Exploring the streets of Pompeii, the cypress trees sway, and Mount Vesuvius looms … How will your business move before you have to?

April 28, 2023

A gentle breeze cools the hot sunshine. The cypress trees sway, but the blue sky looks serene. In the distance, the volcanic cone of Vesuvius looms mistakenly beautiful.

This week I’m in Italy, and taking a few days off to explore the incredible Roman city of Pompeii.

We are all familiar with the story. Indeed, as a child I always thought of it as one of those classical legends, but as I grew older I realised it was real.

Largely preserved under the 4-5m of volcanic ash, the excavated city offers a unique snapshot of Roman life, frozen at the moment it was buried. It was a wealthy town, with a population of 11,000 in AD 79, enjoying many fine public buildings and luxurious private villas with lavish decorations, furnishings and works of art. Beautiful courtyards at the heart of wealthy family homes, fast-food stalls serving the many sea-faring visitors, even a brothel with a graphical menu of services.

Organic remains, including wooden objects and human bodies, were interred in the ash. Over time, they decayed, leaving voids that archaeologists found could be used as moulds to make plaster casts of unique, and often gruesome, figures in their final moments of life. The numerous graffiti carved on the walls and inside rooms provide a wealth of examples of the largely lost “vulgar” latin spoken colloquially at the time, contrasting with the formal language of the classical writers.

As you explore the endless stone-cobbled, well-preserved streets, it is obvious that there was great opulence in the city. The city’s people clearly took pride in showing off their immense wealth. The prosperity of Pompeii was a key reason for its prominence back in the day, built on a strong economic foundation that was served by fertile grounds and an excellent geographical location. The lava terracing around the city gave it a security advantage, and the volcanic soil allowed flourishing agriculture.

As I walked around the deserted, but largely intact streets, I couldn’t help think about that day. When the volcano erupted. And within hours, the city was no more.

In spite of its desirable position, and great wealth, the city was engulfed by a massive volcanic explosion. One fateful morning, in 79 AD, the population met a tragic end in just a few hours. As lava ashes fell on the city, the population perished. Some were running away from the ashes while others were buried in their own homes. None of the great wealth, opulence, and superior vantage point could prevent the tragedy that stuck them.

Pompeii is a tragic reminder of the ephemeral nature of life.

In today’s business world, companies are not supposed to be transitory. They are expected to outlast the mortals that build them. When Tom Peters wrote In Search Of Excellence, he sang the praises of companies like Atari and GE. Where are they today? Remember MySpace or SecondLife? These organisations prided themselves on their quality of management, how they were shaping the future of markets, and should be worthy investments.

Or consider the threat of tsunamis across the vulnerable Pacific rim? Or the rising oceans threatening the Maldives?

Was the outcome in Pompeii ever preventable or should we just accept death as a part of natural events? Did the city’s leaders consider the risks of the nearby mountain, even in the days before, as smoke billowed out of the summit? Did they consider the risks? Did they have early warning systems, and escape plans? Or did they live in ignorance?

The challenge for every organisation today is, however prosperous their current environment might seem, there is always a Vesuvius on the horizon. Maybe a new entrant, a disruptive technology, or changing regulation. Something that can fundamentally transform the current world. Most often it will be visible but not directly threatening, coming from an adjacent or emerging market for example, already embraced by early adopters or extreme users, perhaps.

I work with many organisations – their boards, their exec teams, their strategists – on making sense of their future direction. How will they continue to innovate, to create and sustain profitable growth? How do they address the changing nature of markets, from climate change to digital platforms, changing consumers and new competition?

Most of the time, they are fixed within the mindset of optimising performance within their currently defined markets. It’s not easy to imagine how markets themselves will change, could be disrupted from beyond the current paradigms, or indeed how the companies themselves could proactively reshape markets, the nature of their business, and sources of value and advantage.

