple regeneration

- Insights into reshaping economic systems to promote social and ecological harmony

He, and the book, are catalysts for positive change.

Business leaders need to achieve more in today’s fast, dynamic and intensely competitive markets. Peter Fisk explores what it takes to deliver peak performance.

Imagine that you are days away from competing in the Paris 2024 Olympic Games. As you prepare for the greatest race of your life, you consider the moments ahead, anticipate what might happen, your alternative strategies. And maybe, you just dare to dream.

In reality, you need to be ready for anything. It’s no use overthinking. You are in the best condition of your life, you have the training behind you, you’re ready. In reality you are simply consumed by the moment, at one with your body, focused on the race.

When you are at your “peak”, your body and mind flow in unison, you know what to do.

In the world of business, you need to be an elite athlete too. Here we explore the physical and mental characteristics required to perform at the highest levels.

Finding your peak performance

Mihaly Csikszentmihalyi believes that peak performance comes from inside, and that people have the unique ability to create environments that facilitate the development of a state of mind which he calls “flow”, or what some might call “in the zone”.

Flow is the experience I get when I’m working intensely on a project, the challenge is significant, the team around me are great people, the timeframes are tight, and the ambition is very high.

Once I am into the project, I find I can work at great pace, there is a stream of consciousness, ideas emerge rapidly.

Under the stress and stretch of high octane situations, we can often do our best work. Csikszentmihalyi says “the best moments usually occur when a person’s body or mind is stretched to its limits in a voluntary effort to accomplish something difficult and worthwhile. Optimal experience is thus something we make happen”

It is a feeling of immersion, focus and concentration, removed from the repetition and distractions of everyday, you feel like you have more purpose, with heightened awareness of the situation and possibilities. Complexity seems less intimidating, and uncertainty less daunting. You are energised, you are empowered, you can achieve so much more.

Flow is achieved through an intensity of concentration and effort as you apply yourself to the task. You are energised by possibility, and released from the fear of failure. You rise above yourself, above the distractions of today. The experience of this flow is as good as the outcomes.

5 ways for business leaders to find their “flow” state every day are:

- Select tasks that are stimulating and engaging, they challenge you to the point of excitement. They are problems you would love to solve.

- Assemble a great team, people you love and trust, who you know that together you can do great things (or you, on occasions, you can also do this alone).

- Define audacious goals, that go beyond the accepted norms, 10x not 10% targets, and also a sense of what the rewards could be, personal or organisational.

- Focus your mind, a stream of consciousness towards the goal, eliminating the daily trivia, the distractions of the normal workspace

- Immerse yourself in the moment, active not passive, thinking ideas, doing tasks, making progress, building momentum, going for the goal.

The “flow” state of mind becomes the everyday state of business leaders. It becomes normal. Every day, working towards the future, whilst also delivering today. Your mind working overtime, connecting ideas, searching for progress, focused on the actions which will create a better tomorrow. Indeed, you can only ever do things today, even it is focused on a better future.

Playing to your athletic strengths

We have grown used to exploring the “strengths and weaknesses” of human character, or in this case of leadership behaviour. The problem is that this kind of diagnostic encourages us to focus on our weaknesses, to make them better, to be “good enough” at everything.

An alternative is focus on your strengths and how to make them better.

Yet few business leaders say they get to use their strengths in most of their work. The challenge in any team is to bring a diverse group of people together, where their combined strengths are irresistible. This means that as long as all the important attributes are covered, then the team will be strong in all areas, and amplify its impact far beyond that of any individual.

Psychologist Martin Seligman studied cultures around the world to understand what they regarded as “strengths” in leaders. The research explored major religions and philosophical traditions and found that the same six virtues were shared in almost all cultures.

Gallup’s StrengthFinder assessment model is one of the most useful tool for exploring the practical component of these virtues as 24 character strengths:

- The Wisdom of Leaders: the more curious and creative we become, the more we gain perspective, knowledge and wisdom. Component strengths are creativity, curiosity, open-mindedness, love of learning, and perspective.

- The Courage of Leaders: the braver and more persistent we become, the more confident we feel, and more courageous we act. Component strengths are bravery, perseverance, honesty and vitality.

- The Humanity of Leaders: the more we approach people with respect, appreciation, and interest, the more engaged they become. Component strengths are love, kindness and social intelligence.

- The Justice of Leaders: the more responsible we are, embracing fairness and justice, the more stable community we can build for mutual benefit. Component strengths are teamwork, fairness and leadership.

- The Temperance of Leaders: being forgiving, humble, prudent, and in control of our behaviours, helps us to avoid being arrogant, selfish, and unbalanced. Component strengths are forgiveness, humility, prudence and self-control.

- The Transcendence of Leaders: never losing hope in humanity’s potential, appreciating nature and people, enables us to connect with a higher purpose. Component strengths are appreciation of beauty, gratitude, hope, humour and spirituality.

Additional studies have shown that women typically score higher in interpersonal strengths, such as love and kindness, honesty and gratitude. Men tend to score higher on cognitive strengths, creativity and curiosity, hope and humour, but also highly on honesty. Whilst these differences are interesting, and largely conform to stereotypes suggesting that they might be shaped by culture, there are also many shared strengths.

Playing to your strengths not only enables you to perform better, and contribute more to a team, it can also result in feeling more engaged and confident, and enable you to progress faster.

The leader’s athletic brain

We used to assume that we each have our established ways of thinking and behaving, and as we get older the capability of our brain to learn and adapt declines. Yet our brain can grow new neurons at any age. Each neuron can transmit up to 1,000 nerve signals a second and make as many as 10,000 connections with other neurons. Our thoughts come from the chemical signals that pass across the synaptic gaps between neurons: the more connections we make, the more powerful and adaptive our brain can be.

Tara Swart is a neuroscientist, practising medical doctor, and executive coach, with a background in psychiatry. I first met her on stage in Bratislava, where we both were delivering our “Big Idea” for Europe. Her first book, “Neuroscience for Leadership” was more of an academic text, while her new book is “The Source” is more populist, and claims most of the things we want from life – health, happiness, wealth, love – are governed by our ability to think, feel and act. In other words, by our brain.

Keeping the brain fit through exercise, continual learning and rich experiences, enhances your mental agility. In the past leaders relied more upon experience and procedure, in today’s world we need leaders who can make sense of new patterns, imagine new possibilities, thrive on diversity of thought and complexity of action. Leaders need to have a mind that is always ahead, seeing and anticipating what next.

“Think of the brain as the hardware of a computer” says Swart. “Your mind is the software. You’re the coder who upgrades the software to transform the data (your thoughts). You also control the power supply that fuels the computer — the food and drink you consume, when and how to exercise and meditate, who to interact with… You have the power to maintain or destroy your neural connections.”

