What will they do next? … ASML to BYD, Eli Lilly and Illumina, Next Era to Nvidia … Some of the world’s most innovative companies ready to deliver huge stock market growth over the next 5 years, and how they could do it

June 9, 2025

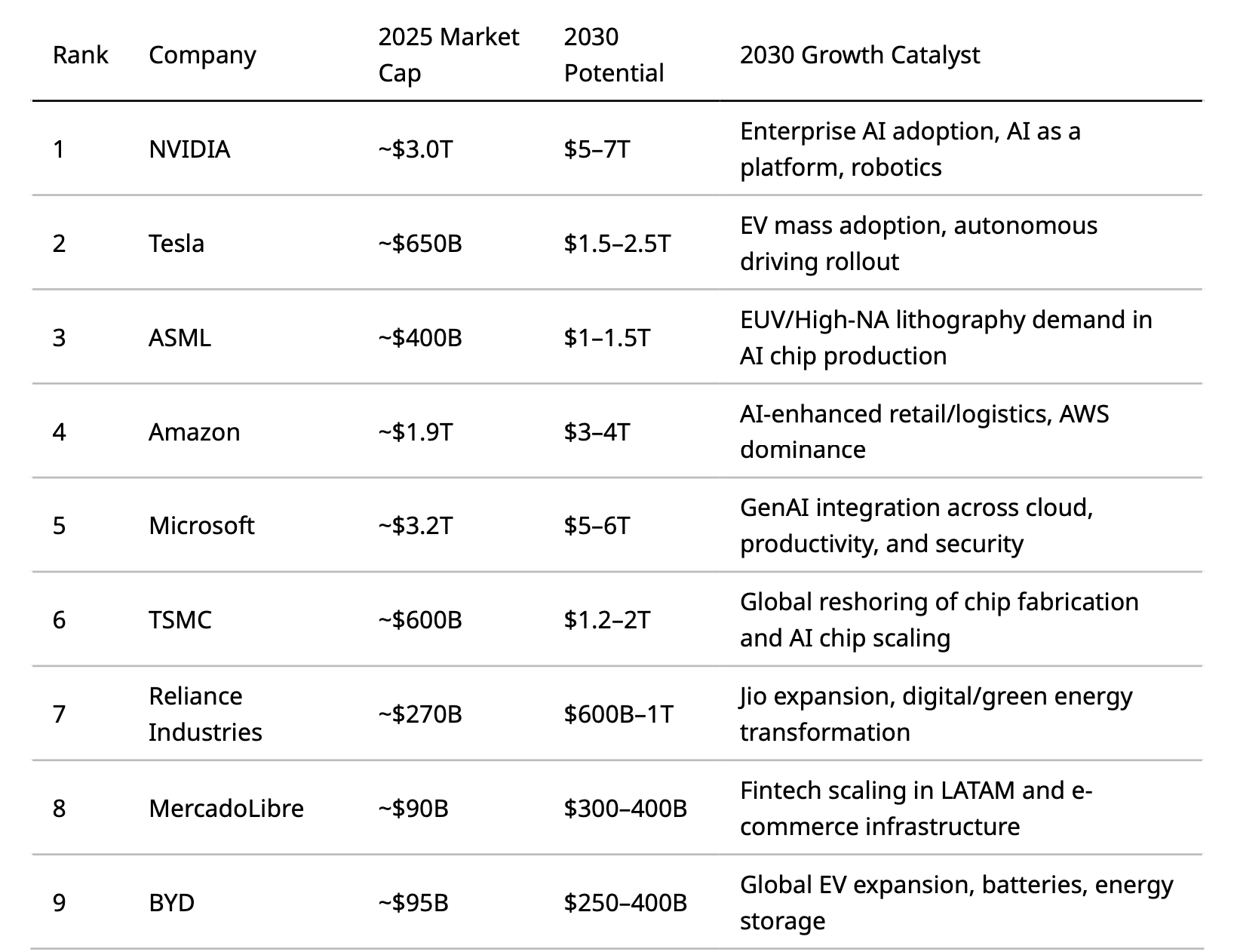

Predicting which companies will see the most significant stock market growth by 2030 involves identifying those best positioned at the intersection of exponential technologies, structural global shifts, and strong execution. These are companies driving or benefiting from megatrends such as AI, climate tech, biotech, digital transformation, and changing demographics.

Here is a curated selection of companies across sectors and geographies that are well-positioned for outsized growth — along with the reasons why. (Remember these are not investment recommendations, simply an analysis of markets and companies, and illustration of their value-based growth potential!).

