Lead the Change: Transforming Business

September 23, 2025 at ESP25 at IE Business School, Madrid

Incredible technologies and geopolitical shifts, complex markets and stagnating growth, demanding customers and disruptive entrepreneurs, environmental crisis and social distrust, unexpected shocks and uncertain futures.

For every business leader, the challenge is about making sense of today’s rapidly changing world, and understanding how to prepare for, and succeed, in tomorrow’s world.

We explore how businesses can survive and thrive, and move forwards to create a better future. How to reimagine business, to reinvent markets, to reengage people. We consider what it means to combine profit with more purpose, intelligent technologies with creative people, radical innovation with sustainable impact.

We learn from the innovative strategies of incredible companies – Alibaba and ASML, Biontech and BlackRock, Canva and Collossal, NotCo and Netflix, Patagonia and PingAn, Spotify and Supercell, and many more. We also take a look at what this means for insurance, and some of the most innovative companies in the field.

Are you ready to seize the opportunities of a changing world?

How will you – and your strategy, organisation, people and projects – embrace the challenges and opportunities of change ahead of us? Where are your biggest opportunities for innovation and growth? What are your priorities to balance short and longer term? How will you behave as a manager and leader?

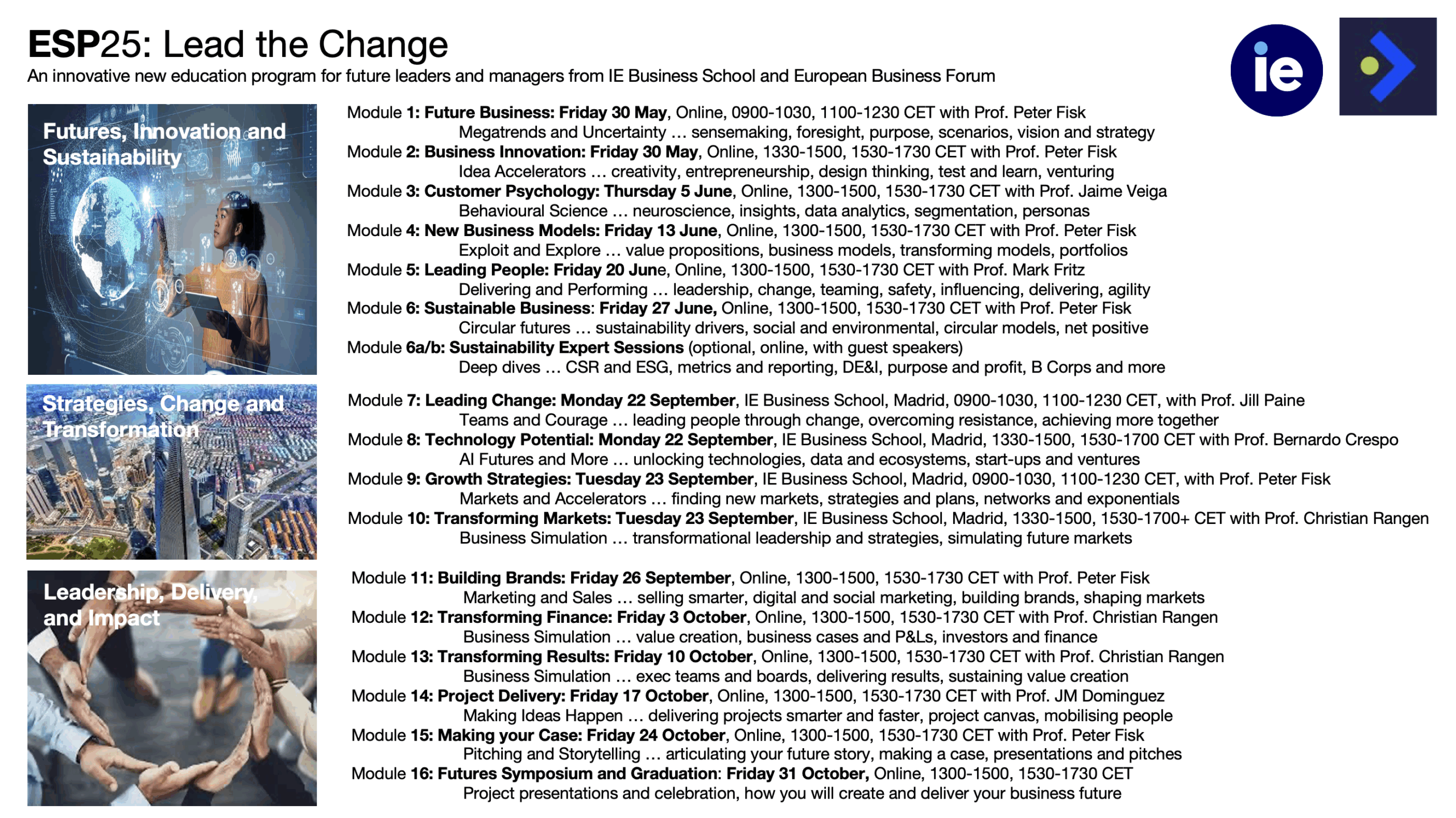

We’ve developed a new program for business leaders, managers of companies large and small, to get up to speed with the very latest ideas, tools and approaches to business, learning from companies and experts around the world. It’s called the Executive Management Program, delivered as a hybrid program online and in face to face in Madrid.

It’s like a Mini MBA, but fit for today’s world, where challenges like economic uncertainty and climate change are matched by opportunities like the applications of AI and new business models. It includes an exciting dynamic business simulation, about managing and leading change, plus insights and ideas from the world’s most interesting companies, right now.

In fact it brings together much of the Global Online MBA from IE Business School, which is ranked #1 in the world, and in particularly for topics such as ESG and sustainability. The faculty is made up of expert professors from IE and beyond, and we spend a number of days in Madrid at IE’s Executive Education campus.

For more info, contact me directly: peterfisk@peterfisk.com

Module 10, 12, 13: Transforming Business

In a world of relentless technological change, shifting consumer expectations, and mounting environmental and societal pressures, the ability to fundamentally reinvent a business has become a prerequisite for survival and success. Business transformation today is no longer about marginal efficiency gains or tweaking product lines; it’s about reshaping the core of what a company is and what it does. Automakers must evolve into mobility platforms. Social media companies branch into commerce. Retailers become content creators. It’s a time of tectonic shifts that demand bold thinking, deep reinvention, and sustained commitment.

