Ecosystems Inc … How the music industry was reinvented through ecosystem thinking … from Napster and Apple, to Spotify and Youtube, TikTok and Fortnite … and what it means for every other industry

June 12, 2025

“The future of music is access, not ownership” says Daniel Ek, founder and CEO of Spotify. “We no longer compete for shelf space, we compete for attention” adds Lucian Grainge, the CEO of Universal Music Group.

TikTok has become the new radio. It’s the primary platform for launching new music. Or YouTube, or Fortnite, or QQ. Artists now have to think like startups. It’s no longer just about the song, but the story, the brand, the community.

The music industry has undergone one of the most radical transformations of any creative sector in the past two decades.

From vinyl and CDs to downloads and now streaming, it has shifted not just in how music is distributed and consumed, but in how value is created, shared, and monetised. At the heart of this reinvention lies ecosystem thinking—a strategic mindset where companies co-create value by building interconnected platforms, partnerships, and services rather than operating as isolated entities.

Ecosystem thinking

Ecosystem thinking transformed the music industry from a linear value chain—where record labels controlled production, distribution, and promotion—into a dynamic, digital-first network of platforms, creators, tech companies, rights holders, fans, and brand partners. This reinvention enabled new business models, global scale, personalised experiences, and powerful feedback loops of data and innovation.

Before the digital era, the music industry operated under a vertically integrated model. Artists signed to labels who controlled recording, marketing, manufacturing, and distribution. Revenues flowed primarily through physical sales. This model was lucrative but rigid, and power was concentrated in the hands of a few major players.

The rise of file-sharing platforms like Napster in the late 1990s exposed the vulnerability of this model. While illegal, peer-to-peer sharing revealed the latent consumer demand for digital access, personalization, and convenience. The industry’s initial response was defensive—lawsuits and DRM restrictions—rather than innovative.

This fragmentation of control marked the beginning of a new phase: reinvention through ecosystems.

Phase 1: The rise of platform ecosystems

The true shift began with Apple’s iTunes in 2001, which offered a legal alternative to piracy by unbundling albums into single tracks, priced affordably. iTunes created a platform ecosystem in which Apple aggregated content from labels and delivered it through proprietary devices like the iPod. The key shift was toward access over ownership—users didn’t need CDs, they just needed a device and a store.

Apple’s model integrated hardware, software, and content. The success of iTunes proved that digital music could be monetized at scale—but the model still emphasised downloads, a one-time transactional economy.

Phase 2: Streaming and the subscription ecosystem

The next leap came with Spotify (founded in 2006, launched in 2008), which championed streaming as a service. Instead of buying individual tracks, users could subscribe and gain access to an entire music library. This was not just a new revenue model—it was an entirely new ecosystem logic:

-

Platform-centric: Spotify didn’t own the content but created a platform where listeners, artists, labels, curators, advertisers, and developers could interact.

-

Data-driven: Personalization engines like “Discover Weekly” used listening behavior to recommend new music, creating a virtuous cycle of engagement.

-

Global reach: Spotify scaled rapidly by partnering with mobile operators and telecoms in emerging markets.

-

Multi-sided revenue: Free users brought in ad revenue; premium users brought subscription income; artists and labels got new promotional and monetization tools.

This shift made continuous access, algorithmic discovery, and social sharing central features of music consumption.

“Streaming didn’t just change the format; it changed the business model, the marketing, and the global flow of culture” says Rob Stringer, Chairman, Sony Music Group

Ecosystem value creation

Spotify and competitors like Apple Music, YouTube Music, Amazon Music, and TikTok now function as platform orchestrators—connecting and enabling a vast range of ecosystem participants:

-

Artists: Self-publishing tools (e.g. Spotify for Artists, SoundCloud) allow artists to release and promote music directly, monitor analytics, and monetize streams—democratizing entry.

-

Fans: Personalized playlists, AI-generated recommendations, and social features deepen emotional connections and increase engagement.

-

Labels & Rights Holders: Gain access to real-time data on performance, regional preferences, and virality—transforming strategy.

