The Future of Food … Embracing the rapidly changing world of food, driving innovation in products and experiences, and reinventing value in dynamic markets

January 20, 2026

Food is no longer a slow-moving sector defined by incremental change. It has become one of the most dynamic arenas of reinvention in the global economy — shaped by economic pressure, scientific breakthroughs, cultural shifts and radically changing consumer expectations.

Across markets, consumers are rewriting the rules. They are trading down ruthlessly on staples while paying more for products that feel healthier, more ethical or more meaningful. They are sceptical of marketing claims yet hungry for innovation. They demand transparency, functionality and flavour — simultaneously. And they expect brands to evolve as quickly as the rest of their lives.

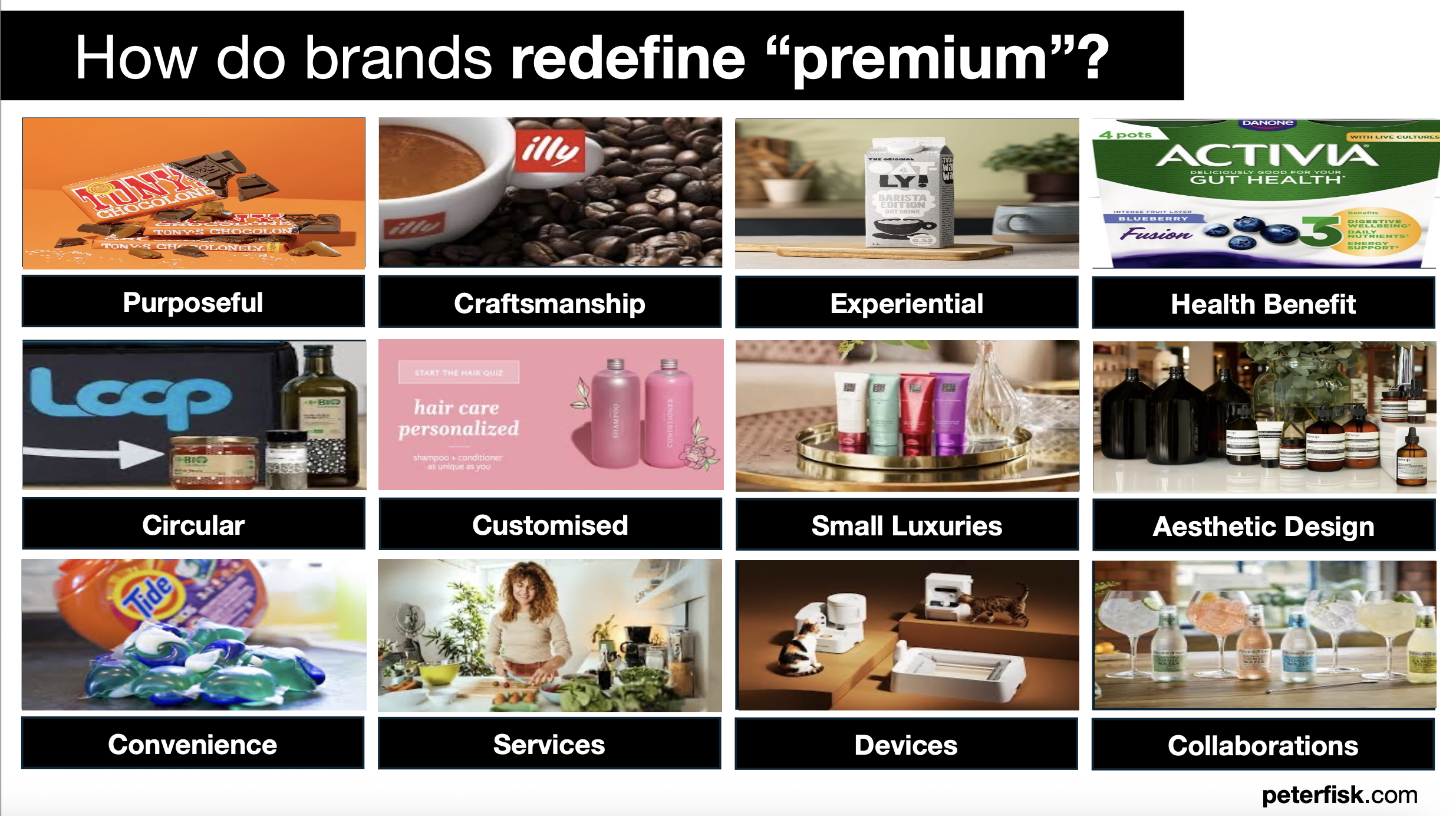

For food businesses, this creates tension — but also extraordinary opportunity. The winners of the next decade will not be those that merely defend market share, but those that reimagine value, redefine premium, and turn food into an experience, not just a product.

