Reinventing the book publishing industry … while every other kind of content, media and retail business is transformed, books just don’t change … time to reinvent the business models of publishing

March 18, 2024

The book publishing industry is in a bind.

While the world changes – as digital platforms transform every other industry, as new generations engage in new ways, as the sources of value are rapidly upturned – the world of books continues to dismiss the need for real change.

Maybe technology can automate some of the slowest processes, maybe AI can improve production efficiency, maybe tweaks can reduce waste and improve sustainability, but most publishers still like books – ideally 300 pages, black and white, standardised format, hard back.

Of course there is a cultural love of printed books, the antiquated romance of literature, the refuge of an old book shop, the comfort of a physical tome. And, in fact, more books were sold across the world than ever before.

But it’s a pure fantasy to assume this can be the future.

All around, every industry has changed. 25 years ago, platforms like Amazon and Netflix challenged the old world of retail and entertainment. Now they are the establishment.

In a world of smartphone primacy … where payments are a digital click, retail is gamified entertainment, pizzas are delivered in minutes, events are personal and immersive, relationships are social, and influence is communal … isn’t it time for books to innovate?

The publishing world, more generally, woke up long ago.

News is live across multiple channels, movies are on demand, advertising is programatic. Time Magazine to Rolling Stone are delivered by monthly download, with daily updates. Many young people have never even watched a scheduled TV program, or read a newspaper.

Book publishing requires more than tweaks to its old model. Tweaks to reduce costs, increase speed, embrace social, are just tweaks. Diminishing returns in an outdated world.

Publishers need new business models

New business models are the most effective way to transform organisations, to innovate the whole way in which the business works. Inspired by a new generation of businesses – Airbnb to Uber, Revolut to Netflix – we see dramatically new business models in every market, through collaborative platforms, data analytics and personal recommendations, or subscription-based payments.

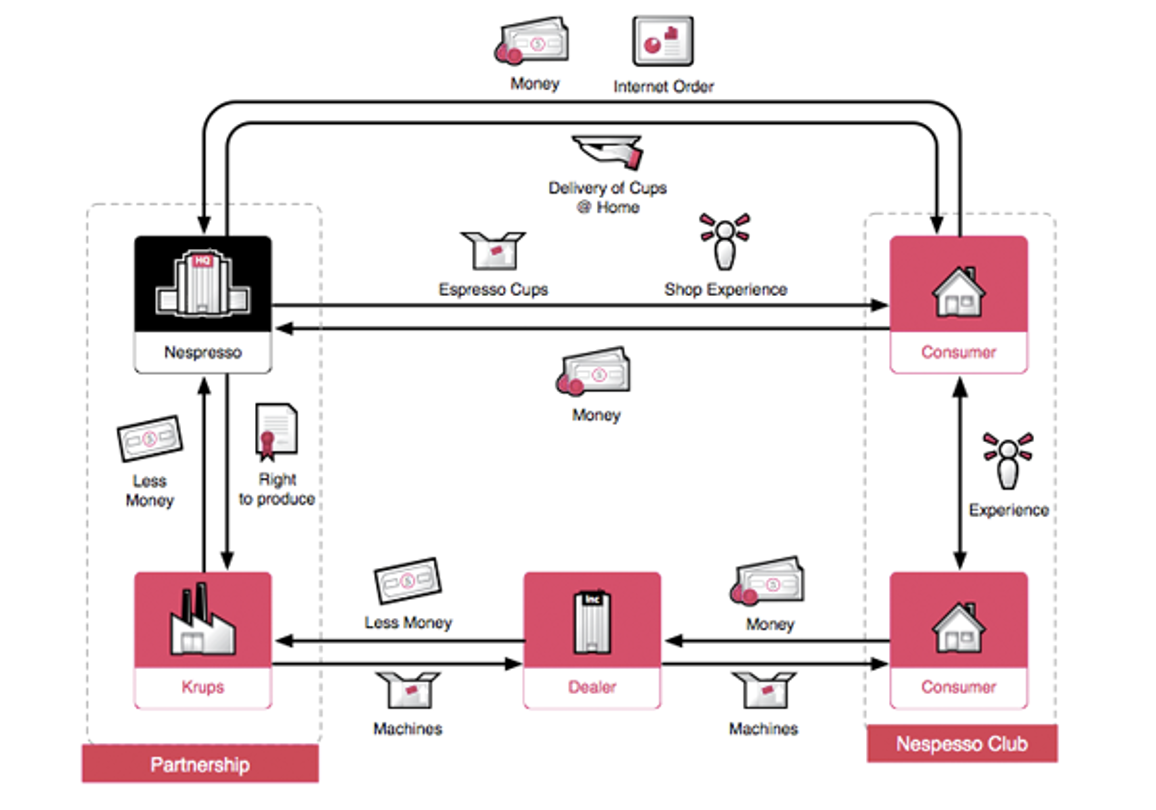

Airbnb makes money by helping you to make money out of your spare room, connecting host and guest, then taking a small fee from each. Nespresso makes great coffee, selling discounted machines, and then getting you to sign up to an everlasting and incredibly profitable direct revenue steam of coffee pods.

