A century ago, the world’s most valuable companies were measured by how much land they owned, how many tons of steel they produced, or how many barrels of oil they extracted from the ground. Today, the most valuable companies own few factories and carry little inventory. Their value lies not in what you can touch—but in what you cannot.

Apple, Alphabet, Amazon, Microsoft, and Nvidia are trillion-dollar businesses not because of their physical assets, but because of the brands they’ve built, the ecosystems they’ve cultivated, the trust they’ve earned, the data they control, and the software they deploy at planetary scale. What makes these businesses so valuable is largely invisible—intangible assets that never show up fully on a balance sheet, yet define competitive advantage in the modern age.

We are living through a silent revolution. According to Ocean Tomo, intangible assets made up just 17% of the market value of S&P 500 companies in 1975. By 2020, that number had soared to over 90%. The traditional accounting lens— designed in the industrial era—struggles to capture this shift. In boardrooms and spreadsheets, what matters most is often missing. Leaders trained to manage physical assets and short-term profits are now navigating a world where value lives in code, content, relationships, creativity, culture, and algorithms.

This book is about that unseen world. It is about the hidden engines of exponential growth, the value drivers that define market leadership today, and the reasons so many companies still overlook them.

The Intangible Economy

The signs are everywhere. A shoe company like On Running can IPO with billion- dollar valuations thanks to its cult brand and community before turning a profit. A firm like OpenAI can become one of the most watched organizations on earth while giving away its most valuable product for free. A cosmetics company like LVMH can dominate not by owning raw materials, but by commanding desire, loyalty, and prestige.

These examples point to a profound truth: in an age of abundance, what’s scarce is trust, attention, belief, identity, and insight. Intangible assets are the levers that create this scarcity—and therefore, value.

What makes this shift difficult for many leaders to grasp is that intangible assets don’t behave like physical ones. A factory depreciates over time. A brand, when nurtured, can appreciate. A machine wears out. A great culture compounds. A physical product scales linearly. A software product scales exponentially, at zero marginal cost. In the industrial economy, more capital meant more capacity. In the intangible economy, more creativity, trust, and data mean more leverage.

What We Fail to See, We Fail to Manage

For all their importance, intangible assets remain poorly understood. Many leaders default to thinking of them as “soft,” “fluffy,” or hard to quantify. They focus on what they can measure—plant, property, and equipment—while ignoring what truly drives performance.

The consequence is a profound misalignment. Businesses underinvest in brand, culture, design, and systems thinking because they don’t appear as “assets.” They overlook customer data as a strategic asset. They treat software as an expense, not an investment. They outsource creativity while trying to own factories.

Meanwhile, the companies that win today—from Tesla to TikTok, from Figma to Ferrari—build their entire business models around intangible leverage. They invest in creating ecosystems, not just products. They design brands with emotional resonance. They use culture as a strategic weapon. They understand that what people feel, believe, share, and remember matters as much as what they buy.

From Value Chains to Value Loops

Industrial-era thinking treated businesses like linear machines: input goes in, value is added, and output goes out. But the intangible age favours loops—feedback systems, compounding advantages, and reinforcing dynamics.

A strong brand attracts customers, which improves data, which improves products, which deepens loyalty, which strengthens the brand. A thriving culture attracts talent, which builds better software, which drives customer satisfaction, which attracts more talent. These loops don’t just create value—they accelerate it.

That’s why intangible assets matter more than ever: they don’t just create one-time benefits; they create flywheels. The most successful businesses build, protect, and invest in these flywheels. The least successful ones treat them as “nice to haves.”

Blind Spots of Traditional Management

There is a paradox at the heart of modern capitalism. What creates long-term value—brand equity, trust, culture, intellectual property, proprietary data—is largely ignored in quarterly earnings calls. Analysts ask about costs and margins, not community or design. Boards evaluate risk in terms of financial compliance, not reputational fragility.

This isn’t just a gap—it’s a governance crisis. When leaders don’t understand what’s driving 90% of their company’s value, bad decisions follow. Cost-cutting initiatives gut creative teams. Rebrands miss the cultural moment. Technological capabilities are treated as IT problems, not core strategy. Culture is seen as HR’s domain, rather than the foundation of execution.

To succeed in the era of intangible value, we need to upgrade our models—not just our metrics, but our mental models.

The New Literacy of Leadership

What’s needed is a new literacy for leadership—an ability to see, value, and build the invisible. This includes:

- Understanding how brand equity compounds and how to measure it

- Treating data not just as a byproduct, but as a core asset

- Investing in software and design as growth multipliers

- Leading culture not through slogans but through systems

- Designing ecosystems that scale beyond the firm

The most successful modern leaders—from Satya Nadella to Melanie Perkins— have embraced this shift. They’ve moved beyond managing inputs and outputs to curating experiences, enabling ecosystems, and empowering cultures of innovation.

This is not about softening business. It’s about sharpening it for the realities of the new economy.

I’m currently writing a new book, The Invisible Business

We are at a moment of radical economic and technological change. AI, Web3, platform economies, remote work, and creative tools are altering how value is created, measured, and captured. At the same time, trust is eroding in institutions, misinformation spreads rapidly, and customers demand more meaning and transparency from the brands they engage with.

In this environment, the businesses that understand their intangible advantage will lead. Those that don’t will struggle to compete—even if their factories are full and their financials look strong.

This book will explore how to recognize, build, and invest in these invisible assets. It will offer a roadmap for leaders who want to reimagine their business for a world where the most powerful assets can’t be seen—but shape everything we do.

We’ll look at companies reinventing their business models around brand, data, and community. We’ll explore how trust, culture, and creativity are becoming strategic differentiators. And we’ll provide tools to help you measure, manage, and multiply your own intangible advantage.

Welcome to the Invisible Business

The age of tangible advantage is over. We’ve entered a new era, one where unseen forces determine success. If we can learn to see what others ignore, we can unlock extraordinary value.

This is your guide to the future of value creation. Welcome to the invisible business.

Chapter 1: From Steel to Stories, How Value Has Shifted

In 1911, U.S. Steel became the world’s first billion-dollar corporation. Its value was measured in iron ore, blast furnaces, railway lines, and rolling mills. Capital investment meant physical scale, and industrial power meant control over supply chains and manufacturing capacity. Business success was made of concrete, steel, and sweat.

Fast forward to today, and the world’s most valuable companies look entirely different. Apple, Alphabet, Amazon, Microsoft, and Meta sit at the top of the list— not because they produce more physical goods than their rivals, but because they dominate in software, platforms, ecosystems, brand trust, user data, and design. Their true value lives not in things, but in intangibles: code, ideas, relationships, culture, and networks.

We have undergone a profound shift in the way economic value is created, measured, and understood. The industrial economy rewarded those who built the biggest factories and shipped the most units. The post-industrial economy—our economy—rewards those who build the strongest brands, harness the most useful data, and design the most engaging experiences.

We have moved from steel to stories—from atoms to bits, from scale to networks, from ownership to access, from extraction to attention.

The Age of Tangibles

For most of the 20th century, economic success was synonymous with industrial prowess. Oil giants, car manufacturers, mining conglomerates, and heavy engineering firms defined global capitalism. Value creation was linear and physical: extract raw materials, transform them through machinery, and distribute them through logistics networks.

Business models were built on vertical integration and economies of scale. The goal was efficiency, the metric was output, and the advantage was size. This was the age of assembly lines, smokestacks, and scale economics. Companies built value by owning more—more factories, more assets, more inventory, more people.

Accounting standards were designed to measure this world. Balance sheets captured physical plant and equipment. Profit and loss statements tracked input costs and unit margins. Depreciation schedules mirrored asset wear and tear. Tangible assets dominated both corporate strategies and financial reports.

But as the century wore on, something began to change.

The Rise of Intangibles

In 1975, the average S&P 500 company derived 83% of its value from tangible assets. By 2020, that number had reversed: more than 90% of corporate value came from intangibles. Brands, patents, software, algorithms, relationships, customer lists, organizational know-how, and proprietary data now drive the lion’s share of enterprise value.

This shift wasn’t just a feature of tech companies. It was everywhere. A luxury goods firm like Hermès generates value through scarcity, craftsmanship, and storytelling. A media platform like Netflix wins on user experience, original content, and engagement data. A company like Tesla builds not just electric vehicles but a cult-like brand, proprietary AI systems, and a massive software-defined platform.

What these companies have in common is that their most valuable assets are not visible on a factory tour—and in many cases, not fully captured on a balance sheet.

Why This Shift Matters

Intangible assets behave differently than tangible ones. They scale faster, last longer, and interact in more complex ways.

- Brands compound emotional trust, allowing premium pricing and customer loyalty.

- Software can be duplicated at near-zero marginal cost, enabling exponential scaling.

- Data gets more valuable the more it is used, especially in machine learning.

- Culture drives internal performance and external perception.

- Networks grow stronger with every new node, creating winner-take-most dynamics.

These properties create new kinds of competitive advantage. While tangible assets depreciate, intangible assets—when well managed—often appreciate. A factory may produce a million units a year. But a viral app, a trusted brand, or a magnetic story can reach billions—instantly.

The best companies build intangible flywheels. For example, Amazon collects customer data to improve recommendations, which increases engagement, which attracts more sellers, which improves selection, which brings more customers— who then provide more data. This self-reinforcing loop creates momentum that is hard to replicate with physical assets alone.

The Industrial Mindset vs. the Intangible Reality

Despite this profound shift, many leaders and organizations still operate with industrial-era mental models. They view value creation through the lens of control, ownership, and output. They prioritize efficiency over emotion, scale over meaning, and cost-cutting over trust-building.

This creates strategic blind spots. For example:

- A company cuts its marketing budget to protect margins, eroding brand equity that took decades to build.

- A business outsources its software development, losing control over its core platform.

- A team undervalues culture as a “soft” issue, only to suffer high turnover and low innovation.

- A firm treats its customer data as a compliance risk rather than a strategic asset.

The iPhone Moment

The story of Apple and Nokia offers a stark illustration of this shift. In the early 2000s, Nokia was the world’s leading phone manufacturer. It had factories across the globe and a dominant market share. Apple, on the other hand, had no experience in phones—but it had a powerful brand, a design philosophy, and an ecosystem mindset.