Global trends reinventing food

1. Value sensitive with premium splurges

Consumers everywhere are more price-conscious than they have been in decades. Staples are scrutinised, brands are swapped without hesitation, and private label continues to gain ground. Yet this is not a race to the bottom.

Instead, consumers practise strategic frugality. They save aggressively on basics in order to splurge on one or two items that matter — a healthier oil, a premium snack, a product with meaning or indulgence attached.

The new rule: Value and premium now coexist in the same basket.

2. Premium redefined as “better-for-you”

Luxury cues alone no longer justify higher prices. Today’s premium is increasingly nutritional, functional and preventative: more protein, more fibre, less sugar, cleaner labels, functional ingredients.

Health is no longer a niche — it is a decision filter. Consumers may still buy indulgence, but they increasingly want reassurance that it fits a healthier lifestyle.

The new rule: Premium equals credibility, not decoration.

3. Plant-based goes mainstream

The plant-based movement has moved beyond early adopters. The future is not strict veganism, but flexitarianism — consumers blending plant and animal proteins based on taste, health, cost and occasion.

Innovation is shifting from ideology to sensory performance: better texture, better taste, simpler ingredients and hybrid solutions.

The new rule: Plant-based wins when it feels normal, not worthy.

4. Technology enters the kitchen

AI, fermentation, precision processing and even 3D printing are reshaping food formulation. These technologies are closing the taste and texture gaps that once limited healthier or sustainable alternatives.

What was once R&D-led experimentation is now commercially viable at scale.

The new rule: Food innovation is becoming computational.

5. Private label becomes premium

Retailer brands are no longer generic substitutes. They are curated, premiumised and often more innovative than national brands — offering exclusivity, storytelling and price advantage simultaneously.

This shifts power in the value chain and forces brands to rethink their role.

The new rule: Retailers are no longer just distributors — they are brand builders.

6. Sustainability moves from ethics to economics

Sustainability has crossed a crucial threshold. It is no longer just a moral argument; it is a growth strategy. Brands that reduce waste, upcycle ingredients, shorten supply chains or improve transparency increasingly win loyalty and justify premium pricing.

Consumers reward brands that prove — not proclaim — their impact.

The new rule: Sustainability must pay its way.

7. Food as functional medicine

Consumers increasingly view food as a tool for long-term wellbeing — supporting gut health, energy, immunity and metabolic balance.

This blurs the boundary between food, beverage and wellness, opening new premium categories and consumption moments.

The new rule: Food is preventative care.

8. Convenience gets premiumised

Busy, urban lifestyles drive demand for convenience — but not at the cost of quality. Premium ready meals, meal kits and prepared foods are thriving by combining time-saving with restaurant-level expectations.

The new rule: Convenience is no longer cheap — it is curated.

9. Digital discovery reshapes brand building

Social platforms, influencers and DTC channels increasingly define what gets noticed, trialled and shared. Brands can scale faster than ever — but also lose relevance just as quickly.

Marketing is no longer about campaigns; it is about continuous participation in culture.

The new rule: Visibility beats shelf space.

10. Trust, provenance and local relevance

In many regions — particularly MENA — consumers place growing emphasis on halal integrity, traceability, local sourcing and family trust.

Global brands must feel local, authentic and accountable.

The new rule: Trust is the ultimate differentiator.

Additionally

Trends specific to consumers in the MENA region are

11. Halal as a trust architecture, not a badge

Across MENA, halal has evolved from a regulatory requirement into a trust systemencompassing sourcing, processing, logistics, ethics and transparency. Consumers increasingly expect halal to signal purity, safety and integrity — not just permissibility.

Digital traceability, ingredient disclosure and visible governance are becoming as important as the logo itself, particularly for families and premium buyers.

The new rule: Halal is a brand promise, not a stamp.

12. Premium gifting, hospitality and seasonal peaks

Food plays a central role in hospitality, religious observance and social status across MENA. Ramadan, Eid, weddings, family gatherings and guest hosting create predictable premium spikes, where consumers are willing to trade up on quality, presentation and provenance.

Packaging, format and story often matter as much as taste.

The new rule: In MENA, premium is often occasion-based, not everyday.

13. Imported brand fatigue and regional pride

After years of aspirational imported brands, there is growing enthusiasm for high-quality regional and locally rooted food brands. Consumers increasingly value products that reflect local tastes, traditions and ingredients — provided they meet modern standards of quality and design.

Local no longer means lower-quality; it means more relevant.

The new rule: “Made here” is becoming a premium cue.

14. Convenience without compromise for families

Urbanisation and rising dual-income households are increasing demand for convenience, but MENA consumers are reluctant to sacrifice family meals, freshness or cultural relevance.

The fastest growth is in semi-prepared, premium convenience — sauces, oils, bases and ready components that enable home cooking with less effort.

The new rule: Convenience must still feel homemade.

