Accelerating Growth … in a world defined by rapid change, sustained profitable growth is not just about having a great product, it’s about having a strategy and system for scaling effectively

April 14, 2025

Accelerating profitable business growth has become not just a challenge of execution, but one of vision, agility, and strategic leadership. Today’s business environment is shaped by rapid technological change, shifting consumer expectations, geopolitical instability, climate imperatives, and economic volatility. Against this backdrop, leaders are under immense pressure to deliver sustained growth while navigating a landscape that is uncertain, complex, and frequently unpredictable.

At the heart of the challenge is the tension between speed and sustainability. Growing quickly often requires aggressive investments—in marketing, talent, product development, or global expansion. These investments can erode short-term profits and introduce strategic risk. Conversely, focusing too heavily on cost control and profit margins can lead to stagnation, missed opportunities, and underinvestment in innovation. Striking the right balance is especially difficult in rapidly changing markets, where customer needs, technologies, and business models evolve constantly.

Leaders need to become adept at making the right growth bets in an increasingly fragmented world. Traditional markets are saturated, while emerging ones are volatile. New technologies emerge faster than many companies can adapt. In this environment, identifying which opportunities to pursue—and which to avoid—requires leaders to rethink conventional strategy. Long-term planning cycles are being replaced by more adaptive, scenario-based approaches. Yet even as they move quickly, leaders must ensure that every growth initiative is aligned with core capabilities, customer needs, and long-term brand equity. Overextension, or chasing growth at any cost, can undermine profitability and erode strategic focus.

Leaders also face the challenge of balancing innovation with operational discipline. Profitable growth depends not only on breakthrough ideas but on executional excellence—scaling efficiently, managing costs, and maintaining quality. This tension is particularly acute in periods of uncertainty, where resource allocation decisions must be made with incomplete information. The best leaders create organizations that can innovate at the edges while staying grounded in strong business fundamentals.

At the same time, the leadership challenge is increasingly about building cultures that can thrive in ambiguity. Organizational agility, speed, and resilience have become competitive differentiators. This requires more than adopting agile methods or digital tools; it demands a fundamental shift in mindset. Leaders must empower teams to take initiative, embrace experimentation, and learn quickly from failure. Hierarchical, risk-averse cultures that once protected profits may now inhibit growth. Shaping a more entrepreneurial, adaptive culture is one of the most difficult—and essential—tasks for today’s executives.

The people dimension of leadership is equally critical. Amid a generational shift in workforce expectations, businesses must align growth ambitions with purpose, inclusivity, and sustainability. Employees want to work for companies that stand for more than just shareholder value. Customers expect brands to take a stand. Growth strategies that fail to address these shifts risk backlash, disengagement, or irrelevance. Strategic growth in today’s world must be both profitable and responsible.

Moreover, the external environment adds layers of complexity. Trade tensions, inflation, regulatory changes, and geopolitical risks can rapidly reshape market dynamics. Leaders must be fluent in macroeconomics and geopolitics, not just balance sheets. They must also develop organizations that are capable of sensing change early and responding decisively. This requires robust data systems, scenario thinking, and a strong leadership bench that can navigate through turbulence.

In this context, accelerating profitable growth is not just about scaling up—it’s about building organizations that are bold, resilient, and adaptable. Strategic clarity, cultural alignment, and visionary leadership have become the new cornerstones of sustainable success in an age of relentless change.

Growth champions

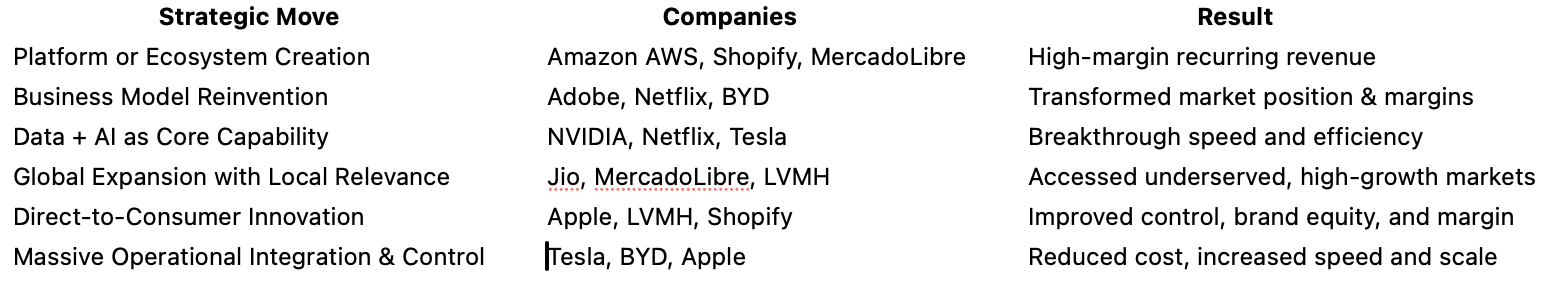

Here are real-world examples of larger companies (not just startups) from around the world that have achieved exponential, supercharged, and profitable growth—along with what they did and the results they achieved.