When the iPhone launched in 2007, it didn’t just introduce a new product—it redefined the value equation. Apple focused on the user experience, the emotional connection, the app ecosystem, and the seamless integration between hardware and software. Nokia, focused on cost-efficient manufacturing and feature lists, couldn’t keep up.

Within a few years, Apple became the most valuable company in the world. Nokia exited the phone business. Tangibles lost to intangibles.

Today’s Real Economy is Intangible

Today, value doesn’t reside on the factory floor. It lives in the minds of customers, the relationships between users, the algorithms inside platforms, and the ideas embedded in design. The most important assets are often invisible—until they’re gone.

To lead in this world, businesses must learn to see, measure, and manage these new value drivers. That requires letting go of outdated assumptions and building new capabilities. It means investing in creativity, culture, brand, and systems. It means designing business models that harness flywheels, data loops, and network effects.

Most importantly, it means telling better stories—not just to customers, but internally, to guide strategy, mobilize teams, and shape identity.

Because in the age of intangibles, stories scale better than steel.

The Intangible Building Blocks

Let’s unpack some of the most critical intangible assets shaping today’s organisations:

1. Data and Algorithms

Data is the new oil, but unlike oil, it doesn’t get used up. It gets more valuable with use. Businesses that can gather, analyse, and deploy data effectively create powerful feedback loops—improving products, anticipating demand, targeting customers, and optimising operations.

Example: Palantir, the US-based analytics firm, doesn’t manufacture anything. Its entire business is about helping organisations—from governments to corporations—unlock value from their data. The company’s value lies in its algorithms, analytics tools, and ability to turn invisible streams of data into insight and impact.

2. Brands and Reputation

A strong brand is a trust signal, an emotional connection, and a multiplier of value. Brands encapsulate the values, voice, and promise of a company—turning a commodity into a preference.

Example: Patagonia’s brand is a beacon of environmental integrity and purpose-driven capitalism. Its tangible products—jackets and backpacks—could be made by others. But its brand is a magnetic asset, built on trust, activism, and community.

3. Intellectual Property and Software

Software eats the world, and IP defines defensibility. Patents, proprietary code, algorithms, and design rights create sustainable moats for many companies.

Example: ASML, the Dutch semiconductor equipment maker, derives its strategic power from its extreme ultraviolet lithography technology. It holds patents so complex and advanced that it effectively monopolises the machinery needed for cutting-edge chips. The machines are real, but the crown jewels are the ideas and knowledge embedded within them.

4. Relationships and Ecosystems

In the platform economy, value isn’t just in what you control but in who you connect. Ecosystem thinking means value is co-created across networks of users, partners, and developers.

Example: Shopify, the Canadian ecommerce platform, is successful not just because of its technology but because of its ecosystem of app developers, agencies, and online sellers. It doesn’t own the products being sold—but it owns the relationship with sellers and buyers.

5. Culture, Purpose, and Talent

Culture and values shape how work gets done, how people collaborate, and how organisations adapt. In the knowledge economy, the ability to attract and retain the best minds is itself a strategic asset.

Example: GitLab, the remote-first DevOps company, has no physical headquarters. Its most prized asset is its culture—transparency, asynchronous collaboration, and radical documentation. This invisible infrastructure enables it to operate across 60+ countries with no loss in speed or coherence.

Invisible business are different

Traditional companies were built on control of physical resources, economies of scale, and linear supply chains. The organisation’s success was a function of capital intensity, operational efficiency, and asset utilisation. Value was something you could weigh, ship, or store.

Invisible businesses flip that logic. They are:

-

Light on physical assets but rich in intellectual property.

-

Customer-centric, with deep insights derived from real-time data.

-

Platform-based, co-creating value through users and partners.

-

Agile and adaptive, driven by ideas, innovation, and culture.

-

Valued more by future potential than by current physical output.

They are also harder to measure using traditional metrics. GDP still doesn’t count intangible investments like R&D or brand development very well. Accounting standards often force software development costs to be expensed rather than capitalised. As a result, intangible-rich firms may appear asset-light or low-margin on paper—while being extraordinarily valuable in reality.

Reimagining Value Creation

Invisible businesses are not just tech companies. They are businesses that reimagine how value is created—by investing in the intangible, the relational, the experiential.

These companies:

-

Prioritise customer experience over production capacity.

-

See code as capital and culture as infrastructure.

-

Use ecosystem leverage rather than vertical integration.

-

Scale exponentially, not incrementally.

They may not show up in the traditional rankings of asset size or headcount, but they dominate the rankings of brand value, venture capital funding, or customer growth.

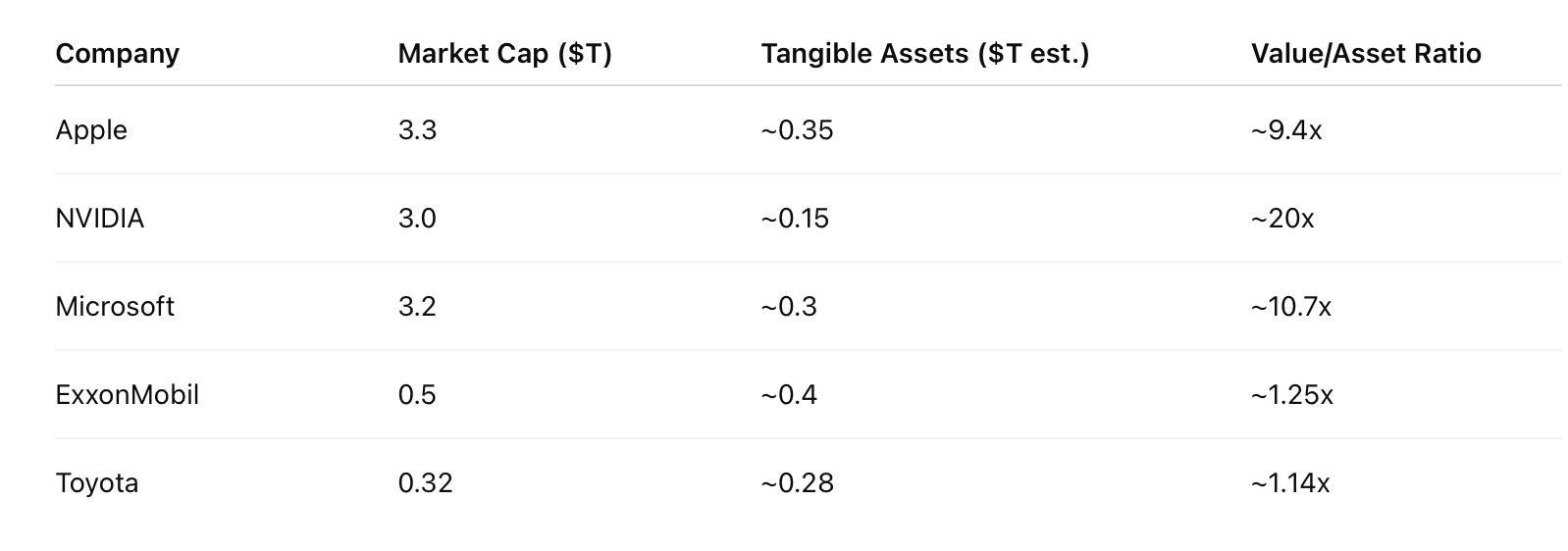

The contrast between intangible asset-based (invisible) companies and tangible asset-based (traditional) companies is stark when viewed through the lens of market capitalisation—a reflection of perceived value, future growth potential, and economic relevance.

As examples (with current valuations, June 2025), Apple has a market value $3.3 trillion, driven by intangible assets like brand, software ecosystem (iOS), design IP, customer loyalty, developer platform, proprietary silicon design (e.g. M-series chips). Visa is valued at $560 billion, driven by global network effects, brand trust, secure payment IP, relationships with financial institutions.

Compare this to ExxonMobil with market cap $500 billion driven tangible assets like refineries, oil fields, pipelines. Or Toyota with $320 billion driven largely by manufacturing plants, global supply chain, physical inventory.

The world’s most valuable companies today are those whose worth is built on invisible assets: networks, platforms, data, software, and trust. While traditional companies still generate significant cash flows, their capital intensity reduces scalability, and they often lack the exponential upside of intangible-driven businesses.

This comparison clearly shows that the market now rewards scalable ideas over physical scale, ecosystem control over asset ownership, and innovation capacity over industrial capacity.

The Invisible Advantage

In this world, competitive advantage doesn’t come from owning the factory—it comes from owning the idea. The data. The interface. The standard. The narrative.

For business leaders, this demands a shift in mindset:

-

Invest in the invisible: Brand, culture, community, and IP need the same strategic focus as factories once did.

-

Measure what matters: New metrics are needed to assess intangibles—from innovation velocity to brand trust to ecosystem health.

-

Build ecosystems, not empires: Collaboration becomes more powerful than control.

-

Adapt relentlessly: In a fast-changing world, intangible businesses are more fluid, experimental, and resilient.

The most valuable businesses of our age don’t look like businesses of the past. They are invisible businesses—defined by what you can’t see but can feel, experience, and benefit from. Their value lies in relationships and data, in trust and creativity, in community and code.

As the intangible economy continues to grow, companies that understand and embrace this invisible logic will lead the way—not just in valuation, but in relevance, resilience, and reinvention.

Examples of Invisible Companies

- ByteDance: The Chinese parent of TikTok has no physical products but has built a global empire on attention, algorithms, and user engagement. Its true asset is its recommendation engine—an invisible force that keeps users hooked, informed, and entertained.

- Klarna: This Swedish fintech firm enables “buy now, pay later” services. Its value lies in its software, consumer trust, and partnerships with retailers—not in any bricks-and-mortar footprint.

- Canva: The Australian design platform makes design accessible to anyone, anywhere. It owns no creative agencies, but its intuitive interface, templates, and brand assets make it indispensable to millions of users. It’s real assets? Usability, community, and vision.

- Arm Holdings: Arm doesn’t make chips—it designs them. Its intellectual property is licensed to nearly every chipmaker in the world, from Apple to Qualcomm. The company’s value is entirely based on IP, talent, and standards.