15. Youth-led digital food culture and rapid switching

MENA has one of the world’s youngest populations, with high social media usage and strong openness to novelty. Discovery increasingly happens through influencers, short-form video and peer recommendation, driving fast trial and fast switching.

Brand loyalty exists — but must be continuously re-earned.

The new rule: Relevance decays quickly without digital presence.

How premium brands can respond to price pressure

Trading down is structural and persistent. Private labels and low-cost alternatives continue to capture share, and this is particularly evident in staple categories. Successful premium brands do not fight this trend head-on; they design around it.

- Nestlé: Precision premium through segmentation

Nestlé has created a multi-tiered portfolio that separates accessible everyday nutrition from high-value offerings. Premium is not decorative; it is structural. Brands such as Nestlé Health Science justify their higher price points through scientific validation, clear outcomes, and ecosystem innovation. This segmentation ensures that premium does not cannibalise volume while remaining relevant and aspirational. - Danone: Health outcomes as a premium moat

In functional dairy and gut-health categories, Danone leverages science and medical credibility to defend premium. Gut health, immunity, and overall wellbeing create a functional moat, making products less substitutable with private labels. Here, premium is not just about taste or packaging; it is about delivering verifiable, meaningful outcomes. - Arla: Trust and provenance as differentiators

Arla’s cooperative model, farmer ownership, and radical transparency turn provenance into a premium asset. Integrity, traceability, and governance are harder to copy than packaging or flavour. By investing in trust and operational excellence, Arla makes premium substitution costly and undesirable. - Heinz Gourmet: Premium through taste and provenance

Heinz Gourmet sauces and condiments differentiate through refined recipes, natural ingredients, and heritage-driven branding. By highlighting superior taste, authentic sourcing, and occasional-luxury positioning (e.g., truffle ketchup, artisanal sauces), Heinz makes substitution with standard supermarket ketchup or private-label sauces less compelling. Premium is maintained by combining quality, provenance, and sensory distinction. - Cook: Premium through craftsmanship and provenance

The UK premium frozen‑meal brand, defends its position through chef-led preparation, high-quality ingredients, and authentic “cooked-from-scratch” experiences. Each dish emphasizes provenance, with locally sourced produce and high-welfare meat, while the chef responsible is named on the packaging, reinforcing care and authenticity. Ethical credentials, including B Corp certification and Living Wage practices, add trust and differentiation. - Kikkoman: Premium through authenticity and culinary trust

Kikkoman defends premium in soy sauce and seasonings by emphasising traditional brewing methods, ingredient quality, and global culinary credibility. Its naturally fermented sauces are positioned as the reference standard in kitchens worldwide, relying on heritage, consistency, and performance outcomes in cooking. This deep technical trust — chefs and home cooks alike — makes low‑cost substitutes feel inferior, reinforcing premium through habitual use and expertise rather than price alone. - Nespresso: Premium through experience and ecosystem

Nespresso defends its premium positioning not through the coffee itself alone, but through a carefully curated ecosystem and consumer experience. By combining high-quality coffee capsules, precision machines, exclusive boutiques, and a subscription model, Nespresso turns brewing into a ritualised, consistent, and aspirational experience. Brand storytelling, barista-level expertise, and recycling initiatives reinforce both trust and sustainability, making low-cost alternatives less appealing. Premium is earned through convenience, consistency, and lifestyle integration rather than price, demonstrating how structural and experiential differentiation can protect and grow a premium brand even amid trading-down pressures.

Across these brands, five patterns consistently emerge:

- Premium must be functional or emotional — not symbolic.

- Clear portfolio segmentation beats one-size-fits-all brands.

- Occasion-based premium is more resilient than everyday luxury.

- Trust, science, and provenance are harder to copy than product features.

- Smart format and pack architecture protects accessibility without dilution.

By embedding these principles, brands are able to protect premium positions even as consumers trade down, creating resilient, sustainable growth.

Inspiration from other sectors

Premium pressure is not unique to food. Lessons from adjacent sectors — beverages, fashion, personal care, and health — show that premium survives when it is experienced, habitual, trusted, and differentiated, not merely marketed.

- Yakult: Habit and science as defence

Yakult leverages proprietary probiotic strains, scientific validation, and daily consumption rituals to make premium habitual. The combination of functional outcomes and consistent usage protects the brand from low-cost competitors, demonstrating the power of routine and credibility in defending premium. - Illy Coffee: Quality and ritual as premium defence

Illy Coffee maintains premium through quality, provenance, and experiential consistency. Meticulous sourcing, expert roasting, and iconic design ensure that every cup delivers a reliable sensory experience. Rituals around brewing, tasting, and cafe experiences make premium habitual, while the combination of provenance and repeatable quality reduces substitutability with lower-cost coffees. Premium is experienced, trusted, and repeatable, not merely symbolic. - Uniqlo: Premium defined by usefulness

