The Next/Now Innovation Playbook … 33 practical innovation tools to shape the next decade … from AI-enabled co-creation to foresight flywheels and next-gen business models

January 15, 2026

Innovation is no longer episodic. It is continuous, strategic, and existential. The forces reshaping business — artificial intelligence, platform economics, climate transition, demographic shifts, geopolitical fragmentation — are not incremental trends. They are structural changes that redefine how value is created and who captures it.

In this environment, yesterday’s innovation playbooks are no longer sufficient. Leaders need tools that help them see around corners, orchestrate ecosystems, harness intangible assets, and reinvent organisations repeatedly. Many of the most powerful innovation tools now sit at the intersection of technology, strategy, culture, and purpose — not in product development alone.

- What’s new and next in innovation by Peter Fisk

From Apple to BYD, from Canva to SpaceX, today’s most valuable companies don’t treat innovation as a product feature — they build it into the architecture of their business. They reshape markets, orchestrate ecosystems, and invest ahead of demand. They lead with long-term conviction while delivering short-term performance. Their advantage is not a single breakthrough, but a system for continuously creating what’s next. Innovating “Next Now” is about building that system — strategically, enterprise-wide, and relentlessly focused on future value creation.

Innovating Innovation

Innovation is no longer defined by isolated breakthroughs or linear progress. It is being transformed by speed, scale, and system-wide impact. What once took decades now takes years — sometimes months. AI has collapsed discovery cycles, digital technologies have blurred physical and virtual boundaries, and platforms have enabled innovations to scale globally almost instantly. As a result, innovation today reshapes not just products and services, but entire value chains, institutions, and societies.

Nowhere is this clearer than in AI-enabled drug discovery and development. Companies such as Insilico Medicine are using generative AI and deep learning to identify novel drug targets, design molecules, and predict clinical outcomes in a fraction of the time and cost of traditional pharmaceutical R&D. What once required 10–15 years and billions in investment can now be compressed dramatically, with AI-designed drugs already entering human trials. Innovation here is no longer incremental improvement — it is a fundamental reconfiguration of how science, data, and medicine interact.

At the same time, digital twins are transforming how organisations design, test, and operate complex systems. From manufacturing and energy networks to cities and supply chains, digital twins allow leaders to simulate future scenarios, stress-test decisions, and optimise performance in real time. In logistics and infrastructure, this enables more efficient border crossings, trade flows, and resilience planning — reducing friction, emissions, and risk. Innovation moves from reacting to problems to anticipating and shaping outcomes before they occur.

A new generation of companies exemplifies this shift. Xiaomi has evolved from a smartphone manufacturer into an ecosystem orchestrator, integrating hardware, software, data, and services across smart homes, mobility, and consumer electronics — scaling innovation through platforms rather than products alone. Colossal Biosciences applies advanced genetics, AI, and synthetic biology to de-extinction and biodiversity restoration, reframing innovation as a tool for long-term planetary resilience. These companies are not just innovating faster; they are innovating differently, operating across disciplines, industries, and systems.

Taken together, these examples point to a profound change: innovation has become continuous, convergent, and consequential. It demands new tools, new mindsets, and new forms of leadership — capable of navigating uncertainty, orchestrating ecosystems, and turning accelerating progress into meaningful, sustainable advantage.

Next/Now Innovation: 7 principles for strategic innovation

Over my 35 years in business, innovation has continued to be dominated by the product. My first big job was managing the Concorde brand, where the “product” was just one component in a multi-step customer experience. Indeed the brand itself, or you could say the market – for supersonic travel, LHR to JFK in 3 hours – was an innovation. Product innovation still dominates, largely because of its tangibility. But there is so much more, a wider frame, and a bigger frame to innovate.

The most important insight for leaders today is this: innovation tools do not create advantage — leadership systems do.

The real challenge is making sense of:

