The Invisible Business … today’s best organisations are built on intangible assets … ideas and brands, algorithms and ecosystems … but few leaders know how to effectively unlock their real value

December 17, 2024

A century ago, the world’s most valuable companies were measured by how much land they owned, how many tons of steel they produced, or how many barrels of oil they extracted from the ground. Today, the most valuable companies own few factories and carry little inventory. Their value lies not in what you can touch—but in what you cannot.

Apple, Alphabet, Amazon, Microsoft, and Nvidia are trillion-dollar businesses not because of their physical assets, but because of the brands they’ve built, the ecosystems they’ve cultivated, the trust they’ve earned, the data they control, and the software they deploy at planetary scale. What makes these businesses so valuable is largely invisible—intangible assets that never show up fully on a balance sheet, yet define competitive advantage in the modern age.

We are living through a silent revolution. According to Ocean Tomo, intangible assets made up just 17% of the market value of S&P 500 companies in 1975. By 2020, that number had soared to over 90%. The traditional accounting lens— designed in the industrial era—struggles to capture this shift. In boardrooms and spreadsheets, what matters most is often missing. Leaders trained to manage physical assets and short-term profits are now navigating a world where value lives in code, content, relationships, creativity, culture, and algorithms.

This book is about that unseen world. It is about the hidden engines of exponential growth, the value drivers that define market leadership today, and the reasons so many companies still overlook them.

The Intangible Economy

The signs are everywhere. A shoe company like On Running can IPO with billion- dollar valuations thanks to its cult brand and community before turning a profit. A firm like OpenAI can become one of the most watched organizations on earth while giving away its most valuable product for free. A cosmetics company like LVMH can dominate not by owning raw materials, but by commanding desire, loyalty, and prestige.

These examples point to a profound truth: in an age of abundance, what’s scarce is trust, attention, belief, identity, and insight. Intangible assets are the levers that create this scarcity—and therefore, value.

What makes this shift difficult for many leaders to grasp is that intangible assets don’t behave like physical ones. A factory depreciates over time. A brand, when nurtured, can appreciate. A machine wears out. A great culture compounds. A physical product scales linearly. A software product scales exponentially, at zero marginal cost. In the industrial economy, more capital meant more capacity. In the intangible economy, more creativity, trust, and data mean more leverage.

What We Fail to See, We Fail to Manage

For all their importance, intangible assets remain poorly understood. Many leaders default to thinking of them as “soft,” “fluffy,” or hard to quantify. They focus on what they can measure—plant, property, and equipment—while ignoring what truly drives performance.

The consequence is a profound misalignment. Businesses underinvest in brand, culture, design, and systems thinking because they don’t appear as “assets.” They overlook customer data as a strategic asset. They treat software as an expense, not an investment. They outsource creativity while trying to own factories.

Meanwhile, the companies that win today—from Tesla to TikTok, from Figma to Ferrari—build their entire business models around intangible leverage. They invest in creating ecosystems, not just products. They design brands with emotional resonance. They use culture as a strategic weapon. They understand that what people feel, believe, share, and remember matters as much as what they buy.

From Value Chains to Value Loops

Industrial-era thinking treated businesses like linear machines: input goes in, value is added, and output goes out. But the intangible age favours loops—feedback systems, compounding advantages, and reinforcing dynamics.

A strong brand attracts customers, which improves data, which improves products, which deepens loyalty, which strengthens the brand. A thriving culture attracts talent, which builds better software, which drives customer satisfaction, which attracts more talent. These loops don’t just create value—they accelerate it.

That’s why intangible assets matter more than ever: they don’t just create one-time benefits; they create flywheels. The most successful businesses build, protect, and invest in these flywheels. The least successful ones treat them as “nice to haves.”

Blind Spots of Traditional Management

There is a paradox at the heart of modern capitalism. What creates long-term value—brand equity, trust, culture, intellectual property, proprietary data—is largely ignored in quarterly earnings calls. Analysts ask about costs and margins, not community or design. Boards evaluate risk in terms of financial compliance, not reputational fragility.

This isn’t just a gap—it’s a governance crisis. When leaders don’t understand what’s driving 90% of their company’s value, bad decisions follow. Cost-cutting initiatives gut creative teams. Rebrands miss the cultural moment. Technological capabilities are treated as IT problems, not core strategy. Culture is seen as HR’s domain, rather than the foundation of execution.