In apparel, Uniqlo has redefined premium around utility. Fabric innovation, functional design, and consistency create everyday relevance. Premium is earned through reliability and performance rather than status or trendiness. Consumers buy trust and practicality, which reduces susceptibility to short-term discounting or competitive novelty. - H&M Studio: Premium through design and exclusivity

H&M Studio, the brand’s high-end seasonal line, elevates fashion beyond mass-market basics by offering limited-edition collections, high-quality materials, and design-forward aesthetics. By creating scarcity, storytelling, and aspirational yet accessible fashion, H&M Studio allows consumers to trade down on everyday items without abandoning the brand entirely. Premium is defended through curation, design credibility, and experience, rather than relying solely on price. - L’Oréal: Evidence-based premium

L’Oréal exemplifies scientific credibility as a lever for premium. Across a multi-tiered portfolio, the company maintains luxury and mass offerings without diluting brand meaning. Products are premium because they deliver measurable results, reinforcing that outcomes can underpin pricing and loyalty more effectively than image alone. It has reframed as a beauty-tech company, with many innovations beyond products, such as personalisation tools and applicators. - On Running: Performance and innovation as premium justification

Swiss sportswear company On has built a premium brand by prioritising technical innovation and athletic performance, and using assets like Roger Federer and Zendaya. Proprietary cushioning technology, biomechanical design, and consistent performance across conditions create habitual usage and loyalty. Premium is anchored in functional outcomes rather than fashion or trendiness, allowing the brand to maintain pricing and relevance even as competitors offer cheaper alternatives. - Dyson: Engineering and outcomes as premium defence

Dyson defends its premium position through patented engineering, design innovation, and measurable performance outcomes. Across vacuum cleaners, hair care, and air purifiers, the brand focuses on tangible benefits — suction power, airflow efficiency, and durability — rather than image alone. Consumers pay for demonstrable results, not status, which protects Dyson from low-cost competitors and reinforces loyalty through trust in technology and innovation.

Across categories and regions, premium brands that survive pressure:

- Redefine premium — they do not simply defend it.

- Build moats that are hard to copy (trust, technology, culture, ecosystems).

- Segment access without diluting meaning.

- Create rituals, habits, and emotional bonds.

- Resist short-term discount logic.

For food companies, the implication is clear: premium must be earned through experience, outcomes, and habit, not merely inherited from legacy or aspiration.

Premium brands need new thinking

To thrive in the face of strategic frugality, food companies must think radically and act systemically. Beyond conventional measures, there are six game-changing strategies that executives should consider.

- Redefine premium around outcomes, not ingredients

Health, family wellbeing, preventative nutrition, and functional benefits are the real premium. This shifts the conversation from price or decoration to meaningful impact, ensuring that products are indispensable to consumers’ lives. - Design occasion-led premium, especially in MENA

Premium moments are often occasion-based: Ramadan, Eid, family gatherings, gifting, and hospitality. Structuring premium offers around these predictable high-value moments maximises willingness to pay while reinforcing brand relevance. - Architect smart value in parallel

Controlled partnerships with private labels, tiered brands, or value-focused extensions protect accessibility without diluting premium meaning. Brands can participate in lower tiers while preserving structural premium elsewhere.

Additional radical ideas

- AI-Driven Personalization at Scale

Tailor meals, ingredients, and functional foods to individual or household preferences using AI and data. This creates hyper-relevant products, reduces waste, strengthens loyalty, and justifies premium pricing. - Premium Ecosystem Subscription

Move from selling products to offering curated lifestyle experiences — combining meals, wellness content, and occasion-based services through subscriptions. This approach builds emotional bonds, recurring revenue, and positions premium as ongoing value rather than a single transaction. - Ingredient-to-Table Transparency with Blockchain

Provide end-to-end traceability of sourcing, sustainability, and ethical practices visible to consumers in real time. This strengthens trust, defends against private label substitution, and enables premium pricing tied to verifiable impact.

Together, these approaches represent a leap from product-centricity to system-wide value creation, blending technology, trust, and experience into the very definition of premium.

From products to possibility

The era of comfortable premium is over. Trading down is structural, competition is relentless, and consumers will not pay for symbolism alone. Food companies that cling to old definitions of premium — defending price points, relying on heritage, or cutting across all categories indiscriminately — will see relevance and margins erode.

Stop doing:

- Defending price points without rethinking what consumers actually value.

- Treating premium as decorative or aspirational rather than functional and emotional.

- Applying one-size-fits-all strategies across portfolios, markets, and occasions.

- Discounting aggressively to chase short-term volume at the expense of trust and differentiation.

Start doing:

- Redefine premium around outcomes, trust, and experience. Consumers must feel the difference in health, convenience, ritual, or sustainability.

- Build moats that are hard to copy: science, technology, provenance, and ecosystem-driven experiences.

- Segment access strategically, offering multiple tiers without diluting the meaning of premium.

- Create rituals, habits, and emotional bonds that embed your brand in daily life.