- Nubank: This Brazilian digital-first bank has scaled rapidly without branches. Its key assets? A user-friendly app, an iconic brand, and trust among young Latin Americans underserved by traditional banks.

- Stripe: The payments infrastructure firm simplifies online transactions for millions of businesses. It owns no physical point-of-sale systems—but it owns the trust of the digital economy.

Profiles of Invisible Companies

Airbnb, Unlocking Trust

Airbnb has built a global hospitality empire without owning a single hotel. Its core asset isn’t real estate—it’s trust. From its early days, Airbnb recognized that enabling strangers to stay in one another’s homes required more than a clever platform. It needed to create a global sense of safety, community, and emotional connection. By investing heavily in design, reputation systems, host standards, and a narrative around “belonging,” Airbnb turned trust into its most valuable currency.

Its brand identity—rooted in local experiences and authentic connections— differentiates it from traditional hotel chains. Features like verified ID, guest reviews, and Super host status create reputational capital. Meanwhile, data from millions of stays feeds into pricing algorithms, fraud detection, and personalized recommendations. Airbnb’s flywheel is intangible: more trust leads to more listings, more guests, better data, and greater network effects.

During the COVID-19 pandemic, Airbnb doubled down on community. While travel plummeted, it nurtured its brand and experience design, supporting hosts and pivoting to long-term stays and online experiences. This intangible focus allowed Airbnb to emerge stronger, culminating in one of the most successful tech IPOs of the decade. Its physical footprint may be light, but its intangible ecosystem—trust, brand, and community—is enormous.

BYD, Building Ideas

BYD (Build Your Dreams), China’s electric vehicle and battery giant, has quietly become one of the most valuable and innovative manufacturers in the world. While its competitors emphasize scale and hardware, BYD’s real strength lies in mission, culture, and intellectual property.

Founded in 1995, BYD began with rechargeable batteries, later expanding into EVs and energy storage. Today, it produces not just cars, but entire clean energy ecosystems. Its success is rooted in deep in-house R&D, holding more than 40,000 patents globally. But beyond patents, BYD’s innovation edge comes from cultural alignment. It operates under a clear mission: to “cool the earth by 1°C.” This shared purpose fosters internal cohesion and long-term thinking.

BYD has vertically integrated most of its operations, but not to control supply chains—instead, to protect its core intangible capabilities in software, powertrain design, and battery tech. It is now exporting vehicles and tech worldwide, surpassing Tesla in EV unit sales in 2023.

Its intangible strength lies not just in technical knowledge, but in how that knowledge is embedded in its culture and purpose—a model for mission-driven innovation at scale.

Canva, Embracing Community

Australia’s Canva is a breakout SaaS success story built entirely on design simplicity, user experience, and community. Founded in 2013, Canva set out to democratize design for non-designers. It didn’t compete with Adobe on technical depth—instead, it focused on intuitive UX, brand templates, and cloud collaboration. This user-first design became its key intangible asset.

Canva’s growth has been driven by viral loops: users invite collaborators, share designs, and embed Canva content across the web. It has also built an emotional connection through a mission of empowerment—making everyone feel like a creator. Canva now supports 170+ languages, with over 175 million users worldwide.

Beyond product simplicity, Canva has nurtured an internal culture that emphasizes humility, learning, and impact. Co-founder Melanie Perkins often credits the company’s success to a relentless focus on culture and purpose.

Its valuation—exceeding $25 billion—reflects the value of its intangible ecosystem: loyal users, a trusted brand, design templates, cloud-based collaboration, and a culture that attracts top talent.

LVMH, Powered by Brands

LVMH Moët Hennessy Louis Vuitton is the world’s leading luxury group, and a case study in how brand equity, storytelling, cultural capital, and craftsmanship can drive enduring value. While its physical products—watches, handbags, wine—are beautifully made, the real value lies in perception, status, identity, and heritage.

LVMH owns over 75 brands across fashion, jewellery, cosmetics, and spirits— including Louis Vuitton, Dior, Tiffany & Co., Fendi, and Dom Pérignon. These brands trade on their legacy, exclusivity, and cultural resonance. LVMH carefully nurtures the intangible magic of each brand while using centralized platforms for digital, data, and retail operations.

CEO Bernard Arnault describes luxury as “the business of selling dreams.” This requires controlling not just design and distribution, but also intangible experience design: exclusive events, influencer partnerships, artistic collaborations, and storytelling that taps into desire and meaning.

LVMH invests heavily in human capital—artisans, designers, brand curators— recognizing that its value lies in symbolic power as much as physical product. Its pricing power, margins, and customer loyalty are grounded in decades (often centuries) of carefully cultivated emotional capital.

Nvidia, Accelerating Technology

Nvidia started as a GPU manufacturer, but has become a foundational company in the AI economy. Its rise is driven by a rare blend of technological imagination, ecosystem thinking, and platform innovation—a masterclass in unlocking and layering intangible assets.

Originally known for gaming graphics cards, Nvidia saw early the potential of GPUs in parallel computing. It built CUDA, a proprietary platform that allowed developers to write software for its chips. This transformed Nvidia from a component vendor into a core enabler of AI, autonomous driving, robotics, and the metaverse.

Today, Nvidia’s value comes not just from chip performance, but from the developer ecosystems, AI models, research partnerships, and software platforms it supports. It owns key layers in the AI stack, from hardware to simulation to neural network training.

Nvidia’s brand is synonymous with innovation—trusted by startups, academics, and tech giants alike. It has built a flywheel of technical leadership, community engagement, and platform lock-in. Its market value now rivals legacy hardware firms many times its size.

Nvidia doesn’t just build chips. It builds the future’s imagination infrastructure— intangible, invisible, yet incredibly powerful.

Ping An, Transforming Platforms

Ping An, one of China’s largest financial services companies, has transformed from a traditional insurer into a tech-driven ecosystem by investing in data, AI, platforms, and digital trust. Ping An has evolved from an insurance provider into a platform- powered technology and health ecosystem, redefining financial services through intangibles like data, algorithms, trust, and cross-sector integration.

The company’s core strategy hinges on “finance + technology” and “finance + ecosystem.” With over 220 million retail customers, Ping An uses AI and cloud infrastructure to personalize risk assessment, predict customer needs, and optimize lifetime value. The firm holds over 100,000 patents, most related to fintech, AI, and health tech.

Ping An Good Doctor, its AI-powered health platform, serves hundreds of millions of users. Its smart city solutions manage traffic, identity, and urban services in real time. These platforms generate intangible capital in the form of proprietary datasets, behavioural insight, and public trust.

Unlike many insurers that outsource tech or treat digital as a channel, Ping An has vertically integrated its data infrastructure and built a culture of digital-first thinking. Its value proposition is not just better insurance—but smarter, more holistic life solutions.

By reimagining itself as an AI-powered, ecosystem-based enterprise, Ping An has become one of the most forward-looking financial institutions in the world. Its real assets are invisible: platforms, people, and predictive intelligence.

Spotify, Unlocking Data

Spotify redefined music not by owning content, but by owning data, algorithms, and user experience. With over 600 million users and 200 million subscribers, Spotify’s power lies in how well it understands what people want to hear—and when.

Its algorithmic playlists like “Discover Weekly” and “Release Radar” generate intense engagement. Spotify collects listening data, mood, location, time of day, and device usage to personalize the experience in real time. This data flywheel is a potent intangible asset: more engagement means better data, which improves personalization, which boosts retention.

Spotify has also invested in audio storytelling—from podcasts to original content— shaping the future of sound and attention. It builds emotional bonds through shared playlists, artist fan experiences, and cultural relevance.

What makes Spotify unique is how it translates data into emotion and identity. In doing so, it’s not just streaming songs—it’s curating culture. Its intangible edge lies in combining data science, emotional resonance, and creative expression.

Tencent, Growing as Ecosystems

Tencent is one of the world’s most successful digital ecosystems, with value creation built not on products, but on platforms, data, networks, and trust. Best known for WeChat, China’s “everything app,” Tencent has created a digital operating system for everyday life—messaging, payments, gaming, commerce, content, and public services—within one unified interface.

What makes Tencent extraordinary is how it turns intangible relationships into exponential value. WeChat isn’t just a messaging app—it’s infrastructure. The platform handles over a billion daily users and connects families, businesses, governments, and brands. By embedding payment and service layers into chat, Tencent unlocked new business models powered by convenience, loyalty, and data.

Tencent also runs the world’s largest video game business through a network of internal studios and strategic investments (including Riot Games, Epic Games, and Supercell). It applies data-driven insights to iterate game features, optimize engagement, and drive in-game monetization.

At its core, Tencent’s strength lies in intangible assets: network effects, behavioural data, content IP, user habits, and ecosystem orchestration. Rather than controlling everything directly, it enables partners, startups, and developers to build inside its environment, turning scale into stickiness. Tencent doesn’t just create value—it multiplies it across networks.

Lamborghini was a tractor company. Samsung was a grocery store. Lego was a wooden toyshop. Nintendo made playing cards. LG was a facial cream. IKEA was a pen company.

In today’s fast-changing markets, the ability to reinvent yourself can often make the difference between thriving and fading into irrelevance. Reinvention isn’t just a buzzword—it’s a crucial survival strategy that allows companies to evolve in response to shifting market dynamics, changing consumer expectations, and disruptive technologies.

This reinvention can take many forms, from overhauling business models to reimagining a company’s purpose and vision. By embracing reinvention, organisations can chart new courses, seize emerging opportunities, and secure long-term success.

The need for reinvention

Most organisations are unlikely to survive the next 10 years, unless they reinvent themselves. Rapidly emerging technologies, evolving consumer attitudes and behaviours, and increasing competition all drive the need for businesses to adapt.

The average lifespan of companies in the S&P 500 has decreased from 67 years in 1920 to about 15 years today. This trend is expected to continue, with half of the companies in the S&P 500 predicted to be replaced within the next 10 years if current trends continue.

Traditional business models that once guaranteed success may now be insufficient in the face of new challenges. Companies that fail to reinvent themselves risk becoming obsolete. Conversely, those that embrace change can find new growth avenues, strengthen their competitive edge, and build deeper relationships with customers.