Mindful activities such as yoga or meditation reduce levels of cortisol and increase the fold of the outer cortex of the brain, allowing the pre-frontal cortex to better regulate our emotional responses. Swart says just 12 minutes a day, most days of the week, will make a noticeable difference. New experiences such as travel, learning a skill, such as a foreign language, and meeting new people can stimulate the growth of new neurons.

There are some obvious ways to improve your brain function, such as drink more water, get more exercise, and don’t read from electronic screens in the last hour before bed. Sleeping less than seven to eight hours a night isn’t sustainable for most people, because that’s how long it takes to clear out toxins. Sleeping on your left side helps the brain to flush out toxins more efficiently, and downing a spoonful of coconut oil before a big meeting boosts brain power for about 20 minutes.

The journey ahead will have high and lows. Endurance demands physical fitness and emotional agility, but also taking moments to pause, and celebrate progress.

James Dyson took 15 years and 5127 attempts to perfect his bagless vacuum. When he succeeded, he created a revolution, but it required incredible persistence to get there. Not only is the future difficult to create, but everything keeps changing on the journey towards it.

The mental toughness, the grit to persist, is not just about keeping going, but the resilience to overcome challenges and obstacles. Sometimes, just the sheer volume of information – emails, analysis, reports, ideas, articles, books, meetings – will become overbearing. As a leader it’s easy to feel overloaded.

It’s also easy to feel you need to know everything, which you don’t, although you do need to prioritise what matters most. The biggest challenge for any visionary leader is not how to make ideas happen, but how to overcome all the people who say that they won’t. Critics and pessimists can be frustrating, and a motivational drain.

There will also be moments of great success, people might even call you a hero. It will feel good, even to the humblest, and you will inevitably remind everyone that it was a team effort. Yet the euphoria can quickly disappear, with the next challenge.

Leaders need endurance, resilience, and gratitude, to cope with relentless change; to be able to change your own mind, to stay on the rollercoaster of progress, to keep teams engaged, and to thrive at both work and in your life.

The athletic endurance of leaders

Endurance is as much about mind as muscle power.

Like an athlete – runner, cyclist, rower – there are many physiological elements at play, from core body temperature to oxygen intake, plus psychological factors, such as perceived effort and pain tolerance. Each of these factors is significant in the level of athletic performance humans which any person is capable of, especially when testing the perceived limits of performance, such as setting new world records.

Almost every athlete will attest to faster recovery if they jump into an ice bath after a competition. Yet studies show that this practice doesn’t actually decrease inflammation levels, the thing the baths are intended to reduce. However most physiologists will still say that if there’s a method that helps you recover, even if it’s purely psychological, then it is useful because sometimes belief is just as influential as science.

In “Endure” Alex Hutchinson starts by retelling the race to break 4 minutes for one mile. For years, men across the globe had raced to within a second or two of the barrier, but never quite breaking the iconic time. When Britain’s Roger Bannister finally ran 3.59.4 in 1954, Australian John Landy who had been trying to run the time for years, went on to improve Banister’s time by another second, only weeks later.

A number of important factors can help people, including business leaders, to endure more:

- We always have a little more to give. Watch how athletes pace themselves so that they always have one final effort at the end of a long distance event. And somehow an Olympic champion, despite a punishing race, can always rise to celebrate victory

- We can endure more than we think. Athletes have a higher than normal pain tolerance enabling them to push harder. They learn to cope with this by training at a “threshold” pace, learning to sustain oxygen debt, despite its searing pain.

- Fitness enables us to perform better. Athletic performance greatly relies on oxygen intake, which is enhanced through heightened fitness. Business leaders also need oxygen, and the physical fitness to sustain leadership performance.

- Fatigue reduces our performance.Having a tired brain can affect how much we can endure physically. A tired brain is one that doesn’t have a break, isn’t refuelled, doesn’t have variety, doesn’t keep learning, doesn’t get enough sleep.

- Stress stops us performing. Of the many factors, stress can be the killer. However stress comes in two forms – stress from outside, eg timescales, and stress we put on ourselves. External stress can stimulate us, internal stress we can control.

Hutchinson’s research led him to South Africa to work with Tim Noakes, the controversial sports scientist who first proposed the “central governor theory,” which argues that the brain limits performance well before the body has reached its maximum output. He also explores the research of another pioneering scientist, Samuele Marcora, who has developed a series of brain-training exercises to push that governor.

He also recalls talking to Eliud Kipchoge just before he ran the world’s first sub-2 hour marathon, when the Kenyan said he hadn’t really changed anything in his training. What then, he asked, would make the difference? “My mind will be different” replied the runner. People he says, have a curiously elastic limit to what they can achieve, driven mainly be their mental toughness.

The athletic resilience of leaders

Resilience is our ability to bounce back from adversity. It’s what allows us to recover quickly from change or setbacks, trauma or failure, whether at work or in life. It is the ability to maintain a sense if purpose, a positive attitude, a belief in better, throughout times of challenge. Resilience sustains progress, whilst others might give up.

Angela Duckworth calls it grit. “Grit is passion and perseverance for long-term goals” she says. She compares it not to a marathon, but to a series of sprints combined with a boxing match. In business you are not just running but also getting hit along the way. As you seek to deliver on your strategy, to make new ideas happen, to transform the business, it’s not just about coping with the time and effort. It’s also about overcoming many challenges.

Grit keeps you moving forward through the sting of rejection, pain of failure, and struggle with adversity. “When things knock you down, you may want to stay down and give up, but grit won’t let you quit” says Duckworth.

Most entrepreneurs have tremendous resilience, because they’ve had to fight for the business through some of the most difficult times. The search for seed funding when every VC dismissed them with a laugh or smile, the long days in a bedroom or garage trying to make the first prototype or win the first contract, the growing pains of scale-up as they have to adapt to survive and thrive. Letting go of control as investors take over, making you wealthy but taking away your baby. Most entrepreneurs know about grit.

But then so do corporate leaders. If not from starting up, then from surviving the challenges of internal politics, of learning how to engage and influence people in a positive way, of progressing as a star individual whilst keeping colleagues and teams on side. Of balancing personal ambition with collective progress. Resilience demands that we:

- Have ambition: Knowing what you truly want, and are prepared to work hard and persevere in order to achieve it. Vision isn’t just a milestone, it becomes a pursuit. Whilst not everybody will know your ambition, you will, and it will keep you striving.

- Have purpose: This is why you want to achieve more, it’s about what will be better when you achieve your ambition, not just for you, but your business, your family, your world. Purpose is how you contribute, what you fight for, why you get up in the morning.

