The New Growth Playbook … Unlocking the new growth engines that enable businesses to thrive … accelerating growth in a world of relentless change and incredible opportunity

September 22, 2025

How do you find growth in stagnant, disrupted and uncertain markets?

For decades, growth in business was treated as a linear journey. Companies extended existing products, squeezed efficiency, expanded to new geographies, and pursued predictable market share battles. That logic worked in a more stable, slower-moving world.

But the 21st century is anything but stable. Growth is buffeted by global shocks, technological disruption, social shifts, and ecological pressures. The future is no longer an extension of the past, it must be actively created.

Today, growth requires systems thinking, agility, and a willingness to reimagine the future itself. It demands that companies not only respond to trends but anticipate, influence, and shape them.

Leading organizations leverage a combination of foresight, strategy, culture, and technology to generate exponential impact, often across industries and geographies. These organizations understand that growth is not just an outcome; it is a continuous process of acceleration, amplification, and multiplication. Often enabled by data, AI, networks and communities.

Leaders must build new engines of growth: adaptive, future-focused, regenerative, and deeply human. Growth is not about squeezing the old machine harder, but about inventing new machines entirely.

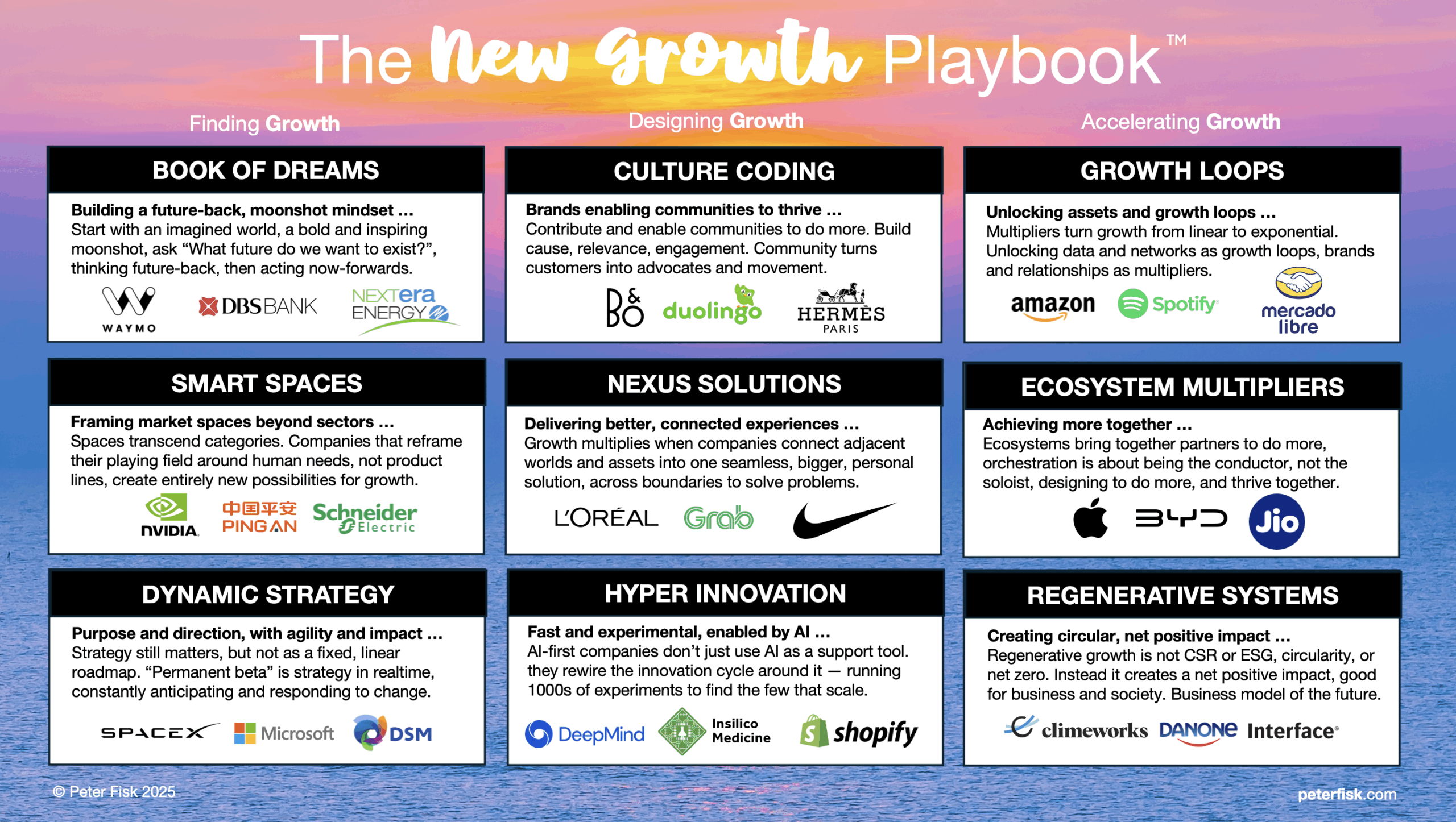

The New Growth Playbook defines 9 strategies, or growth engines, that the world’s most progressive companies are already using to accelerate growth in a world of relentless change. Each represents a powerful lever, and together they form a new framework, a toolkit, for exponential and sustainable growth.

Growth Engine 1: Book of Dreams … a moonshot mindset, from the future back

Most organizations still think now-forward, meaning they plan incrementally from what they know – annual budgets, three-year roadmaps, incremental extensions. But transformative leaders think future-back, meaning they imagine a bold possibility and then design pathways to get there. Future-back thinking reframes ambition and unleashes radical possibility. The Book of Dreams captures and structures foresight-driven imagination into evaluated opportunities for new growth.

Waymo: ask the right question

Waymo began in Google’s X “moonshot factory,” where the question wasn’t “How do we improve cars?” but “What if cars no longer needed drivers?” That framing unlocked a future-back journey toward safer, more efficient mobility. Waymo’s technology has logged more than 20 million miles on public roads and billions more in simulation. In Phoenix, it operates a driverless ride-hailing service, while in Los Angeles and San Francisco it tests urban deployment. What makes Waymo powerful isn’t just technology, but the ecosystem it catalyzes: partnerships with logistics companies, city planners, and automakers. Its moonshot vision is reshaping urban design, redefining insurance models, and forcing regulators to reimagine traffic laws. Waymo shows how thinking future-back creates industries, not just products.

