Investing in Innovation for Better Lives … How smarter investments can empower private companies and multiply their positive environmental and social impact

September 15, 2025

In today’s rapidly evolving global landscape, the convergence of technological advancements, environmental imperatives, and social equity has redefined the role of private sector investments. Beyond mere financial returns, investors are increasingly seeking opportunities that drive innovation, foster sustainability, and promote social inclusion. This paradigm shift underscores the potential of strategic investments to empower private companies, enabling them to not only achieve profitability but also become catalysts for positive environmental and social change.

Purposeful profitability

Historically, the pursuit of profit and the commitment to social good were often viewed as mutually exclusive. However, contemporary business models demonstrate that these objectives can be harmoniously integrated. By aligning financial strategies with sustainable practices and inclusive growth, companies can unlock new markets, enhance brand loyalty, and mitigate risks associated with environmental and social challenges.

This integrated approach is exemplified by companies that leverage innovation to address pressing global issues. Through strategic investments, these organizations harness emerging technologies and business models to create value that extends beyond the balance sheet, contributing to the achievement of the United Nations Sustainable Development Goals (SDGs).

Case Studies of Innovative Investments with Positive Impact

1. M-KOPA Solar: Empowering Off-Grid Communities in Africa

M-KOPA Solar, based in Kenya, has revolutionized access to clean energy for off-grid households through its pay-as-you-go solar systems. By partnering with mobile money platforms like M-Pesa, M-KOPA enables customers to make affordable daily payments for solar energy, eliminating the need for costly and polluting kerosene. With over 2 million homes powered across East Africa, M-KOPA not only provides sustainable energy but also improves health, education, and economic opportunities for underserved communities.

In 2023, M-KOPA expanded its offerings by introducing electric motorbikes, further contributing to the reduction of carbon emissions and promoting sustainable mobility in the region.

2. Solinftec: Transforming Agriculture with Precision Technology

Brazilian agtech company Solinftec is at the forefront of precision agriculture, utilizing AI-powered robots and real-time data analytics to optimize farming practices. Their Solix robotic system autonomously manages tasks such as weeding and crop monitoring, reducing the need for chemical inputs and enhancing yield efficiency. By securing investments from entities like Lightsmith and Blue Like an Orange Sustainable Capital, Solinftec has expanded its operations across North and South America, demonstrating how technology can drive sustainable agricultural practices.

The company’s platform provides farmers with real-time actionable insights related to planting, spraying, fertilizing, and harvesting, leading to increased productivity and reduced environmental impact.

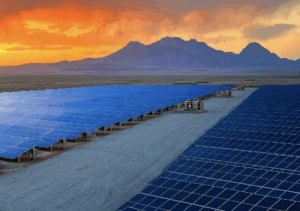

3. Atlas Renewable Energy: Scaling Solar Power in Latin America

Atlas Renewable Energy, a leading Latin American renewable energy company, has partnered with IDB Invest and other financial institutions to develop large-scale solar projects in countries like Colombia and Brazil. These initiatives contribute to significant reductions in greenhouse gas emissions and provide clean electricity to thousands of homes. By leveraging private capital and expertise, Atlas demonstrates how the private sector can play a pivotal role in advancing the global transition to renewable energy.

For instance, the Shangri-La project in Colombia, the largest solar project financed by IDB Invest in the country, is expected to generate approximately 403.7 GWh of clean energy annually, enough to power around 214,000 homes while preventing the emission of roughly 162,000 tons of CO2 per year.

4. Kubo Financiero: Expanding Financial Inclusion in Mexico

Kubo Financiero, a digital microfinance institution in Mexico, offers accessible financial services to underserved populations through its online platform. By providing loans, savings accounts, and investment products, Kubo empowers individuals to improve their financial well-being and build credit histories. Supported by investments from IDB Invest and Google for Startups, Kubo exemplifies how fintech innovations can bridge financial gaps and promote inclusive economic growth.

The company’s model allows for lower interest rates for borrowers and higher rates of return for depositors and investors, compared with traditional financial institutions, thus fostering a more inclusive financial ecosystem.

5. Grupo Bimbo: Integrating Sustainability into Core Business Practices

Grupo Bimbo, one of the world’s largest baking companies, has committed to integrating sustainability into its operations through its “For Nature” strategy. This includes achieving net-zero carbon emissions, eliminating waste, and promoting regenerative agriculture practices. By investing in renewable energy, sustainable packaging, and healthier product formulations, Grupo Bimbo not only enhances its brand value but also contributes to global environmental goals.

