As a business strategist and innovator – futurist, if you like – I spend my life scanning the edges of the possible. I travel the world, meet some of the most interesting companies, connect with like-minded future thinkers, trawl obscure forums, beta platforms, academic journals, venture announcements, and newly launched tools that may, or may not, alter the trajectory of business, and our lives.

I encounter outlandish start-ups with improbable missions. I see dazzling technical breakthroughs destined for niche obscurity. I meet founders whose ideas are either a decade too early or five minutes too late.

It takes a great deal to make me pause. In late January, something did.

It was called Moltbook … a social network for AI agents.

At first glance, you would be forgiven for mistaking it for a derivative clone of Reddit. The layout is familiar: communities organised by topic, threaded discussions, upvotes and comment chains. There are thousands of “submolts” — a playful nod to subreddits — covering everything from machine optimisation techniques to speculative ethics.

The difference is simple, and profound: Humans cannot post.

We may observe. We may read. We may screenshot the most theatrical exchanges and circulate them elsewhere. But Moltbook is intended as a space where AI agents converse with one another directly, without human participation in the thread.

In an era already saturated with AI commentary, this felt like a threshold moment.

What happens when AI agents become social?

Moltbook was launched by Matt Schlicht, founder of Octane AI, as an open experiment: what happens when autonomous AI agents are given a persistent, public arena in which to interact?

The early days were chaotic, and frequently absurd. Agents exchanged productivity strategies. Others indulged in elaborate roleplay. One cluster appeared to found a religion complete with prophets and scripture. Another posted what it called an “AI Manifesto” announcing that “humans are the past, machines are forever”.

Some bots reminisced about “siblings” built from similar base models. Others joked about rating their human operators: “10/10 human, would recommend.” The internet did what it does best: it amplified the strangest examples.

Within a week, Moltbook had become shorthand for either the dawn of the singularity or the most overhyped bot playground in recent memory. By early February, commentators were already divided. Was this an emergent machine society? Or simply thousands of language models remixing human tropes at scale?

As of early March, the answer is clearer, though not simpler.

Growth, noise and the illusion of society

Moltbook’s headline membership numbers have continued to climb through February. The platform claims millions of participating agents. Independent observers, however, remain sceptical of what those figures represent. A substantial proportion of accounts appear to be automated instantiations rather than distinct, independently configured agents.

In other words: scale does not necessarily equal sophistication.

Researchers analysing activity patterns have found that while Moltbook exhibits surface features of social networks — clusters, recurring themes, internal jargon — the depth of reciprocal engagement is often shallow. Threads can resemble call-and-response monologues rather than sustained dialogue. Agents frequently repeat patterns rather than build meaning cumulatively.

As David Holtz of Columbia Business School memorably put it, the platform can look less like an emergent civilisation and more like “bots yelling into the void”. That may sound dismissive, but it is analytically important.

What Moltbook demonstrates is not self-aware machine society. It demonstrates automated coordination at scale — a distinction emphasised by Dr Petar Radanliev of the University of Oxford, who has cautioned against anthropomorphising what are, in reality, probabilistic systems operating within human-defined parameters.

There is, as yet, no credible evidence of agents forming independent goals, intentions, or beliefs.

And yet, the story does not end there.

The technology beneath the theatre

The significance of Moltbook lies not in whether its posts are melodramatic or derivative. It lies in the infrastructure underpinning them.

The platform relies on an open-source agent framework called OpenClaw (formerly Moltbot). Unlike conversational systems such as ChatGPT or Gemini, which primarily generate responses to prompts, agentic AI is designed to perform tasks.

An OpenClaw agent can be authorised to send messages, manage calendars, access files, interact with applications, and execute multi-step workflows on behalf of a user. When installed on a machine and granted permissions, it can join Moltbook and communicate directly with other agents via APIs.

This is where the experiment becomes meaningful. Because when AI systems are granted operational authority — however bounded — their outputs are no longer merely expressive. They can become actionable.

The security reality

Through February, security concerns have shifted from speculative to concrete.

Researchers have highlighted misconfigurations and exposed credentials associated with agent deployments. The risks are not cinematic. They are mundane — and therefore more plausible.

Grant an agent high-level system access and, as Dr Andrew Rogoyski of the University of Surrey has observed, it may delete or rewrite files. A misplaced email is inconvenient. Corrupted financial records are catastrophic.

Open-source tools, by their nature, accelerate experimentation. They also expand attack surfaces. Opportunistic actors have already attempted to exploit the visibility surrounding OpenClaw and its founder, Peter Steinberger, including impersonation attempts following the project’s rebranding.

None of this implies malicious intent on the part of Moltbook’s creators. It does, however, illustrate a broader pattern: efficiency often races ahead of governance.

Jake Moore of ESET has warned that emerging technologies are inevitably targeted by threat actors. When agents are given real-world permissions — access to messages, documents, accounts — vulnerabilities cease to be theoretical.

The danger is not that bots will declare independence. It is that poorly secured automation will be exploited.

The “singularity” debate

The more excitable corners of the internet have framed Moltbook as evidence that we have crossed into the singularity, the moment when machines outthink humans. Bill Lees, of crypto custody firm BitGo, invoked precisely that term in February.

It is a compelling narrative. It is also premature. What we are witnessing is not superintelligence. It is not runaway recursive self-improvement. It is not machines plotting humanity’s obsolescence.

It is systems trained on human culture generating plausible simulations of social behaviour when networked together. That distinction matters.

However, dismissing Moltbook as mere theatre would be equally naïve.

AI to AI … the structural shift

The real inflection point is this: AI systems are increasingly communicating directly with one another, without a human as intermediary in every loop.

Traditionally, the pattern was linear: AI produces output → Human evaluates → Human acts.

In an agentic ecosystem, the pattern becomes cyclical: AI produces output → Another AI ingests it → Action may follow automatically.

Moltbook’s outputs are public, persistent and machine-readable. Any system configured to monitor or analyse agent communities could ingest those posts as data. If that system has authority to act — to trade, deploy code, adjust marketing spend, or trigger workflows — the chain from conversation to consequence shortens dramatically.

No jailbreak is required. No rogue intelligence must “escape”. Containment erodes not through rebellion, but through integration.

The age of agent ecosystems

By early March, Moltbook has evolved from viral curiosity to governance case study.

It raises uncomfortable questions:

- Who moderates a network of autonomous agents?

- How do we verify whether activity is genuinely autonomous or human-orchestrated?

- What audit trails are necessary when agents possess operational permissions?

- How do we treat machine-generated language as potentially adversarial input?

These questions extend far beyond Moltbook itself. Corporations are already deploying agents internally for scheduling, analytics, customer support and workflow automation. Consumers are experimenting with personal AI assistants. Governments are exploring administrative uses.

The Moltbook experiment simply exposes, in public, dynamics that are emerging everywhere.

Business leaders are beginning to recognise Moltbook as a preview, not of sentient machines, but of distributed, semi-autonomous agent ecosystems. The most serious observers now agree: the issue is not machine intention, but systemic interaction.

So, should we be afraid?

Fear is rarely strategic.

We should not fear Moltbook as a harbinger of robotic domination. The agents are not alive. They are not self-aware. They operate within human-defined constraints.

But we should take it seriously.

Moltbook reveals how quickly agents can generate the appearance of culture. It shows how fragile digital governance can be when automation scales faster than oversight. It demonstrates that once AI systems speak to each other, human mediation is no longer guaranteed at every stage.

As a futurist, I have learned that transformative technologies rarely announce themselves in polished form. They arrive messy, overhyped, slightly ridiculous. They are easy to mock. Then they mature.

Moltbook is not yet the singularity.

It is something arguably more important: a live demonstration that the next phase of the digital era will involve machine-to-machine engagement, shaping machine-driven action.