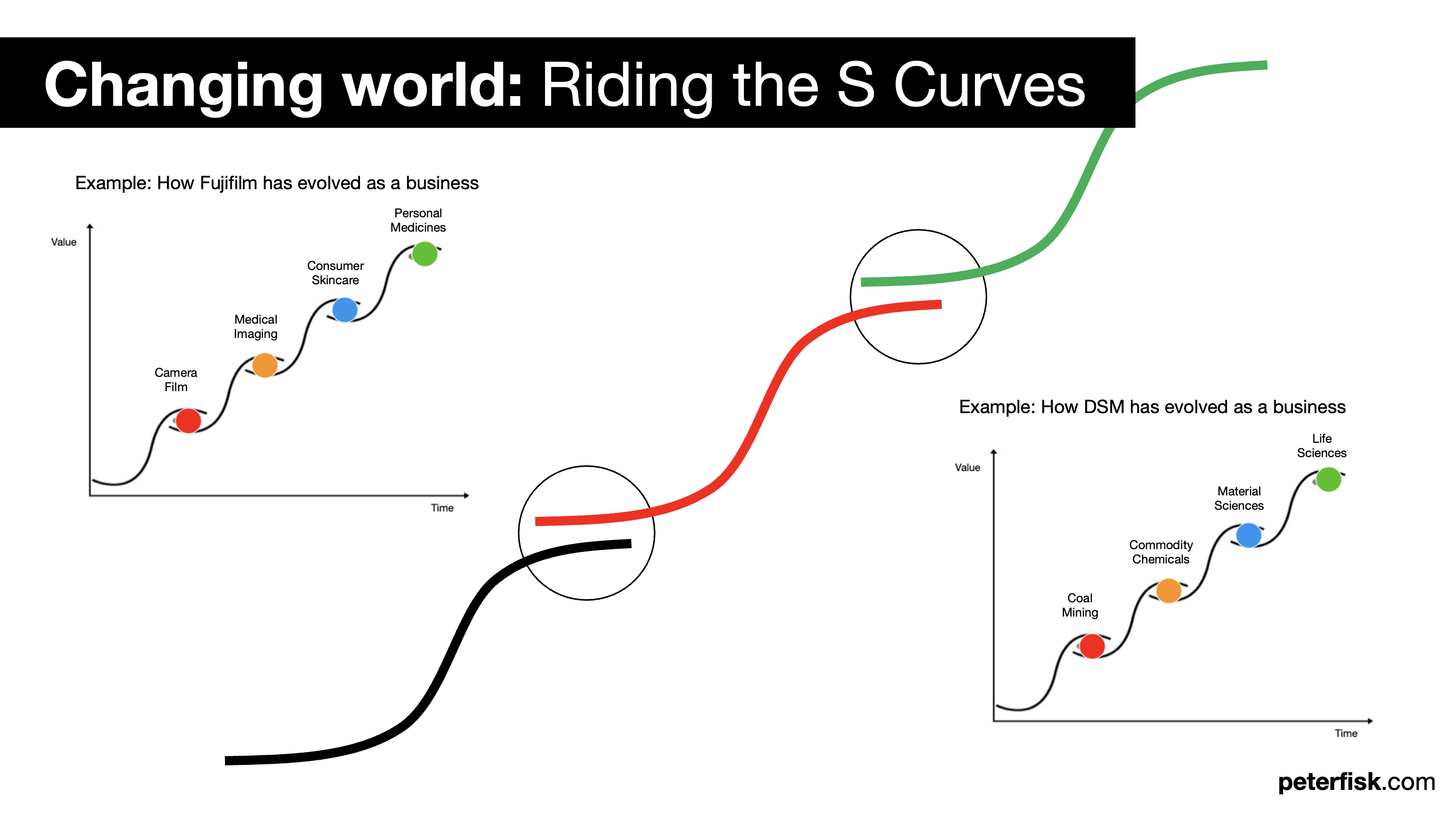

“S Curves” are a simple visualisation of these changing environments, and how companies can both create and respond to the relentless macro-waves of change. Consider the history of Dutch life sciences business DSM, or Japan’s Fujifilm, that have evolved far beyond their respective worlds of coal mining and camera film. Every market is constantly evolving, every company is constantly riding an S curve of change.