- Have passion: You need to love it, to be great at it. Otherwise it’s not worth the sacrifices, the long hours, and the pain. Aligning your purpose and ambition allows you to find love, for your work, your team, your business, and the world you seek to impact.

- Have persistence: You will sometimes fail. Few things change without challenges. Failure doesn’t define you, it refines you. If you didn’t fail, you wouldn’t learn. There is always another way. Stay confident and stay strong.

Michael Phelps, winner of an epic 23 Olympic gold medals, said “You can’t put a limit on anything. The more you dream, the farther you get.” Mia Hamm, Olympic champion in women’s soccer said “I am building a fire, and every day I train, I add more fuel. At just the right moment, I light the match.” And the great Jesse Owens said “We all have dreams. But in order to make dreams come into reality, it takes an awful lot of determination, dedication, self-discipline and effort.”

One of my personal favourite Olympic moments was in the Sydney 2000 Olympics when Cathy Freeman, the small, shy aboriginal Australian 400m runner had the expectation of her nation on her shoulders. She knew this was the moment that would define her career, even her life. She decided to embrace the event by wearing a unique one-piece body suit, alongside gold spikes. She stood on the start line, and looked upwards to the dark Sydney sky. “You got to try and reach for the stars or try and achieve the unreachable.”

© Peter Fisk 2024

Peter Fisk is a global thought leader, bestselling author, and inspiring keynote speaker. Scientist to strategist, entrepreneur and academic, he has worked with over 250 companies in 50 countries. Airlines to automotive, cosmetics to cement, finance and pharma, he helps leaders to make sense of change, explore innovative strategies to compete, and embrace the mindset to transform organisations and deliver sustainable impact. With 10 books in 35 languages, most recently Business Recoded, he continues to inspire and shape the business landscape.

- Next is Now: Superfast chips to fast-busting drugs

- 24 for 2024: New ideas, new trends, new possibilities

- The New Leadership DNA: Creating a better future

- 100 Inspiring Leaders: Bernard Arnault to Zhang Yiming

Over 30 years of working with some of the world’s leading companies, I am still amazed by the lack of real strategy development in so many companies.

Many like to dream big, but then jump to the delivery, without really understanding what is the strategic shift they seek to make. Others are obsessed with planning and metrics, but fail to explore the changing world, to see the bigger picture, or to make decisive choices.

And then, you have public sector.

Government-related organisations struggle even more to define clear strategies, and implement them. Often an even more difficult challenge given the multitude of stakeholders, conflicting objectives, and typically lack of rigorous processes and practices to fall back on.

Over the years I’ve worked with many public sector organisations – from the UK’s health service and justice system, to UAE’s ministry for the future.

I’ve worked with governments in Egypt and Estonia, Kazakhstan and Kuwait, Saudi Arabia and Singapore, UAE and USA – and in areas from education to heritage, transport and tourism, healthcare to housing, local services and financial services, parking and prisons,

Of all these, Estonia’s E-Government Strategy was probably the most impressive, in its vision and delivery.

The small Baltic nation implemented an entirely paperless e-government system, allowing citizens to access nearly all public services online. This innovative approach to digital government is built on trust, transparency, and ease of use.

Developing a strategy within a government department or agency requires a clear vision, comprehensive planning, effective stakeholder engagement, and an understanding of the unique constraints and opportunities that come with the public sector.

Unlike private businesses, government departments must balance efficiency and effectiveness with public accountability, political realities, and social impact. Below are key principles for developing a successful strategy within a government department, along with examples of best practices from around the world.

Each year, I get invited by the OECD to lead a masterclass for their own member organisations, and others like IMF and UN, to explore the latest ideas in strategy and innovation. We look at the drivers of change around the world, how private companies like Apple or Alibaba, are responding, and what it also means for their organisations. What to do, and how.

So what have I learnt about developing strategy in governments, and other public sector organisations?

1. Clear Mission and Vision Alignment

- Principle: A government department’s strategy should align with the broader national or regional objectives and serve the public interest. The mission and vision must be clear, focused on outcomes that improve public well-being, and reflect political, economic, and social priorities.

- Singapore’s Smart Nation Initiative: The vision of making Singapore a global leader in smart cities guides all public sector strategies. The Smart Nation Initiative focuses on improving urban living using technology to enhance economic opportunities and public services, aligning with Singapore’s long-term national goals of sustainability, innovation, and inclusivity.

2. Evidence-Based Decision Making

- Principle: Government strategies should be based on data, evidence, and rigorous analysis. This involves collecting, analyzing, and using quantitative and qualitative data to shape policies and decisions.

- Estonia’s E-Government Strategy: Estonia is a leader in digital government, with its e-Residency program allowing global citizens to access Estonian services digitally. The government makes strategic decisions using data-driven insights from citizen usage patterns, digital transactions, and feedback loops to refine policies and services.

3. Stakeholder Engagement and Consultation

- Principle: A successful strategy must be developed in consultation with key stakeholders, including the public, civil society, the private sector, and other government departments. Engagement helps ensure that the strategy reflects a wide array of perspectives and has broader support.

- Finland’s Education Strategy: Finland’s education policy is developed through a collaborative approach with educators, parents, businesses, and local communities. The ongoing dialogue and consultations help maintain Finland’s reputation for high-quality education and ensure that all relevant stakeholders are invested in the success of the strategy.

4. Clear Objectives and Measurable Outcomes

- Principle: The strategy should have specific, measurable, achievable, relevant, and time-bound (SMART) objectives. Setting clear goals allows the department to track progress and ensure accountability.

- UK “Digital Strategy”: The UK government’s digital strategy set clear targets, such as making 100% of government services digital by 2025. The digital transformation agenda includes measurable objectives such as increasing online access to public services, improving user experience, and achieving cost savings.

5. Integration with Other Government Policies and Initiatives

- Principle: Government strategies should be consistent with other national and local policies, ensuring coherence across sectors. This requires a holistic approach where each department’s strategy is connected and complementary to others.

- The Netherlands’ Sustainable Development Strategy: The Dutch government has integrated sustainability into its national development strategy, linking various policies in areas like climate action, economic growth, and social equity. This cross-departmental approach has helped the country make significant strides toward achieving the United Nations Sustainable Development Goals (SDGs).

6. Flexibility and Adaptability

- Principle: The political, economic, and technological landscape can shift rapidly. A good government strategy should be adaptable to change and resilient in the face of unforeseen challenges.

- New Zealand’s Public Service Strategy: New Zealand’s public service strategy, particularly the “Better Public Services” program, emphasizes adaptability. For example, the government introduced flexibility in policy delivery and used a results-focused approach to allow departments to modify strategies as new information and conditions arose.