- Leverage data, AI, and digital tools to personalise offerings, reduce waste, and reinforce relevance.

- Design products as part of a living system, where each interaction, moment, and occasion strengthens premium credibility.

The companies that act boldly will stop defending yesterday’s definitions of value and start shaping tomorrow’s market. Premium is no longer an entitlement — it is an earned, lived, and measurable experience.

“In dynamic markets, the future will belong to those who stop defending, and start inventing value at every level.”

10 innovators reinventing food

These companies are not just innovative — they are commercially successful, reshaping categories and expectations.

1. NotCo … Reinventing food with AI

Origin and evolution

NotCo was founded in Santiago, Chile, in 2015 by a technologist, a food scientist and a brand builder who shared a provocative idea: food formulation could be radically improved if humans stopped relying solely on intuition and tradition. Instead of starting with ingredients, NotCo started with data. They built an AI platform — nicknamed “Giuseppe” — capable of analysing molecular structures, flavour compounds and consumer preferences to design plant-based foods that mimic animal products.

What they do differently

Rather than marketing plant-based food as an ethical compromise, NotCo focuses obsessively on taste, texture and familiarity. Their products — such as NotMilk, NotMayo and NotBurger — are designed to be direct replacements for everyday staples. AI allows the company to test thousands of ingredient combinations rapidly, dramatically shortening development cycles and improving sensory performance.

Commercial success and scaling

NotCo has raised hundreds of millions of dollars and expanded far beyond Latin America into North America and Europe. Crucially, it has partnered with major global food companies, using its AI engine to reformulate existing products — including dairy and ice cream — rather than positioning itself purely as a challenger brand.

Why it matters

NotCo demonstrates that the future of food innovation may be computational. It shows how AI can unlock scale, speed and consistency — turning plant-based from a niche ideology into a mainstream solution. For large food groups, it offers a blueprint for how technology can augment, rather than replace, industrial food systems.

2. Meati … Whole-food protein without compromise

Origin and evolution

Meati was founded in Colorado, drawing inspiration from traditional fermentation and the natural structure of fungi. Instead of isolating proteins and rebuilding them through heavy processing, Meati grows mycelium — the root structure of mushrooms — in controlled environments to create whole-food protein.

What they do differently

The company’s approach stands in contrast to earlier generations of alternative proteins. Meati products are minimally processed, naturally fibrous and nutritionally dense, containing complete protein, fibre and micronutrients. They are positioned not as substitutes, but as a new category of protein altogether.

Commercial success and scaling

Meati has attracted significant investment and experienced rapid growth in consumer awareness and retail distribution. Its products appeal not only to vegans but to mainstream consumers seeking healthier, less processed foods. The brand has gained traction in both retail and foodservice, accelerating trial.

Why it matters

Meati signals a shift away from ultra-processed alternatives towards biologically inspired food. It suggests that the future of protein innovation may lie in working with nature more intelligently, rather than engineering around it — a powerful idea for both consumers and regulators.

3. Tru Fru … Making health indulgent again

Origin and evolution

Tru Fru was founded in the USA to address a gap in the snacking landscape: the binary choice between indulgent treats and purely healthy options. The founders’ idea was deceptively simple — real fruit, lightly processed, coated in chocolate, yoghurt or freeze-dried for freshness. By bridging this divide, Tru Fru created a category of “health-forward indulgence” that appealed to children, adults, and health-conscious consumers alike. The brand emerged at a moment when consumers were increasingly seeking snacks that delivered both pleasure and nutritional reassurance.

What they do differently

Tru Fru distinguishes itself through a combination of clean ingredients and playful indulgence. Its products are visually appealing, portion-controlled, and approachable, making them feel like everyday treats rather than niche health foods. Branding is bold, modern and inclusive, emphasising fun and quality without moralising. The company also invests in flexible formats — from single-serve options to family packs — to meet multiple consumption occasions.

Commercial success and scaling

Revenue growth has been extraordinary, with repeat purchase rates demonstrating strong consumer loyalty. Distribution spans grocery chains, specialty retailers, and online channels, allowing the brand to scale nationally while maintaining a premium feel. Tru Fru’s success demonstrates that simplicity, when combined with strong branding and clear value, can outperform more complex product innovations in crowded snack categories.

Why it matters

Tru Fru shows that “better-for-you” doesn’t need scientific jargon or functional claims to resonate. It highlights the enduring power of intuitive value propositions, particularly when health and indulgence are combined seamlessly. For brands, it underscores the importance of making nutritious options emotionally and culturally compelling.

4. FieldGoods … Elevating ready meals to restaurant quality

Origin and evolution

FieldGoods, from Australia, was launched with the mission of challenging the perception that convenience food must compromise on quality. Drawing inspiration from fine-dining kitchens, the founders focused on seasonal ingredients, chef-driven recipes, and sustainable sourcing practices. The brand aimed to transform ready meals from mundane pantry staples into premium, restaurant-quality experiences that could fit into busy modern lifestyles.