- Overlapping waves of technological and societal change

- Tensions between performance today and progress tomorrow

- Fragmented initiatives that never add up to transformation

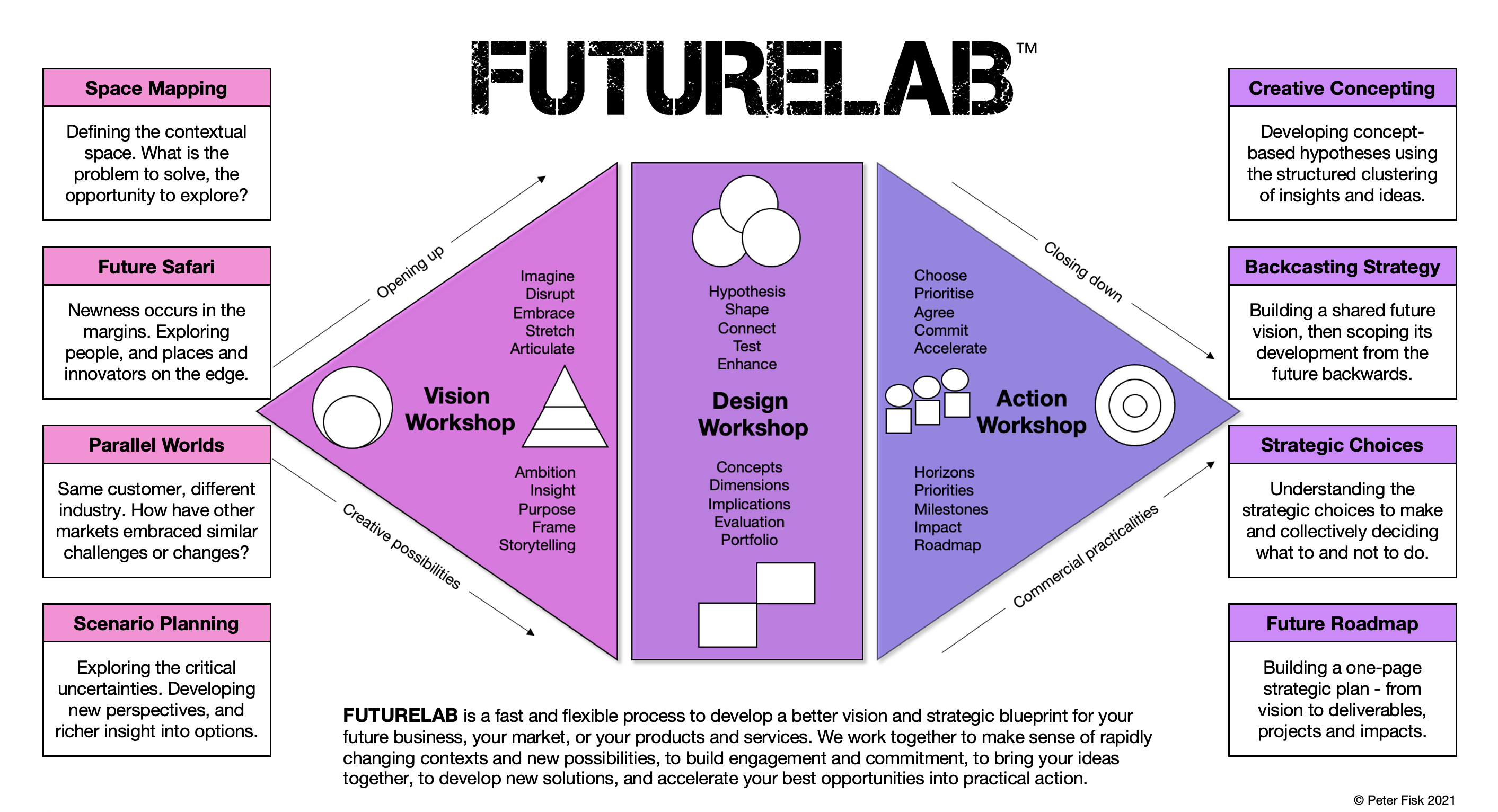

My “FutureLab” approach addresses this challenge directly. It helps leaders step back from day-to-day pressures to:

- Understand the forces shaping the future

- Identify where value will shift next

- Integrate foresight, strategy, innovation, and execution

- Mobilise teams around bold ambition and practical action

In a world defined by uncertainty, the organisations that win will not be those with the most tools — but those with the clearest sense of direction, the courage to reinvent, and the capability to turn future insight into impact.

That is the real work of innovation leadership — and the reason the future belongs to those prepared to design it.

Here are my 7 Principles for innovating “Next Now”, designed for leaders who see innovation not as a function, but as the engine of long-term value creation:

- Build enterprise-wide innovation systems

- Redesign markets, not just offerings

- Lead from the top

- Tie innovation directly to value creation

- Manage portfolios across time horizons

- Institutionalize continuous renewal

- Architect for adaptability

1. Innovate the whole business

Innovation must extend across the entire enterprise, not just products or R&D.

The Ten Types of Innovation framework shows that breakthrough performance often comes from combining innovations across:

- Profit model

- Network and partnerships

- Structure and process

- Product performance

- Service and customer experience

- Brand and engagement

Organizations that innovate across multiple types outperform those focused only on product features. “Next Now” innovators build enterprise-wide capability — not isolated creativity.