For each company we consider the strategic significance of the company—”why” it is well-positioned to grow significantly. We also identify the “2030 growth catalyst”, meaning the specific events likely to supercharge the company’s growth by 2030, and the broader “growth drivers”, ie the structural, longer-term factors that will sustain and support the company’s growth over time – technologies, capabilities, business models, partnerships, or geographic expansion.

1. Nvidia … powering the AI revolution

Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, NVIDIA began as a graphics chip company for gaming. Under CEO Jensen Huang, it has evolved into a dominant force in AI computing, data centers, autonomous vehicles, and more. It grew exponentially with the rise of GPU computing and now leads the AI revolution with its full-stack AI platform, including CUDA software, GPUs, and supercomputers like DGX.

- 2025 Market Cap: $3 trillion

- 2030 Potential Market Cap: $6 trillion

- Why: The foundational infrastructure provider for AI, from GPUs to full-stack AI computing platforms.

- 2030 Growth Catalyst: Enterprise adoption of generative AI, AI-as-a-platform services, expansion into robotics and autonomous systems.

- Growth Drivers:

- World’s leading supplier of GPUs, central to AI, machine learning, and edge computing.

- Expanding into AI software, networking, and data centre platforms.

- Strong ecosystem dominance, high margins, and strategic leadership in generative AI.

2. ASML … the machines that make semiconductors

Founded in 1984 as a joint venture between Philips and ASM International, ASML is headquartered in Veldhoven, Netherlands. Under CEO Peter Wennink, it has become the global monopoly in extreme ultraviolet (EUV) lithography. ASML plays a pivotal role in the semiconductor value chain, enabling the production of the smallest and most advanced chips. Its technology is critical to Moore’s Law and the future of AI and high-performance computing.

- 2025 Market Cap: $500 billion

- 2030 Potential Market Cap: $1.2 trillion

- Why: Sole supplier of EUV lithography, essential for advanced semiconductor manufacturing.

- 2030 Growth Catalyst: Surge in demand for next-gen chips across AI, 5G, and quantum.

- Growth Drivers:

- High-margin, high-barrier tech monopoly

- Long-term supplier contracts with TSMC, Intel, Samsung

- Expanding capacity to meet global reshoring demand

3. Tesla … accelerating the transition to clean energy

- 2025 Market Cap: $750 billion

- 2030 Potential Market Cap: $2.5 trillion

- Why: Beyond EVs: energy, AI robotics, and autonomy leader.

- 2030 Growth Catalyst: Commercialisation of autonomous vehicles and Tesla Energy at scale.

- Growth Drivers:

- Energy storage and solar business

- Robotaxi network

- Dojo AI training platform and humanoid robots

4. BYD … dreams driving the future of mobility

BYD (Build Your Dreams) was founded in 1995 by Wang Chuanfu as a rechargeable battery company. It entered the auto industry in 2003 and became one of the world’s largest EV makers. Known for vertical integration, BYD manufactures its own batteries, chips, and EV components. Backed by investors like Warren Buffett, it leads China’s EV market and is rapidly expanding into global markets.

- 2025 Market Cap: $100 billion

- 2030 Potential Market Cap: $450 billion

- Why: Vertically integrated EV manufacturer dominating China and expanding globally.

- 2030 Growth Catalyst: Global mass-market EV adoption, battery exports.

- Growth Drivers:

- In-house batteries and chips

- Affordable EV models for emerging markets

- Global expansion (ASEAN, LATAM, EU)

5. Reliance Jio … becoming India’s leading lifestyle brand

- 2025 Market Cap: $250 billion

- 2030 Potential Market Cap: $800 billion

- Why: India’s most diversified conglomerate, pivoting from oil to digital, retail, and clean energy.

- 2030 Growth Catalyst: Jio as India’s dominant digital ecosystem across telecom, finance, and commerce.

- Growth Drivers:

- Jio Financial, JioMart, JioCinema, and 5G services

- Green hydrogen and solar investments

- 1.4B person digital consumer base

6. MercadoLibre … the digital backbone of Latin America

Founded in 1999 by Marcos Galperin in Argentina, MercadoLibre is Latin America’s leading e-commerce and fintech platform. It operates in 18 countries, offering online marketplaces, digital payments, logistics, and credit services. With its MercadoPago and MercadoEnvios platforms, it serves both consumers and merchants. Under Galperin’s leadership, it continues to scale digital services in a region with growing internet penetration and fintech demand.

- 2025 Market Cap: $80 billion

- 2030 Potential Market Cap: $350 billion

- Why: Amazon + PayPal of Latin America with strong moat in logistics and fintech.

- 2030 Growth Catalyst: Latin America’s digital finance revolution and rising e-commerce penetration.

