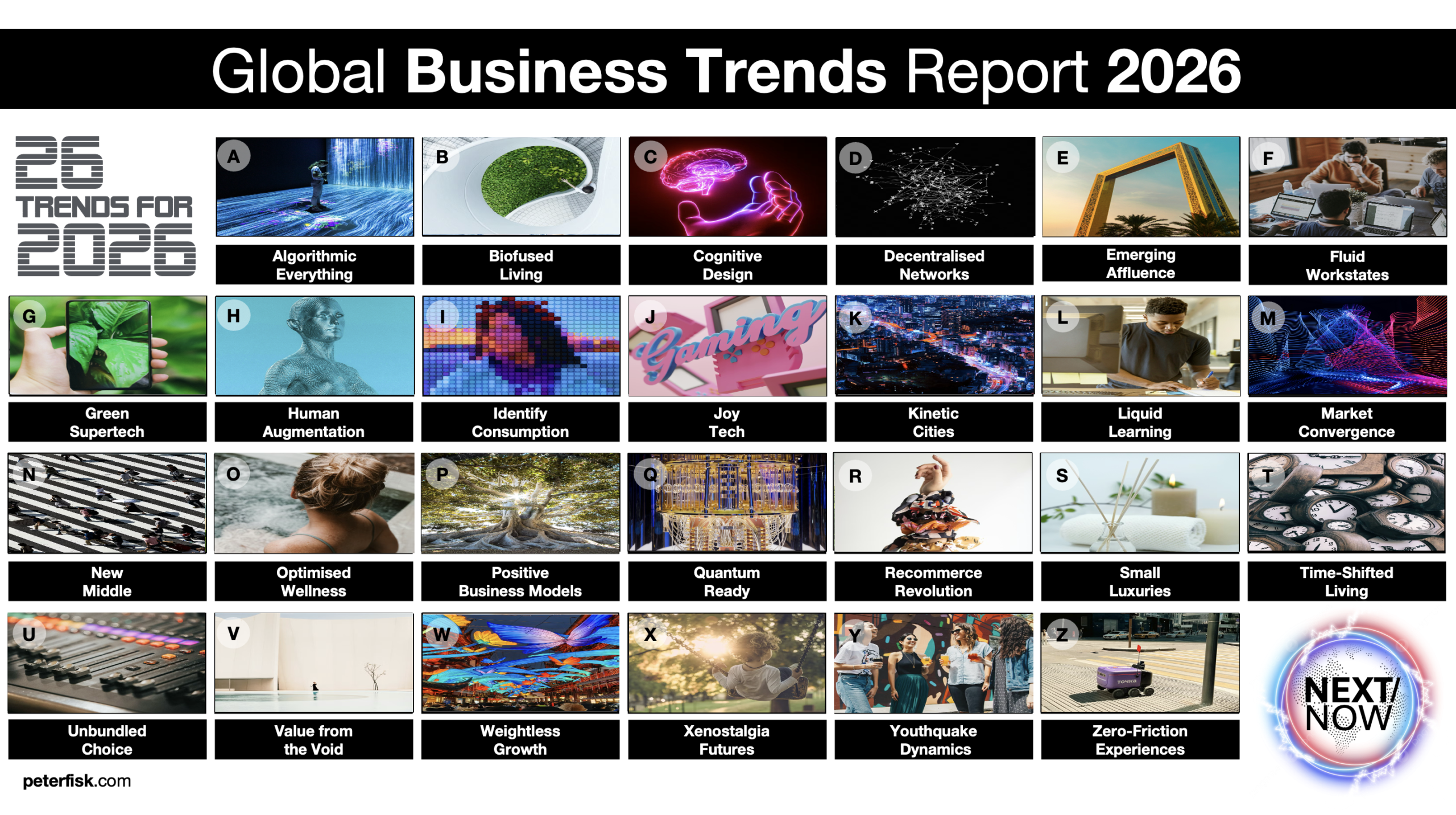

Trend 1: Algorithmic Everything

AI and algorithmic systems are the operational backbone across industries. Algorithms anticipate needs, optimise supply chains, orchestrate workflows, and personalise services. From healthcare to fashion, logistics to marketing, organisations embedding AI as a strategic foundation transform operations and decision-making. Algorithmic mastery accelerates innovation, reduces human error, and generates predictive insights that redefine competitive advantage. Businesses converting AI into an enterprise-wide platform gain continuous improvement loops, operational resilience, and new business models.