7. Resource Allocation and Risk Management

- Principle: Effective strategy development involves identifying available resources and budgeting appropriately to ensure the goals are achievable. It also requires recognizing potential risks and preparing mitigation plans.

- Canada’s Innovation Strategy: The Canadian government’s strategy prioritizes innovation funding for key sectors, focusing on science and technology. It integrates robust risk management frameworks to anticipate challenges in areas like cybersecurity and global competition, ensuring resources are allocated to high-impact initiatives.

8. Public Transparency and Accountability

- Principle: Public trust is key in government strategy, and transparency should be built into the strategy development process. Clear reporting mechanisms, open data, and regular progress reviews foster accountability and trust.

- South Korea’s Open Government Strategy: South Korea has made significant progress in establishing open government initiatives. The government regularly releases detailed information on budgetary allocations, progress on strategic goals, and evaluations of policy effectiveness, engaging citizens in the policy process through digital platforms.

9. Performance Management and Evaluation

- Principle: Regular monitoring and evaluation of strategy implementation help ensure that the strategy is on track. Continuous performance reviews and feedback loops allow for course correction and ensure public funds are being spent efficiently.

- Germany’s “Performance-Oriented Budgeting”: Germany uses a performance-oriented budgeting system where the impact of government spending is evaluated against predefined outcomes. This system helps ensure that taxpayer money is allocated efficiently and that public services meet defined performance targets.

A well-crafted government strategy is built on clear, evidence-based objectives, and is driven by stakeholder engagement, accountability, and adaptability. Global best practices—from Estonia’s digital governance to Singapore’s Smart Nation Initiative—demonstrate how public departments can leverage technology, data, and collaboration to drive sustainable outcomes that benefit society.

This year’s top marketing campaign came from DoorDash.

The brand scooped the top prize, the Titanium Grand Prix, at Cannes Lions 2024, the advertising world’s self-indulgent booze fest on the French Riviera, plus a host of other awards at the D&ADs and OneShow.

You probably know DoorDash for restaurant delivery, particularly if you live in America.

DoorDash, originally founded as PaloAltoDelivery.com in 2013 by four Stanford University students, has become a dominant player in the online food delivery market in the USA.

The business expanded rapidly, reaching 70 restaurants in the Bay Area within its first year of operations. Y Combinator reported that DoorDash grew at a remarkable rate of 20% every week. The company’s goal was to build an AI system (named “Deep Red”) to optimize delivery by considering various factors and reducing errors. Aggressive market expansion helped DoorDash surpass competitors like Grubhub and Uber Eats. Acquisitions also played a key role: DoorDash acquired Square’s Caviar food delivery service and Wolt, gaining a foothold in the European market.

In 2021, DoorDash went public on the New York Stock Exchange with a valuation of $72 billion. In 2023, DoorDash reported revenues of $8.63 billion (a 31% increase from the previous year) and an annual net loss of $558 million (a 58% reduction from 2022). The company boasts 37 million users, primarily in the United States, and holds over 60% market share in the US food delivery app industry.

Now it wants to be more than just a food delivery company.

And so to the award-winning advertising campaign.

Wieden+Kennedy, the Portland-based creative agency that grew rapidly on the coat tails of local company Nike, is the agency behind DoorDash’s award-winning ad.

DoorDash, with a new brand platform “Your Door to More”, wanted to showcase their ability to deliver just about anything.

Where better to do this than the Super Bowl? Not just by telling people that DoorDash could deliver anything, but by proving it: delivering every product advertised during the Super Bowl broadcast to one lucky person.

In the days before the Super Bowl, as brands announced they were in the game, W+K added them to a DoorDash cart creating anticipation, excitement, and speculation about how big the prize would get. Then during the game, as ads aired, we continued to add them to our shopping cart, whether a pallet of Reese’s, four separate cars, or 60lbs of mayo – creating one epic prize that spanned 76 brands.

As the grand prize grew in scale, and absurdity, we updated consumers live. Social media was clamouring for hints and prize suggestions, and by the time our ad aired in the 4th quarter, anticipation was at a fever pitch. The film was simple: it told people to visit doordash-all-the-ads.com and enter a promo code. But of course, this promo code wasn’t going to be easy. Some got mad, many made memes, but most got crafty, banding together IRL and online to crack the code.

The 30 second ad became the catalyst to hours of conversation, interaction, and social. People didn’t just watch our ad: they rewatched it, over and over again – some missed overtime entirely. By turning every Super Bowl ad into a DoorDash delivery, W+K surpassed their goal with 11.9 billion earned impressions, 8 million+ entries, nearly 300 million earned social impressions, and 117 million viewers. But most importantly, the ad captured America’s attention, proving DoorDash’s ability to deliver just about anything.

Here are some more best campaigns of the year, winners from Cannes Lions:

Digital Public Library of America (DPLA) is fight America’s book banning crisis. Conservative politicians are silencing Black, Brown and LGBTQIA+ voices by forcing librarians to take their books off the shelf. In 2023 alone, 3,059 books were banned – more than in any other year. DPLA holds that our democracy relies on our freedom to read. And believes books should always be available to everyone.

The DPLA created the most up to date database of all of the books banned in America. Then, geo-fenced the exact footprint of every library that banned the books – and made those books available for any person when they are within those very libraries. Sending a strong message to the book banners – that every time they try to take a book off the shelf, the DPLA will put it right back, virtually.

The Banned Book Club was launched in partnership with President Barack Obama, the most notable defender of our freedom of speech. The campaign reached people in the more than 20 states that have books banned with geo-located Instagram and Facebook ads, that alerted people just as they were near those offending libraries. The Banned Book Club is a social first, digital solution designed for the future. Whenever a book is banned – it can simply be added to our dynamic database, making it available instantly in any library. Ensuring no book is ever banned again.

Dove has long been a campaigning brand. From women, it is now focused on kids. Kids are experiencing severe mental health issues from the onslaught of seemingly endless toxic beauty content on social media. Anxiety, depression, self-harm, eating disorders, PTSD, and even suicide – the harm social media can cause has no limits. Because neither does social media. In fact, the majority of young girls say they feel the pressure to look perfect and match what they see on social media. Our brief was twofold: first, highlight the scale of the social media-induced mental health crisis among kids; and second, inspire the world to act, demand change, and save kids from the dire consequences of toxic beauty content. Our goal was to mobilize the masses by creating a single, shareable film and get viewers to sign the petition to support the Kids Online Safety Act. Dove surpassed its goal of 50,000 petition signatures for the Kids Online Safety Act, resulting in the bill passing in the Senate.