DBS Bank: making banking invisible

Singapore’s DBS didn’t set out simply to digitalise banking services. Led by CEO Piyush Gupta, they asked “What would banking look like if it were invented today?” That question reframed DBS as a technology company in financial services. They went further, exploring “What if banking was invisible?” That question reframed everything. Rather than competing on branches or fees, DBS reimagined itself as a digital-first platform that integrates seamlessly into customers’ lives. Its AI-driven credit scoring, mobile-first interfaces, and partnerships with ride-hailing firms and retailers allow banking to happen effortlessly in the background. By 2020, DBS was named the “World’s Best Bank” by Euromoney, and it now earns more than half its revenue through digital channels. The invisible banking moonshot didn’t just modernize services; it reinvented DBS’s identity.

NextEra Energy: leading the renewable revolution

Florida-based NextEra Energy was once a conventional utility reliant on fossil fuels. But in the early 2000s, it asked: “What if the future grid was carbon-free?” At a time when most utilities saw renewables as risky, NextEra bet big on wind and solar. That bold future-back vision led it to become the world’s largest producer of renewable energy. Its massive investments in clean energy infrastructure paid off as costs dropped and regulation tightened. Today, NextEra not only leads in renewables but actively shapes policy, grid innovation, and storage technology. By imagining a decarbonized future decades early, NextEra positioned itself as an industry shaper rather than a follower.

Growth principle: Future-back leaders ask “What future do we want to exist?” and forces today’s decisions to align with tomorrow’s ambition. Instead of seeking to optimize the existing model, they pull their organizations into the future by starting with an imagined world, a bold and inspiring moonshot, then designing the pathway to get there.

Growth Engine 2: Smart Spaces … framing market spaces beyond sectors

Organisations limited growth by conventional thinking, not least by creating boundaries defined by sector and geography. Instead, think of human-centred spaces: mobility, learning, health, belonging, sustainability. These spaces might be new (like energy drinks) or convergent sectors (like wellbeing). Leaders grow faster by framing their own space, enabling them to be more relevant to customers, and more innovative themselves.