-

Advertisers & Brands: Can target specific audiences through audio ads, branded playlists, and partnerships with artists.

-

Third-party Developers: Build integrations via APIs for DJ tools, fitness apps (e.g., Peloton), or AI-music analysis platforms.

In this model, value is co-created through the interplay of multiple participants. The platform becomes more than a distributor; it is a marketplace, a promoter, a data provider, and a collaboration space.

Ecosystem reinvention beyond streaming

The reinvention of the music industry didn’t stop at streaming. It extended into a broader creative and commercial ecosystem, with music integrated into:

-

Social media platforms like TikTok, where music clips go viral, sparking new hits and reviving old ones.

-

Gaming environments such as Fortnite or Roblox, where artists hold virtual concerts, selling digital merchandise and building new fan experiences.

-

Brand partnerships, where companies use music and artists to tell stories, build cultural relevance, and reach new audiences.

-

Fitness and wellness, through collaborations with apps like Calm, Strava, or Apple Fitness+.

Artists now think in ecosystems too—launching podcasts, virtual experiences, NFTs, fashion collaborations, and exclusive fan clubs (like Patreon or Discord communities).

Monetization and new value pools

Through ecosystem thinking, the music industry has found new monetization streams:

-

Subscriptions (Spotify, Apple Music)

-

Ad revenues (YouTube, free-tier platforms)

-

Live-streamed events and virtual concerts

-

Digital merchandise, NFTs, and metaverse performances

-

Brand partnerships and sync deals

-

Fan subscriptions and exclusives

In some cases, artists make more from social integrations or brand deals than from streams alone. The rise of “middle class” musicians—who don’t top charts but thrive within niche ecosystems—is enabled by direct fan relationships and alternative monetization.

Ecosystem enablers: data, AI, and open APIs

Data is the nervous system of the modern music ecosystem. Spotify’s discovery algorithms, YouTube’s content ID, and TikTok’s trend monitoring all use AI to connect artists to fans more efficiently than ever before. APIs allow innovation at the edges, enabling third parties to build remix apps, lyric tools, visualizations, and fan engagement features.

Moreover, open data helps drive artist-centric tools like Songkick for tours, Chartmetric for insights, and LANDR for mastering and promotion—extending the value chain horizontally.

Winning in an ecosystem world

Reinvention through ecosystems has required a new kind of leadership in music:

-

Orchestrators like Spotify or TikTok balance the needs of creators, users, brands, and regulators.

-

Labels now operate more like venture capitalists—investing in artist development, building brands, and managing rights across platforms.

-

Artists act as entrepreneurs—developing personal brands, multi-platform presence, and diverse revenue streams.

Ecosystem thinking is strategic, collaborative, and adaptive. Success is no longer about controlling assets, but enabling others to create value with them.

Despite its many successes, the music ecosystem still faces challenges, and need for further business model reinvention:

-

Artist compensation remains a hot topic—many argue that streaming revenues are too low.

-

Market concentration is a risk, with a few platforms controlling discovery and monetization.

-

Algorithmic influence shapes not just consumption, but what gets created—potentially narrowing diversity.

-

Copyright management across platforms and countries remains complex.

Nonetheless, the industry continues to innovate, exploring AI-generated music, blockchain-based rights tracking, immersive virtual experiences, and deeper fan personalisation.

Music as a living ecosystem

The reinvention of the music industry through ecosystem thinking has redefined how music is made, discovered, shared, and monetized. It has turned passive listeners into active participants, centralized players into enablers, and static catalogues into living, evolving digital experiences.

More than a technological shift, this transformation reflects a deeper change in business philosophy: from ownership to access, from control to coordination, and from isolated value chains to dynamic, networked ecosystems.

As platforms, creators, fans, and brands continue to co-evolve, the music industry stands as a powerful example of how ecosystem thinking can unlock growth, resilience, and creativity in a digital world.