3 in 5 kids experience mental health issues from social media. So, we told the story of Mary; a real girl who almost lost her life from an eating disorder. However, we didn’t need to shoot her story, Mary already had. Using her own photos, videos, and journal entries, spanning over a decade, we created a film that shows her downward spiral after getting her first phone and joining social media. Set to an emotional female cover of Joe Cocker’s ‘You Are So Beautiful to Me,’ we see how quickly social media shapes Mary’s view of her own beauty, causing her mental health to severely struggle. At the end, we learn this isn’t just Mary’s story. It’s the story of millions of girls. The film concludes with a rallying call for people to sign the petition in support of the Kids Online Safety Act.

Mercado Libre, Latin America’s leading e-commerce platform, executed a unique campaign named “Handshake Hunt” during Black Friday. Partnering with the TV channel Globo, the campaign displayed QR codes for discounts whenever a handshake appeared on-screen. This innovative strategy aimed to increase transactions in Brazil. Targeting the online retail market in Brazil, the campaign utilized various media channels including product placement, outdoor, out-of-home, and sales promotions.

In 2023, Mercado Libre’s Black Friday campaign achieved unprecedented success. The company saw a remarkable 39% year-over-year increase in overall sales during the period, and an extraordinary 80% year-over-year boost specifically on Black Friday itself. This impressive performance stands out even more considering the challenging market conditions in Brazil, where many competitors struggled.

Nativa, a Colombian beer from AB InBev, has initiated a creative and sustainable project called Nativa Meter, aimed at repurposing its traditional bottles to aid Colombian farmers in making more informed decisions about their crops. Teaming up with the globally recognized independent agency L&C New York, Nativa has transformed its bottles into rain gauges, providing a practical solution for farmers to plan their planting seasons more effectively.

The redesigned Nativa bottles now feature measurement indicators to gauge rainfall levels per square meter. This innovative initiative aims to repurpose packaging for a positive impact on Colombian farming communities.

“Cerveza Nativa is a brand that is committed to the Colombian countryside. For this reason, for us, initiatives like Nativa Meter are essential because they allow us to innovate and find creative solutions that arise from the real needs of the community,” said Diego Pomareda, Marketing Director of Cerveza Nativa. “This is a simple way to incorporate technology into an everyday product that farmers consume, and at the same time, help prepare them to face the challenges of a world that is being affected by climate change.” added Rolando Cordova, Co-Founder and Chief Creative Offier of L&C New York.

Siemens Healthineers introduces “Magnetic Stories”, an innovative technology transforming terrifying MRI sounds into enchanting children’s audio books. Imagine the daunting roar of an MRI machine, reaching decibel levels louder than a military jet. Now, consider the impact on a child undergoing cancer treatment.

This pioneering campaign seeks to replace anxiety with awe and fear with fascination, ensuring young patients experience a journey of magic and wonder during medical procedures. By harnessing the power of storytelling, Siemens Healthineers aims to redefine healthcare experiences, making them not just tolerable, but inspiring for every child in need.

WhatsApp, the messaging service, and The Lab, the creative incubator within the award-winning production company Anonymous Content, announced the release of their new documentary, “We Are Ayenda.” This film tells the extraordinary story of the Afghan Youth Women’s National Football Team and their remarkable escape from Afghanistan after the Taliban took power in 2021. The documentary debuted during the Women’s World Cup and is now available on Prime Video.

The half-hour film, adapted and produced by The Lab and directed by award-winning documentary filmmaker Amber Fares, showcases the bravery of these young women and their determination to continue playing the sport they love. The documentary aims to raise awareness of the challenges people face when forced to migrate and highlights the power of sport to unite people. It reveals the profound relationship between Farkhunda Muhtaj, the former captain of Afghanistan’s women’s national football team and a humanitarian activist, and the members of the women’s youth team.

Despite never having met in person, Farkhunda led the young women to safety through WhatsApp texts and voice messages, which are woven throughout the documentary to retell their story. “These incredible young women just want to continue competing in football and aspire to achieve their dreams,” said Farkhunda Muhtaj. “To help them escape successfully, I knew the stakes were extremely high for secure communication. If something was intercepted, whether it be their passports or IDs, not only would the mission be jeopardized but everyone’s life would be at risk.”

“From the moment we first shared this story with the WhatsApp team, we were all in awe of the girls and Farkhunda,” said Zac Ryder, Executive Producer at The Lab. “Everyone was on the same page that our number one job was to honor them and their families, which meant telling the story as authentically as possible. It takes a very brave client to sign up for something like that. We’re so fortunate to be working with such thoughtful, committed partners.” Vivian Odior, Global Head of Marketing at WhatsApp, added, “We are honored to support these brave women who are an inspiration to everyone pursuing their dreams.” The film captures the sheer determination and unwavering spirit of these young athletes, offering a unique perspective into their lives.

Since the Taliban took control of Afghanistan, women and girls have been denied their human rights, including the right to go to school, work, and play sports. According to UN estimates, eight million Afghans have been displaced from their homes due to violence, including millions of refugees now living abroad.

I’ve been a runner for over 45 years.

In my youth I competed over 1500m and cross country. In those early days I was inspired by local world champion Steve Cram and particularly by Brendan Foster who was a great event innovator, launching the Great North Run in 1981 (yes I was there, running 1 hour 30 as a 14 year old!).

Over the years I’ve continued to follow the sport of track and field athletics, with a passion. I still run, almost every day. The London 2012 Olympics were a pinnacle. In the stadium as Mo Farah won his double gold. Paris was nearly as good. And more recently I sat with World Athletics president Seb Coe, talking about the past, but more about the future.

Running is the world’s highest participation sport. But it is nowhere when it comes to public profile. Rarely does it attract big crowds, or live TV, or big sponsors, or million dollar pay days for champions like in other sports. Why? Because it hasn’t really innovated. As the world has changed beyond recognition in the last 45 years – digital, social, brands, celebrity, global – athletics hasn’t. It’s traditional, can be amazing, but it hasn’t innovated.

And then Michael Johnson, the superstar multi record holder and Olympic gold medallist, announced Grand Slam Track.

Grand Slam Track is a professional track and field league founded by four-time Olympic champion Michael Johnson. The league was announced in 2024, with its inaugural season set to run from April to September 2025. The concept behind Grand Slam Track is to create a professional, lucrative, and engaging league that focuses on rivalries rather than just times, aiming to draw more attention to the sport.

Michael Johnson, a former 200m and 400m world record-holder, had the idea for Grand Slam Track since the 1990s. He was inspired by how other professional sports leagues, such as the NFL and Formula One, operated and wanted to bring a similar model to track and field. Johnson’s vision was to create a league that would increase the sport’s visibility, attract more fans, and provide athletes with better opportunities and financial rewards.