To succeed in the era of intangible value, we need to upgrade our models—not just our metrics, but our mental models.

The New Literacy of Leadership

What’s needed is a new literacy for leadership—an ability to see, value, and build the invisible. This includes:

- Understanding how brand equity compounds and how to measure it

- Treating data not just as a byproduct, but as a core asset

- Investing in software and design as growth multipliers

- Leading culture not through slogans but through systems

- Designing ecosystems that scale beyond the firm

The most successful modern leaders—from Satya Nadella to Melanie Perkins— have embraced this shift. They’ve moved beyond managing inputs and outputs to curating experiences, enabling ecosystems, and empowering cultures of innovation.

This is not about softening business. It’s about sharpening it for the realities of the new economy.

I’m currently writing a new book, The Invisible Business

We are at a moment of radical economic and technological change. AI, Web3, platform economies, remote work, and creative tools are altering how value is created, measured, and captured. At the same time, trust is eroding in institutions, misinformation spreads rapidly, and customers demand more meaning and transparency from the brands they engage with.

In this environment, the businesses that understand their intangible advantage will lead. Those that don’t will struggle to compete—even if their factories are full and their financials look strong.

This book will explore how to recognize, build, and invest in these invisible assets. It will offer a roadmap for leaders who want to reimagine their business for a world where the most powerful assets can’t be seen—but shape everything we do.

We’ll look at companies reinventing their business models around brand, data, and community. We’ll explore how trust, culture, and creativity are becoming strategic differentiators. And we’ll provide tools to help you measure, manage, and multiply your own intangible advantage.

Welcome to the Invisible Business

The age of tangible advantage is over. We’ve entered a new era, one where unseen forces determine success. If we can learn to see what others ignore, we can unlock extraordinary value.

This is your guide to the future of value creation. Welcome to the invisible business.

Chapter 1: From Steel to Stories, How Value Has Shifted

In 1911, U.S. Steel became the world’s first billion-dollar corporation. Its value was measured in iron ore, blast furnaces, railway lines, and rolling mills. Capital investment meant physical scale, and industrial power meant control over supply chains and manufacturing capacity. Business success was made of concrete, steel, and sweat.

Fast forward to today, and the world’s most valuable companies look entirely different. Apple, Alphabet, Amazon, Microsoft, and Meta sit at the top of the list— not because they produce more physical goods than their rivals, but because they dominate in software, platforms, ecosystems, brand trust, user data, and design. Their true value lives not in things, but in intangibles: code, ideas, relationships, culture, and networks.

We have undergone a profound shift in the way economic value is created, measured, and understood. The industrial economy rewarded those who built the biggest factories and shipped the most units. The post-industrial economy—our economy—rewards those who build the strongest brands, harness the most useful data, and design the most engaging experiences.

We have moved from steel to stories—from atoms to bits, from scale to networks, from ownership to access, from extraction to attention.

The Age of Tangibles

For most of the 20th century, economic success was synonymous with industrial prowess. Oil giants, car manufacturers, mining conglomerates, and heavy engineering firms defined global capitalism. Value creation was linear and physical: extract raw materials, transform them through machinery, and distribute them through logistics networks.

Business models were built on vertical integration and economies of scale. The goal was efficiency, the metric was output, and the advantage was size. This was the age of assembly lines, smokestacks, and scale economics. Companies built value by owning more—more factories, more assets, more inventory, more people.

Accounting standards were designed to measure this world. Balance sheets captured physical plant and equipment. Profit and loss statements tracked input costs and unit margins. Depreciation schedules mirrored asset wear and tear. Tangible assets dominated both corporate strategies and financial reports.

But as the century wore on, something began to change.

The Rise of Intangibles

In 1975, the average S&P 500 company derived 83% of its value from tangible assets. By 2020, that number had reversed: more than 90% of corporate value came from intangibles. Brands, patents, software, algorithms, relationships, customer lists, organizational know-how, and proprietary data now drive the lion’s share of enterprise value.

This shift wasn’t just a feature of tech companies. It was everywhere. A luxury goods firm like Hermès generates value through scarcity, craftsmanship, and storytelling. A media platform like Netflix wins on user experience, original content, and engagement data. A company like Tesla builds not just electric vehicles but a cult-like brand, proprietary AI systems, and a massive software-defined platform.