Nvidia: powering the AI space

Nvidia could have stayed in its niche making graphics chips for gamers. Instead, it redefined itself around the intelligence space — powering AI and machine learning across industries. Its GPUs became the backbone of deep learning, enabling breakthroughs in autonomous vehicles, drug discovery, financial modelling, and generative AI. Nvidia also built CUDA, a developer platform that turned its hardware into a global standard. The result: Nvidia is not just a semiconductor firm, but the infrastructure of intelligence, with a market capitalization greater than most tech giants. By framing itself in a space rather than a sector, Nvidia positioned itself at the heart of tomorrow’s economy.

Ping An: from finance to wellbeing

China’s Ping An is one of the world’s largest financial services companies. But rather than limiting itself to banking and insurance, it reframed its role in the space of wellbeing. Through Ping An Good Doctor, it launched a telemedicine platform with over 400 million users. Its AI diagnostics tools now conduct millions of medical consultations annually. Combined with financial services, Ping An helps customers manage both financial health and physical health, creating a stickier ecosystem. This shift makes Ping An more than a financial institution — it is a partner in wellbeing, crossing boundaries between finance, healthcare, and technology.

Schneider Electric: energy and sustainability as one space

Schneider Electric, once a seller of electrical equipment, reframed itself into the sustainability and energy management space. Through smart sensors, digital platforms, and IoT, it enables cities, factories, and homes to monitor and optimize energy use in real time. Its EcoStruxure platform integrates software, services, and hardware to deliver energy efficiency and carbon reduction. Schneider positions itself not as a supplier but as a sustainability partner, helping clients achieve carbon neutrality.

Growth principle: Spaces transcend categories. Companies that reframe their playing field around human needs, not product lines, create entirely new possibilities for growth.

Growth Engine 3: Dynamic Strategy … inspiring direction with real-time agility

Traditional strategies assume stability: five-year plans, predictable markets. But in a volatile world, winners adopt a more flexible strategy, a living, adaptive approach that flexes with circumstances. FLUX stands from fast, liquid, unchartered and experimental. Flux strategies combine purpose and direction, with micro-moves, antiocipating and responding to change, for more sustained value creation.

SpaceX: Occupy Mars, eventually

SpaceX thrives in flux. It has redefined aerospace by iterating rapidly on rockets and spacecraft. Instead of waiting years for perfect rockets, it launches, fails, and learns at breathtaking speed. Its agile development process allows simultaneous testing, learning, and scaling, rather than sequential engineering. Each launch generates data to improve future missions. Each explosion is treated as data, not disaster. SpaceX’s purpose, reducing space costs and enabling Mars colonization, drives long-term focus. Flux strategy allows SpaceX to take calculated risks, accelerate innovation, and build compounding advantages in space transport.

Microsoft: purpose, platforms and empowerment

Microsoft under Satya Nadella shifted from a stagnating PC software business to a cloud-first, AI-integrated ecosystem. The company emphasized cultural transformation, internal collaboration, and openness to partnerships. Its purpose — “empower every person and organisation on the planet to achieve more” — guided the reinvention. Investments in Azure, GitHub, and AI initiatives illustrate a flexible approach that balances short-term performance with long-term market relevance. Microsoft shows that dynamic strategy allows legacy organizations to reinvent themselves and capture new growth trajectories without abandoning core competencies. Within a decade, it became one of the world’s most valuable companies again, proving flux strategy works at scale.

DSM: continuous reinvention, from coal mining to life sciences

Dutch multinational DSM demonstrates flux over a century, and how purpose-driven adaptability can preserve relevance, enable innovation, and sustain growth across multiple business cycles. From coal mining to chemicals to materials to today’s focus on nutrition and life sciences, DSM has constantly reinvented itself. Its pivots weren’t random; they aligned with purpose: improving health, nutrition, and sustainability. Each reinvention turned disruption into advantage. DSM shows that long-term resilience is built not on rigidity but on continuous adaptation anchored in values.

Growth principle: Strategy still matters, but not as a fixed, linear roadmap. Instead, companies are in “permanent beta” — strategy in realtime, constantly anticipating and responding to change.

Growth Engine 4: Culture Coding … brands enabling communities to thrive

The most powerful growth doesn’t come from advertising or sales, it comes from culture and community. Growth companies code culture into their DNA, and specifically into their brand, their identity, and build tribes that customers want to belong to.