The development of Grand Slam Track involved securing significant investments, including a $30 million funding round. Johnson also brought on board key personnel, such as former middle-distance runner Kyle Merber as Senior Director of Racing and Olympic champion Morolake Akinosun as Head of Athlete Relations. The league’s structure was designed to resemble other sports leagues, with global athletes competing in a series of events throughout the track season.

It consists of four “grand slam” events or meetings per season, held in different cities: Kingston, Miami, Philadelphia, and Los Angeles. Each event features six event categories for both men and women, including short sprints, long sprints, short hurdles, long hurdles, short distance, and long distance. A total of 48 athletes, known as “Racers,” are contracted to compete in one of six event groups in each of the four Slams. Additionally, 48 “Challengers” will compete against the Racers, with the identities of the Challengers changing from Slam to Slam.

Each Racer must participate in two different disciplines at each Slam, and the winner of each event group is determined by the highest point total across both events. The league offers substantial prize money, with the first prize for each Slam being $100,000. The overall prize pool for the season is the highest in the history of track racing.

Grand Slam Track aims to disrupt the traditional track and field landscape in several ways:

- Professional League Structure: By creating a professional league with contracted athletes, Grand Slam Track seeks to provide more stability and financial security for athletes. This model is similar to other professional sports leagues and aims to elevate the status of track and field.

- Focus on Rivalries: The league emphasiss head-to-head matchups and rivalries rather than just times and records. This approach is designed to create more engaging and exciting competitions for fans.

- Increased Visibility and Fan Engagement: Grand Slam Track aims to increase the sport’s visibility through live broadcasts on linear TV and streaming platforms, as well as partnerships with media and betting companies. The league’s focus on storytelling and promoting athletes’ personalities is intended to attract a broader audience.

- Global Reach: By hosting events in different cities around the world, Grand Slam Track aims to promote the sport on a global scale and attract international fans.

- Innovative Competition Format: The league’s unique format, with athletes competing in multiple disciplines and earning points across events, adds a new layer of strategy and excitement to the competitions.

- Financial Incentives: With the highest prize pool in track racing history, Grand Slam Track aims to attract top talent and provide athletes with significant financial rewards.

In summary, Grand Slam Track, seeks to revolutionise the world of track and field by creating a professional league that emphasises rivalries, increases visibility, and provides substantial financial incentives for athletes. The league’s innovative structure and global reach aim to attract more fans and elevate the sport to new heights.

Joshie the Giraffe

A family staying at a Ritz-Carlton hotel accidentally left behind their son’s stuffed giraffe, Joshie. When the hotel found the toy, they went beyond simply returning it. The staff took photos of Joshie enjoying various hotel amenities, like lounging by the pool and getting a spa treatment. They sent these photos along with the giraffe, creating a delightful and memorable experience for the family. What can we learn? Adding a personal touch and a bit of creativity to customer service can turn a potentially negative situation into a positive and shareable story.

Molly the Bride

Molly, a regular Zappos customer, needed shoes for her wedding and expressed concern about receiving them on time. A Zappos representative upgraded her order to overnight shipping at no extra charge. Molly received the shoes the next day, in time for her wedding, and was deeply grateful for the exceptional service. What can we learn? This story is one of many that highlight Zappos’ commitment to going above and beyond for its customers. Empowering employees to make decisions that benefit the customer can create memorable and positive experiences, fostering customer loyalty and brand advocacy.

Sam’s PlayStation

Sam, an Amazon customer, ordered a PlayStation during the holiday season. Due to a delivery delay, the package didn’t arrive on time. Before Sam even contacted Amazon, he received an email apologising for the delay, offering a full refund, and informing them that the item would still be delivered. Sam ended up receiving the PlayStation for free and was highly impressed by Amazon’s proactive customer service. Anticipating customer issues and addressing them proactively can prevent dissatisfaction and turn a negative experience into a positive one.

Having a Customer Mindset

“Hello, I am your customer. Do you see the world like I do? It’s simple really. Start with me and everything else follows. Together we can do extraordinary things … “

Customers are now in control of our markets, demanding that we do business on their terms. Their expectations are high, and loyalty is rare. They are individual and emotional, well-informed and highly organized. They know what they want, and only accept the best.

In my book “Customer Genius” I explore a 10 step blueprint for building a customer-centric business; proving that the right customer strategies, based on deeper customer insight, driving more compelling propositions and distinctive experiences, can engage those ‘wonderful people’ we call customers.

- Outside in. Power has shifted to customers, and business must learn to think and act from the outside in.

- Bigger picture. Customers see their challenges and solutions more holistically, without sectors or categories.

- Less is more. Better to attract and retain fewer, more profitable customers than to try to serve everyone.

- Deep diving. Use more personal immersion to discover what factors really drive attitudes and behaviours.

- Get personal. People are more irrational and emotional. Focus on the energisers, not just the essentials.

- Pull don’t push. Don’t sell products, engage people on what matters to them – where, when and how they want.

- Work together. Collaborative, help people to solve problems and achieve more with co-created solutions.

- Intuition rules. Throw away the rule book, and enable customer service people to be human and responsive.

- Word of mouth. Customers are more loyal to each other than any business, so harness the power of advocacy.

- Future results. Customer metrics are lead indicators, whilst financials only tell you about the past.

There’s nothing new about customer-centricity. Call if customer-focus, customer-driven, customer-intimacy, or customer-obsession, companies have been seeking to install a customer mindset in their organisation’s culture for many decades. It’s obvious, but not easy. It’s easy to start from what you know, what your organisation does, what products you offer, and what you think. It’s much more difficult to start with the customer.

Amazon seeks to be the world’s most customer-centric business, and indeed customer obsession means that every decision – strategic or operational – starts with what’s right for the customer, and then finding a way to make it happen practically, and hopefully profitably too. Disney has long communicated a story of magic, and seeks to deliver magic moments in everything it does. Apple famously don’t research what customers say they want, but use their intuition to solve the right problem, thinking like a customer. It’s about being human, its about looking beyond the transaction, and its more fun and rewarding too.

So what’s a customer mindset?

- Be me: put yourself in the mind of your customer, what’s going on in their world, what makes them tick; listen harder, what do they really want to achieve, use their language, make connections, meet their needs?

- Be more: how can you enable your customer to achieve more, not just the product or service they’re buying, but how they will use it, what it helps them to do; save time, live better, care for the environment?

- Be magic: what’s the special thing you can do for your customer; a small favour, something personal, a joke, a smile; how will you leave an impression, be a little different, and memorable?

And what does this take?