Leadership actions:

Executives must prioritise AI literacy, integrate predictive intelligence into strategy, and align teams around human-machine collaboration. Decision-making increasingly relies on algorithmic insight.

Example: Relativity Space (USA)

Relativity Space uses AI-driven generative design and autonomous 3D printing to produce rockets. Each print cycle informs material science and engineering improvements, compressing timelines from years to months. Predictive maintenance, rapid prototyping, and scalable production illustrate how algorithmic intelligence transforms manufacturing and strategy.

Trend 2: Biofused Living

Biotechnology, materials science, and computation converge to create regenerative, circular systems. Products self-heal, biodegrade, or convert waste into resources, transforming production in food, fashion, construction, and energy. Bio-design enables sustainable, resilient operations and functional, ethical, ecological products that resonate with conscious consumers. Living systems shift sustainability from marketing claim to operational strategy, driving circularity, efficiency, and long-term resilience. Companies embedding biofused processes unlock value while reducing environmental impact, bridging science, design, and consumer engagement.

Leadership actions:

Leaders should foster cross-disciplinary innovation, invest in R&D, and integrate sustainability into strategy as a source of growth and differentiation.

Example: Bolt Threads (USA)

Bolt Threads creates sustainable textiles using engineered proteins, including spider silk and mycelium leather. These materials are biodegradable, high-performance, and reduce environmental impact. By integrating bio-design into fashion, Bolt Threads demonstrates regenerative production while delivering premium, innovative products.

Trend 3: Cognitive Experiences

Consumer experiences increasingly combine neuroscience, behavioural design, AI, and sensory engagement. Experiences adapt dynamically to attention, emotion, and context, enhancing memory, engagement, and satisfaction. Retail, hospitality, entertainment, and digital platforms optimise cognition while creating emotional resonance. Functional utility and experience blur, making experiences as valuable as products. Organisations mastering cognitive design improve loyalty, retention, and cultural impact. Adaptive experiences turn routine interactions into personalised, emotionally meaningful journeys, providing differentiation in attention-fragmented markets.

Leadership actions:

Leaders should integrate behavioural science into product and service design, invest in adaptive experience technology, and track emotional engagement as a KPI.

Example: Calm (USA)

Calm delivers AI-driven, personalised meditation and wellbeing experiences. The platform adapts content to users’ stress levels, moods, and goals, blending neuroscience, behavioural design, and digital interface. This demonstrates cognitive experiences enhancing emotional and mental engagement while fostering loyalty.

Trend 4: Decentralised Networks

Power, commerce, and value creation shift from hierarchies to distributed digital, physical, and hybrid networks. Peer-to-peer marketplaces, community platforms, and decentralised governance enable scalability, resilience, and co-creation. Organisations acting as ecosystem orchestrators gain influence through network effects rather than command-and-control structures. Distributed systems empower smaller players, enhance participation, and foster innovation. Businesses leveraging networks can access diverse talent, engage consumers directly, and unlock scalable growth. Distributed networks are reshaping commerce, work, and content creation.

Leadership actions:

Executives should embrace platform thinking, facilitate community engagement, and enable value creation through network orchestration rather than direct control.

Example: Aragon (Spain)

Aragon builds decentralised governance platforms using blockchain, enabling organisations and communities to manage resources and decision-making without centralised control. This empowers distributed collaboration, autonomy, and scalable ecosystems, illustrating how decentralised digital worlds redefine organisational structures.