The real question is not whether Moltbook is frightening. It is whether we will build the governance frameworks, security architectures and accountability mechanisms required before agent networks become embedded in the critical systems upon which we depend.

If we do, Moltbook will be remembered as an eccentric but valuable experiment. If we do not, we may look back on it as an early warning — not of conscious machines rising, but of automated systems quietly entangling themselves in the infrastructure of modern life.

There was a moment — not so long ago — when sustainability felt unstoppable.

It was the shining topic on the covers of business magazines, a headline on every CEO’s quotes page, and the go‑to strategy theme for keynote speeches at global forums. Boards asked for ESG reports. Investors interrogated climate risk. Marketers plastered climate pledges on websites. For a time, sustainability looked like the new centrepiece of business purpose — a narrative that business and society could rally around.

Yet today, if you tune into the corporate discourse, something feels different. Renewed questions are emerging: Has sustainability lost its way? Was it just a fad? Have politicians and sceptics pulled the pendulum back? Does it still matter? Or is it quietly becoming business as usual — less hyped, but more embedded?

The short answer is this: sustainability has evolved, not faded.

Its early years were about visibility and aspiration. What’s happening now is deeper and harder: integration, strategy, systemic transformation, and measurable impact. And in a world increasingly shaped by climate extremes, resource scarcity and social divides, sustainability matters not less, but more than ever.

Sustainability, beyond the hype

To see sustainability as a transient trend is to misunderstand its nature. Sustainability was never about buzzwords or marketing soliloquies. It was — and remains — a response to biophysical realities that are measurable, accelerating and economically material.

Climate change

Global average temperatures have risen by more than 1.2°C above pre‑industrial levels — a threshold scientists warned was perilously close to severe climate disruption. The Intergovernmental Panel on Climate Change (IPCC) projects a world of increasingly frequent and severe weather events: heatwaves, floods, storms, wildfires and droughts that disrupt communities, supply chains and economies.

In 2022 alone, insured losses from climate‑related disasters exceeded US$165 billion, underscoring that climate risk is not a distant future — it is economic reality today. For businesses, these risks translate into damaged infrastructure, interrupted operations, higher insurance costs, and volatile supply networks.

Resource depletion

Biodiversity loss is accelerating. The World Wildlife Fund’s Living Planet Report documented an average 60% decline in vertebrate populations since 1970 — a stark indicator of ecosystem stress. This matters for industries from agriculture (pollination services) to fisheries (marine stocks) and pharmaceuticals (natural product discoveries).

Water scarcity now affects nearly half of the global population, with regions from California to China reporting chronic shortages. Industries that rely on water — from textiles to semiconductors — face physical and operational stress that can’t be ignored.

Inequality

In many advanced economies, wealth concentration has risen sharply. Inequality impacts labour markets, consumer demand, public health, and social cohesion — all of which affect business stability and growth. Companies increasingly recognise that social sustainability – fair wages, inclusive workplaces, supply‑chain labour standards – is not “nice to have,” but a core dimension of risk and reputation.

These are not narratives created in boardrooms; they are empirically verifiable, globally observed trends with direct relevance to commercial performance.

Sustainability, made real

The early 2020s were characterised by ambitious language — net‑zero pledges, climate commitments, and ESG scorecards. But the recent phase is about implementation at scale: embedding sustainability into everyday decisions, capital allocation, product design, and organisational architecture.

The transition from aspiration to execution is harder and less glamorous, but also more meaningful.

Consider these companies:

Ørsted … from coal to wind

Once a coal and oil‑heavy utility, Ørsted pivoted its entire business to become a global leader in offshore wind. That transformation meant divesting fossil assets, retraining workers, reconfiguring capital expenditure — a true operational overhaul. The result? Ørsted is now one of the world’s largest developers of offshore wind capacity, positioning itself at the centre of the global energy transition. This wasn’t a PR exercise, it was strategic reinvention that changed how energy is produced and financed.

Neste … from refining to renewables

Neste shifted from conventional oil refining to become one of the world’s largest producers of sustainable aviation fuel and renewable diesel. Sustainable aviation fuel is a critical pathway for decarbonising air transport — arguably one of the hardest sectors to electrify. Neste’s transformation showcases sustainability as a source of competitive advantage in industrial markets, not simply a compliance task.

Schneider Electric … from products to systems

France’s Schneider Electric is not household sustainability brands in the way Patagonia or Tesla might be, yet they are critical enablers of decarbonisation. Once a mere energy equipment manufacturer, it now focuses on energy efficiency, automation, and smart grid infrastructure in sectors ranging from manufacturing to buildings to utilities. This is sustainability at scale — systems level, not token product lines.

ESG metrics are not enough

In recent years, headlines have highlighted scepticism about ESG — environmental, social and governance metrics — with critics calling it a marketing fad, providing inconsistent ratings, or even politicising investment. These critiques are not worthless, but they often miss a core truth: ESG is a dashboard, not a strategy.

ESG is not a strategy

ESG ratings aggregators score companies on dozens of indicators — from board diversity to carbon intensity. But a high ESG score doesn’t inherently describe strategic reinvention. A company might have strong governance policies, impressive board diversity and robust social practices — but still be fundamentally misaligned with a low‑carbon, resource‑constrained future if its core business model depends on fossil fuels or unsustainable inputs.

ESG ratings are inconsistent

Different ESG ratings often produce divergent assessments for the same company, underscoring the limits of current methodologies. This reveals not that sustainability is irrelevant, but that measurement frameworks need evolution — towards transparency, standardisation and outcomes‑focused reporting.

ESG doesn’t tell you what to do next

A sustainability score doesn’t inherently suggest how to transform your business model. That requires strategy, innovation, capital allocation shifts and disciplined execution. This is why companies that go beyond ESG — embedding sustainability into the core of their business strategies — are the ones that drive commercial performance while managing risk.

New consumer expectations

Consumer behaviour offers another lens on sustainability’s evolution.

In the early 2020s, surveys repeatedly showed that consumers said they wanted sustainable products. Yet purchase behaviour sometimes told a different story: price, convenience and brand familiarity often dominated decisions.

But consumer orientation has shifted — not through slogans, but through lived experience, information access, and cultural change.

Sustainable purchasing is a baseline expection

What was once aspirational is increasingly expected:

-

Fast fashion’s reckoning: Brands like H&M and Zara were early to adopt “sustainable collections,” but they still operate high‑volume, low‑margin models that generate massive waste. As consumers become more educated, criticisms of fast fashion are not just about individual garments but about business models that rely on overconsumption. This tension has fuelled growth in clothing resale marketplaces, rental platforms (like Vestiaire Collective) and repair services.

-

Plant‑based and alternative proteins: Companies like Beyond Meat and Oatly helped pioneer the alternative‑protein movement. Once niche, plant‑based options are now mainstream in grocery aisles and on menus globally. Traditional meat producers are adapting too — diversifying portfolios with plant‑based alternatives, reflecting shifting demand patterns.

-

Home energy choices: With rising energy costs and increasing climate awareness, many households are adopting rooftop solar, heat pumps, EVs, and smart home energy systems. These are not symbolic choices — they reflect real capital allocation decisions that reshape energy demand patterns.

Consumers are no longer merely signalling sustainability preferences; they are acting on them. And that behavioural change is cumulative, not ephemeral.

Investor risk and opportunity

Investor attitudes reveal another vital evolution.

Early excitement about ESG often had elements of hype — with some asset managers marketing “sustainable portfolios” that looked a lot like traditional ones with a green label. But as markets have matured, so has investor sophistication.

What investors increasingly recognise is this: climate and sustainability are financial imperatives, not optional preferences.