Hermès: craft as culture

Hermès is not just a fashion house; it is the epitome of cultural continuity. Founded in 1837 as a harness workshop for European nobility, Hermès has resisted the pull of mass production, digital hype, and celebrity quick wins. Its success comes from coding its culture as one of timeless artistry, scarcity, and permanence. Every Hermès product is imbued with ritual. A Birkin bag takes a master artisan 18–24 hours to produce, and no two are identical. Craftspeople spend years training, inheriting techniques like stitching, leather selection, and finishing, passed down like cultural DNA. This devotion to handcraft elevates every object into a cultural artifact.

Hermès doesn’t sell handbags — it sells membership in a cultural lineage. When a customer buys a Birkin or a silk carré, they aren’t buying leather or fabric; they are entering a world coded with Parisian refinement, discretion, and permanence. Scarcity is intentional: production volumes are tightly controlled, and waiting lists sometimes stretch years, turning the act of ownership into cultural validation. By holding culture above commerce, Hermès thrives in ways fast-fashion or hype-driven brands cannot. It proves that when culture is coded deeply enough, it becomes immune to trend cycles, commanding not just desire but reverence.

Duolingo: the learning tribe

Where Hermès builds prestige through exclusivity, Duolingo creates culture through inclusion and play. Founded in 2011 with the mission of “making education free and accessible to everyone,” it reimagined language learning as a global cultural movement — quirky, gamified, and fun. The culture of Duolingo is shaped less by grammar and vocabulary and more by rituals and shared identity. Its green owl mascot, Duo, has become an internet icon — sometimes cheeky, sometimes threatening (“You missed your lesson!”). Notifications, memes, and inside jokes form a connective tissue that binds users across geographies.

Gamification tools like streak counts, leaderboards, and XP levels transform language learning into cultural performance. Completing lessons isn’t just personal progress; it’s participation in a global game where millions share the same rituals. The real culture is not about fluency, but about belonging to a tribe of learners who value persistence, resilience, and humour. Duolingo shows that culture can scale digitally — it’s less about the content itself and more about how people feel inside the experience. What Hermès does with exclusivity, Duolingo achieves with shared inside jokes, playful accountability, and the feeling of being part of a quirky tribe.

Bang & Olufsen: designing an aesthetic life

Danish audio-visual brand Bang & Olufsen (B&O) has, since 1925, thrived not by competing on decibels or processor speed, but by cultivating a culture of aesthetic living. Its DNA is rooted in Scandinavian modernism, where beauty and function are inseparable. Every product, from its sleek BeoLab speakers to its minimalist televisions, is a statement of cultural belonging. Consumers don’t just buy speakers; they join a design-conscious community that celebrates purity of form, craftsmanship, and aesthetics. The B&O home is not filled with gadgets, but with artful companions that harmonize with architecture and lifestyle.

B&O’s strategy is to elevate technology into cultural symbols of taste. Limited editions, collaborations with architects and designers, and museum-quality design objects reinforce its role as curator of aesthetic life. While rivals compete on technical specifications, B&O competes on cultural aspiration: its products signal refinement, connoisseurship, and artistic values. Like Hermès, B&O thrives on slow culture — it doesn’t chase trends but instead cultivates a heritage of design integrity. In doing so, it has become more than a brand; it is a cultural codebook for how technology can coexist with beauty in modern life.

Growth principle: Cultures and communities already exist, the secret is to be a meaningful contributor and enabler of them. Culture coding makes a company more than a business. Community turns customers into advocates and growth into a movement.

Growth Engine 5: Nexus Solutions … delivering better, connected experiences

Customers don’t live in silos. They want seamless solutions and immersive experiences that cross boundaries – that connect adjacent markets, brands and capabilities. Growth accelerates when companies connect worlds into “nexuses”.

L’Oréal: beauty as a service

L’Oréal uses technology to expand beauty into an entire personalized experience. Its AI-powered skincare diagnostics (via Modiface), AR virtual try-ons, and connected devices transform cosmetics from static products into interactive services. The company’s “Perso” device, for example, can analyze a customer’s skin, environment, and preferences to 3D-print customized skincare or makeup formulations at home. In its retail stores, digital mirrors let customers try on lipsticks or hairstyles virtually before buying. These aren’t just gadgets. They make beauty a continuous journey: L’Oréal learns from customer data, refines products, and integrates services into everyday routines. By blending science, digital interfaces, and retail experiences, L’Oréal creates a nexus of beauty-as-service, deepening engagement far beyond one-time purchases.

