The Human Value Era … from shareholders to stakeholders, humans as core assets, not costs to minimise

January 22, 2022

In late 2019 the Business Roundtable declared the end of the Shareholder Value Era.

Heather McGowan, in her article for Forbes, articulates her belief that the pandemic has shifted us into a new age: the human capital era; and explains how we got here.

Her key points include

- we have treated humans as a cost to contain rather than as the main generator of value (90% of S&P enterprise value is now generated from human capital)

- we have under invested in humans halting social mobility (in 1950 you had a 90% chance of doing better than your parents, by 1980 that dropped to 50%)

- racism is not only immoral, it is expensive (costing $16 trillion over the past 20 years)

- income inequality depresses growth (perhaps as much as 1% of GDP), and much more.

Business education from the 1980s to late 2019 preached that business existed to return profits to shareholders and investors at all costs. Many of those “costs” were humans which was reasonable in the 1970s as most human work was in contribution to production of physical asssets.

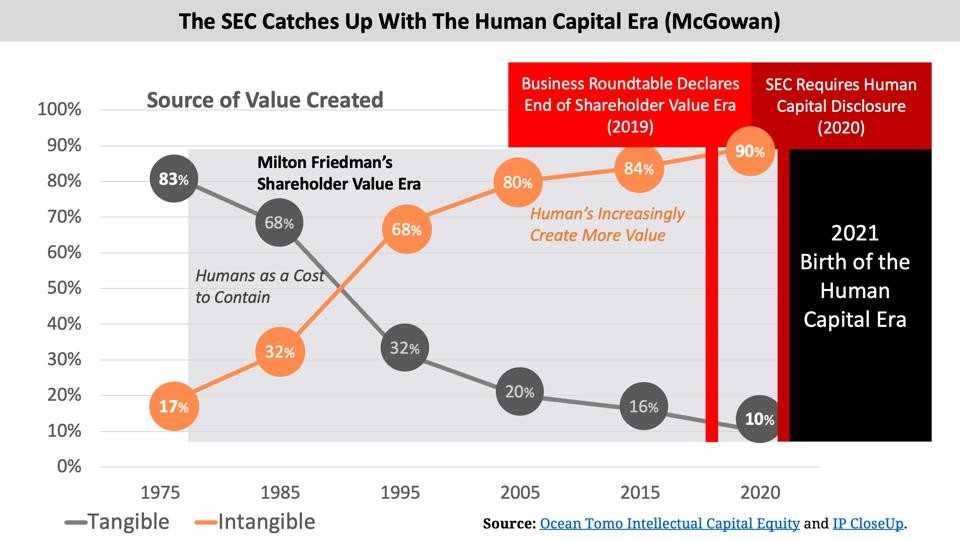

Recent data from Aon shows that in 1975 tangible, physical assets comprised 84% of enterprise value on the S&P 500, while only 17% of that value was intangible, notably human capital.

By 2020, these categories had flipped and intangible assets comprised 90% of all value. Missing this shift not only created income inequality, it also squandered human and economic potential. While the stock market soared, our actual return on assets declined by 75% since 1965, according to research by Deloitte’s John Hagel.

More from the blog