Reinvention is a response to this dynamic environment. It goes beyond mere improvement or iteration; it involves rethinking how a company operates, how it connects with customers, and how it delivers value. Reinvention can be intentional and strategic, or it can be a reaction to external pressures—economic shifts, technological advances, or shifts in consumer behaviour—that demand immediate change.

Great examples of reinvention

The business world abounds with stories of reinvention – both start-ups who quickly realise they need to adapt their initial dreams, to well established companies who ride with changing nature of consumers and markets. Instagram was originally called Burbn, enabling users to share their location, typically bars and restaurants. Youtube started as a video dating site called Tune In Hook Up.

The best stories of reinvention are in larger companies. This is where a profound change in thinking is demanded to sustain long-term success. These companies realised that as the world changes, they have to change. Not just in creating new products and services, but in their fundamental purpose, sector, business model, strategy, organisation and culture:

- Nokia: from paper mill to a rubber company to a ship builder, to a telecoms business known for mobile phones and now focuses on network infrastructure.

- IBM: from hardware manufacturer to IT services and consulting firm, including cloud computing, and AI innovations like IBM Watson.

- Alibaba: from B2B e-commerce platform called China Pages into a consumer platform (AliExpress) to entertainment, online grocery (Hema), and healthcare.

- Disney: from animation and film production, into television, theme parks, and streaming platform with brands like Marvel and Star Wars.

- Samsung: from textiles and groceries into consumer electronics like the Galaxy mobile phone series, and one of the largest producers of semiconductors.

- Nintendo: from playing card manufacturer, into an iconic video game company behind franchises like Super Mario and Zelda.

- Grupo Bimbo: from a small Mexican bakery, to the world’s largest bakery products company (incl. Sara Lee and Entenmann’s) and health foods.

- Amazon: from online bookstore into an e-commerce “everything store”, to cloud services (AWS), streaming (Prime Video), and AI-driven logistics.

- Siemens: from electrical engineering and telegraphs, to digital infrastructure healthcare tech (Siemens Healthineers), and energy efficiency solutions.

- Natura: from cosmetics made from natural ingredients in Brazil, to a global portfolio of sustainable brands including Aesop and The Body Shop.

- Slack: from video game company called Tiny Speck with a game called Glitch to become a leading workplace collaboration and productivity tool.

- Tata: from steel and heavy industry, into automotive (eg acquiring Land Rover Jaguar), to hospitality, food and beverage, and a global technology provider.

- Netflix: from DVD rental by mail, into a streaming service and became a major content producer with award-winning original productions, and now gaming.

- Paypal: from online payments for eBay transactions, to a global digital payment platform, including peer-to-peer transfers (via Venmo), credit, and crypto.

- Shopify: from online store for snowboarding equipment, to become an e-commerce platform powering retail businesses worldwide.

Reinventing every aspect of business

Reinvention touches every facet of business: from strategy and business models to culture, leadership and performance. Below, we explore how each of these dimensions is being reimagined by forward-thinking organisations around the world:

Reinventing strategy … from predictive planning to adaptive platforms

Traditional strategic planning—anchored in stability, annual reviews, and five-year roadmaps—has given way to fluid, real-time strategy. In a world of relentless change, strategy must be a living process, where organisations continuously sense shifts in the market and respond fast.

DBS Bank in Singapore exemplifies this shift. Once a staid local bank, DBS has reinvented itself as a tech company with a banking license. Its “GANDALF” strategy (inspired by global tech giants) enables it to evolve its digital platforms, experiment with new ventures, and lead Asia’s fintech revolution. Strategic agility is now central, with teams empowered to pilot and scale ideas rapidly, aligned to customer needs and ecosystem opportunities.

Reinventing innovation … from R&D Labs to open ecosystems

Innovation can no longer be a siloed department—it must be embedded across the organisation and expanded into networks and ecosystems. The best innovators now blend human creativity with AI-powered insights, internal capabilities with external partnerships.

GitLab, a DevOps company born remotely, thrives by enabling distributed, transparent, and continuous innovation. Meanwhile, DeepMind, based in the UK, reimagines innovation through AI to solve complex problems—from protein folding to energy optimisation. The key is dynamic learning and collective intelligence.

Reinventing business models … from pipelines to platforms

The shift from ownership to access, products to services, and control to collaboration is redefining business models. Traditional linear value chains are giving way to ecosystem thinking and platform dynamics.

Shopify, a Canadian e-commerce company, didn’t just build a tool for online stores—it built a global platform where millions of merchants, developers, and partners co-create value. Its business model scales through network effects, embedded services, and third-party integrations. Similarly, Tesla disrupted the auto industry by integrating energy, software, and services into a vertically integrated platform model.

Reinventing brands … from identity to activism

A brand today is no longer just a logo or marketing message—it’s a vehicle for values, a social actor, and a lived experience. Customers expect brands to take a stand on societal and environmental issues, and deliver authentic value in every interaction.

Patagonia has redefined what it means to be a purpose-driven brand. From suing the US government over public lands to giving away ownership to fight climate change, the brand leads with bold actions. In South Korea, Amorepacificrepositions beauty as wellness and sustainability, aligning product innovation and brand storytelling with ecological responsibility.

Reinventing experiences … from transactions to transformations

Customers today don’t just buy products—they buy experiences, outcomes, and shared identities. Experience is the new differentiator. Reinvention means designing every touchpoint around the customer’s life—not the company’s processes.

Disney has masterfully reinvented its customer experience through Disney+, blending content, data, and personalization across digital and physical worlds. On Running, the Swiss sportswear brand, combines tech-infused shoes, sustainability stories, and community experiences to offer more than athletic gear—it sells a performance lifestyle with purpose.