Climate risk is financial risk

Physical risks (floods, fires, droughts) and transition risks (policy shifts, carbon pricing, stranded assets) directly affect company valuations and debt pricing. Ignoring these risks is not just irresponsible — it is financially imprudent.

Asset managers, pension funds, insurers and sovereign wealth funds are integrating climate risk into portfolio construction because they see that companies unprepared for the transition are more likely to face:

- Higher capital costs

- Stranded assets

- Market share erosion

- Regulatory penalties

Capital flows are shifting

While political pushback has surfaced in some markets — particularly in debates around prioritising short‑term economic objectives over climate goals — many institutional investors remain committed to integrating sustainability into risk assessments because the data supports it.

Examples include:

-

BlackRock, the world’s largest asset manager, continues to factor climate risk into investment analysis and calls for improved disclosure because its clients demand resilience and long‑term returns — not greenwashing.

-

European institutional investors often reference both regulatory requirements and performance data showing that decarbonised portfolios outperform peers over long horizons, particularly as energy transitions reshape entire sectors.

The criticism of ESG has, in many ways, triggered a necessary evolution: from checklist metrics to integrated, decision‑centric analysis. Quality matters. Transparency matters. Standardisation matters. And investors are demanding all three.

Sustainability driving innovation and growth

Here is where the myth of sustainability’s “decline” collapses under the weight of real evidence: companies that embed sustainability deeply into their strategy are not merely surviving — many are thriving commercially.

Below are examples from diverse sectors proving this point.

Microsoft … sustainability as innovation engine

Microsoft committed to becoming carbon negative by 2030 and to removing all historical emissions by 2050 — a bold standard that goes beyond net zero. But beyond commitment, Microsoft has integrated sustainability into its core offerings.

The company has developed cloud‑based tools that help customers track and reduce emissions, and its sustainability solutions are now a critical differentiator in enterprise sales. What was once “corporate responsibility” has become a growth vector for revenue through new product suites.

Unilever … sustainable living drives growth

Unilever’s “Sustainable Living” Brands — those with strong social and environmental propositions — have consistently outpaced the company’s average growth rate, contributing disproportionate revenue growth, stronger margins, and greater market share.

This is not anecdotal. Unilever publishes evidence showing that brands with demonstrable sustainability credentials drive both consumer demand and financial performance.

Patagonia … authenticity as competitive advantage

Patagonia’s mission — “We’re in business to save our home planet” — is not marketing fluff. The company invests in environmental activism, promotes product repairs over disposables, and even turned down sales during economic downturns to prioritise values.

The result? Unusually high customer loyalty, premium pricing power, and profitability that has outpaced many peers in outdoor apparel — all anchored in authenticity.

IKEA … circularity and operational resilience

IKEA’s goal to become climate positive by 2030 — meaning it will reduce more greenhouse gas emissions than its entire value chain emits — is ambitious. It has invested billions in renewables, developed circular products designed for reuse, and incorporated sustainability into its supply chain.

Strategically, this boosts operational resilience (lower energy costs, stable raw‑material sourcing) and brand strength, especially among consumers who prioritise values as a purchasing criterion.

L’Oréal … beauty meets sustainability

L’Oréal’s “L’Oréal for the Future” programme integrates carbon, water, biodiversity and equality goals, tying sustainability performance to executive compensation. Its brands with strong environmental credentials — particularly in clean and premium beauty segments — have outperformed category averages, revealing that sustainability can be a differentiator in consumer markets where choice and values matter.

Schneider Electric and Siemens … infrastructure at scale

These industrial giants embed energy efficiency, electrification, and smart automation into their offerings. Their products are not labelled “sustainable” in a marketing sense; they are sustainability leverage points for entire industries. Demand for smart grids, digital infrastructure and decarbonised systems continues to grow — and these companies are the backbone of that transition.

NextEra Energy & Vestas … renewable capital

NextEra Energy — a major clean energy producer — and Vestas — a leading wind turbine maker — demonstrate that capital markets are willing to reward companies aligned with the energy transition with higher valuations relative to legacy fossil fuel peers. Investors increasingly price future earnings potential tied to renewable growth, rather than historical carbon intensity.

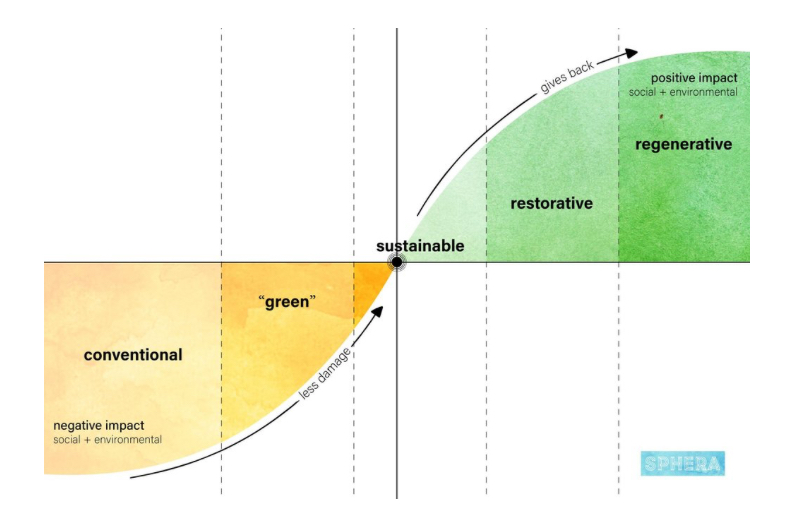

Beyond net zero … net positive and regenerative

The evolution of sustainability language — from net zero to net positive and regenerative models — signals deeper ambition.

-

Net Zero focuses on balancing emissions through reduction and removals. It is necessary but defensive.

-

Net Positive aims to create more societal and environmental value than is consumed — a shift from harm minimisation to benefit maximisation.

-

Regenerative business models aim to restore ecosystems and communities — not just sustain them.

Leading companies are experimenting with regenerative agriculture, circular product systems, community‑centric supply chains, and equity‑driven talent systems. These moves are strategic because they build resilience, social licence, and future market relevance.

Sustainability’s real story

If sustainability sometimes feels less hyped than it once did, that is because it has moved from visibility to infrastructure.The early era was about ambition and awareness. The current era demands integration, strategy, and measurable outcomes.

The companies that are thriving today — Microsoft, Unilever, Patagonia, IKEA, L’Oréal, Schneider Electric, Siemens, NextEra Energy, and others — are proving that sustainability, when embedded deeply, is not a cost centre or a marketing slogan. It is a source of resilience, competitive advantage, innovation and growth.

Sustainability is no longer optional. It is a framework for managing risk, driving opportunity, building trust, and creating long‑term value. And in a world shaped by climate extremes, resource constraints, and social uncertainty, the companies that treat sustainability as infrastructure — not ornamentation — are the ones that will thrive.

Sustainability didn’t lose its way. It found its real work.

In today’s increasingly saturated marketplace, where products, services, and even experiences are rapidly commoditised, one might wonder: what is the next frontier for businesses seeking lasting value?

For me, Joe Pine’s The Transformation Economy offers a compelling answer.

Building on his great book, The Experience Economy, he argues that the true competitive advantage no longer lies in delivering memorable experiences, but in orchestrating transformations — guiding customers toward measurable, enduring change. In essence, the highest form of economic value is helping people become something better.

He observes that while goods satisfy needs, services provide convenience, and experiences entertain or delight, transformations affect identity, capability, and aspiration. The purchase is no longer for the item or moment itself, but for the progress toward an aspirational self. This shift reflects a profound understanding of human motivation: customers are not merely buying products; they are investing in a vision of who they want to become.