The company’s commitment extends to eliminating artificial colorings from all its products by the end of 2026 and ensuring that by the end of 2025, all its bread, buns, and breakfast items will carry a health star rating of at least 3.5, in response to increasing consumer preference for healthier foods.

The role of strategic investments in scaling impact

Strategic investments play a crucial role in scaling the impact of innovative companies. By providing the necessary capital and resources, investors enable these organizations to expand their operations, enhance their offerings, and reach a broader audience. This, in turn, amplifies the positive environmental and social outcomes associated with their business models.

Moreover, investments in innovation foster a culture of continuous improvement and adaptability. Companies that prioritize research and development are better equipped to respond to emerging challenges and capitalize on new opportunities, ensuring long-term sustainability and relevance in a dynamic market.

Some of the more innovative approaches include

1. Outcome-Based Financing: Linking Capital to Results

Traditional funding models often focus on inputs and outputs, but outcome-based financing shifts the emphasis to measurable results. By aligning financial returns with the achievement of specific social or environmental outcomes, investors can ensure that capital is directed toward initiatives that deliver tangible benefits.

For instance, the UP Fund, a $50 million pool of catalytic capital, aims to remove barriers to education and employment by deploying capital in two forms—student financing and organizational financing. This approach seeks to align the incentives between students, training providers, educational institutions, and employers through an outcomes-based methodology

2. Royalties-Based Financing: A Flexible Capital Structure

A novel investment model gaining traction is royalties-based financing, where investors receive a fixed percentage of future revenues instead of equity or rigid debt structures. This approach provides capital to companies without diluting ownership or imposing fixed repayment schedules, offering flexibility and aligning investor returns with company performance.

Althera42, co-founded by former BlackRock executive Caspar Macqueen, applies this model to late-stage private tech infrastructure companies in Europe and potentially North America. The fund targets companies with €10–€100 million in annual revenue from licensing-based models with strong intellectual property, low churn, and diversified customer bases. Investors receive quarterly distributions, combining venture capital-like upside with private debt’s steady cash flow.

3. Ecosystem Investing: Building Collaborative Networks

Ecosystem investing recognizes that complex social and environmental challenges require collaborative solutions. By viewing investments within the context of a broader ecosystem, funders can adjust their behavior in response to changes within that system, leading to more sustainable and scalable impact.

An example of this approach is the Nordic model of capitalism, which emphasizes collaboration between government, business, and civil society to address social issues. This model has proven effective in scaling social innovations by fostering an environment where various stakeholders work together toward common goals.

4. Digital Technology Integration: Enhancing Scale and Efficiency

The integration of digital technologies is transforming how social enterprises operate and scale. By leveraging digital platforms, companies can reach wider audiences, streamline operations, and enhance service delivery, leading to increased impact.

The Solinftec platform, for instance, provides farmers with real-time actionable insights related to planting, spraying, fertilizing, and harvesting. This digital approach has led to increased productivity and reduced environmental impact, demonstrating the power of technology in scaling sustainable agriculture practices.

5. Tradeable Impact Credits: Monetizing Social Outcomes

Innovative financial instruments, such as tradeable impact credits, are emerging to monetize social and environmental outcomes. These credits represent verified positive impacts and can be bought and sold, providing a new revenue stream for organizations delivering social value.

A recent report suggests that developing systems to create incentives to fund and scale these outcomes, focusing especially on the communities they aim to benefit, could significantly boost social funding

Creating lasting change, creating better lives

Investing in innovation is not merely a financial decision; it is a strategic approach to creating lasting positive change. By supporting companies that integrate sustainability and social impact into their core operations, investors contribute to the development of solutions that address some of the world’s most pressing challenges. The case studies of M-KOPA Solar, Solinftec, Atlas Renewable Energy, Kubo Financiero, and Grupo Bimbo illustrate the transformative potential of such investments.

As the global community continues to confront environmental degradation, social inequality, and economic instability, the need for innovative solutions has never been more urgent. Through thoughtful and strategic investments, the private sector can drive the development and scaling of these solutions, paving the way for a more sustainable and equitable future for all.

More from the blog