What these companies have in common is that their most valuable assets are not visible on a factory tour—and in many cases, not fully captured on a balance sheet.

Why This Shift Matters

Intangible assets behave differently than tangible ones. They scale faster, last longer, and interact in more complex ways.

- Brands compound emotional trust, allowing premium pricing and customer loyalty.

- Software can be duplicated at near-zero marginal cost, enabling exponential scaling.

- Data gets more valuable the more it is used, especially in machine learning.

- Culture drives internal performance and external perception.

- Networks grow stronger with every new node, creating winner-take-most dynamics.

These properties create new kinds of competitive advantage. While tangible assets depreciate, intangible assets—when well managed—often appreciate. A factory may produce a million units a year. But a viral app, a trusted brand, or a magnetic story can reach billions—instantly.

The best companies build intangible flywheels. For example, Amazon collects customer data to improve recommendations, which increases engagement, which attracts more sellers, which improves selection, which brings more customers— who then provide more data. This self-reinforcing loop creates momentum that is hard to replicate with physical assets alone.

The Industrial Mindset vs. the Intangible Reality

Despite this profound shift, many leaders and organizations still operate with industrial-era mental models. They view value creation through the lens of control, ownership, and output. They prioritize efficiency over emotion, scale over meaning, and cost-cutting over trust-building.

This creates strategic blind spots. For example:

- A company cuts its marketing budget to protect margins, eroding brand equity that took decades to build.

- A business outsources its software development, losing control over its core platform.

- A team undervalues culture as a “soft” issue, only to suffer high turnover and low innovation.

- A firm treats its customer data as a compliance risk rather than a strategic asset.

The iPhone Moment

The story of Apple and Nokia offers a stark illustration of this shift. In the early 2000s, Nokia was the world’s leading phone manufacturer. It had factories across the globe and a dominant market share. Apple, on the other hand, had no experience in phones—but it had a powerful brand, a design philosophy, and an ecosystem mindset.

When the iPhone launched in 2007, it didn’t just introduce a new product—it redefined the value equation. Apple focused on the user experience, the emotional connection, the app ecosystem, and the seamless integration between hardware and software. Nokia, focused on cost-efficient manufacturing and feature lists, couldn’t keep up.

Within a few years, Apple became the most valuable company in the world. Nokia exited the phone business. Tangibles lost to intangibles.

Today’s Real Economy is Intangible

Today, value doesn’t reside on the factory floor. It lives in the minds of customers, the relationships between users, the algorithms inside platforms, and the ideas embedded in design. The most important assets are often invisible—until they’re gone.

To lead in this world, businesses must learn to see, measure, and manage these new value drivers. That requires letting go of outdated assumptions and building new capabilities. It means investing in creativity, culture, brand, and systems. It means designing business models that harness flywheels, data loops, and network effects.

Most importantly, it means telling better stories—not just to customers, but internally, to guide strategy, mobilize teams, and shape identity.

Because in the age of intangibles, stories scale better than steel.

The Intangible Building Blocks

Let’s unpack some of the most critical intangible assets shaping today’s organisations:

1. Data and Algorithms

Data is the new oil, but unlike oil, it doesn’t get used up. It gets more valuable with use. Businesses that can gather, analyse, and deploy data effectively create powerful feedback loops—improving products, anticipating demand, targeting customers, and optimising operations.

Example: Palantir, the US-based analytics firm, doesn’t manufacture anything. Its entire business is about helping organisations—from governments to corporations—unlock value from their data. The company’s value lies in its algorithms, analytics tools, and ability to turn invisible streams of data into insight and impact.

2. Brands and Reputation

A strong brand is a trust signal, an emotional connection, and a multiplier of value. Brands encapsulate the values, voice, and promise of a company—turning a commodity into a preference.

Example: Patagonia’s brand is a beacon of environmental integrity and purpose-driven capitalism. Its tangible products—jackets and backpacks—could be made by others. But its brand is a magnetic asset, built on trust, activism, and community.

3. Intellectual Property and Software

Software eats the world, and IP defines defensibility. Patents, proprietary code, algorithms, and design rights create sustainable moats for many companies.