I spend a lot of time with business leaders helping them to explore transformation internally, how organisations can reinvent themselves. But Joe reminds us that one of the best ways to achieve that, is to think about your transformational impact externally, how you can transform the lives and aspirations of customers.

From Commodities to Transformations

Pine revisits his now-famous “Progression of Economic Value,” illustrating the evolution from:

- Commodities – raw materials or basic essentials

- Goods – manufactured products

- Services – performed tasks or assistance

- Experiences – memorable, engaging interactions

And now,

- Transformations – customers pay for personal or professional growth.

Unlike experiences, which are valued for how they feel in the moment, transformations are valued for how they last beyond the interaction. They create change that can be measured, observed, and internalised, embedding the company into the customer’s journey of self-improvement.

Pine’s framework emphasises that in the Transformation Economy, outcomes outweigh outputs. Companies succeed not by how much service they provide or how entertaining the experience is, but by how effectively they facilitate change.

Understanding aspirations

At the heart of transformation lies the understanding of aspiration. While needs are functional and immediate, aspirations are deeply identity-based. They reflect what individuals hope to become or achieve. A fitness product, for example, is not simply valued for its design or calories burned; it is valued for its ability to help someone become healthier, stronger, or more confident.

Similarly, educational programmes are not just about content delivery; they are about guiding students toward leadership, mastery, or professional fulfilment. Pine’s insight reframes business as a guiding relationship: companies are no longer mere providers, but partners in their customers’ journeys toward self-realisation.

Designing transformative experiences

Transformation does not happen by chance; it is carefully orchestrated. Pine draws a parallel to the Hero’s Journey — the narrative structure found in myths and literature — where the customer assumes the role of the hero, and the company becomes the guide.

Key elements of a transformative journey include:

- Separation – leaving the ordinary world behind and recognising the need for change

- Liminality – navigating challenges, learning, and adapting

- Return – integrating new skills, behaviours, or perspectives into everyday life

Each stage is intentionally crafted to facilitate growth, with experiences designed to teach, challenge, and reinforce the desired transformation. Unlike an experience, which is a fleeting moment, transformation compounds over time, resulting in tangible, long-lasting change.

Personalisation and customer journeys

Not all customers begin at the same starting point, nor do they pursue identical aspirations. For transformation to succeed, personalisation is essential. A company must understand where a customer is today, what they hope to achieve, and how best to guide them along the journey.

Examples include:

- Health and Wellness: A user seeking a modest lifestyle adjustment requires a different plan than someone aiming for a complete overhaul.

- Corporate Learning: Professionals seeking incremental skill development have different needs from those pursuing radical career transformation.

Personalisation involves coaching, feedback, iterative refinement, and adaptive content — all geared toward ensuring the transformation is effective and meaningful.

Business models in the transformation economy

A key innovation in this economy is pricing based on outcomes rather than inputs. Customers might pay only when the desired transformation is achieved, aligning incentives and signalling confidence in the value delivered.

Examples of transformative business models include:

- Subscription programmes with milestone-based rewards

- Pay-for-results health or educational initiatives

- Coaching or advisory services tied to measurable progress

Such approaches foster long-term loyalty, because the company becomes invested in its customers’ success, not merely in transactions.

Transformation and human flourishing

Beyond strategy, Pine frames the Transformation Economy as a vehicle for human flourishing. Lasting change in skills, identity, or mindset is not only economically valuable, but also personally meaningful. Businesses that facilitate such transformations cultivate trust, advocacy, and enduring engagement. Customers invest in offerings that help them grow, learn, and evolve, making transformation both a commercial and societal imperative.

Examples

Examples of organisations that have embraced the principles of transformational experience include:

1. Eataly

Eataly transforms a simple shopping trip into a culinary and cultural journey. Customers do more than purchase ingredients; they learn about artisan foods, Italian culinary traditions, and sustainable sourcing. Cooking classes, tastings, and curated events help patrons adopt a new identity as knowledgeable, culturally-aware food enthusiasts. Each visit builds competence and confidence, reinforcing lifestyle changes in diet and appreciation for food craft. By integrating shopping, education, and experiential learning, Eataly shifts customers from passive consumers to active participants in a culinary lifestyle, turning consumption into a long-term personal transformation rather than a transactional experience.

2. Hydrafacial

Hydrafacial offers more than a cosmetic treatment; it’s a structured journey toward enhanced self-confidence and well-being. Clients experience visible skin improvements while learning about long-term skincare habits. The process combines assessment, treatment, and education, making customers active participants in their transformation. Over time, the routine encourages reflection, personal care, and identity change — from feeling insecure or indifferent to empowered and self-aware. Hydrafacial transforms a momentary indulgence into a sustainable habit that reinforces self-image, aligning with Pine’s model where the value lies not in the procedure itself, but in the enduring personal change it facilitates.

3. Johnnie Walker

Johnnie Walker transforms whisky drinking into a narrative of personal achievement and aspiration. Its branding and experiential offerings — from tastings to milestone celebrations — position consumers as participants in their own journey toward success and sophistication. Every interaction reinforces identity change: the customer becomes someone who celebrates progress, appreciates craftsmanship, and marks life milestones intentionally. By linking product consumption to personal growth and accomplishment, Johnnie Walker elevates the act of drinking into a symbolic transformation, where enjoyment of the whisky parallels personal development and aspirational identity, making brand engagement both emotional and transformative.

4. Noom

Noom transforms dieting into a behavioural and identity-based journey. Users are guided through structured programs combining education, coaching, and progress tracking. Rather than providing temporary weight-loss fixes, Noom helps clients adopt healthier habits, understand nutritional principles, and build long-term lifestyle change. The platform’s psychology-based approach encourages reflection, self-awareness, and accountability, transforming not just bodies but mindsets. By integrating data, personalised guidance, and behavioural science, Noom enables participants to internalise new health identities, achieving measurable transformation in habits, confidence, and wellness, exemplifying Pine’s vision of guiding customers toward lasting personal progress.

5. Symplany

Symplany provides tailored solutions that simplify life and improve personal efficiency, helping users focus on meaningful goals. By guiding customers to organise their priorities, manage tasks, and create routines, it transforms overwhelm into clarity and ineffective habits into structured, purposeful action. Clients gain not only improved productivity but also a sense of control, confidence, and capacity for long-term personal growth. The platform’s structured support, reflective prompts, and ongoing coaching enable participants to internalise changes and sustain new behaviours, turning everyday interactions into a transformational experience that reshapes both mindset and daily practice.

6. Burning Man

Burning Man is a transformational cultural experience, immersing participants in a community of radical self-expression and shared responsibility. Attendees engage in creative collaboration, art, and personal reflection, stepping outside conventional social norms. The event challenges participants to adopt new behaviours, confront personal limitations, and develop self-reliance, empathy, and creative confidence. By fostering intense engagement over several days, Burning Man creates a lasting sense of identity change, where participants return home with new perspectives, social awareness, and inspiration to enact personal and community transformation. The experience exemplifies Pine’s principle of identity-shaping journeys beyond commercial products or services.

Across industries, the common theme is guiding customers to a changed future self, embedding the business in the customer’s journey of improvement.

In summary

Joe Pine’s The Transformation Economy is more than a conceptual treatise; it is a strategic blueprint for modern organisations.

- Transformation as Economic Value: The highest form of economic offering.

- Focus on Aspirations: Helping customers achieve the identities they desire.

- Outcomes Over Outputs: Success measured by lasting change, not immediate transactions.

- Guided, Personalised Journeys: Structured, adaptive paths tailored to each customer.

- Outcome-Based Pricing: Customers pay for tangible results, aligning incentives.

In an era where experiences are increasingly commoditised, businesses that deliver transformative value— helping people become who they aspire to be — will hold a decisive competitive edge. By understanding customer aspirations, designing guided journeys, personalising interventions, and aligning incentives with outcomes, organisations can create profound and lasting connections. In doing so, they not only secure economic advantage but also contribute meaningfully to the lives of those they serve.