- Customer Purpose: start with why your business exists, what’s your purpose, how do you make the world better in some way, and typically the lives of customers.

- Customer First: make choices from the customer’s perspective first, meeting their need, solving their problem, and then find a way to achieve it practically and profitably.

- Customer Insight: remember Maslow’s pyramid has functional things at the bottom (and that includes price!), and more emotional things at the top (everybody is emotional, you just have to find it).

- Customer Problem: what’s the context, the job to be done, the bigger thing which your customer is trying to achieve; not just the product or service they say they need?

- Customer Journey: consider the stepping stones in what they’re doing, and how you can be a better part of it, not just by addressing your specific items, but facilitating more of it too.

- Customer Personalisation: how can you use AI, or data, or simple listening, to deliver a more personal solution for the customer, perhaps by anticipating what they need, or tweaking something to make it more relevant.

- Customer Loyalty: this starts with trust, and ideally moves to return, and recommendation; but look beyond the cards and points schemes, to think what genuinely earns the customer gratitude and support over time.

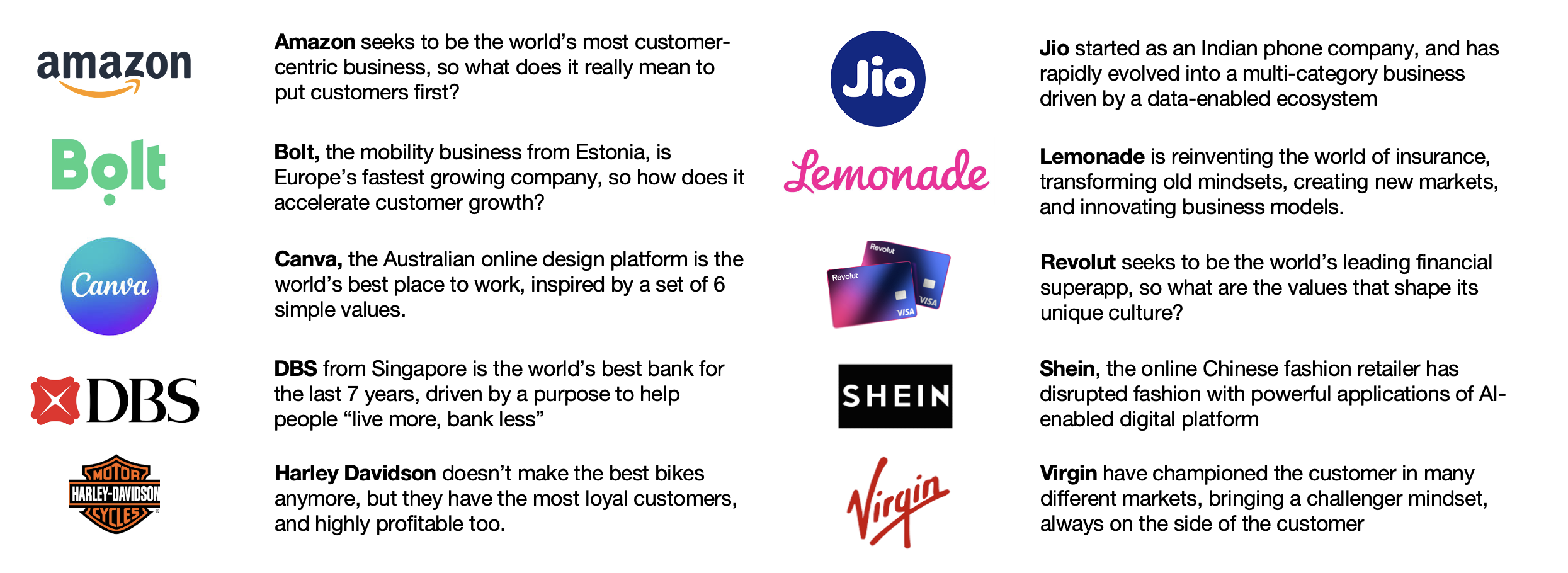

Here are some of the world’s most customer-centric companies:

Walk into an IKEA, pull out your phone and use their AR app, and you’re transported to your future home …

Nike is not a sportswear company, it’s a sports company … obsessed with helping people do better sport

Virgin is all about being human, as captured in its cultural values …

Buc-ee’s is a Texan gas station, ranked as the world’s most customer-centric business …

Zappos is a story of happiness, how to do more for every customer … happiness delivered

Disney seeks to bring out the magic in every human being … delivering moments of magic

It all started with a cheeseburger. Dinner and a movie… classic combo! What could go wrong?

Well, “dinner” turned out to be a Fudd 66 Green Chile Cheeseburger, cut down the middle (so was the check). And the movie? Well, that was a not-so-subtle invitation to “watch an awesome documentary about Peruvian jungle sloths” back at the dude’s apartment, which he shared with three roommates. No thanks!

But from this colossal bummer of a night came an idea—a bold, innovative way to make dating feel a little bit less like hell.

Dating insurance offers peace of mind against terrible dates that leave your mind in pieces. Even better—coverage is available nationwide, including high-risk areas like New York and Los Angeles. Take advantage of benefits, including full coverage for all “named perils,” such as Rebound Syndrome, “didn’t have anything better to do so why not,” post-11pm meet-ups, and “u up?” texts. Does your wallet need protection against your heart? We thought so.

Insurance companies have long struggled to innovate.

Lemonade is different.

Lemonade is reinventing insurance to be instant, easy, and transparent. It offers home insurance powered by artificial intelligence and behavioral economics. By replacing brokers and bureaucracy with bots and machine learning, Lemonade promises zero paperwork and instant everything. And as a Certified B-Corp, where underwriting profits go to nonprofits, Lemonade is remaking insurance for social good, rather than a necessary evil.

Lemonade is led by Daniel Schreiber, a British-trained lawyer, who was previously SVP corporate marketing at Sandisk where he was in charge of the press relation and social media. He then became president at Powermat, where he oversaw major transformations in the industry and various features for top brands like Samsung, Starbucks and GM. He also co-founded content security company Alchemedia.

In 2015, Schreiber and tech entrepreneur and inventor Shai Wininger founded Lemonade. Schreiber believes the current insurance model is outdated, frustrating and brings out the word in people. Quoting data from the Insurance Research Council, which suggests that insurance fraud costs an average family around $1300 yearly.

Lemonade prides itself as being a gamechanger in the insurance industry. He sees technology as the way going forward “We’ve got over a quarter million customers but less than 100 employees. It’s about using technology to do stuff that humans would otherwise be doing so that as we scale our company, there’s continuously innovation and processes that we try to automate both to collapse time and the hassle for customers and to collapse cost concurrently.”