Principle: Design innovation as an integrated system that touches every part of how the business creates, delivers, and captures value.

2. Innovate the market

True innovation reshapes how the market works — redefining categories, pricing logic, access, or participation.

Think of:

- Netflix reinventing distribution and consumption.

- Airbnb redefining asset ownership.

- Stripe simplifying digital payments infrastructure.

They didn’t just improve products — they re-architected ecosystems.

Principle: Challenge industry assumptions. Redesign value exchanges. Change the rules of competition.

3. Make innovation a leadership activity

Innovation is not a side initiative — it is how leadership embraces the future.

The CEO and top team must:

- Set ambition beyond incremental improvement

- Allocate capital deliberately across horizons

- Protect long-term bets from short-term pressures

- Signal that experimentation is expected, not optional

When innovation is delegated, it becomes incremental.

When innovation is led, it becomes transformational.

Principle: Make innovation a visible, measurable leadership priority — owned at the top and embedded across the organization.

4. Anchor innovation in value creation

Innovation is not about novelty. It is about durable value creation.

Investors consistently reward companies with credible innovation strategies. Research (see BCG’s Innovation Index) continually shows that top innovation performers generate superior total shareholder returns over time.

Markets place a premium on:

- Strong innovation pipelines

- Category-defining growth plays

- Scalable platforms

- Future-facing capital allocation

Analysts often attribute a significant portion of market valuation to expectations of future growth — meaning innovation capability is priced into enterprise value.

Principle: Manage innovation as a disciplined driver of growth, margin expansion, and long-term enterprise value.

5. Build portfolios that exploit and explore

“Next Now” innovation requires managing across time horizons:

- Core (Exploit Now): Improve today’s business model

- Adjacent (Expand Next): Scale into near-term growth arenas

- Transformational (Create Later): Place bets on future disruption

This portfolio logic — often described in the Three Horizons model — prevents over-optimization of the present at the expense of the future.

High-performing innovators typically allocate meaningful resources (often 20–30% or more) to beyond-core initiatives while maintaining discipline in the core.

Principle: Balance short-term performance with long-term positioning through deliberate innovation portfolio management.

6. Make innovation continuous and progressive

Innovation is not a workshop. Not a hackathon. Not an annual strategy offsite.

It is a repeatable capability built through:

- Talent systems that reward curiosity and execution

- Governance that funds experiments

- Metrics that track learning velocity

- Processes that scale what works

Organizations that treat innovation as episodic fall behind. Those that institutionalize it compound advantage.

Principle: Build the structures, incentives, and rhythms that make innovation perpetual.

7. Design for adaptability

Today’s environment is defined by interdependence — technology shifts, geopolitical change, sustainability demands, AI acceleration.

Innovators must design systems that:

- Adapt quickly

- Leverage ecosystems

- Integrate digital and physical experiences

- Anticipate regulatory and societal expectations

The future will not reward the strongest product — it will reward the most adaptive business model.

Principle: Architect the organization for resilience and reinvention, not stability and control.

Next/Now Innovation Toolkit: 33 practical innovation tools

Here’s my curated list of 33 essential innovation tools, reordered to reflect likely impact over the next decade, while still grounded in proven foundations. Together, they form a modern innovation system, not a loose collection of techniques.

1. AI-Augmented Innovation & Co-Creation

Created by: Emerging practice (OpenAI, DeepMind, IDEO, Accenture, 2019– )

What it is: Using generative AI to accelerate ideation, insight generation, scenario building, prototyping, and experimentation.

When to use it: To radically compress innovation cycles and scale creativity across the organisation.

Free resource: https://www.promptingguide.ai/

2. Strategic Foresight & Scenario Planning (Next Gen)

Created by: Shell, Institute for the Future; evolved (1970s– )

What it is: A structured way to explore plausible futures and stress-test today’s strategies against uncertainty.

When to use it: Long-term strategy, capital allocation, and resilience planning.

Free resource: https://www.iftf.org/futures-toolkit/

3. Platform Strategy & Flywheel Models

Created by: Van Alstyne, Moore, Parker; practice-led (2010s)

What it is: Designing multi-sided platforms that scale through network effects and ecosystem participation.

When to use it: When value shifts from products to orchestration and data.

Free resource: https://platformstrategyinstitute.com/resources/

4. Ecosystem Mapping & Orchestration

Created by: BCG, World Economic Forum (2018– )

What it is: Designing value creation across partners, startups, regulators, and customers rather than within firm boundaries.

When to use it: Complex challenges such as energy transition, health, mobility, or smart infrastructure.