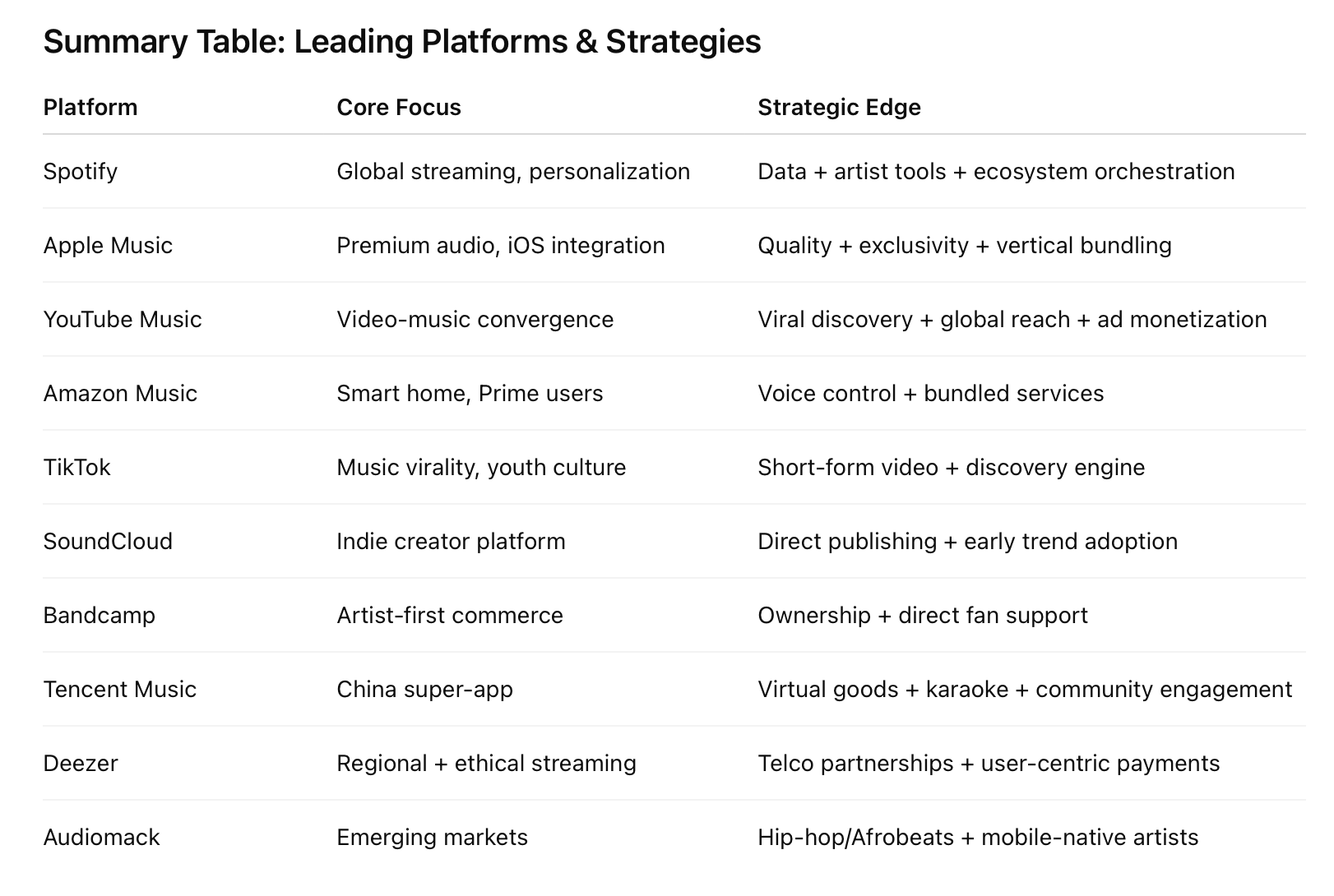

Here are profiles of the leading digital music platforms and how each has strategically positioned itself within the new music ecosystem:

1. Spotify

Founded: 2006 (Sweden)

Business Model: Freemium streaming (ad-supported + subscription)