What they do differently

FieldGoods pays meticulous attention to every touchpoint — from recipe development to packaging design. Meals are crafted to feel freshly prepared rather than mass-produced, with premium ingredients and authentic flavours. The brand also emphasises sustainability and transparency, ensuring sourcing practices and ingredient quality align with the values of its target consumers.

Commercial success and scaling

FieldGoods has consistently delivered strong year-on-year growth and secured listings with high-end retailers. Its products command a price premium justified by quality, convenience and ethical sourcing. The success of the brand demonstrates that consumers are willing to pay more for convenience when it is paired with a sense of craftsmanship and trust.

Why it matters

FieldGoods represents the premiumisation of time. In an era of increasingly busy lifestyles, convenience itself has become a luxury. The brand highlights how ready meals can be repositioned from utilitarian solutions to aspirational, value-driven offerings.

5. DASH Water … Turning waste into brand equity

Origin and evolution

DASH Water was founded in the United Kingdom to tackle two challenges simultaneously: reducing sugary drink consumption and addressing food waste. The brand uses surplus and “wonky” fruit — often rejected by conventional retail — to flavour sparkling water, turning ingredients that would otherwise be discarded into a central product proposition.

What they do differently

Sustainability is embedded into the product and brand DNA rather than being an afterthought. DASH positions upcycled ingredients as aspirational, playful, and desirable, making environmental responsibility both accessible and culturally appealing. Its branding combines transparency, humour, and clarity to create a compelling narrative that resonates with environmentally conscious consumers.

Commercial success and scaling

DASH has experienced rapid growth and wide distribution in the UK and beyond, becoming a recognised name in a competitive beverage market. Its B Corp certification reinforces credibility, building trust among premium-conscious consumers who care about ethical and sustainable consumption.

Why it matters

DASH proves that sustainability can drive commercial performance. By reframing food waste as an opportunity for innovation and differentiation, the brand illustrates that environmental responsibility can become a strategic growth lever rather than a compliance exercise.

6. Olipop ... Reinventing soft drinks for the gut-health age

Origin and evolution

Olipop was founded out of frustration with traditional soft drinks and early functional beverages that lacked mainstream appeal. The founders sought to reimagine soda as a functional, gut-friendly option by combining prebiotics, botanical extracts, and nostalgic flavours. The idea was to deliver both health benefits and the familiar sensory pleasures of classic sodas.

What they do differently

Olipop maintains the emotional and taste cues of traditional soda while providing tangible nutritional benefits. Its product positioning bridges wellness and enjoyment, making functional beverages appealing to consumers who might otherwise avoid health-forward drinks. Packaging, messaging, and product innovation all emphasise modern, approachable health without alienating mainstream audiences.

Commercial success and scaling

The brand is among the fastest-growing beverages globally, with strong retail presence in North America and e-commerce channels. It has achieved near-unicorn valuation territory, reflecting strong investor confidence and market traction.

Why it matters

Olipop illustrates how legacy categories can be revitalised by integrating science with emotional resonance. It demonstrates that even well-established markets like soda can be disrupted when health and nostalgia converge.

7. Banza … Disrupting the middle of the aisle

Origin and evolution

Founded by young entrepreneurs in the United States, Banza was created to address the nutritional shortcomings of staple foods like pasta. The founders sought to deliver a product that improved health without asking consumers to change familiar cooking or eating habits, using chickpeas as the primary ingredient.

What they do differently

Banza combines higher protein and fibre content with the taste, texture, and cooking experience of traditional pasta. The brand positions itself as approachable and fun rather than preachy, making nutritional enhancement feel natural rather than forced. Packaging, marketing, and messaging reinforce accessibility and everyday use.

Commercial success and scaling

Banza has become one of the largest pasta brands in the United States, with national retail presence and strong consumer loyalty. Its success demonstrates that health-focused innovation can thrive in conventional categories without requiring significant behavioural shifts.

Why it matters

Banza shows that transformation does not always require dramatic lifestyle changes. Instead, incremental improvements, smart ingredient choices, and relatable branding can shift the market from within.

8. Infinite Roots … Scaling through foodservice first

Origin and evolution

Germany’s Infinite Roots originated in Europe’s alternative protein ecosystem with a deliberate focus on foodservice rather than retail. The founders recognised that chefs could act as early adopters and taste influencers, accelerating the acceptance of plant-based protein formats that were unfamiliar to everyday consumers.

What they do differently

By targeting professional kitchens first, Infinite Roots ensured high-quality execution and rapid feedback loops. Foodservice acted as a credibility engine, allowing the brand to perfect formulations and build trust before entering mass retail channels.

Commercial success and scaling

The company’s products have been rapidly adopted across hospitality networks, creating momentum for broader retail expansion. Partnerships with premium restaurants and institutional buyers have established a strong foundation for growth.