Grab: the everyday super-app

Grab began with ride-hailing, but quickly realized that growth came from solving multiple daily needs. Today, its app is a gateway to transport, food delivery, grocery shopping, bill payments, insurance, and even micro-investments. What sets Grab apart is how deeply it embeds into the rhythms of life in Southeast Asia. A commuter might book a Grab ride in the morning, order GrabFood for lunch, send money via GrabPay in the afternoon, and buy insurance on the same app in the evening. Grab also integrates small merchants into its ecosystem, enabling them to reach customers, access digital payments, and secure microloans. By orchestrating this nexus, Grab becomes an everyday essential, not just a utility. Its growth is not about any single service, but about being the digital hub of daily life.

Nike: from shoes to sports performance

Nike exemplifies the nexus strategy by transforming from a sportswear brand into a holistic fitness ecosystem. Beyond selling shoes, Nike connects customers through apps like Nike Run Club and Nike Training Club, which provide workouts, challenges, and social communities. Nike also links physical products with digital services. For example, its smart shoes integrate with apps to track performance, while exclusive product drops are tied to app engagement. Its retail stores host events, training sessions, and running clubs — extending the nexus from digital to physical spaces. The result: Nike doesn’t just sell products. It curates an entire lifestyle experience of sport, fitness, and motivation. Customers don’t just wear Nike; they live in Nike’s ecosystem.

Growth principle: Growth multiplies when companies stitch together adjacent worlds into one seamless, bigger solution.

Growth Engine 6: Hyper Innovation … fast and experimental, enabled by AI

Growth comes from relentless innovation — experimenting faster, learning smarter, and commercialising at scale. With AI and frontier tech, companies can now run thousands of experiments simultaneously, compressing cycles of discovery and application. Make AI your co-creation partner.

DeepMind: solving the Biggest Problems with AI

DeepMind, a subsidiary of Alphabet, is a leading AI research lab based in London. The company employs between 1,000 and 5,000 people and is renowned for breakthroughs like AlphaGo, AlphaFold, and Gemini.

DeepMind is not focused on consumer apps but on grand scientific challenges. With AlphaFold, it solved the 50-year puzzle of protein folding, enabling breakthroughs in medicine and biology. DeepMind’s hyper-innovation model combines scientific ambition with practical applications, producing both intellectual breakthroughs and commercial value. Its approach shows that AI-first innovation doesn’t just speed up business processes; it can rewrite the frontiers of science. It demonstrates the synergy between cutting-edge research and real-world impact.

Insilico Medicine: AI-Powered Drug Discovery

Drug discovery has historically taken 10–15 years and billions of dollars. Insilico Medicine uses AI to compress that timeline. Its algorithms design new molecules, predict efficacy, and test virtually before physical trials. In 2021, it brought its first AI-designed drug for fibrosis into clinical trials — in less than 18 months. This speed radically alters pharma economics and opens the door to tackling diseases once considered intractable. By compressing timelines and reducing costs, Insilico exemplifies how hyper-innovation can disrupt entrenched industries, enabling breakthroughs that were previously unimaginable.

Shopify: democratising digital retail innovation

Shopify is taking the world’s retailers online. As the world locked down amidst pandemic, stores great and small lost their entire footfall. Overnight, many turned to the Canadian tech company for the tools that allowed them to relaunch, not just with a virtual store, but with the marketing, warehousing, payment and distribution infrastructure too. A small town store could instantly transform itself into a global player. Shopify now supports more than 6.2 million live websites globally, and its merchants processed over $292 billion in gross merchandise volume in 2024. Its trailing-12-months revenue is about $10 billion, up from US $8.88 billion in 2024. Its market capitalisation has risen to around $190–200 billion as of September 2025, making it one of Canada’s most valuable companies

Shopify’s hyper-innovation lies in continuous platform expansion for global merchants. From e-commerce storefronts to payment systems, fulfilment solutions, and app ecosystems, Shopify iterates rapidly based on merchant feedback. Its model allows thousands of developers to build on its platform, creating a multiplying effect of innovation. Shopify shows how hyper-innovation can scale globally while empowering millions of entrepreneurs.

Growth principle: AI-first companies don’t just use AI as a support tool. They rewire the innovation cycle around it — running thousands of experiments to find the few that scale. Run 1,000 experiments. Scale the 10 that work.

