Radius Recycling is the world’s most sustainable company of 2023 … Iberdrola is biggest investor, Storebank is most equitable, Xerox is most diverse, and Commerzbank pays most tax

October 5, 2023

Radius Recycling, previously known as Schnitzer Steel, is the world’s most sustainable company of 2023, followed by Denmark’s wind turbine business Vestas, and Australian furniture maker Brambles.

Radius is a story of how a one-man scrap metal recycler from Portland, Oregon, rose to lead the world, and demonstrate the importance of both the circular economy and low-carbon metals in the energy transition.

Steel, of course, is one of the world’s most carbon-intensive products (accounting for roughly 7% of human-produced CO2 emission). However Radius, originally known as Alaska Junk Company when founded by Sam Schnitzer in 1906, has become a global leader in the collection, processing and sale of the world’s most recycled product: steel.

The company generates most of its revenues from recycling steel and other metals. And about a third comes from forging recycled scrap steel into finished products in electric arc furnaces that are powered by hydropower, making the metal extremely low carbon.

The spark for its current performance came almost a decade ago when the company launched what it called a sustainability framework. “We’ve been recycling for about a century,” says Radius’ CEO Tamara Lundgren. “But how do we incorporate that into a framework that our employees, suppliers, investors and communities can identify with?

In 2019, the company set about bolstering its framework by adopting specific goals and metrics to track progress. These included reducing Scope 1 and 2 greenhouse gas emissions from recycling operations by 25% from 2019 levels by 2025, and reaching net-zero GHG emissions for all operations (steel manufacturing, metals recycling and auto dismantling) by 2050.

Radius’ 2022 emissions were 24% lower than in 2019, its baseline year when it started tracking its GHGs. This reduction has come from the introduction of measures such as investments in best-available-technology emission control systems that, at the company’s Oakland, California, facility, reduce its Scope 1 emissions by around 3,500 metric tons of carbon dioxide equivalent a year. Other measures include improved energy efficiency, the use of alternative fuels and resource-conservation projects.

The approach to sustainability has ultimately paid off, with the company returning a top-quartile performance on a range of Global 100 indicators. It saw a 74% increase in energy productivity over last year and made significant improvements in water (69%) and carbon (55%) productivity. It also scored well for its proportion of non-male board members (five out of nine are women) and racially diverse executives, while it also saw a significant drop in its worker injury rate. The company’s ranking also received a boost by its linking of its CEO’s pay to the achievement of sustainability targets (11% of variable compensation is tied to reaching these goals) and its policy of offering paid sick leave.

Financially, last year was the second-best year in the company’s history. “Our people and planet goals are clearly not coming at the expense of profit,” Lundgren says. “For a company that is 116 years old and that many consider to be ‘old economy’ to be recognized as a leading force in sustainability is a great example of how sustainability principles can be successfully applied to an industrial company.”

Yet there is still a widespread ignorance of the importance of recycling steel, copper, aluminum and nickel – all of which Radius recycles using its advanced metal recovery systems – in the energy transition, Lundgren adds. “There has been underinvestment in metals and mining for years, and there are shortages of some critical ferrous and non-ferrous metals, which we recover and recycle,” she says. “We can’t eliminate these shortages, but we can alleviate them. Metals recycling is one of the foundational pillars for global decarbonization.”