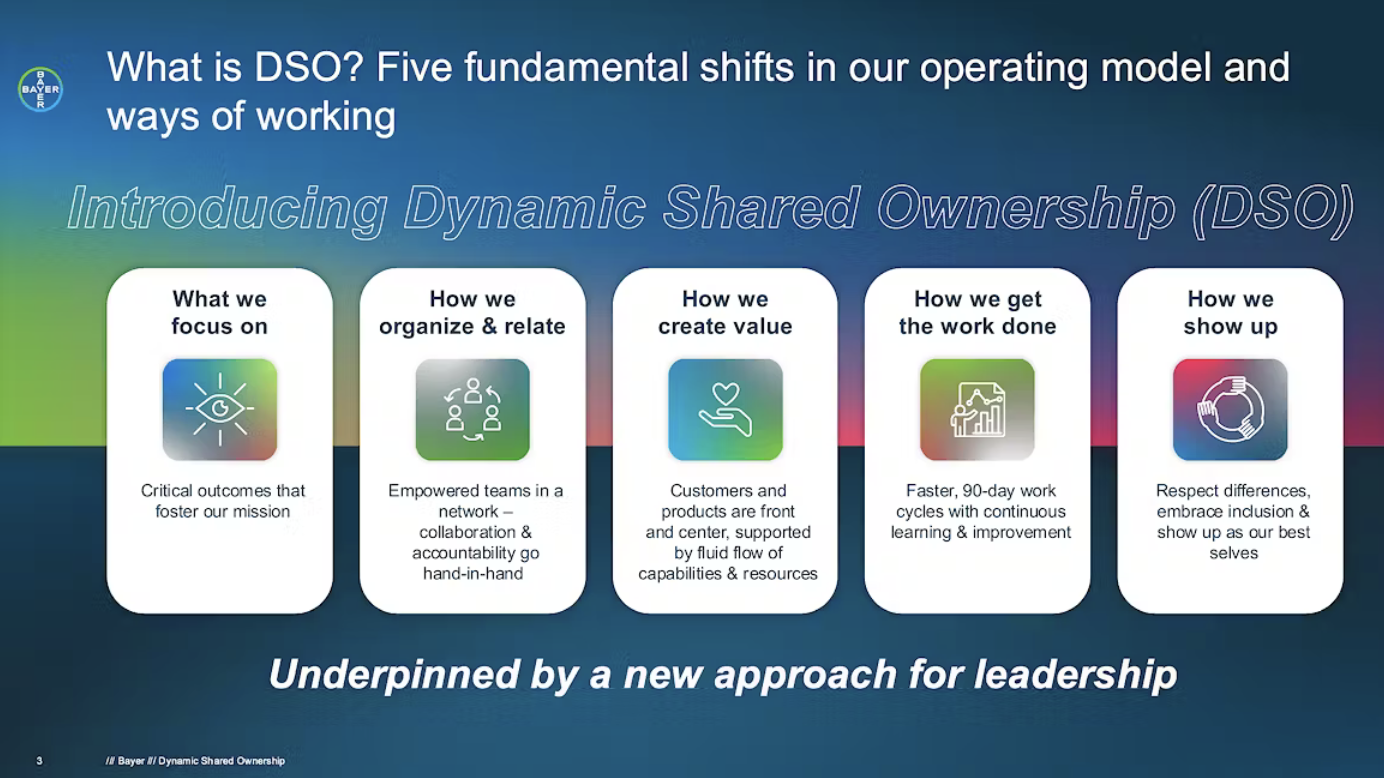

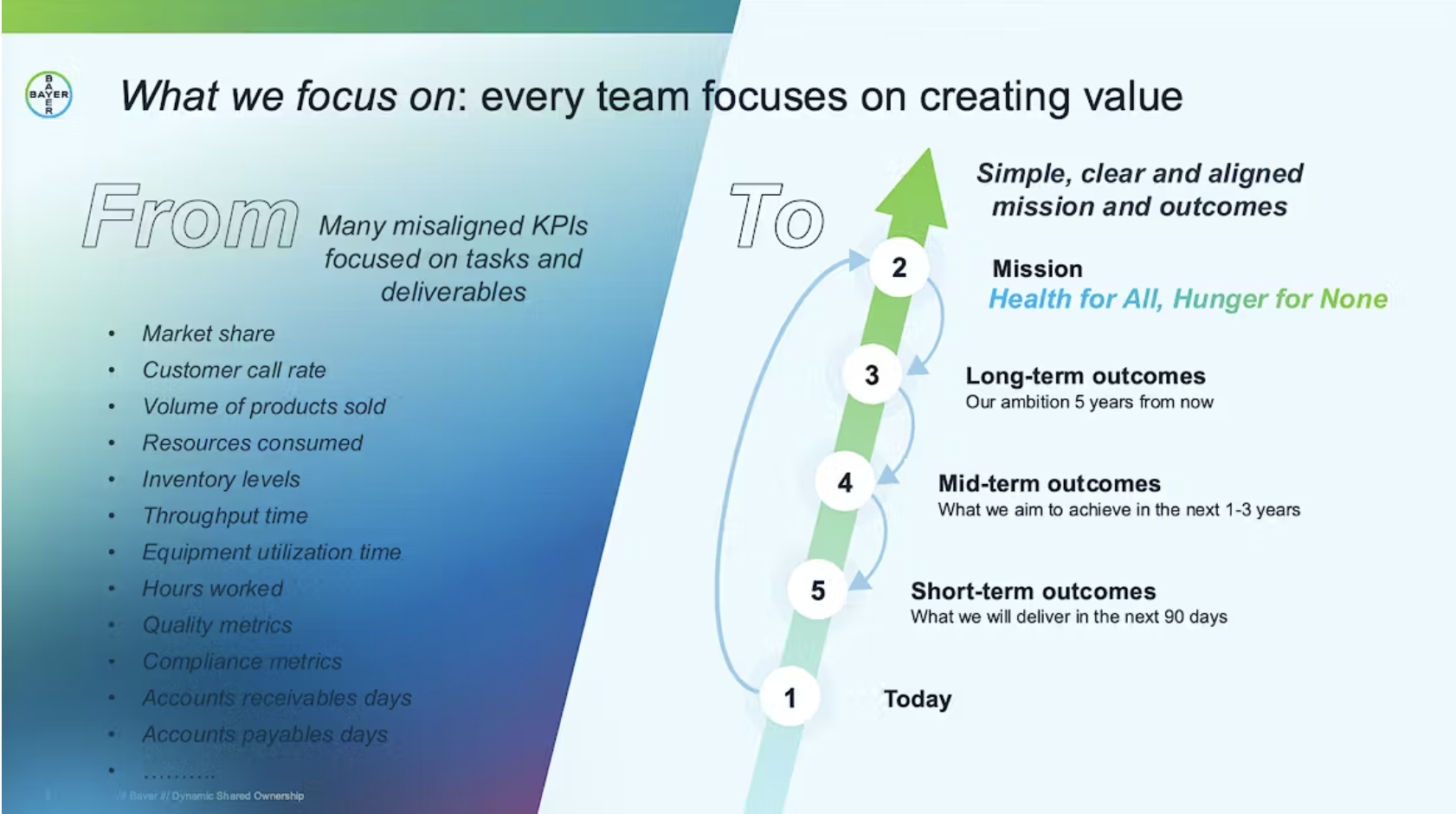

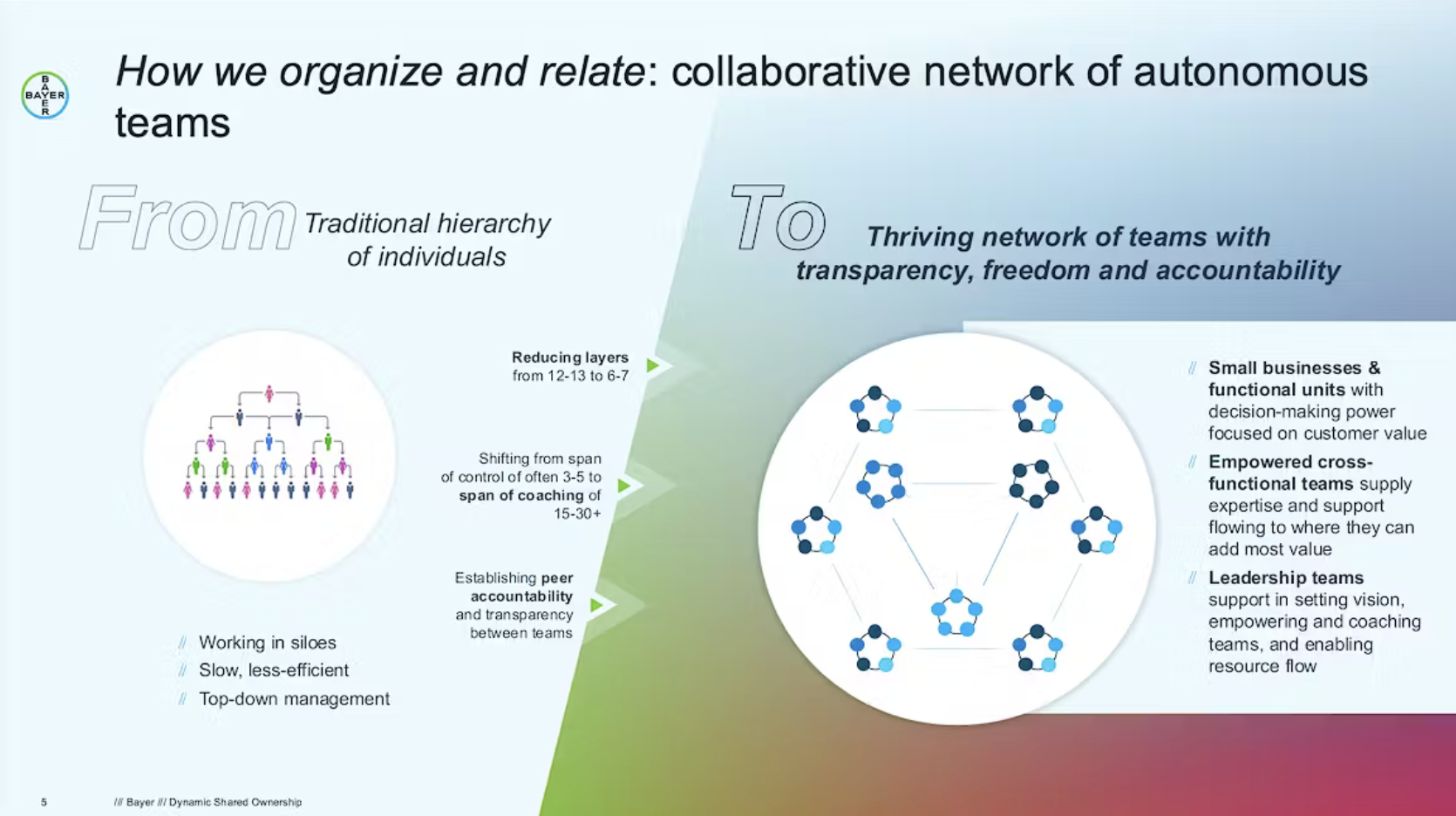

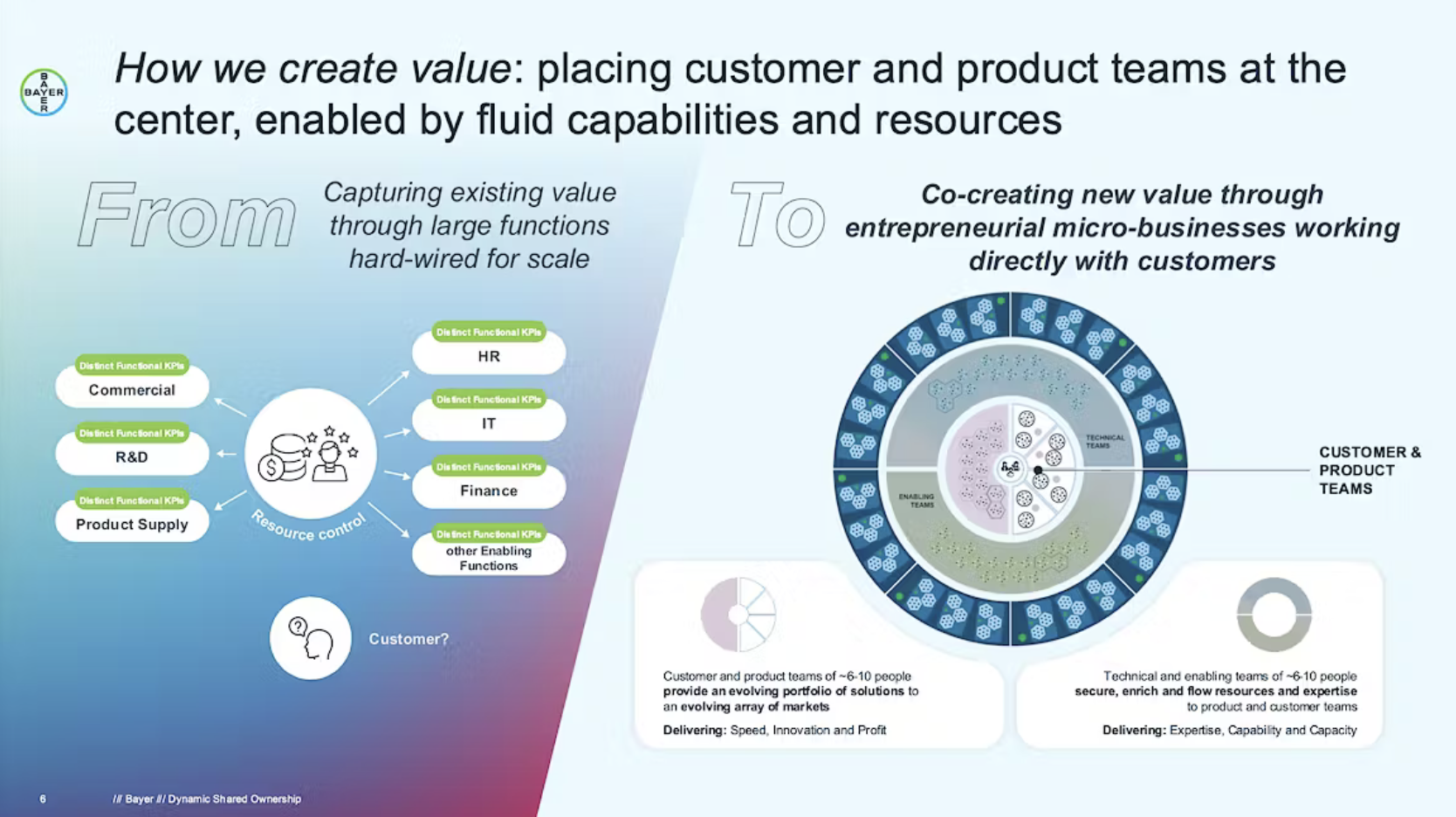

Reinventing organisations … from hierarchies to networks

Rigid hierarchies and departmental silos stifle agility and innovation. The new organisation is a living system—flat, cross-functional, self-organising. It thrives on speed, fluidity, and empowered teams.