Trend 5: Emerging Affluence

Rapidly growing middle and affluent classes in Africa, Asia, and Latin America redefine global consumption. Digitally connected, aspirational, and culturally influential, these consumers drive demand for accessible luxury, wellness, mobility, and fintech solutions. Businesses must design offerings that respect local context while meeting aspirational expectations. Emerging affluence often leapfrogs Western models, creating opportunities for innovation in pricing, service, and digital infrastructure. Companies that understand cultural nuance and income elasticity unlock sustainable growth while engaging diverse consumer identities.

Leadership actions:

Leaders should prioritise local market insight, cultural relevance, and scalable digital infrastructure to capture emerging middle-class demand.

Example: Mercado Libre (Argentina)

Mercado Libre provides e-commerce, payments, and logistics infrastructure across Latin America. By addressing middle-class needs for convenience, trust, and cultural relevance, it enables participation in modern digital economies. Starting as a marketplace like eBay, it now dominates fintech and e-commerce, illustrating how understanding local contexts drives growth.

Trend 6: Fluid Workforces

Workforces are increasingly modular, global, and hybrid. Talent flows between projects, companies, and platforms, supported by AI augmentation. Hybrid human-machine teams, freelancers, fractional executives, and automated agents provide agility, scalability, and resilience. Organisations must manage dynamic teams across geographies while fostering purpose, autonomy, and culture. Flexible workforces allow rapid response to market changes, cross-disciplinary problem-solving, and operational efficiency, redefining talent as a strategic, movable asset.

Leadership actions:

Leaders need to focus on culture, engagement, and ecosystem orchestration rather than direct oversight. Recruitment, retention, and upskilling strategies must embrace flexibility and autonomy.

Example: Upwork (USA)

Upwork connects freelancers with companies worldwide, enabling flexible, project-based work. The platform supports distributed teams and adaptive talent allocation, demonstrating how fluid workforce models drive agility, scalability, and market responsiveness.

Trend 7: Green Supertech

Climate innovation now relies on advanced engineering and science rather than incremental sustainability. Fusion energy, carbon capture, precision agriculture, renewable energy, and battery breakthroughs drive decarbonisation at scale. Companies integrate technology, infrastructure, and industrial capacity to deliver profitable environmental solutions. Green supertech turns sustainability from narrative to operational imperative, creating measurable environmental impact while generating new business models. Organisations mastering these technologies achieve competitive advantage, system-wide transformation, and long-term resilience in climate-conscious markets.

Leadership actions:

Executives must invest in frontier climate technologies, integrate sustainability into core strategy, and measure impact rigorously. Strategic adoption of green supertech defines market leadership.

Example: Climeworks (Switzerland)

Climeworks captures CO₂ directly from air and provides carbon removal services for businesses. Its modular technology delivers measurable impact while creating scalable climate solutions. Climeworks demonstrates how advanced environmental technology can combine profit with purpose, setting a benchmark for green innovation.

Trend 8: Human Augmentation

Technology increasingly enhances physical, cognitive, and emotional capabilities. Wearables, exoskeletons, neurotech, and AI-enabled interfaces improve productivity, performance, wellness, and decision-making. Human+ solutions extend lifespan, enhance skill sets, and transform work structures. Companies embedding augmentation into products and services unlock new markets while improving quality of life. Ethical considerations—privacy, accessibility, autonomy—are central as augmented humans redefine societal norms, job expectations, and personal capabilities.

Leadership actions:

Leaders must balance innovation with ethics, invest in workforce augmentation, and prepare teams for hybrid human-machine collaboration.

Example: Mizuno (Japan)

Mizuno’s Well-Aging programs combine wearable technology, mobility support, and social engagement for older adults. This initiative extends independence, resilience, and quality of life while creating a market for human-centric performance solutions.

Trend 9: Identity Consumption

Consumers increasingly make choices reflecting personal, social, and ethical identity. Purchases convey values, lifestyle, and cultural affiliation. Identity-driven markets shape fashion, wellness, digital products, and sustainability. Brands that authentically align with identity codes cultivate loyalty, advocacy, and emotional resonance. Social media amplifies expression, making identity a strategic asset. Understanding fluid, multi-layered identities enables companies to co-create products, services, and experiences that deeply engage consumers.