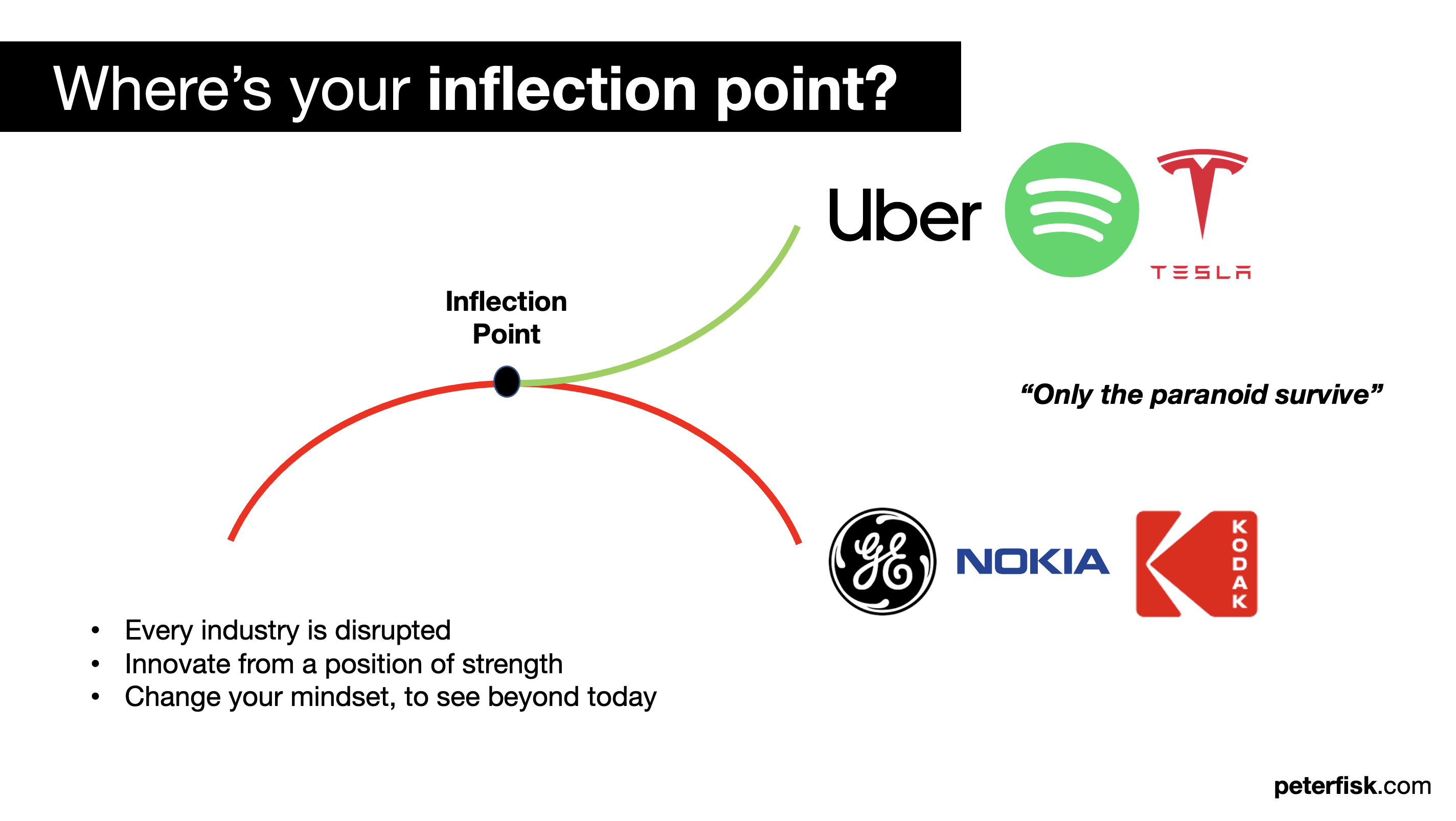

The challenge is then to change before you have to. Get to the top of the S curve and decline will probably already have set in – Vesuvius is already exploding – and it might be too late to change, as customers have already deserted you, and alternatives have already grabbed the future. The time to change is when times are still good, from a position of strength – part way up the curve – and when you still have time to move to your future market space, to create your future business.

It’s not easy, of course. Few of the Kodaks, Intels and GEs of the world were able to reinvent themselves. Largely because their mindset was locked into enjoying their current successes, and a mistaken belief that what got them this far, will take them further. But it rarely does. And so a new generation of companies like Spotify and Tesla reinvented their worlds.

As I walked around those Pompeii streets. A historic civilisation frozen in time. How good is your early warning system? As markets will inevitably change, how will you change before you have to?

More from the blog