Strategy: Ecosystem Orchestrator + Data Innovator

Spotify is the world’s largest music streaming platform by users, with over 600 million monthly active users and around 236 million premium subscribers (as of 2025). Its core strength lies in data-driven personalization, with features like Discover Weekly, Release Radar, and Wrapped. Spotify positions itself as a neutral platform between creators and listeners, offering artist tools (Spotify for Artists), podcasts, and an expanding AI stack (e.g. AI DJs, real-time lyric translation). It has made strategic acquisitions in podcasting (e.g. Anchor, Gimlet) and is moving into audiobooks, aiming to become the “audio home” across formats.

2. Apple Music

Founded: 2015 (USA)

Business Model: Subscription-only streaming

Strategy: Premium Experience + Vertical Integration

Apple Music leverages the Apple ecosystem (iOS, AirPods, Apple Watch) to deliver a high-quality, seamless user experience. It emphasizes exclusive content, artist-led shows (e.g., Elton John’s Rocket Hour), and higher-quality audio (lossless, Dolby Atmos). Unlike Spotify, Apple focuses less on social discovery and more on curation and integrationwith user lifestyles, including fitness, spatial audio, and live radio (e.g. Apple Music 1). Apple uses music as a value-added feature to retain subscribers within its larger services bundle.

3. YouTube Music

Founded: 2015 (USA)

Business Model: Freemium streaming + integrated with YouTube Premium

Strategy: Video-Music Integration + Global Reach

Owned by Google, YouTube Music benefits from deep integration with YouTube, the world’s most-used platform for music videos. It excels in global accessibility and virality, especially in emerging markets and among Gen Z. Its ecosystem strength lies in combining video, audio, user-generated content, and fan engagement. Many music trends now begin on YouTube Shorts. Google’s AI also helps power personalized recommendations and smart playlists, while its advertising infrastructure supports monetization for both majors and independents.

4. Amazon Music

Founded: 2007 (as Amazon MP3), rebranded in 2016

Business Model: Bundled with Prime + stand-alone subscriptions

Strategy: Ecosystem Bundle + Smart Devices

Amazon Music leverages its Prime ecosystem and Alexa-enabled smart devices to build frictionless music experiences. Its strategy emphasizes access through voice, integration with shopping and home automation, and bundling music with Prime subscriptions. While it has less cultural influence than Spotify or YouTube, it is strong in households and among passive users. It also offers high-definition and spatial audio options to compete on quality.

5. TikTok (ByteDance)

Founded: 2016 (China)

Business Model: Ad-based + e-commerce + music licensing

Strategy: Viral Discovery + Creator-Driven Ecosystem

TikTok has emerged as the most powerful music discovery platform for younger audiences. Songs often go viral on TikTok before reaching traditional charts. The platform’s short-form video format and algorithmic feed prioritize engagement and shareability. TikTok is building a deeper music ecosystem through SoundOn (artist distribution platform), licensing deals with major labels, and partnerships with streaming services. It doesn’t replace music platforms but acts as a catalyst for discovery and culture, influencing everything from Spotify playlists to brand campaigns.

6. SoundCloud

Founded: 2007 (Germany)

Business Model: Freemium streaming + creator subscriptions

Strategy: Independent Artist Hub + Creator Monetization

SoundCloud pioneered open music sharing and remains a go-to platform for independent and experimental artists. Its strategic focus is on creator empowerment—offering tools for publishing, monetizing, and analyzing tracks. It allows artists to control rights and monetize directly through SoundCloud Premier, Repost, and fan-powered royalties. The platform is a testing ground for trends, subcultures, and new genres, often ahead of mainstream platforms.

7. Bandcamp

Founded: 2008 (USA)

Business Model: Direct artist-to-fan sales

Strategy: Ethical Commerce + Artist Control

Bandcamp offers an alternative model centered around ownership and direct support. Fans can buy digital downloads, vinyl, merch, and more, with a majority of revenues going directly to artists. Bandcamp Fridays (fee-free sales days) have become a cultural event. It fosters niche and indie communities by emphasizing transparency and artist-first ethics. While small in scale, it has loyal users and is often used by creators as a primary income source.

