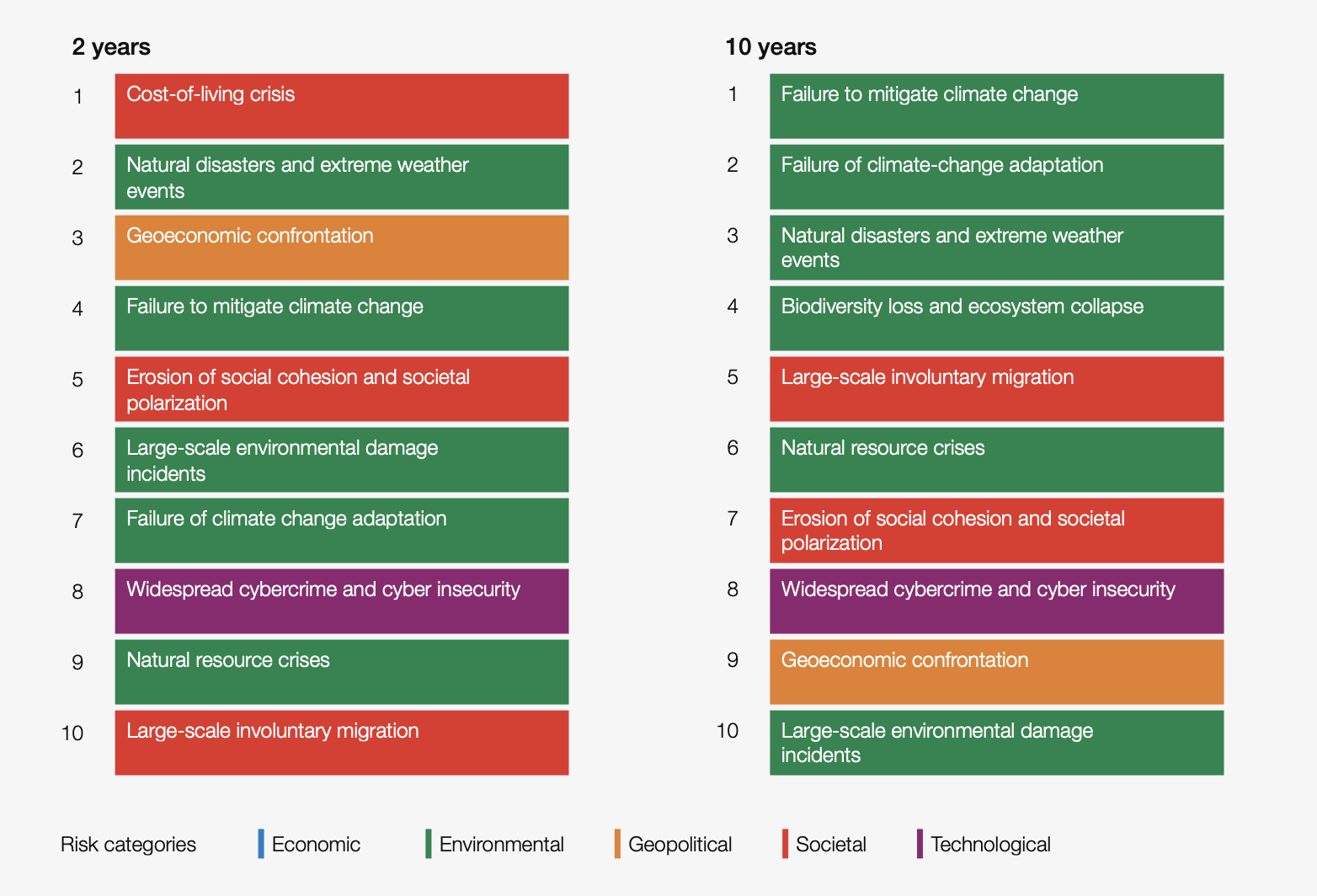

Climate change is the biggest global risk to business and society, although the cost of living crisis might dominate short-term. How can you address both?

January 14, 2023

The new Global Risks Report 2023 by the World Economic Forum with Marsh McLennan is well worth a read, particularly as the world find itself as a cross-roads of so many challenges.