Haier in China has dismantled its traditional corporate hierarchy to become a “microenterprise” ecosystem—over 4,000 autonomous teams run as mini start-ups within the larger group. This radical decentralisation fosters entrepreneurship, responsiveness, and accountability at scale. In Europe, Spotify introduced “squads” and “tribes” to scale agile work structures globally.

Reinventing culture … from control to creativity

Culture is no longer a background issue—it’s the front line of transformation. Today’s high-performing cultures value experimentation, inclusivity, resilience, and purpose. Reinventing culture means building psychological safety, growth mindsets, and the freedom to challenge.

Netflix famously champions a culture of “freedom and responsibility.” Employees are trusted to act in the company’s best interest and empowered to make bold decisions. Unilever, meanwhile, embeds purpose at the core of its culture, training thousands of “purpose ambassadors” and linking employee engagement to social impact.

Reinventing leadership … from command to co-creation

The role of the leader is evolving—from visionary and controller to coach and catalyst. In volatile times, the most effective leaders are those who inspire, listen, learn fast, and lead through shared purpose.

Satya Nadella’s transformation of Microsoft is one of the clearest examples of leadership reinvention. He shifted the culture from know-it-all to learn-it-all, prioritised empathy and curiosity, and opened the company to partnerships and openness. In Africa, Phuthi Mahanyele-Dabengwa, CEO of Naspers South Africa, champions inclusive leadership, digital empowerment, and long-term innovation for impact.

Reinventing performance … from profit to progress

Finally, the definition of business success is shifting. Performance is no longer measured solely by short-term financial results, but by broader metrics of long-term value—social, environmental, and economic. The shift to stakeholder capitalism is redefining what great looks like.

Danone became the first listed company to adopt “Entreprise à Mission” status in France, embedding social and environmental goals into its legal structure. It tracks health, sustainability, and trust alongside revenue and margins. Meanwhile, Schneider Electric ranks as one of the world’s most sustainable companies, linking executive compensation to ESG outcomes.

Reinvention … as a Continuous Capability

What unites these examples is not a one-time pivot, but an ongoing capacity to reinvent. Reinvention is not a project—it’s a mindset, a muscle, and a method. It requires ambidexterity: the ability to exploit today while exploring tomorrow. It means building systems that sense and respond to change, and cultures that embrace uncertainty as a source of opportunity.

From Indian tech giants like Reliance Jio, creating a digital lifestyle ecosystem, to Nordic innovators like IKEA, rethinking circularity and low-carbon living, the future belongs to the reinventors—those willing to challenge themselves before the market does.

As Peter Drucker once said, “The greatest danger in times of turbulence is not the turbulence—it is to act with yesterday’s logic.” Reinvention is the antidote to irrelevance. In a world of relentless change, the only sustainable strategy is to stay in motion.

Business impact of reinvention

Reinventing a company can initially be about survival, but it is also about profitable growth, and also having a broader net positive impact on the environment and society. The impact of reinvention varies depending on the company, the industry, and the strategies adopted, but several studies and real-world examples show that companies can see significant benefits from transformation efforts. Below are some key statistics and examples of how reinvention can impact financial performance:

Companies that have successfully executed digital transformations can experience up to a 20% improvement in cash flow and 10-15% revenue growth on average. Additionally, they report a 30-50% reduction in costs due to efficiency improvements and better customer experiences. (McKinsey, 2022). Since embracing the Azure cloud platform, Microsoft’s cloud revenue surged. In Q2 2021, Azure grew by 50% year-over-year, helping Microsoft’s total revenue increase by 17%, and net income grew by 33%. By focusing on cloud computing, Microsoft transformed from a traditional software company into a dominant player in cloud services, with Azure contributing nearly 30% of its total revenue.

Companies that complete successful transformations outperform the market by 3x over a period of five years. Bain also found that about 70% of transformations fail, meaning that successful reinvention can produce outsized returns for companies that get it right. (Bain 2018). Between 2012 and 2022, Netflix’s market value increased from $8.5 billion to over $200 billion, reflecting a 25x increase in value. Its subscriber base grew from 23 million in 2011 to over 230 million in 2022. Revenue grew from $3.2 billion in 2012 to $31.6 billion in 2022, with net income growing from $226 million to $4.5 billion in that time.

Companies that embrace sustainability found that those with a focus on environmental, social, and governance (ESG) goals have outperformed the market by 3-6% annually over a 10-year period. These companies also see higher employee satisfaction and brand loyalty (HBR 2019). After acquiring The Body Shop in 2017 and Aesop in 2012, Natura’s revenue grew by 45% between 2017 and 2020, and the company became a leader in eco-friendly products. Natura’s focus on sustainability and natural ingredients has also led to higher customer loyalty and brand equity, resulting in strong market share in Latin America and globally.

Companies using data analytics to improve operations and customer experience are 5x more likely to make faster decisions and 3x more likely to achieve above-average profitability compared to their peers. Inditex, revolutionized the retail fashion industry by using real-time data analytics to quickly adjust inventory and respond to customer preferences. By integrating big data into its supply chain and production processes, Zara reduced inventory waste, shortened lead times, and improved profit margins. As a result, Zara has maintained high same-store sales growth and profitability. The company has grown from $10 billion in revenue in 2002 to over $32 billion in 2022, with operating profit margins consistently above 10%.

Leading the revolution

While reinvention can yield enormous rewards, it is not without its challenges. Companies must be willing to take risks, confront failure, and often make tough decisions about the direction of their business. Reinvention may require major investments in research and development, technology, or talent acquisition. Additionally, the need to balance short-term performance with long-term vision can be a difficult tightrope to walk.

One of the biggest challenges of reinvention is overcoming internal resistance to change. Employees and leaders alike may be attached to the company’s legacy practices and products. For successful reinvention, a company must foster a culture of innovation and openness to new ideas, even if they challenge the status quo.

Reinvention is a complex, multifaceted process that requires bold thinking, creativity, and leadership. Companies that successfully reinvent themselves are able to navigate changing market conditions, anticipate future trends, and build deeper connections with their customers. Whether it’s through redefining a business model, refreshing a brand, or embracing new technologies, reinvention is a key to enduring success in today’s fast-paced, ever-evolving business environment.

As we look to the future, businesses that are committed to reinvention will continue to be the ones that thrive—those that can reinvent their products, their organizations, and their leadership will set the stage for the next era of innovation and growth. Reinvention is not a one-time event; it is an ongoing process that requires continuous adaptation, learning, and forward thinking. It is the hallmark of resilient, forward-thinking companies that refuse to rest on their laurels and instead embrace the constant change that defines the modern business world.

Building a faster and more entrepreneurial organization to succeed in fast-changing markets is a multifaceted challenge that requires a comprehensive approach. Here’s a guide that draws from academic models and lessons learned from successful companies to help you on this journey:

10 ways to think and act like an entrepreneur

The pace of change in today’s markets is unprecedented. Technology advancements, globalization, and shifting consumer preferences mean that businesses must be agile and innovative to stay competitive. As a business leader, fostering an entrepreneurial mindset within your organization can drive creativity, quick decision-making, and resilience.

1. Customer inspiration

Start with a customer-centric approach that ensures that the organisation remains aligned with rapidly changing markets. It also embraces a problem solving approach, rather than just selling products. This involves:

- Understanding Customers: Continuous deep, formal and informal ways to gain more insight.

- Delivering Value: Creating products and services that meet customer needs and exceed their expectations.

- Building Relationships: Developing strong relationships with customers to enhance loyalty and retention.

Apple’s customer-centric approach is evident in its product design, retail experience, and customer support. By prioritising customer needs and delivering exceptional value, Apple has built a loyal customer base and a strong brand.

2. Founder spirit

Have a founder mindset, even in a large corporation. Not just the boss, everyone. An entrepreneurial culture encourages employees to take risks, think creatively, and act like owners. This culture can be cultivated through:

- Empowerment and Autonomy: Giving employees the freedom to make decisions and pursue innovative ideas.

- Rewarding Innovation: Implementing incentive systems that reward creativity and successful risk-taking.

- Learning from Failure: Encouraging a mindset that views failures as opportunities for learning and growth.

Google’s “20% time” policy, which allows employees to spend 20% of their time on projects of their choosing, has led to the development of successful products like Gmail and Google News. This policy fosters a culture of innovation and entrepreneurial thinking.

3. Technology enablers

Technology plays a crucial role in enabling agility and fostering an entrepreneurial spirit. By embracing digital transformation, organizations can streamline processes, enhance decision-making, and create new value propositions.

- Cloud Computing: Facilitates scalability and flexibility.

- Data Analytics: Provides insights for informed decision-making.

- Automation: Streamlines repetitive tasks, freeing up employees to focus on higher-value activities.

Netflix’s transition from a DVD rental service to a streaming giant was driven by its ability to leverage technology. By harnessing data analytics, Netflix offers personalized content recommendations, enhancing customer satisfaction and retention.