AWS … the power of cloud

Growth strategy:

-

Transformed Amazon’s internal infrastructure into a cloud services platform for the world.

-

Scaled a highly profitable, usage-based SaaS business while others still sold physical servers.

-

Offered APIs and tools that enabled startups and enterprises to build rapidly.

Growth impact:

-

Became the profit engine for Amazon: ~$90B revenue (2023), ~30% operating margin.

-

Powers a massive portion of the global internet economy.

-

Enabled Amazon to subsidize retail operations and expand into healthcare, devices, and AI.

Apple … ecosystem growth engines

Growth strategy:

-

Shifted from being a hardware innovator to building a services ecosystem (App Store, iCloud, Music, Pay).

-

Designed a closed ecosystem with high customer lock-in and premium branding.

-

Invested heavily in proprietary chips and vertical integration.

Growth impact:

-

Gross margins regularly exceed 42%.

-

Apple Services segment alone generates $80B+ annually, with higher margins than devices.

-

Became the world’s first $3 trillion company (2022).

BYD … from batteries to automobiles

Growth strategy:

-

Transitioned from battery maker to EV and hybrid vehicle giant.

-

Developed a closed-loop model with internal batteries, chips, and semiconductors.

-

Benefited from Chinese government incentives and global demand for affordable EVs.

Growth impact:

-

Surpassed Tesla in EV sales (2023) in certain quarters.

-

Revenue grew to $75B+, with strong profitability.

-

Expanded to global markets (Europe, Asia, LATAM), becoming a key global EV player.

Shopify … enabling every store to be global

Growth strategy:

-

Democratized e-commerce with an intuitive platform for SMBs and creators.

-

Avoided competing with Amazon directly; instead built tools and an app marketplace.

-

Integrated payments, logistics, and marketing into its platform.

Growth impact:

-

Revenue grew from $205M (2015) to over $7B (2023).

-

Reached profitability in key quarters while maintaining strong reinvestment.

-

Became one of Canada’s most valuable companies, with a global merchant base.

Netflix … making and streaming movies

Growth strategy:

-

Moved from DVD rentals to a streaming-first, content-producing tech platform.

-

Leveraged data analytics and AI to drive content investments and personalization.

-

Scaled globally fast with local content in multiple markets.

Growth impact:

-

From 22M subscribers (2011) to 260M+ globally (2024).

-

High user retention and average revenue per user (ARPU).

-

Operating margins grew from single digits to over 20% in recent years.

Nvidia … chips to power the future

Growth strategy:

-

Pivoted from graphics chips to powering AI, data centers, and deep learning.

-

Developed CUDA, a platform that made GPUs essential for modern AI work.

-

Benefited massively from the generative AI and LLM boom.

Growth impact:

-

Stock price rose over 20x between 2016 and 2024.

-

Became a $2 trillion company and one of the most profitable chipmakers globally.

-

Gross margins regularly exceed 65%, with exponential revenue growth.

Reliance Jio … from petrochemicals to super apps

Growth strategy:

-

Launched ultra-low-cost mobile data and telecom services to underserved masses.

-

Bundled services like streaming, messaging, and payments.

-

Funded through Reliance Industries’ oil & gas business, and then spun into a digital platform.

Growth impact:

-

Gained 400M+ subscribers in under 5 years.

-

Drove India’s digital transformation and increased data consumption 10x.

-

Raised billions from global investors (Facebook, Google), valuing Jio at over $65B.

LVMH … unlocking the brand portfolio

Growth strategy:

-

Consolidated luxury brands across fashion, jewelry, wines, and cosmetics.

-

Preserved brand exclusivity while digitally modernizing marketing and direct-to-consumer.

-

Expanded aggressively into Asia, especially China.

Growth impact:

-

Became the world’s most valuable luxury company ($500B+ market cap).

-

Operating margin over 25%, with strong pricing power and global brand dominance.

-

Acquisitions like Tiffany & Co. strengthened portfolio and cross-brand synergy.