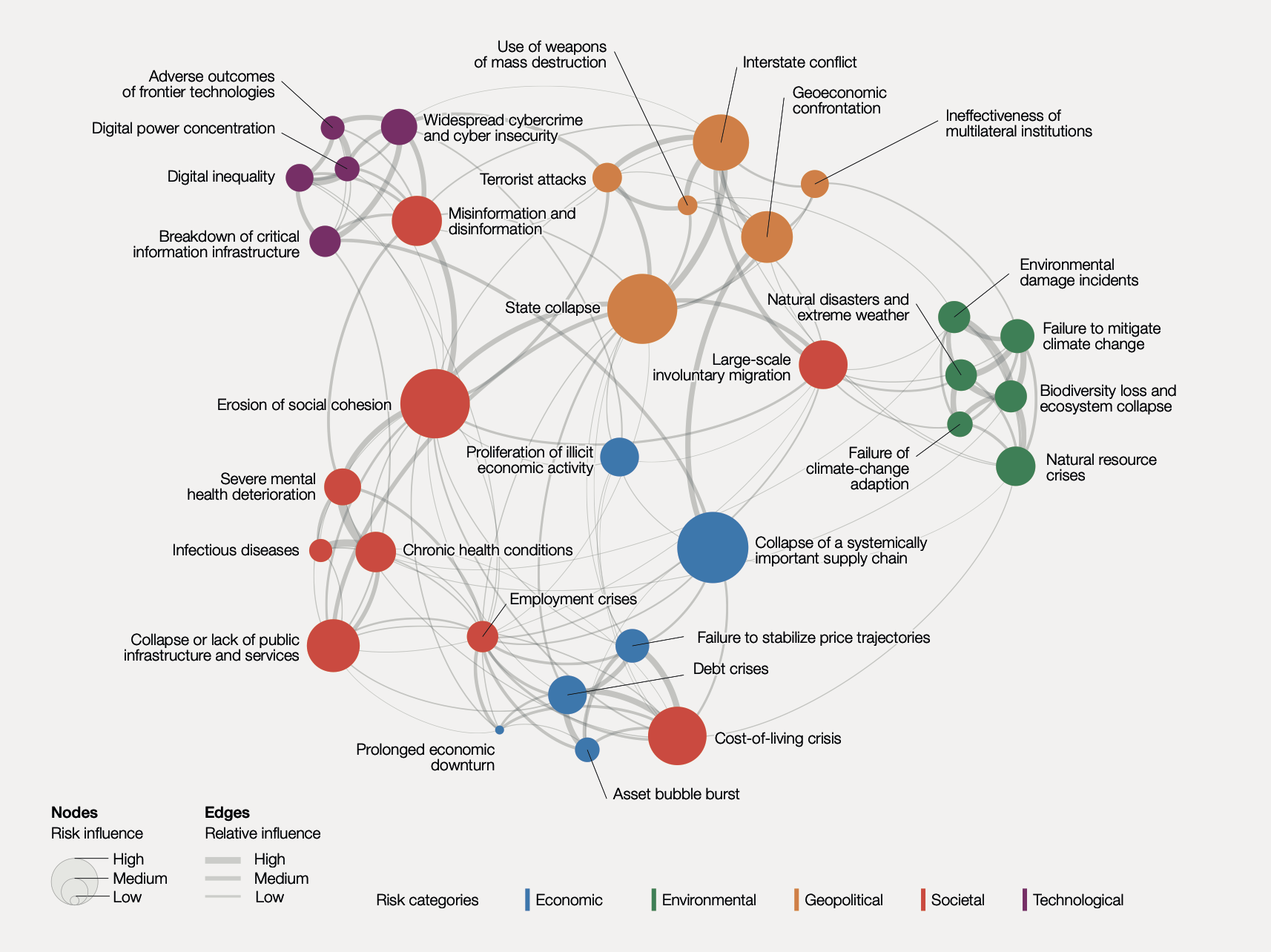

Some have called the relentless waves of challenge, a “polycrisis” in that most have interconnections. The pandemic of recent years fundamentally disrupted a relative stable world, bringing not just health challenges, but economic too. Shifting geopolitical alliances have fragmented a world order. Social and environmental issues get ever more urgent.

At the same time, a recent McKinsey report shows that the biggest risk to business is not just but the changes, but in not responding to this changing world. In disruptive times “business as usual becomes riskier than innovation” it says, with the best performers typically innovating twice as much as others, and twice as collaborative with other businesses.

The WEF annual risk report is a 98 page articulation of the many challenges, but also about how to address them in more enlightened, joined up, and proactive ways:

“As 2023 begins, the world is facing a set of risks that feel both wholly new and eerily familiar. We have seen a return of older risks – inflation, cost-of-living crises, trade wars, capital outflows from emerging markets, widespread social unrest, geopolitical confrontation and the spectre of nuclear warfare – which few of this generation’s business leaders and public policy-makers have experienced.

These are being amplified by comparatively new developments in the global risks landscape, including unsustainable levels of debt, a new era of low growth, low global investment and de-globalization, a decline in human development after decades of progress, rapid and unconstrained development of dual-use (civilian and military) technologies, and the growing pressure of climate change impacts and ambitions in an ever- shrinking window for transition to a 1.5°C world.

Together, these are converging to shape a unique, uncertain and turbulent decade to come.”

The interconnections between these challenges is perhaps more interesting, as it starts to interpret cause and effect loops, so that we can address causes rather than just symptoms, and so that we can address short and long-term risks more holistically. The modelling echoes the recent Wicked7 project that seeks to use system-based thinking – creating viscous (the current state) and then virtuous (possible future state) cycles – to address the world’s most “wicked” challenges.

As we enter a low-growth, low-investment and low-cooperation era, the actions that we take today will dictate our future risk landscape. Lack of preparedness for longer-term risks will destabilize the global risks landscape further, bringing ever tougher trade-offs for policy-makers and business leaders scrambling to address simultaneous crises.

Each risk requires concerted, specific and customized efforts but several cross-cutting principles can support preparedness across themes:

1. Strengthening risk identification and foresight

Enhanced risk identification and foresight can be a key enabler for strategic decision-making, agenda-setting and resilience measures, helping to prioritize areas that would benefit from data collection and monitoring, risk controls and resources, and redundancie

2. Recalibrating the present value of “future” risks

For better planning and preparedness, institutions must de-anchor risk prioritization from shorter-term incentives. Business leaders and policy-makers need to embrace complexity and adopt a dual vision that more effectively balances current crisis management with a longer-term lens

3. Investing in multi-domain risk preparedness

As global risks become more intertwined, preparedness also needs to become more of a hared responsibility between sectors, with local and national governments, business and civil society each playing to their strengths, rather than traditional models of governments addressing market failures when they occur

4. Strengthening preparedness and response cooperation

In a complex risks outlook, there must be a better balance between national preparedness and global cooperation. We need to act together, to shape a pathway out of cascading crises and build collective preparedness to the next global shock, whatever form it might take. Leaders must embrace complexity and act on a balanced vision to create a stronger, prosperous shared future

5. Seizing now as the moment to act

Some of the risks described in this year’s report are close to a tipping point. This is the moment to act collectively, decisively and with a long-term lens to shape a pathway to a more positive, inclusive and stable world.

More from the blog