Schreiber told Business Insider that “Insurance companies make money by disappointing their consumers. It’s difficult to think of another sector where that’s true. But if they delighted all of their consumers, they’d go out of business, because the way insurance providers make money is by denying your claim. Insurance companies now are justified in treating them with suspicion, and that spirals onwards and downwards.”

“Lemonade was founded on the idea that the current state of the insurance industry was frustrating, outdated, and brought out the worst in people,” says Schreiber. “Lemonade, built on AI and behavioural economics, is trying to change that. We’ve seen that a whopping 90 per cent of our consumers are first-time buyers. This means they did not have insurance before, and now they need coverage for their stuff and a home! The extraordinary benefits of having simple and inexpensive protection versus not having any coverage is significant.”

Like most startups challenging the increasingly creaky financial institutions, Lemonade has a familiar advantage: it’s nimble. Users (currently limited to certain states in the US) can make claims via their smartphones, and because the company only employs around 30 people and uses algorithms to process claims, it can make decisions more quickly, for less money. On top of that, Lemonade takes a flat fee out of its customers’ monthly payments which it uses to pay out on claims, taking away the traditional incentive for an insurer to deny claims to save cash.

“We have bots instead of brokers, and an app instead of paperwork. You can get insured in seconds, and get your claims paid in minutes. Insurance shouldn’t be more difficult than that. In fact, we recently reviewed, approved, and paid a claim in three seconds, setting a world record for fastest claim ever.”

There’s one more part in Lemonade’s pitch to potential customers that’s a little more left-field: when you sign up for its service, the company asks you to pick a charity. And then at the end of each year – if you and other supporters of the same cause don’t make too many claims – a portion of the money that you have paid to Lemonade is then passed on to your chosen nonprofit, as part of what Lemonade calls ‘Giveback’.

Richie McCaw, the former captain of New Zealand’s “All Blacks”, is regarded by many as the greatest rugby player of all time.

His teams won a remarkable 89% of their 110 matches in which he was their leader, including two World Cups. He even played through one cup final with a broken foot, knowing that he was a key component of the team. Whilst he recognises that the team is always more than any individual, he also believes that a leader defines a team, brings together and creates great individuals.

After lifting the World Cup in 2015, McCaw said “We come from a small Pacific island, a nation of only 4.5 million, but with a winning mindset. At the start of each game, when we lock together in our traditional Maori haka, we know that we are invincible”.

Create your “Kapa o Pango”

The All Blacks have a bold and unwavering ambition to win, working on a 4-year cycle with a common team, and setting mini goals along the way to retain sharpness and evaluate progress. They search out the best players who bring each technical specialism, but equally who will work best together, whilst also retaining a search for new talent and skills.

Being part of the team is everything, with a sacred induction, and commitment to the higher purpose.

As a team they constantly evaluate, challenge and stretch, themselves. They search the world of sport and beyond for new ideas, ways to improve physiological fitness, mental agility or technical skills. Like most sports, whilst they have a coach to guide them and captain to lead them out. Their approach once in the game is that every one of them is a leader, all equal, all responsible, and all heroes when they win.

In his book “Legacy” James Kerr says describes some of their team beliefs

- “A collection of talented individuals without personal discipline will ultimately and inevitably fail.”

- “A sense of inclusion means individuals are more willing to give themselves to a common cause.”

- “The first stage of learning is silence, the second stage is listening.”

- “High-performing teams promote a culture of honesty, authenticity and safe conflict.”

- “If we’re going to lead a life, if we’re going to lead anything, we should surely know where we are going, and why.”

- “Be more concerned with your character than your reputation or talent, because your character is what you really are, while your reputation is merely what others think you are.”

Richie McCaw talks about some of the distinctive beliefs which the team has embraced. These include many concepts from Maori culture, such as the “Kapa o Pango” which is the name of the haka, the traditional dance performed by the team before every match, and reflects the diversity of the nation’s Polynesian origins. Such rituals become important in bonding the team, but also in creating its identity to others.

Another Maori concepts is “whanau” which means “follow the spearhead” inspired by a flock of birds flying in formation which is typically 70% more efficient than flying solo. And finally “whakapapa” which means leave a great legacy, or translated more directly, plant trees you’ll never see by being a good ancestor.

The team always wins

Netflix has built a culture of “freedom and responsibility” which has helped it to dare to innovate more radically, and transform an industry. Pixar’s teams work together in wooden huts as an individual but collective workspace, embracing an openness of debate to turn initially mediocre ideas into billion-dollar hits.

Teams are where innovative ideas are most often conceived, futures shaped, projects implemented, and where employees experience most of their work. But it’s also where the biggest problems can arise in limiting the effectiveness of organisations.

Alphabet recently set about investigating what makes a great team, in what they called Project Aristotle, a tribute to Aristotle’s quote, “the whole is greater than the sum of its parts”.

Effective teams, they concluded, have a high degree of interdependence, more than just a group working on a project, or functionally aligned. They have a distinctive identity, and loyalty to each other. They plan work, solve problems, make decisions, and review together, and know that they need one another to achieve success.

Alphabet found that what really mattered was less about who is on the team, and more about how the team worked together. In order of importance, they found that effective teams are:

- Safe: this relates to people’s perceptions of the heightened risks of taking part, or reduced risks of acting together, determined by their confidence in each other.

- Dependable: participants trust each other to embrace their individual responsibilities, deliver work of quality and on time

- Structured: there are clear goals, with clear responsibilities of each participant, and an agreed way of working together.

- Meaning: the team has its own sense of purpose, which is relevant to the organisation, but also to the values and ambitions of the team

- Impact: each participant’s contribution is seen as important, whilst the real measure of impact is what the team can achieve together.

Each Whole Foods store manager can act largely autonomously, aligned by clear metrics but responsive to local communities and the passions of their local team. Zappos, the online fashion retailer, also now part of Amazon, embraces “weirdness and fun” as the ingredients to sustain their team success.

Fearless and fearsome

Amy Edmondson’s book “The Fearless Organisation” focuses on Alphabet’s top priority, that teams need to have psychological safety, and how teams create safe spaces in organisations for people to be open, creative and grow.

Organisations can easily become paralysed by fear, which reduces people to conformity, to easy compromises, to incremental developments, and mediocre performance. Leaders are responsible for creating such cultures of fear, and are equally responsible for creating an environment where people can be fearless, or even together, fearsome.

Psychological safety is created through 3 factors:

- Positive tension: It’s not about always agreeing, about being nice for the sake of harmony, or constant praise. Creating an environment where tensions are constructive not destructive requires trust, allowing and respecting people for talking openly, with different perspectives, and conflicting opinions.