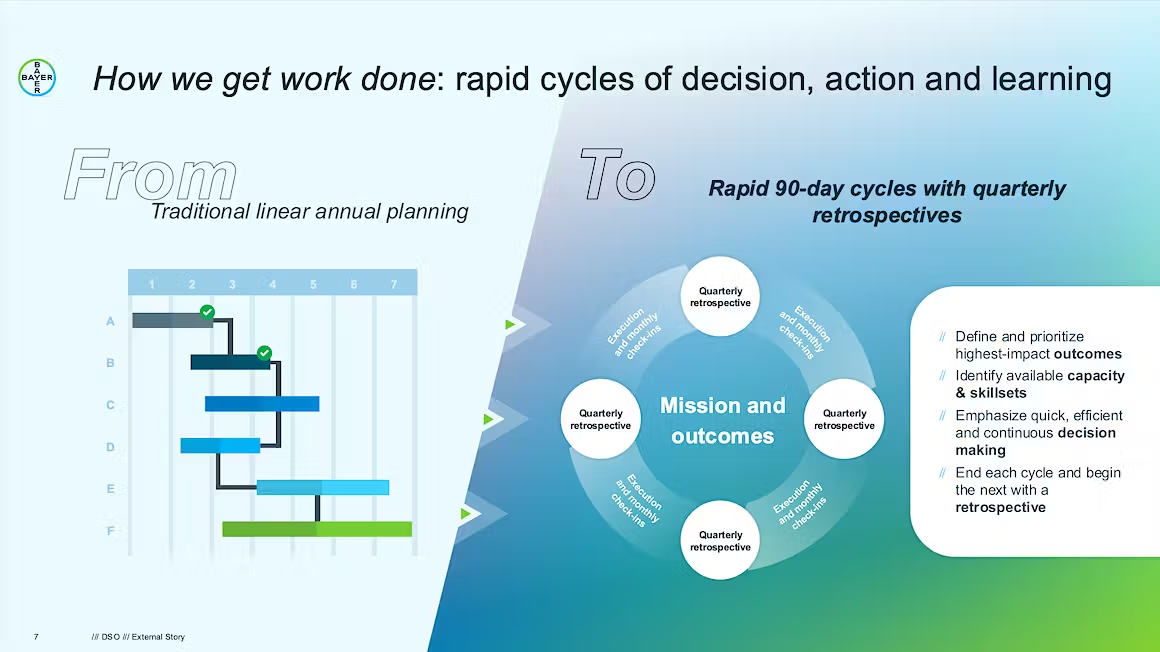

4. Work agility

Agility refers to the ability of an organisation to rapidly adapt to market changes. Anticipating change with more foresight, responding to change with speed. This concept is supported by various academic models:

- The Dynamic Capabilities Framework (Teece, Pisano, and Shuen, 1997) emphasizes the importance of an organization’s ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments.

- The Lean Startup Methodology (Ries, 2011) advocates for a build-measure-learn approach, emphasizing continuous innovation and customer feedback loops.

Amazon’s ability to constantly innovate and adapt to market changes is a testament to its agility. By fostering a culture that encourages experimentation and rapid iteration, Amazon has successfully entered and dominated multiple markets, from e-commerce to cloud computing.

5. Fast teaming

Agile methodologies, originally developed for software development, can be applied across the organisation to enhance responsiveness and collaboration. But the real point is teams – small, fast, cross-functional, experimental teams:

- Iterative Development: Breaking projects into small, manageable iterations.

- Cross-Functional Teams: Encouraging collaboration among employees with diverse skill sets.

- Continuous Feedback: Regularly soliciting feedback to make improvements.

Spotify uses the “Spotify Model,” a framework that emphasizes squad autonomy, tribes, and chapters. This approach enables Spotify to innovate rapidly and respond to market changes efficiently.

6. Flat structure

An organization’s structure significantly impacts its ability to be agile and entrepreneurial. Consider the following strategies:

- Flat org: Reducing layers of management to speed up decision-making.

- Fluid work: Forming small, cross-functional teams focused on specific projects.

- Work together: Promoting open communication and collaboration across departments.

Zappos adopted a holacracy, a decentralized management system that replaces traditional hierarchies with self-organizing teams. This approach has empowered employees and fostered a more agile and innovative culture.

7. Growth mindset

Successfully navigating fast-changing markets requires effective change management. This involves:

- Communicating Vision and Strategy: Clearly articulating the organization’s vision and strategy to all employees.

- Engaging Employees: Involving employees in the change process to gain their buy-in and commitment.

- Providing Training and Support: Offering training and resources to help employees adapt to new ways of working.

Under CEO Satya Nadella’s leadership, Microsoft underwent a significant cultural transformation. By fostering a growth mindset, emphasizing collaboration, and embracing change, Microsoft revitalized its innovation capabilities and market position.

8. Ecosystem building

Collaborating with external partners can enhance an organization’s agility and entrepreneurial capabilities. Strategic partnerships and ecosystem building can provide access to new technologies, markets, and expertise.

- Partners: Let go of the all mindset that you need to own or do everything yourself.

- Open Innovation: Collaborating with external partners to drive innovation.

- Ecosystem Building: Creating a network of partners to co-create value, win-win.

Apple’s success is partly due to its extensive ecosystem of partners, including app developers, hardware suppliers, and service providers. This ecosystem enables Apple to innovate continuously and deliver integrated solutions.

9. Inspiring leadership

Effective leadership is crucial for building a faster and more entrepreneurial organization. Leaders should:

- Inspire and Motivate: Articulate a compelling vision that inspires and motivates employees.

- Lead by Example: Demonstrate the desired behaviors and values.

- Encourage Risk-Taking: Support employees in taking calculated risks and experimenting with new ideas.

Elon Musk’s visionary leadership has been instrumental in Tesla’s success. By setting ambitious goals and fostering a culture of innovation, Musk has driven Tesla to become a leader in electric vehicles and renewable energy.

10. Energising progress

Investing in employee learning and development is essential for fostering an entrepreneurial culture and staying competitive in fast-changing markets. Key strategies include:

- Continuous Learning: Encouraging employees to continuously acquire new skills and knowledge.

- Mentorship Programs: Pairing employees with mentors to provide guidance and support.

- Innovation Training: Offering training programs focused on creativity, problem-solving, and innovation.

Adobe’s “Kickbox” program provides employees with a toolkit for innovation, including a prepaid credit card to fund their projects. This program encourages employees to experiment and develop new ideas, fostering a culture of innovation.

Building a faster, more entrepreneurial organization to succeed in fast-changing markets requires a comprehensive and multifaceted approach. By embracing agility, fostering an entrepreneurial culture, leveraging technology, implementing agile methodologies, enhancing organizational structure, embracing change management, forming strategic partnerships, providing effective leadership, investing in learning and development, and prioritizing customer-centricity, business leaders can position their organizations for long-term success.

Incorporating lessons from academic models and successful companies, these strategies can help you navigate the complexities of today’s markets and drive sustainable growth. Remember, the journey towards building an agile and entrepreneurial organization is ongoing, requiring continuous learning, adaptation, and innovation.

China is becoming the world’s leading technological innovator, and now dominates industries from clean energy to electric mobility. It outspends every other nation on R&D, and files around 70% of the world’s patents, including 60% of those for AI. It makes 65% of the world’s EVs (almost all for domestic sales), and 74% of the world’s lithium batteries.

Over the last decade, companies like Alibaba and Tencent opened the world’s eyes to the scale of Chinese companies, and their potential domestic markets. Yet Chinese products were initially seen as low-cost copycats.

Now a new generation of companies are leading in quality and innovation too. Companies like BYD and Nio, Longi and CATL, are now seen as global leaders in electric mobility and clean energy. Shein and Temu have disrupted the world with ultra fast fashion. Bytedance is the parent company of TikTok, that drives the social lives of GenZ around the world.

Beyond tech, Kweichou Moutei, for example, is now the world’s most valuable drinks company, illustrating the rise of the world’s largest consumer market, now with discerning tastes and money to spend.

- Alibaba: from Jack Ma to connecting the world’s businesses

- BYD: Build Your Dreams, the world’s leading EV company

- Bytedance: Zhang Yimin and the rise of social media giant TikTok

- Haier: rendanheyi, the concept behind the world’s home appliances leader

- Huawei: building an intelligent world, through devices and networks

- Kweichou: the world’s most valuable drinks company

- Nio: building a luxury car brand beyond cars, for a joyful lifestyle

- Oppo making tech friendly with smiley faces and human touch

- Shein: the rise of the world’s ultra fast fashion platforms, Shein and Temu

- Xiaomi: Lei Jun’s tech innovator from MiPhones to the SU7

China’s economy may appear to faltered in recent years, China has made substantial strides in revitalizing its economy in recent years, particularly through the promotion and development of high-tech industries and clean energy sectors. These emerging fields are central to the nation’s economic transformation, as China aims to shift from being the world’s factory to a global leader in innovation, technology, and sustainability.

Through a combination of state-driven policies, significant investments in research and development, and an increasingly dynamic private sector, China is laying the groundwork for a more sustainable, high-tech economy that will shape the future of global business.

A new generation of Chinese companies has been at the forefront of this transition. These firms are excelling in fields such as artificial intelligence (AI), electric vehicles (EVs), renewable energy technologies, and semiconductors. Their rapid growth and ability to innovate are challenging established players from Silicon Valley, Europe, and other advanced economies. Not only are these companies transforming China’s economic landscape, but they are also positioning the country as a dominant player in the global business environment.

Electric Vehicles: Leading the Charge

The electric vehicle (EV) sector is one of the most prominent examples of China’s economic revitalization. Companies such as BYD, Nio, and XPeng Motors have emerged as global leaders in EV technology, surpassing their Western counterparts in several key areas.

- BYD: Founded in 1995, BYD (Build Your Dreams) has evolved from a battery maker into one of the world’s largest manufacturers of electric vehicles and batteries. With its vertical integration model, BYD controls key elements of its supply chain, including the production of batteries, electric drivetrains, and vehicle assembly. In 2023, BYD became the world’s largest EV maker, surpassing Tesla in sales volume for the first time. The company is also a leader in battery technology, particularly in its development of iron-phosphate batteries, which offer advantages in safety, cost, and performance over traditional lithium-ion batteries.

- Nio: Nio is another key player that has taken the global EV market by storm. The company is known for its premium electric SUVs and sedans and has focused heavily on the user experience, offering features like swappable batteries, which allow drivers to replace a depleted battery with a fully charged one in minutes at dedicated stations. NIO’s focus on autonomous driving technology and its cutting-edge AI-powered in-car systems have given it a significant edge in the growing premium EV market.

- XPeng Motors: XPeng is a major competitor in China’s EV market, known for its smart EVs that emphasize AI, autonomous driving, and connectivity. The company’s focus on software integration, including its proprietary XPILOT autonomous driving system, allows its vehicles to offer a level of automation and intelligence on par with Tesla’s Autopilot. In addition, XPeng’s aggressive push into international markets—starting with Europe—shows its ambition to become a global leader in EV technology.