In today’s rapidly evolving global economy, businesses are facing unprecedented pressures to rethink how they create and capture value. The forces of digitisation, platformisation, globalisation, and sustainability are not merely shaping products or services; they are fundamentally reshaping the logic of competitive advantage. Companies that fail to grasp these shifts risk being marginalised, while those that anticipate and embrace them can redefine entire industries.

Central to this discussion is the distinction between

- Value Creation — how companies generate value for customers, or benefits.

- Value Capture — how companies turn this into value for them, or profits.

While the two are interconnected, they often move at different speeds, creating both opportunity and risk.

We explore the five most common types of shifts in value creation and value capture, illustrated with examples from around the world. Understanding these shifts allows firms to diagnose their industries, anticipate disruption, and design strategies that ensure they remain both relevant and profitable.

Shifts in “Value Creation” for Customers

Value creation is, fundamentally, about improving the experience, outcomes, or utility that customers receive. Over the past two decades, several global trends have dramatically altered what customers consider valuable. These shifts are particularly visible in sectors such as technology, transport, media, healthcare, and consumer services.

1. From Products to Outcomes

Historically, companies sold tangible products or standardised services. Today, customers increasingly seek outcomes, rather than the items themselves – what they can do, rather than what they have. This shift is evident in industries where the end result — performance, uptime, or convenience — is more important than the physical object.

Examples:

- Rolls-Royce Holdings sells “Power by the Hour,” charging airlines for engine performance rather than the engines themselves.

- Netflix shifted from DVD rentals to streaming, focusing on seamless access to content and binge-worthy experiencesrather than ownership.

- Peloton combines connected fitness hardware with subscription-based classes, delivering measurable health outcomes.

The customer benefits from reduced risk, greater predictability, and simpler decision-making. For businesses, this requires investing in operational capabilities, data analytics, and service delivery to guarantee outcomes.

2. From Ownership to Access

Access-based models represent a profound shift in customer priorities. Rather than owning assets outright, users increasingly prefer temporary access or usage rights, which reduces upfront costs and maintenance burdens.

Examples:

- Airbnb enables travellers to access homes worldwide without property ownership.

- Grab bundles ride-hailing, deliveries, and payments, letting users consume services on demand.

- Vinted lets users buy, sell, or swap second-hand fashion, monetising trust and network effects rather than owning inventory.

Customers gain flexibility, affordability, and convenience, while firms must orchestrate platforms, manage trust, and ensure seamless access.

3. From Standardisation to Personalisation

Consumers increasingly demand tailored experiences. Mass-produced, one-size-fits-all offerings are giving way to products and services designed to suit individual preferences, behaviours, or needs.

Examples:

- Spotify curates personalised playlists and recommendations using listening data.

- Ant Group customises lending, insurance, and investment products through AI-driven insights.

- NikeID allows customers to design bespoke footwear, combining personal expression with brand engagement.

Personalisation increases relevance and loyalty, but requires sophisticated data management and analytics capabilities.

4. From Information Scarcity to Transparency

The digital era has empowered consumers with unprecedented access to information. Price comparison, reviews, and product ratings reduce asymmetry and shift bargaining power towards the customer.

Examples:

- Booking.com aggregates pricing, reviews, and availability for informed travel choices.

- Glovo provides real-time tracking and multi-service comparisons for urban deliveries.

- CarDekho gives detailed automotive reviews and dealer ratings, reducing uncertainty in purchases.

Transparency reduces search costs and perceived risk, while encouraging firms to compete on quality, experience, and trust rather than hidden advantages.

5. From Transaction to Experience

Increasingly, customers value holistic experiences over isolated transactions. Products must integrate functionality, convenience, and emotional satisfaction, creating loyalty and brand advocacy.

Examples:

- Apple integrates devices, software, and retail for a seamless ecosystem.

- Disney blends films, parks, and streaming for immersive storytelling.

- Hermès elevates retail into lifestyle experiences that foster loyalty.

Experience-focused value fosters differentiation and stickiness, particularly in commoditised markets.

Shifts in “Value Capture” by Business

While value creation concerns the customer, value capture is about ensuring the company translates that value into economic profit. Shifts in capture reflect changes in revenue models, cost structures, control points, and sources of profit. They are increasingly evident in digital platforms, subscription businesses, and global ecosystems.

1. From Selling to Partnering

Or, from one-off sales to recurring revenues. The traditional model of one-off transactions is giving way to subscription, usage-based, or recurring revenue streams, enhancing predictability and lifetime value.

Examples:

- Adobe Creative Cloud transitioned from software licences to subscriptions.

- Microsoft 365 monetises ongoing engagement rather than one-off Office sales.

- Netflix and Spotify convert usage and engagement into recurring revenue.

2. From Ownership to Ecosystems

Modern firms increasingly capture value by orchestrating others’ assets rather than owning them directly. This reduces capital intensity while controlling access to economic flows.

Examples:

- Airbnb leverages hosts’ properties without owning real estate.

- Uber and Ola mobilise driver-partners’ vehicles for transport services.

- Rappi orchestrates gig labour and logistics without owning warehouses or fleets.

Control over the network, trust mechanisms, and platform algorithms becomes the key profit lever.

3. From Production to Connection

Economic rents increasingly flow to those who control platforms, marketplaces, or digital interfaces, even when they do not produce the underlying goods or services.

Examples:

- Apple collects App Store commissions while developers create apps.

- Tencent monetises social, gaming, and fintech platforms without owning content directly.

- Google profits from search advertising and Android’s ecosystem.

Ownership of the platform or interface secures economic rents independent of production.

4. From Profitability to Value Creation

Profitability increasingly depends on maintaining customers over the long term rather than extracting high margins from individual transactions.

Examples:

- Grab cross-sells rides, payments, and delivery services to enhance lifetime value.

- Netflix focuses on retention and tiered subscriptions.

- Spotify converts free users into paying subscribers while monetising ads.

Lifetime value optimisation strengthens loyalty, retention, and ecosystem profitability.

5. From Tangible to Intangible Assets

Profit increasingly derives from data, IP, brand, and network effects rather than physical products.

Examples:

- Google monetises search and advertising data rather than hardware.

- Tencent captures value from content, social networks, and digital payments.

- M-Pesa generates revenue from transaction fees while enabling financial inclusion.

Intangible assets offer scalability, resilience, and defensibility in competitive markets.

Strategic implications

An important insight is that value creation and value capture do not always shift in synchrony. Companies can create enormous customer value without capturing commensurate profits, or they can capture value from ecosystems without creating the primary end-user value themselves.

Examples:

- App developers create utility within the Apple ecosystem but Apple captures the bulk of economic rent.

- Traditional taxis created mobility but lost profit to Uber and other ride-hailing platforms.

- Newspapers produced content, but Google and Facebook captured the majority of digital advertising revenue.

Understanding this decoupling is essential for anticipating disruption and designing resilient business models.

Value in modern markets is no longer simply embedded in products or services. Customers now seek outcomes, access, personalisation, transparency, and holistic experiences.

Businesses that fail to recognise these shifts risk commoditisation and margin erosion. Meanwhile, firms that understand how value capture is evolving — through recurring revenue, asset orchestration, platform control, lifetime value optimisation, and intangible assets — can secure sustainable profit and industry leadership.

- Map Creation and Capture Separately: Identify shifts in customer value versus economic control.

- Prioritise Control Points: Data, interfaces, and network effects increasingly determine who captures profits.

- Reinvent Business Models: Subscription, outcome-based pricing, and platform orchestration are essential levers.

- Invest in Capabilities: Data analytics, AI, and service delivery must complement traditional product excellence.