A Step Change in Value Creation

At the heart of business transformation lies a radical shift in how value is created. No longer is it sufficient to optimize existing operations. Today’s transformative strategies seek to unlock entirely new revenue streams and operating models. Companies must pivot from being product-centric to platform-oriented, from transactional to experiential, from physical to digital, and from linear to ecosystem-based thinking.

This transformation often starts with a critical recognition: the old model is reaching its limits. Market saturation, technological disruption, or changing consumer expectations can all serve as catalysts. What follows is the search for new engines of growth—whether through data monetization, digital services, subscription models, sustainability innovations, or entry into adjacent markets.

Critically, these shifts are not just about operational improvement or entering new verticals—they are about financial reinvention. Transforming a business in a meaningful way often involves redefining how value is measured and unlocked in the market.

From DVDs to Content Streaming: Netflix

Netflix’s story is emblematic of what business transformation means in the digital age. Once a DVD-by-mail rental company, it foresaw the shift toward digital and transformed into a streaming platform. Not content to distribute others’ content, it reinvented itself again as a creator of original content, competing directly with Hollywood. Netflix’s transformation required not only a new business model but a new organizational culture—risk-taking, creative, fast, and data-driven. Today, Netflix continues to evolve, experimenting with ad-supported tiers, gaming, and international content production, demonstrating that transformation is not a one-time act, but a continuous mindset.

From Cameras to Healthcare: Fujifilm

When digital photography disrupted its core film business, Fujifilm faced what many thought would be a slow decline. Instead, the company reimagined itself. Leveraging its deep expertise in chemicals and imaging, it expanded into healthcare, cosmetics, and high-performance materials. Today, Fujifilm manufactures everything from regenerative medicine to anti-aging skincare. Rather than clinging to legacy products, it mined its intangible assets—like R&D capabilities, patents, and brand trust—to enter high-margin, future-facing industries. It’s a model of diversification based not on opportunity alone, but on strategic coherence.

From Banking to Digital Ecosystem: Ping An

China’s Ping An Insurance provides one of the boldest examples of a traditional company building a digital ecosystem. Initially an insurance provider, Ping An evolved into a tech-enabled services conglomerate spanning health, finance, and smart city infrastructure. The company created platforms like Good Doctor (healthcare), Lufax (wealth management), and OneConnect (fintech infrastructure), embedding AI and cloud services into everything it does. These platforms serve as both revenue generators and customer acquisition engines, creating a loop that deepens engagement and data intelligence. Ping An didn’t just add technology—it rebuilt its entire operating system.