- Growth Drivers:

- MercadoPago’s banking and credit services

- Logistics and fulfillment infrastructure

- Cross-border commerce expansion

7. Eli Lilly … biotech powerhouse, AI-powered drugs

- 2025 Market Cap: $850 billion

- 2030 Potential Market Cap: $2.2 trillion

- Why: Dominates obesity and diabetes treatment with Mounjaro; strong biotech pipeline.

- 2030 Growth Catalyst: Mainstream use of GLP-1 drugs for metabolic disease and longevity.

- Growth Drivers:

- FDA approvals for Alzheimer’s and cancer drugs

- Global rollout of Mounjaro/Zepbound

- Expansion in emerging health markets

8. TSMC … the world’s largest chip maker

Founded in 1987 by Morris Chang, TSMC (Taiwan Semiconductor Manufacturing Company) pioneered the pure-play foundry model. Headquartered in Hsinchu, Taiwan, and led by C.C. Wei, it is the world’s largest contract chip manufacturer. TSMC produces the most advanced chips for top tech companies globally and is central to innovation in AI, smartphones, and high-performance computing.

- 2025 Market Cap: $600 billion

- 2030 Potential Market Cap: $1.2 trillion

- Why: World’s most advanced semiconductor foundry powering Apple, Nvidia, AMD, etc.

- 2030 Growth Catalyst: AI, automotive, and IoT chips becoming core infrastructure.

- Growth Drivers:

- Geographical diversification (US, Japan, EU fabs)

- Leadership in 3nm and advanced packaging

- Supply chain resilience and premium pricing

9. NextEra Energy … America’s leading clean energy business

Founded in 1984 and headquartered in Florida, NextEra Energy is the parent of Florida Power & Light and NextEra Energy Resources. Under CEO John Ketchum, it leads in wind and solar energy generation in North America. The company is at the forefront of the clean energy transition, investing in grid modernization and storage, and leveraging policy support like the Inflation Reduction Act.

- 2025 Market Cap: $150 billion

- 2030 Potential Market Cap: $300 billion

- Why: Largest renewable energy generator in the US.

- 2030 Growth Catalyst: Scaling solar, wind, and grid-scale battery storage.

- Growth Drivers:

- IRA subsidies and regulatory tailwinds

- Digital grid infrastructure

- Distributed energy services for businesses and consumers

10. ARM … designing next generation chips

ARM was founded in 1990 as a joint venture between Acorn Computers, Apple, and VLSI Technology. Based in Cambridge, UK, it designs energy-efficient chip architectures widely used in mobile and embedded systems. Now led by CEO Rene Haas, ARM has expanded into data centers and AI edge computing. Its flexible licensing model powers over 250 billion chips globally, making it foundational to modern electronics.

- 2025 Market Cap: $120 billion

- 2030 Potential Market Cap: $400 billion

- Why: Dominant CPU architecture for mobile, AI edge, IoT, and increasingly cloud.

- 2030 Growth Catalyst: AI at the edge, IoT proliferation, and high-margin licensing.

- Growth Drivers:

- Embedded AI chips for smart devices

- Expanding royalty streams from data centers

- Strategic shift toward value-based licensing

In summary

In addition here are some “bonus picks” … smaller, high-potential, higher-risk companies that could see significant stock market growth by 2030:

1. UiPath … smart robotics from Romania

Founded in 2005 in Romania by Daniel Dines and Marius Tîrcă, UiPath is a global leader in robotic process automation (RPA). Headquartered in New York, the company helps enterprises automate repetitive tasks across systems using AI-powered bots. Led by co-founder and CEO Daniel Dines, UiPath has grown rapidly with a strong customer base in finance, healthcare, and logistics. Its automation-first platform is expanding into intelligent automation and process mining.

- 2025 Market Cap: $10 billion

- 2030 Potential Market Cap: $100 billion

- Why: UiPath is a leader in robotic process automation (RPA), offering AI-powered tools that automate repetitive tasks in enterprise workflows. With the convergence of AI and automation, demand for intelligent systems to boost productivity is surging.

- 2030 Growth Catalyst: Enterprise AI adoption, mass automation of back-office functions, AI copilots for every worker.

- Growth Drivers:

- Expansion into end-to-end AI-powered automation platforms

- Deeper integrations with cloud platforms (Microsoft, AWS, Google)

- Growing demand in finance, healthcare, government sectors

- Upselling AI-based orchestration and analytics services

2. Palantir … making sense of complex data

Founded in 2003 by Peter Thiel, Alex Karp, and others, Palantir started as a data analytics company for defense and intelligence. Under CEO Alex Karp, it expanded into commercial sectors with platforms like Foundry and Gotham that help organizations integrate and make sense of complex data. With increasing adoption in healthcare, finance, and manufacturing, Palantir is gaining traction as AI-driven decision-making becomes mission-critical.