8. Tencent Music Entertainment (TME)

Founded: 2016 (China)

Business Model: Freemium streaming + virtual gifts + karaoke + social

Strategy: Super App Ecosystem + Monetization Variety

TME operates QQ Music, Kugou, and Kuwo, dominating China’s streaming space. Its strategy blends music, social interaction, gaming, and virtual gifts, making music part of a broader entertainment super-app. Revenue comes not just from ads or subscriptions, but also from microtransactions, digital merchandise, and fan-driven economies. TME is a case study in ecosystem monetization diversity, with an emphasis on engagement and community.

9. Deezer

Founded: 2007 (France)

Business Model: Freemium streaming

Strategy: Open Partnerships + Local Curation

Deezer positions itself through localization, openness, and integration. It has partnered with telcos, hardware makers, and brands to expand globally. It also advocates for user-centric payment models, aiming to create fairer revenue shares. Deezer emphasizes editorial curation and regional content, particularly in Europe and Latin America.

10. Audiomack

Founded: 2012 (USA)

Business Model: Freemium streaming

Strategy: Emerging Market Focus + Hip-Hop & Afrobeats Culture

Audiomack is a fast-growing player in Africa, the Caribbean, and the U.S. urban music scene. Its strategy centers on youth culture, mobile-first consumption, and direct artist uploading. It builds local ecosystems by investing in emerging artists and providing tools for real-time metrics and monetization.