Example: ASML, the Dutch semiconductor equipment maker, derives its strategic power from its extreme ultraviolet lithography technology. It holds patents so complex and advanced that it effectively monopolises the machinery needed for cutting-edge chips. The machines are real, but the crown jewels are the ideas and knowledge embedded within them.

4. Relationships and Ecosystems

In the platform economy, value isn’t just in what you control but in who you connect. Ecosystem thinking means value is co-created across networks of users, partners, and developers.

Example: Shopify, the Canadian ecommerce platform, is successful not just because of its technology but because of its ecosystem of app developers, agencies, and online sellers. It doesn’t own the products being sold—but it owns the relationship with sellers and buyers.

5. Culture, Purpose, and Talent

Culture and values shape how work gets done, how people collaborate, and how organisations adapt. In the knowledge economy, the ability to attract and retain the best minds is itself a strategic asset.

Example: GitLab, the remote-first DevOps company, has no physical headquarters. Its most prized asset is its culture—transparency, asynchronous collaboration, and radical documentation. This invisible infrastructure enables it to operate across 60+ countries with no loss in speed or coherence.

Invisible business are different

Traditional companies were built on control of physical resources, economies of scale, and linear supply chains. The organisation’s success was a function of capital intensity, operational efficiency, and asset utilisation. Value was something you could weigh, ship, or store.

Invisible businesses flip that logic. They are:

-

Light on physical assets but rich in intellectual property.

-

Customer-centric, with deep insights derived from real-time data.

-

Platform-based, co-creating value through users and partners.

-

Agile and adaptive, driven by ideas, innovation, and culture.

-

Valued more by future potential than by current physical output.

They are also harder to measure using traditional metrics. GDP still doesn’t count intangible investments like R&D or brand development very well. Accounting standards often force software development costs to be expensed rather than capitalised. As a result, intangible-rich firms may appear asset-light or low-margin on paper—while being extraordinarily valuable in reality.

Reimagining Value Creation

Invisible businesses are not just tech companies. They are businesses that reimagine how value is created—by investing in the intangible, the relational, the experiential.

These companies:

-

Prioritise customer experience over production capacity.

-

See code as capital and culture as infrastructure.

-

Use ecosystem leverage rather than vertical integration.

-

Scale exponentially, not incrementally.

They may not show up in the traditional rankings of asset size or headcount, but they dominate the rankings of brand value, venture capital funding, or customer growth.