Leadership actions:

Leaders should prioritise authenticity, culture alignment, and personalised engagement strategies to capture identity-conscious markets.

Example: NewJeans (South Korea)

NewJeans blends fashion, gaming, and lifestyle collaborations to create identity-rich consumer experiences. Fans adopt products as self-expression, merging digital-native aesthetics with cultural relevance. The brand exemplifies how identity-driven engagement drives loyalty, advocacy, and market influence.

Trend 10: JoyTech

Technology increasingly provides emotional, sensory, and lifestyle benefits beyond productivity. Smart devices, entertainment platforms, and services are designed for delight, engagement, and wellbeing. JoyTech integrates play, creativity, and emotional resonance into daily life. Companies embedding joy into design capture attention, loyalty, and cultural influence. Emotional technology turns small, interactive moments into memorable experiences, differentiating brands in saturated markets and establishing long-term preference.

Leadership actions:

Leaders should integrate joy into product design, measure emotional engagement, and explore playful, sensory experiences as a differentiator.

Example: Beat Saber (Slovakia)

Beat Saber combines VR, music, and motion-based gameplay to deliver immersive, joyful experiences. Users interact physically and socially, blending entertainment with exercise. The platform illustrates how emotional, playful technology drives engagement and global cultural impact.

Trend 11: Kinetic Cities

Urban environments are becoming adaptive systems integrating mobility, energy, climate resilience, and digital infrastructure. Smart grids, autonomous transport, real-time optimisation, and responsive buildings redefine urban living. Kinetic cities address congestion, pollution, extreme weather, and social equity while creating livable, resilient spaces. Urban systems operate as continuous feedback loops, merging physical space with digital intelligence, unlocking new service and business ecosystems.

Leadership actions:

City leaders and businesses must invest in integrated infrastructure, coordinate across sectors, and leverage data for urban resilience and efficiency.

Example: Uber Elevate (USA)

Uber Elevate pilots electric VTOL aerial mobility integrated with smart traffic networks. By combining infrastructure, technology, and analytics, it demonstrates how kinetic systems can transform urban transport, accessibility, and sustainability.

Trend 12: Liquid Learning

Learning is continuous, adaptive, and embedded in daily work. AI personalises education, simulations replicate real-world scenarios, and micro-credentials create stackable skills. Learning flows across careers, devices, and contexts, enabling lifelong adaptability. Organisations embedding liquid learning into culture and operations gain agility, resilience, and innovation capacity. Employees continuously upskill while performing work, turning knowledge into a strategic asset and preparing for rapidly changing markets.

Leadership actions:

Leaders should integrate learning into workflow, provide AI-enabled personalisation, and foster a culture of continuous skill development.

Example: Degreed (USA)

Degreed provides a platform that aggregates courses, articles, videos, and on-the-job experiences into personalised learning journeys. AI recommends skills to acquire based on role, career goals, and performance data, enabling continuous, just-in-time upskilling. Companies using Degreed embed learning into daily work, creating agile, future-ready teams.

Trend 13: Market Convergence

Market Convergence describes how once-separate industries, categories, and value chains increasingly overlap, collide, and merge. Boundaries between technology, finance, retail, healthcare, mobility, media, and energy are dissolving as platforms, data, and ecosystems connect multiple needs into unified experiences.

Consumers no longer think in categories; they expect solutions that combine services, products, and experiences seamlessly.

Growth comes from recombining capabilities—payments embedded in commerce, health integrated into insurance, mobility bundled with energy. The winners are those who redefine markets instead of protecting them.

Leadership actions:

Map where your industry is converging with others and identify adjacent capabilities to integrate or partner with. Shift strategy from category defence to ecosystem design. Build collaboration muscle, platform thinking, and flexible governance to compete across blurred market boundaries.