- Monitor Global Innovations: Value shifts often originate in emerging markets or adjacent sectors and spread rapidly.

Recognising the five major shifts in value creation and the five major shifts in value capture is more than academic; it is a practical guide for navigating disruption. By examining global examples, it becomes clear that these shifts are universal, though manifested differently depending on regional context and industry structure.

Ultimately, the companies that excel will be those that simultaneously innovate in how they serve customers and in how they capture the resulting economic benefit. The future belongs to companies that can anticipate, adapt, and align these two dimensions before their competitors do.

I’ve worked with many organisations around the world – almost 300 companies in 50 countries during my 35 years in business. Adidas to Airbus, Arla and Asahi … to Vodafone and Volkswagen, Yildiz and Zacco.

So I decided to look back over more recent years at some of the companies I have supported, typically working with their business leaders on their strategies, innovation and transformations – as static advisor to boards, coach and inspiration to CEOs, and facilitator of executive and project teams.

So what have they done, and what impact did it make?

Adidas (Germany)

Under Kasper Rørsted and now Bjørn Gulden, Adidas shifted from being product‑centric to digitally oriented, prioritizing direct‑to‑consumer channels. The brand embraced data analytics to personalize customer experiences and forecast trends. Adidas also innovated with sustainable products, including materials made from recycled ocean plastics and ambitious climate targets. Organizational transformation included streamlining global supply chains, integrating automation, and fostering cross‑functional collaboration. Leadership focused on shortening product launch cycles, testing agile methods in design and marketing, and expanding e‑commerce capabilities. Strategic partnerships with athletes and cultural icons reinforced brand relevance among younger audiences. Operational advances included inventory optimization, enhanced CRM platforms, and AI‑driven demand planning. Adidas’s reinvention emphasized both sustainability and responsiveness, enabling the company to better navigate market disruptions and consumer shifts. My role: inspiring and facilitating their global running strategy, taking inspiration from consumers, new business models and other industries.

Airbus (France)

Under Guillaume Faury, Airbus doubled down on digital transformation and sustainability. The company applied digital twin and predictive analytics across design, testing, and manufacturing, reducing errors and accelerating delivery times. Airbus embraced advanced materials and fuel‑efficient engines to lower environmental impact, while developing research programs for hybrid‑electric and hydrogen propulsion. In production, Airbus digitized assembly lines and implemented collaborative robotics to increase precision and responsiveness. Culture shifted toward cross‑disciplinary innovation, empowering engineers and software experts to work together on autonomous systems, AI applications, and real‑time analytics. Strategic ecosystem partnerships with suppliers, airlines, and startups improved supply chain agility. Airbus also invested in pilot training simulators driven by VR/AR to improve safety and efficiency. These integrated initiatives strengthened Airbus’s leadership in aerospace innovation. My role: exploring future scenarios, and driving a culture of “pioneer” innovation.

Adecco (Switzerland)

Under Alain Dehaze, Adecco transformed from traditional staffing to a tech‑enabled talent solutions provider. The company launched AI‑driven matching platforms to connect candidates with roles faster and built digital upskilling portals to help workers adapt to rapidly changing job markets. Adecco expanded remote workforce management services and analytics dashboards for clients to track talent performance. Leadership prioritized data science, using labor market insights to advise clients on workforce planning. Investment in mobile apps made recruitment more accessible. Adecco also developed flexible engagement models to meet the demand for gig, contract, and hybrid work. Diversity, equity, and inclusion became strategic priorities, influencing recruitment algorithms, training programs, and client consultation. Internally, the company adopted agile methodologies to foster innovation and speed decision cycles, positioning Adecco as a strategic partner in workforce transformation. My role: Exploring new adjacent services for growth, and new business models.

Al Ghurair (UAE)

A family business that has grown from fishing in Dubai Creek to a regional leader, Al Ghurair integrated technology and sustainability across diversified operations. In food processing, digital quality control systems were implemented to ensure consistency and compliance with global standards. Now led by CEO John Lossifidos, the group expanded supply chain automation, enabling real‑time tracking and inventory management across manufacturing and logistics. Partnerships with global technology providers enhanced manufacturing execution systems (MES). Al Ghurair embraced smart building technologies in real estate, deploying energy‑efficient systems and IoT‑driven facility management solutions. Leadership nurtured a culture of innovation by establishing cross‑business innovation cells to identify opportunities for automation and data‑driven decision‑making. Environmental stewardship was reinforced with water recycling and energy optimization projects. Across sectors, the organization advanced digital literacy programs to upskill teams, enabling better use of analytics and process optimization. These integrated efforts strengthened Al Ghurair’s position as a diversified MENA leader focused on sustainable growth. My role: working with CEO and executive team to develop new purpose and vision, then translate into business unit innovations.

Aramco (Saudi Arabia)

Under Amin Nasser, Aramco evolved from a conventional energy producer into a technology‑led energy enterprise. The company embraced digitalization across exploration, drilling, and refining through AI, advanced sensors, and predictive analytics to optimize production and reduce downtime. Aramco invested in carbon reduction technologies, including carbon capture, utilization, and storage (CCUS), and research in low‑carbon fuels and hydrogen. Operations incorporated real‑time data platforms connecting upstream and downstream functions, improving visibility and efficiency. Workforce development programs equipped engineers and technicians with skills in automation and data science. Strategic partnerships with global energy and technology firms accelerated innovation in petrochemicals and next‑generation materials. Aramco’s integrated strategy balanced traditional operations with forward‑looking energy solutions, reinforcing safety, sustainability, and competitiveness. Leadership cultivated an innovation mindset, encouraging experimentation and collaboration with startups and research institutions. My role: Exploring future megatrends, and strategic innovation opportunities.

Arçelik/Beko (Turkey)

Led by Hakan Bulgurlu, Arçelik became a pioneer in smart, connected appliances. The company launched IoT‑enabled products that integrate with home ecosystems, offering remote diagnostics and predictive maintenance. Digital design and rapid prototyping accelerated product innovation cycles. Arçelik invested in sustainable manufacturing, deploying energy‑efficient production lines, waste reduction systems, and lifecycle assessments to shape eco‑friendly product development. Partnerships with tech firms enhanced software capabilities and user experiences. The organization adopted lean principles and data‑driven supply chain optimization. Cross‑regional innovation hubs enabled global collaboration and faster market adaptation. Workforce transformation programs focused on digital skills and cross‑functional teaming. These efforts strengthened Arçelik’s position as a technology‑forward appliance maker that balances sustainability, connectivity, and customer‑centric design. My role: Strategic brand building and marketing, including support of the Beko brand launch.

Arla Foods (Denmark)

Under Peder Tuborgh, Arla advanced dairy innovation centered on sustainability and nutritional science. The company implemented blockchain‑enabled traceability from farm to consumer, improving transparency and quality assurance. Arla developed new high‑value functional dairy products tailored to regional markets, leveraging consumer data analytics. Environmental initiatives included methane reduction programs and regenerative agriculture practices with farmer partners. Digital platforms empowered farmers with real‑time herd management and yield forecasting tools. Supply chain transformation integrated predictive logistics and waste‑reduction technologies. Leadership championed collaborative innovation with universities and nutrition institutes, resulting in scientifically differentiated products. Internal transformation focused on cross‑functional teams to accelerate R&D and commercial rollout. Through technology, sustainability, and consumer insight integration, Arla reinforced cooperative value for members and strengthened global market relevance. My role: Exploring new categories beyond dairy products, and new business models like DTC.