MercadoLibre … the digital backbone of Latin America

Growth strategy:

-

Built the “Amazon + PayPal of Latin America” with e-commerce, logistics, and fintech.

-

Created MercadoPago to solve payments for the unbanked.

-

Scaled across 18+ countries, solving local infrastructure challenges.

Growth impact:

-

Market cap surged from ~$5B (2015) to $80B+ (2024).

-

Maintained profitability with strong user growth and low CAC.

-

MercadoPago is now a major fintech player across LATAM.

Tesla … not just cars, but an energy business

Growth strategy:

-

Redefined the electric vehicle market with a vertically integrated, software-first business model.

-

Built its own battery tech, charging infrastructure, and AI-based self-driving system.

-

Positioned itself not just as a carmaker but as an energy + tech company.

Growth impact:

-

Market cap surged from ~$50B in 2017 to over $750B by 2024.

-

Delivered profitability across multiple years, despite high capital investment.

-

Created one of the most profitable vehicle businesses globally (per unit gross margin).

Growth leaders

Accelerating business growth is a top priority for leaders across industries and geographies. Yet, their approaches often reflect a combination of bold vision, customer obsession, innovation, and adaptability.

Satya Nadella, CEO of Microsoft, emphasizes the power of continuous transformation:

“Our industry does not respect tradition—it only respects innovation. You have to be willing to be in a constant state of renewal to drive growth.”

Nadella’s strategy has centered on reinventing Microsoft’s core business through cloud computing, AI, and enterprise services—leading to a dramatic turnaround and more than tripling of its market value since 2014.

Melanie Perkins, CEO of Canva, focuses on simplicity and scale:

“We set out to solve a real problem for people. If you truly democratize access to a tool, growth becomes exponential.”

Canva’s easy-to-use design platform now serves over 150 million users, largely driven by word-of-mouth and product-led growth.

Dara Khosrowshahi, CEO of Uber, stresses customer-centric agility:

“Growth is not just about more—it’s about better. We grow when we serve more people more effectively, not just when we expand our footprint.”

Under his leadership, Uber has diversified into delivery, freight, and new mobility formats, driving both expansion and efficiency.

Reed Hastings, co-founder of Netflix, ties growth to culture and speed:

“Don’t tolerate brilliant jerks. The cost to teamwork is too high. And don’t wait—speed is the number one thing we focus on.”

Netflix’s willingness to pivot—from DVDs to streaming, then to content production—has powered global subscriber growth and brand dominance.

From digital disruptors to legacy turnarounds, today’s most effective leaders understand that growth is less about scale for its own sake—and more about evolving with purpose, speed, and clarity.

Growth frameworks

Here are some of the most powerful concepts, models, and frameworks for accelerating business growth today.

1. The Flywheel Model

Popularized by Jim Collins and adopted by companies like Amazon and HubSpot, the flywheel model redefines how businesses think about growth. Unlike the traditional sales funnel, which ends after conversion, the flywheel emphasizes momentum and continuous customer engagement.

The flywheel has three key phases:

- Attract: Draw in prospects through valuable content, branding, and thought leadership.

- Engage: Nurture leads through meaningful interactions, personalized experiences, and exceptional service.

- Delight: Turn customers into promoters through consistent value and support, creating referrals and repeat business.

What makes the flywheel powerful is its self-reinforcing nature—each delighted customer adds energy to the system, generating exponential growth through loyalty and word-of-mouth.

2. The Growth Loops Framework

Growth loops are another evolution beyond funnels. Instead of a linear model where leads go in and customers come out, growth loops are systems where the output of one cycle becomes the input of the next. For example:

- Content Loop: Users create content → more content attracts users → those users create more content (e.g., YouTube, Reddit).

- Referral Loop: A user refers a friend → the friend signs up and refers others → loop continues (e.g., Dropbox, Uber).

- Product Loop: Usage of the product drives value that attracts new users (e.g., Figma’s collaboration features).

Unlike one-off marketing tactics, growth loops embed growth into the product experience itself, enabling compounding returns over time.

3. The Jobs to Be Done (JTBD) Theory

Developed by Clayton Christensen, JTBD helps businesses understand the true motivations behind customer decisions. Instead of focusing on demographics or product features, JTBD asks: “What job is the customer hiring this product to do?”

For example, a person buying a drill doesn’t really want a drill—they want a hole in the wall. Or deeper still, they want to hang a family photo, which may be about creating a feeling of home. Understanding these emotional and functional jobs unlocks innovation, differentiation, and more targeted growth strategies.