The Architecture of Transformation

These transformations didn’t happen by chance. They were designed, often around several key pillars:

-

New Business Models: The shift from ownership to access (e.g., subscriptions, platforms, sharing economy), from physical to digital goods, and from product to service-based revenues is a hallmark of modern transformation.

-

Technology Integration: Cloud, AI, IoT, and data analytics are not just tools—they are catalysts for building new capabilities, reducing costs, enabling personalization, and scaling quickly.

-

Mergers and Acquisitions: Strategic M&A is often a lever to acquire capabilities, enter new markets, or accelerate transformation. Microsoft’s acquisition of LinkedIn and Activision Blizzard, Schneider’s purchase of software firms, and Ping An’s ecosystem spin-offs all show how transformation frequently involves reshaping the portfolio.

-

Culture and Leadership: Cultural reinvention is the hardest but most essential part of transformation. Organizations need to foster agility, curiosity, collaboration, and a willingness to learn and fail. Leaders must be visionaries and system thinkers who can navigate ambiguity and inspire new ways of working.

-

Customer-Centric Design: True transformation starts with a deep understanding of unmet customer needs. It’s not about pushing new technologies but solving real problems in new, scalable ways.

-

Sustainability as Strategy: Increasingly, environmental and social challenges are becoming central to transformation. Schneider, Fujifilm, and Ping An show how companies are embedding purpose into business models, creating long-term value while addressing global issues.

Changing the Narrative

True transformation often means changing not just the business model but the narrative—and this includes the story told to investors. CEOs and boards must help shareholders see beyond short-term financials and toward the company’s long-term strategic potential.

When Schneider Electric transformed itself into a digital sustainability leader, it didn’t just add new services—it repositioned the entire company in the eyes of investors. The market began to value Schneider not just as an industrial player, but as a data-driven, climate-tech innovator. This re-rating contributed significantly to its market cap expansion.

Netflix’s reinvention into a streaming and content powerhouse wasn’t just operational—it fundamentally changed how analysts and investors valued the company. It moved from being seen as a low-margin logistics business to a high-growth media and technology platform. The resulting surge in valuation was not driven by cost control or improved DVD returns, but by a bold reinvention of the company’s future.

Innovation drives Market Value

For public companies, market value is the ultimate scoreboard. To double or triple your market capitalization, you cannot simply keep doing more of the same. Investors reward growth, but not just any growth—growth that is scalable, future-facing, and strategically sound.

Transformational innovation is often the only path to unlocking this kind of exponential financial value. It allows a company to:

-

Expand its total addressable market : By entering new markets or creating new categories, companies redefine their growth potential. Think of Amazon moving into cloud computing or Apple expanding from hardware to services.

-

Shift to higher-margin, recurring revenue streams: Subscription models, platforms, and ecosystems offer predictability and scale that traditional product sales don’t. Microsoft’s transition to cloud and SaaS significantly improved its margins and valuation multiples.

-

De-risk the future: Companies that show a credible roadmap for reinvention are seen by investors as more resilient to disruption and more aligned with long-term trends such as digitalization, decarbonization, and demographic change.

-

Attract long-term, forward-thinking investors: Institutions increasingly seek companies that can sustain growth, demonstrate purpose, and stay ahead of disruption. ESG-minded capital is also flowing toward businesses that align sustainability with profit.

Transformation Journey

Perhaps the most important insight is that business transformation is not a one-time pivot—it’s a continuous discipline. As markets evolve and technologies converge, today’s innovations quickly become tomorrow’s legacy. Companies must build systems, cultures, and leadership practices that allow for constant reinvention.

Tesla is not just an automaker but a software-driven energy company. Amazon morphed from a bookstore to a global logistics, cloud, and AI powerhouse. Meta (formerly Facebook) is shifting its identity toward the metaverse while experimenting with digital commerce. Retailers like Nike and Walmart now operate content studios and tech incubators. Every industry is in motion, every business under pressure.

Business transformation is a journey of reinvention in pursuit of relevance, growth, and impact. It demands courage, clarity, and commitment. It requires a shift from linear thinking to exponential ambition. Most importantly, it calls for a new financial mindset—where growth, valuation, and innovation are inseparable.

Companies that succeed in transformation don’t just evolve—they multiply their market potential. They don’t just adapt—they redefine their industries. And in doing so, they prove that the future belongs not to the biggest or richest—but to the boldest.

Find out more and book >