What if your business started leasing rather than selling, became part of the sharing economy? What if you simply facilitated an exchange between buyers and sellers and took a cut? How about moving to a subscription model, or a freemium model, or a referral model, or an advertising model?

The term “Business Model” is over used and under defined. Business models explain how organisations work – how do they create value for customers, and in doing so how they create value for all other stakeholders. They can map the current business, or explore options for the future.

The approach originates from mapping “value networks” in the 1990s, understanding the systems across business and its partners through which value (both financial and non-financial) is created and exchanged – by who, how and for whom. I remember working with Pugh Roberts to create a multi-million dollar dynamic model for Mastercard which showed varying any one driver – such as interest rates, or branding – affected everything else. And thereby being able to test new ideas and optimise the model.

Business models represent the dynamic system through which a business creates and captures value, and how this can changed or optimised. They are a configuration of the building blocks of business, and their creative reconfiguration can be a significant innovation.

Business models became fundamental to business strategy, driven by them but often driving them. Hambrick and Fredrickson’s Strategy Diamond is all about aligning the organisation, achieving an economic logic between strategic choices. They help to align the business, matching the right strategies for outside and inside, using the proposition as the fulcrum, and profitability as the measure of success.

Business models can often appear very mechanical, lacking emotion and easy to imitate. In 2001 Patrick Staehler, in particular seeking to explain the new breed of digital businesses, created a business model “map” driven by the value proposition, enabled by the value architecture, creating economic value and sustained by cultural values. The last point here is most interesting, in that it captured the distinctive personality of a business, its leadership styles and ways of doing business. This is much harder to copy, and also sustains the other aspects.

Alex Osterwalder’s subsequent Business Model Canvas emerged as the most common template on which to map a business model. He popularised the approach so much so that his supersized canvas now features in workshops throughout the world, always with an array of multi coloured sticky notes as teams debate the best combination of solutions for each box. Whilst the canvas lacks the sophistication of value driver analysis and dynamic modelling, it is about testing hypothesise in each aspect, and how they could work together, and that respect works as a thinking model.

Business models have become a practical tool for rethinking the whole business, seeing the connections and then innovating the business. In fact they offer a great platform to facilitate new strategy and innovation thinking. That’s why we’ve created the Business Innovation Program, which combines design thinking, new business models and strategic implementation – a great way to engage your team, to think about new ways to grow, and to create the future, practically.

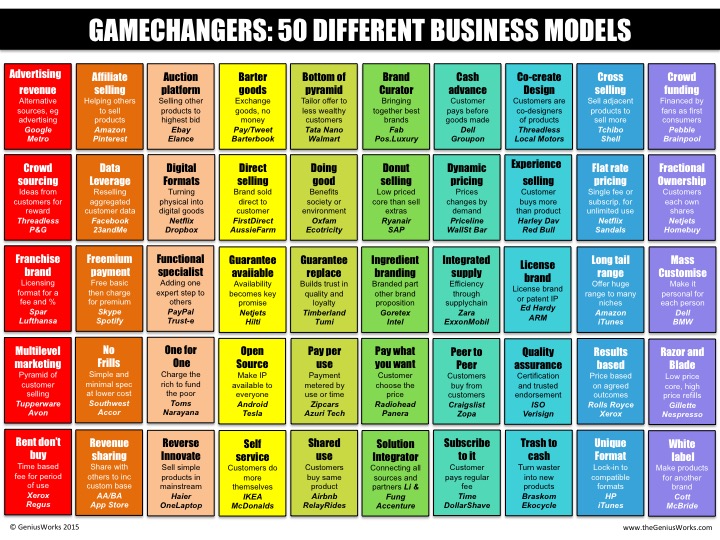

We explore at least 50 different business model templates which could transform your business. We start with the customer, to explore emergent needs and behaviours, shaping better propositions and solutions, then exploring how to deliver them commercially, and as engaging customer experiences.

Here are some examples from other areas of publishing. This is by no means an exhaustive list, as the variations are infinite, and may involve components of multiple examples:

The Paid Content Publisher: Subscriptions or micropayments

- Targets the loyal, demanding consumer who values the objective and relevant content that top news outlets produce

- Examples: The Economist in media publishing, Blinklist in digital book summaries.

- They are clearly the world leaders with the highest credibility, coverage and loyalty from their audiences. Through various forms of payment for content they have been able to sustain their business model. Only those with good quality journalism and community engagement are able to survive with this model.

The People’s Publisher: Crowdfunding

- Targets the consumer who is willing to fund media companies with negative balances, supporting their clear independence and good quality, credible content.

- Examples: Unbound in book publishing, The Guardian in media publishing.

- This business model is recommended for kick-starting a business or a specific

project, with a goal of then achieving sustainability through another model such as advertising or subscriptions. Only in very well developed economies will this model be able to grow. Regulatory restrictions still limit the use of crowdfunding.