JTBD encourages:

- Customer-centric product development

- Better marketing messages

- Disruption of entrenched competitors by meeting overlooked needs

4. Blue Ocean Strategy

Developed by W. Chan Kim and Renée Mauborgne, this framework helps companies escape the bloody waters of “red ocean” competition by creating entirely new markets or “blue oceans.”

Key tools within the strategy include:

- The Strategy Canvas: Visualize how competitors compete and where to differentiate.

- The Four Actions Framework: Ask what to Eliminate, Reduce, Raise, and Create to deliver a unique offering.

Companies like Cirque du Soleil and Tesla used blue ocean thinking to create entirely new customer value propositions, achieving rapid and defensible growth. It’s a powerful framework for innovation-led growth rather than price-led battles.

5. The Ansoff Matrix

A classic model still relevant today, the Ansoff Matrix outlines four main strategies for growth:

- Market Penetration: Sell more of the same product in the same market (e.g., promotions, loyalty programs).

- Market Development: Enter new markets with existing products (e.g., international expansion).

- Product Development: Develop new products for the current market (e.g., upsells, feature enhancements).

- Diversification: Enter new markets with new products (e.g., launching a new business unit).

Each strategy comes with its own risks and rewards. The matrix helps leaders weigh those tradeoffs and decide where to place their bets.

6. The Lean Startup Methodology

Ideal for both startups and established businesses launching new initiatives, Lean Startup encourages fast, iterative growth based on customer feedback.

Key principles include:

- Build-Measure-Learn loop: Quickly build a Minimum Viable Product (MVP), measure user response, and learn what works.

- Validated learning: Use experiments and real-world data to guide decisions rather than assumptions.

- Pivot or persevere: Adjust course quickly based on what you learn.

Companies like Dropbox and Airbnb used lean principles to accelerate early growth by reducing time to market and adapting rapidly to customer needs.

7. Moonshot Thinking

Coined by Google and championed by Moonshot thinkers, 10x Thinking is the idea of aiming for 10 times improvement rather than incremental gains.

This forces radical creativity: Instead of asking “How can we increase revenue by 10%?” ask “How can we grow it 10x?” This approach unlocks:

- Bold innovation

- Systems redesign

- Disruption of legacy models

Companies like SpaceX, Google X, and OpenAI thrive on 10x thinking. It reframes limitations as creative constraints and can spark revolutionary growth strategies.

8. OKRs (Objectives and Key Results)

OKRs, popularized by Intel and adopted by Google, are a goal-setting framework that aligns teams around ambitious objectives with measurable results.

Each OKR consists of:

- Objective: A clear, qualitative goal (e.g., “Become the market leader in AI-enabled design tools”)

- Key Results: Quantifiable outcomes that measure progress (e.g., “Acquire 1M users by Q4,” “Increase NPS to 75+”)

OKRs keep teams focused, aligned, and accountable, while encouraging stretch goals. Growth-driven companies use them to track what truly matters.

9. The Business Model Canvas

Developed by Alexander Osterwalder, the Business Model Canvas offers a one-page visual representation of how a business creates, delivers, and captures value.

It breaks a business down into nine essential building blocks, including:

- Value Propositions

- Customer Segments

- Channels

- Revenue Streams

- Key Partnerships

The canvas helps leaders identify growth levers, spot weaknesses, and quickly prototype new business models—especially helpful when adapting to market shifts or launching new offerings.

10. Pirate Metrics (AARRR Framework)

Developed by Dave McClure, the AARRR framework breaks down the customer lifecycle into five key stages:

- Acquisition – How do users find you?

- Activation – Do they have a great first experience?

- Retention – Do they come back?

- Referral – Do they tell others?

- Revenue – Do they generate income?

This metric-driven framework helps businesses optimize each stage of the funnel with data, enabling sustainable growth. It’s especially popular in SaaS and digital startups, but adaptable to most industries.

What’s the best tool for you?

There’s no one-size-fits-all approach to growth. The best businesses combine these frameworks based on their industry, maturity, goals, and culture. Some will focus on product-led growth, others on ecosystem expansion. But all successful growth strategies share a few things in common: a deep understanding of customer needs, the ability to adapt fast, and the discipline to measure what matters.

To accelerate business growth, don’t just chase tactics. Build a system. Use models like the Flywheel, JTBD, Lean Startup, and OKRs not just as tools—but as ways of thinking. In an era where change is constant, the ability to reinvent, test, and scale is the ultimate growth engine.

Growth Accelerators

The best growth accelerators are strategies, tactics, and capabilities that businesses use to supercharge their growth trajectory—not just by increasing revenue, but by doing so profitably, efficiently, and sustainably. These accelerators span technology, strategy, innovation, marketing, operations, and leadership—and the most successful companies often combine multiple levers simultaneously.