Free resource: https://www.weforum.org/projects/platforms-and-ecosystems/

5. Data-to-Value Innovation

Created by: McKinsey, BCG Gamma, Palantir (2015– )

What it is: Turning proprietary data into new services, products, insights, and business models.

When to use it: When data is abundant but under-monetised.

Free resource: https://www.mckinsey.com/capabilities/quantumblack/our-insights

6. Continuous Transformation & Reinvention Loops

Created by: Practice-led (Amazon, Microsoft, Haier, 2015– )

What it is: Operating models designed for constant renewal rather than episodic change.

When to use it: In fast-moving markets where static strategies fail.

Free resource: https://www.mckinsey.com/capabilities/people-and-organizational-performance

7. Circular & Regenerative Innovation

Created by: Ellen MacArthur Foundation (2012– )

What it is: Designing business models that eliminate waste and regenerate economic, social, and environmental value.

When to use it: Sustainability-led growth and long-term resilience.

Free resource: https://ellenmacarthurfoundation.org/resources

8. Shared Value & Impact Innovation

Created by: Porter & Kramer (2011– )

What it is: Solving societal problems through profitable, scalable business models.

When to use it: When growth, legitimacy, and impact must reinforce each other.

Free resource: https://www.sharedvalue.org/tools

Strategic Value Creation & Business Reinvention Tools

9. Blue Ocean Strategy

Created by: Kim & Mauborgne (2005)

What it is: Creating uncontested market space by redefining value, not out-competing rivals.

When to use it: In saturated or commoditised industries.

Free resource: https://www.blueoceanstrategy.com/tools/

10. Business Model Canvas

Created by: Osterwalder & Pigneur (2010)

What it is: A visual framework for designing and challenging how a business creates and captures value.

When to use it: Strategy resets and new venture design.

Free resource: https://www.strategyzer.com/canvas/business-model-canvas

11. Value Proposition Design

Created by: Osterwalder & Pigneur (2014)

What it is: Structuring customer jobs, pains, and gains to design differentiated offerings.

When to use it: Product, service, and experience innovation.

Free resource: https://www.strategyzer.com/canvas/value-proposition-canvas

12. Jobs-to-Be-Done (JTBD)

Created by: Clayton Christensen (2016)

What it is: Understanding customers by the progress they seek to make.

When to use it: When insight needs to go beyond demographics.

Free resource: https://jtbd.info/2-steps-to-jtbd-success/

13. Outcome-Driven Innovation (ODI)

Created by: Tony Ulwick (2005)

What it is: Quantifying unmet outcomes to prioritise innovation.

When to use it: High-stakes or complex innovation decisions.

Free resource: https://strategyn.com/jobs-to-be-done/

14. Ten Types of Innovation

Created by: Larry Keeley et al. (2013)

What it is: A framework broadening innovation beyond products.

When to use it: To expand strategic imagination.

Free resource: https://www.doblin.com/ten-types

Scaling, Execution & Risk Management Tools

15. Innovation Portfolio & Capital Allocation Models

Created by: McKinsey, BCG (2010s)

What it is: Managing innovation as a portfolio of bets with different risk profiles.

When to use it: To avoid over-investing in the core.

Free resource: https://www.mckinsey.com/innovation/our-insights

16. Three Horizons Framework

Created by: Baghai, Coley & White (1999)

What it is: Balancing performance today with growth tomorrow.

When to use it: Long-term strategy and investment decisions.

Free resource: https://www.mckinsey.com/featured-insights/three-horizons

17. Build–Measure–Learn (Lean Startup)

Created by: Eric Ries (2011)

What it is: Rapid experimentation to reduce uncertainty.

When to use it: Early-stage innovation.

Free resource: https://leanstartup.co/resources/

18. Metered Assumption Testing

Created by: Rita McGrath & Iain MacMillan (2009)

What it is: Testing strategic assumptions before committing capital.

When to use it: High-uncertainty growth bets.

Free resource: https://www.ritamcgrath.com/tools/

19. Stage-Gate Process

Created by: Robert Cooper (1993)

What it is: Structured governance for innovation portfolios.

When to use it: Large, complex organisations.

Free resource: https://www.stage-gate.com/resources/

20. Zone to Win

Created by: Geoffrey Moore (2015)

What it is: Separating core execution from disruptive innovation.

When to use it: When legacy systems block growth.

Free resource: https://www.geoffreyamoore.com/zone-to-win/

21. Crossing the Chasm

Created by: Geoffrey Moore (1991)

What it is: Scaling innovation from early adopters to the mainstream.

When to use it: Commercialising breakthrough offerings.