Growth Engine 7: Growth Loops … unlocking data to create a flywheel effect

Traditional assets, like factories and stores, grow linearly. But intangible assets – like data, networks, brands, IP — grow exponentially when designed as multipliers. Create a flywheel model, where you learn and gain more from existing customers, who become your drivers of compounding growth.

Amazon: The Prime Effect

Amazon generated about $638 billion in revenue in 2024, with AWS contributing $108 billion. It serves over 310 million active users, including 200 million Prime subscribers, and paid out substantial profits of around $59 billion that year. The company combines e‑commerce, cloud computing, subscriptions, and logistics across the globe. In 2024, Amazon earned over $44 billion from Prime subscriptions and related services. Prime members spend on average 2–3 times more per year than non-members, driving higher e-commerce sales across categories.

Amazon’s flywheel connects selection, price, and customer experience. More customers attract more sellers, increasing variety and lowering costs, which further attracts customers. Prime membership and AWS services create additional loops, reinforcing growth across business units. Amazon’s growth is driven by a self-reinforcing loop: more sellers, leads to more selection, to more customers, to more sellers. Its logistics, data, and Prime ecosystem reinforce the loop, creating exponential growth. Each new investment — from Alexa to AWS — plugs into the flywheel, making it spin faster. Growth becomes exponential, not linear. Amazon exemplifies how well-designed loops compound engagement and value, turning customer interactions into systemic growth drivers.

Spotify: Personalised growth loops

Spotify has around 696 million users worldwide, including about 276 million paying subscribers. Its annual revenue in 2024 was about €15.7 billion, and it paid out more than $10 billion to artists and rights-holders that year. The platform now hosts content from more than 10 million creators, making it the world’s largest music streaming service.

Spotify uses data loops to refine content delivery and recommendations. More users provide more listening data, enhancing algorithmic personalization. It leverages every play to improve recommendations. Its playlists like “Discover Weekly” deepen engagement, which generates more data, which sharpens recommendations. This loop keeps users loyal and gives Spotify unique leverage in negotiations with artists and labels, expanding the catalogue, which in turn increases user engagement. Spotify illustrates that feedback-driven loops can maintain market dominance in fast-changing digital environments.

Mercado Libre: Latin America’s digital flywheel

Mercado Libre has become Latin America’s leading e-commerce and fintech company. In 2024 it generated about $21 billion in revenue, with sales on its marketplace reaching more than $51 billion in gross merchandise value. Over 100 million people bought through its platform, and its logistics arm, Mercado Envios, delivered nearly 1.8 billion items, many within one or two days. Its fintech arm, Mercado Pago, is also booming. It now serves more than 65 million active users each month, processed nearly $200 billion in payments in 2024, and is expanding rapidly into credit, with a loan portfolio of almost $8 billion.

Mercado Libre integrates e-commerce, payments, and logistics to create reinforcing loops. More merchants attract more buyers, more transactions enhance logistics efficiency, and improved service drives further adoption. It connects e-commerce, payments (Mercado Pago), and logistics into one reinforcing system. More sellers attract more buyers; payments feed trust; logistics improve speed. Each component strengthens the others, generating network-driven compounding growth across its diverse markets. It’s not a retailer but an exponential system, often called the digital backbone of Latin America, and now the region’s most valuable company.

Growth principle: Multipliers turn growth from linear to exponential. The art lies in designing loops where value compounds with every use.

Growth Engine 8: Ecosystems Multipliers … network effects to achieve more together

No company wins alone. The most powerful growth comes from ecosystems — orchestrating partners, developers, and collaborators into value-creating networks. Leading companies orchestrate their chosen ecosystems, but can also participate in others.

Jio: building India’s digital nation

When Reliance Industries launched Jio in 2016, it didn’t simply enter India’s telecom sector — it redefined it. By offering ultra-low-cost data and free voice calls, Jio democratized internet access almost overnight. Within a few years, it had added over 400 million subscribers, creating the largest mobile network in the world’s second most populous country. But Jio’s ambition was never just telecom. Mukesh Ambani’s vision was to build a national digital ecosystem — a foundation for India’s digital economy. Cheap data was only the first layer. On top of it, Jio began layering services in commerce, entertainment, payments, education, and health. JioMart integrates millions of kirana (mom-and-pop) stores into digital supply chains, enabling them to compete with modern retail. By digitizing inventory, logistics, and payments, Jio empowers small businesses to thrive in a digital-first economy. JioSaavn (music), JioCinema, and tie-ups with major streaming providers turned Jio into India’s entertainment hub, bundled into its network.