Why it matters

Infinite Roots illustrates how channel strategy can accelerate adoption of innovative products. Targeting chefs and foodservice operators first can reduce consumer risk perception, build trust, and validate premium positioning.

9. Revo Foods and Juicy Marbles … Reinventing seafood alternatives

Origin and evolution

Revo Foods and Juicy Marbles joined forces in Germany to tackle one of the most challenging protein categories: seafood. The collaboration combined advanced plant-protein structuring, flavour science, and 3D technology to recreate fish fillets with realistic texture, taste, and nutritional profiles.

What they do differently

Unlike most plant-based brands focused on burgers or mince, this partnership prioritises whole-cut experiences. The products are positioned as premium, sustainable alternatives suitable for restaurants and retail consumers who value authenticity and culinary performance.

Commercial success and scaling

Early adoption in European markets has highlighted strong demand for sophisticated, category-expanding alternatives. The collaboration has generated investor interest and has set the stage for future expansion into new markets and species.

Why it matters

Revo Foods and Juicy Marbles push the boundaries of plant-based innovation, demonstrating that alternative proteins can move beyond simple meat replacements into complex, premium dining experiences.

10. Coccola … Transforming a beverage idea

Origin and evolution

Coccola emerged in 2025 as part of the next wave of food and beverage startups recognised at the World Food Innovation Awards. Founded by a team of Italian entrepreneurs with backgrounds in food science, branding, and sustainability, Coccola was conceived to address three simultaneous market gaps: the need for distinctive functional beverages, the growing consumer demand for sustainability, and the desire for playful, experiential brands.

The company started small, experimenting with unique flavour combinations and functional ingredients that could be positioned as both health-forward and indulgent. Coccola combined innovation in formulation with bold visual branding, creating products that stood out on crowded shelves and social media feeds.

What they do differently

Coccola’s innovation is multifaceted. First, it uses functional ingredients — such as botanicals, prebiotics, and adaptogens — but integrates them into beverages that feel fun and indulgent rather than clinical or medicinal. Second, it focuses heavily on brand experience: colourful, distinctive packaging, interactive marketing campaigns, and social-first storytelling. Third, sustainability is embedded into operations: ingredients are sourced responsibly, packaging is recyclable or plant-based, and supply chains are designed for transparency and minimal environmental impact.

The company also experiments with limited editions and collaborations, creating scarcity and excitement while testing new flavours or formats. This approach leverages both FOMO and social media-driven discovery, appealing to younger, digitally native consumers.

Commercial success and scaling

Although still early-stage, Coccola has achieved rapid growth and recognition. Its products are now stocked in select premium retailers and online platforms across Europe, generating significant consumer buzz and media attention. Winning the World Food Innovation Award has amplified its profile, opening doors for distribution partnerships and investor interest. The brand demonstrates how a small, agile company can punch above its weight by combining taste innovation, strong storytelling, and sustainability.

Why it matters

Coccola exemplifies the modern principles of food and beverage innovation: functional benefits, emotional engagement, and purpose-driven operations. It shows that new entrants can compete with established brands by creating differentiated experiences that resonate with both health-conscious and trend-sensitive consumers. For the industry, Coccola highlights that innovation is now as much about narrative and design as it is about formulation — and that small brands can scale rapidly by aligning product, brand, and social purpose.

5 food innovative specifically from MENA are

11. Almarai … Industrial-scale food excellence

Origin and evolution

Founded in Saudi Arabia in the late 1970s, Almarai began as a dairy company serving a region with limited fresh food infrastructure. From the outset, its ambition was unusual: to build a vertically integrated, world-class food system in one of the most challenging climates on earth.

Over decades, Almarai invested heavily in farming, logistics, cold chains, processing and quality control — creating one of the largest and most sophisticated dairy operations globally.

What they do differently

Almarai’s innovation is not about novelty products, but system-level excellence. Few food companies anywhere control the full value chain at such scale. This enables unmatched consistency, food safety, traceability and trust — critical in a family-oriented, health-conscious region.

In recent years, Almarai has expanded beyond dairy into bakery, poultry, juices and infant nutrition, applying the same operational discipline and brand trust to new categories.

Commercial success and scaling

Almarai is one of the Middle East’s most valuable and profitable food companies, with strong brand loyalty across GCC markets. Its scale, margins and resilience during periods of disruption underline the commercial power of infrastructure-led innovation.

Why it matters

Almarai demonstrates that in MENA, trust, reliability and quality at scale are among the most powerful forms of innovation. It shows how food systems — not just products — can become a competitive advantage.

12. Pure Harvest Smart Farms … Reinventing agri for arid regions

Origin and evolution

Pure Harvest was founded in the UAE with a bold premise: that fresh, high-quality produce could be grown locally in desert climates using advanced controlled-environment agriculture.