These companies benefit from favorable government policies, including subsidies for EV purchases and investments in charging infrastructure. Moreover, they are poised to dominate the global EV market as the world transitions toward sustainable transportation.

Clean Energy: A Green Revolution

China is also making major strides in renewable energy, particularly solar and wind power. The country has become the world’s largest producer of solar panels and is rapidly expanding its wind and hydropower capacity. In addition, China is investing heavily in energy storage technology to support the transition to a clean energy future.

- LONGi Green Energy: As the world’s largest manufacturer of solar panels, LONGi Green Energy is a key player in China’s renewable energy push. The company is a global leader in the production of high-efficiency monocrystalline silicon solar cells and modules. LONGi’s commitment to research and development has allowed it to stay ahead of competitors by continuously improving the efficiency and cost-effectiveness of its solar products. The company has also been expanding its global footprint, with operations in markets such as India, the U.S., and Europe.

- Goldwind: Another notable company is Goldwind, one of the world’s largest manufacturers of wind turbines. Goldwind has a significant presence in both domestic and international wind energy markets. Its technological innovations, such as advanced turbine designs and smart wind power solutions, have enabled the company to lower the cost of wind energy generation and improve efficiency. With growing demand for clean energy, Goldwind is well-positioned to continue its leadership in the global wind power market.

- CATL (Contemporary Amperex Technology Co. Limited): China’s dominance in clean energy extends beyond generation to storage solutions. CATL is a world leader in lithium-ion batteries and energy storage systems. The company supplies batteries for electric vehicles and renewable energy projects, including solar and wind farms, ensuring that clean energy can be efficiently stored and utilized. CATL’s cutting-edge battery technology, including its development of solid-state batteries, positions it at the forefront of the clean energy revolution. As the global demand for energy storage solutions continues to grow, CATL’s role in shaping the future of energy is increasingly critical.

AI and Semiconductor Industry

In addition to clean energy, China is also prioritizing technological innovation in fields such as artificial intelligence (AI) and semiconductors, which are essential for the future of business. AI is transforming industries ranging from manufacturing to healthcare, and China’s leadership in AI development is powered by companies like Baidu, Tencent, and SenseTime.

- Baidu: Known as the “Google of China,” Baidu is a leader in AI research, particularly in natural language processing, autonomous driving, and machine learning. Baidu’s Apollo project is one of the world’s most advanced autonomous driving platforms, and its AI capabilities are now being integrated into a range of applications, from healthcare diagnostics to smart cities.

- Tencent: Tencent, primarily known for its social media and gaming platforms, is also making significant strides in AI and cloud computing. The company’s AI solutions are widely used in various sectors, including finance, e-commerce, and healthcare. Tencent is developing AI-driven platforms that optimize business processes, improve customer experiences, and create new revenue streams for enterprises.

- SenseTime: As one of the world’s leading AI startups, SenseTime focuses on computer vision and deep learning. Its technologies are used in areas such as facial recognition, security, and healthcare. The company’s AI-powered solutions have become integral to China’s smart city initiatives, enhancing public safety, traffic management, and urban planning.

Meanwhile, China’s semiconductor sector, led by companies like SMIC (Semiconductor Manufacturing International Corporation), is also gaining ground. Although still behind global leaders like TSMC and Intel, China’s semiconductor industry is growing rapidly as the country works to reduce its dependence on foreign chipmakers.

Global Impact and Future Outlook

China’s high-tech and clean energy companies are not only revitalizing the domestic economy but also reshaping global industries. By producing cutting-edge products, driving down costs, and investing in next-generation technologies, these companies are setting the stage for a future where China plays a central role in the global economy.

The government’s “Made in China 2025” initiative and its commitment to “green development” are key factors in this transformation. Through state-led investments in infrastructure, education, and R&D, China has created an environment where innovation can thrive. Moreover, the nation’s commitment to achieving carbon neutrality by 2060, coupled with substantial investments in renewable energy and green technologies, positions China to lead the global transition to a low-carbon future.

As these companies continue to scale and innovate, they will likely shape the future of business, not just in China, but globally. They are setting the standard for the next generation of high-tech industries and clean energy solutions, driving both economic growth and sustainable development. The rise of these companies represents a paradigm shift in global business, one that favors technological prowess, environmental sustainability, and digital transformation—key factors that will define the future of the global economy.

Rapidly shifting consumer behaviour and rampant technological revolution are causing a transformation in marketing. How you market has become as significant as what you say, and what you sell.

The new future of marketing

AI is a transformative force in marketing. But not the only one.

From predictive analytics to accelerated innovation, automated processes and hyper personalised communication, ambient intelligence and enhanced experiences, AI rightly drives the thinking of every CMO. Agenic AI, where the AI operates autonomously, will accelerate rapidly, harvesting immense data and iterative knowledge.

Digital, and particularly social, platforms are transforming influence and trust, loyalty and reputation. Who do we trust in this crazy world? Who influences us most? The answer is changing rapidly. Not companies, and increasingly not those so-called influencers either.

Tech will proliferate. From voice-activated devices that now rival SEO, like Alexa and Siri, through to visual search tool, like Lens. AR/VR will blur physical and digital as people seek to immerse themselves physically in a virtual world, although the metaverse-hyped vision is not what it was. Other tech, like blockchain brings transparency and security, speed and ease, making experiences more decentralised and local.

Forget the ad campaign

All of this in real time. Forget the old ideas of planning campaigns for the year ahead, usually more for the convenience of driving sales than satisfying consumers. Forget the old ideas of competitive differentiation as king, distinguishing between different consumers matters much more. Stop trying to do the old things, that don’t work anymore.

Too many marketers are still obsessed with ads. Worldwide ad spending grew nearly 10% in 2024, for a total of $992 billion.

Firstly, marketing is about much more than ads, particularly in a world where retention and growth typically matter more than acquisition. Second people just dont see the ads like before. GenZ dont even own a TV, they watch movies on Netflix and get their news from TikTok. And GenY have time shifted away from terrestrial ad-driven TV, to on-demand viewing.

Live streaming and realtime ads, dynamic pricing, and instant gratification. Intelligent and automated. ChatGPT and Claude. Perhaps Google. But also beyond the sale, rethinking how to support how products are used, performance enhanced, collaboration enabled, impact amplified.

- Next is Now: The future, unfolding right now

- Megatrends: Riding the superhighways to the future

- Lead the future: Leading with curiosity, creativity and courage

- Most Contagious 2024: Great recap of the best recent marketing

- Cannes Lions Winners 2024: Insights from the leading campaigns

- A to Z Trend Kaleidoscope 2025: making sense of the 25 best trend reports

While it would be easy to assume marketing is all about analytics and AI algorithms, digital and social platforms, it’s ultimately about customers – consumers, clients – real people, human beings with emotions and aspirations. The challenge for marketers – in today’s highly complex and competitive, changing and uncertain markets – is how to embrace the tech capabilities to engage and influence people in relevant and meaningful ways.

Same rules, new tools

Time to think differently. But as always, marketing starts with consumers. Real people.

It’s easy to run away with the shiny new tech, and the new business models and experiences that tech enables. Marketing is still about human beings, attitudes and emotions, hopes and fears, dreams and aspirations, experiences and impacts.

As the tech accelerates, the best brands will become more consumer centric, rather than obsessed with tech, or even with the old idea of being the descriptor of companies and products.

Brands and consumers will become more collaborative, marketing more two-way, more symbiotic. And as people trust each other more than any organisation, collaboration between consumers will drive brands. Communal, tribal, enabling people to achieve more. And also authentic, responsible, and with more impact. Think Strava not Nike. Think Vinted not H&M.

Consumers, of course, are facing many external stresses – from financial pressures to environmental crisis, the changing global political landscape and economic and future uncertainty. As a result, they are choosing to take more control of their lives, reconsidering priorities and aspirations, who they trust and believe, and they are evaluating brands more carefully. Brands themselves are responding, recognising that they need to be more, do more, and enable more.

Theme 1: Brands with trusted intelligence … digital and data, AI with authenticity

AI already plays a major role in most marketing strategies. According to Statista, the market value of AI, which was $93.53 billion in 2021 is expected to hit $190.61 billion in 2025. AI-powered tools like ChatGPT and Claude will continue to enable hyper-personalisation at scale, allowing marketers to tailor content, product recommendations, and customer experiences with unprecedented accuracy. Machine learning algorithms will analyze vast amounts of data to predict consumer behavior, optimize ad spending, and automate complex marketing tasks. This AI-first approach will not only improve efficiency but also enhance creativity, as AI assistants and tools help marketers generate ideas and content that resonate with their target audiences.

Yet as tech intensifies, and AI multiplies, reshaping our everyday lives ever more profoundly, people question what and who they trust, and seek new balances in how they live physically in a digital world.

Consumers want to break free from the monotony of over-programmed lives. The ability of an algorithm to curate personalised content was once its most distinctive feature. Now, its ubiquity contributes to a feeling of soulless, bland content. The advancement of AI further contributes to this, with much AI- generated content lacking in originality and producing oddly similar outputs.

Theme 2: Brands as consumer curators … social and personal, content and influence

More than 5 billion people worldwide currently use social media, around 65% of the global population.

The power of authentic, user-generated content can’t be understated. Coca Cola, that icon of marketing practice, said themselves that brand building, and marketing communications as an enabler, was no longer about what they said themselves, but what consumers said about them to each other. The brand’s role becomes that of curator, and communication becomes liquid and linked, helping consumers connect messages and content.

As consumers continue to value peer recommendations over traditional advertising, brands will increasingly rely on UGC to build trust and engagement. With the help of advanced AI tools, marketers will be able to identify and curate the most impactful user-created content across various platforms. With this, more brands will likely develop new strategies to encourage and incentivise high-quality UGC, turning their customers into active brand ambassadors.

Online influencers have reshaped consumer habits, but their growth is slowing, increasingly seen as less real and less trusted. Instead people trust their friends, people most like them. Word of mouth on social media platforms boosting sales for businesses.