Free resource: https://www.crossingthechasm.com/

Leadership, Culture & Foundational Insight Tools

22. Ambidextrous Leadership

Created by: O’Reilly & Tushman (2004– )

What it is: Leading exploitation and exploration simultaneously.

When to use it: Transformation at scale.

Free resource: https://www.hbs.edu/faculty/

23. Psychological Safety & Learning Culture

Created by: Amy Edmondson (2018)

What it is: Creating conditions for experimentation and learning.

When to use it: Team-based innovation.

Free resource: https://www.hbs.edu/faculty/

24. The Innovator’s DNA

Created by: Dyer, Gregersen & Christensen (2011)

What it is: Five discovery skills of innovative leaders.

When to use it: Capability building.

Free resource: https://innovatorsdna.com/assessment/

25. Strategic Innovation

Created by: Govindarajan & Trimble (2005)

What it is: Building new growth engines alongside the core.

When to use it: Long-term reinvention.

Free resource: https://www.hbs.edu/faculty/

26. Competitive Positioning Options

Created by: Michael Porter (1985)

What it is: Cost, differentiation, or focus strategies.

When to use it: Clarifying competitive advantage.

Free resource: https://www.isc.hbs.edu/strategy/

27. Diffusion of Innovation & Bass Model

Created by: Everett Rogers / Frank Bass

What it is: Understanding how innovations spread.

When to use it: Adoption forecasting.

Free resource: https://www.diffusionofinnovation.com/

28. Open Innovation Funnel

Created by: Henry Chesbrough (2003)

What it is: Sourcing innovation beyond organisational boundaries.

When to use it: To accelerate learning and access capabilities.

Free resource: https://www.openinnovation.eu/open-innovation-toolkit/

29. Seven Sources of Innovation

Created by: Peter Drucker (1985)

What it is: Systematic sources of opportunity.

When to use it: Strategic scanning.

Free resource: https://www.drucker.institute/

30. The Medici Effect

Created by: Frans Johansson (2004)

What it is: Breakthrough innovation at intersections.

When to use it: Creative exploration.

Free resource: https://themedicieffect.com/tools/

31. TRIZ

Created by: Genrich Altshuller (1984)

What it is: Pattern-based inventive problem solving.

When to use it: Technical challenges.

Free resource: https://www.triz.co.uk/

32. Backcasting & Future-Back Strategy

Created by: Futures & sustainability practice (2000s– )

What it is: Defining a future state and working backwards.

When to use it: Transformation under discontinuity.

Free resource: https://www.futuresplatform.com/blog/backcasting

33. Ecosystem-Led Open Value Creation

Created by: Emerging practice (2020s)

What it is: Designing shared platforms where multiple actors co-create and capture value.

When to use it: Industry-wide transformation.

Free resource: https://www.weforum.org/projects/platforms-and-ecosystems/

Innovation by Sector

Innovation is no longer linear or isolated — it now transforms entire industries at speed, scale, and scope. Breakthroughs in AI, digital platforms, and biological science are enabling organisations not just to improve products, but to redefine business models, supply chains, customer experiences, and societal value. Below we outline where innovation matters most by sector, which approaches drive impact, real global examples, and the likely effects on growth, profitability, and market value.

Automotive

Biggest opportunities:

-

Software-defined vehicles and over-the-air updates

-

Autonomous systems and AI-led driver assistance

-

EV energy ecosystems and vehicle platforms

Approaches that matter most:

Platform strategy, ecosystem orchestration, digital twins, AI-driven design and predictive maintenance.

Examples:

-

Xiaomi (China): A tech-ecosystem entrant using data and platforms to reinvent the car as part of a broader smart-device network.

-

Rivian (US): Pioneering software and service-centric EV experiences with trip planning, over-the-air-upgrades, and fleet services.

-

Lucid Motors (US): High-efficiency, long-range EVs with luxury positioning.

Impact:

-

10–30% improvement in utilisation through software features and data services

-

New revenue streams via subscriptions and connected services

-

Traditional OEM valuations adjusting towards tech multiples

Banking & Financial Services

Biggest opportunities:

-

AI-driven credit and risk models

-

Embedded finance and platform banking

-

Real-time compliance and fraud detection

Approaches that matter most:

Data-to-value innovation, ecosystem mapping, open platforms, and customer-job mapping.

Examples:

- Nubank (Brazil): digital-first, radically lower cost base

-

Kakao Bank (South Korea): Digital-first bank reshaping customer acquisition and retention.

-

Zimbra (UK-EU): AI-enhanced risk analytics and next-gen compliance automation.