The company combines climate-controlled greenhouses, data-driven growing systems and sustainable practices to produce fruits and vegetables year-round, closer to consumers.

What they do differently

Pure Harvest tackles one of MENA’s greatest structural challenges — food security — through technology rather than imports. By controlling temperature, humidity and water use, it dramatically reduces environmental impact while improving quality and shelf life. The brand positions local produce not as a compromise, but as premium, fresher and more reliable.

Commercial success and scaling

Pure Harvest has raised significant investment and expanded across the region, supplying major retailers and foodservice operators. Its products command premium pricing based on freshness, sustainability and local provenance.

Why it matters

Pure Harvest represents the future of regional food resilience. It shows how agritech can turn geographical constraints into strategic advantages — and how “grown here” can become a premium proposition.

13. Kitopi … Reimagining food brands through platforms

Origin and evolution

Founded in Dubai, Kitopi began as a cloud kitchen platform enabling restaurants to expand without owning kitchens. Over time, it evolved into a broader food enablement ecosystem — supporting brand development, operations, logistics and even proprietary food brands.

What they do differently

Kitopi applies platform thinking to food. It decouples brand, kitchen and location, allowing concepts to scale rapidly across cities and countries. Increasingly, it uses data to optimise menus, pricing and formats — turning food brands into adaptable assets.

Kitopi has also launched and acquired its own food brands, moving from infrastructure provider to food brand creator.

Commercial success and scaling

The company has expanded across the GCC and into Europe, partnering with global restaurant brands while building its own portfolio. It has attracted significant funding and achieved strong operational scale.

Why it matters

Kitopi shows how food innovation in MENA is increasingly digital and platform-led. It challenges the idea that food companies must start with farms or factories — and highlights how data, speed and asset-light models can reshape food economics.

14. Barakat … Freshness, health and local relevance

Origin and evolution

Barakat was founded in the UAE as a fresh produce and juice company focused on quality, hygiene and accessibility. In a market dominated by imports, Barakat built a reputation for freshness and reliability.

Over time, the brand expanded into juices, cut fruit, salads and ready-to-consume healthy options.

What they do differently

Barakat operates at the intersection of health, convenience and trust. Its products feel fresh, local and family-friendly, without the premium pricing of imported wellness brands.

The company continuously adapts formats to modern lifestyles — from grab-and-go to family packs — while maintaining a strong focus on quality and food safety.

Commercial success and scaling

Barakat is widely distributed across retail, hospitality and institutional channels, with strong brand recognition in the UAE. Its growth reflects rising demand for fresh, healthy convenience.

Why it matters

Barakat illustrates how everyday health can scale in MENA. It shows that wellness does not always need global branding or complex science — sometimes it needs proximity, consistency and cultural fit.

15. Al Islami Foods … Modernising halal for a new generation

Origin and evolution

Al Islami Foods was founded in the UAE with a mission to modernise halal food — combining strict compliance with innovation, transparency and contemporary branding.

The company operates across poultry, meat and prepared foods, serving both retail and foodservice markets.

What they do differently

Al Islami treats halal as a total value proposition, not just a requirement. It invests heavily in governance, traceability and communication, helping consumers understand not only that food is halal, but how and why.

The brand also innovates in convenience formats and prepared foods, aligning traditional trust with modern lifestyles.

Commercial success and scaling

Al Islami has built strong brand equity across GCC markets, particularly among families seeking reassurance, quality and ethical alignment.

Why it matters

Al Islami shows how halal can be elevated from compliance to brand differentiation. As consumers demand greater transparency and ethics, this approach positions halal brands for premiumisation rather than commoditisation.

What it means for food companies

Across these trends and innovators, five lessons stand out:

-

Premium must be justified — continuously

-

Technology is becoming a core food capability

-

Health and sustainability drive growth, not trade-offs

-

Speed and experimentation beat perfection

-

Trust and relevance are deeply local

For diversified food groups, the opportunity lies not in choosing one path, but in orchestrating a portfolio — value where it matters, premium where it pays, innovation where it differentiates.

Specifically for MENA region, a distinctive pattern:

-

Trust beats novelty

-

Occasions drive margin

-

Local relevance amplifies premium

-

Convenience must respect culture

-

Youth shapes the future faster than institutions

For food groups operating in MENA, success will not come from simply importing global strategies. It will come from translating global innovation into regional meaning — aligning modern health, sustainability and digital behaviours with deeply rooted cultural norms.

From products to possibility

The next chapter of food will not be written by those who defend yesterday’s categories, but by those who reimagine what food is for — nourishment, prevention, pleasure, identity and impact.

The most successful food companies will behave less like manufacturers and more like curators of value — balancing price and purpose, scale and specificity, tradition and transformation.

Food has always fed the world. Now it must also earn trust, inspire choice and justify its place in a rapidly changing life.

That is the real reinvention underway, and it is only just beginning.

More from the blog