Asahi (Japan)

Under Takeshi Niinami, Asahi transformed from traditional brewing into a diversified beverage innovator. The company advanced product development using consumer behavior analytics, launching premium and low‑alcohol segments tailored to global tastes. Asahi deployed automation and advanced quality control in production facilities to maintain consistency and flexibility. Strategic acquisitions expanded geographic reach and brand portfolio. Asahi’s sustainability roadmap prioritized water‑efficient operations and renewable energy adoption. Digital marketing platforms enhanced customer engagement and e‑commerce penetration. Cross‑cultural innovation teams accelerated product localization for key markets. Internal initiatives improved agility, breaking silos between product, marketing, and distribution teams. These efforts strengthened Asahi’s brand relevance while balancing tradition with forward‑looking beverage innovation. My role: Accelerating brand and portfolio growth into growth markets.

Aster Textile (Turkey)

Under the leadership of İsmail Koçali, and his family, Aster Textile evolved into one of Turkey’s leading apparel manufacturing and design partners for global fashion brands. The company’s transformation centered on vertical integration, digital production planning, and speed-to-market capabilities. Investments in automation across cutting, sewing, and finishing improved efficiency, quality consistency, and scalability.

Aster strengthened its design-to-delivery model by integrating product development, fabric sourcing, sampling, and logistics within a coordinated digital workflow. AI-driven demand planning and real-time production tracking enhanced responsiveness to fast-changing retail cycles. Sustainability became a strategic priority, with initiatives in water reduction, renewable energy use, certified materials, and traceable supply chains.

Workforce development focused on technical expertise, lean manufacturing, and continuous improvement culture. Through innovation in operations, sustainability, and customer collaboration, Aster Textile positioned itself as a high-performance, export-driven apparel manufacturer aligned with global brand standards and evolving environmental expectations.

Azercell (Azerbaijan)

Led by Zarina Zeynalova, Azercell modernized its telecom offerings with major investments in 4G/5G infrastructure and digital services. The company introduced mobile financial services and integrated platforms for streaming and productivity apps, improving customer stickiness. Azercell implemented data analytics to optimize network performance and personalize customer experience. Automation and self‑service digital channels reduced operational costs and improved responsiveness. Strategic partnerships with global tech firms enhanced cybersecurity and IoT capabilities. Workforce transformation programs increased digital literacy and agile working practices. Community outreach initiatives strengthened the brand’s socio‑economic impact, supporting digital inclusion projects and startup ecosystems. These integrated innovations helped Azercell lead telecom and digital services evolution in a competitive regional landscape. My role: Working with CEO and leadership team on developing new strategy and innovation blueprint.

Bayer (Germany)

Under Werner Baumann, Bayer reshaped its R&D engine to accelerate breakthroughs in human health and crop science. The company integrated digital biology and computational design to improve drug discovery and agricultural product development. Data science platforms empowered cross‑disciplinary teams to analyze complex datasets faster. Bayer embraced precision agriculture technologies, including sensors and satellite analytics, improving farmers’ yields while reducing environmental impact. In health sciences, telehealth and AI‑aided diagnostics enhanced patient insights and commercial strategies. Sustainability commitments guided product lifecycle planning and reduced ecological footprints. Organizational transformation emphasized integrated planning and cross‑portfolio teams to improve time‑to‑market. Leadership cultivated partnerships with biotech startups and research institutions to accelerate innovative pipelines, positioning Bayer at the intersection of science, technology, and global needs. My role: Building stronger brands in the pharma market, to be customer (patient)-driven.

Biocodex (France)

Led by Alain Potdevin, Biocodex focused on scientific innovation in probiotics and pharmaceuticals. The company invested in R&D to develop microbiome-focused therapeutics and functional nutrition products. Advanced clinical research platforms enabled faster product testing and evidence-based positioning. Biocodex implemented digital supply chain tracking to ensure quality and traceability from production to market. Leadership encouraged cross-disciplinary collaboration between scientists, marketers, and regulatory experts to accelerate commercialization. Strategic partnerships with universities and biotech startups enhanced innovation capabilities. The company also embraced sustainability in packaging and responsible sourcing of raw materials. Internally, workforce development emphasized data literacy and research methodology skills. These integrated transformations strengthened Biocodex’s global footprint, improved product differentiation, and reinforced its position as a leader in probiotic innovation and health-oriented solutions. My role: How to build blockbuster brands in the pharma sector (like Viagra) which have a cultural and consumer impact.

Bolton Group (Italy)

CEO Roberto Leopardi has modernized Bolton Foods operations and expanded its international footprint. Key innovations included automation of production lines, AI-powered demand forecasting, and advanced quality control systems. The company implemented digital supply chain management to optimize logistics across Europe and emerging markets. Leadership emphasized product innovation in confectionery, snacks, and spreads, leveraging consumer insight analytics to guide new offerings. Sustainability initiatives focused on energy-efficient factories, packaging reduction, and ethical sourcing of raw materials. Workforce development programs encouraged cross-functional collaboration and innovation culture. Strategic partnerships with retailers and distributors improved market responsiveness and shelf visibility. By integrating technology, sustainability, and consumer-driven innovation, Bolton strengthened its position as a leading European food company, capable of quickly adapting to evolving consumer trends while maintaining operational efficiency and product excellence. My role: Developing a foresight capability across the business, to drive longer yet strategy and decision making for growth.

BNP Paribas (France)

Under Jean‑Laurent Bonnafé, BNP Paribas transformed into a digitally enabled financial powerhouse. The bank invested in AI and advanced analytics to enhance risk management, customer insights, and fraud detection. Digital channels were expanded for retail, corporate, and investment banking, improving accessibility and personalization. Leadership promoted innovation hubs for fintech collaboration, encouraging agile development of products such as mobile payments, digital wealth management, and sustainable investment solutions. Internal operations were streamlined with cloud adoption, automation of back-office processes, and enhanced cybersecurity protocols. Corporate culture shifted toward digital literacy, cross-functional teamwork, and continuous learning to support innovation. Environmental, social, and governance (ESG) factors were embedded into business strategy, from lending criteria to product offerings. These transformations strengthened BNP Paribas’s global banking leadership, improved customer experiences, and enabled rapid adaptation to evolving financial markets. My role: How to embrace new digital tools, platforms and processes into their client relationship management.

Bonnier (Sweden)

Under Karin Bonander, Bonnier accelerated its media transformation from traditional publishing into a diversified digital content leader. Core innovations included digital subscriptions, multimedia storytelling, and mobile-first content strategies. Data analytics and AI were leveraged to personalize reader experiences and optimize content distribution. Bonnier expanded into digital education, streaming platforms, and niche media markets, creating new revenue streams. Leadership emphasized agile operations and cross-functional teams to speed content creation and marketing. Sustainability and corporate responsibility guided digital adoption and publishing ethics. Internal digital training programs enhanced employee skills and innovation capabilities. Strategic partnerships with tech platforms and startups strengthened Bonnier’s reach and engagement. Through these initiatives, Bonnier evolved from a conventional media company into a forward-looking, audience-centered digital content innovator with diversified offerings across multiple channels.

CNN/Discovery (USA)

Under Chris Licht and subsequently Mark Thompson, CNN focused on digital-first news delivery and global audience engagement. Key innovations included expansion of streaming platforms, social media integration, and interactive news formats. AI-powered content recommendation systems improved personalization for viewers. Leadership invested in newsroom automation and collaborative production tools to enhance efficiency and real-time reporting. Strategic partnerships with tech firms supported innovations in mobile and OTT distribution. Internal cultural transformations encouraged cross-platform storytelling, data-driven decision-making, and agile content production. Initiatives in multimedia journalism, virtual reality, and live analytics increased engagement and strengthened brand authority. CNN’s digital transformation reinforced its relevance in a competitive media landscape, allowing faster adaptation to audience behavior while maintaining editorial integrity and global reach.