Impact:

-

20–40% lower cost-to-serve via automation

-

Faster growth in underbanked segments

-

Increased valuation multiples for platform-based financial models

Beauty & Personal Care

Biggest opportunities:

-

AI-driven personalised formulations

-

Biotech ingredients for active skincare

-

Community and creator-driven commerce

Approaches that matter most:

AI-augmented innovation, JTBD, circular design.

Examples:

-

Debut (US): Uses AI to accelerate ingredient discovery for skincare performance. Vogue

-

Alta Beauty AI (global): AI platforms for personalised regimens and product matching. Vogue

-

L’Oréal (France): AI skin diagnostics, personalised formulations

Impact:

-

15–25% uplift in repeat purchase through personalisation

-

Faster product cycles, lower inventory costs

-

Stronger brand premium and loyalty

Energy

Biggest opportunities:

-

Renewable integration and grid digitalisation

-

Energy-as-a-service and demand flexibility

-

Green hydrogen and long-duration storage

Approaches that matter most:

Ecosystem orchestration, digital twins, shared-value models.

Examples:

- NextEra Energy (US): data-driven renewables scale

- Schneider Electric (France): digital energy management platforms

-

Tesla Energy (US): Batteries, solar, and vehicle-grid integration.

Impact:

-

Lower operating cost and improved forecasting through digital twins

-

New revenue from services and flexibility markets

-

Re-rating of energy companies based on future growth pipelines

Fashion & Apparel

Biggest opportunities:

-

AI trend sensing and demand forecasting

-

On-demand and circular production

-

Virtual try-on and metaverse retail experiences

Approaches that matter most:

Platform strategy, digital twins, circular innovation.

Examples:

-

ShopMy (US): Creator commerce platform connecting brands and audiences.

-

Lyst (UK): AI-powered shopping discovery across thousands of brands.

-

Faircraft (US/UK): Sustainable materials (lab-grown leather) for circular fashion.

Impact:

-

10–30% reduction in unsold inventory via predictive demand systems

-

New digital revenue streams via marketplaces and metaverse engagement

-

Enhanced brand value through sustainability credentials

Food & Agriculture

Biggest opportunities:

-

Alternative proteins and precision fermentation

-

AI-led breeding and yield optimisation

-

Supply-chain traceability systems

Approaches that matter most:

AI-augmented discovery, ecosystem mapping, shared value innovation.

Examples:

-

Upside Foods (US): Cultivated meat scaling towards commercial volumes.

-

Tropic Biosciences (UK): Gene-edited crops for climate resilience.

-

NotCo (Chile): AI-designed food formulations

Impact:

-

Faster innovation cycles (months not years)

-

Premium pricing for sustainable products

-

Reduced production risk and environmental footprint

Retail

Biggest opportunities:

-

AI-led personalisation and dynamic pricing

-

Omnichannel integration and contactless experiences

-

Marketplace and affiliate platforms

Approaches that matter most:

AI-augmented innovation, platform strategy, JTBD.

Examples:

-

IKEA (Sweden): circular and service-based retail innovation

-

Temu (US/China): Price-driven marketplace scaling globally.

-

GoPuff (US): Instant delivery ecosystem.

Impact:

-

Higher conversion and basket value

-

Lower logistics costs through dynamic routing

-

Market share gains against traditional retailers

Technology & Platforms

Biggest opportunities:

-

AI platforms, cloud-native services, developer ecosystems

-

Digital identity and secure compute infrastructures

-

Data-as-a-service models

Approaches that matter most:

Platform strategy, continuous reinvention, open innovation.

Examples:

-

OpenAI (US): Generative AI platform reshaping software workflows.

-

Snowflake (US): Data cloud enabling ecosystem innovation.

-

UiPath (US): End-to-end automation enabling rapid productivity gains.

Impact:

-

Exponential scaling in revenue and margins

-

New partner ecosystems extending platform reach

-

Large market value multiples based on future growth expectation

Travel & Mobility

Biggest opportunities:

-

AI pricing, contactless border systems, seamless journeys

-

Sustainable fleets and multimodal networks

Approaches that matter most:

Digital twins, ecosystem orchestration, experience design.

Examples:

-

Cruise.io (US): Fully autonomous taxi pilot (AVs).

-

Airwallex (Australia): Cross-border payments integrated into travel commerce.

-

Woven by Toyota (US): Urban mobility platforms.

Impact:

-

Streamlined passenger experience with dynamic pricing

-

Lower friction in travel logistics

-

Revenue diversification beyond traditional tickets

Healthcare & Biotech (Cross-Sector)

Biggest opportunities:

-

AI-driven drug discovery and precision biology

-

Genomics and personalised therapies

-

Decentralised clinical trials

Approaches that matter most:

AI-augmented innovation, ecosystem mapping, strategic foresight.