Example: Ant Group (China)

Ant Group exemplifies Market Convergence by integrating payments, finance, commerce, credit, insurance, and lifestyle services into a single digital ecosystem. Originating in fintech, it expanded across retail, mobility, and everyday services, reshaping consumer expectations. Ant demonstrates how convergence creates powerful new markets by unifying fragmented needs into seamless platforms.

Trend 14: New Middle

Urban middle classes in Southeast Asia, India, and Latin America are reshaping purchasing patterns. These consumers value quality, affordability, convenience, and digital access. Emerging middle markets drive innovation in financial inclusion, mobility, healthcare, and retail. Brands must combine local insight with scalable digital infrastructure to win loyalty and growth. Understanding income elasticity, aspirational consumption, and digital adoption is key for early market leadership.

Leadership actions:

Leaders should design culturally relevant products and services, leverage digital channels, and scale infrastructure to reach rapidly growing middle-class segments.

Example: Jumia (Nigeria)

Jumia provides online shopping, payments, and logistics solutions tailored to African middle-class consumers. By improving accessibility and affordability, it enables participation in digital commerce while building scalable infrastructure and market trust.

Trend 15: Optimised Wellness

Wellbeing is evolving into integrated systems combining mental, physical, emotional, and social health. Digital platforms, AI diagnostics, and personalised wellness services make holistic health accessible and measurable. Consumers and organisations expect proactive interventions and continuous monitoring. Optimised wellness integrates performance, longevity, and emotional satisfaction, turning health into a strategic differentiator. Companies providing seamless, data-driven wellness ecosystems increase loyalty, engagement, and brand relevance.

Leadership actions:

Leaders should embed wellness into products, workplace culture, and digital services, measuring impact and engagement as part of strategic priorities.

Example: Cerebral (USA)

Cerebral provides mental health services via digital therapy, medication management, and continuous care. By reducing stigma and improving accessibility, it makes wellness habitual, personalised, and measurable, exemplifying scalable holistic health solutions.

Trend 16: Positive Business Models

Businesses are embedding ecological and social impact into core strategy. Operations, products, and supply chains are designed to restore ecosystems, enrich communities, and enhance planetary resilience. Circular design, biomimicry, renewable inputs, and ethical sourcing become standard. Net positive business models balance profitability with stewardship, creating shared value for stakeholders, and enable companies to become platforms for good. Companies adopting regenerative strategies redefine competitive advantage, aligning environmental and societal contributions with long-term business success.

Leadership actions:

Leaders should integrate regenerative practices into strategy, measure environmental and social impact, and communicate authenticity to stakeholders.

Example: Interface (USA)

Interface pioneers regenerative flooring, combining recycled materials, modular design, and biomimicry. Its operations achieve net-positive impact while maintaining profitability, showing how sustainability can drive competitive advantage and commercial success.

Trend 17: Quantum Ready

Quantum computing is moving from experimental labs to strategic applications. Early use focuses on optimisation, cryptography, simulation, and materials discovery. Organisations develop quantum-literate teams, hybrid workflows, and experimental algorithms to prepare for disruption. Quantum-readiness accelerates innovation, reduces complexity, and provides first-mover advantages in logistics, energy, pharmaceuticals, and manufacturing. Early strategic exploration enables problem-solving capabilities beyond classical computing, creating competitive differentiation and future-ready infrastructure.

Leadership actions:

Leaders should invest in quantum R&D, train teams in quantum literacy, and explore hybrid algorithms for operational advantage.

Example: D-Wave (Canada)

D-Wave provides quantum annealing systems for optimisation problems in logistics, energy, and finance. Companies use D-Wave’s platforms to experiment with quantum algorithms, accelerating problem-solving and operational efficiency. This highlights practical enterprise applications of quantum computing beyond theoretical research.