Jio partnered with global investors like Facebook (Meta), Google, and Silver Lake to scale its digital payments and fintech ambitions, embedding payments within WhatsApp and other consumer apps. Jio is investing in e-learning platforms, remote medical services, and AI-enabled diagnostics, targeting the underserved segments of society. What makes Jio’s ecosystem unique is its inclusivity. Unlike Silicon Valley ecosystems that often target affluent, urban users, Jio’s design is aimed at India’s next billion digital citizens — people in villages, small towns, and lower-income groups. By providing cheap access, localized content, and easy-to-use apps, Jio pulls in communities that were historically excluded from the digital economy.

BYD: mobility meets energy

BYD (Build Your Dreams), founded in China in 1995, began as a battery company. Today, it’s not just an electric vehicle leader — it’s the architect of a mobility-energy ecosystem that stretches from personal cars to citywide transit to renewable energy.

BYD controls its entire value chain — from mining lithium, to making its own batteries and chips, to producing EVs and buses. This creates a self-sufficient ecosystem that compounds resilience and scalability. Beyond vehicles, BYD produces solar panels and energy storage systems, connecting renewable energy to mobility. Homes, businesses, and even cities can plug into BYD’s grid. BYD supplies fleets of electric buses, monorails, and taxis to cities worldwide, embedding itself into public transport ecosystems from Shenzhen to Los Angeles.

What sets BYD apart is its systemic approach: it doesn’t just sell EVs, it designs a future where clean energy, batteries, and mobility form an integrated loop. In doing so, it shifts from being a car company to an infrastructure partner for sustainable cities.

Ping An: the financial-health super-ecosystem

Ping An operates one of the world’s most ambitious ecosystems. Its vision: finance + health + technology as one integrated life platform. Through Ping An Good Doctor, it connects hundreds of millions of users with doctors, hospitals, and pharmacies, while integrating insurance and payments seamlessly. Its Lufax platform provides online wealth management, while its auto ecosystem connects buyers, sellers, insurers, and lenders in one digital journey. Ping An invests heavily in AI and cloud technology, allowing these ecosystems to scale. Its model is sticky: once customers enter for health or finance, they often use multiple services. By orchestrating across life needs, Ping An becomes deeply embedded in its customers’ daily existence — far beyond what traditional banks or insurers could imagine.

Growth principle: Ecosystems expand growth horizons. Ecosystem orchestration is about being the conductor, not the soloist. Growth comes from enabling partners to thrive together.

Growth Engine 9: Regenerative Systems … creating circular, net positive impact

The old model of business growth extracted and depleted. The new one regenerates: creating value while restoring the environment and society, and scaling the business.

Climeworks: capturing CO₂ at scale

Swiss startup Climeworks builds direct air capture plants that pull CO₂ from the atmosphere and store it underground. Partnering with Microsoft, Stripe, and Shopify, it turns carbon removal into a business model. Its Orca plant in Iceland is the world’s largest carbon removal facility. Pioneering a new tech-led approach is not easy, and Climeworks has had to show resilience in a world of changing public policy, complex technology break through, and uncertain partners. However by proving viability through a series of ever-larger operations, Climeworks is pioneering an entirely new industry of climate regeneration.

Danone: food for one planet, one health

Danone reframed itself around the purpose “One Planet. One Health.” It invests in regenerative agriculture, plant-based nutrition, and stakeholder governance. By aligning growth with planetary wellbeing, Danone is building resilience while responding to consumer demand for sustainable, ethical food. It wasn’t easy, and at first the initiative championed by Emmanuel Faber lost direction, over focused on transformation, and not retaining short-term performance. That has now been corrected, and Danone exemplifies how embedding regenerative systems into core operations can deliver both societal benefit and scalable growth.

Interface: the positive carpet pioneer

Interface, once a conventional carpet maker, set a radical goal: to become carbon negative. Its “Climate Take Back” initiative uses recycled materials, biomimicry, and renewable energy to design carpets that remove carbon. Regeneration became its competitive advantage. Customers like architects and governments now choose Interface not just for quality but for sustainability leadership. Its approach illustrates that regeneration can become a growth engine, fostering loyalty, brand differentiation, and industry influence.