The Self Publisher: Author published

- Targets consumers who are highly segmented, and in a database built up by the author already, without the need for publisher brand endorsement

- Examples: Amazon Kindle, Apple Books

- These platforms have a a DIY platform to enable authors to develop, format, prepare, and produce their books for significantly lower fees. It may include hybrid models which can involve freelance designers, copywriters, being part of the process. The platform may then also distribute the book to its audience, for a relatively minimal fee.

The Custom Publisher: On demand, asset based

- Targets specialist audiences who only want to buy specific content (eg individual chapter, or entity), or want it customised in some way specific to them (eg personal name inserted, corporate branded etc)

- Examples: Publishers House,

- These platforms are often linked to self publishing, but could work for any book. The concept of buying a book by a chapter, or selection of chapters unto the full price of the book can work well in technical subjects. Print on demand technologies in general, allow publishers to access their huge back catalogues of content and titles, without having them preprinted and stored. Also to print on location, to avoid shipping.

The Retailer Publisher: Vertical, ecommerce

- Targets consumers who are highly segmented due to their needs and profile and who are willing to satisfy their purchase needs with the portfolio of products / services offered.

- Examples: Monocle in media publishing, Net-a-Porter in fashion publishing

- These companies have clearly focused on a niche audience with both content

and exclusive and attractive offers, which has increased the purchase intent for their products and captured the advertisers’ interest. With the gradual increase of e-commerce in the retail market, more companies will have to develop this model, independently or through partnerships. A deep understanding of their audiences is a must to survive with this model.

The Events Publisher: Events, experiences

- Targets consumers attracted by the quality and credibility of the brand and their resulting events

- Examples: Ascential in events publishing (Cannes Lions etc), Live Nation in music

- These companies have consolidated the development of events of all their brands into a single area for the sale of tickets and sponsorships or have opted to create independent business units aligned with the growing interest of the consumer in actively participating in new experiences. These events also generate new content, data that feeds databases and become positive influencers for their brands. This model could represent 20 per cent of total revenues with good brand partnerships and with the right management team.

The Community Publisher: Clubs, membership

- Targets consumers who, through subscription packages, not only access editorial products, but attractive discounts in a broad portfolio of products and services. The annual subscription could be recovered through accessing these discounts.

- Examples: The Atlantic in sports publishing, Future in media publishing (eg Americas Test Kitchen)

- All these companies have generated a robust list of benefits so that subscribers have preferential access to relevant events, premieres and discounts across a wide range of services. It requires a proactive telemarketing strategy to make sure that the club members are satisfied and loyalty prevails.

The Advertising Publisher: Advertising, branded content

- Targeting interested advertisers to build and distribute relevant messages associated with their brands and the needs of the audiences

- Examples: Quartz, British Airways High Life

- These companies are among the few that still survive with robust models dependent on advertising, due to their high segmentation and profiling of their audiences which capture sophisticated audiences.

The Agency Publisher: Selling brand content

- Targeting advertisers who do not have the capacity to contract creative agencies to create advertising pieces for their audiences.

- Examples: 23stories by Condé Nast, CNBC Catalyst

- Taking advantage of their content creation potential, these companies have built creative and editorial teams to design 360 marketing campaigns and branded content production for advertisers, that can be disseminated through their media portfolio. It requires leveraging the competency of the marketing team to be able to compete against traditional ad agencies with cost-effective strategies and excellent service level agreements.

The Database Publisher: Data broker

- Targeting advertisers who want to increase their effectiveness in advertising campaigns with databases generated from the media companies’ audiences.

- Examples: ProPublica (US), Schibsted (Norway)

- With the emergence of programmatic advertising, it becomes increasingly important to have your own data, to be able to take advantage of them internally but also to offer them to third parties to increase the effectiveness of your marketing campaigns. Classified ads and verticals are also an excellent vehicle to enlarge databases with more relevant audience information.

The Licensing Publisher: Innovating services

- When the intangible value of the brand is high, it is worth taking advantage of this to license the brand in other related products or services, and thus obtain other related sources of income

- Examples: Disney, National Geographic

- All these brands enjoy great recognition, credibility and acceptance by their audiences. By developing new products and services with this seal of quality, they can generate additional income. In most countries, media companies have a good brand awareness and acceptance; an intangible asset that can be wisely used to enlarge revenue sources with complementary businesses.

The IT Publisher: Selling software

- When internal IT development has proved to be effective, media companies can offer consulting and IT licensing services to their industry peers to increase their operational efficiency.

- Examples: The Washington Post with ARC

- Unfortunately, not many media companies have the capability to offer these types of services. This model requires developing a business-oriented and a consultative selling and consulting culture in the IT team to provide these services to internal and external customers.

The Investor Publisher: Launching a fund

- When you want to invest in other promising and emerging businesses in exchange for advertising

- Examples: Thomson Reuters

- Through alliances with other companies in the same sector, these companies

have created specialized funds to invest in emerging media businesses. It is crucial to have a well developed private equity fund community that can serve as partner for media companies to correctly assess the deal flow and make the right choices.

More from the blog