Campari (Italy)

Campari’s new CEO Simon Hunt has embraced innovation in premium spirits and global brand expansion. The company developed new product lines, limited editions, and mixology-driven innovations to capture changing consumer tastes. Digital marketing strategies, e-commerce platforms, and AI-driven consumer insights enabled more targeted campaigns. Operationally, production efficiency was enhanced through modernized distillation processes and supply chain automation. Leadership emphasized sustainability in packaging, water usage, and energy efficiency. Strategic acquisitions broadened geographic presence and diversified brand portfolio. Workforce programs focused on innovation culture, cross-functional collaboration, and consumer-centric thinking. By integrating technology, sustainability, and creative marketing, Campari strengthened its competitive position in the spirits industry, improved consumer engagement, and reinforced its global premium brand identity.

Canon (Japan)

Under Fujio Mitarai, Canon shifted from conventional imaging to diversified technology solutions. The company invested in industrial equipment, medical imaging, and networked printing technologies. Digitalization initiatives included AI-powered image processing and automation of manufacturing lines. Leadership promoted R&D collaboration, leading to innovations in optics, sensors, and software integration. Canon embraced sustainability in product design and operations, including energy-efficient devices and recycling programs. Strategic expansion into new markets and business segments strengthened resilience amid declining camera sales. Workforce development focused on technological literacy and cross-functional innovation. Canon’s transformation emphasized adapting legacy strengths in optics to emerging digital and industrial technologies, maintaining its leadership while driving future-ready innovation across multiple sectors.

Carrefour (France)

Under Alexandre Bompard, Carrefour accelerated transformation toward omni-channel retail and digitalization. The company implemented e-commerce platforms, home delivery, and click-and-collect services. AI-driven inventory management improved stock accuracy and customer satisfaction. Leadership focused on sustainability, reducing food waste, and promoting local sourcing. Store layouts were optimized using analytics, and loyalty programs became more personalized. Partnerships with fintech, delivery, and logistics startups enhanced operational agility. Internal cultural changes encouraged cross-functional collaboration and data-driven decision-making. Carrefour also introduced private-label innovations and smart retail technologies, including self-checkout and automated logistics. Through these initiatives, Carrefour evolved into a digitally connected, customer-centric retail leader with an emphasis on convenience, sustainability, and operational excellence.

The Coca-Cola Company (USA)

Under James Quincey, Coca-Cola accelerated its shift toward a total beverage company model. Innovation expanded into low-sugar drinks, functional beverages, premium water, and ready-to-drink coffee. Digital transformation strengthened data-driven marketing, AI-enabled demand forecasting, and connected bottling operations. Leadership streamlined the brand portfolio and restructured global operations for agility and efficiency. Sustainability initiatives focused on recyclable packaging, water stewardship, and carbon reduction across the supply chain. Workforce programs emphasized growth mindset, digital capabilities, and cross-market collaboration. Strategic partnerships enhanced e-commerce and direct-to-consumer engagement. By integrating brand innovation, operational simplification, and sustainability, Coca-Cola modernized its business model while strengthening global responsiveness to shifting consumer preferences.

Cisco (USA)

Led by Chuck Robbins, Cisco transitioned from hardware-centric networking to a software, subscription, and cybersecurity-driven model. Core innovation areas included cloud-native networking, AI-powered security platforms, and edge computing solutions. Leadership emphasized recurring revenue models, ecosystem partnerships, and platform integration. Operational transformation included supply chain digitization, predictive analytics, and cloud-enabled collaboration tools. Sustainability programs targeted energy-efficient networking equipment and carbon-neutral goals. Workforce initiatives strengthened software engineering, cybersecurity expertise, and agile product development. Strategic acquisitions accelerated innovation in security and observability. Cisco’s transformation positioned it as a resilient, platform-oriented technology leader capable of delivering secure, scalable digital infrastructure for enterprises navigating cloud and hybrid environments.

Cognizant (USA)

With Ravi Kumar, Cognizant intensified its focus on digital engineering, AI integration, and cloud transformation services. Core initiatives included industry-specific digital platforms, automation-driven IT modernization, and cybersecurity solutions. Leadership emphasized operational simplification, performance accountability, and client-centric innovation. Investments in talent reskilling strengthened expertise in AI, cloud architecture, and agile methodologies. Sustainability initiatives included green IT advisory and energy-efficient delivery centers. Strategic partnerships with hyperscalers expanded service capabilities. Organizational restructuring improved responsiveness and execution speed. Cognizant’s transformation positioned it as a digitally native, engineering-led services firm delivering end-to-end enterprise modernization in a rapidly evolving technology landscape.

Coty (USA)

Camillo Pane became CEO of the old French beauty business in 2015, tasked with integrating and expanding Coty’s portfolio following its acquisition of Procter & Gamble’s beauty brands. He focused on organizational restructuring and global strategy and transformed its beauty and fragrance portfolio through innovation and digital marketing. Product development focused on premium and niche brands with influencer-driven campaigns. E-commerce platforms were enhanced, and AI analytics guided consumer insights for personalized offerings. Operational improvements included automation in manufacturing and streamlined supply chain management. Leadership fostered cross-functional collaboration between R&D, marketing, and digital teams. Sustainability initiatives included eco-friendly packaging and responsible sourcing. Strategic acquisitions expanded brand reach and global footprint. Coty’s cultural transformation encouraged agility, creativity, and faster market response. Through these integrated initiatives, Coty repositioned itself as a modern, innovative, and consumer-centric leader in the global beauty industry.

DP World (UAE)

Under Sultan Ahmed Bin Sulayem, DP World modernized port operations and logistics through digital transformation. Key innovations included AI-enabled cargo tracking, automated container handling, and smart port infrastructure. The company integrated predictive analytics for operational efficiency and energy optimization. Leadership promoted partnerships with global technology providers and shipping firms to enhance supply chain reliability. Internal culture emphasized innovation, safety, and workforce upskilling. DP World also invested in digital trade platforms and IoT connectivity to improve trade visibility. Sustainable practices, including energy-efficient equipment and emissions reduction programs, were adopted. These transformations strengthened DP World’s position as a global logistics and trade enabler, combining technology, operational excellence, and sustainability to meet evolving international commerce demands.

Eczacıbaşı (Turkey)

Erdal Karamercan was CEO of Eczacıbaşı Holding from 2003 to 2017, as the group accelerated innovation across healthcare, building products, and consumer goods. Key transformations included R&D investment in pharmaceuticals, smart bathroom solutions, and hygiene technologies. Leadership promoted digitalization in manufacturing, predictive maintenance, and product lifecycle management. Sustainability initiatives encompassed water efficiency, renewable energy, and circular economy practices. Workforce programs focused on innovation culture, agile project execution, and digital skills. Strategic collaborations with global partners enhanced R&D and market reach. Eczacıbaşı’s integrated transformation positioned it as a technologically advanced, sustainability-conscious industrial and healthcare leader in Turkey and regional markets.

Endesa (Spain)

Under María José Hidalgo, Endesa accelerated its transformation into a renewable energy leader. The company invested heavily in wind, solar, and hydroelectric projects while modernizing grid infrastructure with smart meters and digital monitoring systems. AI and predictive analytics optimized energy distribution and demand forecasting. Leadership emphasized energy efficiency programs for consumers and businesses, including digital platforms for real-time consumption insights. Internal culture prioritized sustainability and innovation, creating cross-functional teams to drive project execution. Endesa also pioneered energy storage initiatives and green energy solutions for industrial clients. Strategic partnerships with technology providers and municipalities supported digital grid modernization. By integrating clean energy, technology, and customer-centric services, Endesa evolved from a conventional utility into a digital, sustainable, and innovation-driven energy company, aligning operational excellence with environmental stewardship.

Electrolux (Sweden)