- 2025 Market Cap: $55 billion

- 2030 Potential Market Cap: $300 billion

- Why: Palantir specializes in AI-driven big data analytics, serving defense, intelligence, and commercial clients. It’s gaining traction for its Foundry and AIP platforms that offer mission-critical decision-making tools powered by LLMs.

- 2030 Growth Catalyst: AI-infused enterprise decision platforms; scaled use across commercial sectors and public infrastructure.

- Growth Drivers:

- Accelerating shift from bespoke to scalable AI platforms

- Strong US and NATO government contracts (defense, healthcare, intelligence)

- Commercial expansion in pharma, manufacturing, energy

- Thought leadership in AI ethics, security, and national resilience

3. Sea Group … Singapore retail meets entertainment

- 2025 Market Cap: $30 billion

- 2030 Potential Market Cap: $120 billion

- Why: Sea operates Southeast Asia’s dominant e-commerce (Shopee), digital financial services (SeaMoney), and gaming (Garena). With Southeast Asia’s growing middle class and digital infrastructure, Sea is well positioned as a regional tech super-app.

- 2030 Growth Catalyst: Regional super app combining shopping, fintech, and entertainment in one platform.

- Growth Drivers:

- Shopee scaling e-commerce in Indonesia, Vietnam, Philippines, Brazil

- SeaMoney expansion into payments, insurance, lending

- Return of gaming growth via Garena’s new titles or cross-border IP

- Digital infrastructure and logistics play in fast-growing economies

4. Illumina … leading the genomics revolution

Founded in 1998 and based in San Diego, Illumina is a pioneer in DNA sequencing technologies and genomics solutions. The company, now led by CEO Jacob Thaysen, enables researchers, hospitals, and pharmaceutical companies to sequence genomes quickly and affordably. Despite recent strategic challenges, it remains critical to the advancement of precision medicine, population genomics, and biotech R&D.

- 2025 Market Cap: $30 billion

- 2030 Potential Market Cap: $120 billion

- Why: Illumina is the global leader in DNA sequencing technology. Its platforms power genomics research, precision medicine, and diagnostics, all central to the healthcare revolution.

- 2030 Growth Catalyst: The “genomics-as-infrastructure” moment: sequencing becomes routine for population health, cancer, rare diseases, and AI-informed medicine.

- Growth Drivers:

- Rapid adoption of genomic testing by health systems

- Falling cost of sequencing (towards $100/genome)

- New clinical diagnostics partnerships and AI applications

- Strategic spinouts or divestments (e.g. Grail) to focus on core

5. CleanSpark … sustainable bitcoin mining

Founded in 1987 and headquartered in Nevada, CleanSpark is a Bitcoin mining and energy technology company that focuses on sustainable mining powered by renewables. Led by CEO Zachary Bradford, CleanSpark distinguishes itself by leveraging energy-efficient operations and vertically integrated power sourcing. The company is also investing in microgrids and grid-interactive energy systems, making it a unique clean-tech and crypto hybrid growth story.

- 2025 Market Cap: $2 billion

- 2030 Potential Market Cap: $12 billion

- Why: CleanSpark provides sustainable Bitcoin mining and microgrid energy solutions. It bridges crypto infrastructure with renewable energy tech — offering a scalable model for energy-intensive industries.

- 2030 Growth Catalyst: Convergence of clean energy + crypto infrastructure + grid balancing services.

- Growth Drivers:

- Renewable-powered mining leadership (low carbon footprint)

- Expansion into smart microgrid tech and virtual power plants

- Leverage of carbon credits and green finance

- Positioned well in US-based digital asset ecosystem with policy tailwinds

6. KlimaDAO … blockchain for climate change

Launched in 2021, KlimaDAO is a decentralized autonomous organization (DAO) aiming to accelerate climate action through blockchain and carbon markets. Built on the Polygon network, it tokenizes carbon credits into the KLIMA token, incentivizing demand for verified carbon offsets. KlimaDAO operates without a central corporate leadership but is stewarded by a community of developers, climate activists, and governance token holders. It seeks to create a transparent, liquid, and scalable market for environmental assets, and is part of a broader trend toward regenerative finance (ReFi).

- 2025 Market Cap: $100 million (token-based market cap)

- 2030 Potential Market Cap: $10 billion

- Why: KlimaDAO is a decentralized autonomous organization creating a programmable carbon market via blockchain. It tokenizes carbon credits to create transparency and liquidity in the voluntary carbon market.

- 2030 Growth Catalyst: Institutional and government adoption of on-chain carbon markets and climate finance infrastructure.

- Growth Drivers:

- Rise of nature-based carbon markets and climate tokens

- Integration with ESG reporting platforms and supply chains

- Partnerships with climate registries and offset projects

- Regulation and demand for transparent carbon accounting

More from the blog