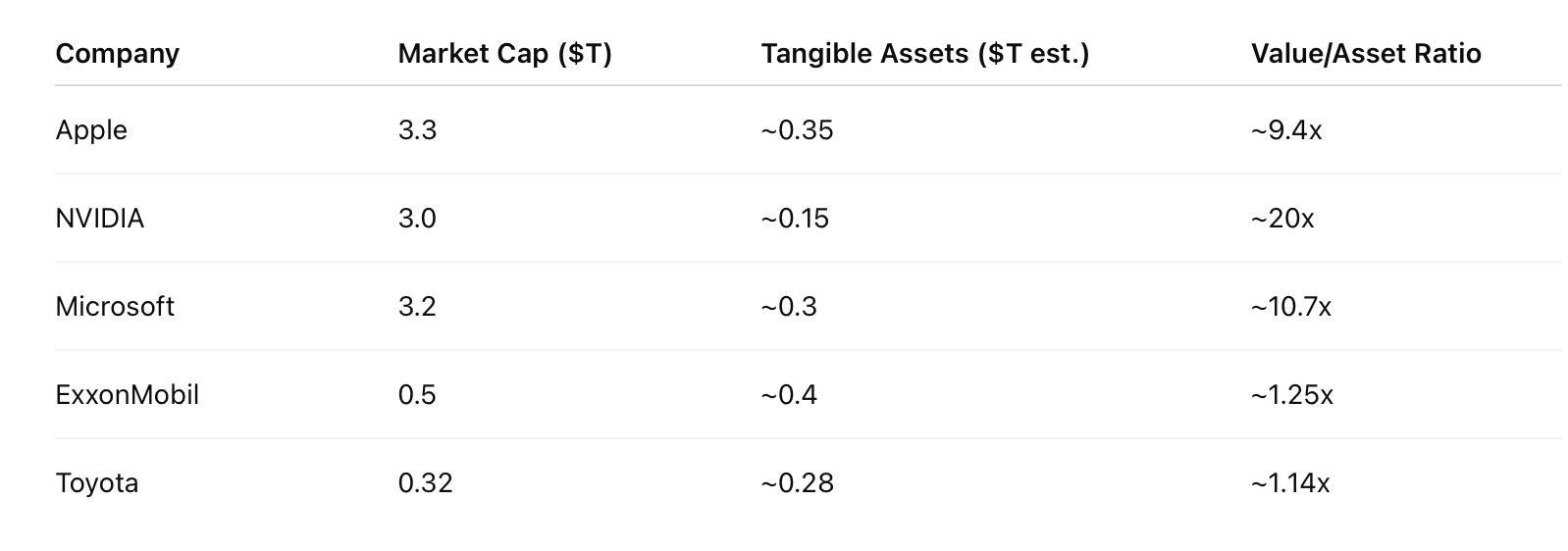

The contrast between intangible asset-based (invisible) companies and tangible asset-based (traditional) companies is stark when viewed through the lens of market capitalisation—a reflection of perceived value, future growth potential, and economic relevance.

As examples (with current valuations, June 2025), Apple has a market value $3.3 trillion, driven by intangible assets like brand, software ecosystem (iOS), design IP, customer loyalty, developer platform, proprietary silicon design (e.g. M-series chips). Visa is valued at $560 billion, driven by global network effects, brand trust, secure payment IP, relationships with financial institutions.

Compare this to ExxonMobil with market cap $500 billion driven tangible assets like refineries, oil fields, pipelines. Or Toyota with $320 billion driven largely by manufacturing plants, global supply chain, physical inventory.

The world’s most valuable companies today are those whose worth is built on invisible assets: networks, platforms, data, software, and trust. While traditional companies still generate significant cash flows, their capital intensity reduces scalability, and they often lack the exponential upside of intangible-driven businesses.

This comparison clearly shows that the market now rewards scalable ideas over physical scale, ecosystem control over asset ownership, and innovation capacity over industrial capacity.

The Invisible Advantage

In this world, competitive advantage doesn’t come from owning the factory—it comes from owning the idea. The data. The interface. The standard. The narrative.

For business leaders, this demands a shift in mindset:

-

Invest in the invisible: Brand, culture, community, and IP need the same strategic focus as factories once did.

-

Measure what matters: New metrics are needed to assess intangibles—from innovation velocity to brand trust to ecosystem health.

-

Build ecosystems, not empires: Collaboration becomes more powerful than control.

-

Adapt relentlessly: In a fast-changing world, intangible businesses are more fluid, experimental, and resilient.

The most valuable businesses of our age don’t look like businesses of the past. They are invisible businesses—defined by what you can’t see but can feel, experience, and benefit from. Their value lies in relationships and data, in trust and creativity, in community and code.

As the intangible economy continues to grow, companies that understand and embrace this invisible logic will lead the way—not just in valuation, but in relevance, resilience, and reinvention.

Examples of Invisible Companies

- ByteDance: The Chinese parent of TikTok has no physical products but has built a global empire on attention, algorithms, and user engagement. Its true asset is its recommendation engine—an invisible force that keeps users hooked, informed, and entertained.

- Klarna: This Swedish fintech firm enables “buy now, pay later” services. Its value lies in its software, consumer trust, and partnerships with retailers—not in any bricks-and-mortar footprint.

- Canva: The Australian design platform makes design accessible to anyone, anywhere. It owns no creative agencies, but its intuitive interface, templates, and brand assets make it indispensable to millions of users. It’s real assets? Usability, community, and vision.

- Arm Holdings: Arm doesn’t make chips—it designs them. Its intellectual property is licensed to nearly every chipmaker in the world, from Apple to Qualcomm. The company’s value is entirely based on IP, talent, and standards.

- Nubank: This Brazilian digital-first bank has scaled rapidly without branches. Its key assets? A user-friendly app, an iconic brand, and trust among young Latin Americans underserved by traditional banks.

- Stripe: The payments infrastructure firm simplifies online transactions for millions of businesses. It owns no physical point-of-sale systems—but it owns the trust of the digital economy.