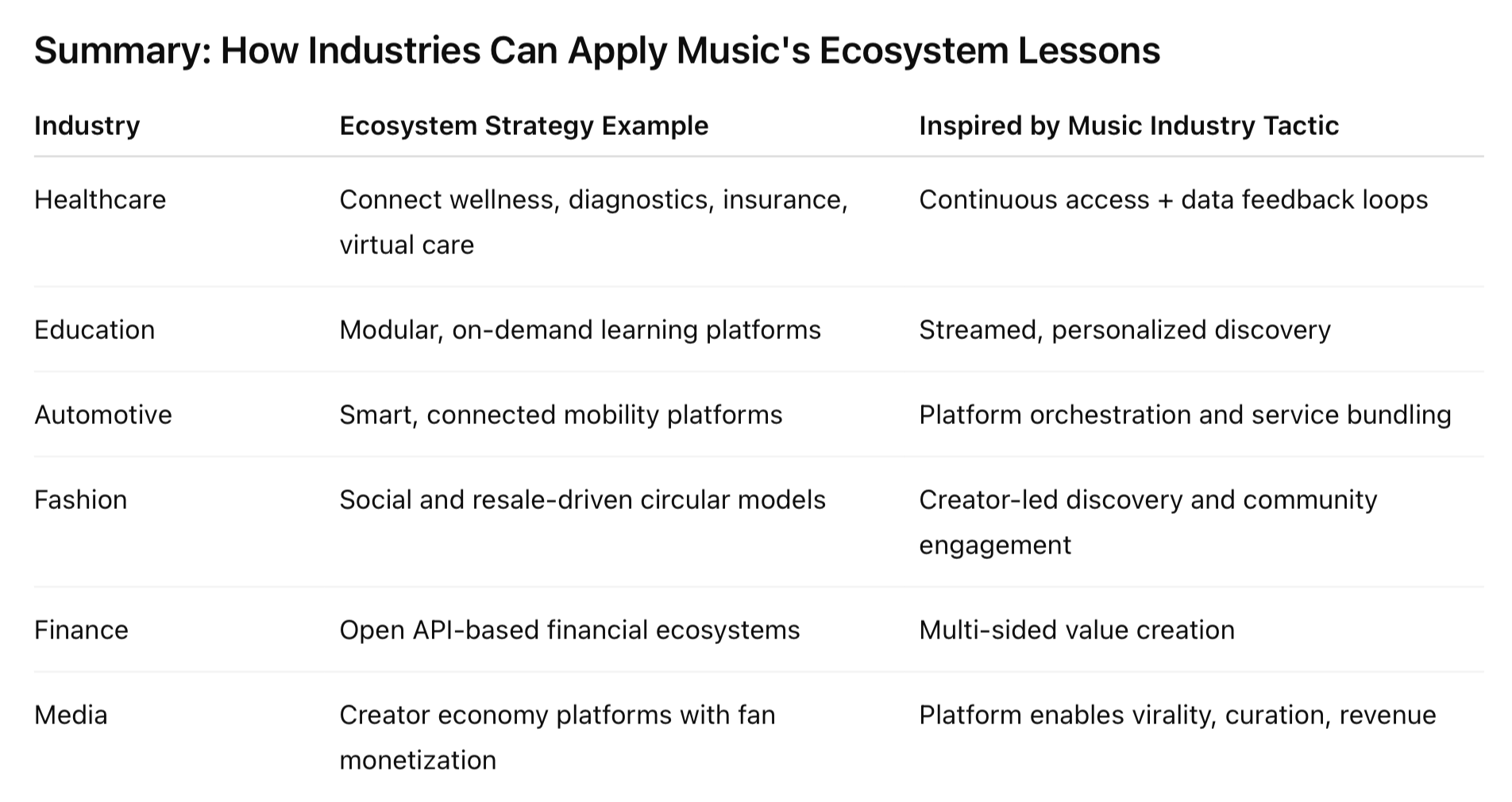

Ecosystems Inc … examples of how to reinvent every industry

The reinvention of the music industry offers powerful lessons for other sectors. Once dominated by physical sales and industry gatekeepers, music has evolved into a dynamic, digital-first ecosystem led by platforms like Spotify, YouTube, and TikTok. These platforms don’t just distribute content—they connect creators, fans, advertisers, developers, and data in ways that continually generate value and innovation.

Other industries—from healthcare to fashion, education to finance—can learn from music’s transformation by embracing ecosystem thinking. This means shifting from linear, siloed value chains to multi-sided platforms where different actors co-create value. Key characteristics include:

-

Connectivity: Linking diverse stakeholders through digital platforms.

-

Personalization: Using data to tailor experiences in real-time.

-

Continuous value creation: Delivering ongoing services rather than one-off transactions.

-

Network effects: Gaining value as more users, creators, and partners join.

-

Open architecture: Allowing integration, innovation, and adaptation over time.

The result is not just a better product, but a more responsive, scalable, and future-ready business model. Just as music moved from ownership to access, so can many other industries—from selling to streaming, from control to collaboration.

1. Healthcare … from treatments to health ecosystems

Old Model: Siloed providers offering one-off services (e.g. hospitals, insurers, pharmacies).

Ecosystem Model: Platforms like CVS Health, Ping An Good Doctor, or Babylon Health connect care, diagnostics, insurance, wearables, and virtual consultations into integrated health ecosystems.

-

Personalization: Just like Spotify recommends music, health ecosystems can use AI to personalize treatment plans or preventive care.

-

Platform Strategy: Connect patients, doctors, insurers, pharmacies, and digital health startups.

-

Value Creation: Continuity of care, lower costs, and better outcomes through real-time data sharing.

Ping An Good Doctor, launched by Ping An Insurance, is China’s largest digital health platform. With over 400 million registered users, it offers online consultations, diagnostics, health checkups, medicine delivery, and AI-powered triage — all in one app.

-

Platform Orchestration: Connects patients, doctors (both in-house and external), hospitals, pharmacies, and insurers.

-

AI-Driven Personalization: Uses AI to provide initial diagnoses, route patients to the right doctor, and suggest health plans.

-

Vertical Integration: Builds offline “One-Minute Clinics” (smart booths) across Chinese cities to bridge physical-digital care.

Ping An’s ecosystem model has reduced friction, increased access to care, and allowed rapid scaling. Like Spotify’s hybrid model of human + algorithmic curation, it blends AI with professional expertise.