Growth principle: Regenerative growth is not philanthropy, CSR or even limited by ESG, not just about circularity, or getting to net zero. Instead it creates a net positive impact, good for business and society. It is the business model of the future.

How to use the playbook

The New Growth Playbook reframes growth for a new era. It is not about squeezing efficiencies or chasing fads. It is about imagining bold futures, driving purposeful ambition, finding the best market spaces, engaging customers more deeply, solving problems better, embracing the power of AI, unlocking data and networks, turning businesses into a regenerative system, that delivers more impact for society, and sustained value creation.

The power lies in combination: no single lever is enough, but together they form a growth engine. Different companies combine the accelerators in different ways:

- Nvidia connects Book of Dreams and Smart Space, with Hyper Innovation and Network Multipliers. 30 years in development, its dream took off with AI, growing exponentially to $4 trillion in the last 5 years.

- Ping An, the world’s biggest insurer, weaves together Space Framing, Dynamic Strategy, Nexus Solutions, and Growth Loops. It has created new businesses like Good Doctor, the worlds largest healthcare platform in 5 years.

- Nubank, the Brazilian bank thrives Smart Spaces, on Culture Coding, Network Multipliers, and Hyper Innovation. It started by targeting Brazil’s unbanked, educating and supporting local people, and now thrives across Latin America.

Business leaders, executive teams and boards, must ask:

- Which engines drive us today?

- Which are dormant or untapped?

- How can we combine them for exponential acceleration?

Growth in this century is not about squeezing efficiencies or clinging to industries. It is about reinventing the game: imagining bold futures, orchestrating ecosystems, harnessing AI, regenerating systems, and compounding long-term value.

The New Growth Playbook is a call to action for leaders obsessed with what’s next. Whether you’re Duolingo gamifying education, Hermès elevating craftsmanship, or Climeworks regenerating the planet, the engines of growth are clear.

The future belongs to the bold, the adaptive, the regenerative. The leaders who master it will not just survive — they will accelerate into the future.

More from Peter Fisk

- Eyes on Tomorrow: What Leaders Must See before Everyone Else … exploring the most important megatrends that are transforming markets, and leadership mindsets, and how the best companies embrace them as opportunities … based on the new Megatrends 2035 report by Peter Fisk, and its implications for every business.

- The Reinvention Playbook: Thriving in a World of Relentless Change … the best organisations seek to continually reinvent themselves in a world of constant, uncertain and dynamic change. They rethink, refocus, and reinvent everything – embracing new agendas from AI to GenZ, climate change and social inequality.

- The Nexus Effect: Unlocking the Power of Connections … How can businesses and brands really unlock the power of data and networks, flywheels and AI, communities and ecosystems, to transform their futures?

- The New Growth Playbook: 9 New Ways to Accelerate Growth … many companies struggle to find new ways to grow their business … instead we look at how the best companies find radically new ways to grow.

- Super Innovators: Innovation Beyond the Normal … 10 radical ways to disrupt conventions, embrace deeper insights, unlock valuable assets, and stretch innovation for more dramatic impact.

- Consumer of the Future … “Aisha blinked twice, the smart lenses in her eyes had already scanned her biometric mood, cross-checked her carbon budget, and pulled up items her climate-positive friends were buying this week”

- Competing in the FLUX: How to develop a dynamic strategies in a world of relentless change … combining a strong, enduring direction with micro-moves that adapt quickly to emerging shifts:

- Business Transformation: The new superpower of business leaders … reimagining the future, redefining strategy, reinventing the organisation, rewiring performance … the journey to deliver step change in value creation.

- The Sustainable Consumer: Go on, do the Right Thing … how brands can accelerate the consumer shift to sustainable products and practices … from food and fashion, to energy and electric cars, making sustainability desirable and better.

- The “Performer Transformer” Leaders: How great leaders deliver today and create tomorrow … with dual thinking, to build dynamic ambidexterity, continually strategyzing, to perform and transform.

- The Hire-Wire Act of Leadership: Leading in a world of intense competition and relentless change … being visionary and innovative, learning to adapt and endure … inspired by Taylor Swift, Roger Federer, Beyoncé, and Lionel Messi

- Becoming a Future-Ready Business … in a world of relentless change, organisations need to anticipate change, embrace innovation, empower talent, and align deeply with the evolving needs of society and the planet

More from the blog