Trend 18: Recommerce Revolution

Resale, rental, and refurbishment are mainstream, driven by circular economy principles. Consumers demand convenience, trust, and quality when engaging with pre-owned goods. Recommerce spans fashion, electronics, furniture, and luxury, growing faster than conventional retail. Platforms, peer-to-peer marketplaces, and authentication services facilitate engagement while reducing waste. Companies integrating recommerce unlock revenue streams, build community, and enhance credibility. Circular consumption becomes strategic rather than niche.

Leadership actions:

Leaders should design recommerce options, build trust through verification, and integrate circular principles into business models for growth and loyalty.

Example:The RealReal (USA)

The RealReal is a luxury consignment platform that authenticates and sells pre-owned designer goods. It provides trust, verification, and convenience, making high-end resale mainstream. This example shows recommerce can scale globally, combine sustainability with premium brands, and generate new revenue streams.

Trend 19: Small Luxury

Consumers seek small, emotionally resonant indulgences that deliver status, pleasure, or wellbeing without extreme cost. Small (or “soft”) luxury spans boutique experiences, skincare, fashion, speciality foods, and personalised services. These products offer authenticity, sensory delight, and storytelling, turning everyday indulgences into identity statements. Micro-luxuries satisfy aspirational desires while remaining accessible, amplified by social media visibility. Emotional resonance and narrative depth are essential for brand success.

Leadership actions:

Leaders should focus on craft, storytelling, and emotional design to create premium-feel experiences that engage aspirational consumers.

Example: Sulwhasoo (South Korea)

Sulwhasoo combines traditional herbal expertise with premium packaging and ritualised use. Its products create accessible luxury experiences, blending heritage, craftsmanship, and emotional satisfaction, appealing to aspirational global consumers.

Trend 20: Time-Shifted Living

Time-Shifted Living reflects how people reorganise life around flexibility rather than fixed schedules. Work, consumption, entertainment, learning, and wellness increasingly happen asynchronously—on demand, remotely, and across time zones.

Technology enables people to reclaim control over when and how they engage, breaking traditional boundaries between work and life. This shift reshapes cities, offices, retail, education, and media, rewarding organisations that design for flexibility, availability, and responsiveness.

Leadership actions:

Redesign systems around flexibility and outcomes, not fixed schedules. Enable asynchronous collaboration, on-demand services, and modular engagement. Rethink performance metrics, customer access, and employee wellbeing to align with time sovereignty rather than traditional nine-to-five models.

Example: Netflix (USA)

Netflix epitomises Time-Shifted Living by enabling global audiences to watch content anytime, anywhere. Its on-demand model breaks linear scheduling, empowering users to control when and how they engage. This flexibility reshaped entertainment consumption worldwide and set new expectations for convenience, personalisation, and autonomy across digital services.

Trend 21: Unbundled Choice

Unbundled Choice describes the disaggregation of traditional products and services into modular components that consumers can mix, match, and pay for selectively. Rather than buying bundled offerings, people choose exactly what they need—features, access, time, or outcomes.

This trend reflects demand for transparency, control, and fairness. Digital platforms accelerate unbundling by reducing distribution costs and enabling customisation at scale. Industries from finance and education to media and mobility are being reshaped as value is atomised and reassembled around individual needs. For organisations, unbundling creates new revenue streams, sharper value propositions, and opportunities to serve niche segments. However, it requires clear articulation of what truly creates value.

Leadership actions:

Audit where value is bundled unnecessarily. Break offerings into clear, modular components and price transparently. Use data to understand which elements customers truly value, and design flexible models that allow recombination without eroding trust or coherence.

Example: Revolut (UK)

Revolut delivers Unbundled Choice by offering modular financial services—payments, savings, crypto, insurance, and subscriptions—allowing users to choose what they need. This flexibility challenges traditional banking bundles and gives customers control, transparency, and personalised value within a single digital

Trend 22: Value from the Void

Value from the Void captures how scarcity, absence, and minimalism become sources of meaning and economic value. In an always-on world, emptiness—silence, space, simplicity, and restraint—becomes desirable. Brands create value by removing noise, features, or excess, offering clarity, calm, and focus instead.