2. Education … from institutions to learning ecosystems

Old Model: Universities and schools as gatekeepers of learning.

Ecosystem Model: Platforms like Coursera, Khan Academy, and Duolingo offer modular, lifelong learning through content, tools, and community.

-

Access over Ownership: Just as music moved from CDs to streaming, learning is shifting from degrees to continuous, on-demand content.

-

Ecosystem Design: Involve content creators (e.g. professors), learners, employers, edtech tools, and credentialing bodies.

-

Feedback Loops: Learning paths are continuously updated based on learner performance and job market needs.

Coursera, founded in 2012 by Stanford professors, is a global online learning platform with over 140 million users and partnerships with 300+ top universities and companies.

-

Multi-Sided Platform: Connects learners, educators, institutions, and employers — creating a rich, interconnected education ecosystem.

-

Modular Learning: Offers flexible, stackable credentials (courses, certificates, degrees), much like how Spotify unbundled albums into playlists and songs.

-

Personalization & AI: Suggests learning paths based on skills, career goals, and usage patterns. Uses AI to tailor content recommendations, mirroring music algorithms.

-

Corporate & Government Partnerships: Offers Coursera for Business, Government, and Campus — embedding education into workforce systems.

Coursera has become a leading force in democratizing education globally, moving from a content library to a full ecosystem of skills, credentials, and career pathways. Like Spotify, it redefined access and empowered both creators (educators) and consumers (learners).

3. Automotive … from selling cars to mobility-as-a-service

Old Model: Buy or lease a vehicle from a dealership.

Ecosystem Model: Platforms like Tesla, Uber, and MaaS apps like Bolt connect cars, ride-hailing, energy, insurance, and smart city infrastructure.

-

Platform Logic: Tesla connects software, EV charging, insurance, and over-the-air updates.

-

Network Effects: Uber builds an ecosystem of drivers, riders, restaurants, and logistics.

-

Data as Asset: Predictive maintenance, usage-based insurance, route optimization—all fed by real-time data.

Tesla is not just a car company — it’s an integrated mobility, energy, and software platform. Its success lies in treating the car as a node in a broader ecosystem, not just a product.

-

Vertical Integration: Controls everything from battery production to software, energy services (Powerwall, Solar Roof), and even insurance.

-

Continuous Upgrades: Like Spotify’s streaming updates, Tesla delivers over-the-air software updates to improve vehicle performance and add features post-purchase.

-

Network Effects: Connects Tesla vehicles into shared systems — from autonomous driving data learning to Supercharger networks.

-

AI + Data Loop: Uses real-time driving data for autopilot training and fleet optimization, akin to music platforms using listening data for personalization.

Tesla’s integrated model offers a seamless user experience while continuously expanding into adjacent spaces (robotaxis, energy storage, grid services). This mirrors how platforms like Apple Music or YouTube built adjacent services around core content.

4. Fashion … from product-driven to creator-driven ecosystems

Old Model: Seasonal collections pushed by fashion houses to retailers.

Ecosystem Model: Platforms like Instagram, Depop, and StockX empower creators, resellers, and consumers to co-create and trade fashion in real time.

-

Creators as Brands: Influencers and micro-brands gain traction without traditional backing.

-

Circular Economy: Secondhand marketplaces and upcycling apps form part of the fashion loop.

-

Digital Goods: Virtual fashion in gaming and the metaverse (e.g. Balenciaga in Fortnite).

StockX launched in 2016 as a “stock market of things,” enabling users to buy and sell sneakers, streetwear, and luxury items with price transparency, authentication, and real-time demand signals. It now processes billions in GMV annually and has become a cultural hub for sneakerheads and collectors.

- Two-Sided Marketplace: Connects sellers (resellers, retailers, individuals) and buyers (enthusiasts, investors) in a transparent pricing environment, like Spotify connects artists and fans.

-

Data as Currency: Provides real-time pricing charts, historical trends, and volume data — turning fashion into a speculative, dynamic asset class.