Examples:

-

Recursion Pharmaceuticals (US): Massive automated AI biology labs speeding target discovery. SkyQuest

-

XtalPi (China/US): AI-driven drug discovery and materials science. Wikipedia

-

Lila Sciences (US): “AI science factories” integrating generative models and automated experimentation. gurustartups.com

-

Owkin (France/US): Precision oncology AI with hospital and pharma partnerships. Wikipedia

Impact:

-

Potential to reduce discovery timelines from years to months

-

New revenue sources through platform licensing and partnerships

-

Biotech valuations increasingly tied to data and AI assets

Governments & Public Sector

Biggest opportunities:

-

Digital public services and identity systems

-

Predictive analytics for health, infrastructure, and resilience

-

Smart cities and digital governance ecosystems

Approaches that matter most:

Strategic foresight, digital twins, ecosystem orchestration.

Examples:

-

Estonia: End-to-end digital citizen services and e-ID.

-

Singapore: Smart Nation initiatives with real-time analytics.

-

EU Digital Identity: Cross-border trusted identity framework.

Impact:

-

Dramatically reduced service costs and error rates

-

Better public trust and transparency

-

New public-private innovation partnerships

Across Sectors: the Innovation Dividend

Across all sectors, the pattern is clear:

-

Innovation is shifting from products to systems

-

From speed to acceleration

-

From competition to orchestration

-

From efficiency to resilience and relevance

The organisations that capture the greatest value will be those that combine next-generation innovation tools with strategic clarity and leadership courage — turning technological possibility into meaningful progress, profitable growth, and long-term advantage.

While exact uplift varies, leaders integrating next-gen tools see consistent outcomes:

-

Revenue acceleration: 10–40% growth via new offerings and digital channels

-

Profit expansion: 15–30% margin improvements through automation and data insights

-

Structural value: Higher market multiples for platform- and AI-led business models

The future of industry belongs to organisations that combine technological foresight with systemic innovation, execute around data-driven platforms, and reinvent continuously rather than episodically.

Benchmarked Performance Scenarios

How Innovation Tools Translate into Business Results

How to read this

-

Baseline = well-run incumbent using traditional innovation (incremental, siloed).

-

Advanced = companies adopting modern tools selectively.

-

Frontier = next-gen innovators combining AI, platforms, ecosystems, and speed.

Percentages reflect 3–5 year impact, not single-year spikes.

1. AI-Augmented Discovery & Design

(Generative AI, digital twins, simulation, science automation)

Applies most to

Pharma, automotive, materials, beauty, energy, semiconductors, food tech

Performance impact

| Metric | Baseline | Advanced | Frontier |

|---|---|---|---|

| R&D cycle time | – | ↓ 20–40% | ↓ 60–90% |

| Cost per innovation | – | ↓ 15–30% | ↓ 40–70% |

| Success rate | – | +10–20% | +30–50% |

| Time to revenue | – | –1–2 yrs | –3–5 yrs |

Frontier examples

-

Insilico Medicine: AI-designed drugs entering clinical trials in record time

-

Recursion: Fully automated “industrialised biology”

-

Xiaomi: AI-driven product design cycles across devices and EVs

Value creation

-

Revenue uplift: +5–15% (earlier launches)

-

Margin uplift: +5–10 pts

-

Market value gain: +20–50% (IP + speed premium)

2. Platform & Ecosystem Innovation

(APIs, marketplaces, developer platforms, embedded services)

Applies most to

Banking, retail, mobility, energy, travel, software, government

Performance impact

| Metric | Baseline | Advanced | Frontier |

|---|---|---|---|

| Revenue growth | GDP+ | +5–10% | +15–30% |

| Customer lifetime value | – | +20–40% | +50–100% |

| Marginal cost to scale | High | Medium | Near-zero |

| Partner-led revenue | <5% | 10–25% | 30–60% |

Frontier examples

-

Stripe: Platform economics replacing banking rails

-

Temu / Shein: Demand-signal-driven ecosystems

-

Tesla Energy: Hardware + software + grid ecosystem

Value creation

-

Revenue uplift: +10–30%

-

Profit uplift: +10–25%

-

Market value gain: +30–100% (platform multiple)

3. AI-Driven Personalisation & Experience

(Real-time data, recommendation engines, adaptive pricing)