This trend applies to design, digital products, wellness, luxury, and leadership itself. Less becomes more when it restores attention, energy, and purpose. Value from the Void challenges growth-through-addition models, replacing them with intentional subtraction. Companies that understand this create differentiation by knowing what not to do, not say, or not sell—transforming restraint into strategic advantage.

Leadership actions:

Practice strategic subtraction. Identify complexity that no longer adds value and remove it. Design for clarity, calm, and focus. Reward teams for simplification and discipline, and measure success not only by growth, but by reduction of friction and noise.

Example: B&O (Denmark)

Bang & Olufsen turns simplicity and emptiness into value through elegant, minimalist audio products. By reducing visual and functional clutter, it creates emotional and sensory impact, positioning luxury as both restraint and experience.

Trend 23: Weightless Growth

Growth increasingly comes from intangible assets such as brand, data, IP, and networks. Organisations focus on digital platforms, ecosystems, and content rather than physical expansion. Weightless growth reduces capital intensity while increasing speed and scalability. Intellectual property, community influence, and software-as-infrastructure are primary levers. Companies mastering weightless growth capture value through relational and informational assets, enabling high-margin, networked expansion.

Leadership actions:

Leaders should prioritise intangible asset development, platform strategy, and network effects over physical scale to drive sustainable growth.

Example: Spotify (Sweden)

Spotify scales globally via curated playlists, algorithms, and community networks rather than physical assets. Its value derives from data, brand, and network effects, exemplifying weightless growth at scale.

Trend 24: Xenostalgia Futures

Xenostalgia merges nostalgia with forward-looking innovation. Products and experiences evoke past eras—retro interfaces, analog warmth—while integrating modern technology. This emotional anchoring provides comfort and cultural resonance, balancing novelty with familiarity. Companies leverage xenostalgia to engage multiple generations, create storytelling depth, and differentiate products. Applied across fashion, tech, and media, xenostalgia strengthens brand identity while embracing innovation.

Leadership actions:

Leaders should combine heritage design cues with modern innovation to evoke emotional resonance while appealing to forward-looking markets.

Example: Nothing (UK)

Nothing blends retro-futurist aesthetics with modern tech through transparent hardware and minimalist design. Its products feel familiar yet innovative, exemplifying xenostalgia-driven design for engagement and differentiation.

Trend 25: Youthquake Cultures

Younger generations disrupt industries with digital fluency, creativity, and social activism. Sustainability, inclusivity, and identity fluidity shape aesthetics, behaviour, and products. Youth-driven networks accelerate trend adoption, influence markets, and redefine brand relevance globally. Authentic engagement enables co-creation, virality, and long-term cultural resonance. Organisations tapping into youth movements gain energy, creativity, and advocacy while embedding themselves in cultural zeitgeist.

Leadership actions:

Leaders must authentically engage youth, foster co-creation, and embrace cultural experimentation to remain relevant and innovative.

Example: TikTok (China)

TikTok empowers young creators to produce, remix, and share content worldwide. Its algorithm amplifies creativity, cultural trends, and activism, illustrating youth-driven platforms’ global influence on markets and culture.

Trend 26: Zero-Friction Experiences

Experiences are designed to eliminate effort, delay, and complexity. Seamless integration of payments, mobility, smart homes, and services creates anticipatory, intuitive interactions. Ambient intelligence reduces cognitive load while enhancing convenience, speed, and trust. Zero-friction design reshapes retail, finance, healthcare, mobility, and home ecosystems. Automation, AI, and connectivity allow services to feel immediate, personalised, and effortless, enabling people to focus on meaningful activities.

Leadership actions:

Leaders should integrate automation, AI, and service design to remove friction and enhance convenience, satisfaction, and loyalty.

Example: Nuro (USA)

Nuro uses autonomous vehicles to deliver groceries and essentials directly to consumers. Its AI-driven logistics remove barriers of time, transport, and human interaction, creating seamless, frictionless experiences that redefine service delivery.