Profiles of Invisible Companies

Airbnb, Unlocking Trust

Airbnb has built a global hospitality empire without owning a single hotel. Its core asset isn’t real estate—it’s trust. From its early days, Airbnb recognized that enabling strangers to stay in one another’s homes required more than a clever platform. It needed to create a global sense of safety, community, and emotional connection. By investing heavily in design, reputation systems, host standards, and a narrative around “belonging,” Airbnb turned trust into its most valuable currency.

Its brand identity—rooted in local experiences and authentic connections— differentiates it from traditional hotel chains. Features like verified ID, guest reviews, and Super host status create reputational capital. Meanwhile, data from millions of stays feeds into pricing algorithms, fraud detection, and personalized recommendations. Airbnb’s flywheel is intangible: more trust leads to more listings, more guests, better data, and greater network effects.

During the COVID-19 pandemic, Airbnb doubled down on community. While travel plummeted, it nurtured its brand and experience design, supporting hosts and pivoting to long-term stays and online experiences. This intangible focus allowed Airbnb to emerge stronger, culminating in one of the most successful tech IPOs of the decade. Its physical footprint may be light, but its intangible ecosystem—trust, brand, and community—is enormous.

BYD, Building Ideas

BYD (Build Your Dreams), China’s electric vehicle and battery giant, has quietly become one of the most valuable and innovative manufacturers in the world. While its competitors emphasize scale and hardware, BYD’s real strength lies in mission, culture, and intellectual property.

Founded in 1995, BYD began with rechargeable batteries, later expanding into EVs and energy storage. Today, it produces not just cars, but entire clean energy ecosystems. Its success is rooted in deep in-house R&D, holding more than 40,000 patents globally. But beyond patents, BYD’s innovation edge comes from cultural alignment. It operates under a clear mission: to “cool the earth by 1°C.” This shared purpose fosters internal cohesion and long-term thinking.

BYD has vertically integrated most of its operations, but not to control supply chains—instead, to protect its core intangible capabilities in software, powertrain design, and battery tech. It is now exporting vehicles and tech worldwide, surpassing Tesla in EV unit sales in 2023.

Its intangible strength lies not just in technical knowledge, but in how that knowledge is embedded in its culture and purpose—a model for mission-driven innovation at scale.

Canva, Embracing Community

Australia’s Canva is a breakout SaaS success story built entirely on design simplicity, user experience, and community. Founded in 2013, Canva set out to democratize design for non-designers. It didn’t compete with Adobe on technical depth—instead, it focused on intuitive UX, brand templates, and cloud collaboration. This user-first design became its key intangible asset.

Canva’s growth has been driven by viral loops: users invite collaborators, share designs, and embed Canva content across the web. It has also built an emotional connection through a mission of empowerment—making everyone feel like a creator. Canva now supports 170+ languages, with over 175 million users worldwide.

Beyond product simplicity, Canva has nurtured an internal culture that emphasizes humility, learning, and impact. Co-founder Melanie Perkins often credits the company’s success to a relentless focus on culture and purpose.

Its valuation—exceeding $25 billion—reflects the value of its intangible ecosystem: loyal users, a trusted brand, design templates, cloud-based collaboration, and a culture that attracts top talent.

LVMH, Powered by Brands

LVMH Moët Hennessy Louis Vuitton is the world’s leading luxury group, and a case study in how brand equity, storytelling, cultural capital, and craftsmanship can drive enduring value. While its physical products—watches, handbags, wine—are beautifully made, the real value lies in perception, status, identity, and heritage.

LVMH owns over 75 brands across fashion, jewellery, cosmetics, and spirits— including Louis Vuitton, Dior, Tiffany & Co., Fendi, and Dom Pérignon. These brands trade on their legacy, exclusivity, and cultural resonance. LVMH carefully nurtures the intangible magic of each brand while using centralized platforms for digital, data, and retail operations.

CEO Bernard Arnault describes luxury as “the business of selling dreams.” This requires controlling not just design and distribution, but also intangible experience design: exclusive events, influencer partnerships, artistic collaborations, and storytelling that taps into desire and meaning.

LVMH invests heavily in human capital—artisans, designers, brand curators— recognizing that its value lies in symbolic power as much as physical product. Its pricing power, margins, and customer loyalty are grounded in decades (often centuries) of carefully cultivated emotional capital.