Here’s a breakdown of some of the most powerful and widely adopted growth accelerators, with real-world examples from companies around the world.

1. Platform & Ecosystem Models

Turn your business into a platform where others create value with you.

-

What it does: Creates network effects, reduces cost of growth, expands customer reach.

-

Examples:

-

Apple (App Store): Developers build apps → more users → more device sales.

-

Shopify: Built an e-commerce platform enabling millions of merchants; ecosystem partners do the selling, development, and services.

-

-

Impact: High-margin, scalable growth with minimal cost per new transaction.

2. Digital Transformation & Automation

Use data, AI, and automation to scale faster and smarter.

-

What it does: Increases efficiency, improves decision-making, enables hyper-personalization, lowers customer acquisition and retention costs.

-

Examples:

-

Unilever: Uses AI to optimize marketing ROI and demand forecasting.

-

Schneider Electric: Built smart energy platforms using IoT and AI.

-

-

Impact: Boosts profit margins while accelerating innovation cycles.

3. Customer-Centric Innovation

Design around what customers truly need—not what you want to sell.

-

What it does: Drives product-market fit, reduces churn, increases CLV.

-

Examples:

-

Netflix: Shifted from DVD rental to streaming, then to original content based on viewing behavior.

-

L’Oréal: Uses AI and AR to personalize beauty products and recommendations.

-

-

Impact: Faster uptake, stronger brand loyalty, more repeat business.

4. Subscription & Recurring Revenue Models

Switch from one-time transactions to ongoing relationships.

-

What it does: Provides predictable, scalable, and higher-margin revenue.

-

Examples:

-

Adobe: Moved from boxed software to Creative Cloud subscription—tripled revenue and boosted margins.

-

BMW & Porsche: Testing subscription-based access to car fleets (mobility-as-a-service).

-

-

Impact: Higher customer lifetime value and stable cash flow to reinvest in growth.

5. Brand-Led Growth & Community Building

Build brand equity and emotional connection to fuel organic expansion.

-

What it does: Reduces CAC, increases retention and referrals, builds pricing power.

-

Examples:

-

Nike: Fuses community, lifestyle content, and digital experiences (Nike Run Club, SNKRS app).

-

Patagonia: Purpose-driven branding created a loyal, activist customer base.

-

-

Impact: Stronger differentiation and long-term customer value.

6. Data Monetization & AI-Driven Insights

Turn data into new products, services, and predictive capabilities.

-

What it does: Opens new revenue streams and drives smarter decisions.

-

Examples:

-

Amazon Web Services (AWS): Built tools for companies to monetize their own data.

-

Uber: Uses ride data to optimize pricing, routes, and driver incentives.

-

-

Impact: Data becomes an asset that multiplies value creation.

7. Aggressive Global or Adjacent Market Expansion

Enter new geographies or verticals with tailored offerings.

-

What it does: Unlocks scale quickly, diversifies risk, leverages brand and IP.

-

Examples:

-

Starbucks: Used hyper-local store design and product menus to expand globally.

-

Tesla: Expanded from luxury EVs to energy storage and grid solutions.

-

-

Impact: Large revenue boosts with relatively low R&D cost if done strategically.

8. Strategic M&A and Venture Investments

Buy, invest in, or partner with innovative companies to accelerate capabilities.

-

What it does: Provides instant access to new tech, markets, or teams.

-

Examples:

-

Facebook (Meta): Acquired Instagram, WhatsApp, and Oculus to dominate social and VR.

-

Google (Alphabet): Acquired YouTube and DeepMind to become AI-first.

-

-

Impact: Rapid acceleration beyond organic growth capacity.

9. Agile Operating Models

Adopt lean, cross-functional teams that can adapt fast and iterate quickly.

-

What it does: Shortens innovation cycles, improves responsiveness to market shifts.

-

Examples:

-

Spotify: Scaled its engineering culture through “squads” and “tribes.”

-

Amazon: “Two-pizza teams” enable autonomy and innovation across the company.

-

-

Impact: Speed becomes a competitive advantage.

10. Sustainability as a Growth Driver

Turn climate action and ESG into strategic growth opportunities.

-

What it does: Attracts talent, opens new markets, aligns with regulatory trends.

-

Examples:

-

Ørsted: Pivoted from fossil fuels to renewable energy and became a global leader.

-

IKEA: Committed to climate-positive operations and circular product design.

-

-

Impact: Growth aligned with future-proof, planet-positive business models.

More from the blog