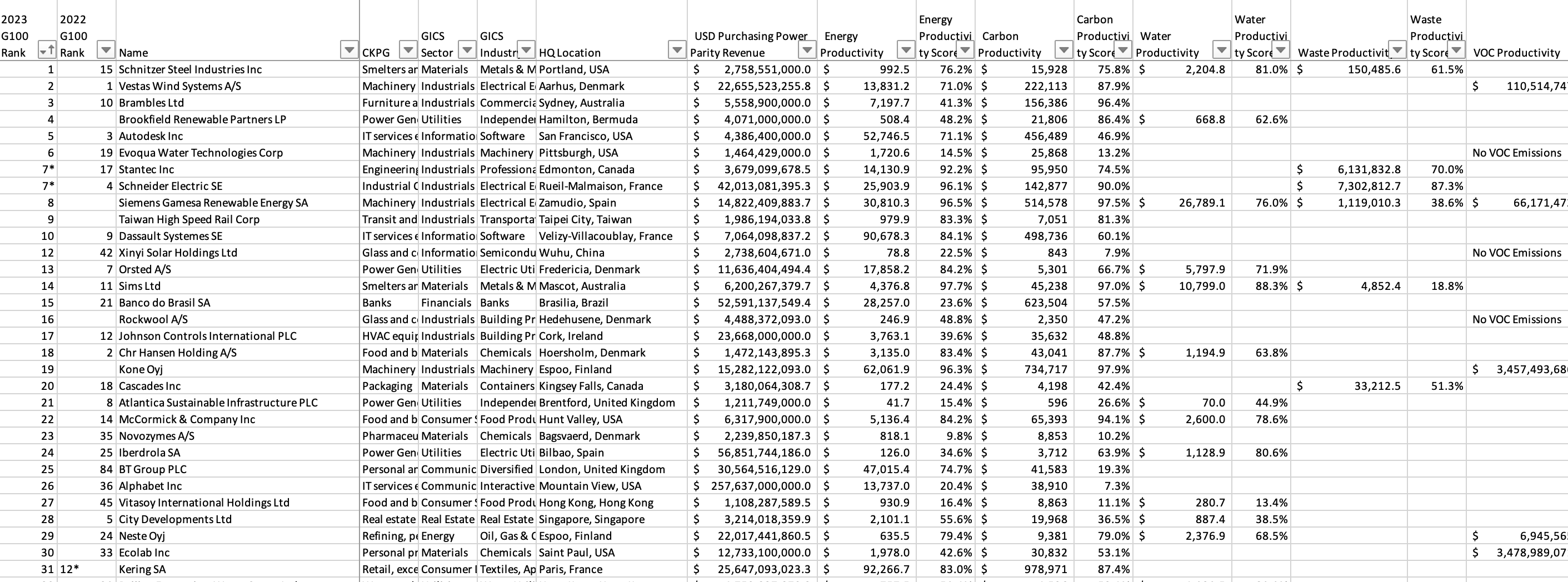

Corporate Knights’ annual ranking of the world’s 100 most sustainable corporations is based on a rigorous assessment of over 6,000 public companies with revenue over US$1 billion. They are assessed across 25 key performance indicators, including % sustainable revenue, % sustainable investment, % taxes paid, carbon productivity, and racial and gender diversity.

It is the best-performing global sustainability index (ticker: CKG100), with more than 10 years of history. Since its inception in 2005, the Global 100 Index has generated a total investment return of 270.7% compared to 222.1% for All Country World Index.

Sustainable revenue contributes around half of gross revenue for the Global 100 compared to just 5% for most companies. For every tonne of carbon they produce, Global 100 companies earn 33 times more revenue than ACWI firms.

Download the full rankings, an XLS evaluating the top 100 across the 25 indicators.

Some other highlights from the analysis include

- Spanish electricity company Iberdrola led all other Global 100 companies in terms of sustainable investments in 2022. It pumped €8.6 billion into green assets, such as renewable energy and EV charging, as well as energy storage and hydrogen production.

- Germany’s Commerzbank had the highest ratio of cash taxes paid over the 2017 to 2021 period, at 30% (down from 34.63% in the previous period). Of the top 10 companies in this category, five others were from Europe.

- Norway’s Storebrand has the lowest gap in CEO-to-average-worker pay. CEO Odd Arild Grefstad’s compensation increased to 9.32 million kroner in 2022, a ration of 6.5 to 1 to average salary.

- Xerox is the leader in gender diversity, in part thanks to the efforts of former CEO Ursula Burns. More than 58% of its execs are women, up from 43% last year.

- In 2020, HP announced a goal of doubling the number of its executives who are black and African American by 2025. It is already well on its way to diversifying its leadership, as 58% of its executives are racially diverse, up from 43% in 2021.

More from the blog