Nvidia, Accelerating Technology

Nvidia started as a GPU manufacturer, but has become a foundational company in the AI economy. Its rise is driven by a rare blend of technological imagination, ecosystem thinking, and platform innovation—a masterclass in unlocking and layering intangible assets.

Originally known for gaming graphics cards, Nvidia saw early the potential of GPUs in parallel computing. It built CUDA, a proprietary platform that allowed developers to write software for its chips. This transformed Nvidia from a component vendor into a core enabler of AI, autonomous driving, robotics, and the metaverse.

Today, Nvidia’s value comes not just from chip performance, but from the developer ecosystems, AI models, research partnerships, and software platforms it supports. It owns key layers in the AI stack, from hardware to simulation to neural network training.

Nvidia’s brand is synonymous with innovation—trusted by startups, academics, and tech giants alike. It has built a flywheel of technical leadership, community engagement, and platform lock-in. Its market value now rivals legacy hardware firms many times its size.

Nvidia doesn’t just build chips. It builds the future’s imagination infrastructure— intangible, invisible, yet incredibly powerful.

Ping An, Transforming Platforms

Ping An, one of China’s largest financial services companies, has transformed from a traditional insurer into a tech-driven ecosystem by investing in data, AI, platforms, and digital trust. Ping An has evolved from an insurance provider into a platform- powered technology and health ecosystem, redefining financial services through intangibles like data, algorithms, trust, and cross-sector integration.

The company’s core strategy hinges on “finance + technology” and “finance + ecosystem.” With over 220 million retail customers, Ping An uses AI and cloud infrastructure to personalize risk assessment, predict customer needs, and optimize lifetime value. The firm holds over 100,000 patents, most related to fintech, AI, and health tech.

Ping An Good Doctor, its AI-powered health platform, serves hundreds of millions of users. Its smart city solutions manage traffic, identity, and urban services in real time. These platforms generate intangible capital in the form of proprietary datasets, behavioural insight, and public trust.

Unlike many insurers that outsource tech or treat digital as a channel, Ping An has vertically integrated its data infrastructure and built a culture of digital-first thinking. Its value proposition is not just better insurance—but smarter, more holistic life solutions.

By reimagining itself as an AI-powered, ecosystem-based enterprise, Ping An has become one of the most forward-looking financial institutions in the world. Its real assets are invisible: platforms, people, and predictive intelligence.

Spotify, Unlocking Data

Spotify redefined music not by owning content, but by owning data, algorithms, and user experience. With over 600 million users and 200 million subscribers, Spotify’s power lies in how well it understands what people want to hear—and when.

Its algorithmic playlists like “Discover Weekly” and “Release Radar” generate intense engagement. Spotify collects listening data, mood, location, time of day, and device usage to personalize the experience in real time. This data flywheel is a potent intangible asset: more engagement means better data, which improves personalization, which boosts retention.

Spotify has also invested in audio storytelling—from podcasts to original content— shaping the future of sound and attention. It builds emotional bonds through shared playlists, artist fan experiences, and cultural relevance.

What makes Spotify unique is how it translates data into emotion and identity. In doing so, it’s not just streaming songs—it’s curating culture. Its intangible edge lies in combining data science, emotional resonance, and creative expression.

Tencent, Growing as Ecosystems

Tencent is one of the world’s most successful digital ecosystems, with value creation built not on products, but on platforms, data, networks, and trust. Best known for WeChat, China’s “everything app,” Tencent has created a digital operating system for everyday life—messaging, payments, gaming, commerce, content, and public services—within one unified interface.

What makes Tencent extraordinary is how it turns intangible relationships into exponential value. WeChat isn’t just a messaging app—it’s infrastructure. The platform handles over a billion daily users and connects families, businesses, governments, and brands. By embedding payment and service layers into chat, Tencent unlocked new business models powered by convenience, loyalty, and data.

Tencent also runs the world’s largest video game business through a network of internal studios and strategic investments (including Riot Games, Epic Games, and Supercell). It applies data-driven insights to iterate game features, optimize engagement, and drive in-game monetization.

At its core, Tencent’s strength lies in intangible assets: network effects, behavioural data, content IP, user habits, and ecosystem orchestration. Rather than controlling everything directly, it enables partners, startups, and developers to build inside its environment, turning scale into stickiness. Tencent doesn’t just create value—it multiplies it across networks.

More from the blog