Applies most to

Retail, beauty, fashion, banking, media, travel

Performance impact

| Metric | Baseline | Advanced | Frontier |

|---|---|---|---|

| Conversion rate | – | +5–10% | +15–30% |

| Repeat purchase | – | +10–20% | +30–50% |

| Marketing ROI | – | +20–40% | +50–100% |

| Inventory waste | – | ↓ 10–20% | ↓ 30–50% |

Frontier examples

-

Lyst: AI discovery layer for fashion

-

Shein: Micro-batch demand sensing

-

Next-gen beauty brands using AI skin/genomics data

Value creation

-

Revenue uplift: +5–20%

-

Margin uplift: +3–8 pts

-

Brand value gain: +15–40%

4. Digital Twins & System Simulation

(End-to-end modelling of factories, grids, cities, supply chains)

Applies most to

Energy, manufacturing, logistics, cities, aviation, infrastructure

Performance impact

| Metric | Baseline | Advanced | Frontier |

|---|---|---|---|

| Downtime | – | ↓ 20–40% | ↓ 50–70% |

| Capex efficiency | – | +10–20% | +25–40% |

| Forecast accuracy | – | +20–30% | +40–60% |

| Time to decision | Weeks | Days | Near-real-time |

Frontier examples

-

Enel / Ørsted: Grid-scale digital twins

-

Siemens Xcelerator ecosystems

-

Smart cities in Singapore, UAE

Value creation

-

Cost reduction: 5–15%

-

ROIC uplift: +2–5 pts

-

Risk reduction: material (often undervalued)

5. Sustainable & Circular Innovation

(New materials, energy systems, regenerative models)

Applies most to

Fashion, food, energy, construction, mobility

Performance impact

| Metric | Baseline | Advanced | Frontier |

|---|---|---|---|

| Cost volatility | High | Medium | Low |

| Regulatory risk | Rising | Managed | Advantage |

| Premium pricing | Low | +5–10% | +10–25% |

| Talent attraction | – | + | ++ |

Frontier examples

-

Colossal Biosciences: Synthetic biology platforms

-

Next-gen materials startups replacing plastics/leather

-

Energy companies shifting to service-based models

Value creation

-

Revenue resilience: significant

-

Margin upside: delayed but durable

-

Market value gain: +10–30% (future-proofing)

Sector-Level Summary: Where the Biggest Upside Lies

| Sector | Biggest Value Lever | Likely Market Value Gain |

|---|---|---|

| Automotive | Software + platforms | +30–70% |

| Banking | Embedded finance + AI | +20–50% |

| Beauty | AI personalisation + biotech | +25–60% |

| Energy | Digital grids + services | +15–40% |

| Fashion | Demand sensing + circularity | +20–50% |

| Food | AI biology + alt proteins | +30–100% |

| Retail | Platforms + AI pricing | +20–60% |

| Technology | AI platforms | +50–200% |

| Travel | Experience + data ecosystems | +15–35% |

| Government | Digital public infrastructure | Economic, not equity-based |

The Strategic Insight for Leaders

From Tools to Transformation: Seeing the Bigger Picture

Individually, these methods are powerful. But the real challenge for leaders today is not choosing a tool — it is seeing the context of change clearly.

That context includes:

-

Exponential technologies reshaping industries

-

Shifting value from physical to intangible assets

-

Rising expectations from customers, talent, and society

-

The need to balance performance today with progress tomorrow

This is where innovation becomes a leadership discipline, not a functional activity.

Innovation has moved:

-

From products → platforms and ecosystems

-

From planning → continuous reinvention

-

From insight → AI-accelerated intelligence

-

From shareholder value → sustainable, shared value

Together, they reinforce a core truth increasingly clear to business leaders:

Innovation is no longer a set of tools. It is a system — shaped by context, culture, technology, and leadership.

Peter Fisk’s Future Lab–style approaches are designed precisely for this challenge. They help leaders and teams:

-

Make sense of future forces and strategic uncertainty

-

Connect foresight to growth opportunities

-

Integrate multiple innovation methods into a coherent system

-

Align strategy, culture, and execution around bold ambition

Rather than applying tools in isolation, Future Lab approaches enable strategic, integrated innovation — turning ideas into impact, and ambition into action.

In a world where the future arrives faster every year, the advantage belongs not to those who know the most tools, but to those who know how to lead innovation as a system — with clarity, confidence, and purpose.

The highest returns do not come from single tools, but from tool stacks:

AI + Platforms + Speed + Ecosystems = Non-linear value creation

Companies that combine these:

-

grow faster and

-

operate cheaper and

-

command higher multiples simultaneously

This is why the newest tools are increasingly rising to the top — not because they are fashionable, but because they compress time, collapse cost curves, and expand scale at once.

More from the blog