-

Trust Infrastructure: Builds authentication, condition grading, and transaction security — key to ecosystem health and stickiness.

-

Cultural Integration: Acts as a hub for sneaker culture, drops, and community-driven demand, leveraging scarcity and social influence like viral hits in music.

StockX transformed secondhand goods into financial assets. Much like how Spotify allowed obscure tracks to gain global traction, StockX gave niche fashion products global visibility and liquidity. The company monetizes not just transactions but the data, culture, and community around them.

5. Finance … from products to financial wellness ecosystems

Old Model: Banks offering siloed services—checking, loans, investing.

Ecosystem Model: Platforms like Revolut, Alipay, and Plaid connect personal finance, investing, insurance, crypto, and rewards.

-

API-driven Ecosystems: Fintechs connect to banks, credit bureaus, payroll providers, and e-commerce platforms.

-

User Control: Like artists using Spotify for Artists, customers can manage their financial data and insights in one place.

-

Embedded Finance: Financial services appear within non-financial platforms (e.g. BNPL in retail).

Revolut started in 2015 as a travel-focused money app and evolved into a financial super app, offering banking, crypto, stock trading, budgeting, and more to 40+ million users worldwide.

-

All-in-One Platform: Combines checking, saving, FX, trading, lending, and insurance — turning financial services into a continuous engagement experience, like Spotify’s audio ecosystem.

-

Personalized Insights: AI-driven notifications and budgeting tools help users manage money better, mirroring personalized recommendations in music apps.

-

APIs + Open Banking: Connects with third-party fintechs, creating a modular system where users can plug in services.

-

Gamified UX: Rewards, challenges, and community engagement drive usage, similar to TikTok’s engagement mechanics.

Revolut is redefining consumer expectations in banking — focusing on UX, real-time updates, and financial control. Like Spotify gave users control over what and how they consume music, Revolut puts customers in control of their financial lives.

6. Media and Entertainment … from channels to content ecosystems

Old Model: Studios create, control, and distribute content through owned channels.

Ecosystem Model: Platforms like Netflix, YouTube, and Twitch enable content creation, distribution, monetization, and fan engagement across communities.

-

Creator Economy: Anyone can be a content creator, and monetization is built into the ecosystem (ads, subscriptions, donations).

-

Personalization: AI-driven recommendations akin to Spotify’s playlists.

-

Community-Driven Discovery: Fans co-create culture, memes, remixes—similar to how TikTok shapes music.

Netflix, founded in 1997 as a DVD rental company, became the first major streaming service in 2007. Today it’s a global media powerhouse, with 270+ million subscribers in 190+ countries, and a leader in both content production and delivery.

-

Vertical Control of Value Chain: Produces, distributes, and curates content end-to-end — like Apple in music or Tesla in mobility.

-

Data-Driven Personalization: Uses viewer data to drive algorithmic recommendations, content commissioning, and global rollouts (e.g. “House of Cards” was greenlit based on viewer preferences).

-

Global Localism: Builds region-specific content ecosystems (e.g. K-dramas, Spanish thrillers) that scale globally, turning local hits into global phenomena (à la “Squid Game”).

-

Multi-Stakeholder Platform: Connects creators, audiences, advertisers (in ad-tier), and now game developers — extending the platform into new media.

Netflix reshaped how content is consumed, produced, and monetized. Like Spotify, it removed traditional industry gatekeepers and used algorithms and audience feedback to shape creative direction. It turned entertainment into a dynamic, participatory, data-led experience.

Explore more

- Next Generation Business Models: Redefining value, ownership, scale, and trust by Peter Fisk

- Reinventing business ecosystems for more profitable growth by Peter Fisk

- Building a Butterfly Brand: How “branded ecosystems” achieve more in a world of relentless change by Peter Fisk

- Has Apple become more or less innovative in recent years? by Peter Fisk

- Cross Industry Innovation for Future Business Ecosystems by Z Punkt

- Ecosystem Strategy Map by Julian Kawohl

- How do you Design a Business Ecosystem by BCG Henderson

More from the blog